A bearish week might be expected for the ZB and ZN market.Those who trusted treasury bonds have lost this trust, we can think of Asians who are the largest holders of treasury bonds.

The interest rate can only go up and up we can expect easy money. The weekly chart shows a significant bearish trend that may have room to extend.

Don't try to surf, just sell and wait.

Gann Fan

Easy money by selling short US bonds market ( ZN & ZB) The interest rate can only go up and up, we can expect easy money.

The weekly chart shows a significant bearish trend that may have room to extend.

Don't try to surf , just sell and wait.

others markets ( stock indices , commodities, and currencies) will be volatile and quite difficult to trade, while the bonds market have only one trend : the south.

IDX: WSKT IT'S TIME!! YET, MAYBE YES/NOweak suport support at 1405

medium resistane at 1465

Weak resistance 1585

market close at 1460. maybe it's paralax from my study or it how it's. but when market surpass 1465 it's potensialy fly to 1585 .

I prefer green trading plan

have a nice trading.

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

IDX: ELSA TRY TO BE NICE WITH EMA55Strong support at 416

Strong resistane at 370

it's not my favorite but after rebound at ema 55 at least it will fly to 410

have a nice trading.

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

IDX: BTPN SIDE WAY BUT WORTHY TO WATCHMedium resistance 3660

weak resistance at 3050 and 3430

medium support at 2660

we can't predict when, but when it surpass 3050 it's good to go. meanwhile it still side way, so be patience

have a nice trading.

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

TZA 4H gann fan RSI This is my way of getting a price range on tza using gann fan

if you follow all my ideas, you'll see im a bear market for the last 2 years

im doing this for fun and get experience

i usually check 3m 15m 4m and weekly montly to make sure im not a idiot

RSI is over needs to go back at 70-80 eventually

and didn't go to 80 since a long time

75 USD clear target for crude oil.The crude oil market is anticipating since three months, the inevitable inflation. The US government decided not to fight anymore the inflation but to deal with it. This strong bullish trend of the crude oil is the big indicator of the bearish trend in the bonds and the dollar market. Nothing can stop the raise of the yield rate.

IDX: BRIS TRY TO CONSIST WITH EMA 55Strong support at 2500

Strong resistane at 2980

in several days, BRIS stay strong at EMA55 , go for 2700 out at 2900, it should be good

I prefer green trading plan

have a nice trading.

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

IDX: BJBR FLY TO STRONG RESISTANCE Weak support at 1595

Strong resistance at 1665

Weak Support 1520

already surpass 1595, go for it and out at 1640

I prefer green trading plan

have a nice trading.

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

IDX: AGRO SURPASS STRONG SUPPORTAll time High 1670

Weak Resistance 1500

Strong Support 1320

I dont realy like at all time condition but, for now , already surpass strong support, it's worth to go at 1350 out at 1450

I prefer green trading plan

have a nice trading.

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

DRGN/BTC LongDRGN/BTC looking like it wants upside movement:

MA30 crossed above MA100 on March 1st

signifying that the the trend will likely be bullish

now for these coming weeks at least.

To add more conviction to the play that it has

turned bullish, we will need to see a clean close

above the Gann Fan 1/1 line which price has been

consolidating against since Feb 10th.

If this happens then we could expect price to visit

resistance at

300 sats

then the .236 and .382 fib levels at

449 sats and 650 sats respectively,

until meeting stronger resistance at the 2/1 Gann

Fan line.

It just needs a nice influx of volume here and

it should start moving.

IDX: TLKM - SHORT MOMENTStrong support at 3260

Strong Resistance at 3520

Dont push your luck, wait until it bouncing at support .

I prefer red Trading Plan

have a nice trading.

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

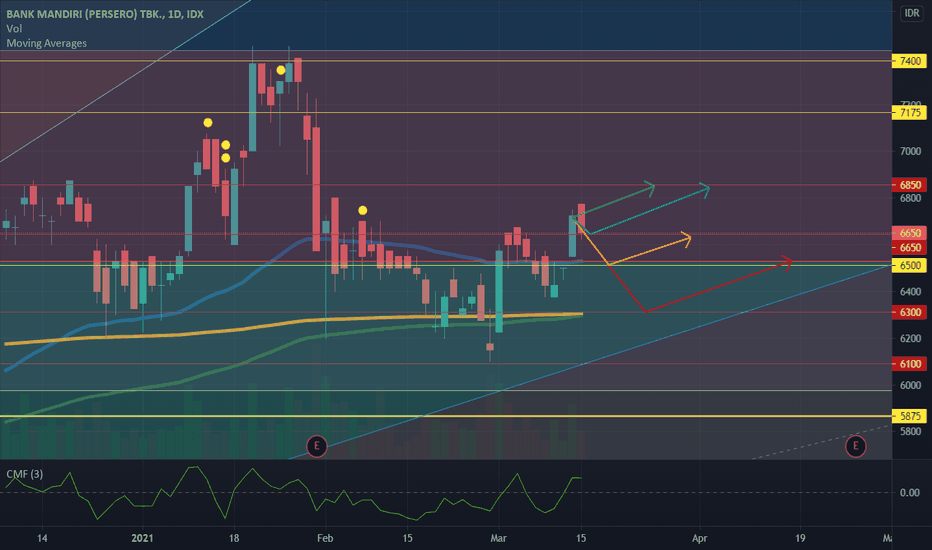

IDX: BMRI FISHY , CLOSE AT WEAK SUPPORTWeak support at 6650

Weak Resistance 6850

It's little bit fishy, market closed at 6650 . it's critical point will it go up or down.

hold your breath for tomorrow , when it confirm to up. go for it.

I prefer cyan trading plan

have a nice trading.

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

IDX: BBCA PREPARE YOURSELFWeak support at 33150

Medium Resistance 34075

we need to be patient, be neutral for tomorrow but when it reach at 33150 prepare for bouncing, after that go for it.

I prefer for orange trading plan.

have a nice trading.

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

GBPUSD - LONG ENTRY PRICE - 1.39350The impulse to the North continues to develop towards the target in the supply zone 1.40800. The price passes the 1x1 support line.

GBPUSD - LONG

ENTRY PRICE - 1.39350

SL - 1.38700

TP - 1.40800

Always follow the 6 Golden Rules of Money Management:

1. Protect your gains and never enter into a position without setting a stop loss.

2. Always trade with a Risk-Reward Ratio of 1 to 1.5 or better.

3. Never over-leverage your account.

4. Accept your losses, move on to the next trade and trust the software.

5. Make realistic goals that can be achieved within reason.

6. Always trade with money you can afford to lose.

Please leave your comment and support me with like if you agree with my idea. If you have a different view, please also share with me your idea in the comments.

Have a nice day!

XEMUSDT 4H Chart AnalysisHello friends

XEM seems to have experienced a sharp fall,

And it also seems to experience a very good price increase after that, express your opinion, thank you.

PYPL Trading PlanPAYPAL Trading Plan

1. (Green) Going Up until Resistance at point 254.39, then bounching down

2. (White) Green goes through soft resistance, until Gan Fan Area

3. (Black) Going Down until Strong Support at point 225.00, then bounce up.

We can see that the last position was it going up after it bounced by a strong support.

and in my opinion, the green arrow is very possible because it would still going up until

point 254.39

As for the possibility of Black arrow, we can see the previous data where every time after

it bounce up from strong support, it will be going up at least until resistance but I'm not

going to choose that.

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.