FTTUSDT

METISUSDT UPDATEMETISUSDT is a cryptocurrency trading at $17.57. Its target price is $32.00, indicating a potential 80%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about METISUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. METISUSDT is poised for a potential breakout and substantial gains.

KAVAUSDT UPDATEKAVAUSDT is a cryptocurrency trading at $0.4711. Its target price is $0.7500, indicating a potential 70%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about KAVAUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. KAVAUSDT is poised for a potential breakout and substantial gains.

Breaking: FTT Has to Break This Price Levels to Start A BullrunThe defunct platform native token TSX:FTT has been on a falling wedge lately losing about 50% of value as the long lasting lawsuit against her founders most especially Sam Bankman-fried is showing no signs of ending.

The token has long been oversold with the RSI at 38.45 further solidifying our thesis and in order for TSX:FTT to start a trend reversal to recent highs it has to break through the 78.6 and 38.2% Fibonacci retracements levels respectively in other to pave way for a bullish spree.

In a Recent new, according to a Bloomberg report, the FTX bankruptcy case has cost almost $1 billion in fees, making it one of the costliest bankruptcy cases in America’s history. So far, lawyers have collected around $948 million to work on the Chapter 11 case through January 2. Meanwhile, court records show that the court has approved over $952 million in fees.

This revelation comes following the FTX repayments, which kicked off on February 18. Despite the hefty fees paid for the bankruptcy case, legal experts suggested to Bloomberg that it was worth it, seeing as these lawyers were able to track billions of dollars in digital assets and cash, which the defunct exchange had scattered across several networks of accounts.

FTX Founder Sam Bankman-Fried's Prosecutor QuitsThe cryptocurrency world is once again witnessing the ripple effects of legal drama surrounding FTX, as Danielle Sassoon, the prosecutor responsible for securing Sam Bankman-Fried’s conviction, has resigned. With speculation mounting about the implications for Bankman-Fried’s appeal, the TSX:FTT token is at the center of renewed attention. But does this development signal a fundamental shift for the beleaguered exchange token, or is it merely another headline in FTX’s tumultuous history?

Prosecutor’s Resignation: What Happened?

Danielle Sassoon, a key figure in the prosecution of Sam Bankman-Fried, played a pivotal role in exposing inconsistencies in his testimony, ultimately leading to his conviction. Bankman-Fried was found guilty of fraud, conspiracy, and money laundering, resulting in a 25-year prison sentence.

However, in a surprising turn of events, Sassoon resigned from her role as Acting U.S. Attorney for the Southern District of New York after just three weeks. Reports indicate that her decision stemmed from a disagreement with the U.S. Department of Justice (DOJ) regarding a corruption case against New York City Mayor Eric Adams. In an 8-page resignation letter, Sassoon expressed her unwillingness to comply with a DOJ directive to drop charges against Adams, citing a lack of legal justification for dismissal.

Her departure has ignited speculation within the crypto community. Some believe that a shift in prosecutorial stance could impact Bankman-Fried’s appeal, potentially influencing TSX:FTT ’s trajectory in the market. While such an outcome remains highly speculative, traders are watching closely for any developments that could alter TSX:FTT ’s sentiment.

Market Reactions and Technical Outlook

As of writing, TSX:FTT is down 4.27%, consolidating within a bearish zone after surging to nearly $4 in recent weeks. The token has struggled to maintain bullish momentum, with volume appearing weak amid market uncertainty.

Key Technical Indicators:

TSX:FTT remains in a downtrend after failing to hold its recent highs. A lack of significant buying While Sassoon’s resignation might be perceived as positive news for FTX’s former CEO, it remains uncertain whether this will translate into tangible gains for $FTT.

Can TSX:FTT Stage a Comeback?

Despite the legal drama, TSX:FTT ’s long-term outlook remains tied to the broader fate of FTX’s bankruptcy proceedings. The exchange collapsed in November 2022, leaving creditors and users grappling with the fallout. While certain developments, such as potential asset recoveries, could provide some relief, TSX:FTT ’s intrinsic value has been severely diminished due to the exchange’s downfall.

However, some traders see opportunities in TSX:FTT as a speculative asset, banking on volatility-driven short-term price swings.

Conclusion

While Danielle Sassoon’s resignation introduces a new narrative into the FTX saga, its tangible impact on TSX:FTT remains speculative at best. The token continues to trade under bearish conditions, and without a fundamental catalyst, a strong recovery remains unlikely in the near term. However, for short-term traders, volatility surrounding legal developments could present trading opportunities.

As the situation unfolds, investors should remain cautious, keeping an eye on both technical patterns and legal updates that could shape TSX:FTT ’s trajectory in the weeks ahead.

FTTUSDT: Is a Major Breakout Coming? Watch These Key Levels Now!Yello, Paradisers! Is FTTUSDT gearing up for a strong bullish reversal, or is this just another trap? Let’s break it down.

💎FTTUSDT has completed a proper ending diagonal with a clear 5-wave count, signaling a potential trend shift. Adding to the bullish case, we’re also seeing an inverse head & shoulders pattern forming, along with a bullish divergence, both of which increase the probability of an upward move.

💎If the price breaks out and closes candle above the resistance zone, it will confirm the pattern, setting the stage for a strong bullish move.

💎If the price breaks down and closes candle below the support zone, the bullish setup will be invalidated, and in that case, it’s best to stay patient and wait for a better price action setup.

🎖The market always gives opportunities, but only disciplined traders take full advantage. Stay sharp, Paradisers—patience and strategic execution are key to long-term success.

MyCryptoParadise

iFeel the success🌴

FTX Set to Begin Creditor Payouts in 2025: What It Means?The long-anticipated creditor repayments for FTX are finally set to commence, marking a pivotal moment in the exchange's financial restructuring. However, as with any major development in the crypto space, there are conditions, concerns, and market implications that traders need to be aware of. Here’s a breakdown of the upcoming FTX payout process and its potential impact on the price of $FTT.

FTX Creditor Payouts: Key Details

On February 18, 2025, certain FTX creditors will begin receiving their payouts, with those in the Convenience Class (claims up to $50,000) first in line. Under the restructuring plan, these creditors will receive 119% of their recorded claims, valued based on November 2022 asset prices, along with an additional 9% annual interest. However, all payments will be made strictly in stablecoins—excluding Bitcoin, altcoins, or any other crypto assets.

To receive payouts, users must complete KYC verification, submit tax documents, and select a distribution platform. Available payout platforms include Kraken and BitGo, but regional restrictions will apply, particularly in jurisdictions like Ukraine.

John J. Ray III, the chairman of the FTX liquidation committee, emphasized the importance of this step, stating:

"Today's announcement reflects the outstanding success of our recovery and coordination efforts over the past 28 months. These efforts are ongoing, and our focus remains on executing these distributions in accordance with our plan while also continuing to pursue the recovery of outstanding assets."

Scam Alerts and Delays in Compensation

As FTX prepares to distribute funds, scammers have seized the opportunity to defraud unsuspecting users. Fraudulent emails, phishing websites, and malware-laced links have surfaced, posing significant threats to creditors. Users are advised to only engage through official FTX channels and to verify any communications regarding payouts.

FTT Price Action: What’s Next?

The FTX Token ( TSX:FTT ) has experienced notable volatility amid these developments. At the time of writing, TSX:FTT is down 5.41%, trading in bearish territory, with eyes on its 1-month low as a support level.

A drop to this critical support zone could serve as an attractive entry point for traders, given that the level previously acted as resistance before flipping to support. If TSX:FTT manages to hold this range, it may attract fresh buyers looking for a reversal opportunity.

Conversely, a break above the 1-month resistance zone could trigger a strong influx of buyers, potentially leading to a 50% price surge. This scenario would depend on overall market sentiment and any further updates regarding FTX’s ongoing asset recovery efforts.

Market Sentiment and Final Thoughts

While the launch of FTX creditor repayments is a step forward in closing one of crypto’s biggest bankruptcy cases, uncertainties remain. Traders should monitor key technical levels for TSX:FTT while staying updated on regulatory and legal developments surrounding FTX’s liquidation.

FTT ANALYSIS📊 #FTT Analysis

✅There is a formation of Falling Wedge Pattern on daily chart with a breakout and currently trading around its major support area🧐

Pattern signals potential bullish movement incoming after a successful retest

👀Current Price: $1.946

🚀 Target Price: $3.050

⚡️What to do ?

👀Keep an eye on #FTT price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#FTT #Cryptocurrency #TechnicalAnalysis #DYOR

ACTUSDT UPDATEACTUSDT is a cryptocurrency trading at $0.4312. Its target price is $0.8000, indicating a potential 100%+ gain. The pattern is a Falling Wedge, which is a reversal pattern. This suggests that the downward trend may be coming to an end. A breakout from the Falling Wedge could lead to a strong upward move. The current price may be a buying opportunity. Investors are optimistic about ACTUSDT's future performance. Reaching the target price would result in significant returns. The Falling Wedge pattern is a bullish signal, indicating a potential trend reversal. This could be a lucrative investment opportunity.

Ftx token ( FTT)Ftt usdt Daily analysis

Time frame 4hours

Risk rewards ratio >2.5 👈👌👈👈

First target 4.5 $

Second target 5.45 $

LS should have been chosen very close to the entry point (a little below the diagonal line), but in order not to be caught, I chose LS much lower, so that over time and as the price grows, I will also raise LS and make it risk-free.

Good news has also been heard in cyberspace about the new management of the FTX exchange, which is paying off its debts, and this is a positive sign for the future this currency and it is likely to return to its original position, the price range before the problems it had with the Binance exchange. (20-25$)

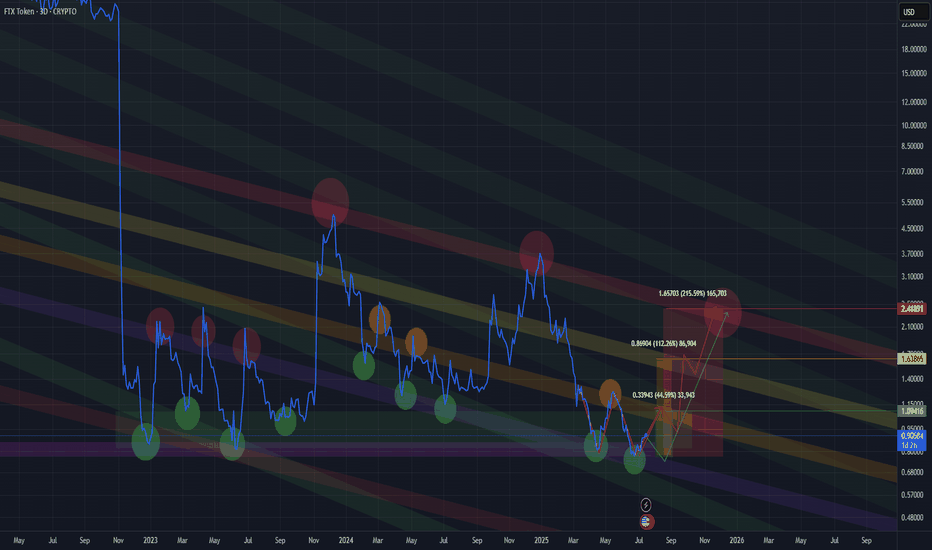

$FTT FTT ftx 2 year consolidation between 0.9 - 2.8.... Uptrend?TSX:FTT Ftt Ftx consolidation has spanned from Nov. 2022 till now

A 2-year consolidation between price range 0.9-2.8

Current price: $3.1

My SuperAI just confirmed a super Uptrend on the 3day Timeframe.

A break out from this range will lead up to major resistance 5.5, 6.4

A continuous uptrend can lead up to $21

Invalidation of this #FTT idea is under $2.7

[FTT/USDT – 4H Update]FTT/USDT has broken out of a bullish pattern, signaling potential upside.

Key Level to Monitor:

Yellow Resistance Zone: This is the area to watch, as sellers could return here.

The breakout looks promising, but keep an eye on how price reacts at this resistance. Are you tracking it?

FTTUSDT %378 Daily Volume Spike FTTUSDT has recorded a 378% daily increase in trading volume.

To capitalize on this increase:

I will closely observe the price movement toward the blue boxes on the chart.

I will evaluate potential upward breakouts in lower time frames from these regions to identify entry opportunities.

This strategy allows for careful monitoring and reduces unnecessary risk.

Let me know if you want further edits or additions!

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

FTT is about to riseFrom the point where we placed the green arrow on the chart, it seems that FTT has initiated an ABC pattern or a more complex structure. Wave B also appears to be a triangle that is nearing completion.

We expect FTT to soon enter a major wave C.

As long as the green zone is maintained, it can pump toward the TPs.

Closing a daily candle below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You