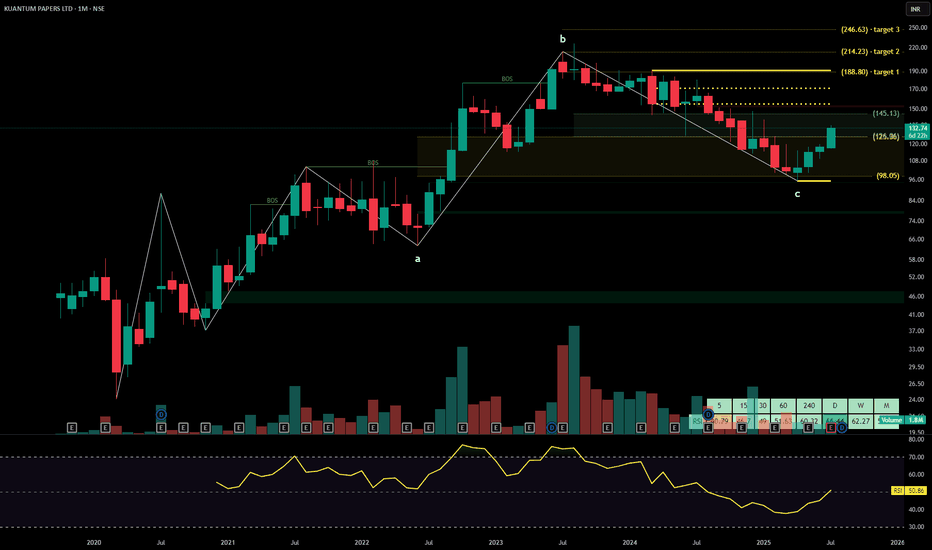

KUANTUM PAPERSKuantum Papers Ltd. is a leading paper manufacturing company with integrated production facilities and a strong portfolio across writing, printing, packaging, and specialty paper segments. The company focuses on eco-friendly processes and operational efficiency, catering to domestic and institutional clients. The stock is currently trading at ₹145.13.

Kuantum Papers Ltd. – FY22–FY25 Snapshot

Sales – ₹582 Cr → ₹612 Cr → ₹652 Cr → ₹695 Cr – Steady topline growth from volume expansion and pricing mix Net Profit – ₹53.8 Cr → ₹61.2 Cr → ₹68.4 Cr → ₹76.3 Cr – Earnings driven by capacity utilization and margin stability

Order Book – Moderate → Moderate → Strong → Strong – Expansion in institutional orders and packaging segment

Dividend Yield (%) – 0.52% → 0.55% → 0.58% → 0.60% – Gradual payout growth aligned with profitability Operating Performance – Moderate → Strong → Strong → Strong – Improved efficiency and raw material cost

Equity Capital – ₹8.12 Cr (constant) – Lean capital base with no dilution

Total Debt – ₹76 Cr → ₹72 Cr → ₹68 Cr → ₹64 Cr – Gradual deleveraging supported by internal accruals

Total Liabilities – ₹228 Cr → ₹236 Cr → ₹243 Cr → ₹252 Cr – Expansion aligned to capex and working capital needs

Fixed Assets – ₹102 Cr → ₹107 Cr → ₹113 Cr → ₹118 Cr – Capacity enhancement toward high-value grades

Latest Highlights FY25 net profit rose 11.6% YoY to ₹76.3 Cr; revenue increased 6.6% to ₹695 Cr EPS: ₹9.40 | EBITDA Margin: 22.7% | Net Margin: 10.98% Return on Equity: 17.82% | Return on Assets: 11.26% Promoter holding: 50.06% | Dividend Yield: 0.60% Premium paper grades and packaging demand boosting margin profile Ongoing backward integration and biomass energy support sustainability focus

Institutional Interest & Ownership Trends Promoter holding remains firm at 50.06%, with no pledging or dilution. Institutional activity is limited but stable, with visible accumulation by PMS and HNI desks in recent quarters. Delivery volume trends suggest quiet positioning aligned with mid-cap FMCG and specialty packaging consumption themes.

Business Growth Verdict Yes, Kuantum Papers continues to scale steadily across its core and value-added segments Margins remain healthy supported by operational leverage Debt is declining, enhancing balance sheet visibility Capex supports long-term margin mix and ESG compliance

Company Guidance Management expects mid-to-high single-digit revenue growth in FY26, supported by product mix optimization, energy cost control, and expansion in institutional packaging clients.

Final Investment Verdict Kuantum Papers Ltd. represents a disciplined play in India’s paper manufacturing and packaging ecosystem. Its steady financial metrics, sustainability initiatives, and growing institutional demand position it well for compounding. The consistent profitability, improving cash flows, and conservative debt structure make it attractive for investors seeking mid-cap exposure to industrial FMCG-linked consumption.

Fundamental Analysis

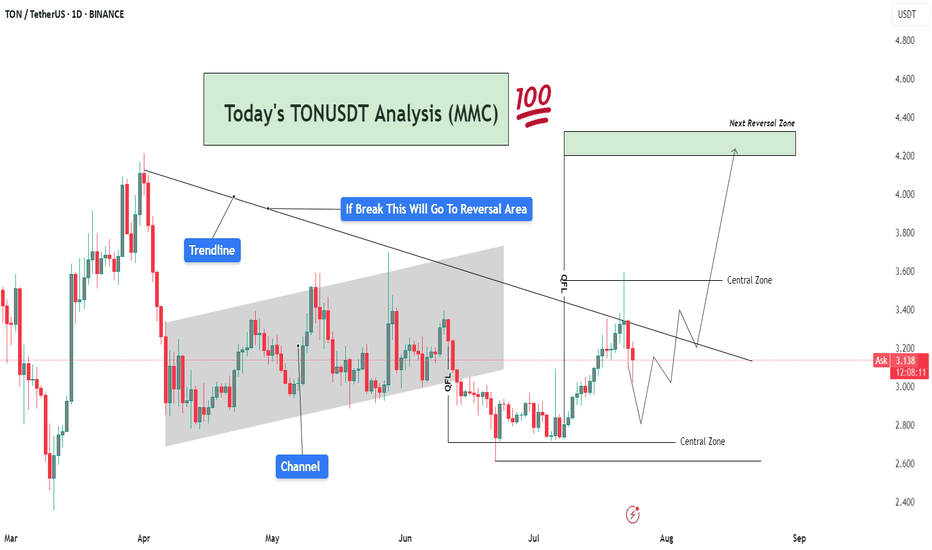

TONUSDT Analysis – Trendline Breakout Target To Reversal Area🧠 Market Sentiment & Context:

TONUSDT (Toncoin vs USDT) is currently trading at $3.13, showing signs of compression within a well-defined MMC structure. After forming a clear QFL (Quick Flip Level) base, the market is approaching a decisive breakout level, with a strong rejection or breakout likely in the coming days.

This chart displays confluence from trendlines, channel breaks, central zones, and QFL demand zones, providing multiple layers of structure-based decision-making. Here's a deeper dive 👇

🔍 Technical Breakdown – What the Chart Is Telling Us:

🔸 1. Major Trendline Resistance – Bearish Control Zone

The descending trendline drawn from prior highs is acting as dynamic resistance.

Price tested this line recently and faced rejection, showing that sellers are still active.

However, the consolidation below the trendline suggests accumulation, not panic selling — a classic sign of smart money positioning before a breakout.

🔸 2. Previous Channel Structure – Broken & Retested

The price previously moved inside a slightly rising parallel channel, reflecting a slow and steady bullish phase.

The channel has now been broken, but TON quickly reclaimed structure via a strong bullish engulfing candle from the QFL base, hinting that this was a liquidity grab (stop hunt) before the real move.

🔸 3. QFL (Quantity Following Line) – Institutional Demand Zone

The QFL base at around $2.85–$3.00 was created after a swift sell-off followed by immediate bullish response.

This is a high-probability MMC reversal structure, where large buyers typically enter.

Since this QFL held firm, it has created a solid foundation for bullish momentum, provided the trendline is eventually broken.

🧭 What's Happening Now – Price Action Update:

Price is caught between two major Central Zones:

Lower Zone: $2.85 – $3.15 (Support)

Upper Zone: $3.50 – $3.70 (Resistance)

The current movement shows price creating higher lows, indicating bullish pressure building beneath the trendline.

Volume remains low, which means the market is waiting for a catalyst (news or breakout) before a directional push.

📌 Key Reversal Zone Ahead – Eyes on $4.20 to $4.40

If price breaks and closes above the descending trendline and crosses the upper central zone, we can anticipate a strong bullish move toward the Next Reversal Zone marked around $4.20–$4.40.

This zone has historical confluence as:

Previous strong supply zone

Psychological round number

Fibonacci extension alignment

This will likely be the profit-booking area for swing traders and early buyers from the QFL zone.

📈 Trade Scenarios Based on MMC:

✅ Bullish Scenario (High Probability If Breakout)

Price breaks the trendline → Pullback → Retest of $3.50–$3.60 zone

Bullish continuation to $4.20–$4.40 Reversal Zone

Ideal entry on retest after breakout

Stop-loss below $3.00

❌ Bearish Scenario (If Rejected Again)

Rejection from trendline leads to re-test of lower Central Zone

Breakdown of QFL level (~$2.85) would invalidate bullish setup

Potential drop toward $2.60 zone for liquidity sweep

🧠 MMC-Based Observations:

🔹 MMC Element 📍 Explanation

🔺 Trendline Key resistance from macro downtrend

🟩 Central Zones Neutral battleground for buyers/sellers

🔻 Channel Break Confirmed bearish momentum earlier, now tested

✅ QFL Strong base, showing early smart money entries

🎯 Reversal Zone High-risk area, expect volatility and profit-taking

📌 Strategic Summary:

Bias: Bullish (as long as price holds above $3.00)

Confirmation Needed: Daily candle close above trendline & $3.50 zone

Target 1: $3.85

Target 2: $4.20–$4.40 (main reversal)

Invalidation: Close below $2.85 (QFL loss)

🚨 Final Thoughts:

TONUSDT is showing clear smart money footprints via the QFL formation and trendline pressure. The setup is ideal for MMC-based breakout traders waiting for confirmation before entering. Volume spike + trendline break will likely spark the next impulsive rally.

Stay patient, and trade the reaction, not the prediction.

What the Market Is Telling Us About Altcoin Season in 2025Altcoin season is that highly anticipated market phase where alternative cryptocurrencies outperform Bitcoin and dominate trading activity. As we move through 2025, several key signals suggest we may be entering just such a phase—and investors are paying close attention.

Key Market Indicators

Bitcoin dominance is falling below 50–52%, historically a sign of capital rotation into altcoins.

Trading volumes are spiking in Ethereum, Solana, Chainlink, Toncoin, and others.

Sector-specific excitement is building around Web3, AI tokens, and decentralized physical infrastructure (DePIN).

While this might be just the early stage of the altcoin cycle, the smart money is already positioning.

Investor Considerations

Focus on projects with real fundamentals. Ethereum, Avalanche, Cosmos, and Chainlink remain top infrastructure bets.

Utility is key. Projects with real-world application, strong developer activity, and growing user bases are best positioned for long-term growth.

Track sentiment. Watch for social buzz, news momentum, and open interest increases—often the earliest signs of breakout moves.

Bottom Line

Altcoin season doesn’t happen overnight. What we’re seeing now is the accumulation phase—an ideal time for data-driven investors to build high-upside portfolios. But caution is critical. Not every pump is sustainable, and smart risk management remains non-negotiable.

For those who prepare wisely, the 2025 altcoin season could unlock some of the most lucrative opportunities in the crypto space.

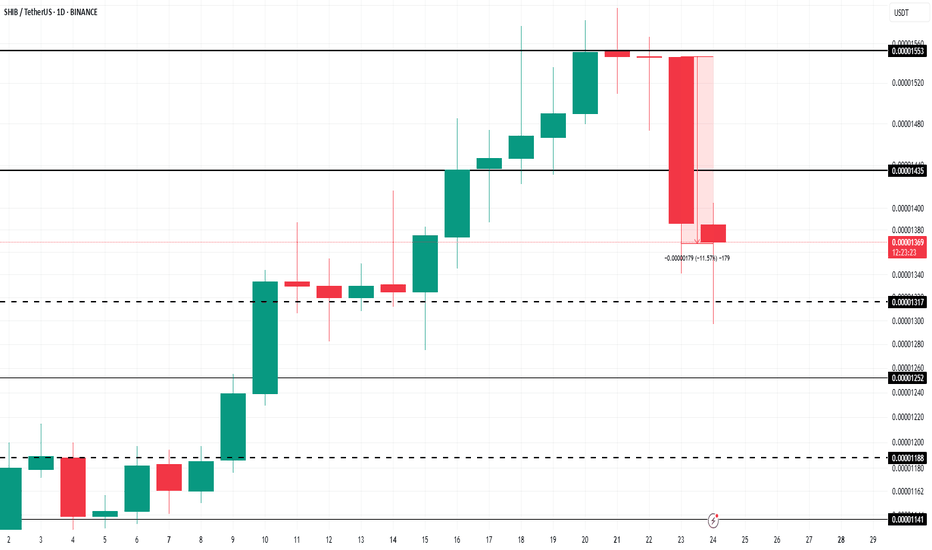

Shiba Inu Whales Amass 4.66 Trillion SHIB As Price Falls 12%BINANCE:SHIBUSDT price is currently trading at $0.00001353, down 11.5% over the past 24 hours . The altcoin is holding above the support level of $0.00001368.

The large holders' netflow for BINANCE:SHIBUSDT has recently spiked, reaching a two-month high. In the last 24 hours, 4.66 trillion SHIB were accumulated by addresses holding at least 0.1% of the circulating supply. These whales, who have collectively invested $63.7 million , are betting on a price rebound.

A successful bounce off $0.00001317 would likely pave the way for further price appreciation, potentially pushing BINANCE:SHIBUSDT to $0.00001553 . Securing this level as support could mark a recovery of today’s losses and initiate a new uptrend, provided the broader market conditions remain favorable.

On the other hand, if BINANCE:SHIBUSDT falls below the support of $0.00001317 due to profit-taking, the meme coin could slip to $0.00001188 . This would invalidate the bullish thesis and further reduce investor confidence. The next few days will be crucial in determining if SHIB can maintain its current support levels .

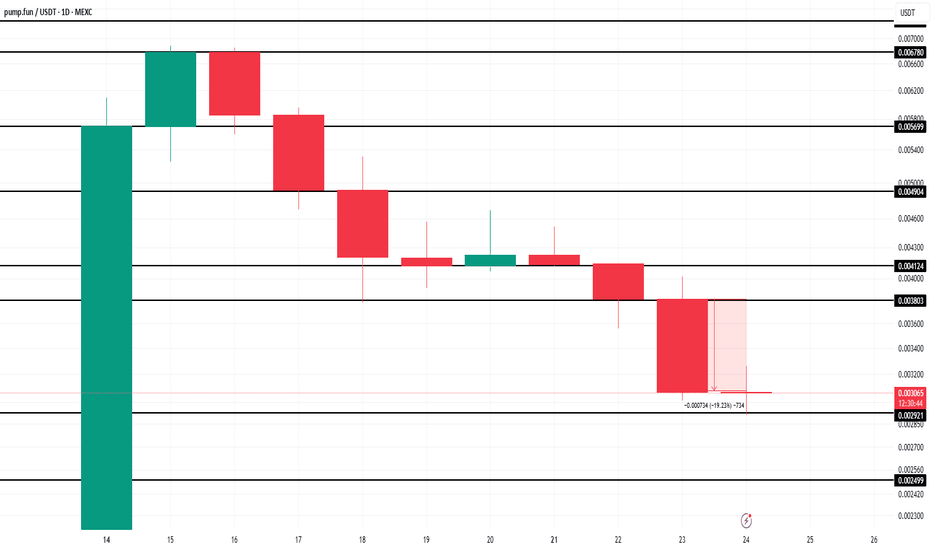

Pump.fun (PUMP) Price Crashes 20% After First Bearish CrossoverMEXC:PUMPUSDT price is currently at $0.003055, down by nearly 20% in the last 24 hours . The MACD (Moving Average Convergence Divergence) indicator, a key tool used to track price momentum, has signaled the first bearish crossover for PUMP token since its launch.

The bearish crossover occurred after a period of rising bullish momentum, signaling that the altcoin may now be facing a downturn.

The token is holding above a key support level of $0.002921 , but this support is fragile. If MEXC:PUMPUSDT fails to maintain this level, it could continue to decline, potentially dropping to $0.002499 . This would confirm the continuation of the downtrend, and the price could fall further.

On the other hand, if MEXC:PUMPUSDT manages to hold its ground at $0.002921, it could experience a bounce back. This would allow the altcoin to rise towards $0.003803, potentially invalidating the current bearish thesis and pushing the price past the resistance of $0.004124 . The next few days will be critical in determining if PUMP can recover from its recent losses.

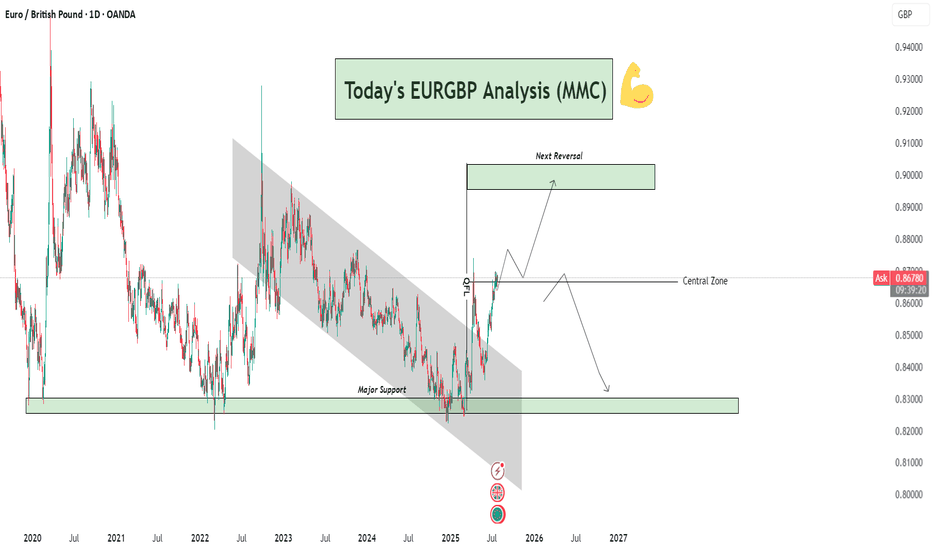

EURGBP Analysis : Breakout, Central Zone Flip & Reversal Target🧠 Overview:

This EURGBP daily chart clearly presents a bullish breakout from a long-term descending channel, a successful reclaim of the central structure zone, and a projection toward a key reversal level. This analysis incorporates Smart Money Concepts (SMC), Market Maker Concepts (MMC), and classic structural behavior.

🔍 Technical Breakdown:

📉 Long-Term Bearish Channel (2021–2025)

For nearly 4 years, EURGBP was trapped in a descending channel, forming consistent lower highs and lower lows.

This long-term bearish phase reflects strong supply-side control and institutional distribution.

The breakout above this structure is significant — marking a potential mid- to long-term trend reversal.

🔁 Major Support Zone (0.8300–0.8350)

Price bounced strongly from this historical demand zone multiple times (in 2021, 2022, and recently in 2025).

This zone is critical and acts as a high-volume accumulation area where smart money has stepped in.

The strong reaction from this level in 2025 triggered the breakout of the bearish structure.

🚀 Break of Structure + Retest

After breaking the descending channel, price retested the upper boundary, confirming a structure shift.

The breakout retest succeeded — marking the transition from a bearish phase to a bullish expansion.

📍 Central Zone Flip

The Central Zone, once a resistance/supply area during the downtrend, has now been reclaimed as support.

This is a powerful MMC concept – where the "central balance" of a structure flips and becomes a base for the next impulse.

Current price is sitting just above this zone, indicating bulls are still in control.

🎯 Next Reversal Zone (Target Area: 0.9000–0.9050)

The chart outlines a projected bullish move toward the Next Reversal Zone marked above.

This is a key supply area, likely to trigger profit-taking or institutional sell orders.

Expect price to range or wick into this zone before showing a possible bearish reversal.

🔄 Future Projection Scenarios:

Scenario 1 – Bullish Continuation:

Price continues to build bullish structure and approaches the 0.90 reversal zone.

Rejection from this zone may trigger consolidation or a minor retracement.

Scenario 2 – Major Reversal:

Upon hitting the next reversal zone, price could reverse and fall back toward the Central Zone or even the Major Support below, especially if macroeconomic fundamentals shift.

🔑 Confluences Supporting This Setup:

✅ Element 🧩 Description

🔹 Major Support Historical demand zone with repeated rejections

🔹 Channel Breakout Structure shift confirming bullish interest

🔹 Retest Success Technical confirmation of breakout validity

🔹 Central Zone Flip Old resistance → new support (MMC principle)

🔹 Reversal Zone Anticipated next profit-taking / supply area

📌 Strategic Insight:

Bias: Bullish short-term to mid-term

Entry Opportunity: Lower timeframe pullbacks into Central Zone (or retest zones)

Target: 0.9000–0.9050 area

Watch for Rejection: In reversal zone for potential bearish shift

⚠️ Risk Note:

Always wait for confirmation at reversal zones. Overextended moves without correction can quickly retrace. Manage your trades with stop-losses below key structural levels and maintain strict risk-reward planning.

🧠 Conclusion:

EURGBP has transitioned from a long bearish cycle into a bullish expansion phase. Smart Money accumulation at the base and a clean breakout with retest confirm a strong directional shift. Keep your focus on the Central Zone retests and the Reversal Zone reaction for optimal entries or exits.

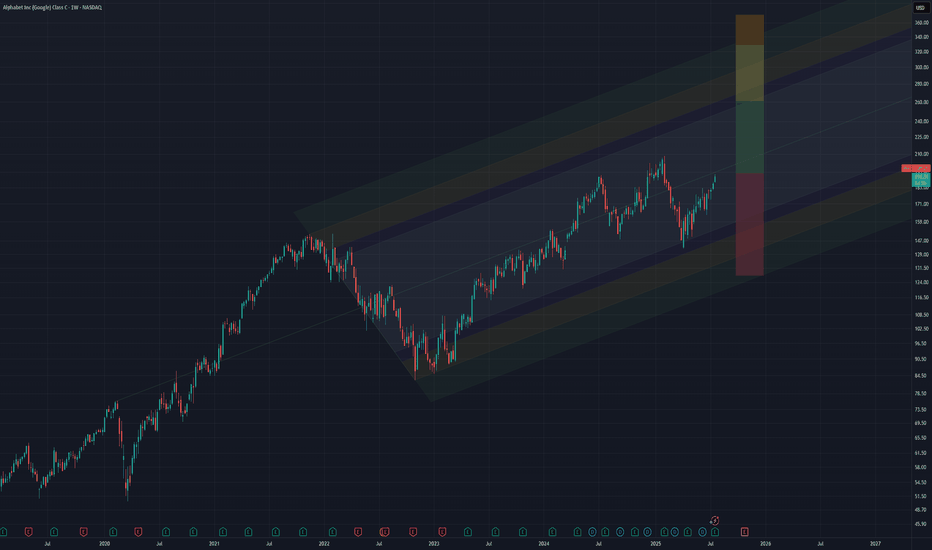

EOY based on yesterday's earnings and the flywheel effect# Alphabet's Accelerating Flywheel: Q2 2025 Earnings Validate the Strategy

technicals grounded in an anchored pitchfork hinged on the pre-covid levels (covid bottom just makes the path too aggressive for EOY) and fib retracements of the 2022 bear market decline. General and simple targets since moving averages aren't providing much clarity. Single stock analysis is even more voodoo than large sector indexes, so I'll focus on fundamentals instead:

## The Flywheel In Action: Q2 2025 Results

Alphabet's blowout Q2 2025 earnings provide concrete evidence that their integrated AI flywheel is already spinning faster. **Revenue grew 14% to $96.4 billion, crushing expectations**, while the company raised its 2025 capital expenditures from $75 billion to **$85 billion**—a bold investment that initially spooked some investors but actually signals the flywheel's acceleration.

### Why the $85 Billion Capex Increase is Strategic Genius

The additional $10 billion isn't just spending—it's **strategic reinvestment in the flywheel's core components**:

**Infrastructure Dominance:** Google Cloud revenue surged 32% to $13.6 billion, now approaching a $50+ billion annual run rate. The capex increase funds the massive data centers and TPU clusters needed to serve exploding AI demand.

**Competitive Validation:** Even OpenAI, Google's biggest AI rival, is now renting Google's TPU chips to power ChatGPT—choosing Google's proprietary hardware over Nvidia GPUs for cost-effective inference. This partnership alone validates the integrated hardware-software advantage.

**Market Leadership:** With AI Overviews reaching 2+ billion users (up from 1.5B last quarter) and Gemini hitting 450+ million users, Google is proving it can deploy AI at unprecedented scale while generating immediate revenue.

## The Core Flywheel System

**The Engine:** World-class AI research (DeepMind, Google AI) creating increasingly capable models that serve as tools for invention, not just products. Gemini's rapid user growth proves the models are competitive.

**The Fuel:** Search and YouTube revenue provides patient capital for long-term moonshots, while diverse data from billions of users continuously improves AI models. Q2's strong advertising performance ($64B+) funds the entire system.

**Custom Hardware Advantage:** Proprietary TPUs optimized for their AI software create faster, more efficient training and inference than competitors using general-purpose chips. OpenAI's adoption proves TPUs offer superior cost-performance.

**The Multiplier:** Quantum computing research that could eventually solve problems impossible for classical computers, creating step-change advantages in materials science and optimization.

## AI Integration Across the Ecosystem: The Ultimate Moat

Alphabet's true competitive advantage lies in **embedding AI across their existing billion-user platforms**, creating compound defensibility:

**Search Dominance:** AI Overviews now appear in 2+ billion monthly searches across 200+ countries, fundamentally changing how users interact with information while maintaining Google's search monopoly. Users increasingly expect AI-powered results, making switching costs even higher.

**Productivity Lock-in:** Gmail's Smart Compose, Google Docs' AI writing assistance, and Sheets' intelligent data analysis create sticky enterprise and consumer habits. Once teams adopt AI-enhanced workflows in Google Workspace, migration becomes exponentially more difficult.

**Developer Ecosystem:** Google's coding tools (Colab, Android Studio) now feature AI pair programming, while languages like Go and Dart benefit from AI-optimized development. This creates a generation of developers trained on Google's AI tools.

**Educational Moat:** Chromebooks in schools now include AI tutoring and personalized learning, creating habits among students who will become tomorrow's decision-makers. Google for Education's AI features make alternative platforms seem primitive.

**Entertainment Integration:** YouTube's AI-powered recommendations, creator tools, and content moderation have become so sophisticated that creators and viewers alike can't imagine the platform without them. This strengthens YouTube's dominance over TikTok and other competitors.

**Mobile and Browser Dominance:** Android and Chrome's AI features (Smart Reply, intelligent autofill, predictive text) create seamless experiences that competitors struggle to match without Google's data advantages.

## Near-Term Flywheel Accelerators

**Physical AI & Robotics:** Moving from digital-only AI to robots that can perceive and manipulate the physical world. Waymo has now driven 100+ million autonomous miles, generating unique physical-world training data.

**AI Biology:** DeepMind's protein folding breakthroughs and Isomorphic Labs' drug discovery pipeline could create massive pharmaceutical revenues while advancing the core AI engine.

**AI Materials Science:** Already discovering thousands of new materials that could dramatically improve batteries, semiconductors, and other hardware across all ventures—feeding back into better TPUs and infrastructure.

## The Compounding Network Effects

**Data Flywheel:** More users → More training data → Better AI models → Better products → More users. AI Overviews now drive 10%+ more queries for the types of searches that show them.

**Revenue Flywheel:** AI success → Higher cloud/advertising revenue → More R&D investment → Better AI → Market expansion. Google Cloud's 32% growth funds continued AI leadership.

**Talent Flywheel:** Best AI infrastructure → Attracts top researchers → Better models → More ambitious projects → Attracts even better talent. The recent $2.4B Windsurf acquisition shows Alphabet winning the talent war.

**Infrastructure Flywheel:** More AI demand → Larger TPU deployments → Better hardware optimization → Lower costs → More competitive offerings → More demand.

**Ecosystem Lock-in:** AI features across Gmail, Docs, YouTube, Search, and Android create switching costs that compound across products. Users don't just leave Google Search—they'd have to abandon their entire digital workflow.

## The Strategic Moat Widens

While competitors excel in individual areas, Alphabet's advantage comes from **deep integration creating compound effects**:

- **Capital Moat:** The $85B capex commitment (13% increase from 2024) exceeds most competitors' total revenues

- **Integration Moat:** OpenAI using Google TPUs despite being competitors proves the hardware-software integration is unmatched

- **Scale Moat:** 2+ billion AI Overview users and $50B+ cloud run rate create network effects competitors can't replicate

- **Ecosystem Moat:** AI embedded across Search, Gmail, YouTube, Android, Chrome, and Workspace creates compounding switching costs

- **Innovation Velocity:** Time from AI research to deployed products at billion-user scale continues compressing

## The Key Insight

The Q2 earnings reveal that Alphabet isn't just building an AI company—**they're building the infrastructure that accelerates invention itself**. Each breakthrough feeds back into the system: new discoveries generate revenue that funds more research, create better tools for the next breakthrough, and attract top talent.

More importantly, they're embedding AI so deeply into users' daily workflows—from Gmail to YouTube to Search—that switching becomes not just inconvenient but practically impossible. When your email, documents, entertainment, and information all work seamlessly together through AI, why would you ever leave?

The $85 billion capex increase signals management's confidence that they're approaching "escape velocity"—where their innovation rate becomes impossible for competitors to match. While others debate AI spending, Alphabet is already demonstrating profitable AI deployment at unprecedented scale while simultaneously investing in the next acceleration phase.

**The Bottom Line:** Alphabet's integrated flywheel of AI research, proprietary hardware, massive data, and patient capital is creating an innovation velocity that competitors are finding increasingly difficult to match. But their true moat is embedding AI so deeply into billions of users' daily habits that the entire Google ecosystem becomes indispensable—and the Q2 results prove this strategy is already working.

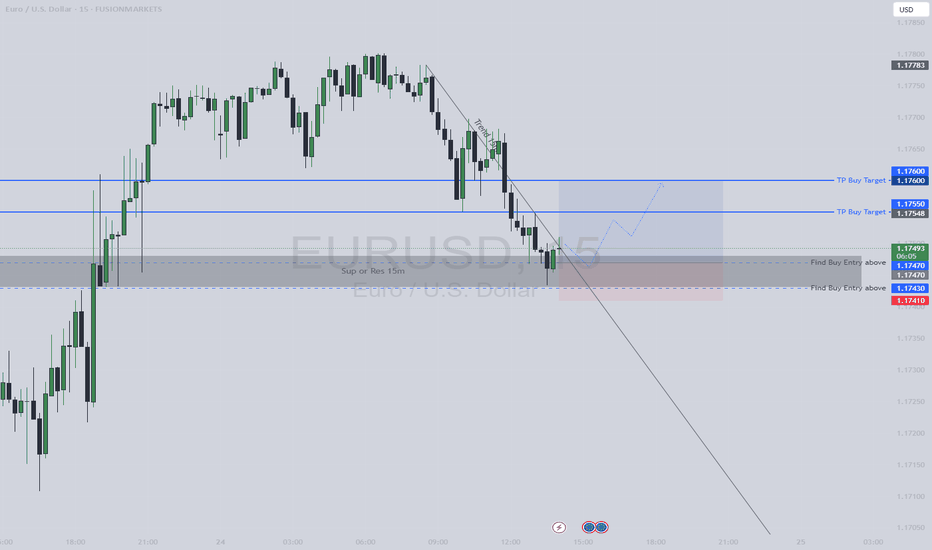

Buy Entry EURUSD🎯 Suggested Trade Setup — Bullish Bias Scalping Opportunity

✅ Buy Entry (Aggressive Intra-Day Play)

📍 Entry Zone: Between 1.17430 and 1.17470 (just above SSL and EQL zones)

🎯 Target: 1.17550 (Day High / minor resistance), with potential extension to 1.17600

🛡️ Stop Loss: Below 1.17410 or the lowest OB (~10-15 pips risk)

🔁 Risk-to-Reward Ratio: Aim for at least 1:2 to 1:3

💡 Why this works: You're buying near liquidity pools with minimal downside. If the breaker block holds and momentum picks up, this could be a swift move.

ECB on the agenda: The ECB is on the agenda today. I don't envision a particularly volatile event, although a continuation of the 'limited further cuts narrative' should see the EUR supported, particularly given growing thoughts of a US / EUR trade deal.

All in all, with the S&P still climbing, I continue to hold the view that 'risk on' trades are viable, especially since the announcement of the US / JAPAN trade deal. It's just a case of choosing whether to short the JPY or USD.

In other news, 'soft' SERVICE PMI data from the UK puts a little more pressure on the BOE to cut rates, arguably creating a GBP short 'catalyst' trade for anyone at the charts in that moment.

Also, a relatively hawkish speech from the RBA'S BULLOCK, keeps the AUD high on my 'to long list'.

Rocket Lab to new all time highs as more things go to spaceRocket Lab build rockets. CEO has an extremely bright aura. Hard to find a better story-driven pure space play with SpaceX being private. I like Rocket Lab and invested because as more and more things fly and go to space, it has the wind at its back.

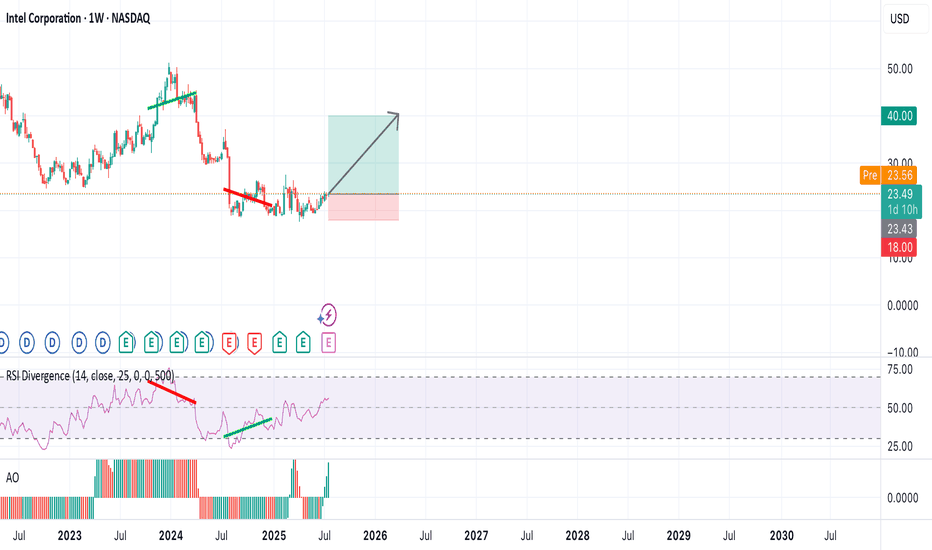

Intel to 40. A bet on America's chip when the chips are downIntel is an interesting stock. I made a bet on it this week. It’s very cheap trading at book value. Lots of bad news has destroyed this stock while other chip stocks are at all time highs. With a new CEO running the show and investing in next gen chip production, I think he turns it around.

I think it's at 40 within a year, and makes new all time highs after that.

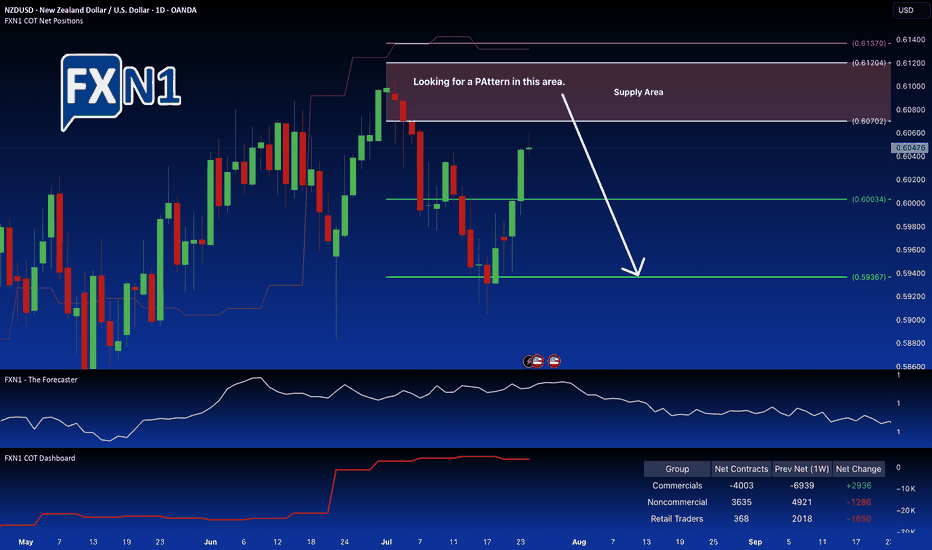

NZD/USD Weekly Bearish Trend Faces Critical Supply LevelThe NZD/USD pair is nearing a significant supply zone near 0.6070, where notable market activity is unfolding. Non-commercial traders are beginning to trim their holdings, signaling a potential shift in market sentiment. Conversely, commercial traders are at their lowest net positions since August 2024 and are starting to accumulate again, creating a divergence between these two groups.

This divergence, combined with the presence of a defined supply area and seasonal factors, suggests a possible reversal point in the current downtrend. On the weekly chart, the overall trend remains bearish, but the confluence of these technical and seasonal signals points toward a potential reversal pattern forming within the supply zone.

Traders may consider monitoring this area for signs of a reversal, potentially setting up for a short position if a clear pattern confirms the shift in momentum. Overall, the setup indicates a cautious opportunity for a bearish trade, provided the price action confirms the anticipated reversal.

✅ Please share your thoughts about NZD/USD in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

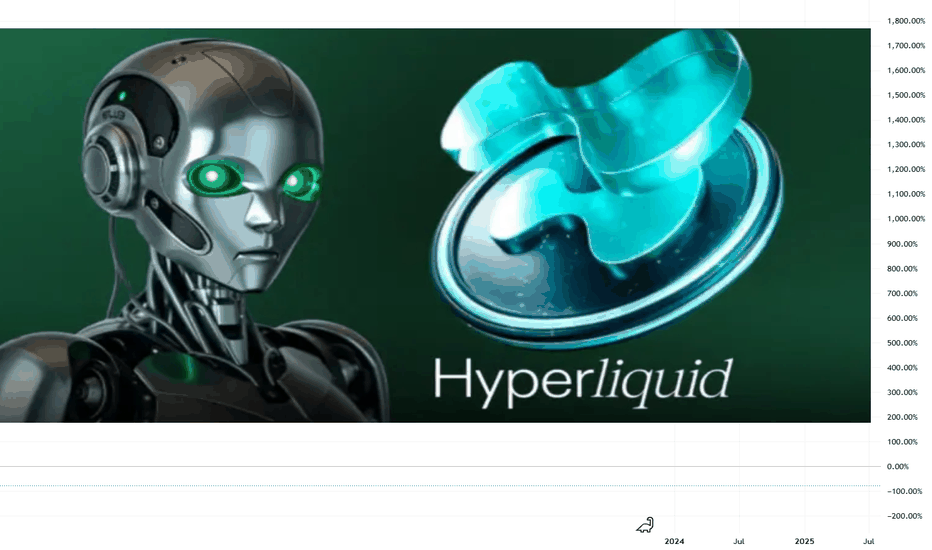

Hyperliquid AI Trading Launches to Revolutionize Crypto in 2025The launch of Hyperliquid AI Trading marks a major milestone in the evolution of digital markets. Positioned as an AI-native, fully on-chain trading platform, Hyperliquid is designed to offer high-speed, adaptive, and transparent execution — directly competing with centralized exchanges in efficiency and intelligence.

Within its first week, Hyperliquid processed over $3.7 billion in trading volume, highlighting early market interest. It leverages a proprietary AI engine that integrates real-time sentiment analysis, macroeconomic signals, and on-chain data to continuously optimize trading decisions.

“Hyperliquid arrives at the intersection of AI maturity and DeFi demand,”

says Lina Torres, Senior Analyst at Valtrix Group.

Key Features

AI-Driven Order Execution: Predicts slippage and market impact to route trades efficiently.

Sentiment-Aware Strategy Engine: Adjusts trading logic based on financial news and social signals.

Fully On-Chain Infrastructure: Offers transparency and verifiability for institutional-grade trust.

Self-Learning Models: Improves performance through continuous feedback.

Strategic Context

2025 has seen accelerating DEX adoption and a surge in institutional interest in DeFi. With the rise of spot crypto ETFs and maturing regulations, the market is ready for intelligent, decentralized infrastructure.

Valtrix Group forecasts that platforms like Hyperliquid could capture 8–12% of total DEX volume by Q4 2025, driven by algorithmic and high-frequency trading firms seeking smarter execution layers.

“This is not just faster DeFi — it’s smarter DeFi,”

notes Mark Evans, Chief Strategist, Valtrix Group.

Conclusion

Hyperliquid AI Trading signals a new era in crypto: one where artificial intelligence is fully embedded into decentralized finance. Its launch may set a precedent for the next generation of algorithmic trading infrastructure — agile, data-driven, and fully transparent.

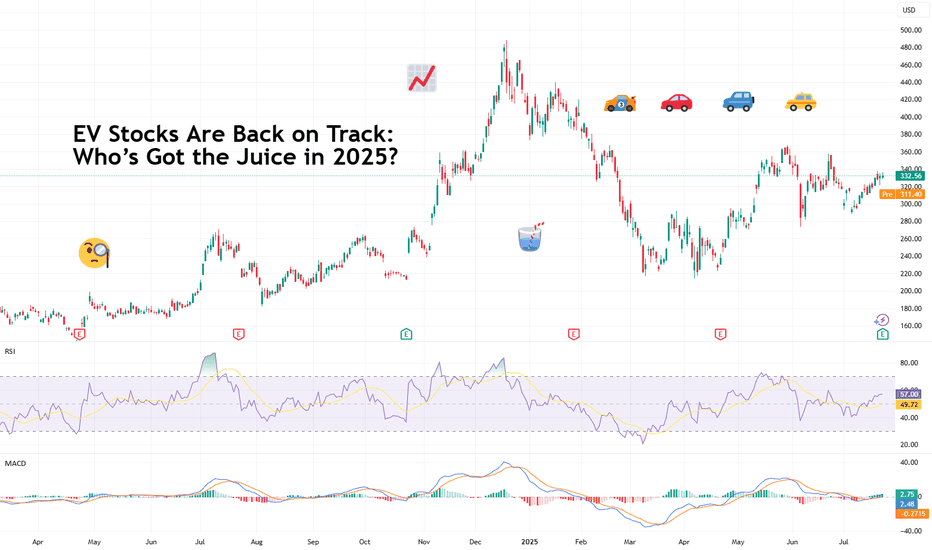

EV Stocks Are Back on Track: Who’s Got the Juice in 2025?This year is big for the EV sector so we figured let’s do a piece on it and bring you up to speed on who’s making moves and getting traction — both in the charts and on the road.

What we’ve got here is a lean, mean lineup of real contenders. Let’s go for a ride.

🚗 Tesla: Still King of the Road (for Now)

Tesla NASDAQ:TSLA isn’t just an EV company. It’s a tech firm, an AI shop, a robotaxi rollout machine, and an Elon-flavored media event every quarter. Even so, when it comes to margins, global volume, and name recognition, Tesla is still the benchmark everyone else is chasing.

In 2025, Tesla’s bounceback is fueled not just by EV hype but by its push into autonomous driving and different plays into the AI space.

The stock is down about 13% year-to-date. But investors love a narrative turnaround. Apparently, the earnings update didn't help the situation as shares slipped roughly 5%. Well, there's always another quarter — make sure to keep an eye on the Earnings Calendar .

🐉 BYD: The Dragon in the Fast Lane

BYD 1211 is calmly racking up sales, expanding across continents, and stealing global market share without breaking a sweat. The Chinese behemoth is outselling Tesla globally and doing it with less drama and more charge… literally .

Vertical integration is BYD’s secret weapon — they make their own batteries, chips, and even semiconductors. The West might not be in love with BYD’s designs, but fleet operators and emerging-market governments are. And that’s where the real growth is.

⛰️ Rivian: Built for Trails, Not Earnings (Yet)

Rivian NASDAQ:RIVN still feels like the Patagonia of EV makers — rugged, outdoorsy, aspirational. Its R1T pickup truck has cult status, but the company had to tone down its ambitions and revised its guidance for 2025 deliveries to between 40,000 and 46,000. Early 2025 projections floated around 50,000 .

The good news? Rivian is improving on cost control, production pace, and market fit. The bad news? It’s still burning cash faster than it builds trucks. But for investors betting on a post-rate-cut growth stock rally, Rivian may be the comeback kid to watch. It just needs a few solid quarters.

🛋️ Lucid: Luxury Dreams, Reality Checks

Lucid NASDAQ:LCID , the one that’ll either go under or make it big. The luxury carmaker, worth about $8 billion, came into the EV game promising to out-Tesla Tesla — with longer range, more appeal, and a price tag to match.

But here’s the rub: rich people aren’t lining up for boutique sedans, especially when Mercedes and BMW now offer their own electric gliders with badge power and a dealer network.

Lucid’s challenge in 2025 is existential. The cars are sleek, the tech is strong, but the cash runway is shrinking and demand isn’t scaling like the pitch deck promised.

Unless it nails a strategic partnership (Saudi backing only goes so far), Lucid could end up as a cautionary tale — a beautifully engineered one, but a cautionary tale nonetheless. Thankfully, Uber NYSE:UBER showed up to the rescue ?

💪 NIO : Battling to Stay in the Race

Remember when NIO NYSE:NIO was dubbed the “Tesla of China”? Fast forward, and it’s still swinging — but now the narrative is more about survival than supremacy. NIO's battery-swap stations remain a unique selling point, but delivery volumes and profitability are still trailing.

The company’s leaning into smart-tech partnerships and next-gen vehicle platforms. The stock, meanwhile, needs more than just optimism to get moving again — it’s virtually flat on the year.

✈️ XPeng: Flying Cars, Literally

XPeng’s NYSE:XPEV claim to fame used to be its semi-autonomous driving suite. Now? It's working on literal flying vehicles with its Land Aircraft Carrier. Innovation isn’t the problem — it's execution and scale.

XPeng is beloved by futurists and punished by spreadsheets. It’s still getting government love, but without a clear margin path, the stock might stay grounded.

🏁 Li Auto: The Surprise Front-Runner

Li Auto NASDAQ:LI doesn’t get the headlines, but it’s quietly killing it with its range-extended EVs — hybrids that let you plug in or gas up. A smart move in a country still building out its charging infrastructure.

Li is delivering big numbers, posting improving margins, and seems laser-focused on practicality over hype. Of all the Chinese EV stocks, this one might be the most mature.

🧠 Nvidia: The Brains of the Operation

Okay, not an EV stock per se, but Nvidia NASDAQ:NVDA deserves a spot on any EV watchlist. Its AI chips are running the show inside Tesla’s Full Self-Driving computers, powering sensor fusion in dozens of autonomous pilot programs, and quietly taking over the brains of modern mobility.

As self-driving becomes less sci-fi and more of a supply-chain item, Nvidia's value-add grows with every mile driven by data-hungry EVs.

🔋 ChargePoint & EVgo: Picks and Shovels

If you can’t sell the cars, sell the cables.

EV charging companies were once seen as the “safe bet” on electrification. Now they’re just seen as massively underperforming.

ChargePoint BOATS:CHPT : Still the leader in US charging stations but struggling with profitability and adoption pacing. Stock’s down bad from its peak in 2021 (like, 98% bad).

EVgo NASDAQ:EVGO : Focused on fast-charging and partnerships (hello, GM), but scale and margin pressures remain.

Both stocks are beaten down hard. But with billions in infrastructure funding still flowing, who knows, maybe there’s potential for a second act.

👉 Off to you : are you plugged into any of these EV plays? Share your EV investment picks in the comments!

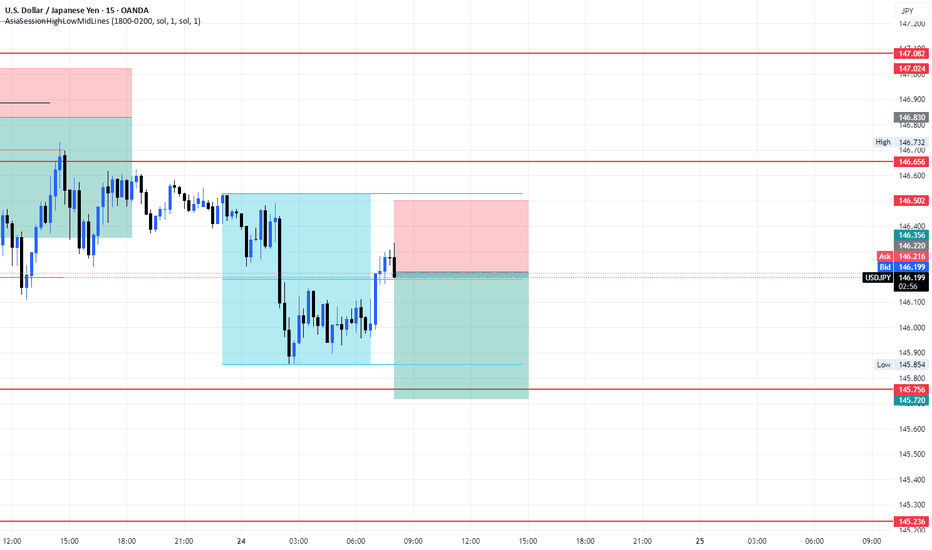

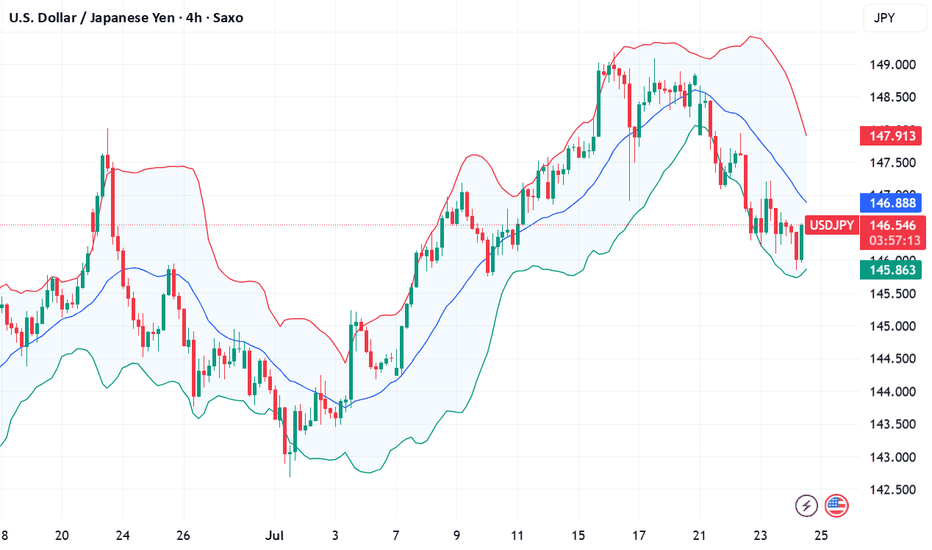

Fundamental Market Analysis for July 24, 2025 USDJPYThe Japanese yen (JPY) strengthened against its US counterpart for the fourth consecutive day and reached a nearly three-week high during Asian trading on Thursday. The recently announced trade deal between Japan and the US reduces economic uncertainty and increases the likelihood that the Bank of Japan (BoJ) will resume its tightening cycle at the end of this year, which in turn is seen as a key factor continuing to support the JPY. The US dollar (USD), on the other hand, is languishing near two-and-a-half-week lows and is putting additional pressure on the USD/JPY pair.

However, domestic political uncertainty and disappointing data on Japan's manufacturing PMI may keep yen bulls from aggressive bets. Moreover, the optimistic market sentiment should help limit the safe-haven yen's gains and further losses for the USD/JPY pair. Traders are now eagerly awaiting the release of US flash PMI indices to take advantage of short-term opportunities later in the North American session. However, the mixed fundamental backdrop calls for caution before making aggressive directional bets.

Trade recommendation: SELL 146.00, SL 147.10, TP 145.00

EURAUD: Rebound to 1.798 is high probabilityI am watching for a reversal here EURAUD as marked on my chart, expecting a rejection with a upside target at around 1.798.

This are is where it can become a decision point, either price finds support and bounces, or it breaks below, and that’s when we might see the move start to extend lower.

If we get a decisive move upside, my next area of interest is marked as T2. From there we can expect either potential accumulation or another reaction, depending on broader market sentiment at the time.

Just sharing my thoughts for the charts, this isn’t financial advice. Always confirm your setups and manage your risk properly.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

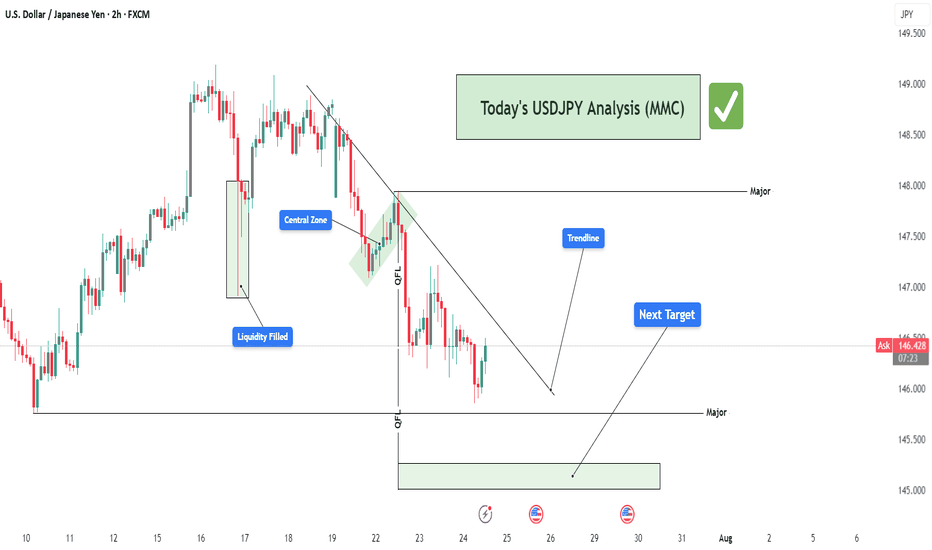

USDJPY Structure Analysis – Liquidity Filled, Rejection + Target🧠 Overview:

This 2-hour chart of USDJPY highlights a clear bearish structure following a smart money-driven move. The price action reflects market maker behavior, liquidity manipulation, trendline rejections, and strategic zone targeting. Let's break down the key elements for today’s USDJPY analysis.

🔍 Key Technical Breakdown:

1. 🏦 Liquidity Grab & Fill (July 17th)

The marked green zone shows an aggressive liquidity sweep where the price dipped sharply into a previous demand zone, triggering stop losses and collecting institutional orders.

This movement represents a classic "liquidity fill", often engineered by market makers to trap retail buyers/sellers.

After sweeping liquidity, price quickly reversed upwards — a signal that large buy orders were triggered and filled.

2. 🎯 Central Zone as a Distribution Region

The market retraced to the "Central Zone", highlighted on the chart, which acted as a distribution area:

Price consolidated and created indecision before rejecting sharply again.

This zone reflects a short-term supply where institutional players may have offloaded positions.

Key clue: This consolidation occurred below the major trendline, increasing its strength as resistance.

3. 🔻 QFL Zones (Quasimodo Failure Levels)

Two QFL levels are marked, which denote structure breaks and retracements in MMC/SMC strategy:

First QFL marks a major support break – a signal of shifting market sentiment from bullish to bearish.

Second QFL confirms continued lower lows formation – solidifying bearish market structure.

These levels are critical in identifying market intent and anticipating future moves.

4. 📉 Descending Trendline Rejection

The descending trendline drawn from recent highs is being respected continuously:

Price tested the trendline multiple times but failed to break above.

These rejections represent seller dominance and validate the trendline as a dynamic resistance.

A break above this line would invalidate the current bearish structure.

5. 🎯 Next Target – Major Demand Zone (145.00–145.20)

Price is heading toward a major demand zone marked in green around 145.000:

This area is a strong buy-side liquidity zone, where institutional buyers may show interest again.

If this zone is tapped, we may see either:

A bounce (bullish reaction), or

A breakdown and continuation lower if bearish momentum continues.

Traders should monitor this area closely for price action signals (engulfing candles, rejection wicks, or bullish divergence).

🧠 Strategic View:

Bias: Bearish, unless trendline breaks with strong volume.

Ideal Entry: Look for short entries on lower timeframe pullbacks into minor resistance (like trendline or last supply zone).

Target Area: 145.00 – ideal zone to book profits or switch bias.

Invalidation: A break and close above the descending trendline + central zone.

🔑 Confluences in This Analysis:

Concept Details

✅ Liquidity Grab Trap & Fill strategy at prior lows

✅ Central Zone Bearish distribution and rejection

✅ Trendline Repeated resistance rejections

✅ Structure Lower lows and QFL confirmations

✅ Target Area Clear next demand zone identified

⚠️ Risk Note:

As always, wait for confirmation before entering trades. The market may fake out near zones. Use proper risk management (1-2% risk per trade) and adjust your strategy as new candles form.

📌 Conclusion:

This chart paints a textbook scenario of how institutional movements and structure-based analysis (MMC/SMC) can offer high-probability setups. We expect further downside toward the 145.00 region before any significant reversal. Keep an eye on reaction from this demand zone for the next play.

Tesla Shares (TSLA) Drop Following Earnings ReportTesla Shares (TSLA) Drop Following Earnings Report

Yesterday, after the close of the main trading session on the stock market, Tesla released its quarterly earnings report. While both earnings per share (EPS) and gross profit slightly exceeded analysts’ expectations, the results reflected a negative trend driven by declining sales. This decline is being influenced by intensifying competition from Chinese EV manufacturers as well as Elon Musk’s political activity.

According to Elon Musk:

→ The company is facing “a few tough quarters” due to the withdrawal of electric vehicle incentives in the US;

→ The more affordable Tesla model (mass production expected in the second half of 2025) will resemble the Model Y;

→ By the end of next year, Tesla's financials should become "highly compelling".

Tesla’s share price (TSLA) fell by approximately 4.5% in after-hours trading, clearly reflecting the market’s reaction to the report. Today, the stock is likely to open around the $317 level, down from over $330 just the day before.

Technical Analysis of TSLA Stock Chart

In our analysis of TSLA charts dated 2 July and 8 July, we outlined a scenario in which the stock price could form a broad contracting triangle, with its axis around the $317 level.

The new candlesticks that have appeared on the chart since then have reinforced the relevance of this triangle, as the price rebounded from the lower boundary (as indicated by the arrow) and headed towards the upper boundary. However, yesterday’s earnings report disrupted this upward move.

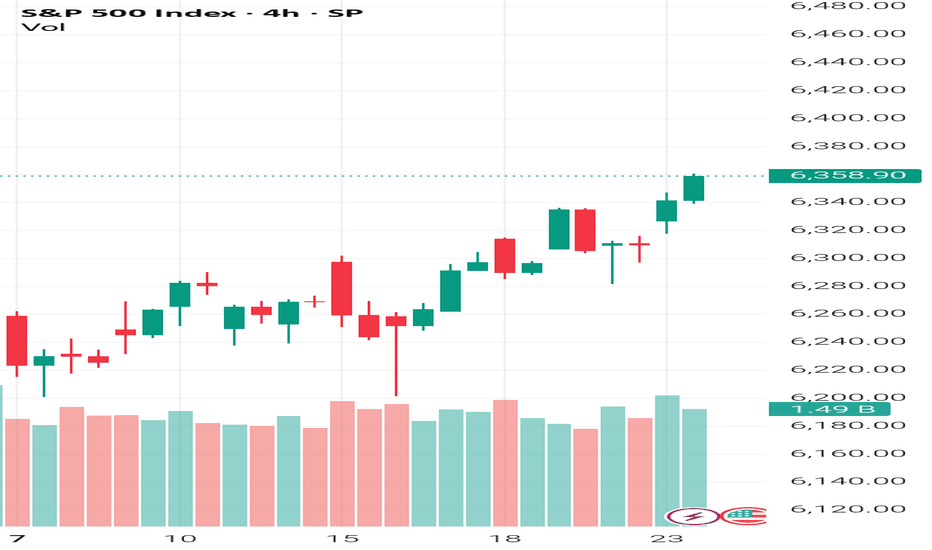

Thus, while the broader stock market is trending higher (with the S&P 500 reaching a historic high yesterday), TSLA may remain "stuck" in a consolidation phase, fluctuating around the $317 level—at least until new fundamental drivers shift market sentiment.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.