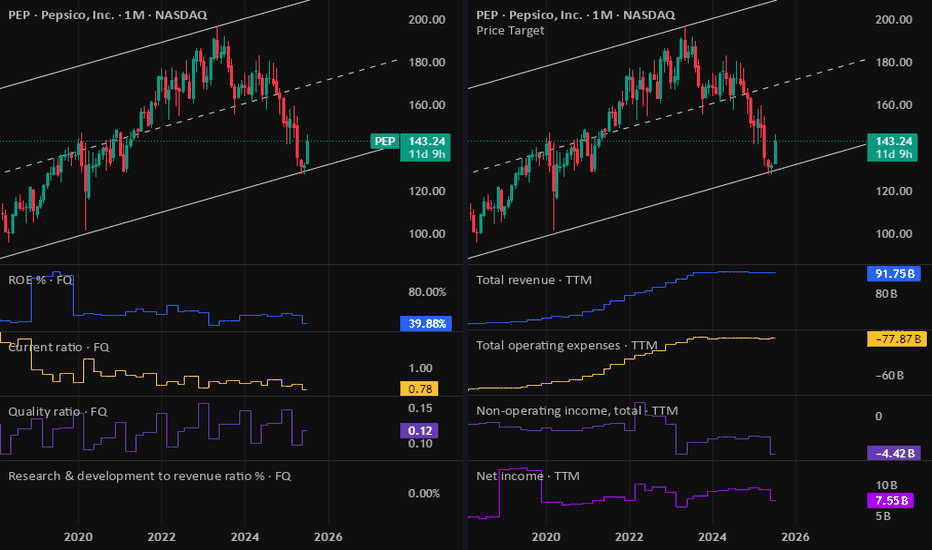

PEP: PepsiCo Earnings resultsIts looks like PEP is a buy now. Just want to double check on future sales growth as it is stable for a while. Lower stock price made the dividend very attractive since PEP is a defensive stock.

Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

Fundementalanalysis

RCL Eiffel Tower CAUTION! UPDATERCL is in a very capital-heavy industry that is very economically sensitive.

I first published this Idea back on February 11, 2025. Since then, it has dropped over -40%.

Normally, I would say that from erections come corrections. However, this has the Eiffel Tower structure in place for a full-on reversal.

I am reposting this chart since TV forced me to post a "target reached."

Here is the original post.

XAU/USD – Trendline Breakout Signals Sell!The XAU/USD Pair on the M30 period offers a potential selling opportunity due to the recent formation of a Trendline Breakout Pattern. This indicates a shift in momentum to the downside in the coming hours.

For a short trade, consider entering around the pattern's trendline.

Target levels: 2904 (first support) and 2880 (second support).

:

🚨 XAU/USD – Trendline Breakout Signals Sell! 📉

💰 Gold Spot (XAU/USD) - 30M Chart Breakdown

🔍 Key Observations:

🔹 Trendline Breakout: Price broke below the strong ascending trendline, confirming a bearish shift.

🔹 Resistance Zone: $2,942 - $2,954 acted as a rejection point, leading to a sharp sell-off.

🔹 Strong Bearish Momentum after breaking key support levels.

📉 Bearish Trade Setup:

📌 As long as price remains below $2,912, we expect further downside towards:

🎯 1st Support: $2,903

🎯 2nd Support: $2,880

📌 A break above $2,912 could lead to a short-term recovery, but overall bias remains bearish.

📊 Key Levels to Watch:

✅ Resistance: $2,942 - $2,954

✅ Support: $2,903 & $2,880

💬 Do you agree with this bearish outlook? Let us know in the comments!👇🔥

#gold #xauusd #forex #trading #priceaction #technicalanalysis

EUR/GBP: Bearish Breakout from Descending Triangle - Watch for FAnalysis:

EUR/GBP is exhibiting a bearish breakout from a descending triangle pattern. This technical development suggests that the GBP is gaining strength against the EUR. A break below the triangle's support line often precedes an accelerated downtrend.

Supporting this bearish outlook is the Relative Strength Index (RSI) currently trading below 50. This indicator reading signifies weakness in the EUR/GBP pair.

it's crucial to stay updated on relevant economic news that may influence price movements.

Key points:

Descending triangle breakout: This chart pattern is a well-recognized technical indicator for a bearish continuation.

RSI below 50: The RSI is a momentum oscillator, and a reading below 50 suggests weakness in the EUR/GBP pair.

News events: Economic data releases or central bank policy announcements can significantly impact currency markets.

EURUSD: Ascending Triangle Hints at Potential Bullish Breakout oKey technical levels and confirmation strategies to watch

The EURUSD currency pair is currently exhibiting a well-defined ascending triangle pattern on the weekly timeframe. This technical formation often precedes a bullish breakout, suggesting a potential rise in the value of the Euro relative to the US Dollar.

Understanding the Ascending Triangle

An ascending triangle is a continuation pattern that emerges during an uptrend. It's characterized by:

Rising trendline support: Prices create a series of higher lows, establishing an upward-sloping support line.

Horizontal resistance: Prices repeatedly encounter resistance at a specific price level, forming a flat horizontal line.

The tightening price action within the triangle signifies a potential buildup of buying pressure. As buyers repeatedly test the resistance but are unable to break through decisively, anticipation builds.

Bullish Breakout: A Sign of Things to Come?

A breakout above the ascending triangle's upper trendline (resistance line) is typically interpreted as a bullish signal. This price movement suggests that buyers have finally overpowered sellers, and the price may be poised to continue its upward trajectory.

However, a few key points to remember:

False breakouts: There's always a possibility of false breakouts, where the price surges above resistance but then quickly falls back. This can be a deceptive signal for traders expecting a sustained uptrend.

Confirmation is key: While breakouts hold significance, many traders look for additional confirmation from other technical indicators such as volume or momentum oscillators. These indicators can help gauge the strength and conviction behind the breakout.

Trading Strategies and Risk Management

Conclusion

The ascending triangle pattern on the EURUSD weekly chart presents a compelling opportunity for bullish traders. However, exercising caution and incorporating additional confirmation measures are crucial before entering any trades. By combining technical analysis with sound risk management practices, you can position yourself to potentially capitalize on this potential bullish breakout.

The information provided in this article is not intended as financial advice. Please do your own research before making any investment decisions.

AUDUSD Daily Analysis: Key Resistance Levels to WatchThe USD is facing a key resistance level at 0.64537. If this level is broken, the currency could fall to a monthly resistance level at 0.63403.

This week there are some important news events for the USD. These include:

The US Federal Reserve interest rate decision

The US non-farm payrolls report

The US trade balance report

These events could have a significant impact on the USD, so traders should be prepared for volatility.

Technical Analysis:

The USD is currently trading in a range between 0.64537 and 0.63403. The RSI indicator is nearing the overbought zone, which suggests that the currency may be due for a pullback.

Traders should watch for a break below the 0.63403 support level, as this could signal a further decline in the USD.

Conclusion:

The USD is facing a key resistance level at 0.64537. If this level is broken, the currency could fall to a monthly resistance level at 0.63403.

Always check the news before making any trades, as this week there are some important news events for the USD. These events could have a significant impact on the USD.

The information provided in this article is not intended as financial advice. Please do your own research before making any investment decisions.

EURUSD 1-Hour: Identifying the Supply ZoneBuilding on our previous analysis, it appears that OANDA:EURUSD holds potential for a continued downtrend towards the daily demand zone

We observe the presence of the QM pattern and the emergence of the maximum pain level formation:

Traders, whether you agree or have your own insights, share in the comments

AMZN: Technical & Fundamental AnalysisTechnical Analysis:

Trend & Moving Averages : The stock recently moved above the 50-day SMA but is currently below the 200-day SMA, suggesting that it's in a consolidation phase. The 200-day SMA is a critical level to watch. A sustained move above it might signal a longer-term bullish trend.

Fibonacci Retracements : The price seems to be hovering around the 0.382 retracement level, which has been a resistance area in the past. A breakout above this could target the 0.5 and then the 0.618 levels.

MACD : The MACD is currently below the zero line and is showing a bearish crossover, indicating possible bearish momentum in the short term.

RSI : RSI is slightly above 40, not indicating overbought or oversold conditions.

Stochastic Oscillator : The stochastic is moving upwards, approaching overbought territory (above 80), suggesting potential bullish momentum in the short term.

Bollinger Bands : The stock price is in the lower half of the Bollinger Band range, indicating a potential for a price rise.

Fundamental Analysis:

Valuation: The price to earnings ratio (P/E) stands at 105.23, which is relatively high compared to historical standards, suggesting that the stock might be overvalued.

Growth & Profitability: The company seems to have seen a dip in its recent performance, with decreasing margins.

Revenue Breakdown: Amazon earns a significant portion of its revenues from online stores and third-party seller services, showing its dominance in e-commerce.

Estimates: The earnings estimate for the recent year seems to be lower than the actual, potentially indicating better-than-expected performance.

Dividends: Amazon does not pay dividends, which means they might be reinvesting all their profits back into the company for growth.

Financial Health: Debt levels have been steady, indicating that the company is not heavily leveraging its growth.

Overall Trading Recommendation and Conclusion:

Short-term Outlook: The recent move above the 50-day SMA and the rising stochastic suggest potential bullish momentum. The next resistance to watch is the 200-day SMA.

Medium-term Outlook: While the stock shows signs of consolidation, the bearish MACD crossover might indicate potential downward momentum. The 0.5 Fibonacci level can act as a key resistance, while the 0.382 level is a crucial support.

Fundamental View: The high P/E ratio might be a concern for some investors looking for value. However, the solid revenue breakdown and stable debt levels highlight the company's strong fundamentals. The lack of dividends indicates a growth-focused approach.

Considering both technical and fundamental aspects, traders should be cautious with their positions, setting appropriate stop losses and taking profits at key resistance levels. Always ensure to do thorough research and possibly consult with a financial advisor before making trading decisions.

EURCHF- Long term Swing TradeTechnical Analysis:

-Trop down analysis shows that there is a strong bearish trend for this pair so I will only be looking for short trades.

-Supply zone and Fibonacci level 62% are in line which shows a strong confluence that price will retrace to from this level.

-According to my algorithm, the seasonality shows a bearish trend for this pair will last till the beginning of may.

Fundamental Analysis:

There will be a few major impact news which could have a massive impact on how how price will react during the news.

SPX Short and Long Term Trend Analysis 2023Summary: Short term Bull Trap and Long Term Bear Trap. Prices may move up or sideways for about a week but over the next month prices will move down to a previous support level. Investors are reallocating their profiles and they will also be digesting negative earnings report outlooks that consider the employment costs from higher interest rates in 2023. Unemployment indicators will be key over the next quarter much like CPI was last quarter. My time horizon for retirement is 30+ years so I will be Dollar Cost Averaging into cheap beaten down stocks like tech and auto, selling covered calls on overpriced stocks I own like energy, and hedging recession capitulation risk with puts.

Best Case: Recession canceled, SPX breaks it's long term 2022 downward trend similar to the DOW. Earnings and unemployment numbers remain decent in 2023. SPX breaks through the double top pattern at the January 2022 highs and makes new highs.

Positive Case: A bullish triangle pattern forms next week and the SPX continues up to form a long term double top pattern with the January 2022 highs and then trades sideways in 2023. Max SPX $4800.

Negative case: Earnings reports from major institutions and unemployment show how bad the economy is getting and the market sells off to continue SPX's downward trend. SPX forms another shoulder to an inverse head and shoulders reversal pattern seen on the Monthly Chart and trades sideways in 2023. Min SPX $3700.

Worst Case: The unemployment data and earnings reports trigger a financial crisis like 2008. The much anticipated capitulation Wall street is waiting for associated with 8 out of 10 recessions causes SPX to drop below March of 2020 lows.

Short Term Technical Indicators (Daily):

1. Volume profile shows more people willing to buy SPX at lower price levels then higher ones.

2. SPX is at the top of it's long term price channel trend from 2022.

3. SMA's indicate negative price movement.

4. MACD indicates positive price movement.

5. RSI indicates the SPX is overbought.

Long Term Technical Indicators (Monthly):

1. Volume profile shows more people willing to buy SPX at lower price levels then higher ones.

2. SPX is well above it's true mean logarithmic growth rate for a recession.

3. SMA's indicate negative price movement.

4. MACD indicates a return to normal bullish levels but is still quite positive from past recessions.

5. RSI indicates the SPX is oversold.

Fundamentals:

1. Consumer and investor sentiment has turned positive.

2. Inflation data is telling us that inflation has peaked and the Federal Reserve may pivot soon.

3. Earnings reports from large financial institutions who are all predicting recession in 2023 come out this week (Wildcard).

4. Unemployment may start to increase due to rising employment costs.

BULLISH ON EURCAD. SWING TRADEEntry: 1.4455

TP 1.4665

SL 1.4380

Vice-President of the European Central Bank Luis de Guindos stated that he believes the actions taken by the ECB so far has not been sufficient. ECB policymaker, Peter Kazimir pointed our that restrictive rates and strong action are necessary and should be in place for a longer period. At least in the first half of 2023. Also said that any recession resulting from this plan will be short and manageable. The current sentiment is mixed. As increasing rates for the euro may contribute to the recent uptrend, but it is uncertain whether markets are completely pricing in the hawkish tone

BEARISH MOVE ON GBPUSDSold GBPUSD

Entry 1.2020

Sl 1.2180 (160 pips)

Tp 1.0685 (1335 pips)

Weekly resistance met +200 MA showing weakness to the bullish side on the daily TF.

Large institution is in a short position on the pair.

The UK economy is in a horrible position. By the looks of it, their major issues such as their energy prices and increased cost of living are being resolved, but in fact are getting worse with their energy prices reaching a new ATH. Until this is addressed properly, I see a continuation to the downside.

Great place to execute a quick tradeSince this will be a short term trade, I won't be going into the fundamentals as much and focusing on the technicals.

There is a nice symmetrical triangle which had a false breakout on the 15th and just retested the lower support (great place to enter trade).

MA is about to cross to the upside.

Squeeze mob finished releasing pressure and is consolidating (in the 15m timeframe, it has already started releasing to the greenside).

Stock split should allow more investors to buy shares and options (mostly retail who don't have access to fractional shares).

RSI is low and has starting going up strongly (Average hasn't moved up yet).

The overall company is doing great (see previous analysis)

The last time Tesla had a stock split, the stock rose over 80% from the date of the split to the end of the year (And 84% from the announcement to the date of the split for an overall increase of almost 200%).

I will be adding more Tesla to my long term position. I am trying to maximize my returns by buying when I feel as if it is under the intrinsic value of Tesla.

This isn't investment advice, do your own due diligence.

EURNZD - Macroeconomic, Global Macro...What I observe from technical analysis is that they have corrected the imbalance that was generated on Monday, and that they will go a little farther UP, at which time I will wait and ride with them.

If it hasn't reached that stage, I'm not expecting anything. After that, I'll embark on a market exploitation spree.

For the time being, I have a very solid figure for this currency pair, and we will see how the market plays out.

Everyone should have a wonderful time and good luck.

EURNZD - Macroeconomic, Global Macro...Prior to two weeks ago, I was looking for a new employment. I hadn't had good statistics for some weeks before to this.

However, the prior week, I received it once again...

Most of the time, when I get a foundational analysis, when I get solid statistics, and I know what should be... even if I go in SL, which is usual between Monday and Tuesday, and then already from Wednesday he is starting to travel in his direction, but it happened in 70% of the instances. That is why I have already opened a position on Monday, and I am not spending my whole day sitting in front of my computer waiting for the right opportunity for Entry, since I literally do not have that much time.

As you can see, I didn't have that type of trouble 5 weeks before on the same currency pair (EUR NZD), and we've gained more than 1500 pips in 3 weeks. That is very wonderful...

Now EUR NZD is doing the same thing, however this time I was moving my stop loss higher, till it didn't start going in the proper way...

If you understand what fundemental anaylisis is, and you see the down figures that I provide you, you will understand what I am talking about... and you will be able to see where they are going after I have posted them...

To be sure, numbers do not lie, and that is a fact :)

Thank you so much, and thank you for your confidence!

EURNZD - Macroeconomic, Global Macro...EUR is the most inflationary currency, whereas NZD is the most deflationary.

Based on Micro Bias, Global Macro Bias, and other factors... My strognerst number was never assigned to this pair....

Consequently, I will maintain my short position in the EURNZD, and based on current information, we might continue in this manner for another week...

Someone among you who has been following the previous three transactions on the EURNZD, Continue reading and don't shut your browser! :)

EURNZD - Macroeconomic, Global Macro...I will simply follow up on the previous two weeks with fresh and stronger knowledge, which I will get at the Microeconomic Information/Fundamental Analysis stage of the process.

Things are rather straightforward; I don't need to say much since figures speak for themselves, and you can see my previous notion, which I have already shared...

If you see the same things I do, please share your observations.

Thank you very much!