Trading Gold? Know the Difference Between XAU/USD and Futures🔎 Let’s address a question I get very often:

“Should I trade spot gold (XAU/USD) or Gold futures?”

It might sound like a technical decision, but it’s actually about how you approach the market, your risk profile, and your experience level.

So let’s break it down 👇

________________________________________

🟡 Two ways to trade the same asset

Both spot and futures allow you to speculate on the price of Gold. But they’re two very different beasts when it comes to execution, capital, and strategy.

________________________________________

1️⃣ Spot gold (XAU/USD)

• Traded mostly via Forex brokers or CFD platforms

• No expiration — you can hold the position as long as you want

• Often used by retail traders for day trading or swing setups

• You can open small trades (even 0.01 lots)

• Costs include spread, swap fees if you hold overnight

• Leverage is usually high — up to 1:100 or more

• Margin is required, but typically lower than in futures

💡 Spot is flexible and accessible, but you pay the price through overnight holding costs, wider spreads during volatility, and slippage. On some brokers, especially during high-impact news, your platform might even freeze or delay execution — and that’s a serious risk if you’re not prepared.

________________________________________

2️⃣ Gold futures (GC)

• Traded on major futures exchanges like CME

• Contracts have a fixed size (usually 100 oz)

• They expire monthly, so you need to manage rollovers

• Common among hedge funds and experienced traders

• You pay commissions and exchange fees, but no swaps

• Margin is required here too — but it's much higher

💡 Futures are structured and professional — but they demand more capital, stricter execution discipline, and higher margin requirements. Just like in spot trading, margin is a collateral deposit, not a cost — but with futures, the bar is set higher.

________________________________________

⚖️ So, which one is for you?

If you're using MetaTrader or any platform offered by a Forex/CFD broker, and you're a scalper, intraday, or swing trader working with flexible position sizes...

→ You're probably better off with spot gold (XAU/USD).

If you're trading big volume, managing diversified portfolios, or involved in hedging large exposure...

→ You should consider futures — but expect to level up your game, capital requirements, and discipline.

________________________________________

🧠 Mindset:

Don’t confuse accessibility with simplicity.

Just because spot Gold is easier to open doesn’t mean it’s always the best choice.

Just because futures look “pro-level” doesn’t mean they’re always worth it for a retail trader.

Understand your tools. Pick the one that aligns with your structure. That’s how you stay in the game. 🎯

________________________________________

📚 Hope this cleared it up. If you want me to cover execution setups for each one, let me know in the comments.

Futuresmarket

The Golden Grain: Trading Corn in Global Markets🟡 1. Introduction

Corn isn’t just something you eat off the cob at a summer barbecue — it’s one of the most widely traded agricultural commodities in the world. Behind every kernel lies a powerful story of food security, global trade, biofuels, and speculative capital.

Whether you’re a farmer managing risk, a trader chasing macro trends, or simply curious about how weather affects global prices, corn futures sit at the crossroads of agriculture and finance. In this article, we’ll explore what makes corn a global economic driver, how it behaves as a futures product, and what traders need to know to approach the corn market intelligently.

🌎 2. Where Corn Grows: Global Powerhouses

Corn is cultivated on every continent except Antarctica, but a handful of countries dominate production and exports.

United States – By far the largest producer and exporter. The “Corn Belt” — spanning Iowa, Illinois, Indiana, Nebraska, and parts of Ohio and Missouri — produces the majority of U.S. corn. U.S. exports also set global benchmarks for pricing.

Brazil & Argentina – These two South American powerhouses are crucial to the global corn supply, especially during the Northern Hemisphere’s off-season.

China – Though a top producer, China consumes most of its own supply and has become a key importer during deficit years.

Corn is typically planted in the U.S. between late April and early June and harvested from September through November. In Brazil, two crops per year are common — including the important safrinha (second crop), harvested mid-year.

Understanding where and when corn is grown is vital. Weather disruptions in any of these regions can ripple through the futures market within hours — or even minutes.

💹 3. Corn as a Futures Market Power Player

Corn is one of the most liquid agricultural futures markets in the world, traded primarily on the CME Group’s CBOT (Chicago Board of Trade). It attracts a diverse set of participants:

Producers and Commercials: Farmers, ethanol refiners, and food manufacturers use corn futures to hedge price risk.

Speculators and Funds: Hedge funds and retail traders speculate on corn price direction, volatility, and seasonal patterns.

Arbitrageurs and Spreads: Traders bet on relative price differences between contracts (e.g., old crop vs. new crop spreads).

The deep liquidity and relatively low tick size make corn accessible, but its price is highly sensitive to weather, government reports (like WASDE), and international trade policies.

🏗️ 4. CME Group Corn Futures: What You Can Trade

The CME Group offers both standard and micro-sized contracts for corn. Here’s a quick overview:

o Standard Corn

Ticker: ZC

Size = 5,000 bushels

Tick = 0.0025 = $12.50

Margin = ~$1,050

o Micro Corn

Ticker: XC

Size = 1,000 bushels

Tick = 0.0050 = $2.50

Margin = ~$105

⚠️ Always confirm margin requirements with your broker. They change with market volatility and exchange updates.

The availability of micro corn contracts has opened the door for smaller traders to manage risk or test strategies without over-leveraging.

📊 5. Historical Price Behavior & Seasonality

Corn is deeply seasonal — and so is its price action.

During planting season (April–May), traders watch weekly USDA crop progress reports and early weather forecasts like hawks. A wet spring can delay planting, leading to tighter supply expectations and early price spikes.

Then comes pollination (July) — the most critical stage. This is when heatwaves or drought can do serious damage to yield potential. If temperatures are unusually high or rainfall is scarce during this window, markets often react with urgency, bidding up futures prices in anticipation of reduced output.

By harvest (September–November), prices often stabilize — especially if production matches expectations. But early frost, wind storms, or excessive rain during harvest can still trigger sharp volatility.

Many experienced traders overlay weather models, soil moisture maps, and historical USDA data to anticipate season-driven price shifts.

Even international factors play a role. For example, when Brazil’s safrinha crop suffers a drought, global corn supply tightens — impacting CME prices even though the crop is thousands of miles away.

🧠 6. What Every New Trader Should Know

If you’re new to corn trading, here are some key principles:

Watch the Weather: It’s not optional. Daily forecasts, drought monitors, and precipitation anomalies can move markets. NOAA, Open-Meteo, and private ag weather services are your friends.

Know the Reports: The WASDE report (World Agricultural Supply and Demand Estimates), USDA Crop Progress, and Prospective Plantings reports can shake up pricing more than you might expect — even if changes seem small.

Mind the Time of Year: Seasonality affects liquidity, volatility, and trader behavior. March–August tends to be the most active period.

Understand Global Demand: The U.S. exports a huge portion of its crop — with China, Mexico, and Japan as major buyers. A tariff tweak or surprise Chinese cancellation can cause wild price swings.

🛠️ Good corn trading is 50% strategy, 50% meteorology.

🧭 This article is part of a broader educational series exploring the relationship between agricultural commodities and weather patterns. In the upcoming pieces, we’ll dive deeper into how temperature and precipitation affect corn, wheat, and soybeans — with real data, charts, and trading insights.

📅 Watch for the next release: “Breadbasket Basics: Trading Wheat Futures.”

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

SOYBEAN, Weekly Supply/Demand+fundamentals we are kicking of the year with a clear technical rejection from $1050 to $1112 weekly supply zone. Price pushed agressively into this area and has now printed multiple rejection candles on the daily, confirming the zones strength.

fundamentals are showing bearish positioning aligned with the technical setup.

entry wil be at market open. first target is at break of recent support and if fundamentals stil support the bias by then we wil also aim for target two.

simple structure, clean confirmation. lets see if price delivers.

Wheat- In a Clean Resistance Zone, can it reach 542.00?Wheat is already within a critical resistance zone that has times before led to bearish reversals. In any case this area, marked by previous price rejections, could once again attract selling pressure.

If bearish confirmation occurs—through rejection wicks, bearish engulfing candles, or a decrease in buying volume—we could see a decline toward the 542,00 level. However, a breakout above this resistance would invalidate the bearish outlook and suggest potential for further upward movement. So keep an eye on that.

Wait for clear signs of rejection before considering short positions.

Optimism setup long and short for future trade As shown below, since three months ago, the ETHBTC reaction has been occurring and slowly taking control. This can be used on coins that are tied to ETH. Fundamentally excellent price for DCA, but I would like to show the chance to those who deal with future trade.

With the setup, it is great to find where our analyzes are no longer valid and we need to admit that we are not right. Optimism is one of the coins that correctly did 1,2,3 according to Elliot. Now the question is whether the 4th wave will manage to reach our order, but we must be disciplined because this analysis is canceled if the fourth wave reaches deep enough to the first, where the setup is no longer valid.

Why this setup gives us the possibility of long - here is daily fvg, 4h fvg, 2h fvg, fibonacci for retest as well as theoretical knowledge about Elliott waves

Bitcoin Failing To PumpHey guys,

It looks like Bitcoin had its little pump from $60K to GETTEX:64K but now it appears that it can't hold up the price. It keep making lower highs in the short term and the signals look pretty bearish right now.

The MACD has a green dot on the daily but all other smaller time frames are rather bearish. Things can get volatile so we might see some pumps and dumps while the price consolidates. This could go on for another month or two yet before we see the price making a clear direction in the upward trajectory in October.

I'm looking at Bitcoin falling to $58,500 before we do a bit of sideways action with a positive twist.

If you agree with my thoughts please boost and subscribe!

When you need to decide. Let your heart be the guide.

TFEX S50 Swing ShortTFEX S50 Swing Short

Still keeping perspective in all my Trend

Primary, Secondary, Minor : Down Trend

This swing cycle saw another short position order at the Island Gap Reversals and Follow Sell when the price jumped down the next day.

Short only strategy with a price target of 770 along the Standard Deviation of the Volume Profile that forms a Normal Distribution shape.

NASDAQ-Feb 2024 3 Days remaining!Nasdaq seems on a fast track to close Feb 2024

And still a lot can happen in 3 days, which is the remaining time left to close the month.

One key point to make:

While Price continues to deliver within Bullish structure.

Weekly Price has been unable to close above 18071.

Current momentum is expected to continue to push price higher, but noting price's inability to close a weekly candle above this price area will open the possibility of repricing down.

It is what it is till its not

Price is expected to continue its up-close trend until it shows clear indication of weakness.

Looking for a possible Bearish Mon-Tues structure, setting the stage for Bullish continuation Wed-Thu.

Are we rushing into the possible next Big Short?Is S&P 500 about to “CRASH”?

Are we rushing into the possible next Big Short?

So the S&P 500 futures contracts are depreciating in value, yes. Yet we foresaw this series of events. Has it been a rapid decline?

No.

The Price Action and structure continues sound.

There is no sign yet of panic or rapid selling signaling the Risk Off scenario all are predicting.

Do I expect further downside? Yes

I will go into my reasoning

1. DXY following a Bullish structure. Currently consolidating in a Bullish Flag pattern that could give us a break out of this pattern with a Higher High soon.

1. With a Bullish Dollar we can expect Bearish Equities.

Lets break ES pice action from top down.

- Monthly

- ES offered a Lower Low from June 23 Lows. But I am looking at the Monthly with caution since the month of October is not over yet.

- Weekly

- ES made its third down leg and yet it was unable to create a Lower Low in comparison to the week of October 2nd 23.

- The down closed weekly candle of last week looks strong enough to take out this low on momentum alone.

- So it is possible we will see 4235.5 before any other move.

-

- Daily

- On the Daily we see the last 4 Bearish days in a row, it can be assumed that the Bearish momentum along could carry price further down to establish a new Lower Low on this Bearish trend which will be at 4235.50

- I also like the potential of 4218.75

In conclusion. I do expect to see further downside but I would like to remind all that this will be the last week of October and to top that we are getting very close to establishing a new Lower Low on this Trend.

What does that mean?

Well we have had and extended leg down on this trend throughout the month of October. I would expect a retracement after a new Low is stablished with a subsequent bounce to settle a possible Lower High on this trend.

To accompany this thought it is the end of the Month and expecting a bit of retracemnt from the Monthly direction is healthy.

If you look at the Daily chart you will notice a gap between Thursday Oct 19,23

And Friday oct 20, 23. I am expecting price to target this Gap once the lows are stablished.

Still always follow price it will never steer you wrong.

Is Nasdaq at the brink?Is Nasdaq at the brink?

To the dismay of many, NQ is currently trading at 14664.00 that was the weekly close of Oct 20, 23. And Price momentum would indicate further downside of price. But how much more?

First let’s bring back into perspective the state of DXY.

If you ask why then it is because if we encounter a stronger dollar in market conditions it reduces an investors reach. A stronger Dollar signifies that everything will be more expensive to produce, purchase or consume.

So typically a strong Dollar would equal weak equities.

Bullish Dollar = Bearish Equities

Dollar right now is in a Bullish trend and currently consolidating in a Bullish Flag Pattern. The expectation is for price to break to the upside of this consolidation giving us a Bullish continuation and therefore a Higher High.

With the expectation of a Bullish Dollar it would be easy to say that obviously NQ’s price will continue to drop as well… Here we have to be more cautious.

Lets look into NQ’s Top down analysis and see what we come up with.

- Monthly

- NQ stablished a Lower High at 13257.75 this was in the Month of July 23. Since we have continued to see Lower Lows on the Monthly candles.

- I would like to point out that we are also returning to the 50% of the previous Bearish range on the Monthly. This can be significant.

- Weekly

- Looking at the Weekly timeframe we see a strong weekly close at 14664.00.

- This close and weekly momentum can indicate a further push to establish Lower Lows if 14586.00 is breached. ( This is my short term expectation)

- The reason I am being careful here is due to this being the last week of the Month and price at the brink of making a Lower Low on the weekly. Typically the Monthly candle will retrace some of its previous movement. Also price once Lower Lows are established could begin its trajectory towards a Lower High.

- But keeping my eyes not only on the potential breach of 14586.00 but for price to even reach as low as 14437.5.

- Daily

- We see on the Daily the downward extension of price these last four days. A considerable drop or I would describe as a controlled descent.

- We can see a break away gap on this price drop between Thursday Oct 19, 23 and Friday Oct 20, 23.

- I would be looking for price to be drawn towards this area at some point. Possibly after breaching the lows at 14586.00

So in conclusion NQ’s price has dropped as we had previously expected. But can price continue downwards without break.

We will see this week and the beginning of next Month.

For now price has enough momentum to continue downwards and establish the new Lower Lows and I would just focus on that.

Stay safe.

Market Makers Buy And Sell ModelThe market Makers' Buy and Sell Model is a strategy that reveals the market maker algorithm model for price delivery.

Basically, there are 3 things market makers' algorithms do with price in every trading session, day, week, and month

Those 3 things are; Accumulation, Manipulation, and Distribution.

AMD:

A: Accumulation

M: Manipulation

D: Distribution

1. Accumulation: They accumulate liquidity through the delivery of a ranging market.

The purpose of delivering a ranging market is to induce both buyers and sellers to enter the market thinking that price will go in their direction.

How to Identify a Ranging Market: You know price is in a ranging market when you see obvious relative equal highs and lows price range.

In a ranging market, price swing points have relatively equal highs and lows, that is, the price is neither delivering a higher high nor a higher low.

2. Manipulation: After accumulating both buy and sell orders, they then manipulate the market to further induce another set of traders which are breakout traders.

But, that particular manipulation move is not their intended direction for the day. They only use it to gather liquidity, Which will then lead them to the next action which is to move and distribute prices in their real direction for the day.

Usually, when price breaks out of a ranging market, the break-out is a manipulation to further induce a new set of traders to enter the market, further proving liquidity for market makers' real intended direction.

3. Distribution: After manipulating the price to a particular direction different from their plan, they then distribute the price to their original intended direction.

e.g to buy, they will first sell the market and then buy at the discount price level.

You know a price distribution through clean candles that left imbalances behind and then break market structure away from the previous manipulation move structure high or low to form a new structure.

Example of Market Makers Buy and Sell Model as described on the chart.

AMD:

A: Accumulation

M: Manipulation

D: Distribution

Accumulation: Price range for some time, accumulating liquidity on both sides of long and shorts.

Manipulation: Price broke the high of the accumulation to take out Buyside liquidity and then create a new higher high and higher low. But it's a manipulation move.

Distribution: Price moves away from the FVG leading to a shift in market structure, plus a short pullback, follow by a massive move to the downside to take out sell-side liquidity below.

Entry: Your entry should be inside the FVG created by price before the shift in market structure, you can set a limit order inside the fvg and place your stop loss at the high of the swing high created prior to the fvg and shift in market structure.

The same thing applies to a bullish market.

Basically, Marker makers push prices higher so they can sell the market at a premium, while they sell the market to lower prices so they can buy that market at very discount prices

This strategy can be used in any time frame and all markets including forex, crypto, stocks, future etc.

Follow me for more updates.

Feel free to ask me any questions in the comment.

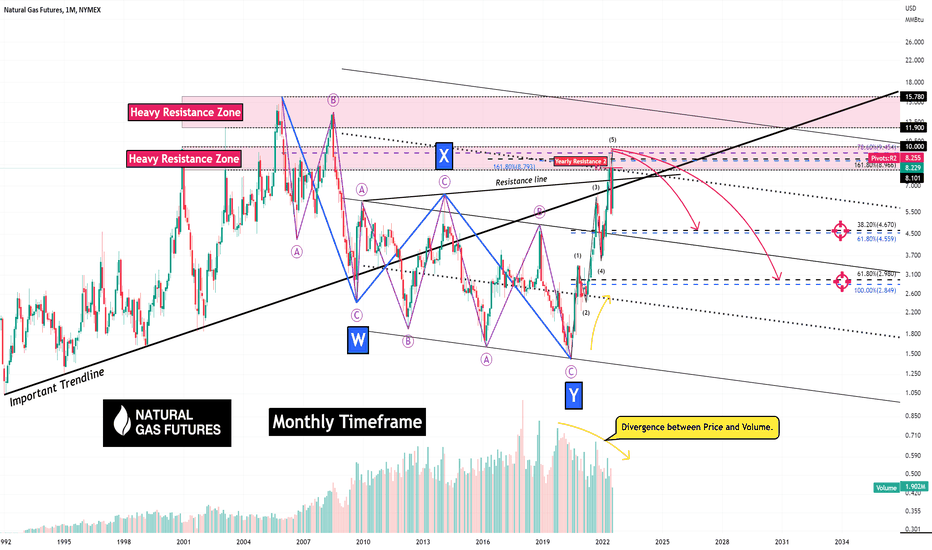

Natural Gas Futures (Road Map)!!!🗺️What are Natural Gas Futures ❗️❓

Natural Gas Futures can be used for hedging or speculating and can be traded nearly 24 hours per day, 6 days per week. Trading Natural Gas Futures allows hedgers to manage risk within the highly volatile natural gas price, which is driven by weather-related demand.

Natural Gas Futures is running in Heavy Resistance Zone & Important Trendlin & Resistance Line, and at the same time, it was able to pass the main wave 5 in this zone. So I expect Natural Gas Futures to go down to my🎯targets🎯 that I showed in my chart.

Where can Natural Gas Futures go (🎯Targets🎯)❗️❓

Target🎯: 4.67$-4.55$

Target🎯: 2.98$-2.84$

Natural Gas Futures Analyze, Monthly Timeframe (Logscale).

Also, we can see one of the valid candlestick reversal patterns (💫Shooting Star💫) at a weekly timeframe 👇

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy, this is just my idea, and I will be glad to see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

S&P Futures Surprise!We have watched Futures price unable to climb above resistance at 4002.

Today buyers gave strong indication that they were not ready to let price reject and drop form here. Closing the day with strength above 4000.

What can we expect next?

Next target for Futures is 4090 and 4132

If price is able to build above resistance near 4090-4132 we might see a push to 4199 without breaking the Macro Bear structure.

Nasdaq NQ hovering @wma200/mma50/June low zone;Diamond again?Nasdaq, si,liar to SPY has made 2 diamond patterns in May & June leading to a reversal with positive Rsi divergence.

Could it be repeating similar set-up this Sept-Oct?

It is currently hovering around the mma50+wma200+June low zone. Sometimes prices break a little below the diamond pattern first eating away the cut-losses before a reversal. If NQ makes another new low after Thursday’s economics data, it will be bad news.

Not trading advice