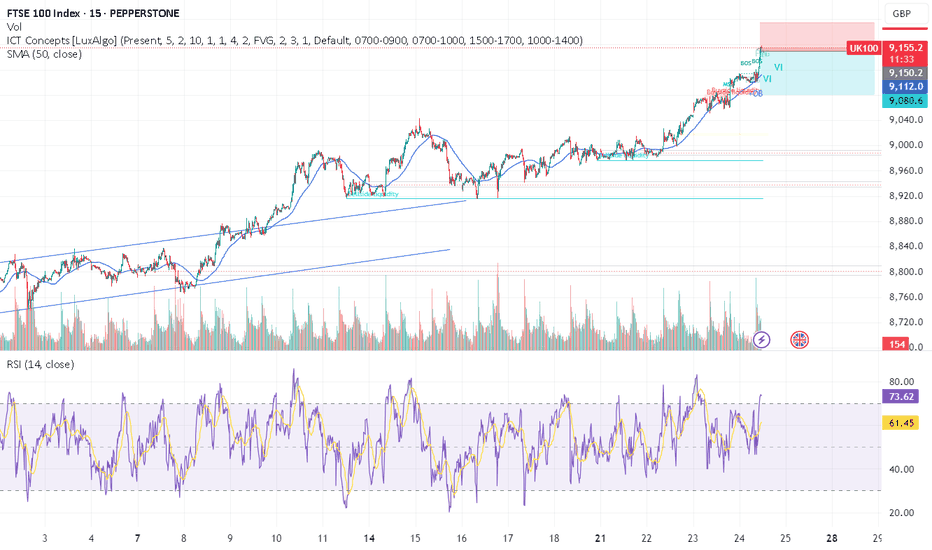

uk100 crazy pump - time to SHORTTeam, those who SHORT UK100, make sure stop loss at 9175

Target 1 at 9135-32

Target 2 at 9109-16

Last few months, UK100 has been aggressively cutting rate due to expose in recession. But now they are out of the wood.

The market has been over pricing and over value.

We expect the market to come down.

Ftse100_tradingsetup

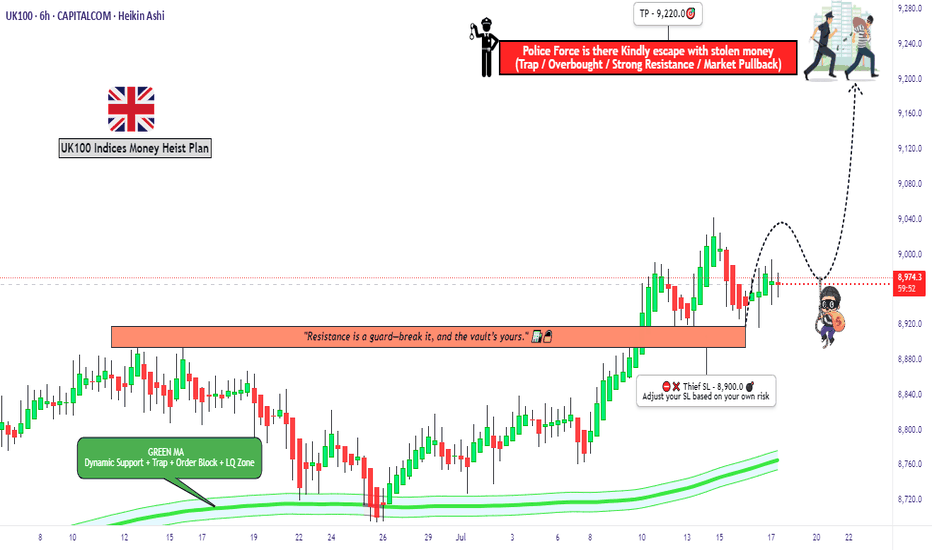

"UK100 Bulls Vault Open! Grab the Loot & Escape Early"🏴☠️💰"UK100 / FTSE100 Market Heist Blueprint" – A Thief Trading Operation for High-Profit Target Extraction 💼📈

🌍 Hola! Hi! Bonjour! Ola! Hallo! Marhaba!

To all the Market Robbers, Smart Thieves, and Strategic Money Makers — welcome to another Thief Trading Heist Plan™.

Ready your gear and charts — the UK100 / FTSE100 index is our next vault.

🔥Heist Objective: Swipe the Bullish Loot Before the Police Trap Hits! 🔥

Based on sharp Thief-style technical and macro-fundamental analysis, the market is showing bullish exhaustion and early signs of trap reversal zones. Our goal is clear: extract max value from the bulls and escape before the heat catches on.

🚨The current price action is nearing a Red Zone — high-risk area filled with potential police traps (supply zones, resistance, and bear setups). Timing and smart entries are key.

🎯 Strategy Overview (Day/Swing Trade)

Entry Plan:

🟢 “The Vault’s Open!” – Start accumulating long positions now or set buy limits near recent 15m/30m swing lows. Layer your entries (DCA method) for better control and efficiency.

Stop Loss (SL):

🔐 SL below recent swing low on 4H timeframe (~8900.0)

Adjust based on your risk appetite, position size, and how many layered orders you've got lined up.

Target Zone (TP):

🏁 Primary Target: 9220.0

Always be ready to exit early if market signals shift. He who escapes lives to rob another day.

🧲 Scalpers Note:

Only operate long within this framework. Big capital players can jump in earlier; others can trail behind with the swing traders. Always use trailing SLs to lock in stolen loot and reduce exposure.

📰 What's Driving the Market?

Current bullish sentiment is backed by:

Fundamental strength

Sentiment & COT reports

Macro data & intermarket correlation

Geopolitical & institutional flow analysis

Stay updated through your reliable sources and plug into key market dynamics and positioning reports.

⚠️ Trading Precaution:

🚫 Avoid new positions during high-impact news

💼 Manage your trades with care

🔁 Use trailing SLs to secure profits during volatility

💥Boost the Robbery – Support the Crew💥

If this heist plan aligns with your mission, smash that Boost button. Support the thief movement, and let’s build a strong trading crew where money is made with precision, strategy, and no mercy. 💰🤑

🔒 Final Notes (Read Before You Rob):

📌 This is a strategic trade setup, not financial advice. Always tailor the plan based on your risk management, capital size, and market conviction.

📌 Markets evolve. Stay alert, adapt fast, and trade like a thief — unseen, smart, and always two steps ahead.

💬Drop your thoughts, results, or setups below — and if you're in, type "HEIST READY" in the comments.

Stay tuned, another plan is on the way... 🏴☠️📊🔥

FTSE 100 Surges Towards Record HighFTSE 100 Surges Towards Record High

Today saw the release of new data on the UK labour market.

According to official statistics, the number of payrolled employees in the UK fell by 55,000 (0.2%) between March and April 2025. Over the broader period from February to April 2025, the number declined by 78,000 (0.3%).

In response to the drop in employment, the UK’s FTSE 100 index (UK 100 on FXOpen) jumped sharply, rising close to the 8,900 mark — near its all-time high reached in early March this year.

Market participants likely interpreted the weakening labour market as an additional argument in favour of interest rate cuts by the Bank of England. Such a move would be seen as supportive of the economy and a bullish factor for equities.

Technical Analysis of the FTSE 100 (UK 100 on FXOpen)

From a technical perspective:

→ The FTSE 100 continues to trade within an ascending channel (shown in blue);

→ Today’s bullish momentum broke through the resistance line from below — a level that had previously capped the upward movement within the channel.

If the bulls can maintain the price above the 8,860 level, the likelihood increases for a continued uptrend and a potential new all-time high for the FTSE 100 index.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

UK100/FTSE100 - FOLLOW THIS STRUCTURE, SURELY YOU MAKE PROFITTeam, last night for the first time I make LIVE trading on video.

Everyday i did LIVE trading but not recording

last night we have SHORT EURUSD, LONG USDCHF, LONG US30 LONG NAS AND SHORT GOLD - 5/5 perfectly hit target

Today I want to show you the structure how we can deal with UK100/FTSE100

SHORT UK at 8817-26 - double up at 8846-62

lets set this LIMIT ORDER IN

Target 1 at 8792-96

Target 2 at 8776-8755

Lets kill the market tonight!

UK100/FTSE100 - time to short slowlyTeam, let's kill the UK100/FTSE100

last night, we got target hit both in 15 minutes during LIVE trading. Today we are going to short the UK slowly according to the strategy set out

Please note: Target 1 will be around 8778-8771

Once it hits, take 70% and bring a stop loss to BE

Target 2 - will unload the remaining 30% volume.

Please carefully look at the chart. There is a section where if the market goes against you, please double up at that section; that would allow us to make double the profit. However, when it pulls down to our original short, we can take those profits.

"UK100 Grand Heist: Bullish Loot Plan with Thief Trading Style!🌍 Hello, Global Wealth Warriors! Ciao, Salut, Guten Tag, Ola! 🌟

Fellow Profit Pirates & Market Mavericks, 💸⚡

Unveiling our cunning blueprint to plunder the "UK100/FTSE100" Index Market, crafted with 🔥Thief Trading’s razor-sharp technical and fundamental insights🔥. Stick to the chart’s game plan, zoned in on a long entry. Our mission? Slip out near the high-stakes ATR Zone Level—a perilous spot with overbought vibes, consolidation, trend flips, and traps where bearish bandits lurk. 🏴☠️💰 Celebrate your wins, traders—you’ve earned it! 🎉

📈 **Entry Point**: The vault’s unlocked! Grab the bullish bounty at current prices—the heist is live!

💡 Pro Tip: Set buy limit orders on a 15 or 30-minute timeframe, targeting recent or swing lows/highs. Don’t forget to set chart alerts for precision! 🚨

🛑 **Stop Loss**:

📍 Thief SL parked at the recent/swing low on the 4H timeframe (8500.0) for day/swing trades.

📍 Tailor your SL to your risk appetite, lot size, and number of orders. Stay sharp!

🎯 **Target**: Aim for 8850.0 or make a swift exit just before.

👀 **Scalpers, Listen Up**: Stick to long-side scalping. Got deep pockets? Dive in now! Otherwise, join swing traders for the grand heist. Use trailing SL to shield your loot. 💰

💹 **Market Pulse**: The UK100/FTSE100 is in a neutral zone but leaning bullish, fueled by key drivers. ☝

🌐 Dive into fundamentals—macro economics, COT reports, geopolitical updates, sentiment, intermarket analysis, and index-specific trends. Check the linkss for the full scoop! 🔗🌍

⚠️ **Trading Alert**: News can shake the market! 📰

🔐 Protect your positions:

- Pause new trades during news releases.

- Use trailing stop-loss to lock in gains.

💪 **Join the Heist**: Smash the Boost Button to supercharge our robbery squad! 💥 With Thief Trading Style, we rake in profits daily with ease. 🚀 Your support fuels our market conquests. 🤝❤️

Stay tuned for the next daring heist, money makers! 🤑🐱👤🎯

UK100 - STRATEGY TO MAKE MILLIONSTeam, you have been killing the UK100 last week,

YESTERDAY, we will the AUS200

every day is a winning for us. I am about to make a video of education on how to kill the market daily!

Today we are preparing to short UK at 8742-8756

DOUBLE UP the short at 8785-96

Target range 1 at 8705-15

Target range 2 at 8672-8658

Remember: be humble, be focused and always care about risk management. Now, let's kill the UK100 market together.

"UK100" Indices Market Bearish Heist Plan (Swing / Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🚀

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "UK100" Indices CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Yellow Moving Average Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (8530) then make your move - Bearish profits await!" however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most nearest or Swing high or low level should be in retest.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at (8670) Day / Swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

Primary Target - 8460 (or) Escape Before the Target

Secondary Target - 8350 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"UK100" Indices Market Heist Plan is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

FTSEFTSE 100

Clear trendline up, pattern formed - you could wait for daily close and see if this bearish formation comes into fluorescent.

Key an eye

1. Trendline and 2. The pull back reaction (Whos in control)

Trade Journal

FTSE pulls back into support zone, bullish trend remains strongAn interesting setup may have formed on the FTSE 100 daily chart. It has seen a strong rally from its October low and since produced a relatively shallow pullback from the 7600 resistance zone. The RSI (2) was oversold on Thursday and curled higher on Friday, which closed the day with a Spinning Top Doji candle to suggest a swing ow has formed. Furthermore, the 50-day EMA and monthly pivot point are supporting the pullback, so we’re now looking for a bullish swing trade and for the market to move higher.

Take note of the plethora of UK data released shortly, and the UK are set to release employment data tomorrow, inflation data on Wednesday and the BOE announce their monetary policy decision on Thursday.

$FTSE - Where to next? Longer term.$FTSE - Where to next? Longer term.

Here's a look of what could happen with the ftse going forward.

Technical view:

Got a stocks and share ISA? Take advantage of the great price points. As we are getting towards end of the year adjusting portfolio and to seek out further long term positioning. One specific instrument I have been looking at is the FTSE - Any pull back towards 700-630 - I will be buying the dip! The same principle goes for various other indices as well. FTSE - Inverse H&S if we break below 620 - this idea is no longer valid. I will be taking into considerations fundamentals as well.

Not Signal Provider or Investment Advice

FTSE100 - UKX - WHERE TO NEXT?FTSE100 - Where to next?

Technical pattern break out to either direction!

It's been my favourite trade since 2019. However, it does look a little overextended but let's see which way it breaks out towards and that's trade I will be taking short term

Don't forget - Follow your trade plan!

Trade Journal

FTSE100 LONG Stocks getting hammered with this risk off mood and although it might not be the time to go bottom picking, I certainly don't want to miss out on this dip. As things stand, the UK is set to open up in the coming weeks, vaccine roll out continue to be a success, and therefore I am adding some FTSE100 to the list of things to buy.

Long - 7030

TP- 7300

SL - Nothing firm in place at the moment.

DARKTRACE Technical Levels Long Opportunity Without question DARK is a stock to be following in the world of AI and Cyberattacks

which seem to be all we read about just lately See WEF for enlightenment .

Technically we are sitting in the middle of a ascending channel

which we have been trading inside of since June .

I have drawn some levels using FIB to provide some areas of support and Entry if

any one wishes to start scaling in .

The IPO was 2.50 back in April and since then DARK has already printed 10.00GBP as a ATH

on Sept 24 followed by a 30% retrace and now retesting those previous highs again although

I am expecting the levels I have given to be claimed in the coming months.

Appreciate Likes Follows and constructive feedback .

See below for other Trade Setups

UK100 long is valid ↗️✅Morning traders we start the week with an UK100 trade.

Trade details for current trade are shown on the chart.

Trade has been live since 7:15 UK time and we are using our POW reversal script.

We are working the 15M time frame on this strategy.

We're looking for the green line which is take profit target.

Little blue long arrow is entry point and purple line is stop loss.

Previous trades can also be seen on chart.

Trade history can be seen at the foot of this trade idea too for full transparency.

------------------------------------------

I try and share as many ideas as I can as and when I have time. My trades are automated so I am not sat in front of a screen daily.

Jumping on random trade ideas 'willy-nilly' on Trading View trying to find that one trade that you can retire from is not a sustainable way to trade. You might get lucky, but it will always end one way.

------------------------------------------

Please hit the 👍 LIKE button if you like my ideas🙏

Also follow my profile, then you will receive a notification whenever I post a trading idea - so you don't miss them. 🙌

No one likes missing out, do they?

Also, see my 'related ideas' below to see more just like this.

The stats for this pair are shown below too.

Thank you.

Darren

Ocado Group Huge potential Time to Buy for 50%+Like many other Businesses that were positively impacted by the Pandemic OCADO was clearly one of them .

This UK Stock is a must have in any portfolio, what the Internet done to Blockbuster is what

Ocado will do to the Supermarket eventually.

March 2020 OCADO begins to break out and establish a Bullish Trend and prints fresh ATHs during Sept,

followed by a 40 % retrace lasting until December 2020 and then a retest of the highs which took us to

the end of January 2021.

Since the retest of the highs in January we have been in a retrace which is very close to completion .

The pattern you see is the Deep Crab harmonic, with the area to buy clearly marked *PRZ Price Reversal Zone

I have marked out some potential take profits that you can expect to recieve upon completion of the Harmonic.

Swing Trade or Long term investment this Stock is a must have and truly is the Amazon of the supermarket industry.

Ocado Group is a publicly-traded company that develops software, robotics, and automation systems for online retailers. Ocado Group undertook an initial public offering on the London Stock Exchange on 21 July 2010, and is a member of the FTSE 100 Index.

Ocado Group was built upon its retail business in the UK, Ocado Retail Limited, which is a separate legal entity today. However, Ocado Group has evolved from a retail business to a technology company and it is claimed that it is valued more like the US technology company Amazon than its retail counterpart Tesco in the UK. On 21 November 2019, following the creation of a 50/50 joint venture company with retailer Marks & Spencer (Ocado Retail Limited), Ocado was no longer required to call itself a grocer by the Competition and Markets Authority.

Ocado Retail Limited (ORL) or Ocado.com is Ocado Group's British retail partner and an online supermarket that uses Ocado Group technology.

The Ocado Smart Platform is Ocado's hardware and software platform for operating retail businesses online. Clients include the following supermarket chains: Morrisons (UK); ICA (Sweden); Group Casino (France); Sobeys (Canada); Kroger (USA) and Bon Preu (Spain).

The Ocado Smart Platform (OSP) is the organisation's 'suite of solutions for operating online grocery businesses'. The platform supports retailers with webshop, mobile applications and voice ordering for their end consumers.

Ocado Group's physical warehouses called “Customer Fulfillment Centres” (CFC) are also part of the smart platform along with the store pick technology that it sells to its partners.

OSP also supports last mile technology which includes fleet management, routing and delivery planning.

Ocado Group claims that the platform was created at an “intersection between six disruptive technologies: AI, Robotics, Digital Twins, Cloud, Big Data, and IoT. Ocado Group’s proprietary technology is protected by over 200 patents.

A must watch www.youtube.com

www.youtube.com

UK100: Daytrade-OPPORTUNITY#WEEK 34 Nr.12Hey tradomaniacs,

welcome to another free signal!

How to trade: 1. Wait for the break through the trendline and see if we bounce off after retest.

2. If we reject at the trendline and see a S&R-FLip we can buy.

-----------------------------

Type: Daytrade

Buy here: 7178,9

Stop-Loss: 7158,7

Target 1: 7198,7

Target 2: 7210

-----------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

FTSE100 GBP hits the channel support | Upto 5.8% potentialAfter Jan 19 the priceline of FTSE100 GBP is hitting the support of up channel.

The price action has also support of 100MA and 200MA.

There is also a golden cross formation expected beneath the candle sticks which will produce a massive bullish divergence insha Allah.

I have used Fibonacci sequence for sell targets as below:

Sell between: 650.3 to 669.2

Regards,

Atif Akbar (moon333)

A long-term trading opportunity to sell in E100. Wait to Hunt!!Technical analysis:

FTSE is in a downtrend, and the continuation of downtrend is expected.

The price is below the 21-Day WEMA which acts as a dynamic resistance.

The RSI is at 45.

Trading suggestion:

The price is still in a downtrend and we forecast the downtrend would continue.

There is possibility of temporary retracement to suggested resistance zone (2900 to 2933), if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (2900)

Ending of entry zone (2933)

Entry signal:

Signal to enter the market occurs when the price comes to "Sell zone" then forms one of the reversal patterns, whether "Shooting star" or "Peak" , in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and special version of our "Price Action" strategy FOLLOW our lessons:

(We have started to prepare these lessons in TradingView. If you want us to continue, give us feedbacks!)

Take Profits:

TP1= @ 2851

TP2= @ 2806

TP3= @ 2764

TP4= @ 2717

TP5= Free