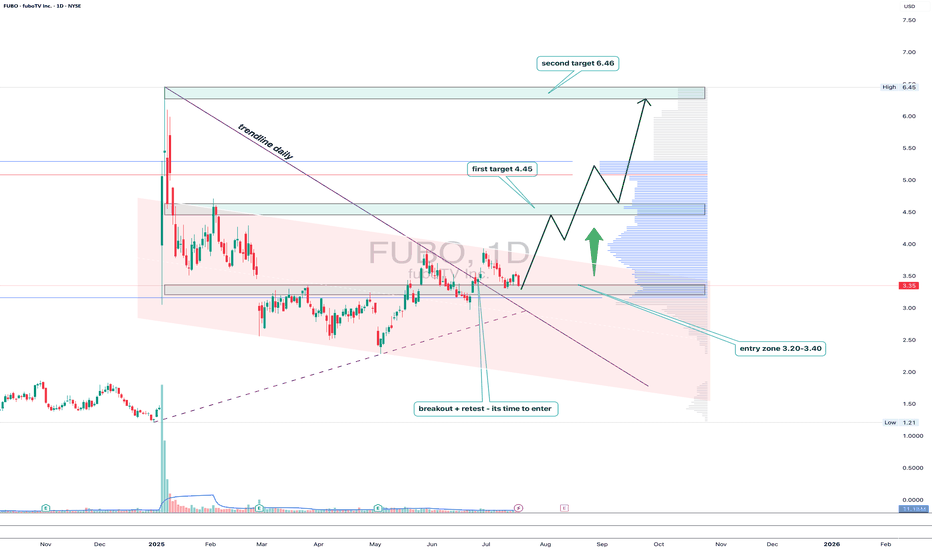

FUBO: trendline breakout with a subscription to $6.46FUBO has broken out of the descending trendline on the daily chart, followed by a clear retest and consolidation above the key 3.20–3.40 area. This zone coincides with the 0.5 Fibonacci retracement and high-volume support, confirming strong buyer interest.

As long as price holds above 3.20, the setup looks bullish with targets at 4.45 (0.382), 5.22, and finally 6.46 — the major resistance and top of the current range. Volume picked up on the breakout, validating accumulation from bigger players.

Fundamentally, FuboTV remains a niche contender in the sports streaming market. With optimized spending and new partnerships with major sports leagues, interest may spike ahead of events like the Olympics and NFL season.

Tactical setup:

— Entry zone: 3.20–3.40

— Must hold: above 3.20

— Targets: 4.45 / 5.22 / 6.46

— Invalidation: break below entry without buyer confirmation

This breakout might just be FUBO’s ticket to prime time.

FUBO

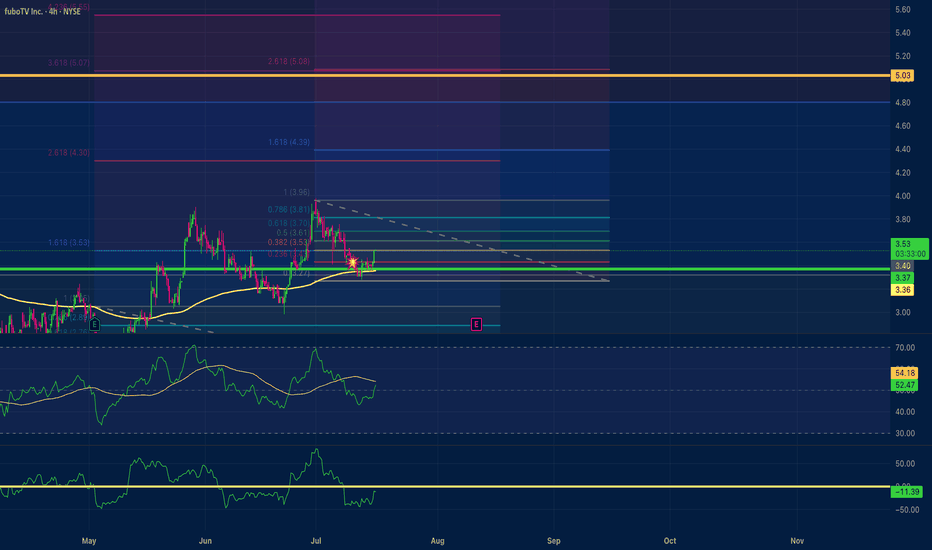

fuboTV $5.00 price target Positive Divergence Multi time frameMy trade on fuboTV has a $5.00 price target. With positive divergence multiple time frames 15,1hr, 4hr. An RSI scoop where the hrly RSI with a length setting of 36 shows upward momentum? The Chande momentum oscillator with a setting of 24 indicates the price may not stall at $4.50.

Daily Halftime Report: FUBO - Long PlayFUBO broke out to $4.99 this morning after announcing an agreement to combine their Online Live TV Businesses, creating a new venture with the merge that would position Disney with 70% Ownership | Fubo with the remaining 30%. This will prompt FuboTV to drop it's legal claims against Disney also. I'm looking for a potential entry at $3.69 after seeing it peak at $4.99, with a price target of $8.14 over time until the merger is completed, with confirmation of close above $3.81 on the stock.

MT-Newswire:

08:31 AM EST, 01/06/2025 (MT Newswires) -- Walt Disney (DIS) and streaming provider FuboTV (FUBO) are nearing an agreement to combine their online live TV businesses, Bloomberg reported Monday, citing sources familiar with the discussions.

Under the deal, Disney will merge its Hulu + Live TV business into Fubo, creating a new venture that would be 70% owned by Disney and 30% by Fubo, Bloomberg reported.

The transaction excludes Hulu's subscription video-on-demand business, which allows users to stream content on-demand for a fee, the report said

As part of the deal, Fubo is expected to drop its legal claims against Disney, Fox (FOX), and Warner Bros. Discovery (WBD) over Venu Sports, Bloomberg said.

Fubo, which had a market value of about $481 million as of Friday, will remain publicly traded after the deal, which could be announced as soon as this week, according to the report.

Representatives for Disney and Fubo didn't immediately respond to MT Newswires' requests for comment.

FuboTV shares soared by more than 60% in premarket trading, while Disney was little changed.

Is FUBO setting up for a MASSIVE MOVE UP? 65% UpsideCharturday #1: NYSE:FUBO 📺

Weekly Chart:

-H5 Indicator is GREEN

-Wr% trending up from bottoms

-Sitting on Volume Shelf

-Triangle Pattern x2 - Need to breakout...again

Daily Chart:

-Triple Bottom with a liquidity grab below 3rd bottom

-At volume shelf

-At bottom of Wr% and swinging higher

-Need to swing back up to $1.90 breakout area

Targets if we breakout of any of the patterns:

🎯$2.17🎯$2.36🎯$2.52🎯$2.82

I'm in this trade and holding on due to the H5 indicator staying GREEN on the weekly. If you aren't in this trade it's not one worth entering until we have a breakout.

Not financial advice.

$FUBO UPDATE! We may be primed for a BIG BOUNCE! NYSE:FUBO

-Staying patient and believe we may now be going for a triple bottom before we have our large move to the upside as you see on the daily chart below.

-Weekly H5 indicator is still GREEN

-We are also on the floor and green bounce area on the williams r%! Which to this point you've see what happens when we get there

-I'm not concerned because we haven't started moving big on the IWM yet and until then most small caps won't move unless they have a catalyst.

FuboTV Stock Surges After Winning Preliminary InjunctionShares of fuboTV Inc. (NYSE: NYSE:FUBO ) skyrocketed by 35.5% in the morning session following a significant legal victory against the proposed Venu Sports joint venture, involving industry giants The Walt Disney Company, FOX Corp., and Warner Bros. Discovery. This joint venture was poised to dominate 60%-80% of live broadcast sports content, which Fubo argued would stifle competition and inflate consumer prices. The court’s decision to grant a preliminary injunction has not only buoyed FuboTV’s stock but also positioned the company as a champion of consumer rights in the streaming market.

The Legal Victory: A Turning Point for FuboTV

FuboTV's victory in the courtroom is being hailed as a win for both the company and consumers. David Gandler, co-founder and CEO of Fubo, emphasized that the ruling helps ensure a competitive marketplace with multiple sports streaming options, thereby protecting consumers from potential monopolistic practices by larger players in the industry.

The injunction has had an immediate and profound impact on FuboTV's stock, which saw a massive gap up in Monday's premarket trading. The stock opened at $1.74, significantly higher than its previous close of $1.53, and continued to rise, last trading at $1.95 with a massive volume of 24,588,413 shares. This surge reflects the market’s positive reception of the ruling and the potential for a more favorable competitive environment in the sports streaming space.

Technical Analysis: Navigating the Volatility

While the legal victory has provided a significant short-term boost, FuboTV's stock remains highly volatile, which is evident in its historical price movements. Over the past year, FuboTV (NYSE: NYSE:FUBO ) has experienced 70 instances where its stock moved by more than 5% in a single session. However, a 35.5% jump is extraordinary even by Fubo’s standards, signaling that the market views this news as a major turning point.

Key Technical Indicators:

- 50-Day Moving Average: $1.30

- 200-Day Moving Average: $1.49

- Current Price: $1.91 (as of the time of writing)

- P/E Ratio: -2.19 (indicating ongoing losses)

The stock’s current price of $1.91 represents a 46.8% drop from its 52-week high of $3.56, reached in December 2023. Despite the recent surge, FuboTV’s stock is down 39.8% year-to-date, reflecting the broader challenges the company faces in turning its operations profitable.

Market Sentiment: Mixed But Improving

Despite the positive news, FuboTV remains a speculative play. The company reported 1.45 million paid subscribers in North America in its most recent quarter, up 24% year-over-year. However, it also posted a net loss of $25.8 million, underscoring the challenges it faces in achieving profitability. The market’s reaction to the injunction suggests a belief that FuboTV could leverage this legal win to improve its competitive standing, but the road to sustained profitability remains uncertain.

Institutional Activity: A Vote of Confidence?

Institutional investors have been active in FuboTV’s stock, with some increasing their stakes recently. Notably, Susquehanna Fundamental Investments LLC and Jacobs Levy Equity Management Inc. bought new positions in FuboTV during the first quarter, indicating a level of confidence in the company’s future prospects.

Conclusion: A Potential Rebound Play with Risks

FuboTV’s legal victory is a significant milestone that has reinvigorated investor interest in the stock. However, the company’s ongoing financial challenges and highly volatile stock price suggest that this is still a high-risk, high-reward investment. The stock's technical indicators show a potential for further gains, especially if the company can capitalize on the legal win to strengthen its market position. However, investors should remain cautious, as the stock’s volatility and negative earnings are key risks that could impact future performance.

FUBO turnaround could be soon?As expected after the rejection of the 200 day MA , a nice head-and shoulder formed, which has almost played out really by book. Notice the descending wedge, where the bottom should provide support (gap down possible, so the HAS could reach its target). Waiting for confirmation to close above 9day EMA, and then expecting an upward trend to fill the gap. Could hit the top of the wedge providing resistance.

FUBO fuboTV Options Ahead of EarningsIf you haven`t bought FUBO here:

Then analyzing the options chain and the chart patterns of FUBO fuboTV prior to the earnings report this week,

I would consider purchasing the $2.50 strike price Calls with

an expiration date of 2023-11-17,

for a premium of approximately $0.81.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

DISH a TV penny before earnings LONGDISH has earnings on 8/2. On the 2H, price just bounced off the support of the longest of the

three EMAs (35/70/280) and tested the POC line of the volume profile again showing buyer

support at a high trading volume and volatility area. the MACD indicator shows a bullish

line crossover and negative to positive on the histogram where convergence ended and

divergence took over. The dual RSI indicator shows the lower time frame green line in a

dip for a few days and then a rise above the 50 level and the higher time frame black line.

DISH has volume voids above the current price and the near-term pivot high is above. If that

cracks, price momentum could accelerate.

DISH is suitably set up for a long trade as traders anticipate the earnings. I will take it.

I may trade a sizeable trade of stocks or alternatively options striking $8 for 8/11.

FUBOTV moves before earnings LONGWith upcoming earnings on August 4th, as shown on the @H chart, FUBO is moving.

The set of three EMAs (35/70/280) show an impending crossover the longest EMA

and a golden cross between the other two has already occurred. The MACD demonstrates

the bullish momentum. The dual time frame RSI has the low/green line crossing the 50

level from well below it and then the high/ black line in the 60 range another confirmation

of bullish trend strength. I can appreciate that other traders are anticipating a bit of

a jump in the event of an earnings beat. I will join that group. The target is the level of

the double top of mid-July. The stop loss is the level of the golden cross of the EMAs.

An identified options trade is the strike of $ 3 expiring 8/11.

8/17/22 FUBOfuboTV Inc. ( NYSE:FUBO )

Sector: Technology Services (Internet Software/Services)

Market Capitalization: $993.186M

Current Price: $5.36

Breakout price trigger: $6.00

Buy Zone (Top/Bottom Range): $5.50-$4.10

Price Target: $8.10-$8.60

Estimated Duration to Target: 30-34d

Contract of Interest: $FUBO 9/16/22 6c

Trade price as of publish date: $0.77/contract

FUBO: Heading to $5-6Fubo is in the midst of a powerful downtrend. It is already down more than 70% in the last few months, and my count leads me to believe that shares will lose another 50% of value before this sell-off concludes. If you hold a long position currently, you should strongly consider selling.