XAUUSD-GOLD can still break upward ? read captionGold (XAU/USD) has just soared to a new all-time high, reflecting heightened investor demand for safe-haven assets amid economic uncertainties. The surge comes as global markets react to inflation concerns, geopolitical tensions, and shifting monetary policies, further strengthening gold’s position as a premier store of value. With central banks increasing their reserves and investors seeking stability, the precious metal continues to shine, marking a historic moment in the financial markets.

Fundamentalstrategy

Gold Price Analysis:Key Supply & Demand Zones with Potential Bkl🔥 Key Levels & Zones

🔵 Supply Zone (3,135-3,140 USD) 📉

Acts as resistance where selling pressure increases.

If price reaches here, expect a potential pullback.

🟢 Demand Zone (3,085-3,095 USD) 📈

Strong support area with buying interest.

Price has tested this zone multiple times = accumulation.

🎯 Target Point (~3,167 USD) 🚀

If price breaks out, it may rally towards this level!

❌ Stop Loss (~3,080 USD) ⛔

Marked below demand zone to limit risk.

---

📊 Trend Analysis

🔹 Trend Line Break ⚡

The price broke the previous uptrend = potential reversal or deeper correction.

🔹 Market Structure 🏗️

Price consolidating inside the demand zone = possible bullish move ahead.

🔹 Double Bottom Formation (DBF) at Supply Zone 🔄

Shows failed breakout attempts = strong resistance.

---

🔍 Indicators & Insights

📌 DEMA (9 close) at 3,099 USD 📈

Price hovering around this moving average = market indecision.

---

🚦 Possible Scenarios

✅ Bullish Scenario:

If price holds the demand zone & breaks above 3,110 USD, it could rally to supply zone (~3,135 USD).

A breakout above 3,140 USD could lead to the target zone (~3,167 USD) 🚀.

❌ Bearish Scenario:

If price breaks below 3,085 USD, it may hit stop loss (3,080 USD) and continue lower.

---

🎯 Trading Plan

🟩 Long Entry ➡️ Around 3,090-3,100 USD 📊

🛑 Stop Loss ➡️ Below 3,080 USD 🚨

🎯 Target ➡️ 3,135-3,167 USD 🎉

Bitcoin (BTC/USD) Trade Setup & Analysis🔹 Trend Analysis:

📉 The chart shows a downtrend followed by a reversal attempt.

📈 The price bounced off a support zone and is moving upwards.

🔹 Indicators:

📊 The 9-period DEMA (83,805.38) is slightly above the current price, acting as a resistance level.

🔹 Trade Setup:

🟢 Entry Zone: Around 82,943 (Current Price)

🔴 Stop-Loss: 81,183.22 ❌ (Below support level)

🎯 Target Point: 85,563.52 ✅ (Upper resistance level)

🔵 Strategy: The trade anticipates a price dip before

Gold (XAU/USD) Bullish trend Demand Zone –Trend Analysis & ts🔵 Demand Zone (Support Area):

This blue zone represents a strong buying area where buyers are expected to step in.

If the price touches this zone and bounces, it confirms bullish strength.

📉 Trend Line Break:

The previous trendline has been broken ⛔, signaling a possible retest before a move up.

🛑 Stop Loss (Risk Management):

Positioned at 3,108.52 🔴, meaning if the price drops below this, the trade setup becomes invalid.

🎯 Target Point (Take Profit Level):

3,167.77 ✅ is the potential profit zone if the price moves upward from the demand area.

🟠 Expected Price Movement:

The orange dotted line 🔶 suggests a likely move:

1. Price dips into the demand zone (🔵).

2. Bounces back up 🔄.

3. Breaks minor resistance 🟦.

4. Rallies to the target zone 🎯.

Overall, bullish movement 📈 is expected if the demand zone holds! 🚀

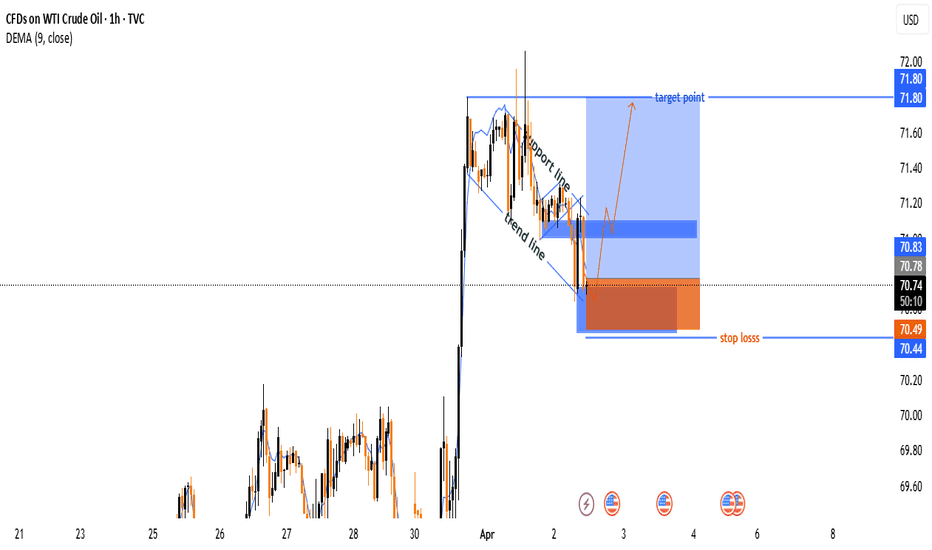

WTI CRUDE OIL TRADE SETUP : BREAKOUT OR BREAKDOWN ?📊 Key Observations:

🔹 Trend:

🚀 Strong bullish move followed by a correction 📉

🔻 Price is testing a support zone

🔹 Pattern Formation:

📏 Descending channel or flag-like structure

📍 Price is near a breakout point

🔹 Trade Setup:

✅ Entry Zone: Around 70.77

🛑 Stop Loss: 70.44 - 70.49 (Risk limit ❌)

🎯 Target Point: 71.80 (Profit zone ✅)

🔹 Indicators & Confirmation:

📊 DEMA (9) at 70.92 → Price is slightly below short-term momentum

🔥 A breakout above resistance could confirm a bullish move 🚀

📌 Conclusion:

✅ If price breaks the trendline upwards → Buy 📈 aiming for 71.80 🎯

❌ If support at 70.44-70.49 fails → More downside possible ⚠️

🚀 Watch for volume & candlestick confirmation before entering!

GBP/CAD 4H ANALYSIS – BULLISH BREAKOUT OR REVERSAL ?📉 Descending Channel

🔴 The price was moving inside a downward trend (channel) 📉, but it broke out ✅, signaling a potential bullish move 📈.

📍 Demand Zone (Support) at 1.85000 - 1.84201

🟦 Buyers stepped in here, pushing the price up 🚀.

🛑 Stop Loss: 1.84201 🔻 (If price falls below this, the bullish setup may fail ❌).

📍 Resistance Area Around 1.86000 - 1.86500

🔵 Key level to watch! If the price breaks above this zone, expect more upside 📈.

🎯 Target Point: 1.87727

🎯 If buyers remain strong, price could hit this level next! 🎯🚀

📊 Indicator Check:

📍 9-period DEMA (1.85000) 🟡 – Price is above this moving average, favoring a bullish bias ✅.

🔥 Possible Trade Setup:

✅ Buy Entry near 1.85000 - 1.85500

🎯 Target: 1.87727 📈

🛑 Stop Loss: 1.84201 🚨

If price breaks below 1.85000, be cautious ⚠️! A reversal to the downside could happen.

🚀 Overall Bias: Bullish (📈) above 1.85000, Bearish (📉) below **1

GBP/JPY Bearish Rejection – Short Trade Setup!🔹 Trendline Rejection ❌📈

Price tested the descending trendline and got rejected.

Bearish pressure increasing! 🚨

🔹 Resistance Zone (📍193.6 - 194.0) 🔵

Strong selling zone 📉

Stop Loss placed at 194.013 🚫

🔹 Support Zone (📍193.0) 🟦

Price might bounce here temporarily 🤔

If it breaks below, expect further drop 🚀📉

🔹 Target Level (📍192.311) 🎯

Bearish Target ✅

Ideal Take Profit 🏆

Trade Setup 💼

🔸 Entry: 📍193.5 - 193.6 📉

🔸 Stop Loss: ❌ 194.0 🚫

🔸 Take Profit: ✅ 192.3 🎯

Final Verdict: Sell Setup Active! 📉🔥

Watch for confirmation before entering! 👀🚀

Bitcoin (BTC/USD) Price Analysis: Bearish Breakdown Ahead?🔥 Bitcoin (BTC/USD) 1-Hour Chart Analysis 🔥

🔹 Trend Analysis:

🟡 Price was moving in an ascending channel 📈 but has broken below the trendline.

🟠 A retest of the broken trendline is happening, suggesting a potential drop 📉.

🔹 Trade Setup:

🔽 Short Entry: Expected rejection from the trendline.

❌ Stop Loss: $85,671 - $85,710 (Above resistance).

✅ Take Profit Target: $81,386 - $81,347 (Bearish target 🎯).

🔹 Indicators & Confirmation:

📊 EMA (9) at $84,254 → Acting as resistance 🚧.

🔄 Break & Retest Pattern → Typical for a bearish continuation 🛑📉.

🔹 Conclusion:

⚠️ Bearish Bias: If the price rejects the trendline, it could drop towards $81,386 🎯.

🚨 Invalidation: If the price breaks above $85,710, the short setup is canceled ❌.

XAUUSD- Gold will continue the Bullish upward (Read caption) XAU/USD is expected to maintain its bullish momentum in the upcoming week, driven by sustained investor demand, a weakening U.S. dollar, and ongoing geopolitical uncertainties that continue to support safe-haven assets. Technical indicators suggest that gold may test key resistance levels, with buyers looking to push prices higher amid strong market sentiment. Traders should keep an eye on economic data releases and Federal Reserve commentary, as any dovish signals could further fuel the rally. As long as gold remains above crucial support zones, the bullish trend is likely to persist, with the potential for new highs in the near term.

DXY (U.S. Dollar Index) Bearish Outlook – Key Levels & PredictioDXY (U.S. Dollar Index) Analysis – Daily Chart

🔹 Recent Downtrend:

The DXY has been in a strong decline ⬇️ after breaking key support around 104.5 📉.

The price dropped sharply, showing bearish momentum 🚨.

🔹 Key Zones Identified:

Resistance Zone (104.0 – 105.0) ❌📊 (Previously support, now acting as resistance)

Support Zone (100.5 – 101.0) ✅📉 (Potential target for further downside)

🔹 Expected Price Movement:

A possible short-term bounce 🔄 back toward the 104.0 - 104.5 resistance ⚠️.

If rejected ❌, the downtrend may continue toward the 100.5 – 101.0 level 🎯📉.

🔎 Conclusion:

✅ Bearish Bias – Trend favors further downside unless the price reclaims 105.0.

📌 Watch for a retracement before another drop 📉.

📊 Key Levels:

Resistance: 104.0 – 105.0 🚧

Support: 100.5 – 101.0 🛑

Bitcoin may rebound up from buyer zone check out and read BTC/USD Bullish Outlook: Potential Rebound from Buyer Zone"

Bitcoin is showing signs of strength as it approaches a key buyer zone. Holding above this level could trigger a strong rebound, with upside targets at key resistance levels. A breakout above confirms bullish momentum, supporting further gains.

PLATINUM - Sell Setup at Key Resistance ZoneOANDA:XPTUSD is approaching a significant resistance zone, an area where sellers have previously stepped in to drive prices lower. This area has previously acted as a key supply zone, making it a level to watch for potential rejection.

If price struggles to break above and we see bearish confirmation, I anticipate a pullback toward the $1,021 level.

However, a strong breakout and hold above resistance could invalidate the bearish outlook, potentially leading to further upside.

This is not financial advice but rather how I approach support/resistance zones. Remember, always wait for confirmation before jumping in.

I’d love to hear your perspective in the comments.

Best of luck , TrendDiva

Bullish on data streaming but CFLT to $15 for better risk/reward- While I believe NASDAQ:CFLT chart looks good and it might go to $40 after earnings in Q1 2025. But data platform infra is getting very competitive.

- First layer of competition comes from Hyperscalers like AWS, GCP and Azure which have their own variant of stream processing. Confluent had some leverage in terms of managed offering.

- I believed that company is unique, in a strong niche but stock based compensation and dilution has always been a problem.

- With volume of data, consumption based model makes sense. I liked that billing strategy over flat subscription type model as the prior one is easier to pass cost to consumers + have some margin (fixed).

Why I'm bearish on this name lately?

- I believe redpanda acquisition by Snowflake NYSE:SNOW would impede growth for NASDAQ:CFLT massively.

- Snowflake has a moat in data warehousing, they are trying to become all things data infrastructure.

- Streaming ingestion into snowflake is a capability which could have great synergy. While I wanted to see NASDAQ:CFLT acquisition by NYSE:SNOW but it is not possible as of now in my opinion as confluent market cap is 10 billion+ which could hamper NYSE:SNOW cash flows.

- Therefore, redpanda would be a better acquisition for NYSE:SNOW but it will severly impact NASDAQ:CFLT technical addressable market.

I would buy NASDAQ:CFLT under $20 because their future business is going to be impacted materialistically.

4 Scenarios for Anticipating The Fed's PolicyBased on prevailing economic conditions and financial pressures

Scenario #1 | The Fed’s Policy and Its Implications

High Inflation Persists & Bank Liquidity Declines

Conditions:

Bank Credit grows slowly, while Deposits grow at a slower pace than Borrowings.

Cash Assets decline significantly, indicating a reduction in liquidity within the banking system.

Interbank lending rates rise, tightening funding among banks.

Inflation remains high, but economic growth slows.

Possible Fed Policy Responses:

Maintain high interest rates or increase further to curb inflation.

Reduce bond holdings through Quantitative Tightening (QT) to absorb liquidity from the financial system.

Open emergency lending facilities for banks to prevent panic in financial markets.

Impacts:

USD may strengthen as higher interest rates make dollar-denominated assets more attractive to global investors.

Increased pressure on banks, especially those heavily reliant on short-term funding.

Stock markets may experience a correction, particularly in interest rate-sensitive sectors such as technology and real estate.

Scenario #2 | Recession Starts to Surface & Credit Tightens

Conditions:

Bank Credit stagnates or turns negative, indicating that banks are restricting credit due to concerns about default risks.

Deposits stagnate, as investors prefer alternative assets such as bonds or gold.

Stock markets begin showing bearish pressure due to economic uncertainty.

Possible Fed Policy Responses:

Gradually lower interest rates to stimulate borrowing and investment.

End Quantitative Tightening (QT) and restart Quantitative Easing (QE) to inject liquidity into the markets.

Adjust bank reserve requirements to allow more flexibility in lending.

Impacts:

USD may weaken as lower interest rates reduce the attractiveness of dollar-denominated assets.

U.S. government bonds will become more attractive, causing bond yields to decline further.

Stock prices may rise, particularly in sectors that benefit from lower interest rates, such as technology and real estate.

Scenario #3 | Liquidity Crisis in the Banking System

Conditions:

Sharp declines in Cash Assets, causing some banks to struggle to meet short-term obligations.

Deposits exit the banking system, as public confidence in banks decreases.

Federal Funds Rate spikes, making interbank borrowing more difficult.

Possible Fed Policy Responses:

Provide emergency lending facilities for banks facing liquidity shortages, as seen during the 2008 and 2023 financial crises.

Lower interest rates in an emergency move if liquidity pressures worsen to maintain financial stability.

Collaborate with the FDIC to guarantee deposits and prevent bank runs.

Impacts:

Financial markets may experience high volatility, with potential panic selling in banking stocks.

Investors will flock to safe-haven assets such as gold and U.S. government bonds, causing their prices to surge.

Confidence in the USD may temporarily weaken, especially if the Fed injects large amounts of liquidity into the system.

Scenario #4 | Soft Landing - Stable Economy & Fed Policy Adjustments

Conditions:

Inflation is under control, and the economy continues to grow positively.

Bank Credit grows steadily, and bank liquidity remains adequate.

Stock markets remain calm, with no signs of panic in financial markets.

Possible Fed Policy Responses:

Keep interest rates stable for an extended period, with no drastic changes.

End Quantitative Tightening (QT), but avoid immediately restarting QE.

Collaborate with financial regulators to maintain banking system stability without major interventions.

Impacts:

USD remains stable, as no major monetary policy changes occur.

Lending rates remain in a moderate range, supporting investment and consumption growth.

Stock markets may gradually recover, particularly in sectors benefiting from stable monetary policies.

Anticipating The Fed’s Policy!

If liquidity declines and inflation remains high → The Fed is likely to maintain high interest rates & tighten monetary policy.

If a recession starts to emerge → The Fed may lower interest rates & ease monetary policy to support credit and investment.

If a liquidity crisis occurs → The Fed may bail out banks, lower interest rates, and stabilize the financial system.

If the economy remains stable → The Fed may hold interest rates & make only minor adjustments.

Recommendations:

Monitor The Fed’s statements and key economic data (CPI, PCE, NFP, GDP) to anticipate upcoming policy changes.

Analyze market reactions to monetary policy to identify trends in stocks, bonds, and USD.

Use bank liquidity and Borrowings data to assess potential liquidity constraints in the banking system.

If you have additional insights or different perspectives, I’d love to discuss them in the comments!

ICEUS:DX1! ICEUS:DXY CBOE:CBOE NASDAQ:CME TVC:US10Y

GOLD Builds Strength in Ascending Channel, next at 2,920?OANDA:XAUUSD remains within a well-defined ascending channel. This suggests a continuation of the uptrend, with the next target near 2,920, aligning with the upper boundary of the channel.

A short-term pullback could present a buying opportunity, particularly if bullish candlestick patterns like an engulfing candle pattern appears, confirming buyer strength. A decisive move above recent highs could reinforce momentum toward the expected target.

But if we get a break below the channel’s lower boundary, it would invalidate the bullish outlook and signal a potential shift in market direction.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management!

Solana Buy Setup - Possible Next Big Move Towards $213!CRYPTOCAP:SOL is heading towards a key support zone, a level that has before seen strong buying interest. If this happens I can see this scenario play— price dips a bit below support, shaking out weak hands before reversing higher. It’s the classic liquidity grab, a move that could start the next leg up.

If this happens, we could see SOLANA take support with strength, signaling that buyers are stepping in aggressively. From there, momentum could build towards $213.

But there’s always the other side of the trade. If buyers fail here and SOL struggles, the direction could shift. What looks like a simple liquidity grab could turn into a breakdown, and be aiming for a deeper correction.

It all comes down to confirmation. Does price reclaim support with strength, or does it get stuck below resistance? That will be the key to watch.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management!

Please boost this post, every like and comment drives me to bring you more analyses! I’d love to hear your perspective in the comments below.

GOLD-XAUUSDXAUUSD Gold Analysis: The market is in the center zone, indicating potential for upward movement. Look for buying opportunities as the price approaches support levels. Once the market reaches a strong resistance, it could signal a sell setup. Stay cautious, plan your entry and exit carefully, and manage your risk effectively!

XAUUSD 1hr chart showing selling opportunity must read caption XAUUSD is showing clear signs of a potential selling opportunity, with market conditions and technical indicators pointing towards a possible bearish movement in gold prices. Traders are advised to closely monitor key levels and patterns that reinforce this trend, as the current setup suggests a favorable environment for initiating sell positions. With global economic factors and technical analysis aligning to support this outlook, now might be an ideal time to prepare for a well-timed sell trade in gold, maximizing the potential for profit as the market unfolds.

Analyzing the Market Performance of Dr. Reddy's Laboratories:Analyzing the Market Performance of Dr. Reddy's Laboratories: Trends, Support, and Resistance

Introduction

Lets delve into the recent market performance of Dr. Reddy's Laboratories (DRREDDY), a prominent player in the global pharmaceutical industry. We will examine the stock's technical aspects, incorporating support and resistance levels, trading volume, and options data to provide a comprehensive view of potential trading opportunities and risk factors.

Technical Analysis

Current Price: ₹1288.15

Resistance Levels:

Resistance 1: ₹1305.52

Resistance 2: ₹1322.88

Resistance 3: ₹1332.82

Support Levels:

Support 1: ₹1278.22

Support 2: ₹1268.28

Support 3: ₹1250.92

The trading volume for the current period stands at 738.79K, indicating moderate market activity. Higher volume often signifies strong investor interest and can be an early indicator of significant price changes.

The chart reveals critical resistance and support zones. The resistance zone around ₹1420.00 serves as a potential barrier to upward price movement, while the support zone around ₹1140.00 provides a safety net against significant downward trends. These zones are crucial for traders to make informed decisions regarding entry and exit points.

Options Data Analysis

The options data provide a detailed view of the current market sentiment and possible future price movements of DRREDDY's stock.

Key Observations:

Call and Put Activities:

Significant call writing activity across various strike prices (1300, 1310, 1320, 1330, 1340, 1360, 1380, 1400) indicates bearish sentiment. Investors are selling call options, expecting the stock not to rise above these levels.

Put short covering is observed at most strike prices, suggesting that investors who had previously sold put options are buying them back, possibly anticipating that the stock's decline might be limited.

At strike prices 1350, 1370, and 1390, there is call long covering, implying that traders are closing their long call positions, which could signal an expectation of decreased upward momentum.

LTP (Last Traded Price) and OI (Open Interest):

Higher LTP for puts compared to calls at lower strike prices indicates a higher demand for put options, reinforcing the bearish sentiment.

Substantial changes in open interest (OI) for calls at various strike prices suggest that traders are actively adjusting their positions in response to market conditions. Increased OI in calls generally signifies a buildup of new positions, while decreased OI indicates position closures.

For puts, the changes in OI also reflect market dynamics, with decreases in OI suggesting that traders are closing their bearish positions.

Strategy - DRREDDY 1300 Strike

DRREDDY is showing signs of action – here’s how you can make the most of it!

Strike Price : 1300 Call Option High: ₹35 Put Option High: ₹36.6

Plan of Action:

Focus on the side (Call or Put) that breaks its high first.

Quick Profits : Lock in gains based on your comfort level and market conditions.

Risk Management : Always implement a strict stop loss to safeguard your capital.

Why This Trade?

This strategy is designed to capture sharp price movements, offering potential opportunities in both upward and downward directions. Ideal for traders prepared to act swiftly on breakout levels.

Stay Ready – Don’t Miss Out! Be prepared to execute when the breakout happens!

Investment Implications

Based on the technical and options data analysis, DRREDDY's stock exhibits a balanced risk-reward ratio. Investors should closely monitor the support and resistance levels for potential breakout or breakdown scenarios. Additionally, keeping an eye on options data such as strike prices, built-up positions, and changes in open interest will aid in identifying the stock's future trajectory and potential trading opportunities.

Conclusion

Dr. Reddy's Laboratories' stock chart and options data offer valuable insights for investors and analysts. By understanding the support and resistance levels, volume trends, market sentiment, and options data, stakeholders can make informed investment decisions. As always, it is crucial to consider external factors and conduct thorough research before making any trading decisions.

CADJPY Rising Wedge Breakout and Targeting Support LevelCADJPY is currently trading at 108.300, with a target price set at 106.000, offering a potential gain of 200+ pips. The analysis is based on a support and resistance pattern, indicating the pair’s key price levels. A rising wedge breakout has already occurred, a bearish signal pointing to further downside potential. The price is now positioned below a major resistance level, confirming sellers' dominance in the market. With this setup, the pair is likely to continue its downward movement toward the main support level, which aligns with the target price. The bearish momentum is expected to persist as long as the resistance level holds strong. Traders should watch for any confirmation of increased selling pressure to solidify this trend. This setup highlights a favorable opportunity for bearish trades with a defined risk-reward ratio. The focus remains on the target support level as the next key price point.

Symbotic Hypergrowth? $850 Price TargetOverview

Symbotic Inc. is an A.I. and robotics automation company based in Wilmington, Massachusetts that is looking to increase the ability for companies to keep up with growing demand. To do this, they utilize artificial intelligence software to maintain records and warehouse organization with the assistance of SKU numbers. Autonomous robots then account for, store, and retrieve items in a fraction of the time that it would take a human being. Symbotic's mission is to increase supply capabilities through the symbiotic relationship of artificial intelligence and robots. Its origins trace back to 2007, before it was known as Symbotic, and the company went public in 2022 ( NASDAQ:SYM ).

Call it FOMO, but I think Symbotic Inc. has the potential of becoming a hypergrowth stock. I built my own fundamentals tracker to get a pulse on the tech company's vitals and, while it still is not a profitable company, it looks like it's in the early stages of becoming so. The fundamentals for Symbotic provide me the confidence to invest despite the presence of red flags which led me to performing a deep dive. My price target for Symbotic Inc. is $850 with a projected timeline before 2030.

What I Don't Like

SYM has lost nearly 60% in value since July 2023 from a high of $64.15 to its current share price of $26.87. If you look up Symbotic Inc. on a search engine then you will also see that there are numerous law firms attempting to build class action lawsuits. The headlines can't help but to sow distrust by utilizing strong statements such as "misleading investors" and "inflated revenue" within their subjects. Within the last few weeks Symbotic had to file a delayed annual report due to self-identified accounting errors within their balance sheets. Also, if you dig through their filings, you will find that Symbotic Inc. was born from a deal with SVF Investment Corp which, according to the filings, was headquartered in the Cayman Islands.

I can only assume that the business dealings with SVF Investment Corp were to facilitate equity financing and an expedited public launch for SYM. From my findings, SoftBank Group Corp ( TSE:9984 ) is an investment conglomerate and the parent company to multiple subsidiaries. You guessed it, it is affiliated with SVF Investment Corp which functions as a "blank check company" for SoftBank. In my limited knowledge, this translates as a way for SoftBank to inject a substantial investment into the company that is now known as Symbotic Inc. No matter how savvy they may have been to launch Symbotic Inc., business deals that originate in the Cayman Islands typically raise one's eyebrows.

What I Do Like

Symbotic Inc. seems to have a pretty solid vision for global expansion and has attracted some significant institutional investors such as SoftBank, Vanguard, BlackRock, and Morgan Stanley to name a few. In fact, according to the NASDAQ site, 282 institutional investors hold 82% of Symbotic Inc.'s Class A Common Stock. Symbotic Inc. was founded by Richard "Rick" Cohen who currently serves as the CEO and is a legacy to the Cohen family who founded C&S Wholesale Grocers. Symbotic's technology is used by C&S Wholesale Grocers which is one of the largest privately held companies in the United States.

Symbotic and SoftBank have partnered on a separate venture known as GreenBox which is meant to deliver automated warehouses made possible by Symbotic's hardware and software. According to the company's site, GreenBox is supplying warehouses as a service to consumers. With an increase in online shopping, I believe that Symbotic is both seeing and filling a need in an industry that its founder is very familiar with. I can also envision Symbotic spreading its reach internationally which helps fuel my massive price target. Megacap stocks need to have a global influence and extend across industries, which Symbotic appears to be preparing for.

Fundamentals

Right now, Symbotic Inc. is in its early stages and is bringing in a negative income which makes it a risky investment. However, the company's total revenue has increased by 200% from 2022-Q4 to 2024-Q4; the gross profit has also increased by 147% in the same timeframe. Symbotic's net income has revealed consistent losses since 2022, but the 2024 annual report had the smallest loss on record at a negative $84.7M which is a 39% improvement from 2022 and a 59% improvement from 2023. No matter which way you cut it, the company is still absorbing annual losses so it will be important to keep an eye on improvements and deficiencies to identify any consistent trends.

NASDAQ:SYM has 585,963,959 total outstanding shares according to the 2024 Annual Report published at the beginning of December. This is a far cry from the 106M outstanding shares reported on some financial websites and even here on TradingView. From my findings, around 100M of Symbotic's shares are Class A Common Stocks and the remaining 485M are Class V Common Stocks. My focus is on the market capitalization which is a tool that I like to use when establishing long-term price targets. For Symbotic, which has the potential for global reach and use across multiple industries, I think it's reasonable to achieve a market capitalization of $500B.

Price Target

With the current number of outstanding shares at a market cap of $500B, this would place Symbotic's share price at $853. This type of growth would turn a $1,000 investment today into $31,710 at the projected target price; a whopping 3,000% return. HOWEVER, a lot has to happen to make this come to fruition. One thing I would like to see, in addition to profitability, is for Symbotic to begin buying back its own stock.

It's become my investing philosophy that companies who believe they are undervalued will buyback their shares while companies that believe they are overvalued will issue new shares. Symbotic's total outstanding shares have increased by 5.8% since its annual report at the end of 2022. I think that my philosophy is best tailored to established companies so it is possible that Symbotic could be an exception. Because the company is so new, it may need to issue more shares to generate enough capital to stay afloat while its roots set.