Freesignals

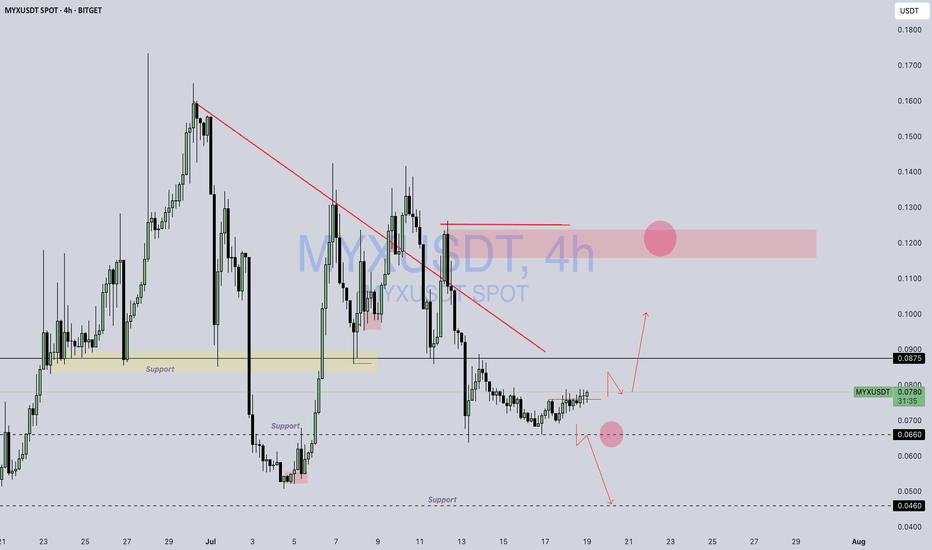

Launchcoin / UsdtBITGET:LAUNCHCOINUSDT

📊 **Technical Analysis – LAUNCHCOIN/USDT (1H, Bitget):**

* 💰 **Current Price:** \$0.10578

* 🟥 **Major Support Zone:** \$0.09000 – \$0.09800 (gray box)

* 🟩 **Resistance Levels:**

* \$0.11037 → short-term resistance

* \$0.14429 → major breakout target

* \$0.19350 → extended resistance zone

---

### 🔍 **Chart Insights:**

1. **Falling Wedge Formation**

A visible falling wedge (marked by dashed trendlines) typically signals a **potential bullish reversal**. Price is currently near the lower end of the pattern.

2. **Projected Scenarios (Red Arrows):**

* 🔁 **Scenario A:** Retest of the **support zone (\$0.090–\$0.098)** before a possible bounce.

* 🚀 **Scenario B:** Immediate breakout from \$0.110 → rally toward \$0.144 if bulls step in strongly.

3. **Key Confirmation Levels:**

* Holding above \$0.098 = Bullish interest.

* Break and close above \$0.110 = Momentum shift.

* Below \$0.090 = Breakdown risk increases.

---

📌 **Conclusion:**

Market is in a **make-or-break zone**. Structure favors a rebound if buyers protect the demand area, but confirmation via volume or a bullish candle close is crucial.

---

⚠️ **Disclaimer:**

*This analysis is for educational and informational purposes only. It is **not financial advice**. Always conduct your own research and use proper risk management before making any trading decisions.*

GBPCAD LONG & SHORT – DAILY FORECAST Q3 | D17/18 | W29 | Y25GBPCAD LONG & SHORT – DAILY FORECAST

Q3 | D17/18 | W29 | Y25

FUN COUPON FRIDAY INCOMING !

Professional Risk Managers 👋

Welcome back to another FRGNT chart update 📈

Today we’re diving into some fresh Forex setups, using a combination of higher time frame order blocks and confirmation through breaks of structure.

Let’s see what price action is telling us today 👀

💡 Key Trade Confluences 📝

✅ Daily order block identified

✅ 4H order block identified

✅ 1H order block identified

🔑 As always, trading involves a degree of risk. That’s why, as Professional Risk Managers, it’s essential that we stay disciplined—sticking to both our risk management plan and our trading strategy.

📈 The rest is left to the balance of probabilities.

💬 Fail to plan, plan to fail.

🏆 It really is that simple.

❤️ Wishing you the very best on your trading journey—I’ll see you at the top.

🎯 Trade consistent,

FRGNT X

ALUMINIUM: Selling opportunity following trendline breakALUMINIUM climbed a steep uptrend but it might meets its end with this recent break through this rising trendline. When price respects a trendline repeatedly, it becomes significant, its break indicating either a potential reversal or major pause in the trend. The candlestick that broke the trendline signals the first hint of structural change.

After breaking, price traced backward to retest the trendline. The retest manifested as a cluster of candles with wicks testing the former trendline but failing to reclaim it. That failure to reclaim, might signal seller conviction and transformation of market structure. But it would need additional confirmation to confirm the signal.

Ideally, what I look for in retests is to be met with a confirming candle, typically a bearish engulfing or marubozu closing below the trendline. This would confirm the sellers have taken over and validate the change from uptrend to potential downtrend or consolidation phase.

If I were to take a side here, I would choose more downside, but again only price action should determine next move.

However, if price breaks back above the trendline with conviction, especially engulfing the retest, it would invalidate the bearish scenario, suggesting that the uptrend may resume with fresh momentum.

Just sharing my thoughts for the charts, this isn’t financial advice. Always confirm your setups and manage your risk properly.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Volume Spread Analysis (VSA) reflects increasing selling!🚨 Bitcoin Market Update 🚨

Bitcoin recently hit an All-Time High (ATH) but is now experiencing a downward correction. Multiple technical indicators suggest continued bearish momentum:

📉 Volume Spread Analysis (VSA) reflects increasing selling pressure.

📊 A bearish engulfing pattern confirms the market is trending lower.

📕 The synthetic order book reveals a heavy concentration of sell orders.

📈 The 50 & 100 SMA are acting as strong resistance levels, keeping price action suppressed below them.

🔍 Key Watch Level: If BTC breaks above the 50 SMA, we could see a potential pump. However, as of now, all confirmations point toward a bearish continuation.

💡 DYOR – Do Your Own Research

🛑 Not Financial Advice

DOGS BUY !!!Hello friends🙌

📉Regarding the price drop, you can see that the price has been suffering for a while and even the resistance has broken, which is not a valid failure (80% of failures are fake in the range)

📈Now, with the successful failure we had and the moneyback that the price has made, we can expect the price to move to the specified targets. Note that for trading, be sure to observe capital management.

🔥Follow us for more signals🔥

*Trade safely with us*

BITCOIN UPDATEHello friends🙌

📈Given the upward trend we had, you can see that the price is in an upward channel and has also formed a bullish pattern, which, given the strength behind the trend, seems to have higher targets.

🔊Be careful, the basic principle of trading is capital management, so be sure to follow capital management.

🔥Join us for more signals🔥

*Trade safely with us*

Is Pepe growing? Read the caption, it's important.Hello friends🙌

✔Some factors caused the price to fall, but in a support area that we have drawn for you with several Fibonacci waves, you can see that a classic double bottom pattern has been formed and buyers have entered.

🔊Now there is no more news of a fall and buyers have raised the price to the point where it has created a higher ceiling and floor, and this is very important and signals a change in trend.

📈Now that the price has broken the specified resistance line and is well supported by the specified support line, we can expect the price to move to the specified areas, but do not forget that the most important thing to observe in trading is capital management⚠

🔥Follow us for more signals🔥

*Trade safely with us*

NEON : How long does the decline last?Hello friends

If you are a holder of this currency or have bought it, you should know that the token release is coming and this will cause the price to drop, so be careful.

We have identified good buying ranges for you, where you can buy in case of a drop, with risk and capital management.

*Trade safely with us*

AGI : The fall is comingHello friends

As the price has reached a strong resistance area, you can see that the price has been corrected and lower lows have been made. Now, given the token release that this currency has, there is a possibility of further decline, so we can buy at lower points with capital and risk management and move with it to the specified targets.

*Trade safely with us*

LITCOIN : So what is an ETF ?Hello friends

Be careful with the recent fluctuations of this coin because the movements of this coin have become unpredictable and we suggest that if you want to buy, buy in the specified support areas and in steps, of course with capital and risk management...

We have also specified targets for you.

*Trade safely with us*

NOTCOIN AGAIN ...Hello friends

Due to the change in the bearish structure and the weakness of the sellers, you can see that the buyers entered and were able to create new ceilings.

Now, according to the trend, we can buy in steps at the specified support points and move with it to the specified targets.

*Trade safely with us*

Will key support be held or broken today?Hello friends

According to the complete analysis we conducted on this currency, we concluded that the price correction can continue with the failure of the specified support and go to lower supports, but if buyers support the price in the support area, it can have a good rise.

Note that with capital and risk management, you can buy in steps in the specified support areas and move with it to the specified targets.

*Trade safely with us*

Solana:Daily free signalhello friends👋

As you can see, after the drop that we had, insider buyers showed and were able to support the price well.

But it was not enough, and as you can see, a noisy pattern has formed, which can indicate a further decrease in the price.

Now we can take advantage of this opportunity and make step-by-step purchases with risk and capital management in the support areas that we have obtained for you and move to the specified goals.

🔥Follow us for more signals🔥

*Trade safely with us*

Ethereum:Daily signalhello guys👋

According to the drop we had, you can see that buyers came in and the price had a good growth, and after that a trading range was made in which the price got stuck.

Now, considering that the price is in the trading range and it seems that the buyers have shown their support, it is possible to step into the specified support areas with risk and capital management and move up to the set goals.

🔥Follow us for more signals🔥

*Trade safely with us*

Xrp:The fate of Ripple in the long termhello friends👋

After a good price growth that we had, you can see that the buyers gradually exited and a triangle pattern was formed.

Now, according to the specified support, it should be seen whether buyers support Ripple or not...

You have to wait and nothing can be said until the failure of the pattern, but we suggest that you buy step by step with capital and risk management in the identified areas that are very good supports and move to the set goals.

And in the end, we must say that don't forget that we are in a strong upward trend, that the probability of the continuation of the Bister trend is the possibility of a fall...

🔥Follow us for more signals🔥

*Trade safely with us*

Dogs:Where is the time and point of purchase?hello friends👋

We come to another analysis, this time a popular coin meme that you requested a lot🔥

Well, let me start with the pattern that we specified for you, which is a sign of a price drop, and you can see this happening...

Now, in the important support areas that we have specified for you, you can buy step by step, of course, with risk and capital management.💰

🔥Follow us for more signals🔥

*Trade safely with us*

When does Bolran start?Read carefullyhello friends👋

💰Many of you are asking when Bolran will start or if it will start at all, we decided to explain it to you in a full post.

Well, you can see the Ethereum chart moving in a channel, and with a drop, it created a big fear that a fall is coming, and meanwhile, the buyers returned the price to above 2000 dollars with a strong and unexpected return.

✅️Now the price is stuck in the specified box between 2200 and 2500, and if this range is maintained, the price will easily move up to the range of 3200 in the first wave, and if it fails to maintain this range, the price will fall below 1500 dollars.

🧐Now, in our opinion, due to the rapid return of the price from the channel, this failure is a fake channel and the range will be maintained, and we are likely to see Ethereum rise in the coming weeks.

🤔You know that Ethereum is the leader of altcoins, and if it grows, important altcoins will grow, which is the beginning of Bolran, and there are important altcoins that can be used for good profit.

🌟You can join us if you like.🌟

🔥Follow us for more signals🔥

*Trade safely with us*

Price explosion is coming?Read carefullyhello friends👋

We have come to analyze a popular Kuwaiti meme that you have asked to analyze a lot.

🌟Well, according to the drop we had, it can be seen that the buyers came in and formed a good upward wave, and after that, Femt entered a channel, which can be said to be a flag pattern...🧐

Now, according to the formed channel, we can enter into a purchase transaction with capital and risk management in case of a valid failure of the channel.

🔥Follow us for more signals on Bolran.🔥

*Trade safely with us*