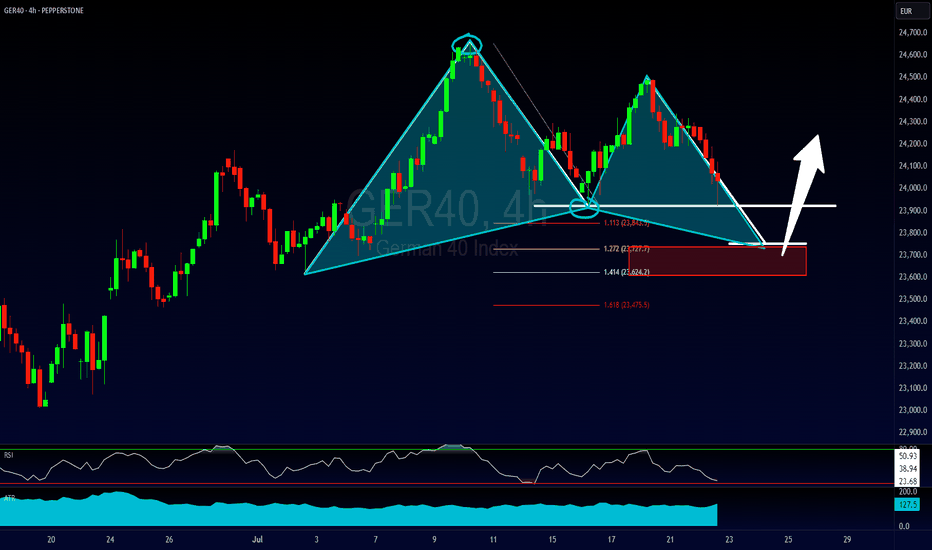

The Kiss of Death Trade & Other Reasons for EntryFollowing up on the 2618 opportunity that we looked at on the FOREXCOM:GER40 this past weekend the market has now created more potential trading opportunities to get involved.

1) A bullish bat pattern that has completed due to a result of a complex pullback into the original double bottom.

2) A potential Kiss of Death trading opportunity

3) A bigger potential bullish gartley pattern IF the current 2618 opportunity is violated.

Please leave any questions or comments below & feel free to share your opinion on the setup.

Akil

Gartleypatern

BellRing Brands (BRBR) Weekly Gartley@ Key Levels + Kijun SignalIn March 2025, I previously took a look at this budding public company BellRing Brands, Inc. for a long-term investment horizon. It was priced around 74 at the time, then the fall of the overall market status put additional pressure on its stock, although the company itself is booming and meets my fundamental parameters. See the following:

Since then, we had an awesome and confident forward guidance from the company in the last earnings call in May 2025: bellring.com

Now, looking at BellRing Brands (BRBR) once again, on a weekly chart, key technical patterns have formed that look very promising and solid with its many confluences.

TECHNICALS:

WEEKLY:

Many weekly confluences have appeared from a technical perspective. Here is what I see:

(1) There is a clear Bullish Gartley-ish pattern in a weekly retracement to 50% followed by a retracement to 78.6% of a preceding move.

(2) The price is around 78% fib support.

(3) Horizontal area of support: The 50 - 58 area is a whole prior area of horizontal support that was a prior resistance area back in July 2024, and the price has landed back on that area. You know what we say as technicians and investors: past resistance = future support.

(4) MACD Hidden Bullish Divergence (weekly)

(5) The price tested the weekly cloud and broke through; however, bullish extremes were triggered when that happen, which is rare based on all my personal studies. In fact, the current level 55-58 marks the end of a bearish double top cycle that began around March 2025.

(6) A weekly Doji with volume support (classified as a "dVa" in my old notes of Volume Price Analysis).

Here is the weekly chart:

MONTHY:

BRBR is poised to rally Q3 and Q4 2025.

We have a potential monthly bounce of the kijun forthcoming along with good fundamentals going forward supporting the growth of the company in the long term.

** potential monthly Kijun Trend Bounce **

Here is the monthly chart:

Target:

Currently, the price is 58.54. My tentative target is around 140 by March 2026.

Thus, with all the fundamental support, good forward-looking guidance, and the technical I believe that BellRing Brands (BRBR) is at a great price right now. It is prime to continue its stretch of growth for 2025. Looking forward with investor foresight, the case for BellRing Brands and its stock (BRBR) is not only a high-probability outlook of positivity, but a high odds outcome of technical price pattern success. What a great discount.... :)

EURAUD ForecastMy observations on FX:EURAUD chart to take a trading position include the following:

- Completion of a Gartley Harmonic Pattern

- Completion of the fourth wave of an Elliott wave pack and waiting for the formation of wave 5

- Overlap of the target of the 5th Elliott wave with the target of the Gartley pattern (if the pattern works)

- Positive price bounce reaction to SMA200 and an upward guard to cross SMA21 and the pivot line as an important resistance. (Pivot Point Standard)

The mentioned signs for my personal trading system are a certificate to take a trade, of course, with risk management and logical budget plan ( risk no more than %1 of capitol)

The goal is to execute the trading plan correctly and systematically, regardless of the outcome.

Bullish Shark On $WIF's Monthly ChartI haven't really posted much on Carney's Harmonic Patterns, but as I was working on some material for The Litepaper, I glanced at dogwifhat's monthly chart and noticed it looked very much like shark pattern - but I wasn't even 80% sure. Had to pull out my notes.

Turns out, dogwifhat's monthly candlestick chart is a perfect Bullish Shark Pattern

AB = 0.982 of XA → Nearly a 1.0 retracement, which fits within the Shark's extended AB range (0.886 – 1.13 XA).

BC = 0.992 of AB → Deep retracement, typical of Shark formations where BC is 0.50 – 1.00 of AB.

CD = 1.147 of BC → Falls within the expected 1.13 – 1.618 BC extension for a Shark.

XD = 1.125 of XA → Bulls-eye confirmation—Shark patterns complete at 1.13 – 1.618 XA extension, and your 1.125 is right in that range.

Given Carney's rules, the targets are the 50%, 61.8% and full reversal of CD:

$2.67

$3.04

$4.83

Will be fun to see how it plays out.

If there's a dip below $0.40, then it's invalidated.

GOLD KEY LEVELS TO WATCHHello Traders, I hope you're having a fantastic trading week so far! Let’s dive into the current setup on Gold, as it's presenting an exciting trading opportunity.

H4 Chart: Price Action Reversal with Key Fibonacci Levels

Overview: On the 4-hour chart, we observe a price action reversal pattern aligning with a 200% Fibonacci extension. The price has recently formed a higher low after completing an impulsive move.

Market Structure: As long as the price remains below the previous higher high (HH), we anticipate the formation of a lower high (LH).

Key Entry Level (EL): The price is trading below the EL, reinforcing bearish potential.

Target: The 100% Fibonacci extension serves as the initial key target, aligning with the ABC pattern’s symmetrical swing.

H1 Chart: Bearish Gartley Harmonic Pattern

Overview: The 1-hour chart showcases a Gartley bearish pattern, nearing the Potential Reversal Zone (PRZ).

False Breakout: There is a clear false breakout above the EL, indicating possible exhaustion of buyers at this level.

Key Levels:

PRZ: Acts as a strong confluence zone for a potential short opportunity.

Target: The first bearish target aligns with the subconfluent low (H4) and the ABC extension target from the higher timeframe.

Trading Plan

Monitor Price Action During U.S.

Trading Hours:

Focus on key reactions at the PRZ and any bearish reversal signals (e.g., engulfing candles, 3-candle reversal).

Bearish Case:

A rejection at the PRZ and a sustained move below the EL could confirm bearish continuation.

Bullish Invalidity:

If the price closes significantly above the EL, this would invalidate the bearish setup and indicate continued upward momentum.

Final Notes:

We’ll keep an eye on the movement and provide any updates as the price unfolds. Let the pips be with you—stay tuned for the outcome!

THETA Long Signal | 130% Profit Potential with 6.8 Risk-Reward✅ Key Trade Levels:

📌 Entry Point: $2.6

🛑 Stop Loss: $2.1

🎯 Take Profit: $6

📊 Analysis and Explanation:

The THETA chart shows a strong Harmonic Gartley pattern, where the price rebounded after touching the 61% retracement level of the XA wave. Additionally, an inverse head and shoulders pattern has formed, and the neckline has been broken decisively. The key resistance at $2.6 is the last barrier. Once this level is broken, a strong upward movement towards the $6 target is highly likely.

Render/RNDR Lond- 420 day Bullish Gartley

- Three Rising Valleys

- Bullish Divergence x2

- Backtest of major support

Just the best you can ask for. Anything can always happen, but this is as good as you can ask for.

TSLA four-hour chart shows a potential Gartley harmonic.NASDAQ:TSLA is forming a potential bearish Gartley on the four-hour chart, which would result in bullish price action on the C to D leg, as long as point C on the chart holds. Point C on the chart also corresponds to the daily 200 SMA, and is right above the psychological $200 level, which adds confluence to the long entry at $202.50.

Gold Market Breakdown: Unfolding Patterns and Key Price MovementGood morning Traders,

Trust you are doing great.

Allow me to continue my storyline of the Gold market.

In my previous analysis of the gold market, I identified two unfolding patterns with similar directional implications. While one pattern was invalidated, the other continues to develop as expected. I projected an appreciation in the gold price from 2370.930 to the 2430-2442 region, which has materialized with gold rallying to 2425.540, where it is currently encountering resistance.

Additionally, a new bearish Gartley pattern has emerged, suggesting a potential decline towards 2314.318 to complete the D-leg of the earlier identified unfolding bullish Gartley pattern. Supporting this bearish outlook are the following factors:

1. The current gold price has met the minimum requirement for leg C of the larger unfolding Gartley pattern, even though there are still room to the upside, but it shouldn't exceed 2436.857.

2. A fully formed smaller bearish Gartley pattern has been observed on the H1 timeframe.

3. The price is currently at a key supply zone that coincides with a critical level in our analysis.

Given these observations, I anticipate a significant drop in the gold price. However, if the price exceeds the maximum harmonic level for the formation of leg C of the unfolding bullish Gartley pattern at 2436.857, this outlook will be invalidated.

Cheers and happy trading!!!

SMCI four-hour chart shows confluence.NASDAQ:SMCI shows a bullish cup and handle on the four-hour chart, as well as a bullish Gartley harmonic. Point C of the harmonic lined up with the lower four-hour 100 linear regression channel and provided the best entry. The middle of the four-hour 100 linear regression channel coincided with the handle of the cup, as well as the weekly 20 SMA, which provided another excellent entry with more confirmation.

Comprehensive Analysis of the Gartley Harmonic PatternThe Gartley Harmonic Pattern, a cornerstone of harmonic trading, was first introduced by H.M. Gartley in his 1935 book "Profits in the Stock Market." This pattern leverages Fibonacci retracement levels and geometric price formations to identify potential market reversals, providing traders with a strategic edge.

__________________________The Bullish Gartley Pattern___________________

Structure:

X-A Leg: The initial upward movement.

A-B Leg: A retracement of approximately 61.8% of the X-A leg.

B-C Leg: An upward move retracing between 38.2% and 88.6% of the A-B leg.

C-D Leg: The final downward movement, retracing 78.6% of the X-A leg, marking the pattern completion at point D.

Entry Criteria:

Entry Point: Enter a long (buy) position at point D, where the price is expected to reverse upward. This is typically the 78.6% Fibonacci retracement level of the X-A leg.

Stop-Loss:

Placement: Set a stop-loss order slightly below point X to safeguard against unexpected price movements. This minimizes potential losses if the pattern fails.

Take Profit:

First Target: Place the initial take profit target at point B, the retracement level of the A-B leg.

Second Target: Set the second target at point C, the retracement of the B-C leg.

Extended Targets: For a portion of the position, consider holding to capture further gains if the price continues to rise.

_________________________The Bearish Gartley Pattern_____________________

Structure:

X-A Leg: The initial downward movement.

A-B Leg: A retracement of approximately 61.8% of the X-A leg.

B-C Leg: A downward move retracing between 38.2% and 88.6% of the A-B leg.

C-D Leg: The final upward movement, retracing 78.6% of the X-A leg, completing the pattern at point D.

Entry Criteria:

Entry Point: Enter a short (sell) position at point D, where the price is anticipated to reverse downward. This corresponds to the 78.6% Fibonacci retracement level of the X-A leg.

Stop-Loss:

Placement: Set a stop-loss order slightly above point X to limit potential losses if the pattern does not play out as expected.

Take Profit:

First Target: Place the initial take profit target at point B.

Second Target: Set the second target at point C.

Extended Targets: Consider holding a portion of the position for additional gains if the price continues to decline.

_________________________Key Considerations__________________________

Precision: Accurate measurement of Fibonacci levels is critical. Even slight deviations can invalidate the pattern.

Confirmation: Utilize additional technical indicators or price action signals to confirm the pattern before initiating a trade. This can include moving averages, trend lines, or oscillators.

Risk Management: Adhere to strict risk management practices. This includes setting appropriate stop-loss levels and managing position sizes to protect capital.

____________________________Conclusion______________________________

The Gartley Harmonic Pattern is a sophisticated and reliable tool for identifying potential market reversals. By mastering the intricacies of both the bullish and bearish Gartley patterns, traders can enhance their analytical capabilities and improve trading outcomes. Integrating these patterns with other technical analysis methods and maintaining rigorous risk management protocols is essential for consistent trading success.

Incorporating the Gartley pattern into your trading strategy involves practice and diligence. Ensure that you continuously refine your skills in identifying these patterns and executing trades accordingly, always mindful of market conditions and broader economic factors.

EURUSD GARTLEY BULLISHHello fellow traders! Today, let's dive into one of the most traded forex pairs, the EURUSD.

The EURUSD, also known as the Euro-Dollar pair, represents the exchange rate between the Euro and the US Dollar. It is one of the most liquid and widely traded currency pairs in the forex market, often influenced by factors such as economic data releases, geopolitical events, and monetary policy decisions from the European Central Bank (ECB) and the Federal Reserve (Fed).

Chart Patterns Analysis: On its daily chart, the EURUSD pair has formed an advanced harmonics pattern known as a Gartley pattern. This pattern is characterized by specific Fibonacci ratios that help identify potential reversal zones in the market.

The price is currently trading above the long entry level (EL) at 1.06707, indicating a bullish bias in the market. This entry level has already been executed on its micro, suggesting early participation in the potential bullish move.

Using Fibonacci Levels: To identify potential resistance levels for profit-taking, we can utilize Fibonacci retracement levels. The wall, or initial target, is set at 1.07640. Additionally, traders may consider partial profit-taking at the 38% Fibonacci retracement level of XA at 1.08660.

Further Targets: The primary target zone 1 is set at the 62% Fibonacci retracement level of XA, which is located at 1.10277. For more ambitious traders, the 79% Fibonacci retracement level of XA serves as an extended target at 1.11466.

As always, it's essential to manage risk effectively by setting stop-loss orders and adjusting position sizes accordingly. Monitoring price action and market developments can provide valuable insights into the strength of the bullish trend and potential reversal zones.

Stay tuned for further updates and happy trading, everyone!

ETHUSD ADVANCE HARMONICS PATTERN **Greetings Fellow Traders! Welcome to Today's Insight.**

Today, we're diving into the world of cryptocurrency, focusing our attention on ETHUSD. A remarkable trading opportunity is unfolding, and we're here to explore it together.

📊 **Chart Analysis: ETHUSD Harmonic Gartley Pattern**

On the daily chart of ETHUSD, an advanced harmonic pattern known as the Gartley Bullish pattern has taken shape. This pattern can offer valuable insights for potential trades.

📈 **Trade Setup:**

- **Chart:** ETHUSD (Daily)

- **Harmonic Pattern:** Gartley Bullish

🎯 **Key Entry Level:**

The current price of ETHUSD is in proximity to a promising entry level.

- **Entry Level (EL):** 1636.6

🚀 **Targeting Potential Profits:**

We're aiming for a specific target calculated based on the harmonic pattern.

- **Target 62% XA:** 2016.3

📈 **Consistency Matters:**

Repeatedly hitting a target or level signifies a potential shift in price dynamics.

📊 **Trade Responsibly:**

Remember to implement prudent risk management strategies that align with your trading approach.

💬 **Join the Discussion:**

We're eager to hear your thoughts on this analysis. Your insights enrich our community.

📊 **Explore Trading Opportunities:**

The ETHUSD Harmonic Gartley pattern presents a compelling case for exploration. Delve into the details and see if it aligns with your trading strategy.

Join Trade Chart Patterns Like the Pros for Comprehensive Trading Insights and embark on a journey to enhance your trading skills! 📊📈💎

USDCAD ADVANCE HARMONICS PATTERN GARTLEY BULLISHHello, Traders! Welcome! Let's explore a promising trading opportunity in USD/CAD. An advanced harmonics pattern has emerged on the hourly chart, and the price is currently trading above the suggested long entry level at 1.33864. We're eyeing two target zones:

Target Zone 1 at 62% XA extension: 1.34814

Target Zone 2 at 127% XA extension: 1.36112

Bullish Gartley MULTI LONG Seeing a possible bullish gartley pattern forming here on lower timeframes. Entry should be around $2.10 and a price surge should occur if plays out

Unlocking Bullish Potential: Gartley Pattern Analysis for AUDCHFHello Traders,

I've got an observation on #AUDCHF. As DXY shows bullish signs, we might see some bearish movements in CHF.

Right now, the pair is sitting on a strong support at 0.5735. This seems like a good spot for the final leg of the Gartley pattern, signaling a potential move to the upside. Keep an eye on it, though – if it drops below 0.5722, we could see a decline in the pair's value.

Cheers!

Pepe Special: $CRSPWOAH.

NASDAQ:CRSP looking like a juicy setup.

Type 3 return. On a gartley. On the weekly chart??

There's only two options. Either this thing dies and goes to goblin town or it pumps to the pearly pearlies.

Currently at basement level prices and the risk to reward ratio is looking v nice. Green boi energy picking up too, check the volume over the past three weeks.

TP 1-3 and SL shown above.