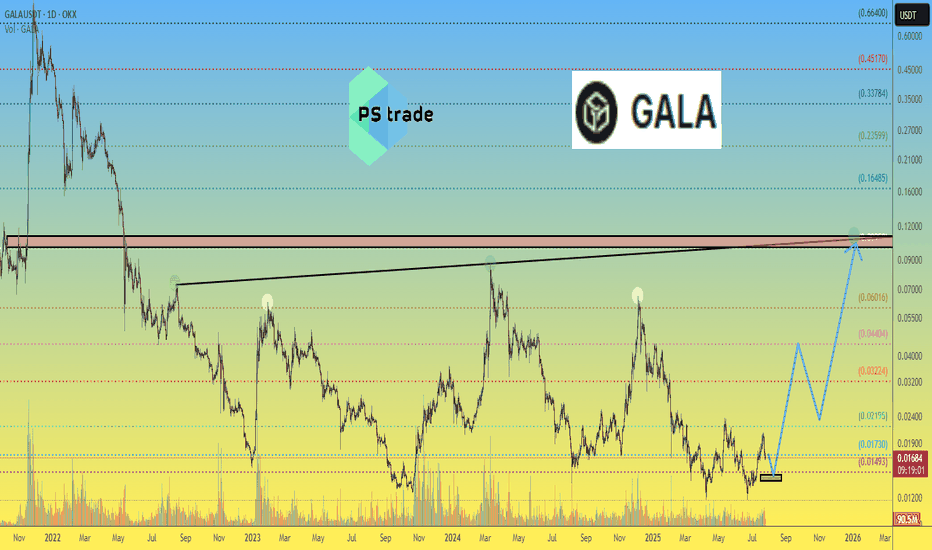

GALA price analysis🪙 Please tell us, is the #GALA project still "alive"?

It's old, has gone through many cycles on the crypto market, and hasn't died yet.

Maybe now (being related to the CRYPTOCAP:ETH Ecosystem) is the best time to “come back to life”?

For this to happen, the price of OKX:GALAUSDT must finally:

1️⃣ confidently hold above $0.01390-0.01460

2️⃣ continue to grow confidently to $0.044

3️⃣ And finally, rapidly grow to $0.10-0.11 by the end of the year.

Is this a realistic scenario? Write your thoughts in the comments.

GALAUSDT

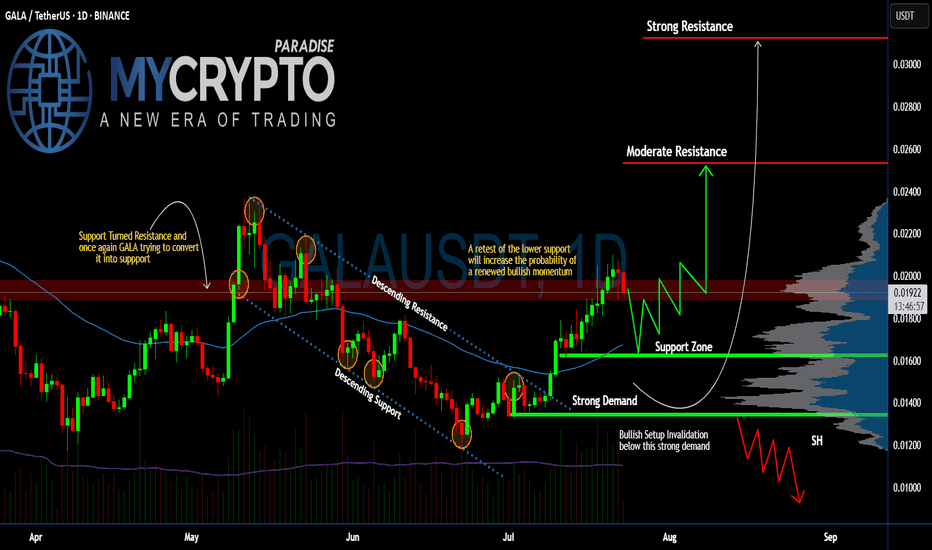

Can #GALA Sustain the Current Bullish Momentum or Will it Fall?Yello, Paradisers! Is this #GALA pullback just a healthy retest before another explosive rally, or are we about to see a deeper drop that will wipe out impatient bulls? Let’s break it down:

💎After weeks of trading inside a descending channel, #GALAUSDT finally broke above the descending resistance, sparking renewed bullish momentum. The breakout has pushed the price toward the $0.020 zone, but now #GALA has encountered a resistance zone (previously support). The question remains: will GALA maintain this level or revisit lower supports before proceeding higher?

💎The current structure shows #GALAUSD attempting to convert its previous resistance into new support around $0.018–$0.020. A clean retest of this support zone would significantly increase the probability of a sustained bullish continuation. The 50EMA acting as support and positive macro trend in crypto market reinforces our bullish bias.

💎If buyers remain in control, the first upside target is the moderate resistance at $0.0253. However, the major profit-taking and strong selling pressure are expected near the $0.0312 zone, where the strongest resistance lies. A successful break and hold above this level would confirm a more aggressive bullish trend.

💎On the flip side, the bullish setup becomes invalid if #GALA loses the strong demand zone at $0.0162–$0.0134. A confirmed close below $0.0134 would flip the structure bearish and open the door for another leg down.

Stay patient, Paradisers. Let the breakout confirm, and only then do we strike with conviction.

MyCryptoParadise

iFeel the success🌴

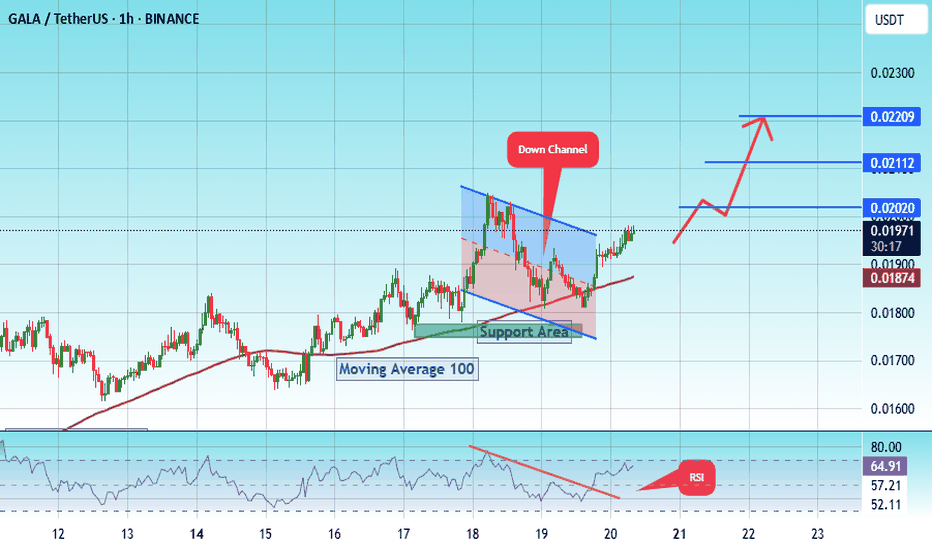

#GALA/USDT Gala bull run possible ?#GALA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel at 0.01750.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.01770, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.01975

First target: 0.02020

Second target: 0.02112

Third target: 0.02210

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#GALA/USDT Gala bull run possible ?#GALA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is poised to break it strongly upwards and retest it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.01630.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a key support area (in green) at 0.01590, which represents a strong basis for the upside.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.01711

First target: 0.01763

Second target: 0.01812

Third target: 0.01874

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

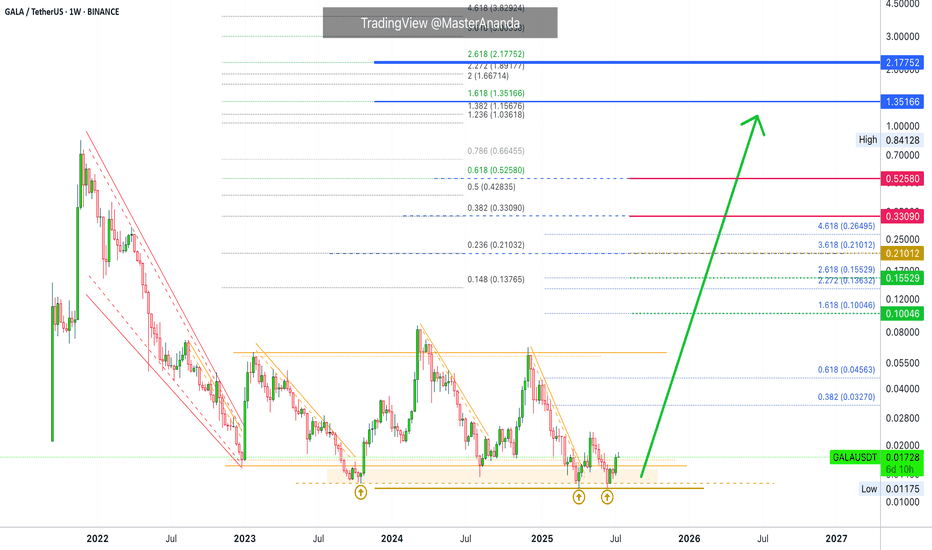

Gala Games · Let's Talk All-Time High & Potential TargetsThe truth is that a new all-time high is just us being optimistic. The truth is that there is not enough data for us to make such a prediction. The altcoins market is turning out to be super strong, Bitcoin is doing great and we expect amazing growth, but I cannot say that a new all-time high is a certainty on this chart, there is simply not enough data. I can't rule it out either, so that's the situation in which we find ourselves.

The next question: Can we make an educated guess based on the data that's available?

Yes! Absolutely.

» Standard projections based on mid-range price action opens up high probability targets around 0.10, 0.15 and 0.21.

» Long-term projections based on the previous cycle (2021-2022) gives us a minimum target of 0.33 and 0.52.

» A great bull market opens up 1.35 and 2.17. But even these numbers can be tricky because we are putting limitations on something that has no limits.

The way we extract these numbers is based on past action, the way the market works is based on present day events and what the future holds. Present day and the future are much different to the conditions we had just a few years ago. Just a few months ago (last year) the market was in such a different situation. A certain group of people whom I won't mention were trying to shutdown the market through capricious lawsuits and abuse of power, today, the market is fully encouraged to grow. This type of development is what can make the difference between a standard high and a major new all-time high. I would aim high just to be on the safe side.

The top will not be over in an hour or days. It can take weeks, sometimes even months. There is also the double-top possibility or in the least, the dead-cat bounce, lower high after the final peak. That is, there will be plenty of time to sell. We just need to become very alert, wise and active when the action is happening around major resistance zones.

We can tell if the top is in by tracking the rest of the market. I will be here sharing charts.

The market will decide, we can only speculate. With that said, we know we are going way beyond the standard and the minimum, the Cryptocurrency market is already doing great. Expect maximum growth; hope for the best, prepare for the best.

Namaste.

#GALA/USDT#GALA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is poised to break it strongly upwards and retest it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.01340.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

There is a key support area in green at 0.01320, which represents a strong basis for the upward trend.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.01430

First target: 0.01465

Second target: 0.01500

Third target: 0.01533

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#GALA/USDT#GALA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is poised to break it strongly upwards and retest it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.01340.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

There is a key support area in green at 0.01320, which represents a strong basis for the upward trend.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.01430

First target: 0.01465

Second target: 0.01500

Third target: 0.01533

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

GALA/USDT | Testing Critical Historical Support – Rebound?🧠 Full & Professional Analysis:

GALA/USDT is currently sitting at a critical inflection point on the weekly timeframe. The price has returned to a major historical demand zone between $0.01200 – $0.01400, which has served as a strong support base for over a year.

This level has repeatedly acted as a launchpad for rallies since early 2023, making it a high-interest area for long-term investors and swing traders.

🔍 Key Technical Structure & Zones:

🟨 Major Weekly Support Zone:

$0.01200 – $0.01400 → A historically proven demand zone that has held multiple times. A stronghold for buyers, and a potential accumulation base.

🟦 Layered Resistance Zones (If Rebound Occurs):

$0.02176 → First minor resistance; initial confirmation of a bullish reversal.

$0.03432 → Mid-range resistance within current consolidation.

$0.06044 → Key breakout level to shift trend structure.

$0.11093 – $0.18485 → Medium-term targets if bullish momentum builds.

$0.26464 to $0.72473 → Historical distribution zones if full recovery unfolds.

🟥 Bearish Risk Zone (Breakdown Scenario):

Break below $0.01200 opens downside risk toward the all-time low at $0.00571, or even lower if sentiment worsens.

✅ Bullish Scenario:

If the $0.01200–$0.01400 support holds:

1. A bullish engulfing candle on the weekly chart could be an early reversal signal.

2. Potential formation of a double bottom in this demand zone (yet to be confirmed).

3. Initial target at $0.02176, with possible extension toward $0.06044—a major pivot zone.

4. Sustained buying and volume confirmation could push GALA toward $0.110 – $0.184 in the mid-term.

❌ Bearish Scenario:

If the price fails to hold above $0.01200:

1. A breakdown may trigger a capitulation move to the $0.00700 – $0.00571 range (historical lows).

2. This would invalidate the current sideways base structure and extend the downtrend.

3. Lack of buying interest could open the door to deeper losses.

📐 Pattern & Technical Context:

Accumulation Base Formation: Still possible if support holds and buyers step in.

Tight Range Compression: Price is coiling at the bottom, indicating a potential breakout move soon.

No major reversal patterns confirmed yet, such as Inverse H&S or W-bottom, but structure suggests accumulation pressure.

🧭 Summary:

> GALA is dancing on the edge of a crucial support level. The price action in this zone will likely determine the next major direction. A bounce could ignite a multi-week rally, while a breakdown may send the asset to new lows. Volume and weekly close will be key confirmation points.

📊 Recommendations:

Swing Traders: Watch for bullish candle patterns and breakout above $0.02176.

Long-Term Investors: Consider conservative accumulation in the support zone with clear risk management.

Bearish Traders: Wait for confirmed weekly close below $0.012 before considering short setups.

#GALA #GALAUSDT #CryptoTA #AltcoinAnalysis #WeeklyChart #BullishSetup #BearishScenario #TechnicalAnalysis #AccumulationZone #BreakoutWatch

#GALA/USDT Gala bull run possible ?

#GALA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel, this support at 0.0600.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward move.

There is a key support area in green at 0.01312, which represents a strong basis for the upward move.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.01360

First target: 0.01412

Second target: 0.01450

Third target: 0.01500

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

GALA/USDT - 4HR TIME FRAME - BULLISH!!This chart illustrates a bullish reversal setup using Elliott Wave Theory, Fibonacci retracement levels, and RSI divergence. Here's a detailed breakdown:

📉 Elliott Wave Count:

The chart shows a complete 5-wave impulse down labeled (1) to (5), suggesting a potential end of a bearish trend.

Wave (5) appears to have just completed, indicating a possible reversal point.

🔍 Falling Wedge Pattern:

A falling wedge is visible between waves (4) and (5), which is typically a bullish reversal pattern.

Price is near the wedge’s apex, hinting at an imminent breakout.

🟡 Strong Demand Zone:

Price is currently inside a yellow demand zone (roughly $0.0136 to $0.0144).

This zone coincides with the 0.786 Fibonacci retracement level at $0.01363, a common reversal level.

📊 RSI Indicator:

The RSI at the bottom shows a bullish divergence:

Price made a lower low, while RSI made a higher low.

This signals weakening bearish momentum and potential upside ahead.

🧠 Summary:

This is a technically sound bullish setup, suggesting a bottoming structure and an upcoming uptrend. The confluence of Elliott Wave completion, wedge breakout, RSI divergence, and Fibonacci support all point to a strong reversal probability.

#GALA/USDT#GALA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.01477.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading towards stability above the 100 Moving Average.

Entry price: 0.01550

First target: 0.01582

Second target: 0.01627

Third target: 0.01682

#GALA/USDT#GALA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel, this support at 0.01560.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.01666

First target: 0.01760

Second target: 0.01835

Third target: 0.01935

#GALA/USDT#GALA

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.01940, acting as strong support from which the price can rebound.

Entry price: 0.02042

First target: 0.02101

Second target: 0.02193

Third target: 0.02300

GALAUSDT📢 Crypto Signal – GALAUSDT 1-Hour TF

🖨️ Let the Chart Print Smart Money

Bullish divergence formed earlier, and price is now prepping a breakout. 📈 Buy Stop at 0.02078 catches the move with momentum confirmation.

🎯 Trade Setup

🛑 SL: 0.01904

🎯 TP1 (1:1): 0.02254

🎯 TP2 (1:2): 0.02426

📊 Bull Score: 2 vs 0

(✅ Bullish Divergence, ✅ Breakout Setup)

💰 Clear setup. Clean risk. Smart profits. 🟢📊🚀

Forecast for #GALAUSDT📉 Forecast for BYBIT:GALAUSDT.P (1H TF)

🕒 Current Situation: The price is in a key decision zone near POC $0.01851, consolidating after a breakout from the Falling Wedge pattern.

➡️ The direction depends on the reaction to this area.

✅ Overview:

➡️ A Triple Bottom (Bottom 1-2-3) pattern is visible — a bullish signal.

➡️ Price broke out of the wedge and is now retesting.

➡️ Two scenarios remain: LONG if support holds or SHORT if it breaks.

📢 Bullish sign: candle wicks down + rising volume on bounce.

🧭 Watch price action and volume near $0.0185–0.0190.

************************

📈 LONG SCENARIO - Conditions: Holding above $0.0190

Entry: BYBIT:GALAUSDT.P from $0.02020

🛡 Stop loss: $0.01986

🎯 TP Targets:

💎 TP 1: $0.02040

💎 TP 2: $0.02065

💎 TP 3: $0.02085

📍 Confirming bullish strength after wedge breakout.

**************************

📉 SHORT SCENARIO - Conditions: Break and close below $0.0185

Entry: BYBIT:GALAUSDT.P from $0.01800

🛡 Stop loss: $0.01825

🎯 TP Targets:

💎 TP 1: $0.01784

💎 TP 2: $0.01766

💎 TP 3: $0.01756

📢 Confirmation: high volume + multiple closes below POC.

⚠️ Losing $0.0185 reactivates the bearish structure toward $0.01700.

🚀 Conclusion: We are in a decision zone.

📍 Hold above POC = bullish setup.

📍 Breakdown = bearish setup.

📢 Wait for confirmation with volume and price reaction BYBIT:GALAUSDT.P

#GALA/USDT#GALA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.02226.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.02232

First target: 0.02308

Second target: 0.02380

Third target: 0.02471

Gala Games Update: Looking—Still Bottom Prices—Good!Gala Games, we looked at it recently, just a month ago. Nothing changes but one small detail, there is a strong bullish breakout from the buy zone.

This weekly candle is full green. GALAUSDT lasted a total of four weeks in the buy zone after the All-Time Low. Leading to the ATL, four more weeks the action happened around this level. So total is 8 weeks, minimum for you to buy at bottom prices. With the action we are seeing now, these prices are now gone forever, but there is good news. It is still early.

The chart is very clear. Actually, we can change/extend the buy zone to include current prices. For example, the buy zone we identified a month ago was the green box on the chart. Now, I drew a new box, blue, and this can be our new buy zone. Since it is still early and Gala Games has so much potential for growth, it is easy to buy now focusing on the long-term, you can't go wrong.

The chart is very clear, Gala Games is trading still at bottom prices with a young bullish breakout. Growth is expected for months if not years. On a broader picture, we are set for an entire decade of financial prosperity and growth. Not only Crypto of course, everything related to finance. But, this does not change the fact that there will still be bear markets and strong corrections, it is only that the bullish cycles will be uncharacteristically strong while the bearish cycles will be weak and short. This is based on hundreds of years of data and a combination of so much... So much that I don't have the space nor time to share it all here.

It is only necessary to say, that GALAUSDT is still early for those looking to profit from a massive bullish wave. Literally, All-Time Low. Once we hit bottom, there is no other place left to go but up.

Prepare to be amazed as the Cryptocurrency market takes over the world.

Namaste.

#GALA/USDT#GALA

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 0.01727, which acts as strong support from which the price can rebound.

Entry price: 0.01764

First target: 0.01790

Second target: 0.01818

Third target: 0.01842

#GALA/USDT#GALA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.01500.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.01509

First target: 0.01538

Second target: 0.01558

Third target: 0.01590