EURUSD BUYING CORRECTION AND SHORTThe price is now at a strong support level and if it can be a double bottom it will retest the descending channel line and reach the orange resistance, but in the general direction the price prefers to fall due to breaking the black uptrend line. We also have a more beautiful scenario, which is if it can break the strong support we will go with the downward trend.

Fundamental Analysis

Up only desuTon has crashed a lot from its all time high and it seems to be rebounding now. Today will be the fifth daily green candles in a row and yesterday's daily closed above EMA 200

IN ADDITION TO THIS

Some bullish news for Ton i found from elfabot

The recent surge in CRYPTOCAP:TON price is primarily attributed to strong ecosystem activity, including significant NFT purchases by Pavel Durov (Telegram’s founder), such as buying a Plush Pepe NFT for 15,000 TON (about $53,000), which has boosted market confidence and demonstrated TON’s real-world utility. This has been widely discussed in the crypto community and cited as a bullish catalyst (source).

⦁ Additional bullish factors include Grayscale considering investment in TON, the launch of new Telegram NFT features, and US users being able to access TON Wallet directly inside Telegram without a VPN (source).

So, yea, i think we're breaking previous ATH and hitting $10 soon

cheers

XRP/USD Breakout Watch: $3.22 Target in SightA key blue trendline on the XRP/USD chart that reflects market sentiment. If price breaks above it with strong volume, we could see a rally toward $3.22.

Support zone: $0.55–$0.60

Bullish case: Improved sentiment, easing tariffs, and regulatory cooling

Strategy: Wait for breakout confirmation before entering

Share your thoughts — are you preparing for a breakout?

EURAUD Ready to Bounce? Key Support & Fundamentals Aligned!Today I want to share a Long position idea on EURAUD ( OANDA:EURAUD ) with you.

From a fundamental perspective , both the Euro (EUR) and Australian Dollar (AUD) are currently under pressure. However, the Aussie appears fundamentally weaker in the short term, making the EURAUD Long setup more favorable at this stage.

AUD Weakness :

The Reserve Bank of Australia (RBA) has held rates steady at 3.85%, but recent inflation data has dropped to 2.7%, the lowest in over 3 years.

Most economists now expect the RBA to cut rates in its next meeting in August, possibly by 25 basis points.

Slowing economic growth and dovish forward guidance from the central bank are weighing heavily on AUD sentiment.

EUR Outlook :

The European Central Bank (ECB) is also facing weak economic data, but is taking a more cautious approach toward cutting rates.

Despite softer PMIs and sluggish growth in countries like Germany and France, the ECB has not confirmed a near-term rate cut, keeping EUR relatively stable.

This divergence between the RBA’s dovish stance and the ECB’s pause is supportive of EUR strength against AUD.

Summary :

With the RBA likely to ease policy soon and the ECB holding ground for now, the interest rate differential favors EURAUD upside. Fundamentals point toward further weakness in AUD, making the EURAUD Long a strategically sound trade idea for the coming days.

-------------------------------------------

Now let's analyze the conditions of the EURAUD chart on the 4-hour time frame .

EURAUD is currently trading near the Support zone(1.772 AUD-1.763 AUD) , Potential Reversal Zone(PRZ) , and near the lower line of the descending channel .

According to Elliott Wave theory , EURAUD appears to have completed a Zigzag Correction(ABC/5-3-5) .

Also, we can see the Regular Divergence(RD+) between Consecutive Valleys .

I expect EURAUD to rise to at least 1.784 AUD .

Second Target: 1.792 AUD

Note: Stop Loss(SL): 1.762 AUD

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/Australian Dollar Analyze (EURAUD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

AUDNZD Technical + Fundamental Align for DownsideToday I want to analyze a short position on the AUDNZD ( OANDA:AUDNZD ) pair, first, let's look at it from a fundamental analysis perspective .

Fundamental View on AUDNZD

Key reasons to short AUDNZD:

Australian weakness:

Recent data show weakening consumer sentiment and declining building approvals. The RBA seems hesitant to hike further, putting pressure on the Aussie.

New Zealand resilience:

The RBNZ maintains a relatively hawkish stance. Inflation is still a concern, and the central bank is committed to keeping rates high, supporting NZD strength.

Monetary policy divergence:

The divergence between RBA’s dovish stance and RBNZ’s hawkish approach supports further downside in AUDNZD.

----------------------

Now let's take a look at AUDNZD from a technical analysis perspective on the 4-hour timeframe .

AUDNZD is currently trading in a Heavy Resistance zone(1.0963 NZD-1.0870 NZD) near the upper line of the Range Channel , Potential Reversal Zone(PRZ) and Yearly Pivot Point .

In terms of Elliott Wave theory , AUDNZD appears to be completing microwave B of microwave Y of the main wave 4 .

I expect AUDNZD to drop to at least 1.0904 NZD(First Target) based on the above explanation .

Second Target: 1.0886 NZD

Note: Stop Loss(SL): 1.0963 NZD

Please respect each other's ideas and express them politely if you agree or disagree.

Australian Dollar/New Zealand Dollar Analyze (AUDNZD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

What now for the dollar after a poor NFP report?It is difficult not to link the bad US data to the impact of tariffs. Indeed, it certainly looks that way, especially given that the slowdown in jobs started in early Q2 when reciprocal tariffs were announced. Companies expecting margins to be squeezed by higher duties probably thought twice about hiring workers in order to keep costs down. So, the US labour market has been losing steam fast, undoubtedly due to tariff concerns. Unless the data surprises on the upside soon, the Fed may have no choice but to cut—and cut again. Against this backdrop, the recovery in the dollar is going to a long bumpy road.

We noted the area around 100.00 to be resistance in the previous update, and that level has held, thanks to the weak jobs report (and ISM survey that was released later). The DXY was testing potential support around 98.95 at the time of writing. Will it be able to bounce there? Break that on a closing basis and next week could bring more technical dollar selling.

By Fawad Razaqzada, market analyst with FOREX.com

8/2/25 - $fc - Sidelines w better oppty costs8/2/25 :: VROCKSTAR :: NYSE:FC

Sidelines w better oppty costs

- came to this company over a yr ago bc it's a well managed business, throws off cash and still does

- the issue are maybe 3 things in this current environment, all of which are likely transient but nevertheless relevant to my sidelines and not interested at the moment thinking.

- so this hit my "alert" on Fri (as did a lot of stuff), so i'll be reviewing those this weekend and this is simply the top of that list. TradingView also limits my posts... or else i'd review all 20 of them ha.

1/ stock just missed expectations and in an environment were businesses are likely cutting these "nice to have but not right now" type coaching, improvement services. and/or where pricing discussions are probably weaker on the mgn. so it's hard to even consider names rn in this tape that just had a negative reaction to their prints, nevermind those that are already re-testing their mar/apr lows. so it goes into a secondary bucket right away

2/ at $200 mm cap, it's small and factor matters right now. the opportunity set of so many things means that in order for this type of name to get recognized it *needs* to have a positive catalyst or reason to own it or step in "now". with #1 above, that's not the case, and if small caps continue to bleed to large caps, even the quality names suffer a lemons problem. NASDAQ:GAMB is probably my favorite small cap name rn, and i can only justify having it at 4% size and on 2.5x leverage so about 10%. it's growing double digits, isn't missing results, the industry is growing, it's fcf generation is 15% (for NYSE:FC for comparison it's 10% on possibly numbers that need to come down). point is, even in small cap land, my alternative is something that scores higher on nearly all metrics and i'm already finding that hard to own

3/ and this point is similar in a way to 2, as this venn diagram has a lot of circles. but on valuation mid teens PE with no "E" growth and "only 10% fcf yield" is just not good enough w better valuations and pictures, elsewhere, even in much higher caps that i think will get bid first, posted good results etc. etc. and can buyback stock.

so while i will probably keep this on my watchlist, and even though my gap fill from the April 2 comment happened (and i'll leave it on my chart for my notes), the tape has changed. this is important to put into your process. people often ask "at what price i'm a buyer or seller". realistically this changes day by day, week by week and depends on a lot of things. in a vacuum and at any given day, i can give you an answer to this question. but if we zoom forward now nearly 4 months from this point, that gap fill price (where we are today) is not good enough. and i'd probably need PE closer to 10-12x minimally and FCF yield in the mid teens. this means minimally 20% and ideally 30% lower, i'll be bothered to look again.

now, will it get there? idk. again, this is the beauty of trading view alerts and notes. i'll post this comment, set my alert at $15.55 (which is only 16% lower - not this 20% - because maybe things have changed, who knows - and if/when we get there i pull up this note, saves me another 10 mins of work - and either reset the bogey or update). that's my target and alert-setting process, fwiw.

V

$UNH BEARISH SETUP – WEEK OF AUG 1

🔻 **\ NYSE:UNH BEARISH SETUP – WEEK OF AUG 1** 🔻

**UnitedHealth Group (UNH)** is showing classic breakdown signs. Here’s what the data says:

📉 **RSI Breakdown**

• Daily RSI: **20.6**

• Weekly RSI: **19.3**

→ Deeply oversold + no bounce = 🚨 momentum flush risk

📊 **Volume Surge**

• Weekly Volume: **145M** (1.9x avg)

→ Heavy **institutional selling**, NOT dip buying

🧠 **Options Insight**

• Call/Put Ratio: **1.17** = Slight bullish noise

• But... Expiry Gamma is 🚨HIGH = IV Crush incoming

• VIX: **20.7** = Volatility tailwinds intact

💣 **TRADE IDEA (PUT PLAY)**

• Direction: **BUY PUTS**

• Strike: **\$230**

• Expiry: **08/08/2025**

• Entry: **Monday Open**

• Target Premium: **\$0.10**

• 🎯 PT: \$0.30 | 🛑 SL: \$0.03

• Confidence: **70%**

📌 **Narrative**:

Oversold + High Volume Dump + No support bounce = Perfect storm for continuation dump. This is a high gamma play, time-sensitive, low-cost lotto setup. Risk small. Aim big.

---

💥 **Watchlist Tag**: ` NYSE:UNH AMEX:SPY AMEX:XLV `

🧠 **Strategy Tag**: #OversoldFlush #PutPlay #0DTETrap

🚀 Follow for more weekly earnings & options breakdowns!

The Low Is In: Why the S&P 500 Just Confirmed a Bullish Reversal🔥 The Low Is In: Why the S&P 500 Just Confirmed a Major Bullish Reversal 🔥

The market just gave us a gift.

After weeks of drifting lower and sentiment turning cautious, the S&P 500 has touched — and bounced — off a critical rising trendline for the third time since May 2025. That third touch isn't just a technical coincidence… it's often the launchpad for a new impulsive leg higher.

📈 The Power of the 3rd Touch: Trendline Validation Complete

Look at the chart. This isn’t guesswork. Since May, the S&P 500 has been respecting a well-defined ascending trendline, one that connects multiple higher lows during this bull run.

The first touch was the May liftoff after the April consolidation.

The second came in June — a clean retest and bounce.

Now, as of early August, the third touch has held once again, exactly where the bulls needed it most.

This isn’t a random line on a chart. This is institutional flow stepping in to defend structure.

And when a rising trendline holds for a third time after a strong uptrend? That’s a classic continuation signal.

📉 RSI Washout + Structural Support = Perfect Storm for a Bottom

The RSI printed a dramatic dip to ~32, a level that screams “oversold” on the 4-hour timeframe. But notice the context — it happened right at structural support.

This is not weakness. This is accumulation.

Big players shake out weak hands on low timeframes… right before they send it.

🧠 Sentiment Is Offside… Again

Let’s not forget: this retrace came after a huge run-up since March. People expected a deeper correction. Bears started getting loud again.

That’s how bull markets trap you — by convincing you it’s over right before the next leg higher.

And with macro tailwinds (liquidity expansion, fiscal spend, tariff rollbacks), earnings season beats, and global capital rotation into U.S. equities, this setup is ripe for a violent upside squeeze.

🚀 8,700 in Sight: My End-of-Year Price Target Is Very Much in Play

Today’s close around 6,220 means the S&P 500 would need to rally ~40% to hit my target of 8,700 by year-end.

Sounds crazy? Not if you’ve seen what happens during parabolic melt-ups.

This isn’t just hope:

📊 Strong breadth under the surface

🏛️ Dovish policy pivot now expected in Q4

💸 Retail and institutional capital both re-engaging

📉 Bond yields are starting to roll over, supporting equity valuations

When bull markets enter their euphoria phase, they don’t stop at “reasonable” targets. They blast through them.

💡 The Setup Is Textbook — Now It’s About Execution

✅ Trendline defended

✅ RSI reset

✅ Sentiment shaken out

✅ Structure intact

The technicals just aligned with the macro. The low is in — and the runway to 8,700 is wide open.

Strap in. Q4 could be one for the history books.

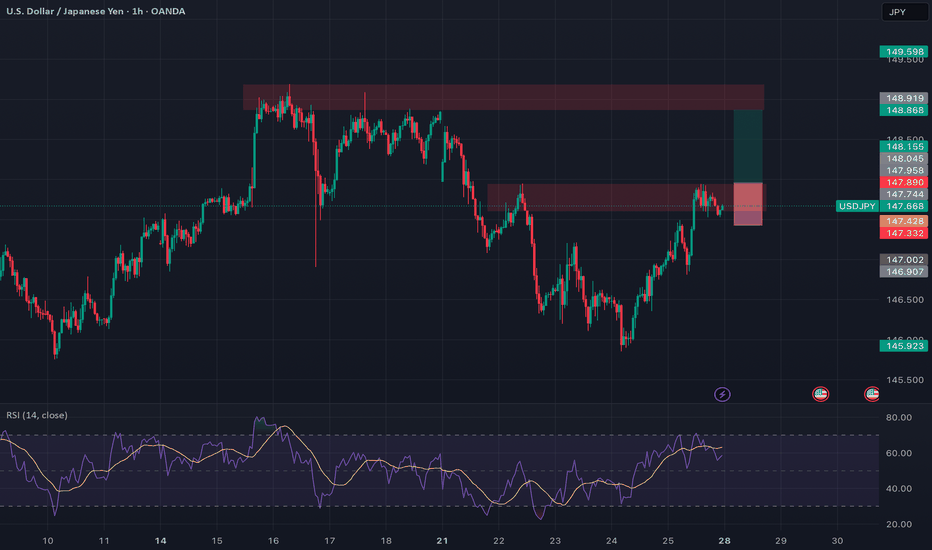

USDJPY: Breaking Out With Macro Backing 🟢 USDJPY | Breakout Opportunity Above Resistance

Timeframe: 1H

Bias: Bullish

Type: Break and Retest

📊 Technical Setup

USDJPY is currently consolidating at a key 4H resistance zone (147.75–147.90). A clean breakout and retest of this area will confirm bullish continuation.

• Entry: Above 147.90 (after confirmed candle close + retest)

• SL: Below 147.30

• TP: 148.90 / 149.60

• RR: ~1:2.5

• Indicators: RSI showing strong upside momentum, holding above 50

🧠 Fundamentals + Macro Confluence

• USD Strength: Strong macro & delayed rate cuts support USD upside

• JPY Weakness: BOJ remains dovish; risk-on sentiment weighing on JPY

• COT + Conditional Score: USD score increased to 17, JPY dropped to 8

• Risk Sentiment: VIX at 14.2 = RISK ON → bearish JPY bias

🧭 Gameplan

“Wait for confirmation above resistance before entering”

🔔 Set alerts around 147.90 and monitor lower timeframes for retest and bullish candle structure.

Quantum's TSLA & NVDA Trades 8/1/25Simply breaking down what I look at going into the trading day. Premarket watchlist was short but nailed TSLA short for 150% and could have made double that on TSLA and NVDA longs. Due to hitting my daily goals I had to walk away to avoid overtrading but what an amazing day.

$BTC needs a massive diaper change....BTC is crossing key technical points, pointing clearly in an bearish trend. The trend will likely accelerate and potentially aggressively. I have been through several turns, not financial advise and always do your due diligence, but for those who are up: sell and and don't get emotional about BTC, unless there is a clean / clear support levels. Crypto bros will be eating rice and beans very soon and still be trying to FOMO crypto. This could be way worse than FTX!

Stay safe and for signal support levels use UltraAlgo to avoid wasting time trying to find support / resistance levels.....best of luck!

DAILY SCALPING PLAN | CLINTON SMC STYLE✅ XAU/USD - DAILY SCALPING PLAN | CLINTON SMC STYLE

📆 Date: August 1st, 2025

📍 Strategy: Smart Money Concepts (SMC)

🔑 Focus: Liquidity Sweep | Order Block | BOS | Premium/Discount Model

🔍 Market Overview

Gold (XAU/USD) is currently in a manipulation phase after a strong move down from a premium supply zone. The market has swept key liquidity and is preparing for a high-probability move in both directions based on Smart Money footprints.

Current structure suggests:

Bullish intent forming from a discount demand zone.

Liquidity resting above recent highs – perfect for short-term scalps and intraday swings.

🟢 BUY SETUP – DISCOUNT DEMAND REACTION

🎯 Entry: 3275

🛡️ Stop Loss: 3268

🎯 Take Profits:

TP1: 3285

TP2: 3295

TP3: 3305

TP4: 3315

TP5: 3325

TP6: 3335

Reasoning:

This is a clean bullish OB resting beneath a CHoCH and BOS zone. Price may wick into this area as Smart Money reloads after sweeping early long positions. If held, expect sharp upside expansion toward previous liquidity highs.

🔴 SELL SETUP – PREMIUM SUPPLY REJECTION

🎯 Entry: 3356

🛡️ Stop Loss: 3362

🎯 Take Profits:

TP1: 3350

TP2: 3345

TP3: 3340

TP4: 3330

TP5: 3320

Reasoning:

This level is a key supply block where price previously distributed. If price expands into this zone, it’s likely to act as a liquidity magnet for Smart Money to offload longs and enter short-term shorts. Expect reaction.

🧠 SMC Insights

Internal BOS & CHoCH signal early signs of accumulation.

Price respects the premium vs. discount framework with clear liquidity targets.

SMC traders understand that price doesn’t move randomly – it targets liquidity, mitigates OBs, and respects structure.

🔔 Note:

Always wait for clear confirmation (rejection wick, engulfing pattern, or M15 structure shift) before execution. Entries without confirmation are riskier in current volatility.

📌 Follow @ClintonScalper for daily SMC scalping plans & deep institutional insight.

🔁 Like, comment & share if you find this helpful!

Top in Place? NASDAQ100 Signals Exhaustion After Incredible Run📈 The crazy run since April

NASDAQ100 has had a spectacular run since early April, when the index dipped to 16,300 amid rising tensions caused by Trump’s tax war. From that low, we’ve seen a mind-blowing rally of over 7,000 points, which translates to a 40% gain in just 4 months.

Such a rise is not just impressive— it’s overextended , especially by historical standards. Markets don’t move in straight lines forever, and this one might be showing signs of fatigue.

🕯️ Bearish signal at the top

Fast forward to this week: yesterday, the index marked a new all-time high at 23,700, but closed the day with a strong bearish engulfing candle — one that wipes out the gains of the previous 4 trading sessions.

This is not a small technical detail. Such candles, when appearing after an extended rally, often signal exhaustion and a potential shift in momentum.

❗ Top in place?

In my opinion, there's a high probability that a top has been set, at least temporarily. We might be looking at the beginning of a healthy correction, or even something more meaningful, depending on follow-through in the next sessions.

📉 Where to next?

The first major support to watch is the 22,200 level.

I expect that zone to be tested soon — and honestly, considering how much the index has gone up, this shouldn’t surprise anyone. It’s nothing more than a minor pullback, all things considered.

🧠 Stay smart!

When markets go vertical, it pays to stay disciplined and realistic. Tops rarely announce themselves, but when signals like this appear, it’s wise to listen.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

BTC - Not the End of the DropRather the beginning. Bitcoin has fallen below this bearish intersection. Anticipating price to fall rapidly on one of these two pathways to the Uber low liquidity levels.

DXY is retesting a major bearish breakdown - this is the conduit that will justify a flash crash of this magnitude prior to a 3-5 year bull run.

Happy trading.

GOLD Analysis – Bullish Recovery Setup After Trendline Breakout ⚙️ Technical Structure Overview

This 4-hour chart of Gold (XAUUSD) illustrates a classic reversal setup developing after a significant correction. Price previously faced strong selling pressure from the 3,470+ zone and declined sharply. However, the recent price action suggests a shift in control from sellers to buyers, signaling a likely medium-term trend reversal or a bullish wave formation.

The key to this setup lies in three confluences:

Completion of a previous supply zone, which no longer holds influence.

Aggressive buyer activity from a major support zone.

A clean break above the descending trendline, which is a common signal that bearish momentum is losing strength.

🔑 Key Levels & Concepts Explained

🟢 1. Major Support Zone (3,260–3,280)

This zone has been tested multiple times and each time, buyers stepped in and prevented further downside. The most recent rejection from this area shows long wicks and bullish engulfing candles, indicating accumulation by institutional players. This is the foundational support that has held the entire corrective structure.

📉 2. Trendline Breakout

The descending trendline connecting swing highs has now been broken to the upside. This is a critical technical signal, especially on the 4H timeframe, as it suggests a potential trend reversal or at least a deep retracement in the opposite direction.

Trendline breakouts typically result in a retest of the trendline or a nearby support-turned-resistance zone (as is the case here with the Mini SR level).

It also implies that supply is weakening, and buyers are ready to push.

🧱 3. Mini Support/Resistance Interchange (~3,300–3,320)

This zone now plays the role of an interchange level—a previous minor resistance that could act as a support after the breakout. This level is crucial for intraday and swing traders because it can offer a low-risk long entry if price retests and confirms it with bullish momentum.

The chart projection suggests a bounce off this mini S/R, followed by successive higher highs and higher lows, forming a new bullish structure.

📈 Forecast Path & Trade Scenario

✅ Bullish Path (Preferred MMC Scenario)

Stage 1: Price retests the 3,300–3,320 zone (Mini S/R).

Stage 2: Buyers step in, leading to a bullish continuation.

Stage 3: Price targets the Minor Resistance (~3,440).

Stage 4: If momentum is sustained, it aims for Major Resistance (~3,470–3,480), completing a clean reversal formation.

This path reflects perfect bullish market structure—a breakout, followed by a retest and rally.

❌ Bearish Invalidation

If the price closes strongly below 3,260, the structure would be invalidated.

This would suggest that the support zone failed, possibly triggering deeper downside toward 3,220–3,200.

🧠 MMC Trader Mindset & Risk Considerations

Don’t Chase: Wait for a confirmed retest of the Mini S/R zone. Let the market come to your entry.

Entry Confirmation: Use candlestick signals like bullish engulfing, pin bars, or inside bars near the Mini S/R.

Volume Consideration: Volume should ideally rise on breakout legs and decline on pullbacks—this confirms healthy bullish structure.

Risk-Reward: With a stop below 3,260 and targets toward 3,470, the RR ratio favors long entries, especially after confirmation.

🔁 Summary Plan for Execution

Entry Zone: 3,300–3,320 (after bullish confirmation)

Stop Loss: Below 3,260 (structure break)

Take Profit 1: 3,440

Take Profit 2: 3,470–3,480

Risk-to-Reward: 1:2+ if planned carefully