Gann Fan

ETH - USD, BTC & Dominance :: Consolidating before next leg upThis 4 pane chart breaks down the current consolidation on the 4H chart and looks at the 1D uptrends in terms of USD, BTC and market dominance. Taking a breather in the 2700s before heading for ~3300 by mid-May-ish. Looking at moving averages, Gann fan up trending channel, volume profiles, a little RSI and AX/DX for verification.

4 pane chart:

4H ETHUSD - consolidating

1D ETHUSD - consolidating

1D ETHBTC - BTFD!

1D ETH.D - Correcting before leg up

XLMUSD - Rocket has left the pad, quick pause then retest ~0.7XLM blasted through the 50D MA like a rocket, followed with a solid break & close above the down trend and has moved into a very positive Gann Fan channel. Volume oscillator seems to be bottoming out, confirmed by the RSI confirming a rising trend in strength. Should see a mild bounce & some consolidation near local ATH.

Presently bumping it's head against the 21D MA, might get a quick dip before moving on up.

Dogecoin! Possible strong breakout to the border of 0.35 cents Hello traders, the chart above shows the likely price movement. Currently, the price is strongly pushed up, which may result in the price breaking above the MA50, it seems that at the moment we can count on a bullish correction.

greetings

IDX: JPFA GOOD VIBE FOR A WHILE, WAIT..medium Support at 2150

medium resistance at 2390

Market close at 2210, weekly chart already golden cross. this week will be last time you in before up to 2390.

Red plan is my recommend,

have a nice trading.

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

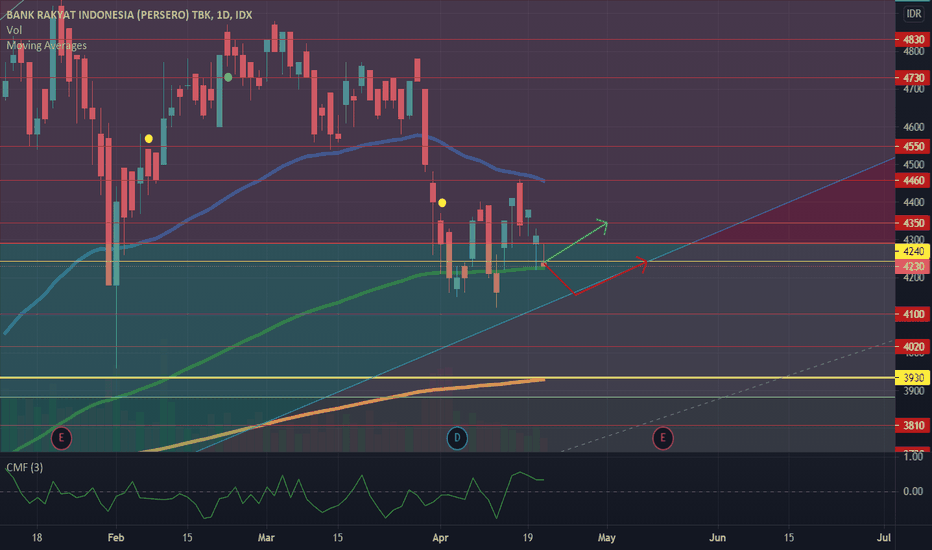

IDX: BBRI REBOUND AT EMA 144weak resistance at 4300 4350 4450

medium resistance at 2440

Market close at 2430, it'll testing his EMA 144, and it so strong , possibly rebound to his weak resistance.

Green trading plan is my recommend,

have a nice trading.

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

Stairway to Heaven... Hell... or Purgatory $algoThis set up goes all the way back to lowest point of Algo on Nov. 4, 2020 following the previous peak in Aug. 2020.

Notice the trend since Feb. 12th peak at 1.8585. The dips occur at the cross of the 3/1 (red ). The peaks occur at the cross of the 2/1 (yellow).

If the trend continues I see 3 possible scenarios to play out:

1. Algo breaks out in a big way when the 2/1 crosses the previous high of $1.8585. That has the look of a cup and handle. (Stairway to Heaven)

2. Rejection at $1.8585 with a retrace to the 3/1 line where it finds support. (Purgatory)

3. Rejection at $1.8585 with a retrace to the 3/1 line. Support lost and we enter a bear market. (Hell)

I don't trade. I HODL. Not investment advice.

Please share your thoughts or predictions.

The Gann of Truth - ETHUSDUsing an old 2017 gann for my upper resistance levels.

Money seems to be rotating back into ETH and ETH defi because devs were able to reduce network fees to a tolerable level. We got a slick 30% pamp on ETH the last week or so and finally found some resistance.

Clear rejection at 2548. If this bitch bounces at 2310 & breaks thru 2548, we ridin straight to 3400. If not, next support level is 2134. I'd be looking to buy there.