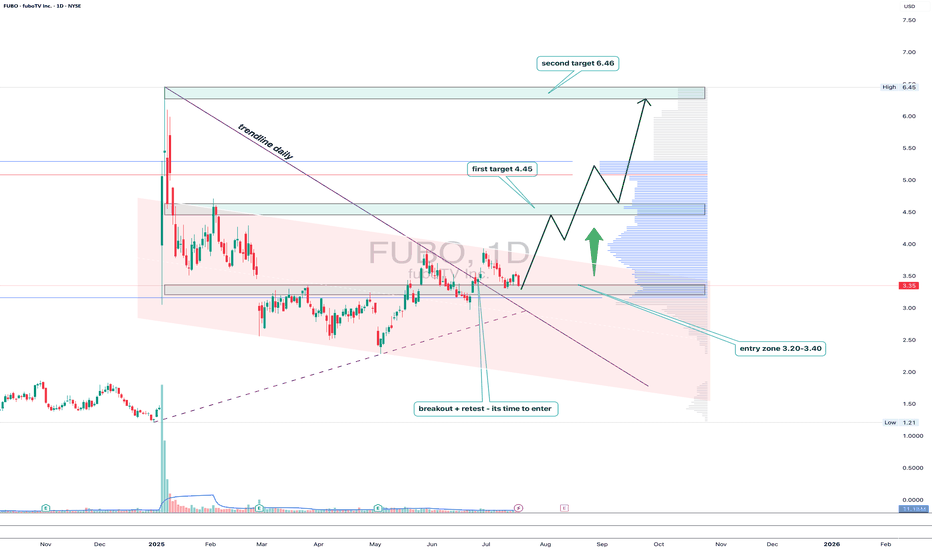

FUBO: trendline breakout with a subscription to $6.46FUBO has broken out of the descending trendline on the daily chart, followed by a clear retest and consolidation above the key 3.20–3.40 area. This zone coincides with the 0.5 Fibonacci retracement and high-volume support, confirming strong buyer interest.

As long as price holds above 3.20, the setup looks bullish with targets at 4.45 (0.382), 5.22, and finally 6.46 — the major resistance and top of the current range. Volume picked up on the breakout, validating accumulation from bigger players.

Fundamentally, FuboTV remains a niche contender in the sports streaming market. With optimized spending and new partnerships with major sports leagues, interest may spike ahead of events like the Olympics and NFL season.

Tactical setup:

— Entry zone: 3.20–3.40

— Must hold: above 3.20

— Targets: 4.45 / 5.22 / 6.46

— Invalidation: break below entry without buyer confirmation

This breakout might just be FUBO’s ticket to prime time.

Fubotv

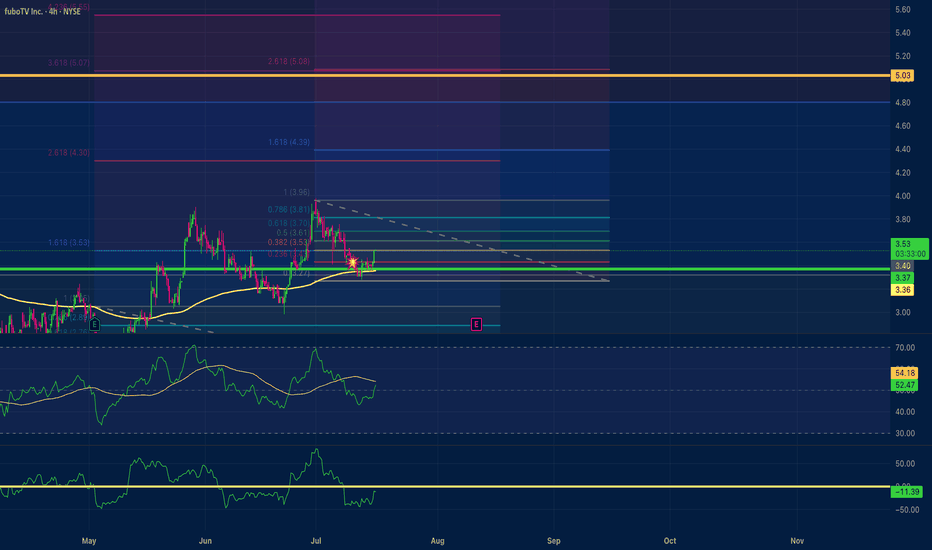

fuboTV $5.00 price target Positive Divergence Multi time frameMy trade on fuboTV has a $5.00 price target. With positive divergence multiple time frames 15,1hr, 4hr. An RSI scoop where the hrly RSI with a length setting of 36 shows upward momentum? The Chande momentum oscillator with a setting of 24 indicates the price may not stall at $4.50.

Daily Halftime Report: FUBO - Long PlayFUBO broke out to $4.99 this morning after announcing an agreement to combine their Online Live TV Businesses, creating a new venture with the merge that would position Disney with 70% Ownership | Fubo with the remaining 30%. This will prompt FuboTV to drop it's legal claims against Disney also. I'm looking for a potential entry at $3.69 after seeing it peak at $4.99, with a price target of $8.14 over time until the merger is completed, with confirmation of close above $3.81 on the stock.

MT-Newswire:

08:31 AM EST, 01/06/2025 (MT Newswires) -- Walt Disney (DIS) and streaming provider FuboTV (FUBO) are nearing an agreement to combine their online live TV businesses, Bloomberg reported Monday, citing sources familiar with the discussions.

Under the deal, Disney will merge its Hulu + Live TV business into Fubo, creating a new venture that would be 70% owned by Disney and 30% by Fubo, Bloomberg reported.

The transaction excludes Hulu's subscription video-on-demand business, which allows users to stream content on-demand for a fee, the report said

As part of the deal, Fubo is expected to drop its legal claims against Disney, Fox (FOX), and Warner Bros. Discovery (WBD) over Venu Sports, Bloomberg said.

Fubo, which had a market value of about $481 million as of Friday, will remain publicly traded after the deal, which could be announced as soon as this week, according to the report.

Representatives for Disney and Fubo didn't immediately respond to MT Newswires' requests for comment.

FuboTV shares soared by more than 60% in premarket trading, while Disney was little changed.

Is FUBO setting up for a MASSIVE MOVE UP? 65% UpsideCharturday #1: NYSE:FUBO 📺

Weekly Chart:

-H5 Indicator is GREEN

-Wr% trending up from bottoms

-Sitting on Volume Shelf

-Triangle Pattern x2 - Need to breakout...again

Daily Chart:

-Triple Bottom with a liquidity grab below 3rd bottom

-At volume shelf

-At bottom of Wr% and swinging higher

-Need to swing back up to $1.90 breakout area

Targets if we breakout of any of the patterns:

🎯$2.17🎯$2.36🎯$2.52🎯$2.82

I'm in this trade and holding on due to the H5 indicator staying GREEN on the weekly. If you aren't in this trade it's not one worth entering until we have a breakout.

Not financial advice.

$FUBO UPDATE! We may be primed for a BIG BOUNCE! NYSE:FUBO

-Staying patient and believe we may now be going for a triple bottom before we have our large move to the upside as you see on the daily chart below.

-Weekly H5 indicator is still GREEN

-We are also on the floor and green bounce area on the williams r%! Which to this point you've see what happens when we get there

-I'm not concerned because we haven't started moving big on the IWM yet and until then most small caps won't move unless they have a catalyst.

FUBO fuboTV Options Ahead of EarningsIf you haven`t bought FUBO here:

Then analyzing the options chain and the chart patterns of FUBO fuboTV prior to the earnings report this week,

I would consider purchasing the $2.50 strike price Calls with

an expiration date of 2023-11-17,

for a premium of approximately $0.81.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

DISH a TV penny before earnings LONGDISH has earnings on 8/2. On the 2H, price just bounced off the support of the longest of the

three EMAs (35/70/280) and tested the POC line of the volume profile again showing buyer

support at a high trading volume and volatility area. the MACD indicator shows a bullish

line crossover and negative to positive on the histogram where convergence ended and

divergence took over. The dual RSI indicator shows the lower time frame green line in a

dip for a few days and then a rise above the 50 level and the higher time frame black line.

DISH has volume voids above the current price and the near-term pivot high is above. If that

cracks, price momentum could accelerate.

DISH is suitably set up for a long trade as traders anticipate the earnings. I will take it.

I may trade a sizeable trade of stocks or alternatively options striking $8 for 8/11.

fuboTV: Double Top at the 0.382 Retrace and 200 Day SMAfuboTV right now has gapped up and hit a 38.2% Fibonacci Retrace and is now Double Topping and Bearishly Diverging on both the MACD and RSI at this level. As things currently are, I would expect the gap to eventually be filled, but overall, fundamentally looking at their financials, I think the stock goes down to the 1.272 Fibonacci extension, which would take it all the way down to around 6.18 cents.

8/17/22 FUBOfuboTV Inc. ( NYSE:FUBO )

Sector: Technology Services (Internet Software/Services)

Market Capitalization: $993.186M

Current Price: $5.36

Breakout price trigger: $6.00

Buy Zone (Top/Bottom Range): $5.50-$4.10

Price Target: $8.10-$8.60

Estimated Duration to Target: 30-34d

Contract of Interest: $FUBO 9/16/22 6c

Trade price as of publish date: $0.77/contract

FUBO: Heading to $5-6Fubo is in the midst of a powerful downtrend. It is already down more than 70% in the last few months, and my count leads me to believe that shares will lose another 50% of value before this sell-off concludes. If you hold a long position currently, you should strongly consider selling.

FUBO LONG

$FUBO is one of these stocks that I always hoped I had as a huge soccer fan in the United States. I have been a subscriber for over a year now and I'm loving it. I was hoping for it to drop to the 22ish region when it was in the 30s so I can load up but didn't have enough cash to do so. I do now and I'll be loading up at these delicious price levels.

Another confirmation to taking the long position here is the downward sloping channel which is a bullish signal. Look at the divergence in the RSI too. I will be holding this long-term.

Monster bull flag on FUBO chartFubo has been on a nice run lately but I think its just getting started. I expect a massive breakout of this bull flag and a push to $38-$40 in the next few weeks. Great growth stock that is being slept on. Not for long though, FOMO buyers will be plowing in before you know it.

FuboTV Channel!!Money Makers!

When looking at FuboTV on the daily TF we can see it trading in a nice parallel channel. It's making lower highs into support which is a sin of weakness and may continue lower if support is broken. We'll need to watch closely how this stock reacts at this zone in the coming days.

Love it or hate it, hit that thumbs up and share your thoughts!

Don't trade with what you're not willing to lose. Safe Trading Calculate Your Risk/Reward & Collect!

This is not financial advice.

Simplicity Wins