What do we think of ALICE?Here is a potential long...

I use leverage and do not give financial advice.

Levels are marked on the chart for buy stop/loss and take profit.

So this all depends on Bitcoin, BTC is in a similar situation coming down for a re-test of a previous resistance flipped support...

Also increasing volume and the decreasing price is a negative divergent so that's always good, add in the small strength gain over USD things are not looking too scary.

Futurestrading

ICICIGI - ACCUMULATION OR DISTRIBUTION?NSE:ICICIGI

ICICIGI formed a good trading range.

its been consolidating for 25 days now with a total volume of 10.5 Million shares.

Big players are getting it ready for a big move as they are slowly building positions in the stock.

I will watch for a breakout to the one side with above-average volume.

#Breakout levels are marked on chart

Use position sizing according to your stop loss level.

Like this idea if you find it helpful and please share it with your friends.

Keep learning,

Happy trading.

Thank you.

TRADE PLAN 01/06/2023 TP1> If we manage to Trade/Bid above MAIN POC 3863,

we can go for 3830 > 3841 > 3862 (Range POC) > 3878 > 3913.

>To the upside, the level I'm looking it right now is the 3860, that's the POC of those last 13 days, we need to trade/bid above so we can try to break the LIS 3913/3915, where BULLS are losing the battle.

TP2> If we manage to Trade below MAIN POC 3830,

we can visit 3826 > 3800 > 3787 > 3766.

>To the downside, the level I'm looking is 3826 (RANGE VAL), as we are already trading below 3960 12 days POC, so once we confirm below 3824, we have to break lower to find strong sellers to push below 3800, where BEARS are losing the battle.

* We are trading in this 100 points RANGE from 3800 to 3900 levels for the last 13 days or about 2 weeks,

I would say that the market structure are balanced, looking for stronger BUYERS or SELLERS around the VALUE AREAS.

Below is my previous comment from yesterday:.

For now no direction in the markets, just range trades, we should break anytime soon out of this BOX, and I was hoping that today with FOMC minutes we could go search some new levels, out of balance, but...

Mr Market had other plans, so for now lets trade the levels and see how it goes by Friday NFP.

>As we didnt break the RANGE, now its a matter of one single REPORT, NFP by tomorrow 8:30am, there's only one way to make money tomorrow, and the way is to be IN ALREADY !! The movement will be soon, and the TRADE will make it or break it bt 8:30am and will set the tone for the following weeks for a BEARISH or BULLISH continuation.

>I'm using $IWM PUT DEBIT SPREAD with 43DTE for my BEARISH BET, this is kind of a LOTTO PLAY, because the TRADE will be moving a lot in one direction, the advantage here is that if its a fake out UP, I have 43 days to manage and decide what to do with it... If you want to take a trade now, you would have to go with FUTURES, or FUTURES OPTIONS using GLOBEX .

#tradesafe #sizekills #justonemoretrade

ETH SHORT SETUP FROM RETRACEMENTDay's Bias: Bearish

Plot:

Previously a strong drop from a rising wedge pattern made a strong bearish impulse move leaving huge amount of gaps along the way.

Price recently shows bullish momentum on the lower TF signals the retracement within 50 to 61.8% to take out some of the gaps.

Price momentarily consolidates exactly at the retracement area.

Price created liquidity pools and has been taken out.

Today Asian Range has the highest probability of no longer being revisited to continue another bearish impulse move.

After price revisits 50% of the Asian Range multiple times, then creating a displacement leaving small gaps to be revisited before it continues towards the expected direction.

Bearish Pennant 24HR TF Bearish Pennant forming RSI peaking at 50 before news from Fed regarding Job Opening/Manufacturing PMI reports looking at negative inflation reports. Fed Meeting minutes at 2:00PM gives more insight into monetary policy and rate hike forecasts. Labour market strong but might be forced into an Fed induced recession.

Looking for steep correction to recent price action my TP @ 1000$ per ETH.

High volatility expected.

XAUUSDBefore everything 🌟🥰🌲Merry Christmas🌟🥰🌲

I wish 2023 will be the best years of your life

We can see the price how much

Retest on the trend resistance

We have most probability

To break trend resistance and keep rise to next resistance.

KEEP YOUR TRADING SIMPLE.

for more details contact me;

Please don't forget Like and subscribe.

Price Action Analysis of Corn Futuresas we can see the apparent divergence was shown between April 2021 and April 2022.

followed by a drop-down below 0.236 Fibonacci level.

the price is still moving in a trading range which makes it hard to predict his next move.

Break bellow MA 209 with Big Volume signal a short entry.

Gold offers opportunities for intraday tradersvery obvious that gold has been on a downtrend since March. the trend is moving below MA 209 which confirms the trend.

As long as there is no obvious trend reversal signal, I will only look for sell signals on my daily trading.

By focusing only on selling signals, I will increase my win rate and avoid many losses.

On the weekly chart, the MA 209 is broken and confirms that the trend is bearish.

What do you think? are you only going to sell gold or buy it :)

BTC BREAKDOWNGreetings dear traders, although of late I wish you a wonderful holiday and Merry Christmas 🎄

Tonight over the Asian session BTC fell out of the holiday range and headed down for liquidity to $16554 from where it bounced slightly and we will wait until at least NY today for confirmation of possible entries

XAUUSDThe price come again the trendline.

As you can see and with new year approaching

Will take some small position at the end of year

Liquidity will be low

We will waiting for second retest

At the trendline nd will look for

Some buy postion.

Thanks. and for more ideas dont' forget "Like" and "Follow".

Happy christmas nd happy new year.

LAST CONSOLIDATION BEFORE NEXT BULL RUNMy Idea of consolidation towards next bull run. Best time to Buy and HODL.

ETH and BTC showing tendency of having a pullback soon before finally moving down towards the last consolidation area.

Expecting to see strong bullish formation after taking out previous HTF Low towards the GAP on 3D TF

We could already be at the start of the next bull run very very soon. Probably between March to June of 2023. :)

Time to study the best crypto projects out there.

I think the timing is just perfect, as most of the influencers out there area calling for the next bull run to be in 2024.

Momentarily my bias is a short swing upwards as a retracement of 50% to 61.8% taking out some of the gaps left recently before the continuation towards the last consolidation area.

Hard dump is coming in BTCIts December the year closing, businesses need money in their bank accounts not crypto accounts. So, be ready for the hard dump 18 December to 22 December.

Recovery will start after 20 January.

Its not a matter market bullish or bearish. The thing is whats your strategy to handle your trades.

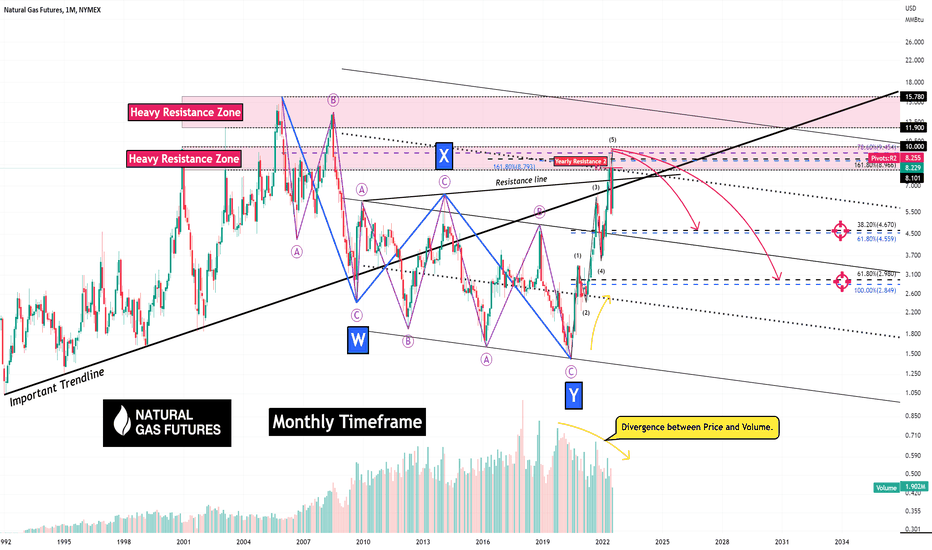

Natural Gas Futures (Road Map)!!!🗺️What are Natural Gas Futures ❗️❓

Natural Gas Futures can be used for hedging or speculating and can be traded nearly 24 hours per day, 6 days per week. Trading Natural Gas Futures allows hedgers to manage risk within the highly volatile natural gas price, which is driven by weather-related demand.

Natural Gas Futures is running in Heavy Resistance Zone & Important Trendlin & Resistance Line, and at the same time, it was able to pass the main wave 5 in this zone. So I expect Natural Gas Futures to go down to my🎯targets🎯 that I showed in my chart.

Where can Natural Gas Futures go (🎯Targets🎯)❗️❓

Target🎯: 4.67$-4.55$

Target🎯: 2.98$-2.84$

Natural Gas Futures Analyze, Monthly Timeframe (Logscale).

Also, we can see one of the valid candlestick reversal patterns (💫Shooting Star💫) at a weekly timeframe 👇

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy, this is just my idea, and I will be glad to see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

SOLANA: The end of an era or not?Hello everyone! This is our second idea in a fundamental project analysis (the first one about Aptos is right here ). This idea will tell you about the Solana project in terms of product, competitive advantages, team, tokenomics, and prospects. If you understand the project from all angles, including its essence and goals, as well as the fundamental approach and metrics, you will be able to enter the project more consciously and profitably.

THE PROJECT and IT'S TOKEN

Solana - SOL token

What is the project?

Layer 1 blockchain based on the Proof-of-Stake (PoS) and Proof-of-History (PoH) consensus systems. The project was founded in 2017 and was officially launched in 2020.

PRODUCT PART

Key mechanics

The Proof-of-History algorithm is designed to synchronize the blockchain and transactions. The higher the throughput, the faster the blockchain synchronization rate. PoH is a method for reducing time costs, not a consensus algorithm.

Tower Byzantine Fault Tolerance (TBFT) is a consensus algorithm that is based on Proof-of-Stake that uses PoH to reduce computational resources and time costs.

Turbine is a transaction transfer protocol that shortens the time it takes to transfer data between validators..

Gulf Stream is a transaction transfer protocol that does not use mem-pools because validators are detected in advance.

Sealevel is a parallel execution of transactions and signature verification.

Strengths

High throughput due to a combination of PoH and TBFT, as well as the Gulf Stream and Sealevel.

High scalability due to Turbine

Weaknesses

When there is a high load on the Solana network, the blockchain stops processing transactions and becomes inactive due to a lack of mem-pool. For example, when a large number of mint bots were launched, which sent transactions to the blockchain very quickly, the network was unable to handle transaction processing and went into an inactive state.

Not a reliable level of decentralization – the nodes vote for the block and pass the votes on to the leaders. Leaders collect votes and sign the block themselves. The issue is that in other networks, validators (leaders) validate blocks, and then nodes decide whether or not they agree with the validator's action.

BUSINESS PART

How does the product make money?

The situation is comparable to Aptos and other blockchains. Investing in projects from their ecosystem and the most promising projects from other ecosystems are currently the main sources of income for Layer 1 blockchains, aside from collecting investments.

How can a product make money in the long run?

Selling your infrastructure to third-party companies like web2 or TradFi is the best way to make money with blockchain. However, at the moment, there are several limitations to this:

1. Unreliable technical solutions

Solana has proven that it can stop its work at any moment.

2. Weak regulation

Because there is no clear regulation, any company that decides to integrate into blockchain must accept the risk of pressure from their country's regulators.

3. Lack of business logic

It's still unclear why large corporations should use blockchain infrastructure and what benefits this solution will provide.

TEAM

Anatoly Yakovenko – Co-founder, ex Dropbox, Mesosphere, Qualcomm

Raj Gokal – Co-founder, ex Omada Health, General Catalyst Partners

FUNDS AND INVESTORS

Solana has had 9 rounds of investments, total fees ~315m USD

The main investors:

Tor Kenz Capital

Buck Stash

Collab + Currency

Alameda Research

Memetic Capital

Blockchange Ventures

CoinFund

Genesis One Capital

Multicoin Capital

CoinShares

TOKENOMICS

1. Total number of tokens: SOL deflationary token, unlimited maximum number

2. Current circulation: 363,963,170 SOL

3. Current market capitalization: 5.1b USD

All member groups will receive their tokens in the first half of 2023, and token issuance will be limited to Staking Rewards. On the one hand, this is a good thing because SOL will become a fully marketable asset whose value is determined solely by supply and demand, and the issuance will only benefit network contributors. On the other hand, it is bad because Solana has currently lost the DeFi niche due to the network's poor performance and NFT due to the extremely low value of the SOL token. If Solana as a blockchain does not find its niche and users, the SOL token will not have a sufficient level of demand; additionally, the amount of SOL supply will increase every year due to the growing issue of Staking Rewards.

CONCLUSION

What to expect in the future?

Solana, as a project, is basically finished. In 2020-2021, it was an advanced blockchain on which innovative products were released. Solana had the backing of Alameda and FTX, preventing the SOL token from falling below $3 in 2021.

Solana experienced an NFT-boom in the fall of 2021, when the token price reached over $100, and many users became wealthy (or very rich as a result of Solana). However, in November 2021, the crypto-winter began, affecting all market assets. However, the crypto-winter began in November 2021, affecting all market assets. This year, SOL lost more than 90% of its value, lost many NFT users (no one wants to earn $20-30 and spend many hours of time grinding), lost the DeFi sector (users don't want to wait for Solana network to work and process transactions again, developers find more profit to run their application on L2 EVM network), and lost the support of their main sponsors – Alameda and SBF (these guys have enough problems right now). Along with the death of the previous cycle's market narratives, one of the cycle's brightest projects is likely to have died as well.

Solana and the SOL token have two chances to recover their positions:

1. To attract new investors and real-world businesses that will use Solana's infrastructure. It is unlikely because Solana has already demonstrated weaknesses in their solutions, and it is unclear whether they can address those weaknesses. Furthermore, there are more advanced and promising solutions on the market (Aptos (here is a link to our article about Aptos on TV), SUI, Starknet, Scroll, Shardeum), investment and use of which will yield greater long-term benefits.

2. To develop or attract new projects and audiences. It is also unlikely because EVM networks are more likely to be chosen by developers and users due to their larger user base, network activity, and potential.

Our output: long or short

In the short run, SOL token will follow the market, but will rise slower and fall faster than others.

In the long run, Solana resources are limited, the market is becoming increasingly competitive, and Solana and SOL are no longer of product and business interest. The project has run its course; SOL will most likely be among the top 50/100 projects in terms of capitalization, but Solana's golden days are over.

P.S

In any case, your trading strategy, investment and trading planning horizon are significant to make decisions and these decisions are up to you! Don't forget about risk management; the market is volatile, and you must successfully arrive at the right long-term forecasts without losing all of your capital. Keep in mind that many participants in the crypto market undervalue or overvalue projects and assets, and the true evaluation occurs only after the appropriate events occur.

Thank you for reading!

Feel free to share your thoughts about SOL in comments