FTSE MIB Elliott Wave Analysis UpdateCompared to the last update, the first scenario seems to have been confirmed, which represented Minor X wave as an expanding triangle. The first Intermediate 4 wave target we had set was reached (0.5 Intermediate 3 retracement and Minor W 0.786 extension). Minor Y wave is still in construction and seems to be forming like a zig zag. Wave B Minute seems to have ended up as a double correction (w-x-y / descending triangle - zig zag). The next target is 20600 (Minor W extension and 0.382 Minute A extension). It follows the target 20800 (0.618 retracement of Intermediate 3 and 0.618 extension of Minute A.) The alternative scenario is that Minute B wave has not yet concluded (hypothesis valid if there is a further extension with respect to the 3 Minuette wave currently in formation and if consequently the index goes below 20290, overlap of Minuette 4).

FTSE MIB Index

FTSE MIB Elliott Wave Analysis UpdateThe FTSEMIB remains in its phase of correction of the long-term bearish trend. In particular, Wave 4 Intermediate would seem to be forming as a double three (double correction) WXY of Minor degree. The latter after finishing the W as flat expanded, has given way to the X, which at the moment seems to have completed as a double three (WXY) Minute grade. The latter was formed as a double zig zag, and the sub-waves of X Minute are a double correction of Minuette degree (expanded triangle / zig zag). The current scenarios in the short term are:

-as just described Wave X Minor ended and Wave Y Minor started, in particular we would be in its first sub-wave;

- Wave X Minor did not end as a double three, but is forming a triangle (ABCDE) or a triple correction (WXYXZ).

One possible target of Y Minor is the Fibonacci retracement of Wave 3 Intermediate as illustrated in the daily chart on the left.

Bullish channelBullish channel on FTSE MIB on the daily chart. 20226 could play resistance.

***As usual, not a trading advice of any sort. Informational and educational purposes only***

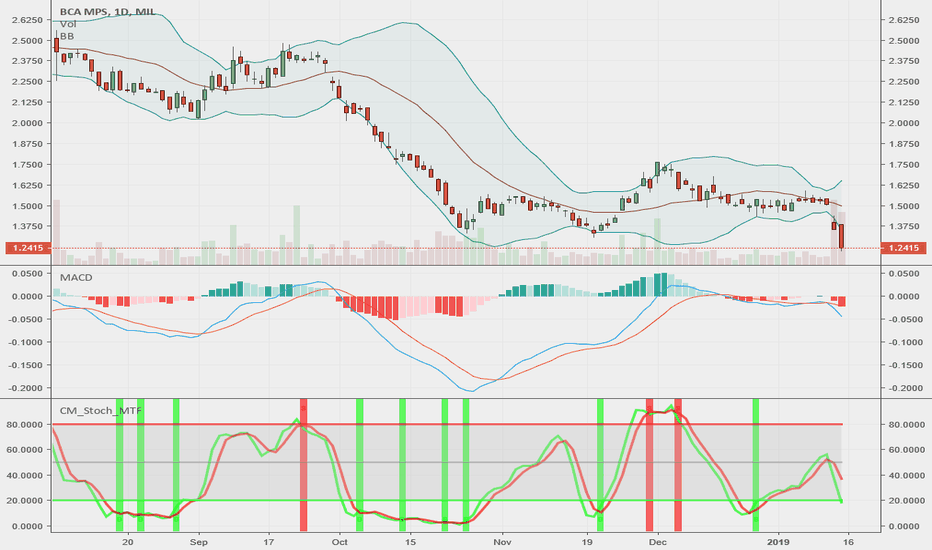

BANCA MONTE DEI PASCHI DI SIENA - SHORT Guys,

A long black candle associated to increased volumes and the widening out of the Bollinger Bands give us a clear indication about the

next direction downwards.

A closure below the horizontal support will be devastating. 1st target at 1 euro. There is much more room to see the stock tumbling down

below 1 Euro

Thank you guys,

Simone

A friend of mine from Morgan calls me because stocks are cheap And the answer is... not exactly! FTSEMIB It could go even lower than you think. This is a weekly chart so there's no call here.

Sidenote: "Top-notch entries are exclusive to members of Cream Live Trading"

Learn how to beat the market as Professional Trader with an ex-insider!

Have a Nice Trading Week!

Cream Live Trading, Best Regards!

Italian FTSEMIB compared to US S&P500, Dax30 and UK's FTSE100Just a simple comparison for the italian index starting from its highest peak in 2000 with the US S&P500, Dax30 and FTSE100

In Desperate Need of ‘The Prince’Couldn’t find good long-term data for the Italian stock market. The price action going into 2000 is clearly an upwards correction. Since 2000, the MIB has traced out a Simple Flat, follow by a triangle B Wave and the ensuing Super Cycle C Wave is going to be brutal. 'Italy' will cease to exist as a political entity by mid-2020…

'Italy' has always been desperate to find their ‘Prince’. A good guy who could beat the corrupt villains at their own game, and a champion of the people. This current Band of Merry Socialist Villains are not it. Socialists invariably con the people out of their money with promises of shared wealth and equality. The Socialist politicians embezzle the wealth and the people share equally in misery.

'Italy' needs a hard-core economic reboot. Close the insolvent banks, disavow the unpayable government debt, issue a sound Italian Lira based on PM’s backed by 'Bill's of Exchange, kick out trifling foreigners that bring nothing of value to the country, and raise troops because you are going to have to defend your borders…

FTSEMIB - Negative Bias Continues Our bias on the Italian stock market continues to be short. The deadline for presenting an acceaptable budget to the EU is Oct. 15th, and no progress has been made. Italy still remains on an opposing foot and thus the markets are maintaining the pressure on Italian stocks.

Bounce then sell-off?If there will not be good news for the Italian economic planning, I am expecting a bounce next week to re-test the resistance, then sell-off.

FTSE MIB got rejected hard from the monthly 200 MA on May 2018, when the new government was made. Since then, markets didn't do well at all.

FTSEMIB - Biased Down on Budget IssuesItalian stocks are taking the hardest hit in Europe, on recent budget issues.

FTSE MIB - POTENTIAL BOUNCE FOR ONE MORE WAVE DOWNFTSE MIB has broken the main uptrend on daily chart. Bullish divergence for a potential bounce, but i'm expecting one more wave down.

[FTSE-MIB] BULLISH CONSOLIDATION?From a technical point of view, the Italian index could trigger something like a wave (5), and if this is correct, we do not rule out a new TOP in the medium term. That said, we can try to take a long position around 21.536/21.351, and put stop loss below 21.153. This setup has a good R/R ratio (> 1: 3).

if you think this analysis can be useful, leave a your comment or your LIKE!

Thank you for support and trade with care!

FTSEMIB - Italian IndexHello traders! Today i want to show you FTSEMIB - italian index! It finally broke 24000 resistance area that as you can see from a weekly perspective it was a really important resistance zone! Usually don't post a lot of ideas about indexes but this one is really a nice breakout! Have a nice day traders!

Long FTSE MIB @ 21,750.50; TP @ 22,185.50, SL your choiceLong FTSE MIB @ 21,750.50; TP @ 22,185.50, SL your choice

FTSEMIB index is a short till 22000-21500Hello Guys,

As expected and suggested in a previous post, I was expecting to see the index hitting 25000 points.

Now I expect to see the index going back at least to 22000 / 21500 in the short term.

See you soon with new trading ideas,

Simone

LONG FTSE MIB 23700 Goodmorning everyone,

the corrective wave 4 (minor) now seems to have stopped, and wave 5 (minor) has started,that is a bullish propulsive wave. Currently we are at the beginning of wave 3 (minute), with input signal confirmed by Supertrend. Objective fixed with Fibonacci where wave 3 (minute) would assume equal extension of wave 1 (minute). I remember that wave 3 is never the shortest wave in a propulsive movement. Supertrend is used by trailing stop.