Gann Fan

DRV - Short Real Estate NowMortgage rates are penciling-in to be around 10% on a first mortgage note by Jan/Feb - so everyone with a couple of brain cells to rub together knows what that will do to real estate prices.

Some good things will come out of this - like the Gen Z's in the market will get a chance to become homeowners, but in trading terms, this is a very good opportunity. DRV is an easy ETF symbol to broadly short the real estate market with - I recommend sitting on the thing for several months.

Shorting bonds directly works, but will vary by your broker for availability.

AMEX:DRV

SPX movement midterm analysisMonthly movement is respecting Gann Fan 3/1 line. so a possible retracement to hitting 3/1 line again is highly likely for my point of view.

Also it is respecting Gann Fan 1/1 line as a support, however due to gap between current price to Gann Fan 1/1 line, its unlikely for the price tp hit the line so soon.

looking forward for the price to hit up to 4000 first before another critical trend change.

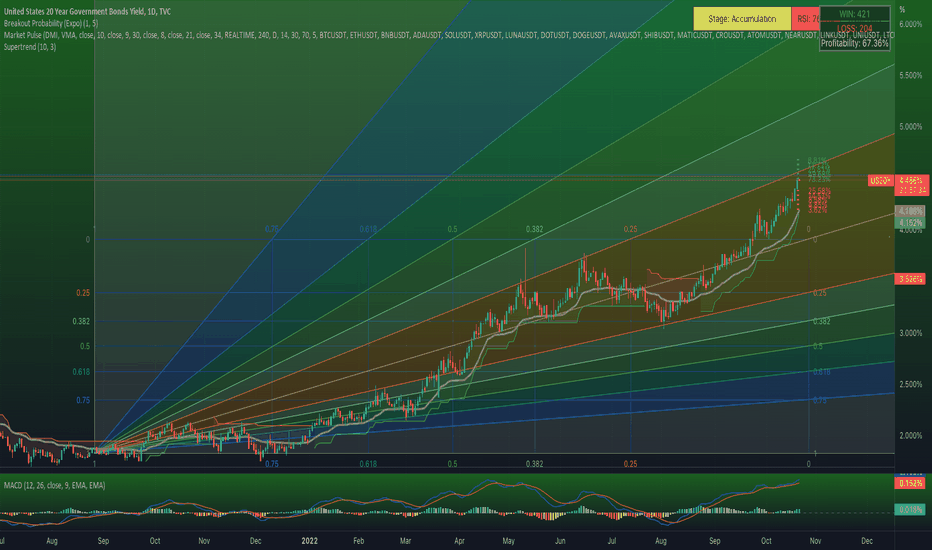

US Treasury 20 Year Bond Yield Curve - Year to DateWho would have thought we might be seeing 20 year guaranteed 10% returns on US Treasuries soon.. but it could certainly happen. Short the things on the way up, and keep your cash available to buy every one of them in sight on the way down.

Rates on a 3month Treasury are up an astounding 7,780% - Year to Date.

TMV is a Super-Simple Way to Short the Bond MarketBond yields are screaming upward, and they won't slow down until they overtake the rate of inflation - so we are basically at 5%+ on a T-bill right now, and probably headed toward double digits by end of winter. Yields Up = Prices Down. Short them until inflation returns to about 2%.

Shorting bonds is of course a little hard for a retail investor, but I have a couple of ETFs that work very well for it. TMV and TTT have proven quite profitable. TMV is up 114.5% in the last 12 months, and about 59.23% YTD. TTT has similar numbers, just some admin fee differences, up 116.5% in last 12 months, and 59.64% YTD.

When these start to level off, just sell the shares and flip all of it into whole $1k bonds. As yields begin to go downward, the values of new-issued / higher-yielding bonds will go to the moon. I made about an 85% return in 3 months in June 2020 doing the same strategy, I shorted them on the way down in June, then bought everything so cheap that I actually had internal interest 12% yields coming off from what I was actually buying Corporate AA+ bonds for. By October, I sold that stuff for ginormous gains when everyone realized the sky wasn't falling.

Using the same approach - I recommend shorting the snot out of real estate too. Technical indicators are pointing toward 10% +/- first mortgage rates by January, and that will kill the housing prices. DRV is a good short ETF tool.

AMEX:TTT

AMEX:TMV

Apologies - I should have posted this a couple of months ago, but people tend to want to see trend/evidence.. I jumped in these around May.

BTC: Potential Short Trading Opportunity at 20800 (-21200)

Just an idea.

Nothing major has changed from my previous ideas (a slight correction was made on the wave count).

If this scenario plays out, we could short at around 20800 (-21200).

Note: In this hypothesis, we are in the first corrective wave 2 (ABC) of a final, impulsive wave C (12345) of a zigzag (ABC) being the last componenet zigzag Z (ABC) of the whole downtrend, i.e., the triple zigzag (WXYXZ).

OIL to mid-50'sOil is going to pull back to the mid 50's.

this chart looks stupid and crazy...focus on the godmode section underneath...

i'm a signal in the noise guy...i don't mind the chaos on the page, i prefer the markers as they turn out more legit than most would realize.

if you mind the chaos...sorry...if you get it...enjoy

(and we closed the month under $90.952 so i'm leaning towards a vicious monthly candle)

Update: ETH's arc suport lost. Next 1250, or 1180

This is an update from my previous post (see the related ideas below).

The arc support, Fibonacci extensions' 0.786 of the large H& S, is now lost. The red candle is testing the bottom of the channel.

A rebound is possible here but considering the absence of the arc's support, together with the established larger and smaller Head and Shoulders, the price might not be grounded still after the plummet.

Instead, I suppose ETH may find more solid support somewhere on Gann Fan (green), as explained in my previous ideas. So watch 1250 (channel) and 1180 (Gann Fan) next.

ETH's support levels- analysis based on Gann Squre and arcs

With the Etherium merge complete, the predicted dump might be incoming.

TA-wise, Gann square played out perfectly and still indicates support levels that could be relied upon based on the previous prediction result.

Watch Gann Fan* 1 x 3 (green) if the price further goes down through the crosspoint of the arcs.

Because significant support lines are absent immediately below, It seems prices like 1256, 1189, and 1123 aren't so far-fetched if a stronger sellout takes place.

The intersections of Gann Fan with Fibonacci levels would provide solid support.

Shaded aqua-colored zones also indicate S & R like Ichimoku cloud, based on my previous observation.

* A component of Gann Square. I emphasized it with a different (green) color.

18600 level before long, but possible revisit to over 20400

The bottom looked rather solid, but the bullish picture is fading under the more stubborn ceiling.

Elliot-wise, the chart reads to be forming a third component of the downward corrective wave.

Because the price actions respect Gann Fan (deep green), we could again find support on one of them- 8/1 - or around 18500-18700.

Speculation.

As I analyzed before, bulls could gain momentum for a very short term, in which case we could revisit over 20400 perhaps for a moment.

If the chart breaks 20400, a price over 20900 or higher isn't unlikely. But it would be until the massive short orders are filled - before long.

IDX: TLKM FOR SEPTEMBER 2022Strong support at 4510

Medium resistance at 4660

I Prefer Yellow trading plan

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

IDX: BBRI FOR SEPTEMBER 2022Medium support at 4550

Weak resistance at 4650

I Prefer Yellow trading plan

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

Gann Square playing out?

Update from the previous idea.

The above image is the linear version.

As we expected, Gann square and arcs stand in the way.

I emphasized some arc colors, but basically no change to the drawing itself.

The breakthrough here would be a surge, but it doesn't necessarily seem likely.

ETH on key levels: Gann Square Analysis

This is an elaboration of my previous idea about the ETH's resistance levels, this time using Gann Square (and arcs).

As can be seen, every arc and fan behaves as support & resistance.

White diagoanl line is Gann 1 x 1. Trends above it are sad to be strong, and trends below it are weak if the square is properly applied.

Overall, this Diagram shows how important but difficult it is for ETH to break through the two key levels: the current price zone and the previous high.

ETH Merge will squeeze price up to unload lockup, Then Down.BINANCE:ETHUSDT

My opinions in order of likelihood

(See more Detail Opinion written on Callouts in Chart)

Option 1 *

- Merge will lead to forcing price up

-- So that those with locked ETH get their value worth back

--- Then it will crash back down through the levels.

Option 2

- Fake out here / Turn now and we fall to the bottom Area on the weekly Low over the last couple of years.

Option 3

- We Range and Crab for months and months while inflation eats away the relative floor value. vs what would have been nominal.

Indecisive trend Leveraged Funds, Asset Managers and Non commercial are pushing the market to the downside. Keep your stops tight things would get real ugly in a blip. Don't hold long positions.

Look at the COT report here:

Scenario on track, but beware of support at 18200-17600

Dump as expected. Gann Fan supports as predicted (see the related idea and the image below).

Except for the minor upside (20130) smaller than expected (20400+), the overall scenario is right on track.

The macro downtrend would persist, but we would see a short-term rebound at the support zone around the previous low.

Check 18200 and 17600. (Previous low and the crosspoint between the parallel channels on the weekly chart.)