#FTX/USDT Breakout soon#FTX

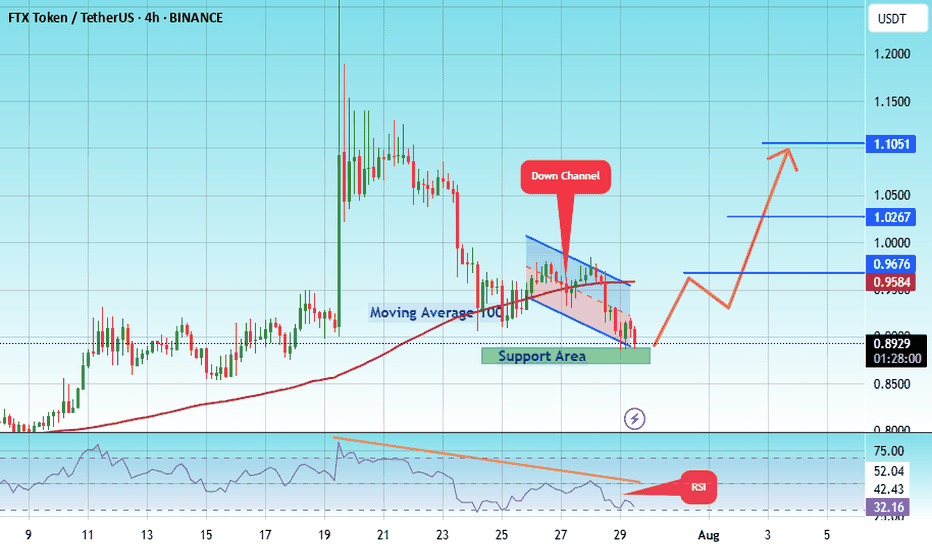

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on track to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.8800.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.8760, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.8932

First target: 0.9584

Second target: 1.0267

Third target: 1.105

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

FTX

The Black Swan Method- Making TA as a trader is like reading a magical ball but some major unpredictable events are out of control.

- i usually accurate most of the time but i should be a fool to think i am always right, it's impossible to make TA in that markets conditions.

- So this post is not to make some kind of predictions but to warn peoples on what's going on right now.

- i will try to explain very basically the situation (with my bad english skills, so forgive me if i make some mistakes) :

1/ the first attack was based on Luna and UST, some entities started to short UST/Luna with some billions $, FTX and SBF surely did it. Luna tried to save the situation with their BTC reserve but it was effortless. they lost all. (Luna have never been hacked, important to specify this )

2/ the fail of UST was the first step to create a snowball effect.

3/ 3AC, Celsius, Voyager, and much more were all involved in Luna/UST and Anchor Protocol witch was giving 18% returns on UST. They used customers funds in UST and staked, when the situation started to turn really bad for Luna, they tried to save the situation trading customers funds and they failed. (any of those companies have been hacked, important to specify this )

4/ FTX used customers funds and started to short their own products, FTT, SOL, SRM, etc , Binance saw the move and twitted that they will drop all their FTT.

FTX locked their customers wallets. FTX used 8B$ Customers funds to short markets. they are still right now trying to short USDT on Binance. (FTX have never been hacked, important to specify this).

5/ The snow ball started to be transformed in an avalanche. The damage here is huge. An exchange implosion of this magnitude is a gift to bitcoin haters all over the world.

6/ Sam bankman-fried was a Trojan horse in the crypto space, surely backed by banks and govs, a kind of worm witch have to be eradicated.

7/ Soon bankers will tell you, " u saw what happened with your exchanges ??!!, better use CDBC and stick with Banks!! ", this is their ultimate goal.

- i pray for everyone who got caught up in this mess and lost money with those bad actors.

- i hope you take care of yourself and continue to be a part of this journey.

- i hope it doesn't turn you off of crypto witch are here to stay in the future.

- BTC is resilient. No matter the magnitude of the earthquake.

- Buy BTC

- Store in Ledger, Trezor or Paper Wallet.

- Hodl and come back later.

Have faith in what you believe and fight. Thanks for reading!

PS : Not sure this post will get me banned or censored, but at this point the freedom of speech is an human right.

#FTX/USDT#FTX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 1.23.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 1.29

First target: 1.37

Second target: 1.44

Third target: 1.52

Breaking: FTT Has to Break This Price Levels to Start A BullrunThe defunct platform native token TSX:FTT has been on a falling wedge lately losing about 50% of value as the long lasting lawsuit against her founders most especially Sam Bankman-fried is showing no signs of ending.

The token has long been oversold with the RSI at 38.45 further solidifying our thesis and in order for TSX:FTT to start a trend reversal to recent highs it has to break through the 78.6 and 38.2% Fibonacci retracements levels respectively in other to pave way for a bullish spree.

In a Recent new, according to a Bloomberg report, the FTX bankruptcy case has cost almost $1 billion in fees, making it one of the costliest bankruptcy cases in America’s history. So far, lawyers have collected around $948 million to work on the Chapter 11 case through January 2. Meanwhile, court records show that the court has approved over $952 million in fees.

This revelation comes following the FTX repayments, which kicked off on February 18. Despite the hefty fees paid for the bankruptcy case, legal experts suggested to Bloomberg that it was worth it, seeing as these lawyers were able to track billions of dollars in digital assets and cash, which the defunct exchange had scattered across several networks of accounts.

FTX Founder Sam Bankman-Fried's Prosecutor QuitsThe cryptocurrency world is once again witnessing the ripple effects of legal drama surrounding FTX, as Danielle Sassoon, the prosecutor responsible for securing Sam Bankman-Fried’s conviction, has resigned. With speculation mounting about the implications for Bankman-Fried’s appeal, the TSX:FTT token is at the center of renewed attention. But does this development signal a fundamental shift for the beleaguered exchange token, or is it merely another headline in FTX’s tumultuous history?

Prosecutor’s Resignation: What Happened?

Danielle Sassoon, a key figure in the prosecution of Sam Bankman-Fried, played a pivotal role in exposing inconsistencies in his testimony, ultimately leading to his conviction. Bankman-Fried was found guilty of fraud, conspiracy, and money laundering, resulting in a 25-year prison sentence.

However, in a surprising turn of events, Sassoon resigned from her role as Acting U.S. Attorney for the Southern District of New York after just three weeks. Reports indicate that her decision stemmed from a disagreement with the U.S. Department of Justice (DOJ) regarding a corruption case against New York City Mayor Eric Adams. In an 8-page resignation letter, Sassoon expressed her unwillingness to comply with a DOJ directive to drop charges against Adams, citing a lack of legal justification for dismissal.

Her departure has ignited speculation within the crypto community. Some believe that a shift in prosecutorial stance could impact Bankman-Fried’s appeal, potentially influencing TSX:FTT ’s trajectory in the market. While such an outcome remains highly speculative, traders are watching closely for any developments that could alter TSX:FTT ’s sentiment.

Market Reactions and Technical Outlook

As of writing, TSX:FTT is down 4.27%, consolidating within a bearish zone after surging to nearly $4 in recent weeks. The token has struggled to maintain bullish momentum, with volume appearing weak amid market uncertainty.

Key Technical Indicators:

TSX:FTT remains in a downtrend after failing to hold its recent highs. A lack of significant buying While Sassoon’s resignation might be perceived as positive news for FTX’s former CEO, it remains uncertain whether this will translate into tangible gains for $FTT.

Can TSX:FTT Stage a Comeback?

Despite the legal drama, TSX:FTT ’s long-term outlook remains tied to the broader fate of FTX’s bankruptcy proceedings. The exchange collapsed in November 2022, leaving creditors and users grappling with the fallout. While certain developments, such as potential asset recoveries, could provide some relief, TSX:FTT ’s intrinsic value has been severely diminished due to the exchange’s downfall.

However, some traders see opportunities in TSX:FTT as a speculative asset, banking on volatility-driven short-term price swings.

Conclusion

While Danielle Sassoon’s resignation introduces a new narrative into the FTX saga, its tangible impact on TSX:FTT remains speculative at best. The token continues to trade under bearish conditions, and without a fundamental catalyst, a strong recovery remains unlikely in the near term. However, for short-term traders, volatility surrounding legal developments could present trading opportunities.

As the situation unfolds, investors should remain cautious, keeping an eye on both technical patterns and legal updates that could shape TSX:FTT ’s trajectory in the weeks ahead.

Phemex Analysis $60: How to Trade SOL Amidst the FTX UnlockThe FTX’s decision to unlock 11.2 million SOL tokens (worth around $2 billion) at March 1st has sent shockwaves through the market. Fear of a potential sell-off has triggered panic among investors, leading to a sharp decline in SOL’s price from $200 to the $160 area.

With uncertainty in the air, traders are now asking: Will SOL continue its downward spiral, consolidate, or stage a strong comeback? In this analysis, we’ll explore three possible scenarios and how to trade them like a pro.

Possible Scenarios

1. Continued Downward Trend – More Selling Pressure Ahead?

Currently, SOL has dropped into the $165-$155 support zone, but if fear continues to dominate and selling pressure increases, further downside is possible. Key support levels to watch:

• $135-$126 – A critical demand zone where buyers may step in.

• $110 – A strong historical support level that could serve as a bottom.

For long-term investors, this could be an opportunity to accumulate SOL at a discounted price. However, for those who entered near $200, this scenario is less favorable.

Pro Tips:

• Use scaled orders to gradually enter the market instead of going all-in at once.

• Set limit buy orders around key support zones to secure an optimal entry.

• Monitor volume and Relative Strength Index (RSI)—if SOL becomes oversold on high volume, it could signal a potential reversal.

2. Bouncing Between $155 & $210 – A Range-Bound Market

While some traders fear a deeper decline, institutional buyers and long-term holders may step in to absorb the selling pressure. This could lead to a sideways trading range between strong support at $155 and resistance at $210.

Pro Tips:

• Use grid trading bots to capitalize on price swings:

• Start a long grid bot near the $155 support level to profit from rebounds.

• Start a short grid bot near the $210 resistance level to take advantage of pullbacks.

• If SOL repeatedly tests $210 but fails to break through, consider taking partial profits.

• Stay cautious—if the $155 support fails, be ready to adjust strategy for a deeper correction.

3. Breakout Rally – A Surprise Upside Move?

While less likely, a major bullish catalyst—such as the approval of a Solana ETF—could spark a breakout. If SOL gains regulatory or institutional backing, it may defy expectations and surge past resistance levels.

Pro Tips:

• Watch for a breakout above $210 with strong volume—this could signal a move toward $250+.

• Consider momentum trading strategies, setting stop-loss orders below $200 to manage risk.

• Stay updated on ETF-related news and broader crypto sentiment.

Final Thoughts

All eyes are on March 1st, when FTX’s SOL unlock event could bring heightened volatility. Whether SOL drops further, consolidates, or stages a breakout, traders need to stay alert and adjust their strategies accordingly.

• For bulls: Look for accumulation zones and wait for a confirmed reversal.

• For range traders: Take advantage of price swings between support and resistance.

• For breakout traders: Keep an eye on volume and fundamental catalysts.

No matter which scenario plays out, staying disciplined, managing risk, and reacting to market conditions is key to trading SOL like a pro.

🚀 How are you planning to trade SOL during this event? Drop your thoughts below! 🚀

Pro Tips:

Trade Smarter, Not Harder with Phemex. Benefit from cutting-edge features like multiple watchlists, basket orders, and real-time strategy adjustments. Our unique scaled order system and iceberg order functionality give you a competitive edge.

Disclaimer: This is NOT financial or investment advice. Please conduct your own research (DYOR). Phemex is not responsible, directly or indirectly, for any damage or loss incurred or claimed to be caused by or in association with the use of or reliance on any content, goods, or services mentioned in this article.

$SOL: warning!**🚨 CRYPTOCAP:SOL Analysis: Major Unlock & Market Impact 🚨**

📅 **March 1st Unlock:**

Approximately 11.16 million SOL tokens (~$2 billion) are set to be released into the market.

🔗 Source: (www.eblockmedia.com)

### **What’s Happening with CRYPTOCAP:SOL ?**

After the $TRUMP pump, Solana faced a significant pullback, which was expected after such hype. However, a more concerning effect of the meme craze is the liquidity drain from the Solana ecosystem.

🔻 **Liquidity Issues:**

- Rug pulls often result in selling SOL for cash, CRYPTOCAP:USDT , or even $CRYPTOCAP:BTC.

- Exchanges like Raydium and Meteora made huge profits from fees in SOL and typically "sell to cash out".

This has led to a liquidity squeeze, causing a prolonged consolidation.

📉 **Technical Outlook:**

- Daily timeframe: Consolidation appears to be ending, and MACD is about to cross bullish, signaling a short-term relief for 1-2 weeks.

- Weekly timeframe: The bearish divergence remains strong and still needs to play out.

- A double top bearish pattern is identified, likely to push the price down.

⚠️ **March 1st Unlock - The Biggest Bearish Factor**

While 11M SOL represents only 2% of circulating supply, it comes at a bad time, adding selling pressure just as the ecosystem struggles with bearish sentiment.

### **Price Outlook:**

🛑 Short-term impact: Likely downside pressure.

✅ Long-term: Solana remains a solid and popular blockchain—it will recover.

**📉 Price Targets:**

- $160 or lower seems likely.

- Worst-case scenario: $120 , which is a major support level.

💡 Potential Buy Opportunity for long-term holders!

**DYOR!**

FTX WILL REFUND IT CUSTOMERS.FTX will be refunding around 16 BILLION USD (in stables) back to its customers from tomorrow on which is overall a very good thing, why? because it is capital that could ENTER the market as customers receive it back in stables so their is no way that that money/liquidity can leave the market.

As this will happen it could cause a pump in FTX's token FTT.

FTT is ranging here at resistance trying to breakout and once a breakout comes it could pump a solid 60-150% (i would trade this in spot, not with leverage)

Be aware of your own risk management but it looks like a solid set up as this refund is a bullish thing.

FTX Set to Begin Creditor Payouts in 2025: What It Means?The long-anticipated creditor repayments for FTX are finally set to commence, marking a pivotal moment in the exchange's financial restructuring. However, as with any major development in the crypto space, there are conditions, concerns, and market implications that traders need to be aware of. Here’s a breakdown of the upcoming FTX payout process and its potential impact on the price of $FTT.

FTX Creditor Payouts: Key Details

On February 18, 2025, certain FTX creditors will begin receiving their payouts, with those in the Convenience Class (claims up to $50,000) first in line. Under the restructuring plan, these creditors will receive 119% of their recorded claims, valued based on November 2022 asset prices, along with an additional 9% annual interest. However, all payments will be made strictly in stablecoins—excluding Bitcoin, altcoins, or any other crypto assets.

To receive payouts, users must complete KYC verification, submit tax documents, and select a distribution platform. Available payout platforms include Kraken and BitGo, but regional restrictions will apply, particularly in jurisdictions like Ukraine.

John J. Ray III, the chairman of the FTX liquidation committee, emphasized the importance of this step, stating:

"Today's announcement reflects the outstanding success of our recovery and coordination efforts over the past 28 months. These efforts are ongoing, and our focus remains on executing these distributions in accordance with our plan while also continuing to pursue the recovery of outstanding assets."

Scam Alerts and Delays in Compensation

As FTX prepares to distribute funds, scammers have seized the opportunity to defraud unsuspecting users. Fraudulent emails, phishing websites, and malware-laced links have surfaced, posing significant threats to creditors. Users are advised to only engage through official FTX channels and to verify any communications regarding payouts.

FTT Price Action: What’s Next?

The FTX Token ( TSX:FTT ) has experienced notable volatility amid these developments. At the time of writing, TSX:FTT is down 5.41%, trading in bearish territory, with eyes on its 1-month low as a support level.

A drop to this critical support zone could serve as an attractive entry point for traders, given that the level previously acted as resistance before flipping to support. If TSX:FTT manages to hold this range, it may attract fresh buyers looking for a reversal opportunity.

Conversely, a break above the 1-month resistance zone could trigger a strong influx of buyers, potentially leading to a 50% price surge. This scenario would depend on overall market sentiment and any further updates regarding FTX’s ongoing asset recovery efforts.

Market Sentiment and Final Thoughts

While the launch of FTX creditor repayments is a step forward in closing one of crypto’s biggest bankruptcy cases, uncertainties remain. Traders should monitor key technical levels for TSX:FTT while staying updated on regulatory and legal developments surrounding FTX’s liquidation.

BTC.D Capitulation Liquidation candle. Bitcoin's price hovers around $97,000 on Wednesday, following a 3.5% drop the day before. David Sacks, President Trump’s crypto czar, has announced plans to assess a Bitcoin Reserve. Meanwhile, traders on the Bitcoin CME are adopting a cautious stance, advising investors to steer clear of leverage at all costs. As uncertainty and volatility rise in the wake of Trump’s supportive crypto regulations, the potential for a Bitcoin reserve is emerging, yet the market remains turbulent due to tariffs and broader economic challenges.

Additionally, Bitcoin is bracing for fluctuations as FTX prepares to start repaying creditors on February 18. The beleaguered exchange, which filed for bankruptcy in November 2022 with debts estimated at $11.2 billion, is set to disburse payouts that could reach up to $16.5 billion. To facilitate this, FTX is actively selling assets and investments in tech companies. This development is pivotal for those impacted by the FTX collapse, sparking significant interest within the cryptocurrency community.

In 2018 and 2019, the BTC.D chart faced rejections from the 60% resistance zone during the bearish years that followed the explosive bull run of 2017.

Now, we find ourselves in a different scenario, with a retest happening in a bull run year post-halvening. While it’s too early to declare the end of the rally, the usual indicators for a BTC bull peak have yet to signal a positive trend.

From a technical standpoint, BTC.D has the potential to climb to 63.84% and possibly reach as high as 72.5%. This development could spell great news for Bitcoin while casting a shadow over the altcoin market.

This shift might be driven by consistent demand from ETFs and institutional investors for Bitcoin, leaving altcoins in the dust until later in the year.

However, some speculators believe that the recent liquidations over the weekend may have drained enough leverage, allowing altcoins to begin their recovery and, at long last, outshine Bitcoin. We await the unfolding drama with eager anticipation.

Breaking: Backpack Acquires FTX EU in $32.7M DealIn a major development for the European crypto market, Backpack Exchange has acquired the bankrupt European unit of FTX for $32.7 million. This strategic move positions Backpack as a key player in regulated crypto derivatives, aiming to restore trust and innovation in the sector following the FTX collapse.

The Acquisition: A New Chapter for FTX EU

FTX EU, previously part of Sam Bankman-Fried’s defunct crypto empire, operated under a MiFID II license from the Cyprus Securities and Exchange Commission (CySEC). The acquisition by Backpack marks a significant step in reviving the platform’s operations. According to Armani Ferrante, CEO of Backpack Exchange, the company plans to offer a full suite of crypto derivatives throughout Europe, starting with regulated perpetual futures—a product currently unavailable in the EU.

Backpack’s entry comes at a time when major players like Bitstamp and Coinbase have secured MiFID II licenses, with other firms like D2X preparing to deliver USD-denominated futures and options. Backpack’s MiCA notification has already been submitted, and Ferrante expects operations to commence in Q1 2025.

Rebuilding Trust and Innovation

The acquisition not only secures Backpack’s foothold in the European market but also provides an opportunity to repair the damage caused by FTX’s collapse. Ferrante emphasized the company’s commitment to returning FTX EU customers’ funds as a priority. Once this process is complete, Backpack aims to launch its regulated perpetual futures product, further solidifying its market position.

Backpack’s founders, known for their contributions to the Solana ecosystem and success in the wallet and NFT business, raised $17 million in funding last year. This financial backing underscores the company’s capability to execute its ambitious plans.

Technical Outlook: TSX:FTT Price Analysis

Despite the acquisition news, TSX:FTT , the native token of the FTX platform, has shown a weaker trend channel, down 2.14% at the time of writing. The Relative Strength Index (RSI) stands at 46, indicating a neutral momentum but leaning towards bearish sentiment due to selling pressure.

Key Technical Levels:

- Support: The 65% Fibonacci retracement level serves as immediate support. A breakdown below this level could trigger a selling spree, potentially driving TSX:FTT to its one-month low.

- Resistance: If TSX:FTT manages to rebound, traders should watch for a move above the current trend channel to confirm a bullish reversal.

While the acquisition provides a positive fundamental backdrop, traders remain cautious, awaiting clarity on how the settlement of affected FTX customers will unfold. The resolution of these issues could act as a catalyst for TSX:FTT ’s recovery.

The Road Ahead

Backpack’s acquisition of FTX EU represents a turning point for regulated crypto derivatives in Europe. With plans to launch a full suite of products and restore customer trust, the company is poised to make significant strides in the market. For TSX:FTT , the path forward depends on both the broader market sentiment and the successful implementation of Backpack’s ambitious plans.

Investors and traders should monitor both technical indicators and fundamental developments closely as Backpack reshapes the narrative around FTX EU and its role in the European crypto landscape.

Ftx token ( FTT)Ftt usdt Daily analysis

Time frame 4hours

Risk rewards ratio >2.5 👈👌👈👈

First target 4.5 $

Second target 5.45 $

LS should have been chosen very close to the entry point (a little below the diagonal line), but in order not to be caught, I chose LS much lower, so that over time and as the price grows, I will also raise LS and make it risk-free.

Good news has also been heard in cyberspace about the new management of the FTX exchange, which is paying off its debts, and this is a positive sign for the future this currency and it is likely to return to its original position, the price range before the problems it had with the Binance exchange. (20-25$)

Breaking: Joe Biden Might Pardon Sam Bankman, Founder of FTXThe crypto world is abuzz with speculation that President Joe Biden could pardon Sam Bankman-Fried, the founder of the defunct cryptocurrency exchange FTX. Bankman-Fried, sentenced to 25 years for fraud and money laundering, remains a polarizing figure. This speculation is fueled by his substantial political donations to the Democratic Party, estimated to total hundreds of millions. These ties have sparked debate about the potential influence on Biden’s discretion to grant a pardon.

Elon Musk’s commentary has added weight to these rumors, suggesting that such a move could distract from the upcoming power transition to Donald Trump, scheduled for January 20, 2025. Despite the speculation, platforms like Polymarket estimate only a 16% probability of a pardon, underscoring the general skepticism among political traders.

FTT’s Resurgence Amid Bankruptcy Developments

While political speculation swirls, FTX Token ( TSX:FTT ) has seen a remarkable 15% surge in value. This comes after FTX announced plans to begin creditor payouts in early 2025 as part of its Chapter 11 bankruptcy process. The court-approved plan will commence on January 3, 2025, with the first tranche of payments targeting "Convenience Classes" claims. The announcement has buoyed investor sentiment, pushing FTT’s price to $3.28 and its market cap to $1.08 billion, with trading volume surging 170%.

Despite this positive step, FTX’s recovery journey remains fraught with legal and financial complexities. The company’s eventual revival hinges on asset liquidation and the resolution of outstanding legal issues, a process likely to take years.

Technical Analysis of TSX:FTT

FTT’s recent price action highlights a bullish reversal pattern, defying the broader crypto market’s bearish trend. Trading at $3.20, FTT has a bullish RSI of 61.77, signaling strong momentum. Key technical levels include:

- Support: Immediate support lies at the 65% Fibonacci retracement level, providing a cushion for potential pullbacks.

- Resistance: The immediate pivot is the one-month high. A break above this level could ignite a bullish rally, targeting higher resistance zones.

FTT’s resilience amid market uncertainty suggests growing investor confidence, potentially driven by the promise of creditor payouts and speculation about the exchange’s future.

Overview

FTX Token’s value proposition has historically been tied to the FTX platform, offering benefits like fee discounts, staking rewards, and leveraged token creation. However, with FTX’s bankruptcy, the token’s utility has diminished. The recent price surge reflects speculative interest rather than intrinsic value, as the token’s future remains uncertain.

FTT Token Overview

- Launch: May 8, 2019

- Utility: Discounts on trading fees, staking rewards, and collateral for leveraged positions

- Current Status: Associated with a defunct platform, under Chapter 11 proceedings

Investor Caution

While the recent rally is promising, investors should approach TSX:FTT with caution. The token’s price movements are heavily influenced by speculative trading and bankruptcy developments. Moreover, the potential for token liquidation to pay creditors poses a significant risk to its value.

Conclusion

The dual narratives surrounding Sam Bankman-Fried’s potential pardon and FTX’s bankruptcy proceedings underscore the complexity of the situation. For TSX:FTT , the path forward is uncertain, balancing speculative optimism against the harsh realities of a defunct platform. Investors should closely monitor legal and market developments to navigate this volatile landscape effectively.

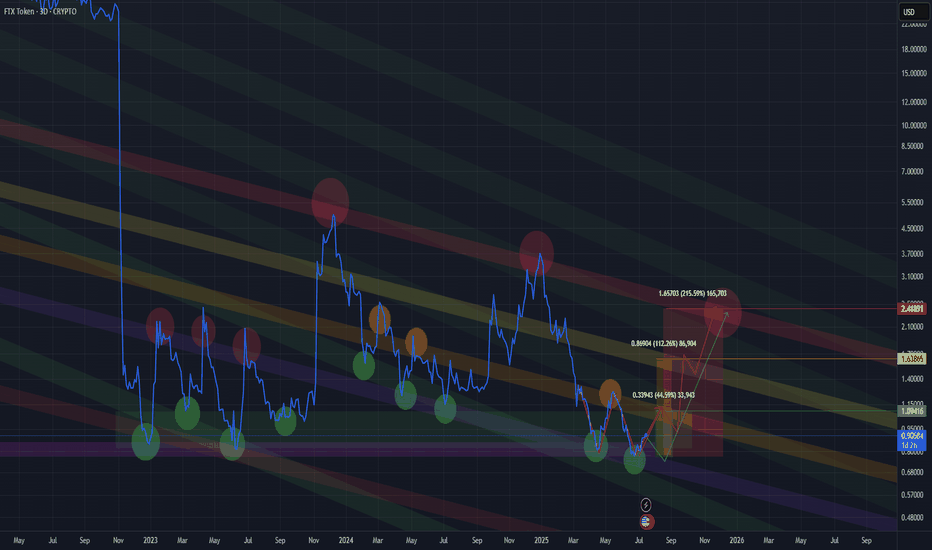

$FTT FTT ftx 2 year consolidation between 0.9 - 2.8.... Uptrend?TSX:FTT Ftt Ftx consolidation has spanned from Nov. 2022 till now

A 2-year consolidation between price range 0.9-2.8

Current price: $3.1

My SuperAI just confirmed a super Uptrend on the 3day Timeframe.

A break out from this range will lead up to major resistance 5.5, 6.4

A continuous uptrend can lead up to $21

Invalidation of this #FTT idea is under $2.7

FTX Can Explode Higher In January MartyBoots here , I have been trading for 17 years and sharing my thoughts on FTX here.

FTX is looking beautiful , very strong base for more upside

Very similar to RSR which is up nearly 170% increase in a similar base

Do not miss out on FTX as this is a great opportunity

Watch video for more details

FTX Token (FTT)It seems FTT is oscillating in a wide sideway channel. Price is currently at the bottom and have to wait to breaks the downtrend line in order to goes up. Let's see what happens.

P.S. Be careful, Since the FTX Token crashed due to the fraud news.

FTX Reorganization Plan Fuels $FTT Rally Amidst Positive OutlookFTX Trading Ltd., the embattled cryptocurrency exchange undergoing Chapter 11 bankruptcy proceedings, has announced significant progress toward its reorganization plan. With a target implementation date set for January 2025, this development has sparked renewed investor confidence, propelling the TSX:FTT token’s price upward by 13% in recent trading sessions.

Reorganization Milestones

FTX’s reorganization plan, approved by the Court, aims to facilitate creditor and customer distributions, marking a critical step in its recovery journey. Key updates include:

- Distribution Framework:

The initial distribution of recovered assets is expected to begin within 60 days of the plan’s enforcement.

- Global Access:

FTX has partnered with specialized distribution agents to ensure global customer access, requiring users to complete KYC verification and tax formalities.

- Timeline:

Final arrangements with distribution agents by December 2024.

Effective date announcement by the end of December.

Initial distributions set for early 2025, prioritizing holders of allowed claims in Convenience Classes.

FTX CEO John J. Ray III emphasized the importance of the timeline, stating, “We are full steam ahead to reach arrangements with our distribution agents and return proceeds to creditors and customers as quickly as possible.”

If successful, the reorganization plan could restore significant trust in FTX, potentially attracting a surge of new and returning investors.

Technical Analysis:

The promising update has significantly impacted the FTT token’s performance:

TSX:FTT has surged 13%, continuing to trade within a bullish zone.

The Relative Strength Index (RSI) at 66, indicates strong upward momentum without entering overbought territory, suggesting room for further growth. The token is trading above key moving averages, reinforcing its bullish trajectory.

The bullish sentiment is further supported by market speculation that FTX’s ability to reimburse creditors could lead to a renewed influx of investor interest, bolstering the exchange’s reputation and operational capacity.

Looking Ahead

FTT’s recent price surge serves as a beacon of hope for FTX’s recovery, reflecting market optimism about its ability to execute its reorganization plan effectively. If the exchange successfully meets its commitments, it could not only restore trust among affected customers but also reposition itself as a formidable player in the cryptocurrency landscape.

With the reorganization plan underway, TSX:FTT appears poised to continue its upward trajectory, solidifying its place as a key token to watch in the coming months. For investors, this may signal a unique opportunity to ride the wave of FTX’s potential resurgence.