MEV Bot Exploit by MIT-Educated Brothers Leads to $25M CryptoIn the dynamic world of crypto trading, where cutting-edge innovation meets finance, abuses are inevitable. One of the most prominent cases of the year involves brothers Anton and James Peraire-Bueno, MIT graduates accused of exploiting Maximal Extractable Value (MEV) strategies to siphon off $25 million from the Ethereum ecosystem within seconds. The case may set a precedent for how automated behavior in decentralized systems is judged under traditional legal frameworks.

What Happened?

According to the prosecution, the brothers deployed several Ethereum validators and used specialized algorithms to reorder transactions within blocks. This allowed them to front-run other MEV bots and redirect transaction flows in their favor—a textbook mempool attack. In just 12 seconds, they allegedly drained $25 million in ETH and other digital assets.

Why Is This Case Unique?

First major MEV case involving such significant financial losses

Criminal charges despite actions operating within protocol rules

Academic background of the defendants adds to the public intrigue

This case raises a key legal question: Can actions that are technically “legal” under protocol rules still constitute fraud if they are knowingly harmful to other participants?

Implications for the Crypto Industry

The trial could redefine ethical and legal standards in the DeFi and automated trading sectors. If convicted, this could trigger a broader review of front-running bots, sandwich attacks, and other MEV strategies that, until now, have existed in a legal gray area.

As the regulatory landscape evolves, this trial may become a cornerstone in shaping how future MEV tactics are governed—and how automated trading fits into the legal definition of financial manipulation.

Gann Box

EUR/USD CRAZZYY BULLISH BIAS (SMC Perspective) | 1H Outlook🔍 Analysis Summary:

Price is consolidating above a clear demand zone after breaking previous structure to the upside.

We’ve seen liquidity engineered above the swing high (marked X), followed by internal structure developing.

I’m watching for a sweep into demand (grey zone) between 1.1520 – 1.1540, followed by a bullish reaction.

Expecting a bullish BOS (Break of Structure) on the lower timeframe to confirm continuation to 1.16340.

📌 Key Levels:

Demand Zone: 1.1520 – 1.1540

Liquidity Sweep: Above recent highs (1.1596)

Target Zone: 1.16340

Invalidation: Clean break below 1.1500

🗓️ Fundamental Drivers to Watch:

USD Weakness – Driven by:

Recent soft CPI & PPI data (cooling inflation)

Increased chances of Fed rate cuts (starting September 2025)

Risk-on market sentiment pushing money out of the USD

Upcoming News Events:

Wed 19 June – Fed Chair Powell Speaks 🗣️

→ Any dovish tone supports the bullish EUR/USD case

Thu 20 June – Initial Jobless Claims 📉

→ A higher-than-expected print could confirm labor market weakness = USD bearish

Fri 21 June – Flash Manufacturing/Services PMI (EUR & USD)

→ EUR strength + weak US data can fuel upside

🧠 My Plan:

Watch for a liquidity sweep into demand

Wait for bullish confirmation on M15 or M5

Target previous high & continuation toward 1.16340

💬 Follow for more SMC-based breakdowns. Let’s stay sharp and react, not predict.

#EURUSD #SMC #SmartMoney #LiquiditySweep #ForexTrading #OrderBlocks #sam_trades_smc #PriceAction #FOMC #Fed #USD

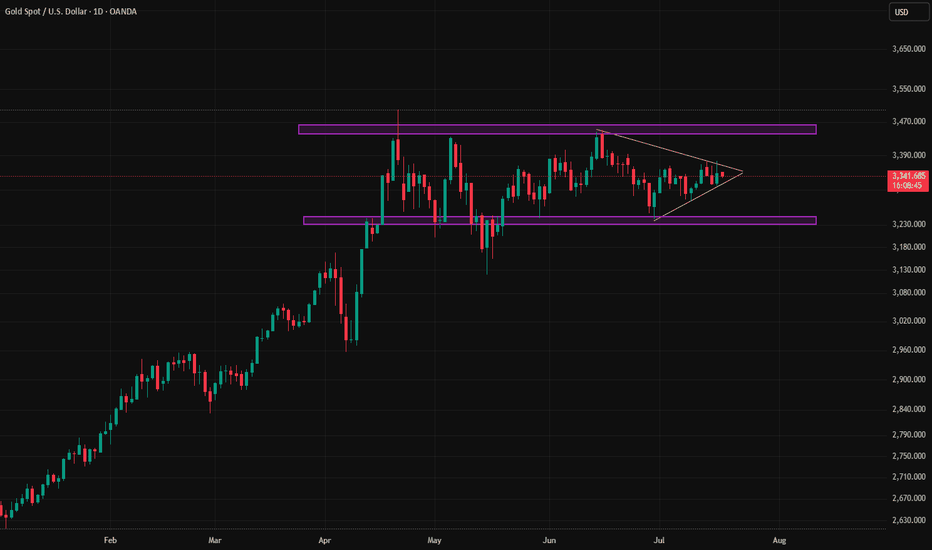

Gold (XAUUSD) Trading Setup – Mid-June 2025 Analysis🔰 Gold (XAUUSD) Trading Setup – Mid-June 2025 Analysis

This chart represents a strategic price action-based setup on Gold (CFDs on Gold – US$/Oz) using a 15-minute timeframe. It includes clearly defined entry zone, support/resistance levels, and profit-taking targets (TP1, TP2) for both bullish and bearish scenarios.

🔍 Current Market Context

Current Price: ~$3431.77

Structure: The price has been in an upward trend with a consolidation phase forming near the key mid-zone.

Highlighted Zone: A decision zone is marked in red (between ~$3422 and ~$3418), acting as the key liquidity zone or breakout area.

📈 Bullish Bias

If price breaks and holds above the red zone:

✅ TP1: $3480

✅ TP2: $3580

These levels act as short- to mid-term bullish targets based on projected extensions of recent upward momentum.

📉 Bearish Bias

If price breaks and holds below the red zone:

✅ TP1: $3320

✅ TP2: $3260

This indicates a possible reversal or correction phase, with targets derived from recent swing lows and support areas.

📌 Trading Notes

The blue shaded areas represent target zones for partial or full exits.

Red zone is the critical breakout decision point.

Ideal for breakout or pullback traders.

Can be combined with volume/confirmation indicators (e.g., RSI, MACD, or price action candles) for entry timing.

EURUSD I Weekly CLS I KL - OB, Model 1 target - 50% AMD in playHey, Market Warriors, here is another outlook on this instrument

If you’ve been following me, you already know every setup you see is built around a CLS range, a Key Level, Liquidity and a specific execution model.

If you haven't followed me yet, start now.

My trading system is completely mechanical — designed to remove emotions, opinions, and impulsive decisions. No messy diagonal lines. No random drawings. Just clarity, structure, and execution.

🧩 What is CLS?

CLS is real smart money — the combined power of major investment banks and central banks moving over 6.5 trillion dollars a day. Understanding their operations is key to markets.

✅ Understanding the behaviour of CLS allows you to position yourself with the giants during the market manipulations — leading to buying lows and selling highs - cleaner entries, clearer exits, and consistent profits.

🛡️ Models 1 and 2:

From my posts, you can learn two core execution models.

They are the backbone of how I trade and how my students are trained.

📍 Model 1

is right after the manipulation of the CLS candle when CIOD occurs, and we are targeting 50% of the CLS range. H4 CLS ranges supported by HTF go straight to the opposing range.

📍 Model 2

occurs in the specific market sequence when CLS smart money needs to re-accumulate more positions, and we are looking to find a key level around 61.8 fib retracement and target the opposing side of the range.

👍 Hit like if you find this analysis helpful, and don't hesitate to comment with your opinions, charts or any questions.

⚔️ Listen Carefully:

Analysis is not trading. Right now, this platform is full of gurus" trying to sell you dreams based on analysis with arrows while they don't even have the skill to trade themselves.

If you’re ever thinking about buying a Trading Course or Signals from anyone. Always demand a verified track record. It takes less than five minutes to connect 3rd third-party verification tool and link to the widget to his signature.

"Adapt what is useful, reject what is useless, and add what is specifically your own."

— David Perk aka Dave FX Hunter ⚔️

4/30 Gold Trading SignalsGold showed limited movement yesterday and did not enter either of our predefined major trading zones, leading to minimal profits.

As of now, the price continues to consolidate. A larger movement is likely to occur during the U.S. session following key economic data.

Until then, consider short-term range trading between 3330-3290.

📌 Why Today’s Data Matters

Gold has been trapped in a tight range for several sessions, and a directional breakout is imminent.

Today’s data release will likely dictate that direction, so it is crucial to stay alert.

✅ Data-Driven Strategy:

If data is bullish (gold rallies):

Avoid chasing the initial breakout. Wait for the first spike to settle, then short the retracement, with a TP of less than $10.

If bulls remain strong, the retracement should stay under $20. Once short positions are closed, watch for confirmation to go long.

If data is bearish (gold drops):

If price doesn't reach the lower buy zones(3258-3223), wait for a minor rebound to short, targeting the next leg lower.

📌 Today's Suggested Trade Zones:

🔻 Sell Zones:

3378–3418

3330–3358

🔺 Buy Zones:

3258–3223

3110–3330 (ladder entries)

4/29 Gold Trading SignalsThe buy orders initiated around 3273 yesterday have already delivered solid profits.

After a slight rally at today’s opening, gold prices have pulled back.

Currently, the candlestick formation shows no clear directional trend, while some short-term technical indicators are pointing downward.

Before any corrective signals appear, we need to closely watch the support near 3306.

As long as this level holds, the short-term bullish momentum still has a chance to continue.

On the news side, today's scheduled data releases are of minor impact.

Focus instead on developments regarding the India-Pakistan situation and US Treasury Secretary Bessent’s press conference.

If geopolitical tensions escalate, gold may break out to new highs.

🔹 Today's Trading Strategy:

Sell within 3407-3428 zone

Buy within 3258-3223 zone

Flexibly trade between 3346-3313 / 3378-3336 / 3273-3316 zones

Please manage your positions carefully and stay alert for unexpected market moves.

How Gann’s Square of 9 Reveals Hidden Time Cycles in the US500In today’s fast-moving markets, most traders are stuck reacting, chasing signals, hunting for breakouts, and trying to make sense of noise. But what if you could predict where the market might turn, not just based on price, but on time itself?

That’s exactly what W.D. Gann mastered. His tools, like the Square of 9, weren’t just about charts, they were about timing the rhythm of the market. Today, I’ll walk you through a real-world example on the US500, using Gann’s time technique on the 5-minute chart. This isn't theory. This is how you can bring Gann’s legacy to life in real-time trading.

Step 1: Don’t Start on the 5-Minute—Zoom Out First

The first thing to understand is that not every swing high or low is meaningful. To apply Gann’s time analysis correctly, you must choose swing points that matter—and that means looking at the higher timeframes.

Before diving into the 5-minute chart, I always analyze the 15-minute, 1-hour, and 4-hour charts. If a swing high or low on the 5-minute lines up with a key support or resistance zone from those larger timeframes, that’s your signal. These are levels where institutions and big players act, and that gives your analysis a real edge.

So, once I identified a swing high and low on the 5-minute chart that aligned perfectly with a 1-hour resistance zone and a 4-hour support level, I knew I had something solid.

Step 2: Counting Bars – The Foundation of Time Analysis

From the chosen swing low to the swing high, the market took 9 bars to complete the move. That number isn’t just a count—it becomes our anchor in time.

Using my custom-built Gann Square of 9 spreadsheet, I plugged in this value. The spreadsheet then calculated future bar counts where the 45-degree time angle repeats, based on Gann’s time rotation principle.

The output gave us these key numbers: 16, 25, 36, 49, 64, 81

These are not arbitrary. They are time-based vibration points derived from Gann’s spiral math—each one representing a future window where the market is likely to shift.

Step 3: Letting Time Lead the Trade

Let’s walk through what happened at each of these time windows:

Bar 16: The market attempted to push higher—a classic manipulation move. Then came a sharp reversal. The 45-degree vibration was in effect. This was a textbook Gann-style turning point.

Bar 25: No sharp reversal, but momentum slowed and price started consolidating. This was a structural pause—just as important as a reversal for those watching intraday shifts.

Bar 36: This one was dramatic. The market had been falling, but as we approached the 36th bar, rejection candles started appearing. Selling pressure dried up, and buyers stepped in. Soon after, a bullish breakout followed. The time vibration had called it again.

Bar 49: After a strong bullish run, the price stalled and reversed almost precisely at this time point. This marked a shift back to bearish sentiment.

Bar 64: The downtrend lost steam. Price began forming a new swing low, and as we passed the 64-bar mark, bullish momentum returned. Another clean reversal.

Bar 81: The final vibration in this sequence. The bullish move slowed, candles shrunk, and volume faded. Then came a breakdown. A bearish turn right on time.

What This Means for You as a Trader

This sequence—from bar 16 to 81—is a masterclass in how time drives the market. It shows that price action is not random. It's governed by hidden cycles that most traders overlook. But when you apply Gann’s methods with precision, the market reveals its rhythm.

All we did was:

Identify a meaningful swing (validated by higher timeframes)

Count the bars between the swing low and high

Let the Square of 9 calculate the future time vibrations

From there, we simply watched and waited. And the market played out almost to the bar.

Conclusion: From Reactive to Predictive Trading

The real power of Gann’s techniques lies not in magic, but in mathematical and astrological precision. When you understand how time and price interact, you stop reacting—you start forecasting.

You stop chasing trades—you start anticipating reversals.

Gann’s Square of 9 isn’t just an old-school tool. With the right application, it becomes a modern forecasting machine. And with the help of tools like my custom spreadsheet, the entire process becomes simple, streamlined, and incredibly effective.

So the next time you’re about to take a trade, ask yourself:

Are you following price? Or are you following time?

Because when time is on your side, the market moves in your direction—not the other way around.

92% Win Rate Strategy Using Gann’s Planetary LongitudeHave you ever wondered how some traders seem to anticipate market reversals with uncanny precision, almost as if they can see into the future?

Well, what if I told you that the secret doesn’t lie in guesswork or traditional retail indicators, but in the heavens themselves?

Let me walk you through one of the most powerful forecasting tools in Gann's arsenal—the Planetary Longitude Method and how I used it to identify the exact price level from which the market reversed.

The Power of Planetary Time Cycles in Trading

This technique isn’t based on patterns, trendlines, or lagging indicators. It’s rooted in precise planetary time cycles, the same natural laws that govern the movement of celestial bodies.

Gann believed the markets were not chaotic but deeply connected to universal rhythm and planetary motion. According to his planetary longitude method, each planet holds a specific degree of longitude at any given time. These degrees can be directly mapped onto price charts, turning astronomical data into actionable trade setups.

When price meets planetary longitude, something extraordinary happens. These degrees act as invisible support and resistance levels—ones that retail traders never see. They are silent yet powerful markers of change, and because they are rooted in cosmic cycles, they give you a strategic edge in timing your trades.

Why These Degrees Matter

As a trader, what you’re truly looking for is reaction zones, areas where price is likely to pause, reverse, or accelerate. When planetary time and market price converge at a particular degree, it creates what Gann called a "vibrational point", a moment of energetic alignment. These are high-probability zones where you can anticipate market turning points with accuracy.

By tracking the longitudes of key planets, such as the Sun, Moon, Mars, Jupiter, or Saturn—you can identify these critical junctures. Each planet brings its own cycle, its own tempo. For deeper, longer-term reversals, I often rely on the slower-moving planets like Pluto, while for short-term setups, I look at the faster ones like the Moon or Mars.

How I Forecasted the US100 Reversal from 19,384.6

Now, let’s get practical.

In this recent example, I was closely watching the US100 index, where I anticipated a potential reversal around the level of 19,384.6. Was this just another support/resistance zone? Absolutely not.

Here’s how I arrived at this precise level using Gann’s Planetary Longitude Technique:

First, I took the price level of 19,384.6 and converted it into degrees. To do this, I simply subtracted 360 repeatedly from the price until I arrived at a number less than 360. This process is based on the 360° circle of the zodiac—once the price cycles through the full circle multiple times, what's left is the vibrational degree associated with that price. In this case, the price level of 19,384.6 converted to approximately 304.6°.

Then, I checked the planetary position of Pluto which was 303.55° in longitude.

This created a near-perfect alignment between Pluto’s time cycle and the vibrational price degree. When planetary time meets price, it forms a cosmic convergence zone—a point of natural balance where the market is highly likely to react. So, I wasn’t just guessing—I was waiting for that moment of planetary resonance.

And as the chart clearly shows, the market reacted sharply the moment it touched 19,384.6, confirming the sensitivity of this degree. It wasn’t random. It was a harmonic response, echoing the laws of cosmic vibration that Gann so strongly emphasized.

This is a real-time example of how combining planetary time with price geometry can give you a decisive trading edge, especially in forecasting major turning points.

Why This Method Works

The market respects these planetary degrees not because of mysticism, but because it moves in cycles—natural cycles that repeat. The alignment of price with planetary longitude often marks pivot points in the market.

And this method doesn’t just help with identifying reversals. It also enhances your entry and exit timing, allowing you to trade with confidence, knowing you're aligned with the larger cosmic structure that influences all things—including financial markets.

Final Thoughts

This is just one example of how planetary geometry, when applied correctly, can lead to powerful trade setups. While Pluto offers long-term signals, don’t underestimate the value of the Moon, Mars, or Jupiter for shorter timeframes. The market dances to their rhythm too.

And once you learn to listen to that rhythm, you'll never look at price the same way again.

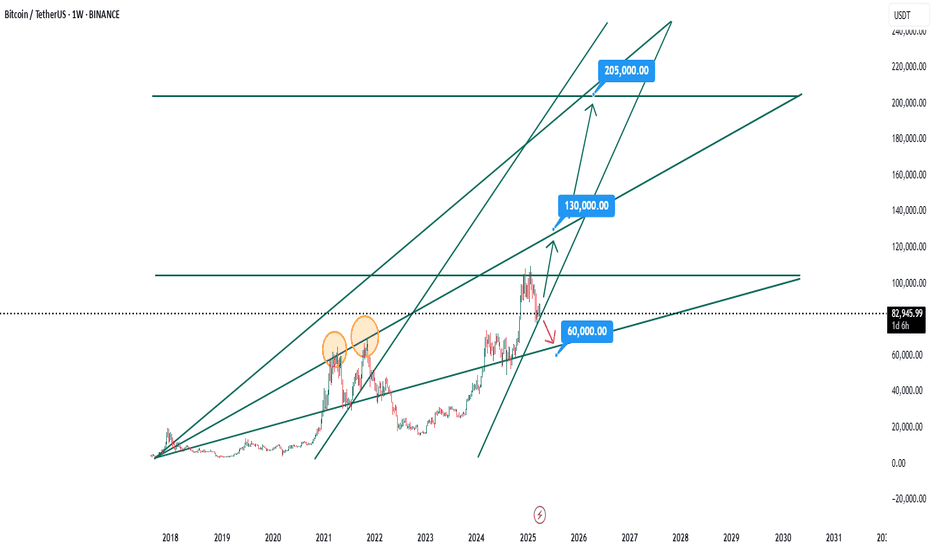

BTC up Or DownBitcoin has not yet completed its ascending channel, with the possibility that inflation and unemployment will increase under Trump's economic policy. Bitcoin price may reach 130k and 200k, but if Trump's economic surgery really works, it will fall to 60k. I am not optimistic about Trump's economic policy. The chart below is drawn with a Gann box.

SUIUSD I Weekly CLS, Key level - OB I Model 2, Multiple targetsHey Traders!!

Feel free to share your thoughts, charts, and questions in the comments below—I'm about fostering constructive, positive discussions!

🧩 What is CLS?

CLS represents the "smart money" across all markets. It brings together the capital from the largest investment and central banks, boasting a daily volume of over 6.5 trillion.

✅By understanding how CLS operates—its specific modes and timings—you gain a powerful edge with more precise entries and well-defined targets.

🛡️Follow me and take a closer look at Models 1 and 2.

These models are key to unlocking the market's potential and can guide you toward smarter trading decisions.

📍Remember, no strategy offers a 100%-win rate—trading is a journey of constant learning and improvement. While our approaches often yield strong profits, occasional setbacks are part of the process. Embrace every experience as an opportunity to refine your skills and grow.

Wishing you continued success on your trading journey. May this educational post inspire you to become an even better trader!

“Adapt what is useful, reject what is useless, and add what is specifically your own.”

David Perk ⚔

SPY: Yet another bearish SPY forecastLooking at the previous sell-off patterns, theres a strong possibility that if the downtrend continues, SPY will head to low 500's by mid-May before rebounding in the summer to retest current levels (540-560) before completing the final leg (or first) of a correction to the high mid-high 400 price level - or potentially low 400s in September. Its been a while since I've shared a predictive chart but the current market behavior makes it hard not to try to paint a picture. Heaps of salt to be taken - I've been wrong many times before

Unlocking Market Secrets with Sacred GeometryIn this post we’ll dive into sacred geometry and how it is used in trading. Geometry isn’t just shapes—it’s the foundation of nature, architecture, and even trading.

From Pythagoras to Gann, great minds have studied these patterns to unlock hidden market signals. Let’s break down these powerful concepts and see how we can apply them to our own strategies!

First, take a look at this picture…

What you’re looking at here is a life-size oil portrait painting that’s displayed in the Manly P. Hall Institute of Metaphysics in Los Angeles, up on Mulholland Drive. This painting was done in 1929 by an artist named Augustus Knapp, and it’s a fascinating representation of one of the greatest minds in history named Pythagoras.

Now, here’s something interesting. There are no actual portraits of Pythagoras from his time. No real images of him exist just written descriptions passed down through the ages. So, this painting is a compilation of those descriptions, a vision of what they believed Pythagoras might have looked like based on historical accounts. But beyond the visual, what really matters is what this man achieved.

Pythagoras lived in 653 BC over 2,500 years ago and his contributions to mathematics, science, and even philosophy were so far ahead of his time that people today still struggle to comprehend how he knew what he did.

If you look closely at the painting, you’ll see a globe to the left-hand side. This is where things get really fascinating. Pythagoras not only knew that the Earth was round long before it became commonly accepted he also knew that the distance between the Earth and the Moon was approximately 250,000 miles. Let that sink in. Over 2,500 years ago, without modern telescopes, satellites, or space exploration, he was able to determine this astonishingly accurate measurement. How did he do it? That remains a mystery.

But his genius didn’t stop there. Pythagoras was the first person in recorded history to use the square root of numbers, laying the foundation for many of the mathematical principles we still use today. His contributions to geometry are legendary, with the Pythagorean Theorem being one of the most fundamental concepts in mathematics. He was able to see numbers not just as mere figures but as an intrinsic part of the universe, something deeply connected to music, nature, and even human existence.

Albert Einstein himself once said that there was God, there was man, and in between, there was Pythagoras. That’s how brilliant he was. Einstein, one of the greatest minds of the modern era, placed him in a category beyond ordinary human intellect. Many scholars and historians consider Pythagoras one of the four or five most intelligent people to have ever walked the Earth.

Now, I want you to pay close attention to something else in this painting. If you look at Pythagoras’ right hand, you’ll notice he’s holding a pyramid above his head. This is extremely significant. The pyramid was not just a symbol of ancient Egyptian architecture; it represented knowledge, sacred geometry, and the hidden mysteries of the universe. Pythagoras believed that the structure of the universe was based on mathematical harmony, and the pyramid was a reflection of this divine order. The way he holds it above his head symbolizes his deep understanding of higher knowledge, knowledge that very few people of his time and even in our time could comprehend.

TradingView

Pythagoras didn’t just study numbers, he studied their meaning, their vibrations, their connection to music, and how they formed the very fabric of reality. His school, which was more of a secret society, was devoted to exploring these truths, and his students followed strict codes of discipline, silence, and dedication to learning. Some say his teachings went beyond what we call science today, delving into the realms of metaphysics and spirituality.

So, when we talk about Pythagoras, we’re not just talking about a mathematician, we’re talking about a man who saw the universe in a way that very few have. He understood numbers not just as tools for calculation but as the building blocks of existence itself. This painting is not just a historical representation; it is a doorway into understanding one of the most profound thinkers in human history.

Alright, let's dive into something incredibly interesting, especially if you have an appreciation for Italian geniuses. We're talking about Leonardo da Vinci's division ratio and proportions of the human body this is pretty fascinating stuff.

If you look closely at da Vinci's sketches, you’ll notice that the ratios and proportions of the human body, like the measurements of bones, joints, and limbs, are not random. There’s an underlying order that we can see across the body. He was the first to really study and break down how the human body relates in terms of proportions, especially with the numbers that make up these proportions. For example, he measured everything from your radius to your phalanges, to the femur and the tibia. These are all linked in a very specific way. From the head to the pubic crest, these measurements fall into the 0.618 ratio, which is one of the most famous numbers in nature.

Now, let's take a look at why this is so significant. This isn’t just a random number—it’s actually tied to something we call the Golden Ratio or Phi, which is 0.618. It’s a ratio that appears in all kinds of natural patterns, from the spirals of seashells to the growth patterns of plants. Da Vinci was keen on observing these relationships, and he recorded them in his Codex, a collection of his writings and drawings.

Let me tell you a Fun fact, Bill Gates bought this Codex in 1982 for $20 million, and today, it’s housed in the Smithsonian Institute, traveling the world half the year and staying in Washington for the rest. Da Vinci was ahead of his time, so much so that when he wrote about this ratio, he didn’t just write it down plainly. In fact, he wrote everything in a mirror image, so you had to read it by holding the paper up to a mirror. Why? Well, a lot of his work was coded, not necessarily because he didn’t want people to understand it, but because he didn’t want to give away his discoveries easily. He was mysterious like that!

Now, let’s zoom out and look at something even more mind-blowing. If you go back to ancient times—way before da Vinci’s time—you’ll see that the Egyptians were using this same ratio. Take the pyramids for instance. The dimensions of the human body, from the head to the feet, also follow this pattern of 3, 5, 8, 13, 21... all culminating in the golden ratio of 0.618. The Egyptians were just as obsessed with these measurements and proportions, and you’ll find this same 0.618 showing up in their designs and architecture, too. It’s something that connects us to the very ancient foundations of human culture and knowledge.

What’s even crazier is that this ratio holds up in medical science. If your body proportions are off by more than 5% from the standard, it actually gets classified under conditions like dwarfism or other abnormalities. So, this ratio is so accurate that it defines what the "ideal" proportions of the human body should be. When you study these numbers and ratios, you realize just how mathematically perfect the human body is designed—at least in theory!

Now let’s take this to a different dimension, The DNA. The very structure of DNA follows this same fibonacci spiral, the same pattern of proportions that we see in the human body. The DNA helix is a perfect example of the golden ratio at play in biology. So when you look at the genetic code, you’re actually looking at the same patterns that show up in the pyramids, the human body, and even the very spiral shape that defines life at its most fundamental level.

And speaking of DNA, there’s an interesting tidbit related to Italy. This is a bit of trivia: There has never been a murder conviction in Italy because of the uniformity of DNA in Italians. Everyone shares such a similar genetic code that it’s almost impossible to distinguish one person from another in certain cases. Fascinating, right?

Alright, now that we’ve explored these mind-blowing connections between da Vinci’s proportions, the golden ratio, and DNA, let’s bring it back to the market and how we can use these ratios to help us with trading.

Here’s what you need to know, The same ratios that define proportions in nature can be applied to price movements in the market. For example, in the AUDUSD pair, you can use these numbers to identify key levels where price may reverse. Let’s break this down a bit further. If you look at the market's movements on a Weekly chart, you might not notice anything special at first. But when you start applying the 618 retracement, 786 retracement, or 161.8% extension, suddenly these numbers start lining up with the price action.

As we’ve seen, the same sacred geometry and mathematical principles that govern nature, architecture, and even DNA also play a crucial role in the financial markets. From Pythagoras to da Vinci, these hidden patterns have guided some of the greatest minds in history—and now, they can guide us in trading.

The market, like the universe, moves in harmony with these timeless patterns.

Keep studying, keep observing, and most importantly—keep refining your strategy. The more you align with these natural cycles, the better your trading decisions will become. See you in the next post, where we’ll continue uncovering the secrets of market geometry!

USDJPY CHART TECHNICAL ANALYSIS CONFIRM TARGET WIN USD/JPY Chart Technical Analysis: TARGET WIN!

Congratulations on a successful trade!

Your technical analysis skills and market insight have paid off, and you've reached your target on the USD/JPY chart!

Take a moment to review your strategy and analyze what worked well. This will help you refine your approach and achieve even more success in your future trades!

What's your next move? Are you setting new targets, adjusting your strategy, or taking a break?

Fridays CLS, Key Level OB, IFVG, Model 1Fridays CLS, Key Level OB, IFVG, Model 1

Bearish USD so bullish on EURUSD, GBPUSD, NZDUSD

you are welcome to comment with your thoughts and share your charts or questions below, I like any constructive discussion.

What is CLS?

This company is trading for the biggest investment banks and central banks. They trade over 6.5 trillion daily volume. They are smart money of the all markets.

CLS operates in the specific times which will give you huge advantage and precisions to you entries. Focus on that. Its accuracy is amazing.

Good luck and I hope this educational post helps to become better trader

“Adapt what is useful, reject what is useless, and add what is specifically your own.”

Dave FX Hunter ⚔