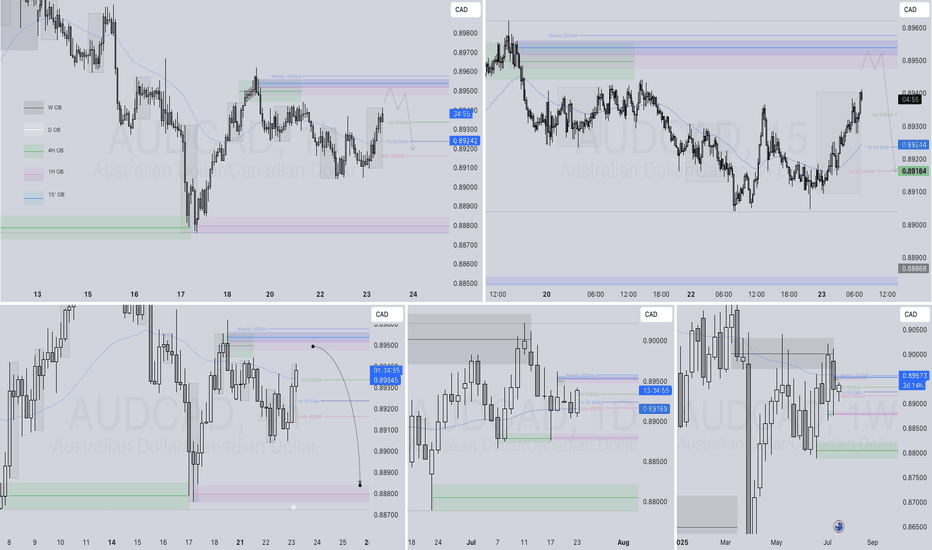

AUDCAD Q3 | D23 | W30 | Y25📊AUDCAD Q3 | D23 | W30 | Y25

Daily Forecast🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT

Freeforextips

EURGBP SHORT DAILY FORECAST Q3 D8 W28 Y25EURGBP SHORT DAILY FORECAST Q3 D8 W28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPJPY SHORT DAILY FORECAST Q3 D2 W27 Y25GBPJPY SHORT DAILY FORECAST Q3 D2 W27 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

USDCAD LONG DAILY FORECAST Q3 D2 W27 Y25USDCAD LONG DAILY FORECAST Q3 D2 W27 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURGBP DAILY FORECAST Q3 D30 W27 Y25EURGBP DAILY FORECAST Q3 D30 W27 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

Weekly outlook of Gold SpotIn June, XAUUSD and MCX Gold crash due to FOMC events. It has recovered almost 60% to 70% loss in the July month.

Gold spot needs to break 1809 levels to retest support of 1793.6 - 1783.6 . These support levels will push the gold price higher. Gold isn't sellable until the breakout of 1766 ( strong support ).

XAUUSD will touch 1858 - 1898 levels soon.

Watch significant releases or events that may affect the movement of gold, silver, crude oil, and natural gas:

Wednesday, Jul 21, 2021

02:00 API Weekly Crude Oil Stock - Medium Impact

20:00 Crude Oil Inventories - High Impact

20:00 Cushing Crude Oil Inventories - Medium Impact

Thursday, Jul 22, 2021

20:00 Natural Gas Storage - Low Impact

Part 2: What Drives Gold (XAUUSD) Prices?PREVIOUS:

-------------------

Weekly outlook of Gold Spot -

WHAT'S NEXT:

----------------------------

Key levels: 1793.6 and 1783.6

According to my previous newsletter, my gold key levels will remain the same. It's not sellable until breakout the 1766 (strong support).

In XAUUSD, buying pressures are increasing. We may see 1812 - 1824 - 1836+ levels.

Alternatively, gold is taking a reversal from the first key level, so its upside rally may be weak. But, day traders can play between my range. And stop buying when it breaks the first key level. That could drag down the gold price directly at the second key level ( 1783.6 ).

And gold's closing price below 1783.6 means blast. It may hit the strong support level directly.

Please note, don't forget to watch significant releases or events mentioned above in the chart that may affect the movement of gold, silver, and crude oil.

USD/JPY May Continue DeclineUSD/JPY has made a high of 111.66 and took a U-turn. Its impulsive wave breaks at support trendline breakout. It can keep falling from the dynamic resistance trendline ( DRT ). We may see 109.54 - 109.15 - 107.48 soon.

Don't sell after a breakout of DRT or 110.7 level. And do not forget to watch significant releases or events mentioned on the above chart that may affect the movement of USD/JPY.

AUD/USD: ELLIOT WAVE THEORY (EWT)AUD/USD started to rise from the support trendline. And it's made the Elliott wave pattern on the daily time frame. After the ABC correction, now it's trying to hit 0.7660 - 0.7700 - 0.7800 .

But what if it breaks the support trendline?

If it starts to fall, the targets will be 0.7400 - 0.7360 .

EURGBP: HEAD & SHOULDER PATTERNEUR/GBP has made the head and shoulders pattern on the daily timeframe.

After breaking the neckline, it's moving to reach 0.8776 - 0.8700 .

But if it starts to move upside by crossing the neckline, then it's a failure of the head and shoulders pattern. And targets are as followings levels 0.8906 - 0.8946 .

Will EUR/AUD Fly to Complete the Butterfly Pattern?EUR/AUD is trying to make the butterfly pattern on the 15m timeframe. And the trend seems positive here. On this chart, it has started to rise by following the support from 21st January 2021. Right now, it's trying to reach the hurdle( 1.5812 ).

It has to cross the hurdle and reach 1.5825 level, to complete the butterfly pattern. So the targets are as following 1.5804 - 1.5812 - 1.5825 - 1.5830 - 1.5970 .

But what if it starts to fall?

If the trend starts to fall and the butterfly pattern fails with the fall, then the targets are 1.5760 - 1.5765 . And if this breaks the support, then it will hit 1.5740 - 1.5715 .

Note: It's a bearish butterfly pattern. After the butterfly pattern, the trend will fall for a short period.

USD/CHF is Trying to Move UpsideHere's the 4H chart of the USD/CHF. Right now, it's moving sideways under the hurdle ( 0.8918 ). If the trend moves upside and crosses the dynamic resistance and hurdle trendline, then the hurdle will react as the support. And targets for the uptrend will be the following 0.8960 - 0.9000 .

But if it falls and breaks the key level, then the target will be 0.8796 - 0.8760 .

Technically the RSI is below its neutrality area at 50. But it's trying to cross this upwards. According to Stoch RSI, the trend is trying to move upwards.

BTC/USD is DwindlingRight now, BTC/USD is falling by breaking the support trendline. I have applied the DMI, and according to this, it's falling. The ADX is less than 25, and -DI is above +DI, which indicates the downtrend. RSI also indicates a fall. The target for the fall will be as following 3224 - 3145 - 3050 .

But if it starts to rise by crossing the support trendline, then the targets will be 3468 - 3500 .

NZD/USD : The Next Step with the Bearish EWTNZD/USD has made the bearish Elliott wave on the hourly time frame. The formation of the Elliott wave is complete. Here we can see 5+3=8 wave Theory so cleanly. 1 to 5 waves and then ABC correction.

It's a bearish Elliott wave pattern, and after the C, now the tren will fall up to 0.7120 - 0.7110 - 0.7085 .

But what if it starts to rise?

If the trend starts to rise by crossing the resistance, then it may hit 0.7165 - 0.7185 .

Will EUR/AUD Takes a U-turn ?Here's the 15m chart of the EUR/AUD. Currently, It's falling. And trying to hit the hurdle ( 1.5674 ). If the consecutive candles break 1.5674 , then there will be a fall. The targets for the fall will be 1.5670 - 1.5650 .

But there is a high possibility of a reversal in the trend. The trend may take a reversal from between 1.5684 - 1.5670 . If it takes a U-turn, then a target for the uptrend will be as following 1.5697 - 1.5700 - 1.5710 .

Is AUD/USD in a Short Time Fall?Here's the AUD/USD 15m chart. It started to rise from the 19th of March,2020. The actual trend is positive. Right now, it's trying to hit 0.7732 , and for that, it has to cross 0.7728 . If AUD/USD keeps moving upward, then a target for the uptrend will be 0.7740 - 0.7749 .

But there is an absolute possibility of the reversal from 0.7732 (nearby level). And if there is a reversal or a fall, then a target for the short time downtrend is as following 0.7705 - 0.7690 - 0.7680 .