#FTX/USDT Breakout soon#FTX

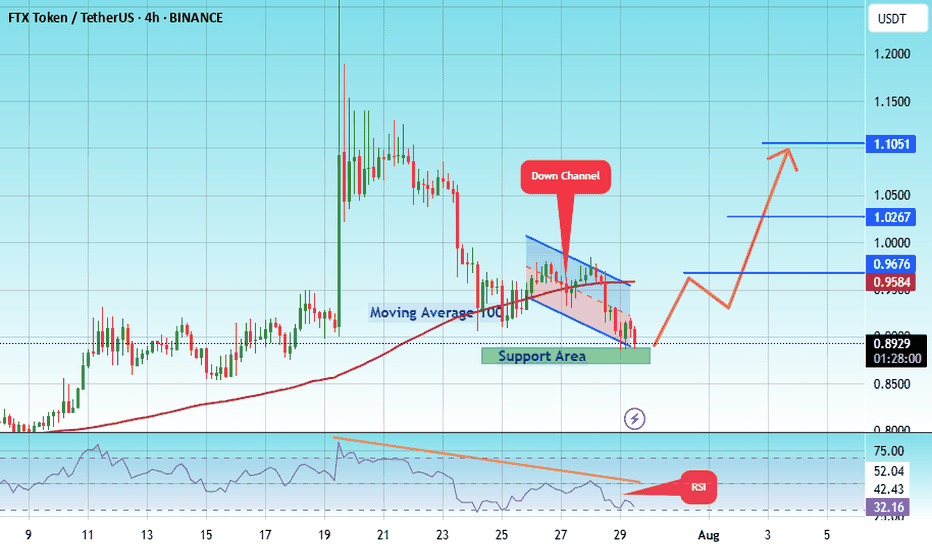

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on track to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.8800.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.8760, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.8932

First target: 0.9584

Second target: 1.0267

Third target: 1.105

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Ftxexchange

#FTX/USDT#FTX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 1.23.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 1.29

First target: 1.37

Second target: 1.44

Third target: 1.52

FTX Founder Sam Bankman-Fried's Prosecutor QuitsThe cryptocurrency world is once again witnessing the ripple effects of legal drama surrounding FTX, as Danielle Sassoon, the prosecutor responsible for securing Sam Bankman-Fried’s conviction, has resigned. With speculation mounting about the implications for Bankman-Fried’s appeal, the TSX:FTT token is at the center of renewed attention. But does this development signal a fundamental shift for the beleaguered exchange token, or is it merely another headline in FTX’s tumultuous history?

Prosecutor’s Resignation: What Happened?

Danielle Sassoon, a key figure in the prosecution of Sam Bankman-Fried, played a pivotal role in exposing inconsistencies in his testimony, ultimately leading to his conviction. Bankman-Fried was found guilty of fraud, conspiracy, and money laundering, resulting in a 25-year prison sentence.

However, in a surprising turn of events, Sassoon resigned from her role as Acting U.S. Attorney for the Southern District of New York after just three weeks. Reports indicate that her decision stemmed from a disagreement with the U.S. Department of Justice (DOJ) regarding a corruption case against New York City Mayor Eric Adams. In an 8-page resignation letter, Sassoon expressed her unwillingness to comply with a DOJ directive to drop charges against Adams, citing a lack of legal justification for dismissal.

Her departure has ignited speculation within the crypto community. Some believe that a shift in prosecutorial stance could impact Bankman-Fried’s appeal, potentially influencing TSX:FTT ’s trajectory in the market. While such an outcome remains highly speculative, traders are watching closely for any developments that could alter TSX:FTT ’s sentiment.

Market Reactions and Technical Outlook

As of writing, TSX:FTT is down 4.27%, consolidating within a bearish zone after surging to nearly $4 in recent weeks. The token has struggled to maintain bullish momentum, with volume appearing weak amid market uncertainty.

Key Technical Indicators:

TSX:FTT remains in a downtrend after failing to hold its recent highs. A lack of significant buying While Sassoon’s resignation might be perceived as positive news for FTX’s former CEO, it remains uncertain whether this will translate into tangible gains for $FTT.

Can TSX:FTT Stage a Comeback?

Despite the legal drama, TSX:FTT ’s long-term outlook remains tied to the broader fate of FTX’s bankruptcy proceedings. The exchange collapsed in November 2022, leaving creditors and users grappling with the fallout. While certain developments, such as potential asset recoveries, could provide some relief, TSX:FTT ’s intrinsic value has been severely diminished due to the exchange’s downfall.

However, some traders see opportunities in TSX:FTT as a speculative asset, banking on volatility-driven short-term price swings.

Conclusion

While Danielle Sassoon’s resignation introduces a new narrative into the FTX saga, its tangible impact on TSX:FTT remains speculative at best. The token continues to trade under bearish conditions, and without a fundamental catalyst, a strong recovery remains unlikely in the near term. However, for short-term traders, volatility surrounding legal developments could present trading opportunities.

As the situation unfolds, investors should remain cautious, keeping an eye on both technical patterns and legal updates that could shape TSX:FTT ’s trajectory in the weeks ahead.

FTX Set to Begin Creditor Payouts in 2025: What It Means?The long-anticipated creditor repayments for FTX are finally set to commence, marking a pivotal moment in the exchange's financial restructuring. However, as with any major development in the crypto space, there are conditions, concerns, and market implications that traders need to be aware of. Here’s a breakdown of the upcoming FTX payout process and its potential impact on the price of $FTT.

FTX Creditor Payouts: Key Details

On February 18, 2025, certain FTX creditors will begin receiving their payouts, with those in the Convenience Class (claims up to $50,000) first in line. Under the restructuring plan, these creditors will receive 119% of their recorded claims, valued based on November 2022 asset prices, along with an additional 9% annual interest. However, all payments will be made strictly in stablecoins—excluding Bitcoin, altcoins, or any other crypto assets.

To receive payouts, users must complete KYC verification, submit tax documents, and select a distribution platform. Available payout platforms include Kraken and BitGo, but regional restrictions will apply, particularly in jurisdictions like Ukraine.

John J. Ray III, the chairman of the FTX liquidation committee, emphasized the importance of this step, stating:

"Today's announcement reflects the outstanding success of our recovery and coordination efforts over the past 28 months. These efforts are ongoing, and our focus remains on executing these distributions in accordance with our plan while also continuing to pursue the recovery of outstanding assets."

Scam Alerts and Delays in Compensation

As FTX prepares to distribute funds, scammers have seized the opportunity to defraud unsuspecting users. Fraudulent emails, phishing websites, and malware-laced links have surfaced, posing significant threats to creditors. Users are advised to only engage through official FTX channels and to verify any communications regarding payouts.

FTT Price Action: What’s Next?

The FTX Token ( TSX:FTT ) has experienced notable volatility amid these developments. At the time of writing, TSX:FTT is down 5.41%, trading in bearish territory, with eyes on its 1-month low as a support level.

A drop to this critical support zone could serve as an attractive entry point for traders, given that the level previously acted as resistance before flipping to support. If TSX:FTT manages to hold this range, it may attract fresh buyers looking for a reversal opportunity.

Conversely, a break above the 1-month resistance zone could trigger a strong influx of buyers, potentially leading to a 50% price surge. This scenario would depend on overall market sentiment and any further updates regarding FTX’s ongoing asset recovery efforts.

Market Sentiment and Final Thoughts

While the launch of FTX creditor repayments is a step forward in closing one of crypto’s biggest bankruptcy cases, uncertainties remain. Traders should monitor key technical levels for TSX:FTT while staying updated on regulatory and legal developments surrounding FTX’s liquidation.

Ftx token ( FTT)Ftt usdt Daily analysis

Time frame 4hours

Risk rewards ratio >2.5 👈👌👈👈

First target 4.5 $

Second target 5.45 $

LS should have been chosen very close to the entry point (a little below the diagonal line), but in order not to be caught, I chose LS much lower, so that over time and as the price grows, I will also raise LS and make it risk-free.

Good news has also been heard in cyberspace about the new management of the FTX exchange, which is paying off its debts, and this is a positive sign for the future this currency and it is likely to return to its original position, the price range before the problems it had with the Binance exchange. (20-25$)

Breaking: Joe Biden Might Pardon Sam Bankman, Founder of FTXThe crypto world is abuzz with speculation that President Joe Biden could pardon Sam Bankman-Fried, the founder of the defunct cryptocurrency exchange FTX. Bankman-Fried, sentenced to 25 years for fraud and money laundering, remains a polarizing figure. This speculation is fueled by his substantial political donations to the Democratic Party, estimated to total hundreds of millions. These ties have sparked debate about the potential influence on Biden’s discretion to grant a pardon.

Elon Musk’s commentary has added weight to these rumors, suggesting that such a move could distract from the upcoming power transition to Donald Trump, scheduled for January 20, 2025. Despite the speculation, platforms like Polymarket estimate only a 16% probability of a pardon, underscoring the general skepticism among political traders.

FTT’s Resurgence Amid Bankruptcy Developments

While political speculation swirls, FTX Token ( TSX:FTT ) has seen a remarkable 15% surge in value. This comes after FTX announced plans to begin creditor payouts in early 2025 as part of its Chapter 11 bankruptcy process. The court-approved plan will commence on January 3, 2025, with the first tranche of payments targeting "Convenience Classes" claims. The announcement has buoyed investor sentiment, pushing FTT’s price to $3.28 and its market cap to $1.08 billion, with trading volume surging 170%.

Despite this positive step, FTX’s recovery journey remains fraught with legal and financial complexities. The company’s eventual revival hinges on asset liquidation and the resolution of outstanding legal issues, a process likely to take years.

Technical Analysis of TSX:FTT

FTT’s recent price action highlights a bullish reversal pattern, defying the broader crypto market’s bearish trend. Trading at $3.20, FTT has a bullish RSI of 61.77, signaling strong momentum. Key technical levels include:

- Support: Immediate support lies at the 65% Fibonacci retracement level, providing a cushion for potential pullbacks.

- Resistance: The immediate pivot is the one-month high. A break above this level could ignite a bullish rally, targeting higher resistance zones.

FTT’s resilience amid market uncertainty suggests growing investor confidence, potentially driven by the promise of creditor payouts and speculation about the exchange’s future.

Overview

FTX Token’s value proposition has historically been tied to the FTX platform, offering benefits like fee discounts, staking rewards, and leveraged token creation. However, with FTX’s bankruptcy, the token’s utility has diminished. The recent price surge reflects speculative interest rather than intrinsic value, as the token’s future remains uncertain.

FTT Token Overview

- Launch: May 8, 2019

- Utility: Discounts on trading fees, staking rewards, and collateral for leveraged positions

- Current Status: Associated with a defunct platform, under Chapter 11 proceedings

Investor Caution

While the recent rally is promising, investors should approach TSX:FTT with caution. The token’s price movements are heavily influenced by speculative trading and bankruptcy developments. Moreover, the potential for token liquidation to pay creditors poses a significant risk to its value.

Conclusion

The dual narratives surrounding Sam Bankman-Fried’s potential pardon and FTX’s bankruptcy proceedings underscore the complexity of the situation. For TSX:FTT , the path forward is uncertain, balancing speculative optimism against the harsh realities of a defunct platform. Investors should closely monitor legal and market developments to navigate this volatile landscape effectively.

FTX Takes Legal Action Against Binance, CZ ZhaoFTX, the once-prominent cryptocurrency exchange, is embroiled in a high-stakes legal battle against Binance Holdings Ltd. and its former CEO, Changpeng Zhao. The lawsuit, filed by FTX, aims to claw back nearly $1.8 billion, accusing Binance and Zhao of participating in fraudulent transactions that involve the transfer of funds by Sam Bankman-Fried, FTX's co-founder, who is currently imprisoned.

This legal dispute centers around a controversial share repurchase deal that occurred in July 2021. Binance, Zhao, and other executives were allegedly involved in a transaction where they sold significant stakes in FTX's international and U.S. units. The funds for this repurchase deal were allegedly provided by Bankman-Fried using a combination of FTX's native token, TSX:FTT , and Binance’s own coins, BNB and BUSD, which were valued at $1.76 billion at the time.

The FTX estate claims that both FTX and its trading arm, Alameda Research, may have been insolvent since their inception and were definitely balance-sheet insolvent by early 2021. Consequently, the share repurchase deal is being challenged as fraudulent. In addition, FTX has accused Zhao of intentionally posting misleading tweets in the lead-up to FTX’s collapse, further accelerating the exchange’s downfall.

While Binance maintains that the claims are “meritless” and has vowed to vigorously defend itself, the legal action adds another layer of uncertainty to FTX’s already precarious situation, impacting not only the exchange but also its native token, $FTT. This article will explore both the technical and fundamental aspects of TSX:FTT amid these ongoing legal battles.

FTX’s Legal Woes and Impact on TSX:FTT

The legal battle between FTX and Binance has significant implications for the future of $FTT. The lawsuit itself stems from accusations of fraudulent transactions, which have already tainted FTX’s reputation. These claims—along with the ongoing bankruptcy proceedings—continue to weigh heavily on the exchange’s viability.

FTX’s insolvency issues, along with the accusations against Binance and Zhao, suggest that there is a long road ahead before any form of resolution can be achieved. As FTX fights to recover assets through lawsuits, the company’s ability to rebuild its reputation and infrastructure is increasingly called into question. With both institutional and retail investors likely to remain wary of TSX:FTT , this legal drama casts a long shadow over the token’s future.

Moreover, the involvement of Binance and Zhao, two major players in the crypto space, could fuel further controversy and market volatility. Given Binance’s prominence and Zhao’s influence, the outcome of this lawsuit could reverberate throughout the broader crypto ecosystem.

Technical Analysis

On the technical front, TSX:FTT has been trading within a rising trend, reflecting a modest 5.74% increase at the time of writing. The Relative Strength Index (RSI) stands at 61.80, suggesting that the token is in a potential continuation pattern. However, a closer look at the 2-hour chart reveals a bearish trend that could pose significant risks for TSX:FTT in the near term.

The token has been fluctuating around key support and resistance levels, and its future trajectory hinges on critical technical levels. Should TSX:FTT maintain support at $1.82, it may avoid a sharp sell-off. However, if it fails to hold this level, it could trigger a selling spree, pushing the price lower. On the other hand, a move to the pivot point at $2.36 could potentially lead to a brief bullish rally, although this could be short-lived given the legal uncertainty surrounding FTX.

What’s Next for TSX:FTT ?

The outlook for TSX:FTT remains uncertain, as the legal battle involving FTX and Binance continues to unfold. Fundamental factors, including FTX’s insolvency and the growing number of lawsuits, will likely weigh heavily on investor sentiment. At the same time, the technical setup for TSX:FTT remains fragile, with the potential for both upward and downward movement, depending on how the market reacts to ongoing developments.

Traders and investors will need to closely monitor both the legal proceedings and market sentiment. For now, the price action of TSX:FTT is bound by key support and resistance levels, with the potential for short-term fluctuations driven by market speculation and news surrounding the case.

Conclusion

The ongoing lawsuit, combined with FTX's bankruptcy and insolvency issues, highlights significant challenges for TSX:FTT in the coming months. While the technical indicators suggest the potential for short-term gains, these should be weighed against the broader fundamental uncertainty surrounding FTX and its legal battles. With the volatility likely to remain high, it is crucial for investors to stay informed about the developments in this case before making any major moves with $FTT.

FTT Surges 13% on FTX Investors to Settle With Sam BankmanA group of FTX investors have filed a court document to settle with Sam Bankman-Fried, the founder and former CEO of FTX, under the condition that he provides relevant information about key firms and celebrities related to the defunct exchange before its collapse. The settlement terms include proof that Bankman-Fried's net worth is negative. If approved by the court, the agreement would discharge all claims against Bankman-Fried.

According to a Bloomberg report, Bankman-Fried has agreed to cooperate with the class representatives to strengthen their case against celebrity promoters of FTX by providing confidential information about their involvement in raising FTX ratings before its eventual collapse in 2022. The list of celebrities includes Shaquille O'Neal, Stephen Curry, Lawrence Gene David, Tom Brady, Gisele Bundchen, and organizations such as MBA's Miami Heat franchises, SoftBank Group, Paradigm Operations LP, and many more.

The agreement mandates that Bankman-Fried release certain documents alongside evidence of these people and organizations' involvement with FTX. He will also provide a financial statement of all his current assets and a sworn affidavit of all his financial assets, including an affidavit stating that his net worth is negative.

The settlement comes after US Senator Elizabeth Warren demanded a full account of the several meetings between the head of the US Commodity & Futures Trading Commission (CFTC), Rostin Behnam, and Bankman-Fried before the FTX implosion.

Bankman-Fried was convicted of wire fraud, securities fraud, and money laundering in November 2023, and on March 28, he was sentenced to 25 years in prison, with a forfeiture of $11 billion worth of assets to fund the repayment of the victims of the FTX collapse.

2x is coming FTTAs i told you many times, i am holding some spot bags of FTT. The price of the FTX Token is holding well even if the exchange is dead (actually). When FTX will be resumed, i expect the price to pump. In the short term, if FTT can break above the mid term resistance at 2.7, a 2x is in play

🚀 FTX coin $FTT to $6 up for some jaw dropping action? 🚀Hey everyone, today we're diving into the price chart of Sam Bankman Freud linked FTX coin BINANCE:FTTUSDT and let me tell you something, the charts are buzzing!

Just a quick few stats before we get to the good stuff. FTX a coin which at one point was regarded by many as a "Blue Chip" coin, rivaling the likes of Binance-linked coin BNB and other heavy-weights is currently sitting with a Fully Diluted Valuation (FDV) of $823 million placing it many positions away from the top 20 leagues it once occupied.

A huge chunk of the price losses that the coin suffered can be traced back to the collapse of FTX exchange and the arrest of the founder. However with the recent move to compensate or allow users to recover the funds that they lost in the debacle it's looking like the exchange is preparing for a major comeback.

**📈 The Chart: Cup and Handle Glory 📈**

Alright, enough of that let's talk technicals! We've got a Cup and Handle formation on the TSX:FTT chart that's as clear as day. You can see it below

Another interesting thing for me with this chart is the handle bit of the cup and handle. It's not just any handle we're seeing— the handle formed from a falling wedge, which for you chart enthusiasts out there know is a MEGA bullish signal that The Blue Investor can never ignore.

**🔍 The Double Bottom Dance 🔍**

Now, let's rewind a bit. A few months ago in January TSX:FTT retested the neckline of a previous double bottom from 2023. In my mind, that was not just a bounce, folks—that's a trampoline leap showing us that TSX:FTT has the legs to jump higher!

Following the bullish breakout from the falling wedge, if this bullish momentum is sustained at the least we can expect the market to push price to $3.20 to complete an AB=CD for the CnH.

At the time of writingwe're sitting at $2.50, a push to $3.21 would be a 30% gain in the spot price. Beyond that, I'll be looking at—$5.50, and for the moonshooters, a jaw-dropping $21.98! These aren't just hopeful dots on a chart; they're calculated destinations based on pure, unadulterated price action.

**🌟 The Rally Cry: Why TSX:FTT Deserves Your Attention 🌟**

In the last 7, 14, and 30 days, TSX:FTT has been on a tear, posting gains of 44% and 46%. That's a green flag waving us towards opportunity.

So, whether you're here for the thrill of the trade or the long-term play, I think KUCOIN:FTTUSDT is a token that deserves your screen time. With technicals that are as compelling as the plot of a blockbuster movie, this is one asset you'll want to keep on your radar over the next few months, you can thank me later!

Remember, in the crypto game, timing is everything, and the TSX:FTT chart is screaming 'now or never.' So, keep those eyes peeled, those minds sharp, and your strategies ready.

And that's a wrap for this trade idea! If you found value in this analysis you already know what to do. Until next time, keep those trades smart and your investments smarter!

(Disclaimer: This content is for educational and entertainment purposes only. Not financial advice. Do your own research and consult your financial advisor before making any financial decisions.)

FTX Can Now Sell Its $1B Stake in Anthropic to Repay CreditorsThe saga surrounding FTX's bankruptcy and subsequent efforts to repay creditors has taken another intriguing turn as a federal bankruptcy court approves the sale of the collapsed exchange's $1 billion stake in Anthropic, the AI company behind the Claude models. This move not only signifies a significant step in FTX's restructuring efforts but also sheds light on the evolving landscape of AI valuation amidst financial turmoil.

1. FTX's Bankruptcy Fallout and Clawback Strategy:

Following FTX's industry-shaking collapse in 2022, the exchange has been navigating a complex bankruptcy process aimed at repaying creditors. One of the pivotal strategies employed by FTX ( TSX:FTT ) has been clawbacks, wherein assets like Anthropic shares are liquidated to recover funds for debt repayment.

2. Approval from Federal Bankruptcy Court:

The recent approval by the U.S. Federal Judge John Dorsey to sell FTX's $1 billion stake in Anthropic comes after thorough scrutiny and highlights the court's acknowledgment of the necessity to settle outstanding debts.

3. FTX's Previous Attempts and Legal Clearance:

FTX's earlier attempts to sell its Anthropic shares through financial services company Perella Weinberg Partners were met with regulatory hurdles and legal complexities. However, with the clearance from the U.S. Department of Justice, citing the irrelevance of FTX's Anthropic investment to the case against its founder, Sam Bankman-Fried, the path has been cleared for the sale.

4. AI Valuation Dynamics:

A notable aspect of this development is the valuation trajectory of Anthropic shares. From an initial worth of $500 million at the time of the launch of Claude 2 AI model to doubling in value to reach $1 billion, it reflects the dynamic nature of AI valuation in the market.

5. FTX's Asset Portfolio and Solvency Measures:

- The sale of Anthropic shares adds to FTX's asset liquidation efforts, which include the previous sale of Ledger X to M7 Holdings for $50 million. Furthermore, court documents revealing FTX's holdings in Solana, Ethereum, Bitcoin, and other assets underscore the comprehensive approach undertaken by the exchange to navigate its solvency challenges.

Conclusion:

As FTX ( TSX:FTT ) progresses in its bankruptcy proceedings, the approval to sell its $1 billion stake in Anthropic marks a significant milestone. Beyond the financial intricacies, this development offers insights into the valuation dynamics of AI companies amidst tumultuous market conditions. With each step, FTX ( TSX:FTT ) inches closer to its goal of repaying creditors and charting a new course in the ever-evolving landscape of cryptocurrency exchanges.

By delving into the intricacies of FTX's bankruptcy, the dynamics of AI valuation, and the broader implications for the cryptocurrency industry, this article provides a comprehensive analysis of the recent developments surrounding FTX's $1 billion stake in Anthropic.

FTT/USDT Local trend (Binance trimmed chart) 30 11 2023Logarithm. Time frame 1 day. On the chart I put a screenshot of the missing part of the Binance chart from my closed learning/work idea on this coin, which I have been trading for almost a year (published 5 01 2023).

In those 11 months, 47 local work updates .

FTT/USD Super Risk - Super Profit. FTT hearing dates

Manipulation . On the one hand the Binance exchange is not cheating, because trading was actually stopped on November 15, 2022 of this FTT/USDT trading pair and re-launched on September 22, 2023. Left on this exchange was the FTT/BUSD trading pair that was recently delisted, with the entire chart history (emphasis mine).

A person looking at the chart for the first time would not see this clever, honest forgery on it. That is, no price chart and a pump/dump of a horizontal channel with a 237% pitch and a duration of exactly 311 days, and 3 significant pump ups in that channel range. This is a 4 and possibly an exit from it, at least this triangle is formed above its resistance.

It is worth noting that if you now decide to work with this coin, remember that the price is now at +263% of the average price of the local set. Therefore, limit your risks.

Linear of this zone looks like this .

Dont worry FTT moves like this First it drops

then ( Green Phase ): Move higher and higher to cover some last candles of drop (But this high will not touch halfway of dip)

Then ( RED phase ): those high are now going to become lows with same resistance and support levels

And when price action reaches the same level that we bottom of previous drop; another Drop starts 😉

FTX Exchange Confirms No Relaunch Ahead

In a shocking turn of events, $FTX, once touted as a promising cryptocurrency exchange, has officially abandoned its efforts to restart operations. The company's decision comes amid months of negotiations with potential investors, all of whom were reluctant to inject the necessary funds to rebuild the beleaguered exchange. $FTX's downfall has exposed a trail of deception, with founder Sam Bankman-Fried convicted on fraud charges, revealing a troubling lack of infrastructure and responsibility behind the scenes.

The Unraveling of $FTX:

The revelation by $FTX attorney Andy Dietderich paints a grim picture of the exchange, labeling it an "irresponsible sham" orchestrated by a convicted felon. The inability to secure sufficient investment underscores deeper issues, as it becomes apparent that $FTX lacked the foundational technology and administration required to sustain itself as a legitimate business. The fallout from these shortcomings has left 9 million customers in the lurch, facing potential losses running into the billions.

Bankruptcy Proceedings:

$FTX's decision to opt for liquidation instead of a restart signals a turbulent end to a once-prominent player in the cryptocurrency landscape. With over $7 billion in recovered assets, the company aims to repay its customers in full, though complications arise as the repayment will be based on cryptocurrency prices from November 2022, a period when the crypto market was mired in a prolonged slump. This decision has sparked dissatisfaction among customers, who argue that using outdated prices shortchanges them, especially considering the significant rise in Bitcoin's value since November 2022.

Legal Battles and Customer Dissatisfaction:

The legal battle surrounding $FTX intensifies as founder Sam Bankman-Fried faces sentencing on March 28 after being convicted on seven counts of fraud and conspiracy. Meanwhile, customers expressing frustration over the use of 2022 prices face a setback as U.S. Bankruptcy Judge John Dorsey overruled their complaints, citing the inflexibility of bankruptcy law. Despite the clear discontent among users, the road to repayment remains uncertain, with $FTX emphasizing the need to thoroughly investigate legitimate claims before disbursing funds.

Conclusion:

The $FTX saga serves as a cautionary tale for the cryptocurrency industry, underscoring the importance of transparency, responsible management, and regulatory compliance. The fallout from $FTX's demise not only highlights the risks inherent in the volatile crypto market but also raises questions about the viability of other platforms. As the cryptocurrency landscape evolves, the $FTX case will likely be scrutinized for lessons on preventing future instances of fraud, deception, and the resulting turmoil for users and investors alike.

FTT Needs attentionThe FTT charts is pretty boring. Slow moves, no strength, a classic chart to avoid. But i think that sooner or later it can give us some emotions. I expect some good news to come out this years, because this is what this chart is telling me. On short term there is a smal trendline that i would like to long only if the red box is flipped into support. But on FTT i am thinking on long term and i think we could see a double digit this year

FTX's Remarkable Turnaround: Cash Reserves Double to $4.4 BilBankrupt crypto exchange $FTX has witnessed a remarkable financial turnaround as it strategically unloads its crypto holdings, doubling its cash reserves to an impressive $4.4 billion within just two months.

The Journey to Financial Recovery:

$FTX's bankruptcy estate has been on a strategic mission to fortify its financial position by shedding crypto assets. According to Chapter 11 monthly operating reports, advisors overseeing the process successfully sold crypto from the FTX group's four largest affiliates, namely FTX Trading, Alameda Research, West Realm Shires Inc, and Clifton Bay Investments. This effort resulted in a substantial increase in cash reserves, surging from $2.3 billion in October to an impressive $4.4 billion by December 2023.

Key Entities Involved:

West Realm Shires Inc, the holding company of FTX's U.S.-based entity FTX.US, and Clifton Bay Investments, a company associated with FTX Ventures, played pivotal roles in this financial maneuver. Alameda Research, a significant player in the crypto space, also contributed to the initiative. The strategic decisions made by these entities have not only bolstered FTX's financial standing but have also raised questions about their broader impact on the crypto market.

Crypto Outflows and Legal Developments:

Since gaining approval to sell its crypto holdings in September, the FTX bankruptcy estate has been actively managing its assets. Reports suggest that FTX's wallets have been transferring funds to other exchanges while unstaking substantial amounts from crypto staking platforms. Notably, the FTX estate has been linked to nearly $1 billion worth of outflows from the Grayscale Bitcoin Trust (GBTC) in the initial days of the trust's transition into an exchange-traded fund (ETF).

Legal complexities have also marked FTX's journey, with Alameda Research voluntarily dismissing a lawsuit against GBTC issuer Grayscale. The lawsuit, initially filed over an alleged "improper redemption ban" on GBTC shares, adds an intriguing layer to FTX's overall narrative.

Challenges from Customers:

Despite the positive strides in recovering value through liquid assets, $FTX faces challenges from some customers who contest the valuation of their claims. The current methodology pegs the value of customer funds to the asset prices at the time of FTX filing for Chapter 11 Bankruptcy. Given the significant surge in Bitcoin's price, up 150% since that date and currently trading at around $43,072, some customers are raising concerns about the fairness of this valuation approach.

Conclusion:

$FTX's journey from bankruptcy to doubling its cash reserves highlights the dynamism of the crypto market and the strategic decision-making within the industry. As the exchange navigates legal complexities, customer challenges, and market dynamics, the crypto community watches with anticipation to see how $FTX's recovery efforts will continue to shape the landscape of the digital asset space.

FTT now or never Just a check up and closer view on FTTs previous TA

FTT, FTX Token, R:R, money management, risk, reward, technique, style, trading, bitcoin , bitcointrading, profitable trading, profittrading, profit trading, secret, divergence, bull divergence, bear divergence, divergencetrading, divergence trading, trading strategy, how to trade bitcoin , bitcoin trades, bitcoin trading, make profit, take profit, trading strategy, trading technique, successful, successful trader, successful technique, successful strategy, successful secret, how to trade, trend analysis, technical analysis , indicators, rsi , relative strenght index, let it rain, successful life, easy strategy, easy trading, easy technique, make money, crypto investing, investing, crypto, cryptocurrency, cryptocurrencies, mentoring, money, chartart, beyond