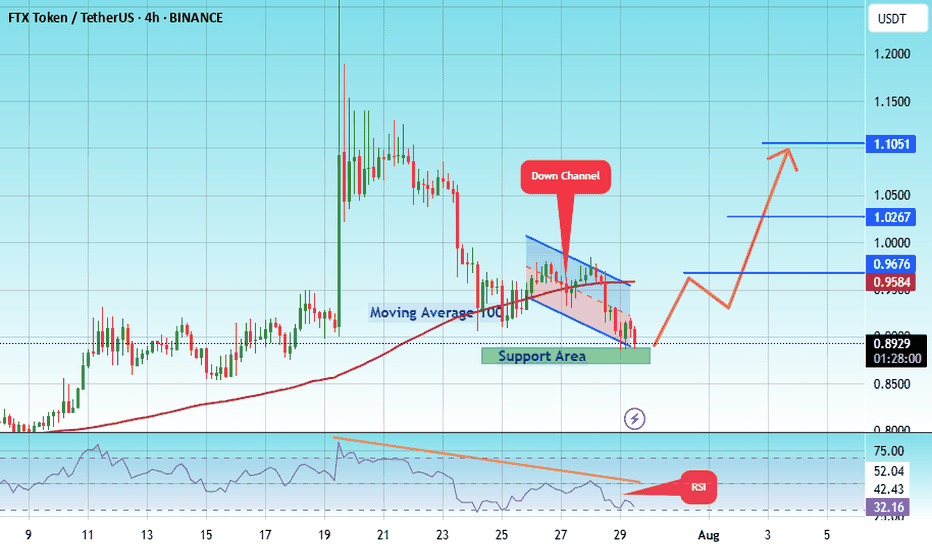

#FTX/USDT Breakout soon#FTX

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on track to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.8800.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.8760, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.8932

First target: 0.9584

Second target: 1.0267

Third target: 1.105

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Ftxtoken

#FTX/USDT#FTX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 1.23.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 1.29

First target: 1.37

Second target: 1.44

Third target: 1.52

FTX Founder Sam Bankman-Fried's Prosecutor QuitsThe cryptocurrency world is once again witnessing the ripple effects of legal drama surrounding FTX, as Danielle Sassoon, the prosecutor responsible for securing Sam Bankman-Fried’s conviction, has resigned. With speculation mounting about the implications for Bankman-Fried’s appeal, the TSX:FTT token is at the center of renewed attention. But does this development signal a fundamental shift for the beleaguered exchange token, or is it merely another headline in FTX’s tumultuous history?

Prosecutor’s Resignation: What Happened?

Danielle Sassoon, a key figure in the prosecution of Sam Bankman-Fried, played a pivotal role in exposing inconsistencies in his testimony, ultimately leading to his conviction. Bankman-Fried was found guilty of fraud, conspiracy, and money laundering, resulting in a 25-year prison sentence.

However, in a surprising turn of events, Sassoon resigned from her role as Acting U.S. Attorney for the Southern District of New York after just three weeks. Reports indicate that her decision stemmed from a disagreement with the U.S. Department of Justice (DOJ) regarding a corruption case against New York City Mayor Eric Adams. In an 8-page resignation letter, Sassoon expressed her unwillingness to comply with a DOJ directive to drop charges against Adams, citing a lack of legal justification for dismissal.

Her departure has ignited speculation within the crypto community. Some believe that a shift in prosecutorial stance could impact Bankman-Fried’s appeal, potentially influencing TSX:FTT ’s trajectory in the market. While such an outcome remains highly speculative, traders are watching closely for any developments that could alter TSX:FTT ’s sentiment.

Market Reactions and Technical Outlook

As of writing, TSX:FTT is down 4.27%, consolidating within a bearish zone after surging to nearly $4 in recent weeks. The token has struggled to maintain bullish momentum, with volume appearing weak amid market uncertainty.

Key Technical Indicators:

TSX:FTT remains in a downtrend after failing to hold its recent highs. A lack of significant buying While Sassoon’s resignation might be perceived as positive news for FTX’s former CEO, it remains uncertain whether this will translate into tangible gains for $FTT.

Can TSX:FTT Stage a Comeback?

Despite the legal drama, TSX:FTT ’s long-term outlook remains tied to the broader fate of FTX’s bankruptcy proceedings. The exchange collapsed in November 2022, leaving creditors and users grappling with the fallout. While certain developments, such as potential asset recoveries, could provide some relief, TSX:FTT ’s intrinsic value has been severely diminished due to the exchange’s downfall.

However, some traders see opportunities in TSX:FTT as a speculative asset, banking on volatility-driven short-term price swings.

Conclusion

While Danielle Sassoon’s resignation introduces a new narrative into the FTX saga, its tangible impact on TSX:FTT remains speculative at best. The token continues to trade under bearish conditions, and without a fundamental catalyst, a strong recovery remains unlikely in the near term. However, for short-term traders, volatility surrounding legal developments could present trading opportunities.

As the situation unfolds, investors should remain cautious, keeping an eye on both technical patterns and legal updates that could shape TSX:FTT ’s trajectory in the weeks ahead.

FTX Set to Begin Creditor Payouts in 2025: What It Means?The long-anticipated creditor repayments for FTX are finally set to commence, marking a pivotal moment in the exchange's financial restructuring. However, as with any major development in the crypto space, there are conditions, concerns, and market implications that traders need to be aware of. Here’s a breakdown of the upcoming FTX payout process and its potential impact on the price of $FTT.

FTX Creditor Payouts: Key Details

On February 18, 2025, certain FTX creditors will begin receiving their payouts, with those in the Convenience Class (claims up to $50,000) first in line. Under the restructuring plan, these creditors will receive 119% of their recorded claims, valued based on November 2022 asset prices, along with an additional 9% annual interest. However, all payments will be made strictly in stablecoins—excluding Bitcoin, altcoins, or any other crypto assets.

To receive payouts, users must complete KYC verification, submit tax documents, and select a distribution platform. Available payout platforms include Kraken and BitGo, but regional restrictions will apply, particularly in jurisdictions like Ukraine.

John J. Ray III, the chairman of the FTX liquidation committee, emphasized the importance of this step, stating:

"Today's announcement reflects the outstanding success of our recovery and coordination efforts over the past 28 months. These efforts are ongoing, and our focus remains on executing these distributions in accordance with our plan while also continuing to pursue the recovery of outstanding assets."

Scam Alerts and Delays in Compensation

As FTX prepares to distribute funds, scammers have seized the opportunity to defraud unsuspecting users. Fraudulent emails, phishing websites, and malware-laced links have surfaced, posing significant threats to creditors. Users are advised to only engage through official FTX channels and to verify any communications regarding payouts.

FTT Price Action: What’s Next?

The FTX Token ( TSX:FTT ) has experienced notable volatility amid these developments. At the time of writing, TSX:FTT is down 5.41%, trading in bearish territory, with eyes on its 1-month low as a support level.

A drop to this critical support zone could serve as an attractive entry point for traders, given that the level previously acted as resistance before flipping to support. If TSX:FTT manages to hold this range, it may attract fresh buyers looking for a reversal opportunity.

Conversely, a break above the 1-month resistance zone could trigger a strong influx of buyers, potentially leading to a 50% price surge. This scenario would depend on overall market sentiment and any further updates regarding FTX’s ongoing asset recovery efforts.

Market Sentiment and Final Thoughts

While the launch of FTX creditor repayments is a step forward in closing one of crypto’s biggest bankruptcy cases, uncertainties remain. Traders should monitor key technical levels for TSX:FTT while staying updated on regulatory and legal developments surrounding FTX’s liquidation.

FTT Breaks Out: Bullish Trend Targets 4.00+ FTT has broken out of a symmetrical triangle and is consolidating above a key support zone.

The ascending trendline supports the bullish structure, with potential upside toward $4.00+.

The bullish trend remains intact as long as the price holds the trendline.

Ftx token ( FTT)Ftt usdt Daily analysis

Time frame 4hours

Risk rewards ratio >2.5 👈👌👈👈

First target 4.5 $

Second target 5.45 $

LS should have been chosen very close to the entry point (a little below the diagonal line), but in order not to be caught, I chose LS much lower, so that over time and as the price grows, I will also raise LS and make it risk-free.

Good news has also been heard in cyberspace about the new management of the FTX exchange, which is paying off its debts, and this is a positive sign for the future this currency and it is likely to return to its original position, the price range before the problems it had with the Binance exchange. (20-25$)

Breaking: Joe Biden Might Pardon Sam Bankman, Founder of FTXThe crypto world is abuzz with speculation that President Joe Biden could pardon Sam Bankman-Fried, the founder of the defunct cryptocurrency exchange FTX. Bankman-Fried, sentenced to 25 years for fraud and money laundering, remains a polarizing figure. This speculation is fueled by his substantial political donations to the Democratic Party, estimated to total hundreds of millions. These ties have sparked debate about the potential influence on Biden’s discretion to grant a pardon.

Elon Musk’s commentary has added weight to these rumors, suggesting that such a move could distract from the upcoming power transition to Donald Trump, scheduled for January 20, 2025. Despite the speculation, platforms like Polymarket estimate only a 16% probability of a pardon, underscoring the general skepticism among political traders.

FTT’s Resurgence Amid Bankruptcy Developments

While political speculation swirls, FTX Token ( TSX:FTT ) has seen a remarkable 15% surge in value. This comes after FTX announced plans to begin creditor payouts in early 2025 as part of its Chapter 11 bankruptcy process. The court-approved plan will commence on January 3, 2025, with the first tranche of payments targeting "Convenience Classes" claims. The announcement has buoyed investor sentiment, pushing FTT’s price to $3.28 and its market cap to $1.08 billion, with trading volume surging 170%.

Despite this positive step, FTX’s recovery journey remains fraught with legal and financial complexities. The company’s eventual revival hinges on asset liquidation and the resolution of outstanding legal issues, a process likely to take years.

Technical Analysis of TSX:FTT

FTT’s recent price action highlights a bullish reversal pattern, defying the broader crypto market’s bearish trend. Trading at $3.20, FTT has a bullish RSI of 61.77, signaling strong momentum. Key technical levels include:

- Support: Immediate support lies at the 65% Fibonacci retracement level, providing a cushion for potential pullbacks.

- Resistance: The immediate pivot is the one-month high. A break above this level could ignite a bullish rally, targeting higher resistance zones.

FTT’s resilience amid market uncertainty suggests growing investor confidence, potentially driven by the promise of creditor payouts and speculation about the exchange’s future.

Overview

FTX Token’s value proposition has historically been tied to the FTX platform, offering benefits like fee discounts, staking rewards, and leveraged token creation. However, with FTX’s bankruptcy, the token’s utility has diminished. The recent price surge reflects speculative interest rather than intrinsic value, as the token’s future remains uncertain.

FTT Token Overview

- Launch: May 8, 2019

- Utility: Discounts on trading fees, staking rewards, and collateral for leveraged positions

- Current Status: Associated with a defunct platform, under Chapter 11 proceedings

Investor Caution

While the recent rally is promising, investors should approach TSX:FTT with caution. The token’s price movements are heavily influenced by speculative trading and bankruptcy developments. Moreover, the potential for token liquidation to pay creditors poses a significant risk to its value.

Conclusion

The dual narratives surrounding Sam Bankman-Fried’s potential pardon and FTX’s bankruptcy proceedings underscore the complexity of the situation. For TSX:FTT , the path forward is uncertain, balancing speculative optimism against the harsh realities of a defunct platform. Investors should closely monitor legal and market developments to navigate this volatile landscape effectively.

FTX Can Explode Higher In January MartyBoots here , I have been trading for 17 years and sharing my thoughts on FTX here.

FTX is looking beautiful , very strong base for more upside

Very similar to RSR which is up nearly 170% increase in a similar base

Do not miss out on FTX as this is a great opportunity

Watch video for more details

FTX Token (FTT)It seems FTT is oscillating in a wide sideway channel. Price is currently at the bottom and have to wait to breaks the downtrend line in order to goes up. Let's see what happens.

P.S. Be careful, Since the FTX Token crashed due to the fraud news.

FTT is about to riseFrom the point where we placed the green arrow on the chart, it seems that FTT has initiated an ABC pattern or a more complex structure. Wave B also appears to be a triangle that is nearing completion.

We expect FTT to soon enter a major wave C.

As long as the green zone is maintained, it can pump toward the TPs.

Closing a daily candle below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

FTX Reorganization Plan Fuels $FTT Rally Amidst Positive OutlookFTX Trading Ltd., the embattled cryptocurrency exchange undergoing Chapter 11 bankruptcy proceedings, has announced significant progress toward its reorganization plan. With a target implementation date set for January 2025, this development has sparked renewed investor confidence, propelling the TSX:FTT token’s price upward by 13% in recent trading sessions.

Reorganization Milestones

FTX’s reorganization plan, approved by the Court, aims to facilitate creditor and customer distributions, marking a critical step in its recovery journey. Key updates include:

- Distribution Framework:

The initial distribution of recovered assets is expected to begin within 60 days of the plan’s enforcement.

- Global Access:

FTX has partnered with specialized distribution agents to ensure global customer access, requiring users to complete KYC verification and tax formalities.

- Timeline:

Final arrangements with distribution agents by December 2024.

Effective date announcement by the end of December.

Initial distributions set for early 2025, prioritizing holders of allowed claims in Convenience Classes.

FTX CEO John J. Ray III emphasized the importance of the timeline, stating, “We are full steam ahead to reach arrangements with our distribution agents and return proceeds to creditors and customers as quickly as possible.”

If successful, the reorganization plan could restore significant trust in FTX, potentially attracting a surge of new and returning investors.

Technical Analysis:

The promising update has significantly impacted the FTT token’s performance:

TSX:FTT has surged 13%, continuing to trade within a bullish zone.

The Relative Strength Index (RSI) at 66, indicates strong upward momentum without entering overbought territory, suggesting room for further growth. The token is trading above key moving averages, reinforcing its bullish trajectory.

The bullish sentiment is further supported by market speculation that FTX’s ability to reimburse creditors could lead to a renewed influx of investor interest, bolstering the exchange’s reputation and operational capacity.

Looking Ahead

FTT’s recent price surge serves as a beacon of hope for FTX’s recovery, reflecting market optimism about its ability to execute its reorganization plan effectively. If the exchange successfully meets its commitments, it could not only restore trust among affected customers but also reposition itself as a formidable player in the cryptocurrency landscape.

With the reorganization plan underway, TSX:FTT appears poised to continue its upward trajectory, solidifying its place as a key token to watch in the coming months. For investors, this may signal a unique opportunity to ride the wave of FTX’s potential resurgence.

FTX Takes Legal Action Against Binance, CZ ZhaoFTX, the once-prominent cryptocurrency exchange, is embroiled in a high-stakes legal battle against Binance Holdings Ltd. and its former CEO, Changpeng Zhao. The lawsuit, filed by FTX, aims to claw back nearly $1.8 billion, accusing Binance and Zhao of participating in fraudulent transactions that involve the transfer of funds by Sam Bankman-Fried, FTX's co-founder, who is currently imprisoned.

This legal dispute centers around a controversial share repurchase deal that occurred in July 2021. Binance, Zhao, and other executives were allegedly involved in a transaction where they sold significant stakes in FTX's international and U.S. units. The funds for this repurchase deal were allegedly provided by Bankman-Fried using a combination of FTX's native token, TSX:FTT , and Binance’s own coins, BNB and BUSD, which were valued at $1.76 billion at the time.

The FTX estate claims that both FTX and its trading arm, Alameda Research, may have been insolvent since their inception and were definitely balance-sheet insolvent by early 2021. Consequently, the share repurchase deal is being challenged as fraudulent. In addition, FTX has accused Zhao of intentionally posting misleading tweets in the lead-up to FTX’s collapse, further accelerating the exchange’s downfall.

While Binance maintains that the claims are “meritless” and has vowed to vigorously defend itself, the legal action adds another layer of uncertainty to FTX’s already precarious situation, impacting not only the exchange but also its native token, $FTT. This article will explore both the technical and fundamental aspects of TSX:FTT amid these ongoing legal battles.

FTX’s Legal Woes and Impact on TSX:FTT

The legal battle between FTX and Binance has significant implications for the future of $FTT. The lawsuit itself stems from accusations of fraudulent transactions, which have already tainted FTX’s reputation. These claims—along with the ongoing bankruptcy proceedings—continue to weigh heavily on the exchange’s viability.

FTX’s insolvency issues, along with the accusations against Binance and Zhao, suggest that there is a long road ahead before any form of resolution can be achieved. As FTX fights to recover assets through lawsuits, the company’s ability to rebuild its reputation and infrastructure is increasingly called into question. With both institutional and retail investors likely to remain wary of TSX:FTT , this legal drama casts a long shadow over the token’s future.

Moreover, the involvement of Binance and Zhao, two major players in the crypto space, could fuel further controversy and market volatility. Given Binance’s prominence and Zhao’s influence, the outcome of this lawsuit could reverberate throughout the broader crypto ecosystem.

Technical Analysis

On the technical front, TSX:FTT has been trading within a rising trend, reflecting a modest 5.74% increase at the time of writing. The Relative Strength Index (RSI) stands at 61.80, suggesting that the token is in a potential continuation pattern. However, a closer look at the 2-hour chart reveals a bearish trend that could pose significant risks for TSX:FTT in the near term.

The token has been fluctuating around key support and resistance levels, and its future trajectory hinges on critical technical levels. Should TSX:FTT maintain support at $1.82, it may avoid a sharp sell-off. However, if it fails to hold this level, it could trigger a selling spree, pushing the price lower. On the other hand, a move to the pivot point at $2.36 could potentially lead to a brief bullish rally, although this could be short-lived given the legal uncertainty surrounding FTX.

What’s Next for TSX:FTT ?

The outlook for TSX:FTT remains uncertain, as the legal battle involving FTX and Binance continues to unfold. Fundamental factors, including FTX’s insolvency and the growing number of lawsuits, will likely weigh heavily on investor sentiment. At the same time, the technical setup for TSX:FTT remains fragile, with the potential for both upward and downward movement, depending on how the market reacts to ongoing developments.

Traders and investors will need to closely monitor both the legal proceedings and market sentiment. For now, the price action of TSX:FTT is bound by key support and resistance levels, with the potential for short-term fluctuations driven by market speculation and news surrounding the case.

Conclusion

The ongoing lawsuit, combined with FTX's bankruptcy and insolvency issues, highlights significant challenges for TSX:FTT in the coming months. While the technical indicators suggest the potential for short-term gains, these should be weighed against the broader fundamental uncertainty surrounding FTX and its legal battles. With the volatility likely to remain high, it is crucial for investors to stay informed about the developments in this case before making any major moves with $FTT.

FTX - BIG NEWS - Everyone Getting Money BackMartyBoots here. I have been trading for 17 years and I am here to share my ideas with you to help the Crypto space. The Bull market is here

FTX BIG NEWS , SETTLEMENT of funds.

Even tho the bull market is here FTX has not fully mooned yet there is still time to buy on DIPS . The market has just hit a critical level . This is a bullish structure and dips are buys, when these dips happen FTX can start its move higher . This needs to be watched carefully .

FTX can get very bullish with the ETH ETF launch also so we need to watch carefully

This can moon

Please watch the video for more information

FTT Surges 13% on FTX Investors to Settle With Sam BankmanA group of FTX investors have filed a court document to settle with Sam Bankman-Fried, the founder and former CEO of FTX, under the condition that he provides relevant information about key firms and celebrities related to the defunct exchange before its collapse. The settlement terms include proof that Bankman-Fried's net worth is negative. If approved by the court, the agreement would discharge all claims against Bankman-Fried.

According to a Bloomberg report, Bankman-Fried has agreed to cooperate with the class representatives to strengthen their case against celebrity promoters of FTX by providing confidential information about their involvement in raising FTX ratings before its eventual collapse in 2022. The list of celebrities includes Shaquille O'Neal, Stephen Curry, Lawrence Gene David, Tom Brady, Gisele Bundchen, and organizations such as MBA's Miami Heat franchises, SoftBank Group, Paradigm Operations LP, and many more.

The agreement mandates that Bankman-Fried release certain documents alongside evidence of these people and organizations' involvement with FTX. He will also provide a financial statement of all his current assets and a sworn affidavit of all his financial assets, including an affidavit stating that his net worth is negative.

The settlement comes after US Senator Elizabeth Warren demanded a full account of the several meetings between the head of the US Commodity & Futures Trading Commission (CFTC), Rostin Behnam, and Bankman-Fried before the FTX implosion.

Bankman-Fried was convicted of wire fraud, securities fraud, and money laundering in November 2023, and on March 28, he was sentenced to 25 years in prison, with a forfeiture of $11 billion worth of assets to fund the repayment of the victims of the FTX collapse.

FTT/USDT Ready to Resume its Bullish Journey? 👀🚀 FTT Analysis💎Paradisers, keep an eye on #FTTUSDT. It’s at a key point, testing the support at $1.65. If it keeps going up, we could see a price jump.

💎The first resistance target is at $2.39 for the FTT. If the asset manages to Break this level it could lead to even bigger gains.

💎If #FTXToken starts to drop at this support level, we’re ready for a bounce back from a deeper support at $1.40. This area is known for its high trading volume and has often led to big upward moves for $FTT.

💎If the price falls below this extra support level, it could mean a shift to a bearish market, with more selling. Stay alert and flexible as we follow the changes in the #FTT market.

Disclaimer : The token, #FTT, is associated with the FTX exchange. Please proceed with caution and conduct thorough research before trading.

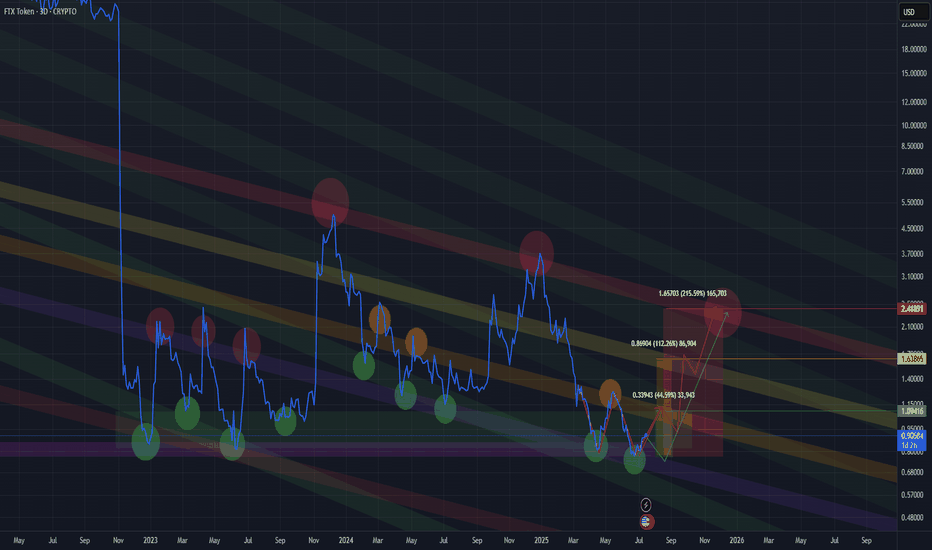

Alikze »» FTT | Completing the last corrective legIn the daily and weekly time, after a deep correction, it recovered a full movement cycle and then corrected the previous wave in the form of a double correction of 0.23 fibo. It is currently completing the microwaves, wave 2 of 3.

🔰 Therefore, I expect that no new floor will be created in the first phase.

🔰 In the second phase, this movement can continue its growth at least up to the range of 4.74. If it can break the first target, this ascending wave 3 or C will have the ability to reach the resistance targets specified on the chart.

However, moving up to Fibo 1.618 can move the important supply area and the beginning of a deep correction.

⚠️ In addition, if it penetrates and stabilizes below Fibo 0.23, this movement scenario will be invalid.

🟩Sup:1.50

⛳️Tp1 : 4.74

⛳️Tp2 : 9.16

⛳️Tp3 : 20.84

⛳️Tp4 : 29.52

»»»«««»»»«««»»»«««

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support.

Sincerely.❤️

»»»«««»»»«««»»»«««

2x is coming FTTAs i told you many times, i am holding some spot bags of FTT. The price of the FTX Token is holding well even if the exchange is dead (actually). When FTX will be resumed, i expect the price to pump. In the short term, if FTT can break above the mid term resistance at 2.7, a 2x is in play