Trading GBPUSD | Judas Swing Strategy 25/03/2025We had a good trading session with the Judas Swing Strategy two weeks ago, as the strategy delivered 3 solid setups, 2 on FX:EURUSD and 1 on $GBPUSD. And guess what? All three hit their targets!

That’s a massive 6% gain for the week! And with these impressive results we wanted to see how the strategy will perform last week.

The strategy did not produce any setups on the currency pair we monitor ( FX:EURUSD , FX:GBPUSD , FX:AUDUSD , OANDA:NZDUSD ) on Monday 24th March and instead of forcing setups like other traders would we sat that day out. Why was this possible? we had backtested the strategy and had enough data to prove that when we stick to this strategy long term we'd be in putting ourselves in a profitable position.

On Tuesday, we returned to the trading desk, scouting for setups, when we noticed a potential opportunity on $GBPUSD. The currency pair had swept liquidity at the high of our zone, signaling a possible shift in direction. We then shifted our focus to selling opportunities for the session. Our strategy required waiting for a break of structure to the downside, followed by a retracement into the FVG before executing a trade

After waiting for an hour and 15 minutes, we finally got the break of structure to the downside. The only step left was a retrace into the FVG. After some patience, the retrace materialized, meeting all the criteria on our entry checklist. We executed the trade, risking 1% of our account with a target return of 2%

Trade Details:

Entry: 1.29513

Stop Loss: 1.29611

Take Profit: 1.29311

After entering the trade, price consolidated around our entry point for a while, showing no clear direction. However, we remained unfazed, trusting our well-backtested strategy, which has a 50% win rate. With a 1:2 risk-reward ratio, we know that consistently following our strategy will yield profits in the long run. Since we had risked only what we could afford to lose, the slow price movement didn’t shake our confidence

Unfortunately, this trade didn’t go in our favor and ended up hitting our stop loss. This serves as a reminder that not every trade will reach take profit and that’s perfectly okay. Losses are an inevitable part of trading, but what truly matters is maintaining a solid risk management strategy, sticking to a proven system, and thinking long-term. As traders, our edge comes not from winning every trade, but from executing consistently and letting probabilities play out over time

Fvg

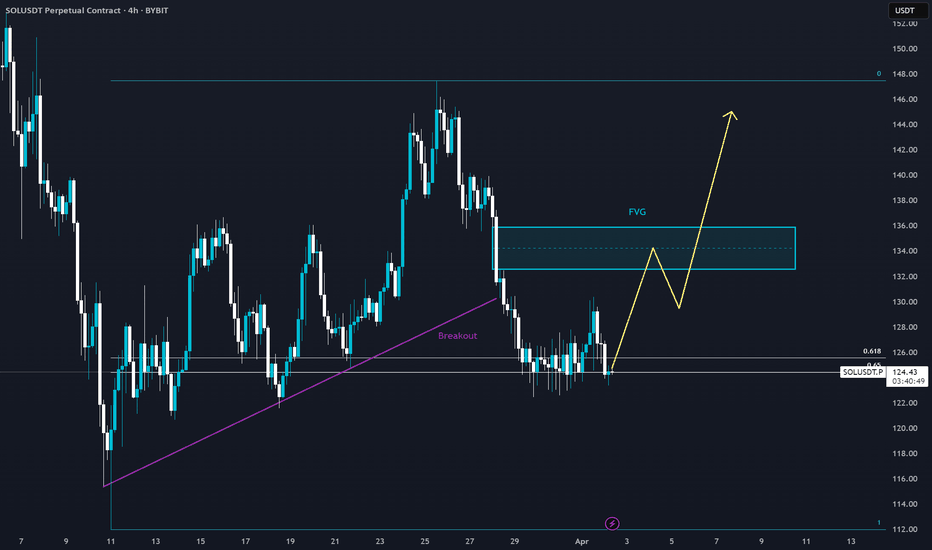

SOL - Breakout Retest & FVG Target This 4-hour SOL/USDT chart shows a breakout retest at a key support level, with a potential move toward the Fair Value Gap (FVG).

Key Observations:

🔹 Breakout & Retest: Price has broken below the trendline and is now stabilizing near support.

🔹 FVG Target: A bullish reaction from this level could send SOL toward the FVG before further continuation.

🔹 Potential Bullish Structure: A strong bounce could lead to higher highs, while failure to hold may invalidate the setup.

Will SOL confirm this bullish scenario? Let’s watch how it reacts! 📈🔥

Bitcoin - Bulls Take Control: Short term rally to $86K?Bitcoin has once again reacted to the $81,000 support level, bouncing from this key demand zone and showing signs of bullish momentum. The price is currently moving upwards, and the next logical target appears to be the $85,500 – $86,000 zone, where a Fair Value Gap (FVG) and the Fibonacci golden pocket align. This area is expected to act as a significant resistance level, meaning we could see a rejection from there, leading to another move back toward support.

The plan is to monitor the price as it approaches $86,000, watching for signs of a reversal or continued strength. If a rejection occurs, Bitcoin could make its way back toward $81,000 or lower, providing another potential buying opportunity.

Bitcoin’s Reaction to $81,000 – A Strong Demand Zone

Bitcoin has consistently found support at $81,000, and this level once again played a crucial role in preventing further downside. This area has been tested multiple times, reinforcing its importance in the current price action. Each time the price has dropped to this level, buyers have stepped in aggressively, causing strong rejections to the upside.

The latest bounce from this support level suggests that there is still demand in the market, at least for now. The presence of long wicks at this level indicates that sellers attempted to push the price lower, but buyers quickly absorbed the selling pressure, resulting in a reversal. This move aligns with the broader market structure, which suggests that Bitcoin is still ranging between support at $81,000 and resistance near $86,000.

Short-Term Target: Fair Value Gap (FVG) & Golden Pocket at $86,000

Now that Bitcoin has rebounded from support, the next major area of interest is the Fair Value Gap (FVG) and the golden pocket retracement zone around $85,500 – $86,000. This level is important for several reasons.

First, the golden pocket (0.618 – 0.65 Fibonacci retracement) is a common area where price reversals occur, especially after a significant move. It acts as a magnet for price action, drawing the market toward it before a potential rejection.

Second, the Fair Value Gap (FVG) represents an imbalance in price, meaning Bitcoin could aim to "fill" this gap before making its next major move. Gaps like these often get revisited before the market decides on a new trend direction.

Finally, liquidity is likely concentrated above $85,000, meaning stop losses from short positions could be triggered in this zone, leading to increased volatility. If Bitcoin reaches this level, traders should closely monitor how price reacts. A strong rejection could signal a move back down, while a clean breakthrough could indicate further upside potential.

Potential Rejection and Move Back to Support

Despite the short-term bullish outlook, there is a high probability that Bitcoin will face resistance near $86,000, leading to a pullback. If this rejection occurs, the price could once again retest the $81,000 support level. This would keep Bitcoin within a broader trading range and present another opportunity for buyers to step in.

A failure to hold $81,000 on the next test could open the door for a deeper correction toward $78,000 – $76,000, where more buyers might be waiting. However, as long as Bitcoin remains above the $81,000 mark, the market structure remains relatively stable.

Final Thoughts

Bitcoin is currently in a short-term bullish phase, with price targeting the $86,000 resistance zone. However, traders should be cautious as this level aligns with key technical factors such as the golden pocket, Fair Value Gap, and potential liquidity grab. A rejection from this area could lead to another move back down to support.

For now, the key levels to watch are $86,000 for a potential rejection and $81,000 for a potential retest. If Bitcoin breaks through resistance convincingly, we could see a more extended rally, but until then, the market remains within a defined range.

__________________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Cardano - Bullish Breakout! Can Bulls Finally Take Control? Cardano (ADA) has recently broken out of a prolonged bearish trend on the 4-hour chart, signaling a potential shift in market sentiment. This breakout suggests that bullish momentum could be building, paving the way for a move higher. The price action indicates that ADA may now target areas of confluence, where technical factors align to create significant levels of interest. The breakout itself is a strong indication that buyers are gaining control, pushing the price above previous resistance levels. This shift in momentum could be the start of a more substantial rally, especially if ADA continues to attract buyers as it moves higher.

The breakout from the bearish trend also marks a change in the broader market structure. Previously, ADA was confined within a downward trend, but now it appears to be transitioning into a more bullish phase. This transition is crucial for traders, as it presents opportunities for both short-term gains and longer-term investment strategies. As ADA moves higher, it will be important to monitor how it interacts with key technical levels, as these will provide insight into whether the breakout is sustainable or if it will be met with resistance.

Short-Term Target: Golden Pocket and Fair Value Gap

The next logical target for ADA is the golden pocket zone (0.618–0.65 Fibonacci retracement level), which coincides with a Fair Value Gap (FVG). This confluence creates a magnet for price action due to several reasons. The golden pocket is a key area where reversals or consolidations often occur after significant moves. It acts as a strong resistance level and is widely monitored by traders because it represents a point where price action tends to stabilize or reverse. Historically, the golden pocket has been a reliable indicator of potential price reversals, making it a critical area to watch for traders looking to capitalize on ADA's current momentum.

The Fair Value Gap (FVG) represents an imbalance in price caused by rapid movement, leaving untraded zones behind. Price tends to revisit these areas to "fill" the gap, making this level crucial for predicting future movements. Gaps like these often get revisited before the market decides on a new trend direction, which means that ADA's approach to this zone could be pivotal in determining its next major move. Additionally, liquidity is likely concentrated around this area, as stop-loss orders from short positions could be triggered here, leading to increased volatility. If ADA reaches this level, traders should closely monitor how price reacts. A strong rejection could signal a move back down, while a clean breakthrough could indicate further upside potential.

Potential Rejection and Support Levels

While the breakout is promising, there remains a high probability of resistance at the golden pocket and FVG zone. If ADA faces rejection here, it could retrace toward key support levels. The primary support zone, which has held firm during recent consolidation phases, will be crucial in determining whether ADA can maintain its bullish momentum. A retest of this area would provide another opportunity for buyers to step in, potentially leading to a continuation of the current trend.

In the event of a rejection, ADA might initially pull back to test its recent breakout levels. If this support holds, it would reinforce the idea that the breakout is legitimate and that ADA is poised for further gains. However, failure to hold these levels could open the door for ADA to drop toward secondary support zones. These areas, typically marked by previous lows or significant trading volumes, would be critical in preventing a deeper correction. If ADA fails to find support at these levels, it could signal a broader reversal in the market, potentially leading to a retest of lower support zones.

Final Thoughts

Cardano’s breakout from its bearish trend presents an exciting opportunity for traders. The golden pocket and FVG alignment around the target zone make it a critical area to watch. Traders should remain cautious as price approaches this resistance level, looking for signs of rejection or continued strength. Monitoring the price action closely will be essential in determining whether ADA has the momentum to push through resistance or if it will be forced back into a consolidation phase.

For now, the key levels to monitor include the resistance at the golden pocket/FVG zone and the support at recent breakout levels. A decisive breakout above resistance could signal further upside potential, while failure might keep ADA within its broader range structure. As ADA navigates these technical levels, traders should be prepared for increased volatility and potential trading opportunities. Whether ADA continues its ascent or faces a pullback, the current market conditions offer a compelling setup for traders looking to capitalize on the cryptocurrency's movements.

__________________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

XRP - Ascending Channel: Will bulls stay in control?XRP continues to trade within a well-established ascending channel on the 4-hour timeframe, maintaining a bullish structure as long as it respects this formation. The price has consistently formed higher highs and higher lows, signaling that buyers are still in control. However, recent price action suggests that XRP is at a critical decision point, with strong support below and short-term resistance above.

4H Timeframe – Golden Pocket and Imbalance Providing Strong Support

One of the key areas to watch is the golden pocket Fibonacci retracement level (0.618 - 0.65), which aligns with a 4-hour imbalance zone. This confluence has already provided two strong bounces, confirming that buyers are actively defending this area.

The golden pocket is a key retracement zone where price often finds strong support before continuing the trend. Additionally, the imbalance zone represents an area of unfilled liquidity, which price often revisits before resuming its move. The fact that XRP has reacted twice from this level suggests that it remains a critical demand zone.

As long as price remains above this level, the bullish structure is intact, and XRP could continue pushing higher within the ascending channel. The next target for bulls would be the 0.618 Fibonacci extension level, which aligns with the upper boundary of the channel.

However, if this support fails and XRP breaks below the golden pocket and imbalance zone, the structure could shift bearish, leading to a potential breakdown toward lower support levels.

1H Timeframe – Bearish Rejection from Imbalance Zone

While the 4-hour structure remains bullish, the 1-hour timeframe presents a short-term bearish case. Recently, XRP was rejected from a significant imbalance zone, suggesting that sellers are stepping in. This rejection indicates a potential short-term pullback before the next major move.

When price fails to break through an imbalance zone, it often signals that there isn’t enough liquidity to sustain the uptrend. This could lead to a retracement back to lower levels, possibly retesting the golden pocket on the 4H timeframe before another push higher.

Key Levels to Watch

Support Zone: Golden pocket (0.618 - 0.65) + 4H imbalance

Resistance Zone: 1H imbalance rejection area

Bullish Target: 0.618 Fibonacci extension, aligning with the upper boundary of the channel

Bearish Breakdown Level: A break below the golden pocket and imbalance could trigger a deeper retracement

Final Thoughts – Bullish Structure, but Short-Term Weakness

The 4H ascending channel remains intact, and the golden pocket support has held twice, indicating that the uptrend is still in play. However, the 1H bearish rejection from an imbalance zone suggests that XRP could face short-term weakness, leading to a possible retest of support before the next major move.

If XRP holds the golden pocket, the bullish bias remains strong, and we could see a continuation towards 2.80 – 2.90 in the coming sessions. However, if support fails, the structure could shift bearish, bringing lower retracement levels into play.

This setup presents both bullish and bearish scenarios, making it crucial to monitor key levels and wait for confirmation before making a trading decision.

__________________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

EURUSD - Will Bears Keep Pushing Lower?Overview of Market Structure

The EUR/USD pair has been experiencing strong bullish momentum over the past few weeks, leading to the creation of an extended bullish leg. However, as with most impulsive moves, the market has left behind imbalances—price inefficiencies where the market moved too quickly without sufficient pullbacks to ensure order fulfillment.

Recently, we have observed a break in bullish structure, signaling a potential shift in momentum. This break suggests that the market may now be in a phase where it seeks to rebalance inefficiencies before deciding its next directional move.

My expectation is that price will first retrace to fill the imbalance zone above, which acts as a supply area, before reversing and targeting the imbalance zones left behind in the bullish rally.

Key Resistance and Market Rejections

A crucial area in this setup is the strong resistance zone (marked in red), which has been rejected twice. Each time price attempted to break through, sellers stepped in, pushing price lower. This level serves as a significant supply zone where institutions may have unfilled sell orders.

With this in mind, the most logical movement for price would be to return to this area, collect liquidity, and then initiate a bearish move.

Imbalance Zones and Market Efficiency

Imbalance zones are areas on the chart where price has moved too quickly, leaving behind inefficiencies. These areas often get revisited later as price seeks to rebalance liquidity.

There are two key imbalance zones in this setup:

The imbalance zone above the current price (first target) – This is the area where price is expected to retrace before reversing.

The imbalance zone below the current price (final target) – Created during the rapid bullish rally, this area remains untested and is likely to be filled once bearish momentum takes over.

These zones are high-probability areas where price is expected to react due to unfulfilled institutional orders.

Break of Bullish Structure & Shift in Momentum

A key element of this trade idea is the break in bullish structure. This break was confirmed when a bearish candle closed below the previous higher low, invalidating the uptrend.

This structural shift suggests that bulls may be losing control, and a deeper retracement is likely before any potential continuation of the overall trend. The break also increases the probability of the lower imbalance zone getting filled before the market makes its next major move.

Trade Execution Plan

Step 1: Identify the Optimal Short Entry

Wait for price to fill the imbalance zone above.

Once confirmation is seen, a short position can be entered.

Step 2: Bearish Move to Lower Imbalance Zone

After rejection from the supply zone, expect price to break lower.

The target for this move will be the imbalance left behind in the bullish rally.

Trailing stop-loss can be used to maximize profits while reducing risk.

Why This Trade Has High Probability

Market Favors Liquidity Grabs – The imbalance zone above is a likely liquidity grab area before the bearish move.

Break in Market Structure – The recent bearish structure break increases the probability of downside continuation.

Historical Resistance Rejection – The resistance zone above has already rejected price twice, indicating strong selling pressure.

Imbalance Fill Below – Price tends to fill inefficiencies left behind in fast-moving markets, making the lower imbalance zone a logical target.

Risk Management Considerations

Stop-loss should be placed slightly above the imbalance zone above to protect against unexpected breakouts.

Take-profit should be set at the lower imbalance zone, allowing for a strong risk-to-reward ratio.

If price breaks past the resistance zone above without rejection, it would invalidate this bearish setup, signaling a reevaluation of market conditions.

Conclusion

This trade idea is based on a smart money concept (SMC) approach, focusing on liquidity grabs, imbalance fills, and structural shifts. If the market follows the expected path, we could see price first push up to fill the imbalance above, reject from that level, and then begin a bearish move to fill the imbalance left in the previous bullish rally.

By patiently waiting for price to reach key areas and confirming rejections, this trade setup provides a high-probability opportunity with a strong risk-to-reward ratio.

__________________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

US500 - Are Bulls Setting Up for a Bullish Push?Overview of Market Structure

The US500 has been trading in a well-defined bearish channel for an extended period, continuously making lower highs and lower lows. This downtrend was respected until recently, when the price broke out of its bearish structure, signaling a potential shift in market sentiment.

Following the breakout, price also breached a key resistance level (marked in red), which had previously acted as a significant supply zone. Now that this resistance has been broken, it may flip into a support level, offering a high-probability area for a bullish continuation.

I expect price to retest this newly-formed support zone before continuing its move upward, targeting the unfilled imbalance zone above (highlighted in green).

Breakout of the Bearish Structure

One of the most important aspects of this setup is the confirmed breakout of the bearish structure. The market was respecting a descending channel, creating lower highs and lower lows. However, with this breakout, price is no longer following the previous downtrend pattern.

A breakout like this often leads to a shift in market direction, meaning buyers are now in control, and the next likely move is bullish continuation.

Resistance Break & Potential Support Retest

The red zone represents a major resistance level that has now been broken. This area had previously rejected price multiple times, showing that sellers were strongly defending it.

Now that price has successfully closed above this level, we can anticipate a retest of this area as new support before price resumes its move higher. This is a classic example of a resistance-turned-support flip, a key concept in technical analysis.

Imbalance Zones & Price Efficiency

An important part of this trade setup is the unfilled imbalance zone above. When price moves too quickly in one direction, it often creates gaps or inefficiencies in the market, which tend to get revisited later.

The unfilled imbalance zone above (highlighted in green) is a key target for this bullish move.

Price is likely to fill this inefficiency after confirming support at the previous resistance level.

Since price action tends to seek out liquidity and inefficiencies, this gives us a clear roadmap for the next likely movement in the market.

Why This Trade Has High Probability

Breakout of Bearish Structure – This suggests a potential shift from a downtrend to an uptrend.

Resistance Turned Support – A classic market structure retest that provides strong confluence for a bullish move.

Imbalance Fill – The market tends to fill inefficiencies left in impulsive moves, making the imbalance zone above a logical target.

Liquidity Grab Potential – Retesting the broken resistance could serve as a liquidity grab before price moves higher.

Conclusion

This setup provides a high-probability long opportunity based on a bearish structure breakout, resistance-turned-support retest, and imbalance fill target. If price follows the expected path, we should see a retest of the red zone before a bullish continuation into the imbalance zone above.

By patiently waiting for price confirmation at key levels, this trade offers a strong risk-to-reward ratio while aligning with smart money concepts and price efficiency principles.

__________________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

TRADE ASSESSMENT: March 23 EuroUSD - LOSSwhen price has made a sweep and is making higher highs on the 15min, look for 1hr FVGs to rebalance. that's your narrative. then look for context and entry. (POC+OTE+FVG)

when price has made a sweep and is making higher highs on the 15min, look for 1hr FVGs to rebalancewhen price has made a sweep and is making higher highs on the 15min, look for 1hr FVGs to rebalancewhen price has made a sweep and is making higher highs on the 15min, look for 1hr FVGs to rebalancewhen price has made a sweep and is making higher highs on the 15min, look for 1hr FVGs to rebalancewhen price has made a sweep and is making higher highs on the 15min, look for 1hr FVGs to rebalancewhen price has made a sweep and is making higher highs on the 15min, look for 1hr FVGs to rebalancewhen price has made a sweep and is making higher highs on the 15min, look for 1hr FVGs to rebalance

My Technical Analysis for $TSLA (Tesla)📊 Technical Analysis: NASDAQ:TSLA (Tesla)

🗓️ Updated: March 24, 2025

🚨 Critical Zone Being Tested

After breaking out of a multi-year symmetrical triangle, NASDAQ:TSLA is now retesting the upper boundary of the pattern — perfectly aligned with the key ACTION ZONE (liquidity zone + long-term MAs).

🔵 ACTION ZONE ($245–265):

High-probability decision area. Holding this level could trigger a fresh bullish leg.

🟣 SWING BOX ($180–210):

If support fails, this is the next logical area for a potential bullish reaction.

🟡 FVG Daily ($75–115):

Unmitigated Fair Value Gap. Only relevant in case of a major breakdown.

📉 SMI (Stochastic Momentum Index):

Currently in negative territory, but nearing oversold — watch for a potential reversal.

🎯 Scenarios:

Bullish: Strong rejection from the Action Zone → potential move to $350–400 ✅

Bearish: Breakdown below the blue zone → eyes on Swing Box or FVG for reentry ⚠️

📌 Reminder: This is not financial advice. Always manage risk and wait for confirmation before entering a trade.

💬 What do you think? Is Tesla preparing for a bounce or heading lower?

👇 Share your thoughts in the comments!

US100 - Testing Key Resistance: Will the 4H Trend Reverse?Market Structure & Trend Overview

The Nasdaq (US100) has been in a 4-hour uptrend, forming a series of higher lows and respecting an ascending channel after a prolonged bearish trend. This structure suggests that buyers are stepping in, and momentum may be shifting in favor of the bulls. However, the index remains at a critical decision point that could determine whether we see a confirmed bullish reversal or a continuation of the larger downtrend.

Key Zone: 4H Imbalance & Resistance Area

Currently, price action is testing a 4-hour imbalance zone, which has already acted as a strong resistance level twice. The market is struggling to break through this supply zone, which is crucial in determining the next major move. If price tests this area again and successfully breaks above it, it could confirm that buyers have gained control, signaling a potential trend reversal back into a bullish phase.

However, if price gets rejected from this level again, it could indicate that sellers are still dominant, increasing the probability of a breakdown from the ascending channel and a resumption of the bearish trend.

Bullish Scenario: Break & Hold Above Imbalance Zone

For a confirmed bullish reversal, Nasdaq must break above the imbalance zone with strong volume and sustain price action above it. A successful breakout could attract more buyers, leading to a push towards higher resistance levels, possibly targeting the $20,000 - $20,300 range in the short term.

Signs to look for in a bullish breakout:

✅ A decisive close above the imbalance zone with strong bullish momentum.

✅ Retesting the broken level as support, confirming it as a new demand zone.

✅ A continuation of higher highs and higher lows after the breakout.

Bearish Scenario: Breakdown of the Ascending Channel

If price fails to break through the imbalance zone and instead rejects for the third time, this could indicate a weakening bullish structure. The key support to watch is the lower boundary of the ascending channel. A confirmed break below this channel could invalidate the short-term uptrend, signaling a return to bearish price action.

If this occurs, Nasdaq could drop towards the key support level at $19,146, a previous liquidity zone where buyers may step in again.

Signs to watch for a bearish breakdown:

❌ A clear rejection from the imbalance zone.

❌ A break and close below the ascending channel.

❌ Increased selling pressure and a shift in market sentiment.

Final Thoughts: A Critical Inflection Point

Nasdaq is at a pivotal moment where the next move will determine the broader trend direction. If bulls can push price above the imbalance zone, we could see a confirmed bullish reversal with upside potential. However, if sellers regain control and force a breakdown of the channel, the downtrend is likely to continue, targeting the $19,146 level as a potential support zone.

Traders should closely monitor price action at the imbalance zone and the ascending channel boundaries, as these key areas will dictate the next major move. Whether we see a trend reversal or continuation, this setup presents significant trading opportunities in either direction.

Key Levels to Watch:

📍 Bullish Breakout Target: $19,900 - $20,000

📍 Bearish Breakdown Target: $19,146

__________________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

Looking for shorts on EUR/USD on pullback from previous EU seshLooking for a retrace, new liq. sweep that will make an nice order block then enter on BOS confirmation. These confluences will give a solid short position with a nice 2R with a good stop buffer and previous session highs. This draw down is result of bad EU news and the US not cutting the interest rates just yet leading to a strong dollar. These shorts will probably not take out the full move on EUR/USD but this pull back and short is highly likely to play out with the end of the week near. Comment below what you think.

Trading GBPUSD | Judas Swing Strategy 18/03/2025Last week, the Judas Swing strategy only gave us 2 setups on FX:AUDUSD , but both hit their targets, locking in a solid 4% gain! Proof that patience and discipline always win in the long run. After these results, we were eager to see how the strategy would perform this week. And sure enough, a setup emerged on FX:GBPUSD on Tuesday! Let’s take you through how this trade played out

On Monday, we scanned our usual currency pairs ( FX:GBPUSD , FX:AUDUSD , FX:EURUSD , OANDA:NZDUSD ) for potential setups, but none met our criteria so we stayed on the sidelines. Then came Tuesday, and a promising setup started taking shape on $GBPUSD. That got us excited and we were eager to see how this trade would unfold!

After liquidity was swept from the lows of our range, our focus shifted to potential buying opportunities. To confirm our bias, we needed to see a break of structure to the upside before committing to the trade. Twenty-five minutes later, we got a break of structure to the upside, confirming our bias. This move left behind a Fair Value Gap (FVG), signaling an inefficiency in pricing. We now anticipate a retracement to fill this imbalance once that happens, we'll be ready to enter the trade

The next five minute candle entered and closed in the imbalance which meant we could execute our trade using 1% of our trading account and aiming for a 2% return, ensuring our winners outweigh our losers. With this strategy maintaining a win rate of around 50%, sticking to it consistently positions us for long-term profitability

After executing the trade, we faced a deep drawdown, a moment where many traders who over-leverage might panic as price edged closer to the stop loss. But we remained unfazed. Why? Because we only risked what we could afford to lose, staying disciplined and accepting whatever outcome the trade would bring—win or lose.

Upon checking the trade once again, we noticed price had turned around and begun moving in our intended direction which was good to see but the objective had not been met so we had to be patient and wait for the final outcome of the trade

After 3 hours and 15 minutes, our FX:GBPUSD trade finally hit take profit, securing a 2% gain so far this week, all from a well-managed 1% risk

Bitcoin - Price Action Heating Up, Will Bulls Take Over?Bitcoin is at a pivotal moment on the 4-hour timeframe, and the next few moves could dictate whether we see a strong breakout or a potential reversal. Let’s break down what’s happening in the market right now.

📌 Rejections at the 4H Imbalance Zone

BTC has tested the 4-hour imbalance zone twice already but hasn’t managed to break through. This area, highlighted in blue on the chart, represents a key resistance level where sellers have stepped in to push the price down.

Every time price approaches this zone, we see wicks and rejections, indicating that there is still supply here. However, the more times a resistance level is tested, the weaker it tends to become. If bulls gain enough momentum, we could see a breakout.

📈 Higher Lows Suggest Bullish Potential

One of the most notable signs in Bitcoin’s price action is the formation of higher lows. This suggests that buyers are stepping in at higher price points, absorbing sell pressure and pushing the price upwards.

This pattern is generally a bullish signal, as it shows that demand is increasing, and sellers are losing control. As long as BTC continues to make higher lows and hold structure, the probability of a breakout to the upside increases.

🔥 Bullish Breakout Scenario – Target $91K

If Bitcoin can break through the imbalance zone with strong volume, this would likely signal the start of another leg up. A confirmed breakout and retest of this zone as support would give additional confidence in the move.

In this case, BTC could rally toward $91,000, which is the next significant resistance level based on previous price action.

⚠️ Bearish Rejection Scenario – Drop to $75K

However, if BTC fails once again to break through this imbalance zone and gets rejected, it could lead to a shift in market structure. The key level to watch will be the higher low trendline.

If price breaks below the most recent higher low, it would indicate that bullish momentum is fading and that sellers are taking over. This breakdown could send Bitcoin toward $75,000, which is a key demand zone where buyers may look to step in.

🔎 Final Thoughts – Key Levels to Watch

A break above the imbalance zone and confirmation of support could lead to $91K.

A rejection followed by a lower low could lead to a decline toward $75K.

Pay attention to volume on the breakout or breakdown—strong volume will confirm the move.

Bitcoin is at a critical point, and the next few days will determine the trend!

__________________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

Short on EUR/USD as order block is now being formedWe have a liquidity sweep and order block forming on the upside. As we look for the break below equilibrium and a full break of structure we will short and target previous lower levels of liquidity. Keep in mind news is strong this week with FOMC on wed. and Unemployment on Thur.

Trading AUDUSD | Judas Swing Strategy 07/03/2025Last week was a slow one for the Judas Swing strategy, with barely any setups presenting themselves. Throughout the week, we closely monitored the currency pairs we trade ( FX:EURUSD , FX:GBPUSD , OANDA:AUDUSD , and OANDA:NZDUSD ) scouting for setups with the Judas swing strategy. After days of waiting, a promising opportunity finally emerged on $AUDUSD. In this write-up, we’ll take you through the details of how this trade unfolded.

We arrived at our trading desk five minutes before our trading session began and immediately started looking for potential setups. After 35 minutes, we saw a sweep of liquidity at the lows of $AUDUSD. The next requirement on our checklist was to wait for a break of structure (BOS) to the buy side to confirm our bias. An hour later, the BOS finally occurred, leaving us with just one last condition to fulfill before executing our trade.

We saw a retrace into the Fair Value Gap (FVG), completing all the criteria on our entry checklist. With our conditions met, we executed the trade with the following parameters:

Entry: 0.63024

Stop Loss (SL): 0.62822

Take Profit (TP): 0.83431

After executing the trade, we were in profit for a few minutes before price reversed, putting us in deep drawdown. But did this phase us? Not at all. Why? Because we had risked only 1% of our trading account an amount we were fully prepared to lose. This meant that regardless of the trade’s outcome, it wouldn’t affect us emotionally or disrupt our trading mindset.

This is exactly how we want you, as traders, to approach the market. When you risk only what you can afford to lose, you protect yourself psychologically, avoid unnecessary emotional stress, and create the foundation for long term success. Trading with this mindset will allow you to stay disciplined, make rational decisions, and ultimately see better results

When we checked on the trade again, we saw that we were back in profit. We didn’t let this affect our mindset because our objective for this trade had not yet been met. Instead of getting caught up in temporary gains, we remained patient and focused, waiting for the trade to play out fully

Unfortunately, we had to hold this trade longer than expected as we waited for the final outcome. This time our patience didn’t pay off, and our OANDA:AUDUSD trade ended in a loss.

Some of you may be wondering why did we hold for so long? Based on our backtesting data, the odds are in our favor when we take a set-and-forget approach rather than actively managing the trade by moving stops to breakeven after reaching 1R or taking partial profits. We have a system, and we followed it. Our data has shown that sticking to this strategy yields better results over time. As traders, we encourage you to remain disciplined and trust your system. No matter the outcome of a single trade, staying committed to your plan is a win in itself

Fair Value Gaps vs Liquidity Voids in TradingFair Value Gaps vs Liquidity Voids in Trading

Understanding fair value gaps and liquidity voids is essential for traders seeking to navigate the complexities of the financial markets. These concepts, deeply rooted in the Smart Money Concept (SMC), provide valuable insights into the dynamics of supply and demand, helping to identify potential price movements. In this article, we’ll delve into both ideas, exploring their characteristics, differences, and use in trading.

Fair Value Gap (FVG) Meaning in Trading

A fair value gap, also known as an imbalance or FVG, is a crucial idea in Smart Money Concept that sheds light on the dynamics of supply and demand for a particular asset. This phenomenon occurs when there is a significant disparity between the number of buy and sell orders for an asset. They occur across all asset types, from forex and commodities to stocks and crypto*.

Essentially, a fair value gap in trading highlights a moment where the market consensus leans heavily towards either buying or selling but finds insufficient counter orders to match this enthusiasm. On a chart, this typically looks like a large candle that hasn’t yet been traded back through.

Specifically, a fair value gap is a three-candle pattern; the middle candle, or second candle, features a strong move in a given direction and is the most important, while the first and third candles represent the boundaries of the pattern. Once the third candle closes, the fair value gap is formed. There should be a distance between the wicks of the first and third candles.

Fair value gaps, like gaps in stocks, are often “filled” or traded back through at some point in the future. They represent areas of minimal resistance; there is little trading activity in these areas (compared to a horizontal range). Therefore, they are likely to be traded through with relative ease as price gravitates towards an area of support or resistance.

Liquidity Void Meaning in Trading

Liquidity voids in trading represent significant, abrupt price movements between two levels on a chart without the usual gradual trading activity in between. These are essentially larger and more substantial versions of fair value gaps, often encompassing multiple candles and FVGs, indicating a more pronounced imbalance between buy and sell orders.

While FVGs occur frequently and reflect the day-to-day shifts in market sentiment, liquidity voids signal a rapid repricing of an asset, typically following significant market events (though not always).

These voids are visual representations of moments when the market experiences a temporary absence of balance between buyers and sellers. This imbalance leads to a sharp move as the market seeks a new equilibrium price level. Such occurrences are not limited to specific times; they can happen after major news releases, during off-market hours, or following large institutional trades that significantly move the market with a single order.

Liquidity voids are especially noteworthy on trading charts due to their appearance as particularly sharp moves. Though they appear across all timeframes, they’re most obvious following major news events when the market rapidly adjusts to new information, creating opportunities and challenges for traders navigating these shifts.

Fair Value Gap vs Liquidity Void

Fair value gaps and liquidity voids are effectively the same thing in practice; a fair value gap is simply a shorter-term liquidity void. Both indicate moments of significant imbalance between supply and demand. At the heart of both phenomena is a situation where one significantly outweighs the other, leading to strong market movements with minimal consolidation. The distinction between them often comes down to scale and timeframe.

An FVG is typically identified by a specific three-candle pattern on a chart, signalling a discrete imbalance in order volume that prompts a quick price adjustment. These gaps reflect moments where the market sentiment strongly leans towards buying or selling yet lacks the opposite orders to maintain price stability.

Liquidity voids, on the other hand, represent more pronounced movements in a given direction, often visible as substantial price jumps or drops. They can encompass multiple FVGs and extend over larger portions of the chart, showcasing a significant repricing of an asset.

This distinction becomes particularly relevant when considering the timeframe of analysis; what appears as a series of FVGs on a lower timeframe can be interpreted as a liquidity void. On a higher timeframe, this liquidity void may appear as a singular fair value gap. This can be seen in the fair value gap example above.

For traders, it’s more practical to realise that both FVGs and liquidity voids highlight a key market phenomenon: when a notable supply and demand imbalance occurs, it tends to create a vacuum that the market is likely to fill at some future point. Therefore, it’s important to recognise that both these types of imbalances can act as potential indicators of future price movement back towards these unfilled spaces.

Trading Fair Value Gaps and Liquidity Voids

Trading strategies that leverage fair value gaps and liquidity voids require a nuanced approach, as these concepts alone may not suffice for a robust trading strategy. However, when integrated with other aspects of the Smart Money Concept, such as order blocks and breaks of structure, they can contribute significantly to a comprehensive market analysis framework.

Primarily, both FVGs and liquidity voids signal potential areas through which the price is likely to move rapidly to reach more significant zones of trading activity, such as order blocks or key levels of support and resistance.

This insight suggests that initiating positions directly within an FVG or a liquidity void may not be effective due to the high likelihood of the price moving swiftly through these areas. Instead, traders might find it more strategic to wait for the price to reach areas where historical trading activity reflects stronger levels of buy or sell interest.

Additionally, these market phenomena can inform the setting of price targets. If there is an FVG or liquidity void situated before a key area of interest, targeting the zone beyond the gap—where substantial trading activity is expected—could prove more effective than aiming for a point within the gap itself.

It's also useful to note the relative significance of these features when they appear on the same timeframe. An FVG, being generally smaller and indicating a discrete order imbalance, is more likely to be filled before a liquidity void. This is because liquidity voids represent more considerable and pronounced market movements that can set market direction, marking them as less likely to be filled within a short space of time.

Limitations of Fair Value Gaps and Liquidity Voids

While fair value gap trading strategies and the analysis of liquidity voids offer insightful approaches to understanding market dynamics, they come with inherent limitations that traders need to consider:

- Market Volatility: High volatility can unpredictably affect the filling of fair value gaps and liquidity voids, sometimes leading to incorrect analysis or false signals.

- Timeframe Relativity: The significance and potential impact of gaps and voids can vary greatly across different timeframes, complicating analysis.

- Incomplete Picture: Relying solely on these phenomena for trading decisions may result in an incomplete market analysis, as they do not account for all influencing factors.

- Expectations: There is no guarantee that a FVG/void will be filled soon or at any point in the near future.

The Bottom Line

As we conclude, it's essential to remember that while fair value gap and liquidity void strategies provide valuable insights, they’re part of a broader spectrum of SMC tools available to traders. They’re best combined with other analytical techniques to form a comprehensive approach to trading.

For those looking to delve deeper into trading strategies and enhance their market understanding, opening an FXOpen account can be a step toward accessing a wide array of resources and tools designed to support your trading journey.

FAQs

What Is a Fair Value Gap?

A fair value gap occurs when there's a significant difference between the buy and sell orders for an asset, indicating an imbalance that can influence market prices.

What Are Fair Value Gaps in Trading?

In trading, fair value gaps reflect moments where market sentiment strongly favours either buying or selling, creating potential price movement opportunities.

What Is the Difference Between a Fair Value Gap and a Liquidity Void?

The main difference lies in their scale: a fair value gap is typically a smaller, discrete occurrence, while a liquidity void represents a larger, more pronounced price movement.

How to Find Fair Value Gaps?

Traders identify fair value gaps by analysing trading charts for areas where rapid price movements have occurred. A FVG consists of three candles, where the second one is the largest and the first and third serve as barriers. The idea of the FVG is that it leads to a potential retracement to fill the gap in the future.

Is a Fair Value Gap the Same as an Imbalance?

Yes, a fair value gap is the same as an imbalance in the Smart Money Concept.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

EURUSD - Bulls vs Bears – Price levels to watch out for!🌍 Market Overview:

Currently, EURUSD is showing strength as the US dollar is experiencing bearish pressure, influenced by the recent news regarding tariffs imposed on certain goods. The new tariffs, aimed at curbing certain imports, have created uncertainty around the dollar's stability. This macroeconomic development is creating a favorable environment for the euro, pushing the pair higher as investors seek alternatives to the weakening USD.

Additionally, the broader economic landscape supports euro strength, with improving Eurozone economic data and a more stable inflation outlook compared to the US. These factors have contributed to the recent bullish momentum seen on EURUSD.

📈 Technical Overview:

After a significant bullish move, the market appears to be overextended, signaling that a cooldown might be imminent. The rapid price increase left behind several imbalances that need to be filled for the market to maintain a healthy structure. When price moves in one direction without much pullback, it often creates inefficiencies or gaps in the order flow that the market tends to fill before continuing the primary trend.

Looking at the Fibonacci retracement levels, the 0.382 level aligns with a minor zone of interest, but the more significant confluence lies between the 0.618 - 0.65 Fibonacci retracement levels. This zone is often referred to as the golden pocket, where price typically reacts during corrections in trending markets. Furthermore, this retracement zone perfectly overlaps with the strong past resistance zone that is now expected to act as support.

🔍 Expected Move:

The expectation is that EURUSD will first tap into the higher supply zone marked in the chart before initiating a corrective move to the downside. The supply zone represents an area where institutional selling pressure could be present, causing a rejection to the downside. The corrective move is anticipated to fill the imbalances left behind during the bullish rally, making the price action healthier and more sustainable in the long run.

The anticipated pullback is likely to target the 1.05000 - 1.06000 area, aligning with the golden pocket and strong support level. This zone offers a high probability for a bullish reaction, making it an ideal point for potential buy entries.

🔑 Key Confluences for the Target Zone:

Golden Pocket Level: This Fibonacci retracement area is a high-probability zone for price reversals in trending markets.

Past Resistance Turned Support: The strong resistance zone that was broken during the bullish rally is expected to act as a support on the way down, offering further confluence for buy entries.

Imbalance Filling: The fast price movement left inefficiencies in the market that are likely to be filled during the retracement, contributing to a healthier market structure.

Psychological Levels: The 1.05000 level is a round number that often acts as psychological support in the market, further increasing the likelihood of a bullish reaction.

Market Sentiment: Bearish USD sentiment caused by recent tariffs and economic uncertainty provides a supportive backdrop for the euro, aligning with the technical setup.

📝 Trade Idea Summary:

Wait for a tap into the higher imbalance zone before considering short positions.

Target the 1.05400 - 1.05000 zone for partial profits.

Watch price action around the golden pocket and past resistance level for potential bullish reactions.

Confirm the trade idea with lower time frame structure shifts before entering.

Monitor economic news related to US tariffs and Eurozone economic releases to align with the technical analysis.

Better overview:

⚠️ Risk Management:

Use a stop loss above the imbalance zone for short entries to limit risk.

Consider scaling into long positions at the golden pocket zone with a tight stop below the 1.04800 level.

Aim for a 2:1 or 3:1 risk-to-reward ratio to maintain a favorable trade setup.

This trade idea combines technical analysis with market fundamentals to anticipate the next potential EURUSD move. By aligning multiple confluences, the setup offers a high-probability opportunity for both short-term and medium-term traders.

__________________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

Possible NQ Bounce Starting Monday 3/10/25Monday and the rest of the coming week could be the start of the NQ making a bounce. If not, it's look out below with a break of 20,000 going to 19,000 rather quickly. Price will dictate how we go but a good bounce is not out of the question. Watch the video for more details.

Feel free to leave your comments.

Thanks for watching.