India, USA, China - Government Debt to GDP PerformanceIndia’s Fiscal Discipline Stands Out in a High-Debt Global Economy

Government Debt to GDP Performance Over the Last 20 Years:

China: +217%

USA: +99%

India: +3%

Over the last 2 decades, global economies have increasingly relied on debt to stimulate growth and manage crises.

However, a closer look at long-term Debt-to-GDP trends reveals a stark contrast in fiscal discipline among major economies:

-----------------------------------------------------------------------

India: A Beacon of Fiscal Stability

India has maintained remarkable fiscal discipline, with government debt increasing by just +3% relative to its GDP over the past 20 years.

This demonstrates India’s conservative borrowing strategy, especially notable given the country’s ambitious development goals, infrastructure push, and welfare programs.

This level of restraint positions India well in the face of rising global interest rates and inflation risks.

-----------------------------------------------------------------------

USA: Steady Climb Amid Stimulus Spending

The United States has seen a +99% increase in its debt-to-GDP ratio over the same period, driven by successive rounds of stimulus, defense spending, and entitlement obligations.

While the U.S. enjoys the unique advantage of issuing the world’s reserve currency, the long-term implications of rising debt—especially as interest payments rise—pose potential challenges to fiscal sustainability.

-----------------------------------------------------------------------

China: Debt-Fueled Expansion

China’s debt-to-GDP has surged +217% over the past two decades, reflecting its aggressive infrastructure-led growth model and significant off-balance-sheet local government borrowing.

While this has powered China's rapid urbanization and industrial growth, the mounting debt burden raises questions about long-term efficiency, default risks in the shadow banking sector, and the need for deleveraging.

-----------------------------------------------------------------------

🔍 Key Insights:

1) India’s 3% debt growth over 20 years highlights an underleveraged economy, offering headroom for targeted fiscal expansion if needed.

2) In a world where debt sustainability is becoming a key investment theme, India stands out as a relatively safer macro environment.

3) This fiscal prudence complements India’s improving trade metrics and strengthens its position in global economic leadership.

-----------------------------------------------------------------------

📈 Conclusion:

As the global economy grapples with inflation, rising interest rates, and debt concerns, India’s modest rise in government debt is a key macro strength.

While China and the USA have seen significant increases in their debt burdens, India’s fiscal balance provides confidence to both investors and policymakers for future growth cycles.

This makes India an attractive long-term investment destination in a world of rising uncertainty.

Futech

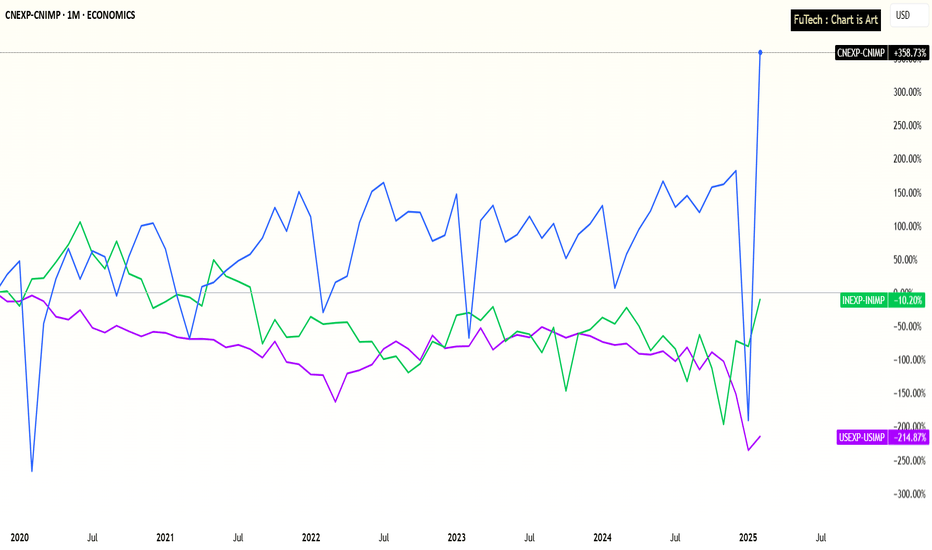

India, USA, China - Trade Deficit Performance after Covid PhaseIndia’s Trade Deficit Nearing a Turning Point – Strong Growth Amid Global Shifts

Trade Deficit Performance Over the Last 5 Years:

India: -10%

USA: -215%

China: +359%

Over the past five years, global trade dynamics have shifted significantly, with India showing promising signs of a turnaround in its trade performance.

India: A Rounding Bottom Pattern?

India’s trade deficit has improved by -10% over the last five years, hinting at a potential rounding bottom pattern that could transition into a trade surplus in the coming years.

This positive shift comes despite global economic headwinds, positioning India as a resilient and emerging export player.

USA: Longer Road to Recovery

In contrast, the United States has seen its trade deficit worsen by -215%, suggesting a deeper structural challenge in its trade balance.

While the U.S. economy remains strong in other metrics, its export-import imbalance will likely take more time and policy adjustments to stabilize.

China: The Export Powerhouse slowdown after Tariffs sanctions ?

China continues to dominate with a staggering +359% improvement in its trade surplus over the past five years, solidifying its position as the world’s top exporter.

However, rising global tariffs and geopolitical tensions could gradually redirect supply chains.

🌏 Macro Implications:

Tariff Realignment: As global companies look to diversify away from China amid escalating tariffs and political tensions, India is emerging as a key beneficiary.

This realignment could significantly bolster India’s export sector.

India’s Growth Story: With structural reforms, expanding manufacturing capabilities, and supportive government policies like PLI (Production-Linked Incentives), India is well-positioned to capture a larger share of global trade flows.

Global Slowdown, Local Resilience: Despite a global economic slowdown, India’s improving trade dynamics signal strong internal momentum and a maturing economy.

📈 Conclusion:

India is on the cusp of a major trade shift.

While China remains the global leader in exports and the USA faces growing imbalances, India’s improving trade performance, geopolitical advantage, and manufacturing push make it a compelling long-term trade and investment story.

Amid Tariffs war and global economy slowdown, India's growth story continues...