Take Two | TTWO & GTA VI. Part IITakeTwo Interactive is preparing for the biggest catalyst in the company's history with the release of GTA 6. Although no definitive timetable has been set for GTA 6, the game will almost certainly release in 2024 or 2025 at the latest given all the information that has come out. Moreover, TTWO itself has started opening up about GTA 6, which is a hint that an announcement is near. The impact that GTA 6 will have on TTWO cannot be understated, given how much resources have been spent developing GTA 6 and the growing consumer frenzy surrounding the title.TTWO could see more upward momentum as GTA 6's release closes in.

GTA 6 is by far the most anticipated video game in the industry's history. The game is so hyped, in fact, that individuals have crashed televised events purely to protest for the release of GTA 6. Even Starfield, which is an incredibly hyped game in its own right, had it Gamescon presentation disrupted by a fan calling for GTA 6. GTA 6 has not even been announced yet, and it seems to have fully captured the attention of the gaming world.

This level of organic hype is an incredibly positive sign for TTWO and its investors. Despite the fact that GTA 5 had nowhere near the hype as GTA 6 at similar stages in their development, GTA 5 still managed to become the best-selling triple A game ever made, with ~185 million units sold. This is a testament to GTA 6's potential, both on a commercial and even cultural standpoint.

If GTA 6 manages to meet or exceed consumer expectations, TTWO should see its shares surge. Given the hysteria surrounding the title, positive reviews will only supercharge demand as consumers will likely find any reason to get their hands on the game. Considering the amount of resources TTWO is rumored to be spending on developing GTA 6, coupled with Rockstar's track record of producing masterpieces, there is very little chance that GTA 6 disappoints.

While GTA is TTWO's most important IP, the company also boasts a strong lineup beyond GTA. In fact, some of its other franchises are bestsellers in their own right. Red Dead Redemption, for instance, has sold more than 55 million units and continues to sell at a solid pace despite the game being nearly 5 years old. Red Dead Redemption has also been critically praised as one of the best triple A games ever made.

TTWO currently has one of its most robust product pipelines in the history of the company across all of its studios. The company has even diversified into mobile gaming, which is proving to be an increasingly large segment in the gaming industry. In fact, TTWO made a huge acquisition in Zynga for a whopping $12.7 billion. Zynga is one of the largest mobile gaming studios in the world and owns massively popular IPs like FarmVille.

Despite TTWO's growing pipeline, the company is still relatively top-heavy compared to peers like EA (EA) or Activision Blizzard (ATVI). This means that underperformance for its flagship franchises, especially GTA, will almost certainly cause the company's value to plummet. So much of TTWO's future prospects are dependent upon the success of GTA 6, especially considering how much revenue the game is expected to pull in.

To gain some perspective on how important the GTA franchise is for TTWO, GTA has generated over $8 billion in revenue since GTA 5's release in 2013. TTWO itself is only worth ~$23 billion. GTA online, for instance, still contributes heavily to the company's recurring revenue and bookings, which came in at $1.2 billion in its most recent quarter.

TTWO has a huge opportunity with GTA 6. The game has garnered unprecedented hype that is starting to grow to a fever pitch. If TTWO delivers a solid sequel, GTA 6 could potentially deliver revenues upwards of ~$20 billion over the next decade, given the revenue trajectory of GTA sequels. At TTWO's current valuation of $23 billion, the company has far more upside, given the potential of GTA 6 and the company's growing pipeline of popular titles.

Gamestock

Breaking: $GME Coin Set For a 80% Breakout Amidst Rising Wedge Gamestop coin ( NYSE:GME ) a token created on the Ethereum blockchain ( NYSE:GME ) is set for a breakout after breaking out of a rising wedge pattern envisioning a move to the 1-month high pivot.

While currently up 3%, with the RSI at 53.95 NYSE:GME is poised to capitalized on this level to pick liquidity up.

What is GameStop?

GameStop, a well-known video game retailer, has recently captured significant attention beyond its traditional business model. The company, symbolized by GME, became a focal point in the financial world due to a dramatic surge in its stock prices. This surge was sparked by a Reddit user's compelling argument for investing in the company, leading to widespread controversy and heightened interest in GME.

GameStop (gamestop-coin.vip) Price Live Data

The live GameStop (gamestop-coin.vip) price today is $0.000097 USD with a 24-hour trading volume of $980,350 USD. GameStop (gamestop-coin.vip) is up 2.69% in the last 24 hours, with a live market cap of $40,009,034 USD, It has a circulating supply of 411,297,484,026 GME coins and a max. supply of 420,690,000,000 GME coins.

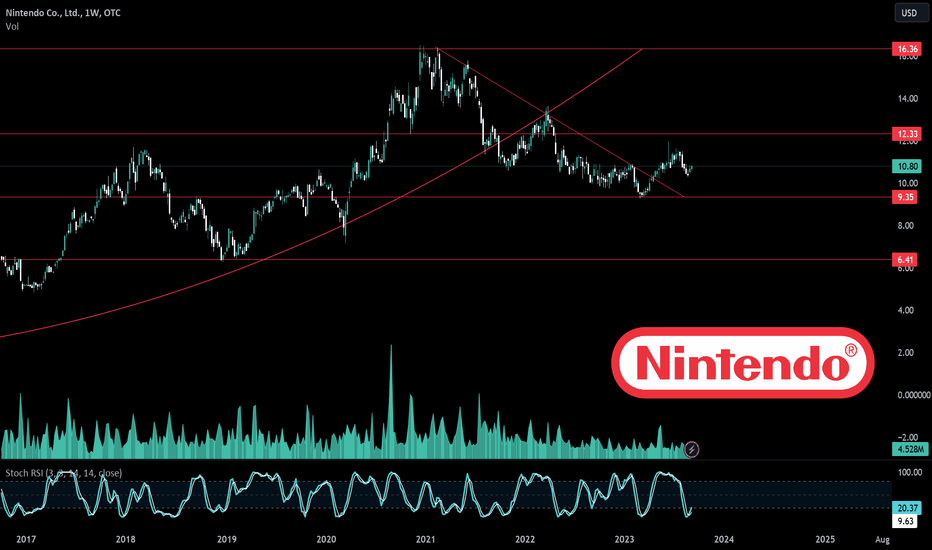

NTDOY | NINTENDO & Nintendo Switch 2 🍄The next Nintendo console might arrive in 2024

Nintendo has reportedly demonstrated the Nintendo Switch 2 behind closed doors at Gamescom last month.some trusted developers got an early look at the Switch 2 and some tech demos of how games run on the unannounced system.

There was reportedly a demo of an improved version of Zelda: Breath of the Wild that’s designed to run on the more advanced hardware inside the Nintendo Switch 2, VGC corroborated the claims and revealed that Nintendo also showcased Epic Games’ The Matrix Awakens Unreal Engine 5 tech demo running on the type of hardware Nintendo is targeting for its next console. The demo reportedly used Nvidia’s DLSS upscaling technology with ray tracing enabled, suggesting Nintendo and Nvidia are working on a significant chip upgrade for this next-gen console. in July that a new Nintendo Switch is being planned for a 2024 release.

With 43 years of making immensely popular video games under its belt, you'd think that the video game pioneers at Nintendo probably have the business of success fully figured out.

But companies must change with the times and, according to Nintendo of America president Doug Bowser, that means finding a way to engage people with the legacy brand that might never pick up a video game controller.

Bowser spoke about what the company learned this year during the Nintendo Live event in Seattle, Wa. on Sept 1, referencing the enormous box office success of the "The Super Mario Bros. Movie" as one of its key indicators that Nintendo has the ability to reach an audience beyond those that naturally reach for a controller.

"We launched The Super Mario Bros. Movie, which very quickly became the second-largest box office grossing animated film of all time at $1.3 billion," Bowser said. "We launched The Legend of Zelda: Tears of the Kingdom, which, 18 million units later after a very brief period of time, it's one of our fastest launch titles ever, and then the event today. So it's really this drumbeat of activities, entertainment-based activities where we're trying to find ways to continue to introduce more and more people, not just players, but people to Nintendo IP… So that's what we're excited about."

Bowser also spoke about the launch of Super Nintendo World at Universal Hollywood, which delivered an impressive 25% bump to Comcast's Q1 earnings this year.

"And if I think about folding into the bigger strategy, this year has really been a very unique, and I dare say banner year for Nintendo in a lot of ways," Bowser said.Nintendo also continues to benefit from the sales of its aging Nintendo Switch console, with 129.53 million units sold worldwide. That makes it the company's second best-selling console of all time, right behind the handheld Nintendo DS, which sold 154.2 million units before it was discontinued in 2014.

The success of "The Super Mario Bros. Movie" drove rumors that another big feature film based on Nintendo's flagship Legend of Zelda series was coming as well, but Nintendo hasn't made a formal announcement about that ... yet.

Gaming is in the midst of an M&A arms race. The protracted pandemic has made sure of that. Companies from all sides of the market, Microsoft, Take Two, Sony to name a few, are cutting deals to secure content. The volume and scale of those deals point to where gaming is heading - the precipice of major shake-ups across its core commercial and distribution models. Microsoft's eye bulging $69 billion deal for Activision is a testament to that shift. Costly as the deal is, it's arguably a small price to pay to secure some of the biggest franchises in gaming: Call of Duty, Warcraft, Candy Crush and Overwatch. Even more so, considering those titles span a community of 400 million active monthly players. In other words, the deal is the boldest sign yet that content is the future of gaming, not consoles.

Should you invest in Nintendo?

The question comes down to whether you are willing to pay about SGX:40B for Nintendo's IP and potential earnings powers. To me, a company that continues to produce in-demand and profitable content is worth that price tag, especially after having generated a net profit of 432.7B yen, or $2.97B in FY2023. That's a P/E of about 13.5 after subtracting out Nintendo's current assets - not a hefty sum given everything Nintendo has going for it. Nintendo's strategy seems to be working, with The Super Mario Bros. Movie not only performing well on its own but also providing a boost to other Nintendo offerings. While there are concerns, there are also plenty of catalysts moving ahead. I am excited to see new Nintendo initiatives including more theatrical releases of their IP and their (positive) effects on the rest of the company's products.

CD ProjektWake the F up Samurai, We have a money to burn!

CD Projekt is a Polish video game developer, publisher and distributor based in Warsaw, founded in May 1994

most people and investors think investing in Metaverse means you should only buy Meta stock but Metaverse already here and big gaming companies are leading it

CD Projekt's three year median payout ratio is a pretty moderate 45%, meaning the company retains 55% of its income. So it seems that CDR is reinvesting efficiently in a way that it sees impressive growth in its earnings and pays a dividend that's well covered.

Moreover, CDR is determined to keep sharing its profits with shareholders which we infer from its long history of six years of paying a dividend. Our latest analyst data shows that the future payout ratio of the company is expected to drop to 18% over the next three years. However, CDR's future ROE is expected to decline to 11% despite the expected decline in its payout ratio. We infer that there could be other factors that could be steering the foreseen decline in the company's ROE.

On the whole, I feel that CD Projekt's performance has been quite good. Particularly, I like that the company is reinvesting heavily into its business at a moderate rate of return. Unsurprisingly, this has led to an impressive earnings growth. The latest industry analyst forecasts show that the company is expected to maintain its current growth rate

not to mention that CYBERPUNK 2077 DLC Phantom Liberty going to release in 2023 and they working on new Witcher game.

Witcher3 next gen update was another success and its good time for gamers to play this masterpiece if they looking for some exciting adventure

I mange to bought CDR stock at 91$ and any price at this range is a dip and good opportunity for long term investment

Happy Christmas chooms!

Take Two | TTWO & GTA VIIs TakeTwo Interactive Software Fairly Valued?

We use what is known as a 2 stage model, which simply means we have two different periods of growth rates for the company's cash flows. Generally the first stage is higher growth, and the second stage is a lower growth phase. To begin with, we have to get estimates of the next ten years of cash flows. Where possible we use analyst estimates, but when these aren't available we extrapolate the previous free cash flow (FCF) from the last estimate or reported value. We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period. We do this to reflect that growth tends to slow more in the early years than it does in later years.

Present Value of 10-year Cash Flow (PVCF) = US $9.1b

The second stage is also known as Terminal Value, this is the business's cash flow after the first stage. For a number of reasons a very conservative growth rate is used that cannot exceed that of a country's GDP growth. In this case we have used the 5-year average of the 10-year government bond yield (2.2%) to estimate future growth. In the same way as with the 10-year 'growth' period, we discount future cash flows to today's value, using a cost of equity of 8.5%.

The total value, or equity value, is then the sum of the present value of the future cash flows, which in this case is US$27b. The last step is to then divide the equity value by the number of shares outstanding. Compared to the current share price of US$139, the company appears about fair value at a 14% discount to where the stock price trades currently. Valuations are imprecise instruments though, rather like a telescope - move a few degrees and end up in a different galaxy. Do keep this in mind.

We would point out that the most important inputs to a discounted cash flow are the discount rate and of course the actual cash flows. You don't have to agree with these inputs, I recommend redoing the calculations yourself and playing with them. The DCF also does not consider the possible cyclicality of an industry, or a company's future capital requirements, so it does not give a full picture of a company's potential performance. Given that we are looking at Take-Two Interactive Software as potential shareholders, the cost of equity is used as the discount rate, rather than the cost of capital (or weighted average cost of capital, WACC) which accounts for debt. In this calculation we've used 8.5%, which is based on a levered beta of 1.071. Beta is a measure of a stock's volatility, compared to the market as a whole. We get our beta from the industry average beta of globally comparable companies, with an imposed limit between 0.8 and 2.0, which is a reasonable range for a stable business.

Valuation is only one side of the coin in terms of building your investment thesis, and it shouldn't be the only metric you look at when researching a company. DCF models are not the be-all and end-all of investment valuation. Instead the best use for a DCF model is to test certain assumptions and theories to see if they would lead to the company being undervalued or overvalued. For example, changes in the company's cost of equity or the risk free rate can significantly impact the valuation. For Take-Two Interactive Software, we've put together three pertinent items you should explore:

Risks: To that end, you should be aware of the 1 warning sign we've spotted with Take-Two Interactive Software

Future Earnings: How does TTWO's growth rate compare to its peers and the wider market? Dig deeper into the analyst consensus number for the upcoming years by interacting with our free analyst growth expectation chart.

Other High Quality Alternatives: Do you like a good all-rounder? Explore our interactive list of high quality stocks to get an idea of what else is out there you may be missing!

long story short

Using the 2 Stage Free Cash Flow to Equity, Take-Two Interactive Software fair value estimate is US$162 and with US$138 share price, Take-Two Interactive Software appears to be trading close to its estimated fair value

GME + Another Live?In the Fibonacci retracement indicator, using the 0.382 level as resistance and the 0.236 level as support has specific implications:

0.382 Level as Resistance: When the price approaches the 0.382 Fibonacci retracement level from below, it often acts as a barrier that prevents the price from rising further. Traders view this level as a potential selling point where the price might reverse downwards. If the price repeatedly fails to break above this level, it confirms its role as a strong resistance.

0.236 Level as Support: The 0.236 level is considered a support level when the price is approaching it from above. It acts as a floor that prevents the price from falling further. Traders might look at this level as a buying opportunity, expecting the price to bounce back up. If the price holds above this level multiple times, it reinforces its status as a strong support.

Green or Red Dildo Party? 😂😂😂😂

GME is the only meme coin with a mainstage narrativesend gme on solana to $3 right now

roaring kitty keith gill wants to blow this market up and its going to drag the gme meme coin with it

...just look at that sell candle, someone dumped and it looks like the did it way too early.

GME/SOL most liquid CA: 9tz6vYKiBDLYx2RnGWC5tESu4pyVE4jD6Tm56352UGte

time to forget your pepe wifs and all that, but dont forget to look into $bozo aka Bozohybrid as thats a gamechanger ;-)

CAPCOM CO.CAPCOM Stock Soars to All Time High After RE4 Remake Is the Latest in a Seemingly Unending String of Success

CAPCOM shares opened at 4,780 today and have now slightly decreased to 4,840, which is still a 2.22% increase. As you can see from the chart, the Japanese publisher and developer has been mostly on a roll over the past few years, owing to a long string of successful game releases. Around seven years ago, things were much different. In 2016, CAPCOM released the Resident Evil Origins Collection, a rather low-effort compilation of Resident Evil and Resident Evil Zero remasters; Street Fighter V, which was supposed to take the world of fighting games by storm but largely failed due to scarce single player content and poor performance during online multiplayer matches; Umbrella Corps, a generic third-person shooter that even the Resident Evil IP couldn't save from being thoroughly panned by critics and fans alike; and Dead Rising 4, which while decent couldn't save CAPCOM Vancouver from being closed less than two years after its release due to poor sales and the cancellation of the studio's next projects.

The rise of the famed developer began in early 2017 with the release of Resident Evil VII: Biohazard, which is largely credited as the spark that reignited CAPCOM's creativity. The developers took a gamble, moving their prized survival horror IP to a completely different playstyle and setting. For the first time in the series, players didn't take charge of a trained cop or member of the special forces but of an ordinary guy who, while desperately looking for his missing wife, finds himself living a nightmare in a godforsaken, sun-drenched spot in Louisiana. Amping up the horror factor was the choice to abandon the third-person camera in favor of first-person view.

The risk paid off. The game sold well and was hailed as a return to form for the developer, delivering a momentum that even the stumble of Marvel vs. Capcom Infinite couldn't break.Then, in early 2018, CAPCOM found itself an even bigger golden goose with Monster Hunter: World, which over time became the best-selling game ever made by the Japanese studio. Previously only popular in Japan, World made the franchise far more accessible and palatable to Western audiences.

The rest, as they say, is history. Resident Evil 2, Devil May Cry 5, Resident Evil 3, Monster Hunter Rise, Resident Evil Village, and last but certainly not least, the Resident Evil 4 remake that just sold over three million copies in two mere days since its launch.

Looking ahead, Street Fighter 6 is poised to redeem even the legendary fighting franchise, at least according to the preview impressions. On the other hand, the next CAPCOM game may turn out to be less than successful. The Japanese publisher was savvy enough to partially insulate itself from the risk by taking Microsoft's money and putting it on Game Pass from day one, though.

Then again, not every game can be a hit, and investors are clearly bullish on the company's future prospects, which also include a brand new sci-fi IP (Pragmata, originally scheduled for 2022 but later moved to 2023 and possibly due for another delay given the absence of communication) and the long-awaited Dragon's Dogma 2 by Hideaki Itsuno, which could be another megahit in the making for CAPCOM if it adds online co-op play as most fans are hoping for.

CAPCOM | Sreet Fighter6 & ATH 🔥Capcom stock prices have hit All Time High ahead of the launch for Street Fighter 6, following positive buzz around the anticipated title. looking at a chart, it’s easy to see what normally influences trends many previous spikes in share prices correlate around major Capcom releases, such as a March spike just two weeks before the release of Resident Evil 4 remake

It’s not just actual game releases that can have an affect on share prices a spike in November isn’t correlated with any major releases, though it does follow reports of Capcom making a mobile spinoff of Monster Hunter, as well as news about a potential release date for Street Fighter 6.

This week’s spike also follows a very optimistic forecast on Capcom’s investor relations page, which also predicts 140 billion yen in sales in the next fiscal year (April 2023 to March 2024).

It’s no surprise that Street Fighter 6 would have so much control over Capcom’s financial value- Street Fighter V is their 9th highest-selling title, with over 7 million units shipped. Combined with the announcement of a 2 million dollar prize pool for next year’s Capcom Pro Tour series and positive critical reception, it’s easy to be optimistic that Street Fighter 6’s launch will be huge for the company.

In its end-year financial results published on Wednesday, which cover the year ended March 31, 2023, the Resident Evil publisher said it had sold 41.7 million games during the 12-month period.

That’s up from 32.6 million games the previous fiscal year and breaks its record for the most games sold in a business year. The company said its game sales helped it achieve a sixth consecutive year of record-high profit “at all levels” and its tenth consecutive year of operating income growth.

The company achieved the record sales figure partly with the release of two new titles in its flagship series, Resident Evil 4 (which released a week before the end of the reporting period in March 2023) and Monster Hunter Rise: Sunbreak, which sold around 3.75 million and 5.45 million units.

The vast majority of its sales came from catalog titles, which Capcom defines as games released in the previous fiscal year or earlier.these sales, which it says were mostly made up of titles in the Monster Hunter, Resident Evil and Devil May Cry series, reached 29.3 million units – exceeding the 24 million units in the previous fiscal year.Capcom said 12.4 million in sales was made up of new titles. The company released 35 ‘new’ SKUs in FY23, including Mega Man: Battle Network Legacy Collection, Resident Evil Village: Gold Edition, Monster Hunter Rise Deluxe Edition, Capcom Arcade 2nd Stadium and Capcom Fighting Collection.

89.4% of its game sales during the 12 months were digital (37.3 million) and 19.7% were sold in its native Japan (8.2 million). Other than MH Rise: Sunbreak and RE4, the company’s top-selling titles during the FY were Monster Hunter Rise (3.7m), Resident Evil 2 (2.25m) and Resident Evil 3 (1.95m).

Capcom said it expects to break records for sales and profit again in its current fiscal year, ending March 31, 2024, which includes the release of Street Fighter 6 in June and new IP Exoprimal in July.Capcom‘s president recently said the company aims to sell 10 million copies of Street Fighter 6, which would break the series record of 7 million met by Street Fighter V

what an easy trade and profit 🥂

GME GameStop Options Ahead of EarningsAnalyzing the options chain and the chart patterns of GME GameStop prior to the earnings report this week,

I would consider purchasing the 18usd strike price Puts with

an expiration date of 2023-11-17,

for a premium of approximately $2.54.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

Square Enix | SQNXFSquare Enix Holdings Co., Ltd. engages in the provision of entertainment contents and services. It operates through the following segments: Digital Entertainment, Amusement, Publication, and Merchandising. The Digital Entertainment segment handles the design, development, sale, license sale, and operation of digital entertainment contents mainly on computer games. The Amusement segment provides the design, development, manufacture, sale, and rental of amusement equipment as well as conducts the planning, development, and distribution of arcade game machines. The Publishing segment provides comic magazines, comics, and game strategy books. The Merchandising segment includes the planning, production, distribution, and licensing of derivative works. The company was founded on September 22, 1975 and is headquartered in Tokyo, Japan.

The Company is listed on the Prime Market of the Tokyo Stock Exchange, with the stock code "9684," and prepares its financial statements according to the Japan GAAP

In the Digital Entertainment segment, the HD (High-Definition) Game subsegment, the fiscal year ended March 31, 2023 saw the release of "CRISIS CORE -FINAL FANTASY VII- REUNION," "FORSPOKEN," and "OCTOPATH TRAVELER II." However, because new titles generated fewer earnings than in the previous year, which had seen the launch of "OUTRIDERS," "NieR Replicant" and "Marvel’s Guardians of the Galaxy," the sub-segment’s net sales declined versus the previous fiscal year.

Net sales declined versus the previous fiscal year in the MMO (Massively Multiplayer Online) Game sub-segment, in part because of the lack of any expansion pack launches for "FINAL FANTASY XIV."

The Games for Smart Devices/PC Browser sub-segment saw a decline in net sales versus the previous fiscal year because of weak performances by existing titles.In the Amusement segment, net sales and operating income for the fiscal year ended March 31, 2023 rose versus the previous year because of sharp year-on-year increase in same-store sales.

In the Publication segment, sales of both digital and print media were solid in the fiscal year ended March 31, 2023, but higher prices on printing paper and other inputs led to higher costs. This, combined with other factors such as increased advertising expenses led to a year-on-year decline in operating income.

In the Merchandising segment, the fiscal year ended March 31, 2023 saw brisk sales of products including new character merchandise based on major intellectual properties. However, while net sales rose versus the previous fiscal year, operating income declined, partly due to changes in the sales mix by product.

FINAL FANTASY XVI going to publish soon and gonna be a hit and good success for SE co.

did you try FF XVI demo? any game recommendation?

$GME - I think i caught the next runI think i've caught the next GME run. The data has been extremely unclear for a while now until yesterday's data came out which shows a strong signal for next week. I won't share the data or the PT here as not to risk things.

TLDR:

-Next week GME there's a chance to run.

I don't know if we will have enough time to buy on Monday or whether one has to buy today on Friday. If you're buying shares, buying on Friday should be fine. If you're buying options, the weekend theta and possible consequent IV on Monday will ruin you, you'll literally open at -80% loss on weeklies.

Obviously this means other meme stocks will go up too and so will the market as well. Right after this run is concluded, the market should finally do it's thing and "correct" itself.

No positions yet. Considering an all in here. Not sure yet and when to buy and what to buy. 85% (made up number, not based on any statistics) confident in this one. Maybe 80%...

YOU DO YOU. This signal comes at a moment where the market is overbought and the whole market is due for a pullback. Buying HERE is NOT NORMAL. It is the OPPOSITE OF NORMAL and a person with half a brain would tell you that too. Regardless, the signal for a run is very strong... Imagine seeing a GME run in a dying market... every... time... I don't know if i have the balls to go for this one yet.

In my own logical opinion, buying today is a mistake and you should wait and buy on Monday or Tuesday. In my illogical opinion, you should buy today. What i'm likely to do... one of the two... i have no idea, the two sides of my brain are fighting over this.

GME bottom confirmed!!! BUY BUY BUY! great time to buy confirmed bottom. last time i buy 160, drop to 140 is better bottom. This time i think its 200 but 180 is better bottom. But i jumped the gun and bought at 216 bec of fomo! Now is perfect time to buy bro buy buy buy and get your NFT dividend next weeeeeeeek babbbbbbbbbbbbbbbbbbbbbbbbbbbbbyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyy. LFG!!!! GME GME GME GME GME GME GME GME

Gann Fann Appreciation Post, plus a word on CharityI just started messing around with this little tool in the last month or so, and it's really interesting what it shows. Kind of incredible, really.

There's an amazing amount of shadiness happening in the background with $gme, so predicting price action in the short term is going to be difficult. All I can say is that this isn't going to be comfortable for individuals or institutions with over-leveraged short positions. How long it might take is hard to say, but this is going to be historic one way or the other.

For all apes hodling with diamond hands, I'm really impressed with you all. You're really doing an amazing thing and your fortitude commands a lot of respect.

I love that you're adopting gorillas, buying game consoles for kids in hospitals, and all the other good things I see you doing. If I have the good fortune to realize the returns we seem to have coming to us, I'm going to donate to three charities. If you are looking for good ones to give to you might consider these:

innocenceproject.org : This is an organization of attorneys pushing for wrongly convicted people to have their cases reviewed and get them released. It's an expensive undertaking, and they need help.

Fight Malaria through www.givewell.org : The cost of saving a human life has been discovered. You can do it, too. Nowhere near as expensive as you'd think. For more info, this article is pretty good medium.com

www.stjude.org : This one is pretty famous, but their work is crucially important for research into the prevention and treatment of pediatric cancers.

Hats off to you, apes. Hold the line. We go moon.

A possibility...So, the red key there I put next to a segment of red line. When it comes to these pennant continuation patterns, my understanding is that when they complete they go up by roughly the measurement of the left side (flat side) of the pennant. That segment of red line is the same length as the green arrow over on the right.

What I'm thinking is that the pattern might complete at some point along the horizontal green line above the pink arrow, and from there go up roughly as high as the length of the back of the previous pennant.

Just thinking out loud here, folks.

Happy to hear your thoughts!

GameStop $440 in premarket GameStop GME, the video-game retailer that is closing shops because of Covid and became famous now with it's association with the Reddit message board-fueled retail attack on institutional short sellers has just touched $440 in premarket trade.

The loss-making retailer was priced at around $19 heading a few weeks ago and $60 last week before storming higher.

GameStop has become the poster child for the 2021 stock market and its incredible volatility and speculation. The stock has gained 1,700% in January, causing pain to short-sellers. A trade like none we have seen before.

The huge moves in GameStop (GME) stock have been, very clearly, the result of a short squeeze. A squeeze is a phenomenon that can occur after big gains happen in a stock that, in turn, cause mounting losses for short sellers who are forced to cover their positions.

Even Investopedia had to rewrite their short squeeze articles.

WHAT'S NEXT?

People hunting for the next Short-squeezes will be a new hobby to many. Especially young traders, normally those who are currently on Instgram and Telegram groups about cryptos.

What I would also expect is the SEC coming out with some new circulars.

ps. I heard about this on Youtube but for sure there will be a film about all this in a few years. Title ' The Big Squeeze' 🙈

GME - how the masses stopped a 8 year old Bearmarketthis is insane and i like it :D they won the battle already at 16.50$ and i guess they dont even know this.

Who ever just longed after the last daily resistance at 16.50$ got rekt, could just sit back and watch the show.

What im more wondering, why the people still keep shorting this rocket when it is clear it broke all reistances and bear was already weak at around 8$. as this is on a moon mission, nobody knows how high this can fly and as there are still people shorting this the bulls get even more fuel :D