GOLD WEEKLY OPEN – Sentiment-Driven Marke🟡 GOLD WEEKLY OPEN – Sentiment-Driven Market as Asian Sellers Hit Early

Gold kicked off the new week with a sharp drop during the early Asian session, falling over 40 points from last week’s highs into the 297x zone — a move that reflects lingering sell-side pressure from last Friday’s close.

However, price quickly rebounded nearly 40 points, showing clear buy-side interest at the 297x zone — which acts as a key structural support on the H4 and D1 timeframes.

📌 If price breaks below this level convincingly, it could trigger a deeper move toward 295x.

🔍 Technical Breakdown:

The overall structure on H4 and D1 remains bullish

But right now, investor sentiment is leading, not just technicals

On H1 and H2, price is reacting to the 0.5 Fibonacci retracement zone

If gold closes below 3030, we could see another leg down into the 295x area

🧠 Sentiment Is In Control (For Now)

So far, only Asia and Australia have shown their hand

We’re waiting on London and New York to step in before confirming trend direction

With price whipping around inside a broad range — only trade from key zones with clear price reaction

🧭 Key Technical Zones:

🔺 Resistance:

3055 – 3076 – 3107

🔻 Support:

3024 – 3005 – 2970 – 2952

🎯 Trading Plan:

🟢 BUY ZONE: 2980 – 2978

SL: 2974

TP: 2984 – 2988 – 2992 – 2996 – 3000

🔴 SELL ZONE: 3076 – 3078

SL: 3082

TP: 3072 – 3068 – 3064 – 3060 – 3056 – 3050

📅 What To Watch This Week:

This week brings major market movers:

CPI → PPI → Fed speakers — all lined up midweek.

→ Be selective with your trades and keep tight risk control.

AD will continue updating intraday zones across sessions.

✅ Trade smart. Respect your risk. Let the market come to you.

— AD | Money Market Flow

Fundamental-analysis

GOLD BREAKS SHARPLY — BUT THE MOVE WAS WRITTEN IN THE STRUCTURE🟡 GOLD BREAKS SHARPLY — BUT THE MOVE WAS WRITTEN IN THE STRUCTURE

A steep drop in gold just rattled the markets — but if you’ve been following the macro and technical setup closely, this was not only expected, but anticipated.

From the first week of April, we’ve been tracking signals of potential exhaustion in XAUUSD:

🕯️ Candlestick wicks on higher timeframes

📈 Overextended structure

🧠 Macro divergence

Now, all signs have converged — and we’re finally seeing the correction play out.

🔍 Why This Isn’t Just About Gold

What we’re seeing is a broader shift in global market sentiment:

U.S., European, and Asian equities are all under pressure

Crypto has stagnated with little to no fresh capital inflow

Gold — after months of aggressive buying — is now facing wave after wave of profit-taking

This is classic risk-off behaviour.

Investors are choosing cash, sitting tight, and waiting for clarity — not only in the charts but in the headlines too.

📉 DXY Building a Case for Recovery

The U.S. Dollar Index (DXY) has been heavily sold in recent months — but is now holding at a multi-year structural support zone that’s been tested multiple times since 2021.

With Trump returning to the spotlight and triggering a fresh round of global tariff negotiations, the USD is regaining narrative strength.

Trump’s stance has already prompted discussions among major economies, putting the U.S. in a dominant position — and the market is beginning to price that in.

🤔 What’s Holding the Fed Back?

Despite rising trade tensions, the Federal Reserve has remained cautious — choosing not to act until the dust settles from geopolitical and policy developments.

This creates a window of opportunity:

If the Fed holds rates while global central banks soften

And if the USD holds this major support

→ We could see strong dollar flows return in Q2.

🔮 Gold Outlook – Where Next?

In the short term:

Expect continued volatility

Potential for gold to slide further toward 308x – 305x range

Any bounce is likely to be technical rather than fundamental

In the medium term:

Once political noise fades, gold may find support again

Especially if inflation expectations persist or the Fed pivots dovish later in Q2

💡 Takeaways for UK Traders

✅ Don't trade the news — trade the reaction

✅ Macro structure matters more than the daily headlines

✅ Capital preservation beats chasing euphoria

We’re not guessing.

We’re reading the story and planning with structure.

XAUUSD-GOLD can still break upward ? read captionGold (XAU/USD) has just soared to a new all-time high, reflecting heightened investor demand for safe-haven assets amid economic uncertainties. The surge comes as global markets react to inflation concerns, geopolitical tensions, and shifting monetary policies, further strengthening gold’s position as a premier store of value. With central banks increasing their reserves and investors seeking stability, the precious metal continues to shine, marking a historic moment in the financial markets.

IS THE GLOBAL “BIG SHORT” ON ITS WAY?TRADE WAR WARNING – IS THE GLOBAL “BIG SHORT” ON ITS WAY?

In the last 24 hours, global financial markets were rattled after Donald Trump unveiled a sweeping set of new global tariffs. This wasn’t just a political move — it may well mark the beginning of a new wave of global economic instability.

Markets across the board took a hit:

📉 US, European, and Asian equities

📉 Gold (XAU/USD), the US Dollar Index (DXY), and even crypto — all plunged into the red.

🔍 So, What Actually Happened?

Gold dropped by over 100 points in a single session — and strangely, the US dollar also fell.

Normally, a weaker USD would support gold. So why did gold sell off this time?

➡️ One likely explanation is that institutional investors sold gold positions to cover losses in equity markets, or to free up margin amidst the chaos.

📉 This wasn’t just a correction — it might be the early signal of a global BIG SHORT forming across multiple asset classes.

🧨 The Start of Something Bigger?

Markets aren’t just reacting to tariffs. They’re pricing in the risk of a full-scale trade war, which could disrupt global supply chains and hammer corporate earnings.

Industries like construction, healthcare, logistics, and manufacturing are already showing signs of strain.

If this escalates, we could be looking at something far more serious than a short-term sell-off.

📉 The Data Doesn’t Look Great Either

While inflation in the US continues to cool, other key data points are deteriorating:

ISM Services PMI (March): 50.8 (vs 53.0 expected)

Employment sub-index: 46.2 (down sharply from 53.9)

New orders, export orders and backlogs also fell

👉 These are real signs of economic slowdown, especially considering that services make up over 70% of the US economy.

🧠 Market Sentiment: FOMO, Fear, and Panic

At the moment, it’s hard to ignore how unsettled sentiment has become.

Retail and institutional traders alike are acting on fear. And that’s dangerous.

🔔 Tonight’s Non-Farm Payrolls (NFP) report could either calm things down — or add more fuel to the fire.

🏦 Will the Fed Cut Rates Sooner?

Markets are rapidly shifting their expectations:

A rate cut could come as early as May or June 2025

Traders are now pricing in 2 to 4 cuts this year (previously just 2)

There’s now a strong chance the Fed pivots earlier than expected

If jobs data continues to soften, the Fed may have no choice but to act faster — despite core inflation not yet fully under control.

⚠️ Trading Strategy: Observation Over Action

Right now, your best position might be… no position.

"Sometimes, the most profitable trade is the one you don’t take."

This isn’t the time to chase wild price action.

It’s the time to prepare and plan with logic — not emotion.

📊 Key Technical Levels on XAU/USD

🔺 Resistance:

3110 – 3119 – 3136 – 3148 – 3167

🔻 Support:

3086 – 3075 – 3055 – 3040 – 3024

🟢 BUY ZONE: 3056 – 3054

SL: 3050

TP: 3060 – 3064 – 3068 – 3072 – 3076 – 3080

🔴 SELL ZONE: 3148 – 3150

SL: 3154

TP: 3144 – 3140 – 3136 – 3132 – 3128 – 3124 – 3120

💬 Final Thoughts

The combination of tariffs, recession fears, and rate cut speculation is building into what could become a perfect storm.

Gold is in the eye of that storm.

Now is not the time to panic — but to trade with clarity and control.

📌 Don’t let emotion drive your trades.

Stick to the chart. Stick to your plan. Protect your capital.

🧠 Patience is what separates the lucky from the consistently profitable.

Fundamental Market Analysis for April 4, 2025 GBPUSDGBP/USD briefly broke above 1.32000 for the first time in six months on Thursday and climbed to fresh highs amid widespread weakness in the US Dollar. The Trump administration's reciprocal tariffs and flat tariffs knocked the legs out from under market sentiment, despite a delayed reaction to the tariff announcements that followed after US markets closed on Wednesday.

A fairly quiet calendar of economic publications is expected in the UK this week. However, investor attention will be focused on Friday's release of the US Non-Farm Payrolls (NFP) report. This data could have a major impact on market sentiment as the US economy enters a post-tariff phase. The March employment report is predicted to be a marker of sorts for the impact of the Trump administration's trade policies.

In addition, the ISM's US services business activity index (PMI) for March, released on Thursday, added to the negativity by falling to 50.8, its lowest level in nine months. The drop in the index was one of the fastest since the pandemic began. Weakening business activity and declining consumer optimism began before the tariffs went into effect, and are unlikely to normalize quickly anytime soon.

President Donald Trump approved the imposition of a 10 percent duty on all imports starting April 5, and the counter tariffs took effect on April 9. Analysts at Fitch Ratings believe U.S. GDP growth will be lower than the March forecast, which had previously been adjusted downward. The agency also warned that the effect of the tariff policy may affect the decisions of the Federal Reserve: the Fed may suspend the easing of monetary policy while it assesses the impact of duties on inflation and labor indicators.

Trading recommendation: BUY 1.30900, SL 1.30200, TP 1.32000

Non-Farm Payrolls – April 4: The key market driver!On Friday, April 4, 2025 at 3:30 PM EET, the U.S. Department of Labor will release one of the most anticipated macroeconomic reports — the Non-Farm Payrolls (NFP). This figure reflects the change in the number of jobs in the non-farm sector and is a crucial indicator of economic health. Strong numbers suggest economic expansion and may prompt the Fed to tighten monetary policy, while weak data could strengthen expectations of rate cuts — impacting stocks, the U.S. dollar, bonds, and commodities.

Historically, NFP reports have triggered significant market reactions, with sharp movements depending on the actual data versus expectations. Analysts forecast a moderate job gain, indicating a slowdown compared to recent months. The release comes amid uncertainty linked to new tariffs introduced by President Trump, which may affect business confidence and consumer spending. Investors are closely watching for signals on the economy’s direction and potential Federal Reserve actions.

How could NFP impact the markets?

• Stock market: Weak data could stoke recession fears, pressuring equities, especially in cyclical sectors. However, if seen as a reason for Fed easing, markets may rebound.

• U.S. Dollar: A disappointing report might weigh on the dollar as investors adjust their rate expectations. Strong figures, on the other hand, would support USD.

• Bonds: Slower job growth could drive demand for U.S. Treasuries, pushing yields lower.

• Gold: In case of weak data, gold may rally as a safe haven amid rising expectations of looser monetary policy.

Economists expect a job gain of around 140,000, lower than previous figures — a scenario that could increase market volatility. Get ready for big moves!

XAU/USD Trendline Breakout (02.04.2025)The XAU/USD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Trendline Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 3077

2nd Support – 3048

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

GOLD TRADING PLAN – After Breaking ATH & Sharp CorrectionGOLD TRADING PLAN – After Breaking ATH & Sharp Correction

🔥 Former U.S. President Donald Trump has officially announced a comprehensive global tariff policy, targeting multiple countries and regions. This sparked:

📉 A major sell-off in risk assets

💵 A sharp weakening in the U.S. Dollar

🪙 A strong rally in gold, reaching a new All-Time High (ATH) at 3167 as a preferred safe-haven asset

📉 Latest Market Reaction – Gold Corrects from ATH

After a strong bullish breakout, gold is now pulling back from its peak, driven by profit-taking and investor caution ahead of key economic data — including the upcoming Nonfarm Payrolls (NFP) report.

Despite the short-term pullback, the overall trend remains bullish on higher timeframes.

📐 Technical Overview

Yesterday, we identified and traded a symmetrical triangle pattern, which broke out sharply as expected. Now, price is retesting previous breakout zones — where new long opportunities may form.

📌 Focus on BUY setups during the Asian & EU sessions, and be cautious during the U.S. session due to expected volatility.

🔍 Key Technical Levels

🔺 Resistance Levels:

3167 (ATH) – 3175 – 3185 – 3198 – 3206

📝 (These are psychological levels & Fibonacci extensions. Wait for clear candle confirmation before entering.)

🔻 Support Levels:

3140 – 3132 – 3120 – 3112 – 3106 – 3100

🛒 TRADE PLAN

🟢 BUY ZONE: 3112 – 3110

🛑 Stop Loss: 3106

🎯 Take Profits: 3116 – 3120 – 3124 – 3128 – 3132 – 3136 – 3140

🔴 SELL ZONE: 3167 – 3169

🛑 Stop Loss: 3173

🎯 Take Profits: 3162 – 3158 – 3154 – 3150

⚠️ Final Notes

📈 The uptrend is still in play — no need to FOMO sell near the highs.

⏳ Be patient, wait for price to react at key support/resistance zones.

🚫 Avoid overtrading or rushing into trades — tariff news has major global impact.

📅 Stay sharp ahead of Friday’s NFP release — we'll reassess trend direction after the data.

✅ Stick to your risk management: follow your TP/SL strictly.

Wishing you safe & profitable trades! 💼📊

Gold (XAU/USD) : Bullish Setup with Key Demand Zone🔹 Trend Line & Demand Zone 📈

* The trend line shows an upward trend. 🚀

* The demand zone 🟦 acts as strong support, where buyers are likely to step in.

🔹 Price Action 🔍

* Price is bouncing off the demand zone ➡️ Bullish Signal 📊🔥

* Higher lows forming, indicating potential upward momentum.

🔹 Trade Setup 🎯

✅ Entry Point: Near the demand zone 🟦

❌ Stop Loss: 🔽 3,099.26 (Below demand zone)

🎯 Target Point: ⬆️ 3,148.58 (Key resistance area)

🔹 Expected Movement 🏆

* A slight pullback 📉 before a strong push up 📈💪

* If price holds the demand zone, 🚀 potential rally ahead!

🔹 Risk-to-Reward Ratio ⚖️

* Favorable trade setup ✅ High reward, controlled risk 🎯

🔹 Final Verdict 🔥

📊 Bullish Bias ✅ As long as demand zone holds!

🚨 Warning: If price breaks below 3,099.26, expect further downside!

Fundamental Market Analysis for April 3, 2025 EURUSDEUR/USD saw a bullish spike on Wednesday after the Trump administration announced tariffs that were less severe than many investors expected given President Donald Trump's flurry of tariff threats over the past 72 days. While the specific tariff proposals are unclear, U.S. consumers should prepare for flat 10 percent tariffs on all imports, significant 25 percent tariffs on all automobiles and auto parts, and “reciprocal” tariffs imposed at different rates depending on the country.

In addition, Trump has reiterated his intention to impose additional tariffs on goods such as copper, microchips, and other important imported consumer goods that are vital to the U.S. economy. As these tariffs are likely to drive up consumer prices in the coming months and there is no obvious alternative in the market to obtain foreign goods without incurring high import duties, inflationary pressures are expected to rise soon and persist longer than desired. According to Federal Reserve (Fed) officials, the uncertainty of the Trump administration's trade policy is likely to keep interest rates elevated for an extended period beyond previous expectations.

European economic indicators are likely to remain moderately light for the rest of the trading week. Meanwhile, new US Non-Farm Payrolls (NFP) data is expected this Friday. The NFP report could have a significant impact on the markets as the US economy moves into a post-tariff phase, and the March labor statistics will be a key indicator of the impact of the Trump administration's tariff strategy.

Trading recommendation: BUY 1.09100, SL 1.08400, TP 1.10300

ADP in Focus: Will Strong Jobs Data Trigger Gold Pullback?🟡 GOLD MARKET BRIEF – Early Asian Surge Meets Resistance Ahead of Key US Jobs Data

Gold kicked off the day with a sharp rally during the Asian session, driven by consistent demand from Asian and Middle Eastern investors — a pattern we’ve seen forming repeatedly during early sessions lately.

However, price reacted swiftly at the 3130–3135 resistance zone, exactly as mapped out in yesterday’s trading plan. With sellers stepping in again, my outlook remains:

🔻 Look for reaction-based SELL opportunities in the Asian and London sessions, especially if price pulls back into key resistance.

📉 Technical Outlook:

Gold is approaching the apex of a symmetrical triangle pattern, suggesting a breakout is imminent.

✅ As always: Wait for the breakout — then trade the retest in the confirmed direction.

📰 Fundamental Focus:

All eyes today will be on the US ADP Non-Farm Employment report, which tends to offer early clues ahead of Friday’s NFP.

Should the data come in stronger than expected, USD could gain traction — likely applying downward pressure on Gold, in line with our target zone around 308x–307x.

🧭 Key Technical Levels:

🔺 Resistance: 3128 – 3135 – 3142 – 3148

🔻 Support: 3110 – 3100 – 3080 – 3070

🎯 Trade Plan:

🟢 BUY ZONE: 3102 – 3100

SL: 3096

TP: 3106 – 3110 – 3114 – 3118 – 3122 – 3126 – 3130

🔴 SELL ZONE: 3148 – 3150

SL: 3154

TP: 3144 – 3140 – 3136 – 3132 – 3128 – 3124 – 3120

📌 Caution: With ADP on deck during the US session, expect a spike in volatility.

Stick to clear levels, protect capital, and trade with discipline — not emotion.

Let the market come to you.

— AD | Money Market Flow

EUR/USD Triangle Breakout (02.04.2025)The EUR/USD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Triangle Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 1.0736

2nd Support – 1.0707

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Fundamental Market Analysis for April 2, 2025 USDJPYThe Japanese Yen (JPY) fails to capitalise on the previous day's modest gains against its US counterpart and attracts fresh sellers during Wednesday's Asian session. The USD/JPY pair, however, remains in the range it has been in since the beginning of this week as traders await a new catalyst before positioning for the next leg of directional movement. As such, attention will remain focused on US President Donald Trump's announcement of retaliatory tariffs later today.

Meanwhile, speculation that the slowdown in the economy caused by the tariffs may force the Bank of Japan (BoJ) to keep policy steady for now is undermining the yen. However, investors seem convinced that the BoJ will continue to raise interest rates amid signs of rising inflation in Japan. This is a significant divergence from the growing confidence that the Federal Reserve (BoJ) will resume its rate-cutting cycle in June, and should support the lower-yielding Japanese Yen.

Trade recommendation: SELL 150.00, SL 150.90, TP 148.60

Gold Eyes Fresh Highs Amid Geopolitical Tensions🟡 Gold Eyes Fresh Highs Amid Geopolitical Tensions & Quarter-End Volatility

Gold started April with a strong bullish gap, reaching another all-time high during the Asian session. Price is now trading near the upper bound of a multi-day structure, supported by ongoing geopolitical risks, macro uncertainty, and flight-to-safety flows.

European and UK traders should remain cautious today, as end-of-month volatility may lead to fake breakouts, stop hunts, and liquidity grabs – especially ahead of key U.S. economic data later this week.

🧠 Market Context:

Risk sentiment remains fragile as global equities faced pressure overnight.

Safe haven demand is elevated following weekend headlines tied to geopolitical conflict and natural disaster risks in Asia.

Traders are also watching the market’s reaction to Trump’s softened tone on tariffs — potentially shifting macro flows in risk assets.

🔍 Technical Outlook:

Price action remains bullish overall, but the pair is extended at current levels.

Expect high volatility today as monthly candles close — with a chance of both upside wicks and liquidation dips.

Scalping or reacting at well-defined zones is preferred over chasing.

🧭 Key Technical Levels:

🔺 Resistance: 3158 – 3166 – 3172 – 3180

🔻 Support: 3133 – 3122 – 3111 – 3100

🎯 Trading Plan:

🟢 BUY ZONE: 3122 – 3120

SL: 3116

TP: 3126 – 3130 – 3134 – 3138 – 3142 – 3146 – 3150

🔴 SELL ZONE: 3170 – 3172

SL: 3176

TP: 3166 – 3162 – 3158 – 3152 – 3148 – 3144 – 3140

⚠️ Final Note:

Today’s session could be chaotic with month-end flows and low liquidity pockets.

Stick to clean setups. Wait for confirmation. Always use SL/TP.

📌 If you found this plan helpful, like & follow for daily setups and institutional-level insights.

📊 Trade with structure, manage your risk, and let the market come to you.

Gold Spot (XAU/USD) Price Analysis – Key Zones & Potential Movem🔵 Key Price Levels:

Current price: 🟠 $3,130.99

DEMA (9): 🔵 $3,138.21

Target price: 🎯 $3,174.92

📌 Zones Identified:

🟢 Demand Zone (Support) ⬇️: Strong buying interest, potential bounce area. If price falls here, buyers may step in.

🟡 RBR Zone (Rally-Base-Rally) 🔄: A mid-level area where price could consolidate before moving up.

🔴 Supply Zone (Resistance) ⬆️: Sellers might emerge, causing a reversal or slowdown in price movement.

📈 Potential Price Action:

🔹 Scenario 1 (Bullish 🐂): A retrace to the RBR Zone 🟡 could lead to a bounce 📈 toward the Target 🎯 at $3,174.92.

🔹 Scenario 2 (Bearish 🐻): If price drops below the Demand Zone 🟢, it may signal a trend reversal 📉.

🔹 Breakout Confirmation: If price breaks above the Supply Zone 🔴, it may continue rallying 🚀 toward the target point.

Fundamental Market Analysis for April 1, 2025 GBPUSDOn Monday, the GBP/USD pair was traversing the charts in familiar territory, passing a familiar accumulation zone as investors awaited the latest iteration of US President Donald Trump's tariff threats. The Trump administration intends to enact a broad catalog of tariffs against virtually all US trading partners starting April 2.

Specific details of the Trump administration's tariff plans this week remain vague and elusive, but the main tariff threats remain “retaliatory” tariffs on all countries that have their own tariffs on imports of U.S. goods, regardless of the economic context. Retaliatory tariffs on Canada and the European Union are also expected, as well as additional flat tariffs on copper and automobiles.

The UK economic data release schedule remains loose this week, however, fresh US Nonfarm Payrolls (NFP) employment data is due out later this week. The release of NFP could be an important factor for the markets as the US economy transitions into a post-tariff economic environment, and the March labor data will serve as an “indicator” of the impact of the Trump team's tariff plans.

Trading recommendation: SELL 1.29250, SL 1.30000, TP 1.28650

Weak US Economic Data Could Drive Prices Higher - 28.03.2025Gold prices have been on a strong upward trend, reaching a high of $3,059. The upcoming US economic data release on March 28, 2025, could provide new momentum for gold, particularly with the following key indicators in focus:

- Core PCE Price Index (MoM)

- Personal Spending (MoM)

- Personal Income (MoM)

Current forecasts suggest a slowdown in inflation and weaker economic activity, which could create a bullish environment for gold.

Economic Data Expectations and Market Implications

The Core PCE Price Index, the Federal Reserve’s preferred measure of inflation, is expected to rise by 0.2%, down from the previous 0.3%. This signals a slowdown in price pressures, increasing the likelihood of the Fed adopting a more dovish stance in the coming months. If inflation continues to decline, expectations for rate cuts could strengthen, which would be supportive of gold prices.

Personal spending is forecasted to increase by 0.3% - 0.5%, a modest recovery from the previous decline of -0.2%. However, this remains a weak rebound, suggesting that consumers are still cautious. Slower spending means less inflationary pressure, which could further encourage the Fed to ease monetary policy.

Personal income is expected to rise by 0.3% - 0.4%, significantly lower than the previous 0.9% increase. A slowdown in income growth could weigh on consumer spending and overall economic activity, reinforcing the case for lower interest rates.

Impact on Gold Prices

The combination of declining inflation, weak spending, and slower income growth increases the likelihood that the Federal Reserve will cut interest rates sooner rather than later. Gold, which tends to perform well in a lower interest rate environment, could see further gains as a result.

Key bullish factors for gold include:

Lower inflation expectations: A weaker Core PCE Price Index supports a more accommodative Fed stance.

Sluggish consumer spending: Less inflationary pressure gives the Fed room to cut rates.

Slower income growth: Weaker earnings could further dampen economic momentum, increasing demand for safe-haven assets like gold.

The main risk to gold prices would be a surprise shift in market sentiment. If the Fed remains cautious and delays rate cuts, gold could face short-term resistance. However, given the current data outlook, the overall trend remains positive.

Trading Idea: Long Position on Gold (XAU/USD)

Given the softer economic data, gold prices could continue their bullish momentum. If inflation shows signs of easing and economic activity slows, traders may start pricing in Fed rate cuts more aggressively, pushing gold higher.

A potential long trade setup could be to enter a buy position around $3,050 - $3,065, targeting $3,080, with an extended upside potential.

To manage risk, a stop-loss below could be placed to account for potential short-term pullbacks.

Conclusion

The upcoming US economic data release suggests a cooling economy, which could lead to increased expectations of Fed rate cuts. This would be a bullish catalyst for gold, reinforcing its role as a hedge against monetary easing.

A long position on gold around $3,065, with targets at $3,080, could be an attractive setup in the short term. Risk management remains key, with a stop-loss set close below.

If economic data confirms a weakening trend, gold could soon test new highs. Stay alert to market reactions and Fed commentary! 🚀

-------------------------------------------------------------------------

This is just my personal market idea and not financial advice! 📢 Trading gold and other financial instruments carries risks – only invest what you can afford to lose. Always do your own analysis, use solid risk management, and trade responsibly.

Good luck and safe trading! 🚀📊

XAU/USD - H1 Chart - Trendline Breakout (27.03.2025)The XAU/USD pair on the H1 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 3051

2nd Resistance – 3065

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

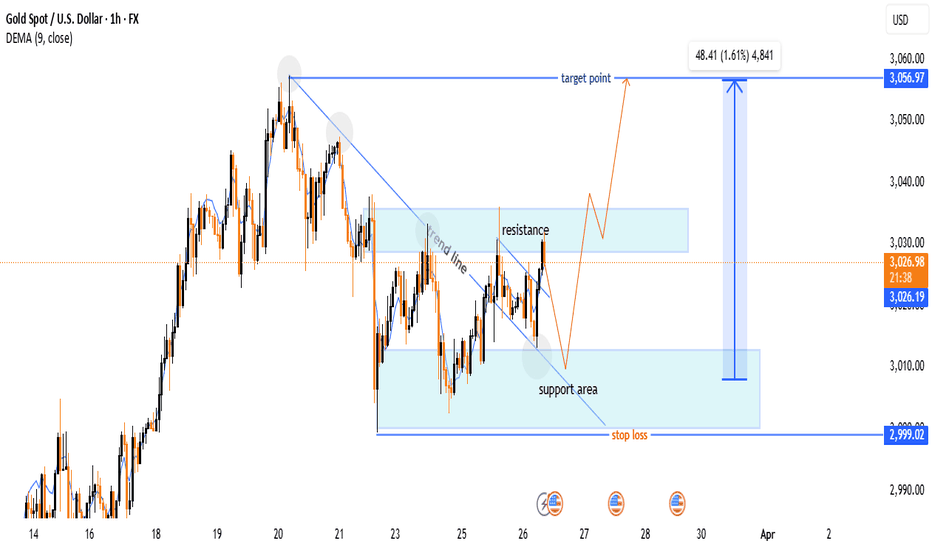

Gold (XAU/USD) Bullish Breakout – Trade Setup & Key Levels🔍 Key Observations:

🔹 Trend Line Breakout:

📉⬇️ A downward trend line was broken, signaling a potential bullish reversal.

📈✅ The price has moved above the trend line, confirming the breakout.

🔹 Support & Resistance Zones:

🟦 Support Area: $3,000 - $3,010 (Buy Zone)

🟥 Resistance Area: $3,030 - $3,040 (Sell Pressure)

📊 Trade Setup:

✅ Buy Plan:

🔄 Wait for a pullback to the support zone (🟦 light blue area) before entering.

🎯 Target: $3,056.97 📈🏁

🛑 Stop Loss: $2,999.02 ❌🚨

📈 Indicators & Confirmation:

📊 DEMA (9-period) = $3,026.48 (near the current price, suggesting a neutral-to-bullish trend).

🔥 Conclusion:

🔵 Bullish Setup Active 🚀

⚠️ Wait for price reaction at support before entering.

❌ If price drops below $2,999, the setup is invalidated.

📌 Final Tip: Watch for a bullish candlestick pattern 📊 at support before executing the trade! 🎯

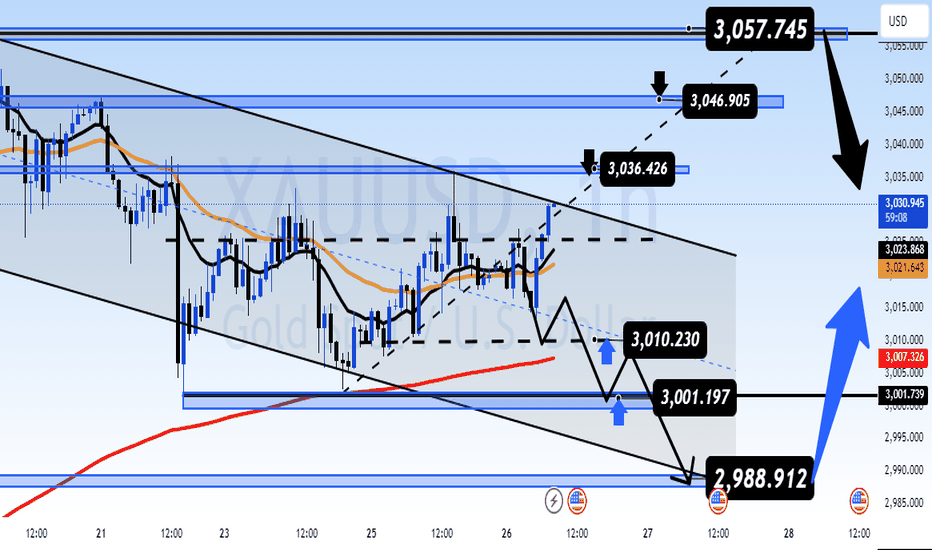

GDP Data in Focus – Gold Traders Prepare for Volatility⚠️ GDP Data in Focus – Gold Traders Prepare for Volatility

🟡 Market Brief – 27/03/2025

📰 Trump’s Latest Tariff Remarks Leave Markets Unshaken

Earlier this morning (end of US session), Donald Trump made new comments on tariff policy.

However, unlike previous occasions, his speech did not trigger significant market volatility.

He stated:

“Reciprocal tariffs will be eased, broadly applied to all countries, but not harshly.”

🔹 A 25% import tariff on cars will take effect from April 2

🔹 No additional tariffs for now on semiconductors or pharmaceuticals

→ It appears the market had already priced in this announcement, resulting in a muted reaction.

📊 Today’s Spotlight – Final US GDP (q/q)

This is the broadest measure of inflation, reflecting price changes for all goods and services included in GDP.

Given the weakness in recent US inflation indicators (CPI & PPI),

AD anticipates today’s GDP may also come in weaker than expected.

⚠️ However, market reaction might remain limited (≈30 pts),

as Core PCE data tomorrow is expected to be the true driver of weekly volatility.

🟡 Gold Strategy – Intraday Setup

Gold may retest resistance levels or recent highs,

before a potential strong move to the downside – the BIG SHORT scenario AD has been tracking.

📌 Plan for Today:

Look for intraday BUY opportunities during the Asian and European sessions,

especially near key support levels marked on the chart.

🧭 Key Technical Levels:

🔻 Support: 3019 – 3011 – 3002 – 2988

🔺 Resistance: 3036 – 3046 – 3056

🎯 Trade Zones – 27/03:

🟢 BUY ZONE: 3002 – 3000

SL: 2996

TPs: 3006 – 3010 – 3014 – 3018 – 3022 – 3026 – 3030

🔴 SELL ZONE: 3055 – 3057

SL: 3061

TPs: 3051 – 3047 – 3042 – 3038 – 3034 – 3030

🧠 Final Note:

This week’s volatility hinges on two major macro releases:

✅ Today’s Final GDP report

✅ Tomorrow’s Core PCE data

→ During Asia & London sessions: respect the levels and trade reactively

→ For New York session: stay alert — AD will update instantly if needed

Good luck, trade safe, and stay disciplined.

— AD | Money Market Flow

CHF/JPY Triangle Pattern (27.3.25)The CHF/JPY Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Triangle Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 169.06

2nd Support – 168.46

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Gold Outlook – Steady Range Before Key Data Hits🟡 Market Context:

Gold has been trading in a steady range since the start of the week, with no significant breakout or momentum shift observed.

Today’s session is expected to remain quiet, as there are no major economic events scheduled.

All eyes are on the Thursday GDP release and Friday’s PCE inflation data from the US — both of which are likely to determine the direction for gold into the end of the month and quarter.

📆 Key Data to Watch:

Thursday: US Quarterly GDP

Friday: US PCE Price Index (Federal Reserve’s preferred inflation gauge)

These events are considered high-impact catalysts that may trigger sharp moves in gold, especially if surprises occur.

🔍 Technical Structure:

Price continues to respect key support and resistance zones identified earlier this week.

There is no confirmed breakout yet, so the strategy remains range-based:

➡️ Trade the levels. Watch for reaction signals at extremes.

➡️ Wait for clearer momentum following the macro releases.

🧭 Key Price Levels:

🔺 Resistance: 3,010 – 3,036 – 3,046 – 3,057

🔻 Support: 3,010 – 3,001 – 2,988

🎯 Trade Plan – 26/03

BUY ZONE: 2988 – 2986

SL: 2982

TP: 2992 – 2996 – 3000 – 3004 – 3008 – 3015

SELL ZONE: 3045 – 3047

SL: 3051

TP: 3042 – 3038 – 3034 – 3030 – 3026 – 3020

🧠 Final Notes:

The market remains in accumulation mode ahead of key US data.

No need to rush — protect your capital, wait for clean setups, and let the market reveal its hand.

— AD | Money Market Flow

Bull Trap Confirmed: HOOD's 8% Rally Faces ExhaustionHey Traders after the success of our last month trade on Tesla hitting all targets more than 35%+

With a Similar Trade setup I bring you today the NASDAQ:HOOD

Short opportunity on Hood

Based on Technical + Fundamental View

-Market structure

-Head and shoulder pattern

-Currently will be trading at supply zone which was a recent support and now an ideal place for a reversal to create the right shoulder of the bigger head and shoulder pattern - Daily time frame.

1. Declining User Growth and Transaction-Based Revenue

2. Regulatory and Legal Challenges

3. Rising Costs and Profitability Pressures

4. Intense Industry Competition

5. Macroeconomic and Market Volatility

Technical View

Head and shoulder pattern - Pretty visible. Right shoulder is yet to be formed, Which makes an ideal place to SELL with a great Risk Reward ratio.

Pro Tip

Wait for a bearish candle stick pattern to execute trades on end of the day keeping stop loss somewhere above the supply zone.

Target 1 - 35.52$

Target 2 - 30.81$

Target 3 - 26.26$

Stop Loss - 44.72$

Fundamental View

1. Declining User Growth and Transaction-Based Revenue

Robinhood’s revenue model relies heavily on Payment for Order Flow (PFOF), which makes it vulnerable to fluctuations in trading activity. After a pandemic-driven surge in 2020–2021, user growth stalled, with monthly active users dropping 34% YoY to 14 million by mid-2022. Transaction revenue fell 55% in Q2 2022, and while assets under custody grew to $140 billion by Q2 2024, the platform’s dependence on volatile crypto and meme-stock trading amplified revenue instability.

2. Regulatory and Legal Challenges

The SEC’s scrutiny of PFOF and proposed trading rule changes threaten Robinhood’s core revenue source. In 2022, New York regulators fined Robinhood’s crypto unit $30 million for anti-money laundering violations. Ongoing legal risks, including backlash from the 2021 GameStop trading restrictions, have further eroded institutional trust.

3. Rising Costs and Profitability Pressures

Operating expenses surged due to aggressive marketing, technology upgrades, and compliance investments. Despite workforce reductions (23% layoffs in 2022), profitability remains strained. The company’s shift toward diversified products like retirement accounts and credit cards has yet to offset these costs.

4. Intense Industry Competition

Traditional brokers like Fidelity and Charles Schwab adopted zero-commission trading, neutralizing Robinhood’s initial edge. Newer platforms like Webull and Public.com also captured younger investors with advanced features, while Robinhood’s limited product range (e.g., lack of wealth management services) hindered retention of high-net-worth clients.

5. Macroeconomic and Market Volatility

- Interest Rate Sensitivity: As a growth stock, HOOD declined amid rising rates in 2022–2023 and broader tech-sector sell-offs.

- Recent Market Turmoil: On March 10, 2025, HOOD dropped 18% alongside crypto-linked stocks like Coinbase due to Bitcoin’s price volatility and fears of inflationary tariffs under new U.S. policies.

- Retail Investor Pullback: Reduced discretionary investing and crypto crashes (e.g., Bitcoin’s 71% plunge in 2022) dampened trading activity.

NOT AN INVESTMENT ADVISE