Fundamental Analysis

WING Earnings Play (2025-07-29)

**🍗 WING Earnings Play (2025-07-29)**

**🔥 Oversold Setup + 88% Beat Rate = Opportunity**

**🎯 Trade Plan**

• **Stock**: \ NASDAQ:WING

• **Type**: Call Option (LONG)

• **Strike**: \$290

• **Entry**: \$19.20

• **Target**: \$38.40

• **Stop**: \$9.60

• **Expiry**: Aug 15, 2025

• **Entry Time**: Before earnings (AMC 7/30)

• **Confidence**: 72%

• **Expected Move**: ±5%

• **IV Rank**: 75 (Elevated)

**📊 Why WING?**

✅ **RSI = 19** (deeply oversold)

✅ 88% earnings **beat rate** (last 8 Qs)

✅ 17.4% **YoY rev growth**

✅ Volume up 1.28x avg

📈 Setup for **volatility crush + upside surprise**

**⚠️ Risk/Reward = 2:1+**

Cut below 50% premium loss. Target double on upside earnings breakout.

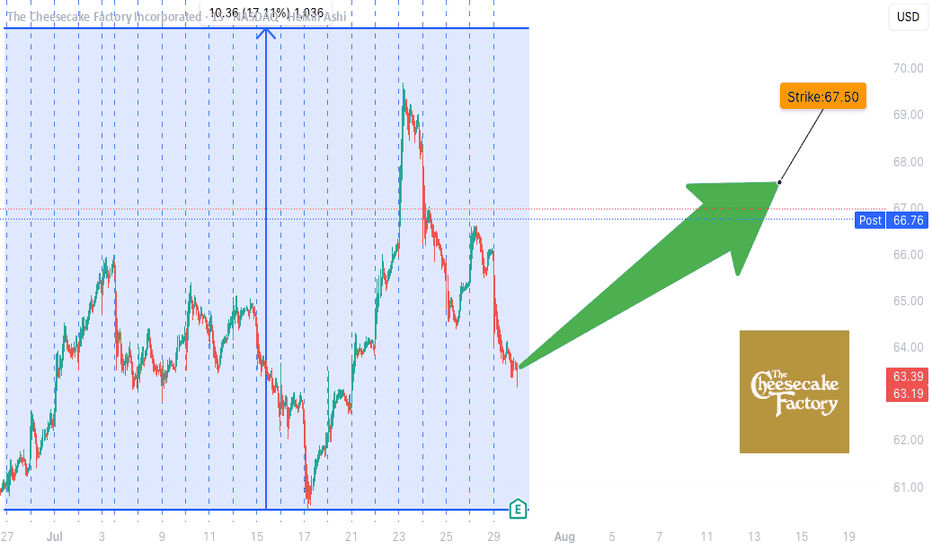

CAKE Earnings Trade Setup (2025-07-29)

**🍰 CAKE Earnings Trade Setup (2025-07-29)**

🎯 **Bullish Bias** | Confidence: **72%**

💡 **Historical Beat Rate: 88%** | Strong pre-earnings drift

**📊 TRADE DETAILS**

• **Instrument**: \ NASDAQ:CAKE

• **Strategy**: Buy CALL

• **Strike**: 67.50

• **Entry**: \$1.45

• **Target**: \$2.90+

• **Stop**: \$0.72

• **Expiry**: 2025-08-15

• **Timing**: Pre-earnings close (AMC)

**📈 Setup Rationale:**

✅ History of positive earnings surprises

✅ Stock above key MAs with room to run

⚠️ Margin pressure & mixed options flow = manage risk closely

**🔥 Risk/Reward: \~2:1+**

Cut early if earnings miss. Target 200%+ return on surprise beat.

**MARA Earnings Setup – TradingView Breakdown**

🚨 **MARA Earnings Setup – TradingView Breakdown** 🚨

📅 *Earnings Play for 07/29/2025*

🎯 *Strike: \$17.00 Call | Exp: 08/01/2025*

💰 *Premium: \$0.59 | Target: \$1.18*

📈 *Conviction: 75% Bullish*

🔹

---

🧠 **What’s the Setup?**

MARA just raised \$950M to expand BTC holdings 💥

Revenue YoY growth: **+29.5%** 📊

Margins still rough: **-46.7% profit**, but potential catalyst is 🔥 if BTC pumps.

---

🧨 **Options Flow Is Heating Up**

👀 Massive open interest on **\$17 Calls**

🤏 Put/Call Skew slightly bullish

🧮 IV low despite high beta (6.55) = **cheap volatility play**

---

📉 **Oversold + Coiled Tight**

📉 RSI: 38.57 (Oversold)

📍 Support: \$16.50 | Resistance: \$17.50

💣 Sitting at key technical inflection pre-earnings.

---

🔮 **Trade Idea**

🎯 *Buy \$17C @ \$0.59*

🚀 Target: \$1.18 (2x gain)

🛑 Stop: \$0.30

📆 Exit within 2 hrs post-ER to avoid IV crush

---

📊 **Risk/Reward**

💰 Max Loss: \$59

📈 Potential Gain: \$118

⚖️ R\:R = 2:1

---

🔥 **Why It Could Go Viral**

✅ Bitcoin bullish narrative

✅ High beta + cheap IV = explosive setup

✅ Oversold technicals + earnings catalyst

---

🔁 **Like & Save this if you're playing MARA ER 🔥**

\#MARA #EarningsPlay #OptionsTrading #BitcoinStocks #TradingView #ShortSqueeze #CallOptions #HighBetaSetup #CryptoStocks #EarningsSeason #MARAAnalysis #TradingStrategy #Fintok #Finfluencer

LINK - The sleeping Giant ready to wake!Don't forget to add LINK to your watchlist — it's a solid project with long-term investment potential.

The weekly chart shows that LINK is currently retesting the downtrend line it recently broke — a textbook bullish retest.

The lower trendline now acts as a key support level, and as long as price holds above it, the structure remains healthy.

Currently trading around $17.6, the price hasn’t moved significantly yet —

You’ve got:

✅ A strong fundamental project

✅ A bullish technical setup

✅ Large market cap

✅ Still early entry

What more do you need to enter?

Accumulate now... and thank me later.

Best Regards:

Ceciliones🎯

LC EARNINGS PLAY – STRIKE WHILE IT'S HOT!**

🚨 **LC EARNINGS PLAY – STRIKE WHILE IT'S HOT!** 🚨

📅 **Earnings Season Heat Check: LC | Jul 29**

💰 **Positioning for a Post-Earnings POP!**

---

🔥 **The Setup:**

LC’s earnings momentum is real –

📈 TTM Rev Growth: **+13.1%**

💹 EPS Surprise Rate: **150% avg**

📊 75% Beat Rate History

💵 Analyst Consensus: **Strong Buy (1.8/5)**

---

📉 **Technical Tailwind:**

✅ Price above 20D + 200D MA

✅ RSI: **60.07** – room to run

📈 Volume Spike: **+61% above 10-day avg**

🚀 Options flow targeting **\$14 CALLS** w/ OI: **864** / Vol: **737**

---

📌 **TRADE IDEA**

🎯 Buy: **\$14.00 Call @ \$0.70**

📆 Exp: **Aug 15, 2025**

🎯 Target: **\$2.10** (Risk/Reward = 1:3)

🛑 Stop: **\$0.35**

---

⚠️ **Earnings Risk:** IV crush real.

🎯 Exit within 2 hours **post-EPS** if no move.

Macro tailwinds + financial sector rotation = 🚀 fuel.

**Beta = 2.45** → Big move potential incoming!

---

🧠 Confidence Level: **75%**

⏰ Timing: Pre-Earnings Close

🧾 Model-Driven Strategy | No Hype, Just Edge.

---

💥 Let’s ride the LC earnings wave – \$15+ in sight! 💥

\#LendingClub #LC #EarningsPlay #OptionsTrading #TradingView #StocksToWatch #CallOption #Fintech #SwingTrade #EarningsHustle #BullishSetup #IVCrush #EarningsGamma #ShortTermTrade

Latest on Fed rate cut debateThe Fed isn’t expected to cut rates this week, but this FOMC meeting should still be very interesting.

Powell will need to address growing pressure from board members Waller and Bowman, who’ve both called for cuts, citing limited inflation impact from tariffs.

Still, Powell is just one of 12 votes on the FOMC, and there’s little sign of broader support for a cut.

With the labour market steady and early signs of tariff-driven inflation, the Fed has reason to hold. The rate decision is due Wednesday at 2 p.m. ET, followed by Powell’s press conference at 2:30 p.m. ET.

This decision will further widen the rift between the Fed and President Trump, whose frustration has grown in recent weeks, with renewed attacks on Powell’s leadership.

The tension has drawn international attention. On Monday, the IMF issued a warning about political interference in central banks, which can pose a threat to global financial stability.

MKR/USDT 4H Chart📉 Short-term situation:

The price is currently trading around 2028 USDT, after a sharp decline from around 2273 USDT (resistance).

The support level around 2000 USDT is currently being tested (coinciding with the SMA 200 – blue line).

A dynamic uptrend line (orange) is also visible, which could act as a key support level in the event of further declines.

🔍 Support and Resistance Levels:

Resistance:

🔴 2188 USDT – recent local high and convergence with the SMA 21.

🟢 2273 USDT – major resistance; previous rebound and point of significant price reaction.

Support:

🔵 1980 USDT – local support + SMA200.

🟠 Uptrend line (~1940–1960 USDT).

🔴 1832 USDT – stronger horizontal support with multiple confirmations.

🔴 1623 USDT – very strong support, from previous lows.

📊 Technical indicators:

RSI (Relative Strength Index):

Current value: ~42, neutral, but approaching the oversold zone (<30).

The RSI is falling rapidly, suggesting selling pressure, but a reaction is possible near current support.

MACD:

Negative signal: signal line crossing from above + descending histogram.

Indicates a continuation of the correction, but we are approaching the potential exhaustion of the downward momentum.

📈 Moving averages:

EMA/SMA 50 and 200:

The price is currently testing the SMA200 – crucial for the medium-term trend.

SMA21 (red) and SMA50 (green) – have reversed downward, which may suggest a weakening of bullish momentum.

🔮 Scenarios:

🟢 Bullish scenario (confirmation of support):

A rebound from 1980–2000 USDT and further upward movement.

Potential target: first ~2180 USDT, then ~2273 USDT.

The condition is a demand response at the current level + an improvement in the RSI/MACD.

🔴 Bearish scenario (breakout of support):

If the 1980 USDT level is broken and the price falls below the uptrend line, a continued decline to 1832 USDT or even lower is possible.

Confirmation will be a strong bearish candle with high volume and a further decline in the RSI/MACD.

SILVER Is About to Collapse? Watch This Critical Supply Zone!Price recently tapped a high near 39.20 before sharply rejecting from the 38.80–39.20 supply zone, confirming strong selling pressure. The current structure shows:

- Supply zone tested and rejected

- Likely return to the previous demand zone (36.50–36.00)

- RSI is turning down, confirming loss of momentum

A pullback toward 38.30–38.50, followed by a bearish continuation toward the 36.50 area, which acts as a key structural and institutional support.

🗓️ Seasonality

Historically, July is bullish for silver:

Last 5Y average: +0.89%

Last 2Y average: +2.18%

However, August–September are bearish months:

August: mildly positive, but weak

September: consistently negative across all time frames (-0.86% to -1.10%)

This increases the probability of a downward move starting in early August, in line with current price action rejection.

🪙 Commitment of Traders (COT) – July 22

Non-Commercials (speculators):

Longs: +656

Shorts: -516

Commercials (hedging):

Longs: +1,337

Shorts: +916

➡️ Commercials are increasing both long and short exposure, while non-commercials remain net long — a sign of moderate optimism.

However, long positioning is slowing down compared to previous weeks. A potential exhaustion in bullish momentum is forming.

📉 Sentiment

52% short vs 48% long

Volume: more lots on the short side (492 vs 454)

Sentiment remains neutral to slightly contrarian bullish, but not extreme. This may allow for a fake breakout before a deeper move down.

🧩 Operational Summary

Main bias: Bearish short to mid-term (starting August), supported by:

- Technical rejection at supply

- Negative seasonal tendencies ahead

- RSI showing momentum loss

- COT showing stabilization, not accumulation

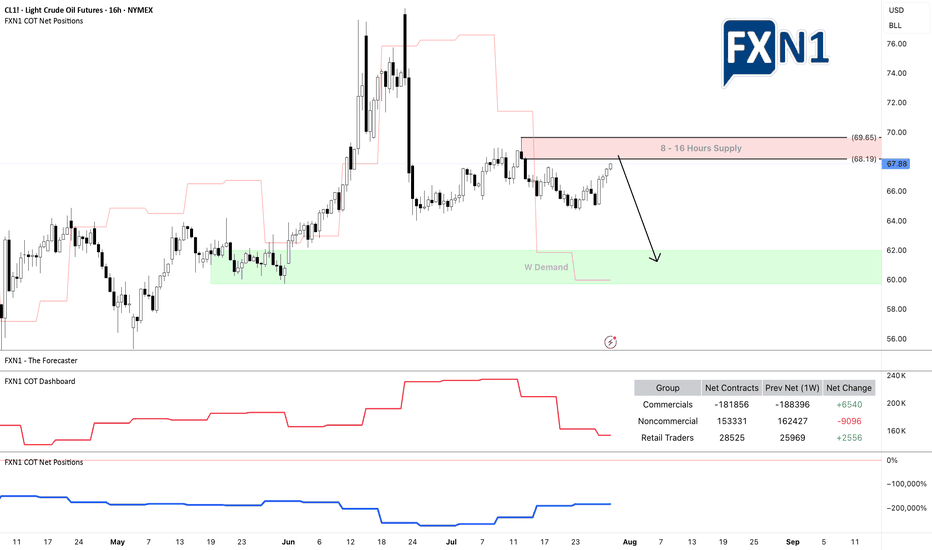

Crude Oil Spikes - Russia / Ukraine / USA sanction? Concerns about the possibility of tighter global oil supplies are supporting crude prices after President Trump warned of "secondary sanctions" if Russia fails to reach a ceasefire in Ukraine within 10 to 12 days.

These sanctions have absolutely burned the shorts in oil and can cause a 3 bar surge on the daily chart if crude breaks this channel.

Keep you eye on the daily 200 MA...if it holds above we should push higher on crude.

FOMC RATE DECISION TOMORROW - Tune into our live stream.

Oil Market Sentiment Shifts After Trump’s Urgent Warning, but...On June 23, 2025, at 9:35 AM, President Donald J. Trump issued a stark warning via social media:

"EVERYONE, KEEP OIL PRICES DOWN. I’M WATCHING! YOU’RE PLAYING RIGHT INTO THE HANDS OF THE ENEMY. DON’T DO IT!"

Since his post, oil prices experienced a notable bullish impulse. From both fundamental and technical perspectives, the market is now approaching a 16-hour supply zone, which could serve as a potential resistance area.

Additionally, I’ve observed a divergence in trader positioning: non-commercial traders increased their short positions significantly last week, while retail traders remain long. This divergence between price action and non-commercial positions suggests a possible shift in momentum, and I am currently eyeing a short setup.

As always, I encourage traders to conduct their own analysis. The trader featured below operates on the D1 timeframe and focuses on scalping, which can be useful for short-term entries.

Stay cautious and keep an eye on how the market reacts near the identified supply zone.

✅ Please share your thoughts about CL1! in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

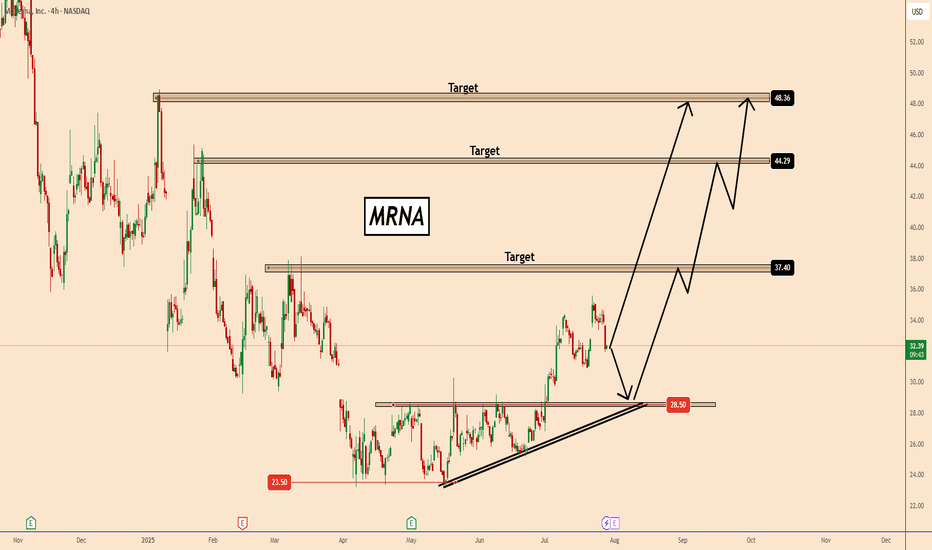

MRNA: Bullish Setup Ahead of Earnings & FOMCMRNA: Bullish Setup Ahead of Earnings & FOMC

Moderna (MRNA) appears to have found a bottom near $23.50, based on recent price behavior. Following that level, the stock began accumulating, suggesting renewed buying interest. This was confirmed when MRNA decisively broke above $28.50, signaling a shift in momentum.

The company is scheduled to report earnings on 01 August 2025. While there is a chance the results could be positive, even a miss may not result in a significant downside move. The real market risk lies with the upcoming FOMC meeting and interest rate decision tomorrow.

Depending on the tone of the Fed and rate guidance, MRNA should take the price direction. I expect the price to remain supported above the $28.50 zone, even in a pullback scenario.

Bullish targets I’m watching: $37.50, $44.50, and $48.50.

PS: In my view, using Call Options with longer expiration dates offers better risk management. You don’t need to put your entire account at risk in one trade. Call Options let you control exposure in a better way.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Plug Power (PLUG): Recovery Play or Terminal Decline?Plug Power Inc. (PLUG) , a company focused on green hydrogen and fuel cell technologies, stands as one of the most emblematic examples of a boom and bust cycle in the speculative clean energy sector.

It reached an all-time high of USD 75.49 in January 2021 , driven by market enthusiasm over the energy transition. However, since then, the stock has collapsed by more than 99% , hitting a low of USD 0.69 on May 16, 2025 . It currently trades below USD 2, reflecting a massive loss in market capitalization and deep investor distrust.

🧮 Fundamental Analysis

1. Business Model

Plug Power develops integrated systems for the generation, storage, and distribution of green hydrogen, mainly targeting logistics, mobility, and high-energy industrial sectors.

2. Financial Issues

Persistent losses: the company has been unprofitable for years. In 2024, it posted a net loss of over USD 700 million.

High operating costs and poor efficiency in hydrogen project execution.

Accounting concerns: the SEC flagged accounting issues in 2021 and 2022, further damaging institutional confidence.

3. Capital Dilution

Plug has repeatedly financed its operations through equity offerings, significantly diluting shareholders. Recent rounds were issued at very low prices, worsening the drop in share value.

4. Cash Position

As of June 2025, the company requires new capital to continue operations, facing the risk of issuing more shares or convertible debt under unfavorable terms.

⚠️ Key Risks

Delisting risk if the stock doesn’t remain above USD 1.00 in the short term.

Bankruptcy risk (Chapter 11) if no strategic financing or partnerships are secured.

The green hydrogen sector is still not cost-competitive without subsidies, and competition is fierce (Air Liquide, Linde, Bloom Energy, etc.).

✅ Opportunities

Potential to secure strategic alliances with utilities, automakers, or industrial partners.

Ongoing green subsidies from the U.S. and EU may offer short-term support.

Much of the negative outlook seems already priced in: current market cap is around USD 1.8 billion, with physical assets and contracts still in place.

📉 Technical Analysis

From its all-time low of USD 0.69, PLUG staged a strong rebound, gaining +294% to reach USD 2.03 on July 21, 2025 . It now trades in a consolidation zone between the 23.6% (USD 1.71) and 38.2% (USD 1.52) Fibonacci retracements , which may act as short-term technical support.

This is a high-risk, high-volatility stock , capable of generating outsized returns — or total losses. Strict risk management is essential.

Repeated Rejections at the 200-EMA

The 200-day exponential moving average (EMA 200) has acted as a dynamic resistance throughout PLUG’s multi-year downtrend. Over the past three years, the stock has attempted to break above it on at least three occasions — in 2022, 2023, and 2025 — but failed each time.

The most recent attempt, in July 2025, ended with a reversal after reaching USD 2.10, which also coincides with the 23.6% Fibonacci retracement from the all-time high. Unless the stock breaks above the 200-EMA with strong volume and an ascending price structure, the bearish trend remains intact.

🧠 Speculative Position

We are currently positioned with a bullish options strategy targeting a speculative upside:

📈 Buy CALL USD 2.00 (exp. January 16, 2026)

🛡️ Sell CALL USD 5.00 (same expiration)

→ This forms a Bull Call Spread, limiting downside risk while maintaining a favorable risk/reward ratio.

🧾 Conclusion

Plug Power is no longer a fundamentally sound investment , but rather a high-risk speculative play , comparable to a synthetic long-term call option . If the company survives, restructures its balance sheet, and secures strategic partners, the upside could be substantial — but the risk of total capital loss remains very real .

🧭 Suitable only for experienced traders with speculative capital and disciplined technical execution.

7/29/25 - $pen - It's a LT buy... seems "reasonable" into print7/29/25 :: VROCKSTAR :: NYSE:PEN

It's a LT buy... seems "reasonable" into print

- medical device company... peripheral thrombectomy products

- it's never been cheap, probably for a good reason

- about 3% fcf yield... mid teens growth... "not" health insurance (which i think is probably part of what's happening here... the read thru from perhaps pricing/ maybe?)

- the way i see this: it's a winner, it's insulated from money changer games (insurance), it's solving real world challenges

- so i'd ideally like to dip buy here... unclear if i'll play the print

- but ultimately i'd expect this stock to head higher. LT winner.

V

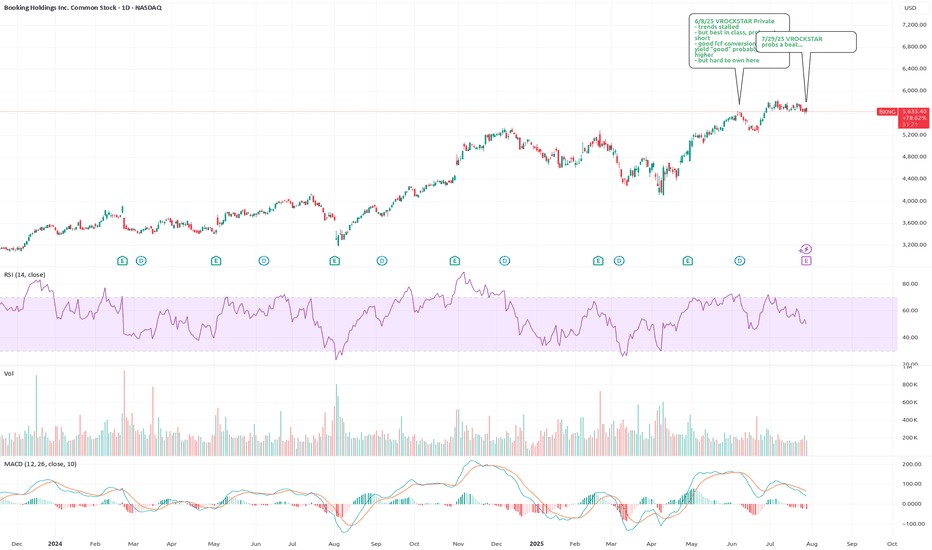

7/29/25 - $bkng - probs a beat...7/29/25 :: VROCKSTAR :: NASDAQ:BKNG

probs a beat...

- while everyone's happy to pay 150x for PLTR... there r a lot of consumer names that seem to be trapped in trump tariff paralysis.

- what happened... is trump... caused a dip... consumer spending paused... then nothing happened... and all that pent up demand came right back in the last quarter... most consumer names are demonstrating just this

- so while on any given consumer name there r specifics that i'm not tuned into... and also some biz models r ostensibly better than others e.g. bkng > abnb

- at 5% fcf yield, leadership position... not even 30x PE

- i just don't get what's not to like here, remember: own the consumer interface (these r the winners in the next 5 yrs... not the backend/ not the saas... the person who owns the interface wins)

V

GOLD → Formation of a trading range. 3345?FX:XAUUSD confirms support for the local range. A false breakdown has formed and the price has returned to the buying zone. We are waiting for the bulls to take the initiative...

Gold is trying to recover after falling to $3302, remaining under pressure ahead of key events in the US: the publication of GDP data and the Fed's decision on interest rates. Support is provided by a pause in the dollar's growth, expectations of an extension of the US-China trade truce, and growing demand for safe-haven assets amid a surge in oil prices due to the threat of new sanctions against Russia. However, the sustainability of growth is in question: the dollar may strengthen thanks to optimism about the US economy and progress in negotiations.

A false breakdown of the support range is forming. Focus on 3310-3320. If the bulls keep the price above this zone, gold will have a chance to grow. BUT! If the price starts to contract and stick to 3310, we can expect the decline to continue...

Resistance levels: 3345, 3375

Support levels: 3320, 3310, 3287

The two-day movement has most likely exhausted its potential, or the market has decided to recover slightly due to the unpredictability factor. A false breakdown of support could trigger a pullback to the strong level of 3345, from which a rebound could form (either before growth or before the continuation of the decline; it is necessary to monitor the reaction and the market background...).

Best regards, R. Linda!

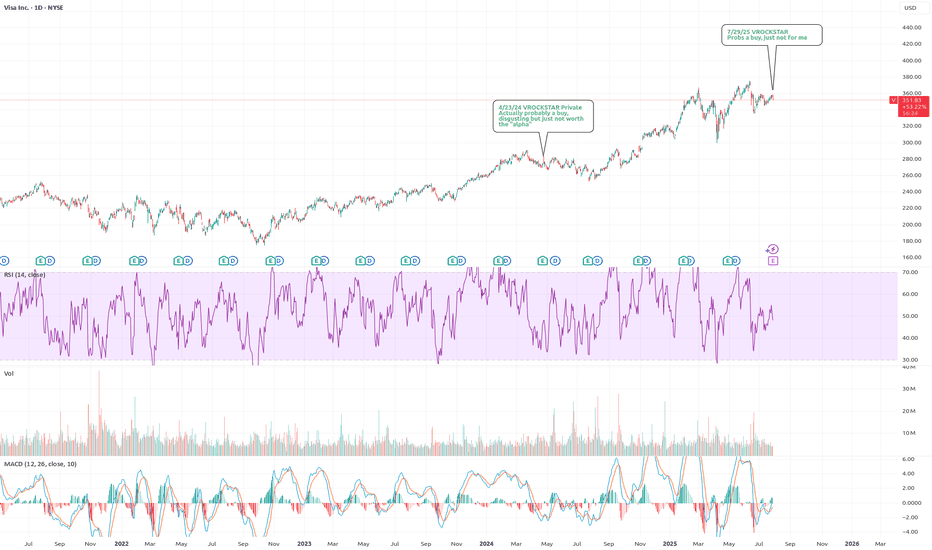

7/29/25 - $v - Probs a buy, just not for me7/29/25 :: VROCKSTAR :: $V

Probs a buy, just not for me

- over 3% fcf yields, growing, consumer spending well

- over time (probably long duration) I think the biz model probably gets eroded, but also mgmt has done a nice job evolving, perhaps they keep up with the times etc.

- don't think anything is broken here

- all else equal a nice barometer for the consumer names in my portfolio (deck, lulu)

- i'd guess stock is higher on this print

- just have too many other things going on to play this $666 bn EV

V

BTC/USD Daily Outlook: Support & Target Levels IdentifiedBitcoin (BTC/USD) Daily Chart Analysis:

Price is currently at $117,758.70, showing a slight decline. Key support levels are marked at $114,785.88 and $107,576.12, while targets are projected near $129,584.15 and $129,692.48. Chart suggests a possible upward channel, with both bullish and bearish scenarios mapped.

$PYPL - nice value gap just formed. Any takers?NASDAQ:PYPL smashed through the $75 resistance a week ago, signaling strong bullish momentum. Holding above the 50 SMA, the stock is poised for further gains. Then earlier 10% dip from mixed signals. UltraAlgo flagged it early, giving traders a heads-up of a potential Buy signal in the making. Charting tomorrow’s giants with UltraAlgo.

TGS (TGS Ltd.) – Breakout Play with Strong Upside Potential🚀 Trade Idea: TGS (TGS Ltd.) – Breakout Play with Strong Upside Potential

📈 Entry: $29.90 (Breakout above resistance)

🛑 Stop Loss: $26.30 (Below key support & SMA-50)

🎯 Take Profit: $37.13 (~24% upside, near next resistance zone)

📊 Risk-Reward Ratio: 1:3 (Favorable setup)

🔍 Analysis Breakdown

📊 Technical Setup

Trend: Daily trend is consolidating, but 4H/1H show bullish momentum.

Key Levels:

Support: $26.30 (SMA-50 & recent swing low).

Resistance: $30 (psychological level, previous highs).

Indicators:

MACD (4H): Bullish crossover, supporting upside.

RSI (Daily): ~65 (neutral, no overbought signal yet).

Volume: Increasing on upward moves (confirms interest).

💰 Fundamental Backing

Strong Revenue & Earnings Growth (See previous analysis).

Undervalued Metrics (P/B, P/S) suggest room for expansion.

Low Debt (Score: 10/10) reduces downside risk.

🎯 Why This Trade?

✅ Breakout Play: A close above $30 confirms bullish continuation.

✅ Strong Fundamentals: Earnings growth supports higher valuation.

✅ Low-Risk Entry: Tight stop below support.

⚠️ Key Risks:

Failure to hold $30 could lead to retest of $26.30.

Market-wide pullback could delay momentum.

📉 Trade Management

Add-on: Consider scaling in above $31.50 (confirmation of trend).

Trailing Stop: Move SL to $28.50 after hitting $33.

📌 Final Thought: TGS has strong upside potential if it breaks $30. The 1:3 R/R makes this a high-conviction trade.

👨💻 Let me know your thoughts in the comments!

#TGS #Breakout #Stocks #Trading #Investing

Disclaimer: Not financial advice. Do your own research before trading.

SLA Moderate Bullish Setup – Weekly Play for 08/01 Expiry

## ⚡ TSLA Moderate Bullish Setup – Weekly Play for 08/01 Expiry

🎯 *"Volume confirms it. RSI supports it. Time to strike—or stand by."*

---

### 🔍 Market Intelligence Snapshot:

📊 **Consensus**: Moderately Bullish

📈 **Weekly RSI**: Rising

📉 **Daily RSI**: Still Neutral (momentum building)

📉 **VIX**: Low → Great environment for call buying

📦 **Volume**: Strong institutional activity across models

---

### ✅ Recommended Trade Setup:

**TSLA \$340 CALL (Exp: Aug 1)**

💰 *Entry*: \~\$0.88

📈 *Target*: \$1.38

🛑 *Stop*: \$0.35

📆 *DTE*: 3 Days

🎯 *Entry*: Market Open

⚖️ *Confidence*: 65%

---

### 🔧 Model Blended Strategy Notes:

* Meta & Anthropic: Suggest ATM/ITM (\$327.50–\$330) → safer, higher cost

* Google & xAI: Prefer \$340–\$342.50 for a better risk/reward

* DeepSeek: Targets \$320 but with heavier premium

🧠 *Takeaway*: \$340 offers a balanced shot — affordable, but still responsive to upside flow.

---

### ⚠️ Risk Notes:

* ⏳ Time Decay → Quick exits = better outcomes

* 📰 External news or earnings reactions = watch for sudden volatility

* 🎯 Position size = keep light due to only 3 DTE

---

### 📊 TRADE SNAPSHOT (JSON):

```json

{

"instrument": "TSLA",

"direction": "call",

"strike": 340.0,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 1.38,

"stop_loss": 0.35,

"size": 1,

"entry_price": 0.88,

"entry_timing": "open",

"signal_publish_time": "2025-07-29 10:16:14 UTC-04:00"

}

```

---

### 🧠 Quick Captions for Social:

* “TSLA bulls waking up? \$340C looks lit for the week 📈🔥”

* “Call volume surging. RSI rising. Low VIX. This \ NASDAQ:TSLA 340C might run 💥”

* “Risk-managed breakout shot — in and out fast 🎯”

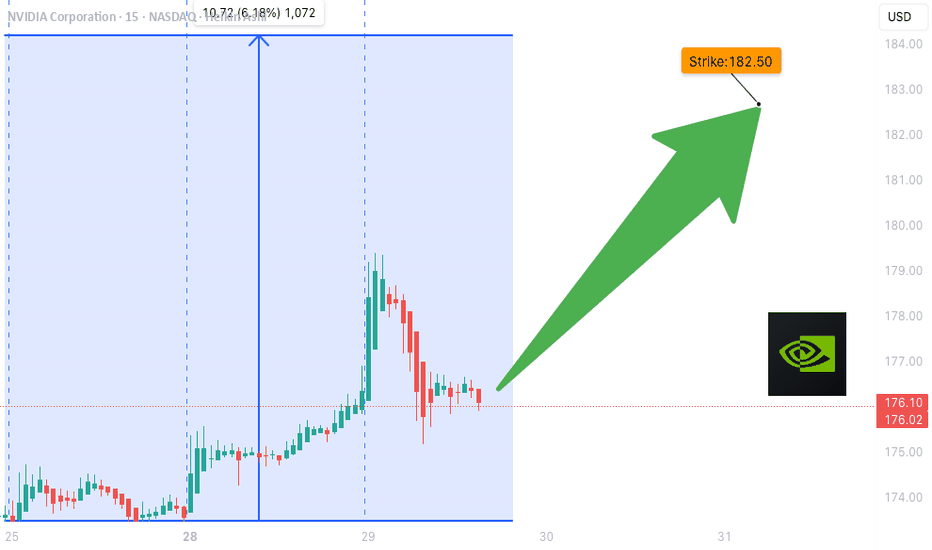

NVDA Bullish Weekly Trade Setup** – 2025-07-29

📈 **NVDA Bullish Weekly Trade Setup** – 2025-07-29

🚀 *"Momentum meets money flow!"*

### 🔍 Market Snapshot:

* 💥 **Call/Put Ratio**: 2.47 → Bullish sentiment confirmed

* 🧠 **RSI**: Rising on Daily & Weekly → Momentum building

* 🔕 **Low VIX**: Favors call strategies (cheap premiums)

* ⚠️ **Caution**: Light volume = soft institutional backing

---

### 🔧 Recommended Options Trade:

**🟢 NVDA \$182.50 CALL (Exp: Aug 1)**

💰 *Entry*: \~\$0.53 (Mid)

📈 *Profit Target*: \$0.69 – \$1.06

🛑 *Stop Loss*: \$0.32

📆 *DTE*: 3 days

🔄 *Entry Timing*: Market Open

✅ *Confidence*: 75%

🔥 *Theta & Gamma Risk*: Elevated — manage position size!

---

### 💡 Why This Trade?

✅ RSI Strength across timeframes

✅ Flow favors upside

✅ Cheap premium in a low-volatility regime

🟡 Just watch that volume…

---

📊 **TRADE SNAPSHOT (JSON):**

```json

{

"instrument": "NVDA",

"direction": "call",

"strike": 182.50,

"expiry": "2025-08-01",

"confidence": 0.75,

"profit_target": 1.06,

"stop_loss": 0.32,

"size": 10,

"entry_price": 0.53,

"entry_timing": "open",

"signal_publish_time": "2025-07-29 11:59:10 UTC-04:00"

}

```

---

📣 **Taglines for Sharing:**

* "NVDA setup is 🔥—momentum + flow = GO!"

* "Gamma risk is real—but so is this profit window 💸"

* "Short-term sprint or fade? This call has range."