FXAN & Heikin Ashi Trade IdeaOANDA:NZDUSD

In this video, I’ll be sharing my analysis of NZDUSD, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

Fxsignals

NZDJPY: Best Gap to Trade Today?! 🇳🇿🇯🇵

Among various gap openings that we see today,

the one that I spotted on NZDJPY looks like one of the best to trade.

I see multiple bullish imbalances on an hourly time frame

after a formation of the gap down opening.

Probabilities are high that it will be filled soon.

Goal - 82.15

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

FXAN & Heikin Ashi Trade IdeaOANDA:AUDUSD

In this video, I’ll be sharing my analysis of AUDUSD, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

FXAN & Heikin Ashi Trade IdeaOANDA:AUDNZD

In this video, I’ll be sharing my analysis of AUDNZD, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

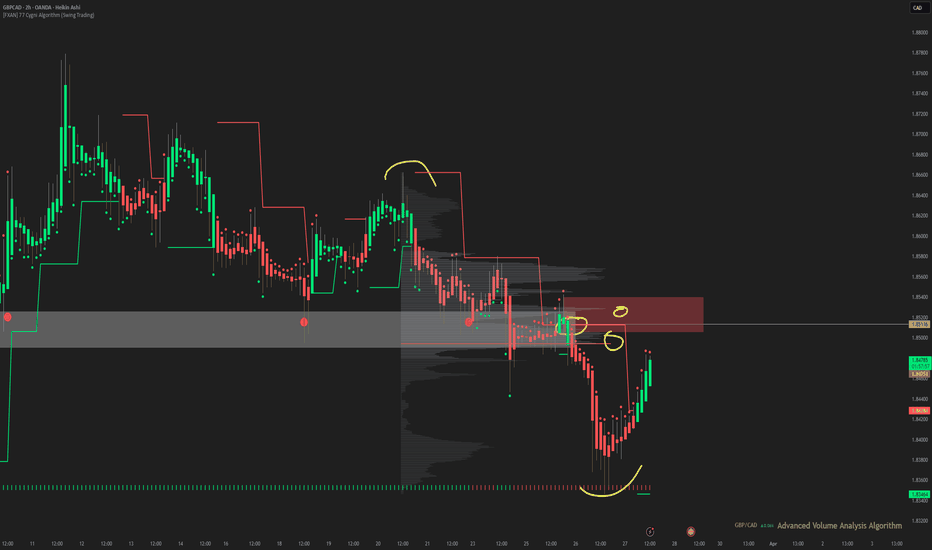

FXAN & Heikin Ashi Trade IdeaOANDA:GBPCAD

In this video, I’ll be sharing my analysis of GBPCAD, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

FXAN & Heikin Ashi Trade IdeaOANDA:USDCHF

In this video, I’ll be sharing my analysis of USDCHF, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

USDJPY; Heikin Ashi Trade IdeaOANDA:USDJPY

In this video, I’ll be sharing my analysis of USDJPY, using my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

Bearish thesis for GOLD for the weekend XAU had been on a steady Bullish Run , Rightfully so.

if any asset deserves to appreciate in its price while doing the most amount of Good, its GOLD

But we traders , look for technical opportunities

that's where this trade idea comes in.

- Gold is pressuring its recent range with limited bullish strength

- also its its most popular cross - USD gaining substantial momentum the last 2 Quarters can make room for a correction before the trend continues to the upside.

therefore falling back on pure technical calculations leads us back to our excel sheets for daily range projections which put our range to be exactly 1.03% or 3034 /303* pips depending your brokerage metrics.

which leads me to make this 1:4 Trade idea for this week.

cheers.

CADCHF; Heikin Ashi Trade IdeaOANDA:CADCHF

In this video, I’ll be sharing my analysis of CADCHF, using my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

super R:R Bullish Thesis for USD/CHFSNB reduced its policy rate by 50 BIPS

As US introduced new tariffs on multiple countries

BOA adviced US CORPs to increase their Hedges

which all Translates to a Bullish outlook for USDCHF.

simple ADR calculations for the last 5 yrs deduces to the TP i marked.

if you read down this far ,

i am trying to make a signal service

please let me know if i should elaborate like a blog story or keep the analysis short and straight to the point like this.

feel free to reach out.

Bearish thesis for GBPNZD UK had some super inflation just in this Q1 2025 rose to 3%

Q4 24 was 2.5%

NZD eased inflation to 2.2 % in SEP2024

which technically did not fully satisfy the momentum on price.

but gave us enough for making projections which puts us on ADR numbers to 137 pips.

Given the bearish outlook and the Q1 ends with this month

i gave such tight SL in the trade idea.

Bearish thesis for Gold This week.I am trading this range currently Long for the day but looking forward to SELL with eventual TP @ 2885.15

as USD has appreciated due to anticipated fiscal policies, tax cuts

and

positive US tresury yeilds can show bearish impact on non yeilding assets like XAU.

Also, the opposite momentum from the crypto correction from the last 2 weeks as the base pair for any /all crypto in the end is USD anyways directly or indirectly

dictates a 1% move will probably be filled within this week.

which drives such tight forecast.

bearish thesis for the week for NZD/JPYBased on my projections of my watchlist a range of 83 pips must be honored within this week ,

(Range projection based on last 5 yrs)

as BoJ is increasing rates by 0.5%

And

Japan accounts for 6.3% of NZD total exports

therefore widening rate gap nzd/jpy faces downward pressure

and taking TA into perspective , we can take advantage by selling for exactly 0.12% or 83 pips.

Usdjpy sell zoneThis is a USD/JPY (U.S. Dollar/Japanese Yen) 1-hour timeframe technical analysis from FXCM, indicating a sell trade setup with the following details:

1. Resistance Level: Identified around 149.546, marked in yellow. This is the level where price is expected to face selling pressure.

2. Entry Point: Around 148.990, which aligns with a key resistance zone.

3. Target Level: 147.459, representing the expected price drop where traders may take profit.

4. Market Outlook: The analysis suggests a bearish setup, expecting price rejection from the resistance zone and a downward move toward the support level.

5. Price Action Strategy: The price is likely to consolidate near resistance before making a decisive move downward.

This setup signals a potential short (sell) opportunity, anticipating that USD/JPY will decline after hitting resistance, making it favorable for sellers.

EURNZD: Massive Breakout 🇪🇺🇳🇿

EURNZD violated a huge resistance cluster and closed above that.

The next key level is 1.8765.

I will look for a pullback/little correction to buy then, expecting a rise.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP/USD March 2025 Technical Outlook: Bearish Pressure below 200What do you think about GBPUSD

It has broke the trend and in my observation it will be more downward

**Trend Direction (EMA 200):**

- The price (1.25756) is trading **below** the 200-period Exponential Moving Average (EMA), suggesting a **bearish bias**. The EMA likely acts as dynamic resistance near 1.26131 or higher, reinforcing the downtrend.

**Critical Levels:**

- **Resistance Levels:**

- Immediate: **1.26131** (likely the 200 EMA level).

- Stronger: **1.2689** (key swing high).

- **Support Levels:**

- Near-term: **1.25000** (psychological round number).

- Lower: **1.24215** and **1.24000** (next targets if bearish momentum continues).

AUDUSD: One More Bullish Wave Ahead 🇦🇺🇺🇸

I strongly believe that AUDUSD will resume growth soon.

2 recent strong bullish breakouts of key resistances on a daily

confirm the strength of a current uptrend.

The price is going to reach 0.642 resistance soon.

❤️Please, support my work with like, thank you!❤️

EURAUD: Important Breakout 🇪🇺 🇦🇺

EURAUD successfully violated a support line of a wide horizontal

range on a daily time frame.

We see a positive bearish reaction to that after the market opening today.

With a high probability, the market is going to drop at least to 1.64 support.

❤️Please, support my work with like, thank you!❤️