Thumzup Bets Big on XRP How $250 Million Could Be a Game-ChangerA New Crypto Strategy: Beyond Bitcoin

In 2025, one thing is clear: publicly traded companies are no longer limiting themselves to Bitcoin-only investments. A prime example is Thumzup Media Corporation, a Nasdaq-listed firm that recently approved a plan to allocate up to $250 million into crypto assets. Unlike past strategies, which were heavily BTC-focused, Thumzup is diversifying — prioritizing XRP, ETH, SOL, DOGE, USDC, and LTC. Among these, XRP stands out as one of the company’s largest bets.

Why XRP?

XRP is a token with a complex history and massive potential. Despite years of legal battles with the SEC, by 2025, XRP has solidified its position as a reliable asset for fast international transactions. Its widespread use among banks and financial institutions makes it unique compared to other altcoins.

Thumzup highlighted several reasons for putting XRP at the forefront:

High Liquidity: XRP trades on most major exchanges with significant volume.

Low Fees: The network enables quick, low-cost transfers of large sums.

Regulatory Progress: After Ripple’s partial victory over the SEC, XRP gained legal clarity in the U.S., making it far more attractive for public companies.

Adding to the momentum, XRP reached a new all-time high above $3.60 when Thumzup announced its strategic move — further boosting investor confidence.

$250 Million — The Source and the Strategy

In 2025, Thumzup’s board approved a major expansion of crypto holdings on its balance sheet. This investment is financed through a mix of free capital, new stock issuance, and partial bonds. The goal is not just to build an investment portfolio but to create an infrastructure-like crypto fund, similar to MicroStrategy’s approach — but with a broader basket of assets.

The company’s ambition goes beyond simply holding assets for price appreciation. Thumzup plans to integrate cryptocurrency into its advertising platform, where users get paid for posting content. XRP and other assets could serve as internal payment tools within this ecosystem.

Media Impact and Brand Boost

The move sparked massive media attention and market buzz. The excitement grew further when Donald Trump Jr. acquired company shares and joined as an advisor, creating a PR storm. As a result, Thumzup’s stock surged over 80% in a single month.

Such attention from political figures and traditional investors reinforces the notion that XRP — and other crypto assets — are evolving from “digital assets” to integral components of operational business models.

Risks to Consider

High Volatility: Significant crypto exposure could harm the company’s balance sheet in a bear market.

Regulatory Shifts: Despite progress, Ripple’s legal situation isn’t fully resolved.

Reputation Risk: Failure in crypto ventures could damage shareholder confidence.

Bottom Line

Thumzup Media has taken a bold step, positioning cryptocurrency — especially XRP — as a strategic growth tool rather than just a hedge. This move signals a paradigm shift: from “Bitcoin as a reserve” to multi-token integration into business models. If successful, this strategy could encourage other public companies to follow suit, marking the dawn of multi-asset corporate crypto treasuries.

Gann

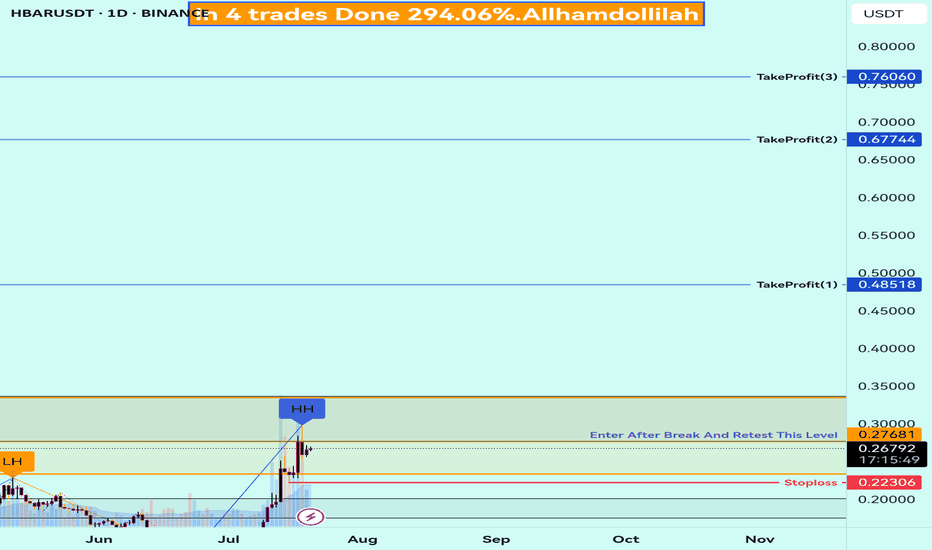

Buy Trade Strategy for HBAR: Backing Enterprise-Grade DLT AdoptiDescription:

This trading idea is centered on HBAR, the native token of Hedera Hashgraph, a next-generation distributed ledger technology (DLT) designed for speed, security, and scalability. Unlike traditional blockchains, HBAR uses a unique hashgraph consensus mechanism, making it exceptionally efficient and suitable for enterprise adoption. Major companies, including Google, IBM, and Boeing, are part of Hedera's Governing Council, which enhances its credibility and long-term sustainability. HBAR is used to power decentralized applications, pay for network services, and secure the network through staking.

As interest in scalable and environmentally friendly DLTs grows, HBAR is well-positioned to benefit from broader institutional and developer adoption. Nevertheless, the crypto market remains highly volatile and is influenced by a variety of external factors such as regulations, market sentiment, and global economic trends. Investing in HBAR requires a balanced risk management approach.

Disclaimer:

This trading idea is provided for educational purposes only and does not constitute financial advice. Cryptocurrencies, including HBAR, involve substantial risks and may result in the loss of your entire investment. Always conduct independent research, consider your financial situation, and seek professional advice before making any investment decisions. Past performance is not indicative of future results.

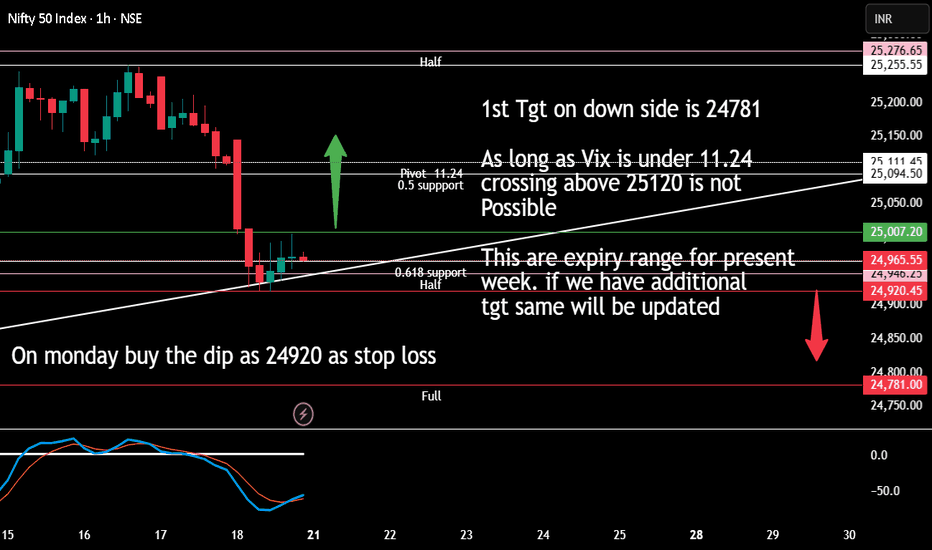

Monday till thursday expiry rangeAs long as vix value is under 11.24 crossing pivot and going on top is not possible as per my mathematical range calculation (accuracy is 80%).

If it is near 25111 level on Thursday (and ind vix is less than 11.24) a very good time to make handsome money as market will touch 24946.27 level (probability s 80%)

For Monday we should follow buy the dip as long 24920 is intact.

Breaching 24920 market will show 24800-24781 as first target. If 30 min candle stays below this level (24780) then next tgt will be open. Will keep you posted if anything changes.

Caution: I am not SEBI registered it is my mathematical analysis and it is not buy or sell recommendation

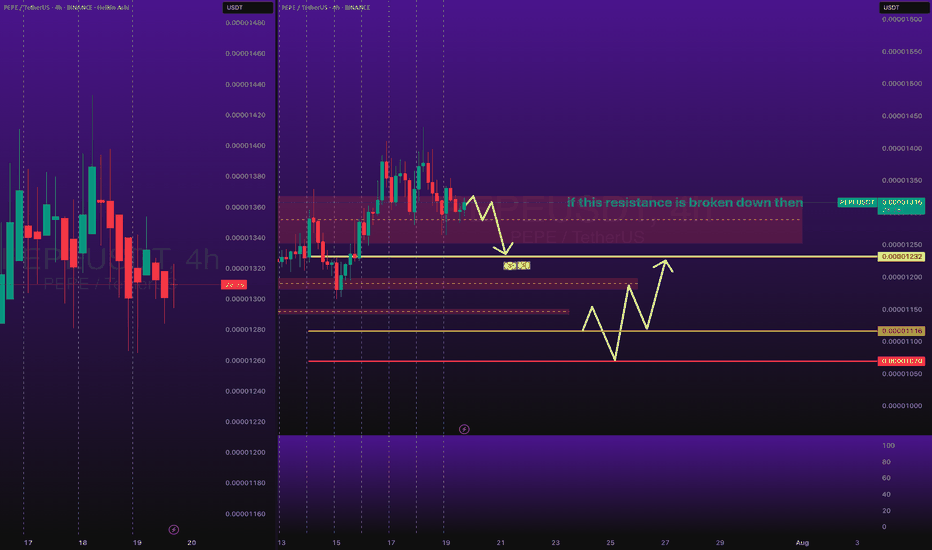

PEPEUSDT Dipping Down for Key Zone 0.00001230 to TouchBINANCE:PEPEUSDT has been quite on bullish trend and last week has been stopped being bullish, and started ranging, now PEPEUSDT will correct itself slightly by dipping down towards 0.00001230 which is very important level.

After 0.00001230 then next key level is 0.00001117 but we need to see if it really need to go down there or will bounce back up from 0.00001230.

0.00001327 is the Key Resistance Level, if its respected well then our target is very obvious to hit.

Use proper risk management

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

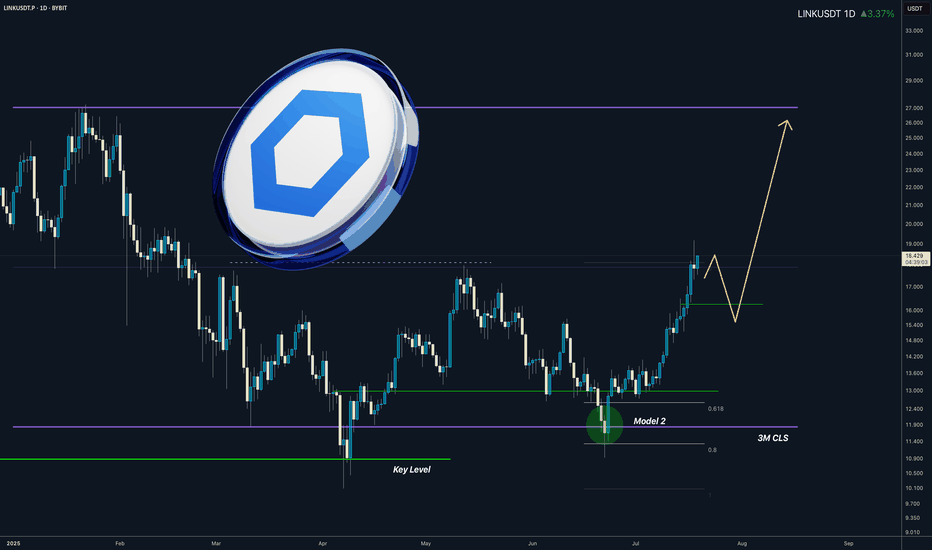

LINK I 3M CLS I Model 2 In the Motion I Target Full CLS rangeYo Market Warriors ⚔️

Fresh Crypto Analysis— if you’ve been riding with me, you already know:

🎯My system is 100% mechanical. No emotions. No trend lines. No subjective guessing. Working all timeframes. Just precision, structure, and sniper entries.

🧠 What’s CLS?

It’s the real smart money. The invisible hand behind $7T/day — banks, algos, central players.

📍Model 1:

HTF bias based on the daily and weekly candles closes,

Wait for CLS candle to be created and manipulated. Switch to correct LTF and spot CIOD. Enter and target 50% of the CLS candle.

For high probability include Dealing Ranges, Weekly Profiles and CLS Timing.

Analysis done on the Tradenation Charts

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Trading is like a sport. If you consistently practice you can learn it.

“Adapt what is useful. Reject whats useless and add whats is specifically yours.”

David Perk aka Dave FX Hunter

💬 Comment any Coin I ll give you my quick view

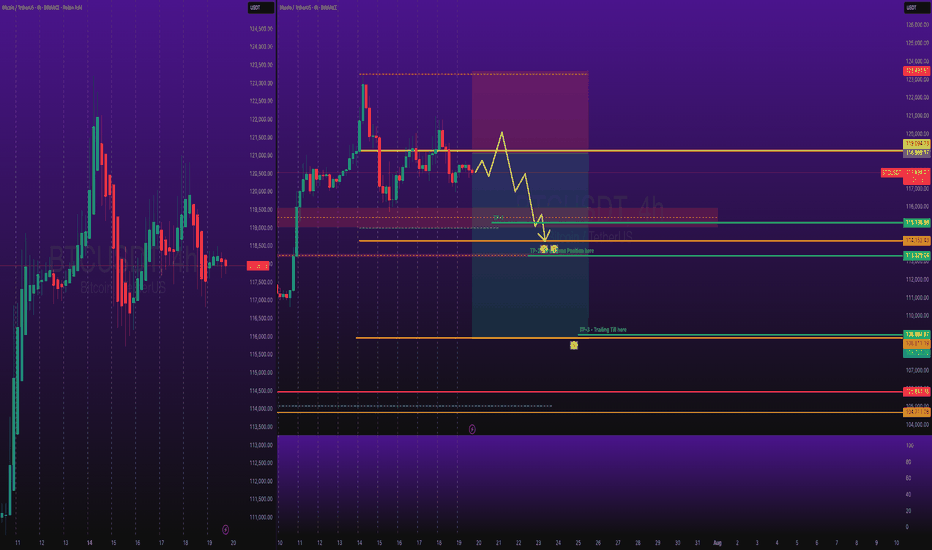

BTCUSDT Short Swing TradeBINANCE:BTCUSDT Short Swing Trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

This is good trade, don't overload your risk like greedy, be disciplined trader.

I manage trade on daily basis.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

ADA GOES DOWN🔍 Still analyzing the markets based on price only?

Markets don't move randomly. They follow precise time-based cycles that repeat with uncanny accuracy.

In this analysis, I focused on:

🔁 Time segmentation using the 3-6-9 cycle

⏳ Key reversal points calculated with Time Cycle Lines

📉 Smart price action based on real Order Blocks and liquidity

🧠 A core belief that “Time is more important than Price”, inspired by Gann and modern cycle theory.

---

✅ Now the real question is:

Do you see how the major shift happened exactly at a timed zone, not just a price level?

🗣️ Let me hear your thoughts:

Do you use time tools in your strategy?

Would you like to learn how I project these reversal zones in advance?

👇👇

💬 Drop your insights in the comments

🔁 Share with traders who think beyond indicators

➕ Follow me if you want to explore how Time-based analysis can give you a real edge.

#TradingView #Forex #MarketCycles #GannTheory #SmartMoneyConcepts #ForexStrategy #DigitalAnalysis #TimeAnalysis #PriceAction #DrGemy

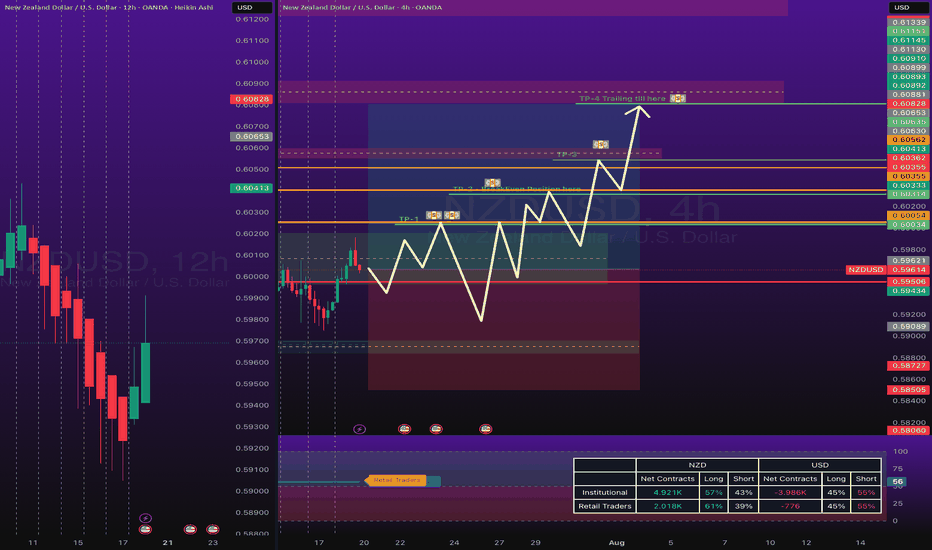

NZDUSD Bullish Pressure coming innOANDA:NZDUSD have finally closed above 0.59485 which is weekly support and NZDUSD is respecting it nicely, now with bullish pressure came it: it will touch 0.60060 as its the most important level at the moment, if price closed above 0.60060 making it good support then next level is 0.60345 if price kept bullish.

Key levels to look are:

0.60060

0.60345

and finally 0.60633 as weekly high.

0.60633 as Strong Resistance.

This is good trade, don't overload your risk like greedy, be disciplined trader.

I manage trade on daily basis.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

EURGBP – WEEKLY FORECAST Q3 | W30 | Y25📊 EURGBP – WEEKLY FORECAST

Q3 | W30 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT FOREX ANALYSIS 📊

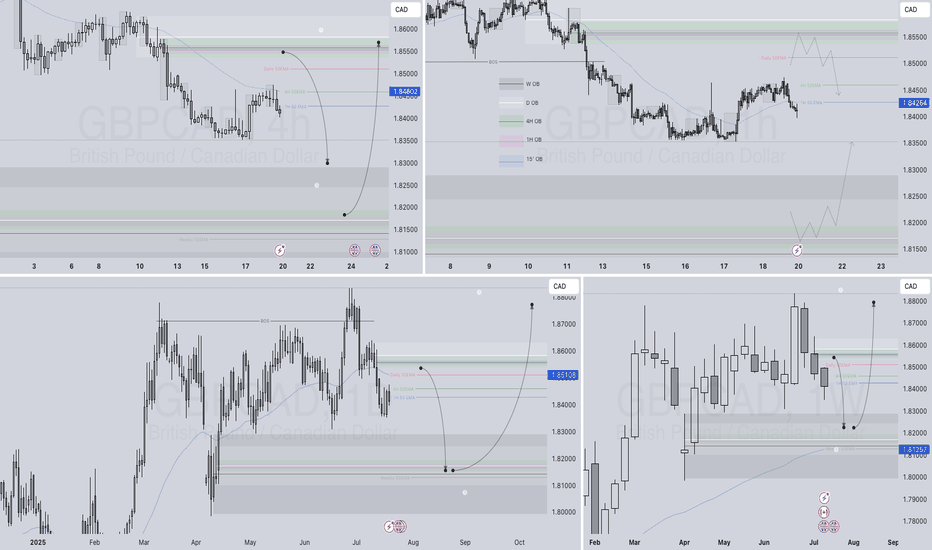

GBPCAD – WEEKLY FORECAST Q3 | W30 | Y25📊 GBPCAD – WEEKLY FORECAST

Q3 | W30 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT FOREX ANALYSIS 📊

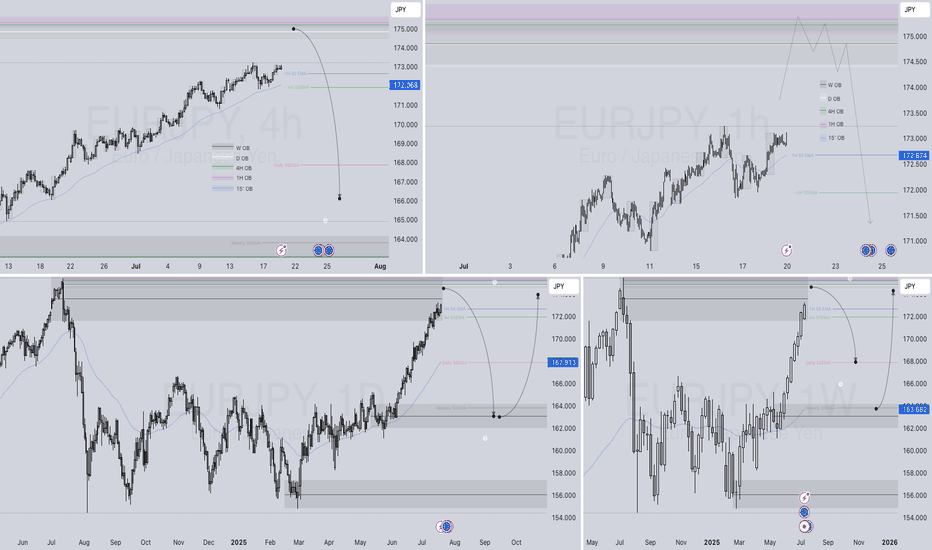

EURJPY – WEEKLY FORECAST Q3 | W30 | Y25📊 EURJPY – WEEKLY FORECAST

Q3 | W30 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT FOREX ANALYSIS 📊

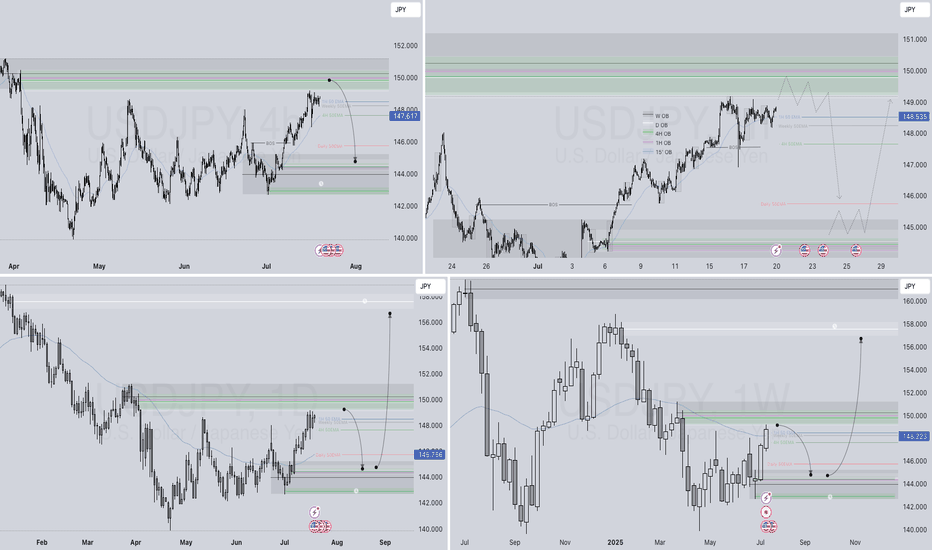

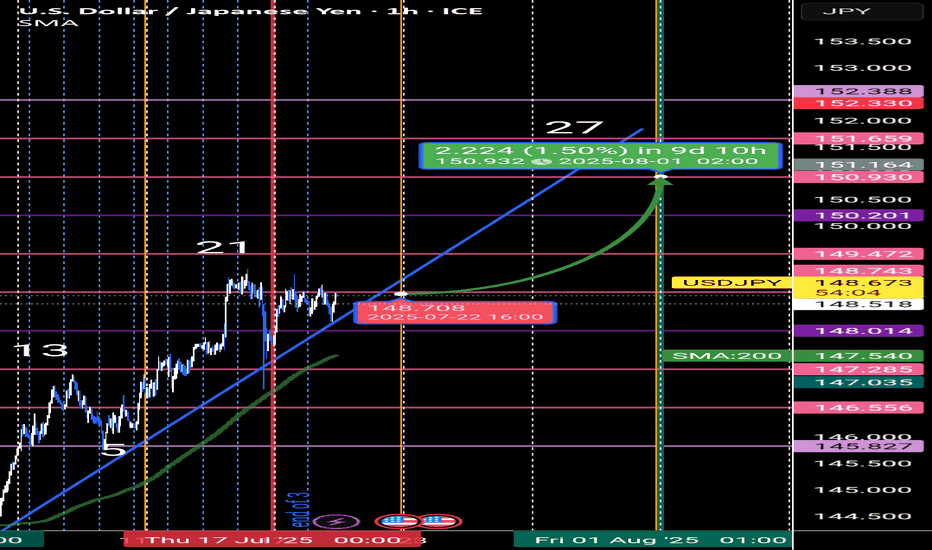

USDJPY – WEEKLY FORECAST Q3 | W30 | Y25📊 USDJPY – WEEKLY FORECAST

Q3 | W30 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT FOREX ANALYSIS 📊

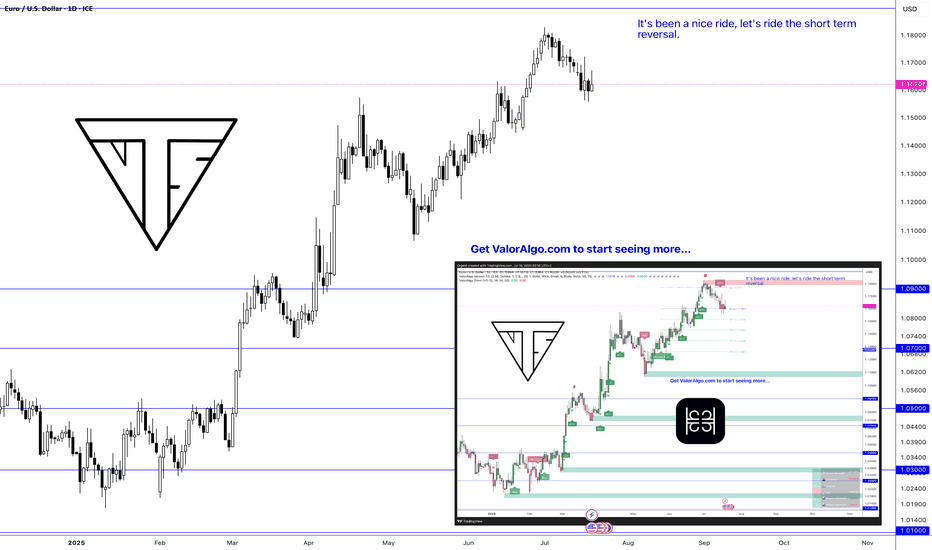

EURUSD – WEEKLY FORECAST Q3 | W30 | Y25📊 EURUSD – WEEKLY FORECAST

Q3 | W30 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT FOREX ANALYSIS 📊

TESLA SELL PLAN – BEWARE BUYERS, FUEL IS BELOW📉 TESLA SELL PLAN – BEWARE BUYERS, FUEL IS BELOW

🔻 Market Structure:

Recent bullish push retraced into a bearish fair value gap (FVG), indicating potential exhaustion in buying.

🟥 Supply Zone Hit:

Price revisited the FVG zone and faced rejection twice, showing sellers are active at that level.

👁️ Liquidity Eyes:

Two major liquidity pools are clearly marked below – price may seek these resting liquidity areas.

🔻 Bias:

Bearish, as price reacted from premium FVG and is forming lower highs.

📍 Execution Plan:

Monitor for continuation patterns on lower timeframe within context.

Ideal short entries can be found after confirmation rejections from FVG zone.

Expect internal liquidity sweeps before the major drop.

🎯 Target:

Watch for price to draw down toward the external liquidity zones below, especially near previous macro demand areas.

⚠️ Note for Buyers:

Current retracement is likely corrective. Until price breaks structure and invalidates the bearish FVG, upside is risky.

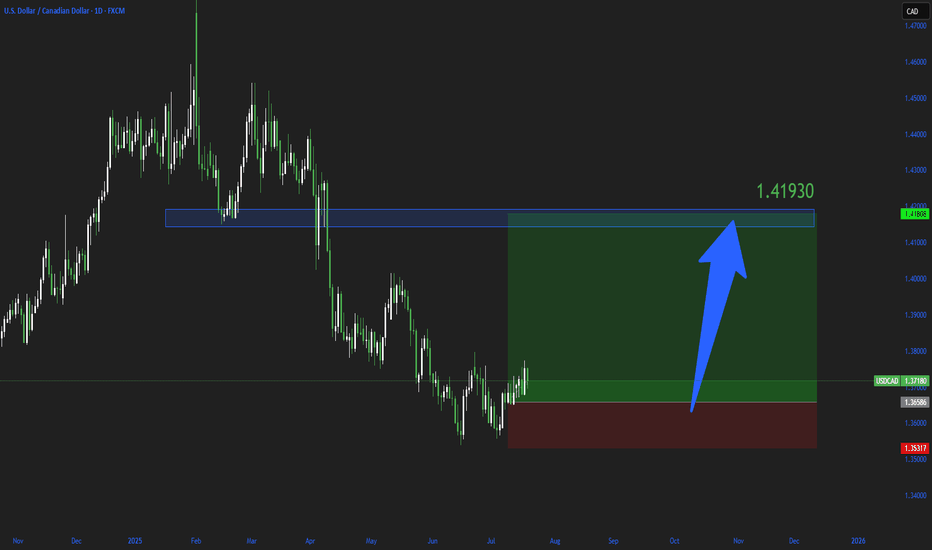

Short Term Market Reversal IncomingRetail’s still buying breakouts, but the music just stopped.

This was the rally they weren’t supposed to catch.

Now it’s time to flip the script and bleed it back to origin.

Trading is a very difficult profession. Most people fail, but it's also not impossible. If you don't trade you're a loser.

It's a zero-sum game. 0 1

Zero-sum game is a mathematical representation in game theory and economic theory of a situation that involves two competing entities, where the result is an advantage for one side and an equivalent loss for the other.

It's all just digits on a screen and if they want your money they'll take your money, so you gotta respect your risk management if you don't want to lose everything or you'll have to break the matrix by seeing into the future,

Once you get to see the future. THERE IS NO TURNING BACK.

If you're reading this I hope you're having a great year. This year is all about endings and new beginnings. So stay locked in.

WAGMI

Oh yeah don't forget I gave you guys FX_IDC:EURUSD at 1.03 and FX_IDC:XAGUSD at $22

Nerds

USD/JPY FORCAST🟦 Time Structure Analysis – USD/JPY | The 3-6-9 Temporal Cycle

📌 Price can lie. But time never does.

While many traders rely on price action or Elliott Wave counts, I take a different route — I trade time. Why?

Because time sets the rhythm, and the rhythm defines everything.

🔄 The 3-6-9 Time Cycle

Every complete market movement follows a hidden structure based on natural timing laws

In the current month, July 2 was the entry gate. That’s where I anchor the beginning of the new cycle.

⏳ Why Time Wins Over Price

Indicators lag

Price patterns repaint

But time never repaints.

Once the temporal cycle is locked in, it dictates future market rhythm.

You can identify where the market must move next — not by guessing the price level, but by counting time bars from a known pivot.

---

⚡ Strategy in Practice

In my system, I use:

✅ Cycle Lines starting from key reversal points

✅ Fixed monthly gates as temporal anchors

✅ Bar counting based on 3-6-9 geometry

✅ Fractal validation from higher timeframes

This gives me a predictive edge based on time pressure, not price patterns.

🎯 “The market doesn’t move because of buyers and sellers...

It moves because of time.”

Time is the structure. Price is just the effect.

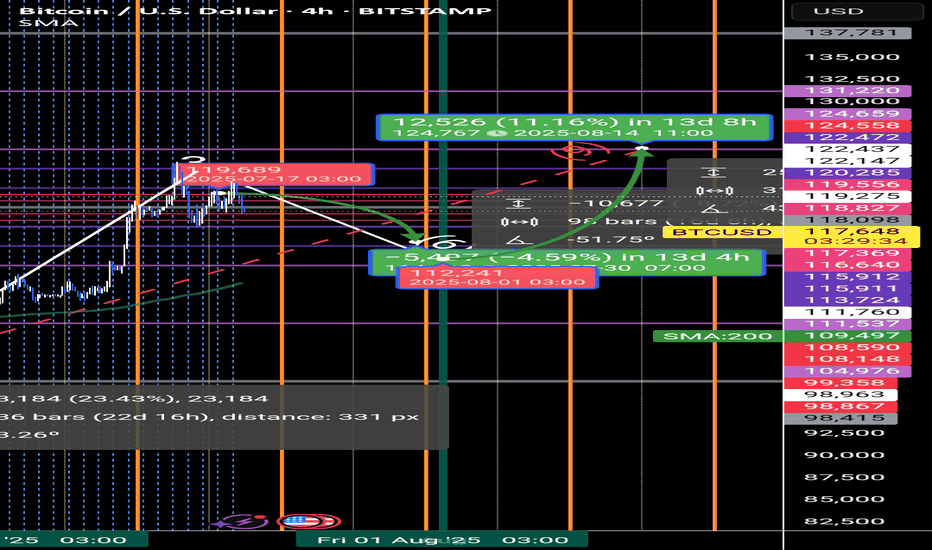

Bitcoin Forecast 🔁 I use a unique time-based cycle method built around the universal law of 3-6-9:

3 = Impulse wave

6 = Correction

9 = Cycle end

we are at the higher time frame cycle 9

each cycle of the 3, 6 ,9

contain a smaller one 3 ,6 , 9

This isn’t just about charts — the number 9 governs all natural cycles:

Pregnancy, learning, lunar cycles, economic growth, etc.

---

🗓️ These are the key monthly turning points I track every year:

> Jan 8 – Feb 7 – Mar 6 – Apr 5 – May 5 – Jun 4 – Jul 2 – Aug 1 – Aug 31 – Oct 30 – Nov 29 – Dec 6

📍 This month, July 2nd was a critical time pivot. From there, Bitcoin entered a new time cycle.

📌 Time Is More Powerful Than Price

Most traders focus on price action, waves, or indicators…

But the reality? Time is the real market driver.

⏳ Entry signals based on time outperform those based on price.

Why? Because price is a reaction — time is the cause.