SPX500 - what's next?Further to my previous idea on SPX.

SPX respected the Resistance at FR 161.8 at 6400.

Price went down and reverted form SMA200 (4H)

Now price has completed the Perfect Gartley Pattern and reached point D.

If (against fundamentals) price reverts down from there and breaks down through SMA50 (4h), I will consider it as Bearish Validation and I will expect correction movement, which cen go down to ca 6000.

Just my humble opinion

Gartley

Natural Gas SpotFormed Gartley though break 0.786 ratio but allowed upto starting point , also forming ABCD pattern, appear ib wave B or X later will decide b or X which wave . Let see. I am not SEBI registered analyst, this is not buy , sell , hold recommendation. Only personal view for educational purpose. Thanz. if goes wrong no offence.

EFIH - anther chance - low risk EGX:EFIH - 1-Day Timeframe

A bullish pattern emerged on Feb 13, but prices adjusted after the 3/2 stock split on Jun 02. Key levels:

- Entry: ~11.00

- Stop loss: 10.00 (7.00% loss)

- Support: 10.60 (6-month low)

- Targets:

- T1: 13.38 (22.24% profit)

- T2: 15.00 (37.12% profit)

This is not investment advice—only my analysis based on chart data. Consult your account manager before investing. Good luck!

EGCH - great opportunity but be carful EGX:EGCH timeframe: 1 week

Identified a bearish Gartley pattern with:

- Sell point: 11.00

- Targets: T1 at 9.55, T2 at 8.52

- Stop loss/rebuy: 12.00

However, prices may still rise if the weekly RSI closes above 70. Currently, MACD and RSI show no negative signs, and EGX30/EGX70 are reaching new highs, suggesting potential upward movement.

Disclaimer: This is not investment advice; consult your account manager before making decisions. Good luck.

Update idea: Ad

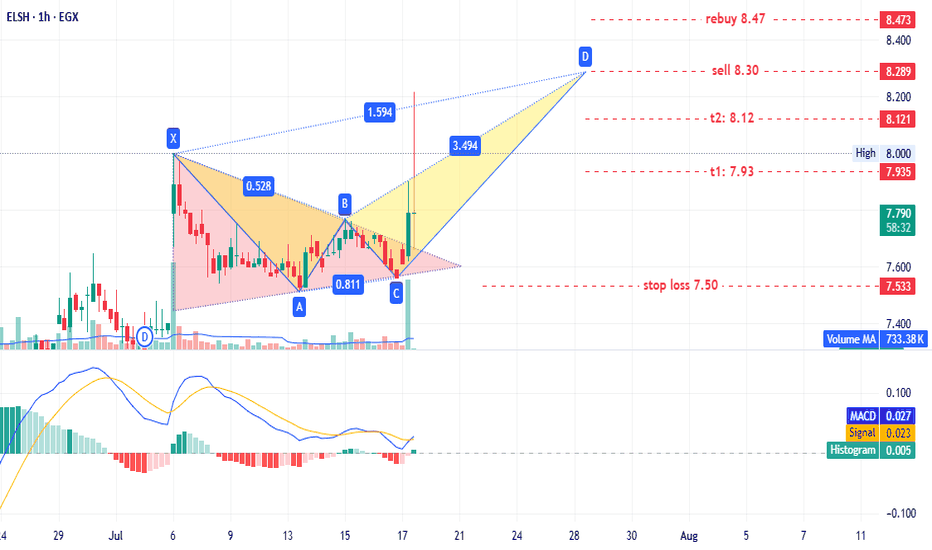

ELSH - old player EGX:ELSH timeframe: 1 hour.

A triangle pattern was identified, targeting 8.20. No new entry is recommended for shareholders, but if prices retest the triangle pattern at 7.65–7.60, it could present a low-risk entry opportunity.

This may also form a potential bearish Gartley pattern with targets:

- T1: 7.93

- T2: 8.12

- T3: 8.30 (sell point)

Stop loss: 7.50.

If prices continue rising and close above 8.47, consider rebuying what was sold at 8.30.

Disclaimer: This is not financial advice, only our analysis based on chart data. Consult your account manager before investing.

Good luck!

Pi Network Faces Scrutiny as Market Cap Hits $3.4BPi Network, the mobile-first crypto project that attracted millions of users with its "mine-on-your-phone" concept, is facing growing scrutiny as its market capitalization has surged to $3.4 billion, despite lingering concerns over its actual utility and use cases. As hype continues to propel its valuation, the community and broader crypto market are demanding answers: What can Pi really do?

Background and Growth

Launched in 2019 by a team of Stanford graduates, Pi Network aimed to democratize cryptocurrency mining by enabling users to earn tokens on their smartphones without expensive hardware. Through aggressive referral-based marketing and a user-friendly interface, it reportedly attracted over 50 million users globally.

However, after years in beta and a still-limited mainnet release, the Pi token is not yet fully tradable on major exchanges, and its price remains speculative. Despite that, Pi's market cap is estimated at $3.4 billion based on limited OTC (over-the-counter) trading and projected supply metrics.

Utility Concerns Intensify

With a large user base and growing token valuation, the pressure is on for Pi Network to deliver tangible value. Key concerns include:

Lack of utility – Most users cannot use Pi to pay for goods or services in real-world scenarios.

No open mainnet – While a “closed mainnet” has launched, the network still lacks full public blockchain access, hampering transparency and developer participation.

Centralization – Pi’s governance and decision-making remain opaque, raising questions about decentralization and long-term sustainability.

No listings on major exchanges – Without real-time market discovery, token valuation remains speculative and potentially misleading.

Community Reaction

Many early adopters continue to support Pi, viewing it as a long-term project that needs time to mature. Some local communities even organize Pi-based bartering systems. However, critics argue that without real-world use cases, Pi remains a glorified points system rather than a functional cryptocurrency.

The disconnect between market cap and utility has fueled concerns of a speculative bubble. In fact, some compare Pi to past projects like BitConnect, which promised much but delivered little.

The Road Ahead

To maintain its momentum and justify its valuation, Pi Network must:

Open its mainnet to public interaction and developer contributions.

Secure listings on reputable exchanges to enable transparent price discovery.

Establish real-world utility, such as integration with e-commerce, payments, or DeFi applications.

Improve transparency around tokenomics, governance, and long-term roadmap.

Failure to address these areas could result in an erosion of community trust and capital flight to more proven projects.

Conclusion

Pi Network’s $3.4 billion market cap is both impressive and problematic. It highlights the power of community-driven growth but also underscores the risks of hype-driven valuations. As the crypto market matures, utility—not just marketing—is what will determine long-term success. For Pi, the clock is ticking to move from potential to performance.

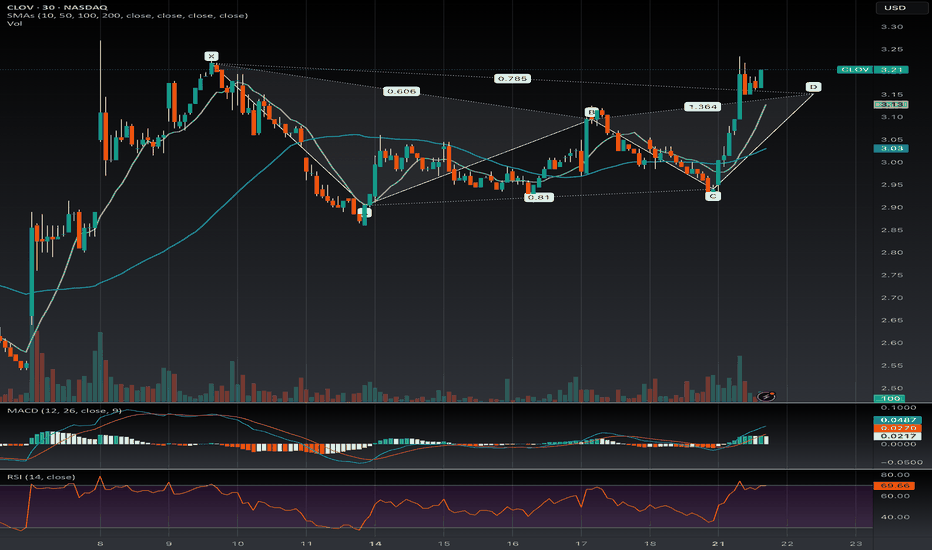

$CLOV Short Term Bearish Gartley NASDAQ:CLOV is forming a Bearish Gartley pattern with the D point projected at $3.10, nearing a potential reversal as of Monday, July 21, 2025. The RSI at 68.46 is close to overbought territory, adding support to the possibility of a bearish move if confirmed below $3.10. Keep an eye on a break below $3.10 with increased volume.

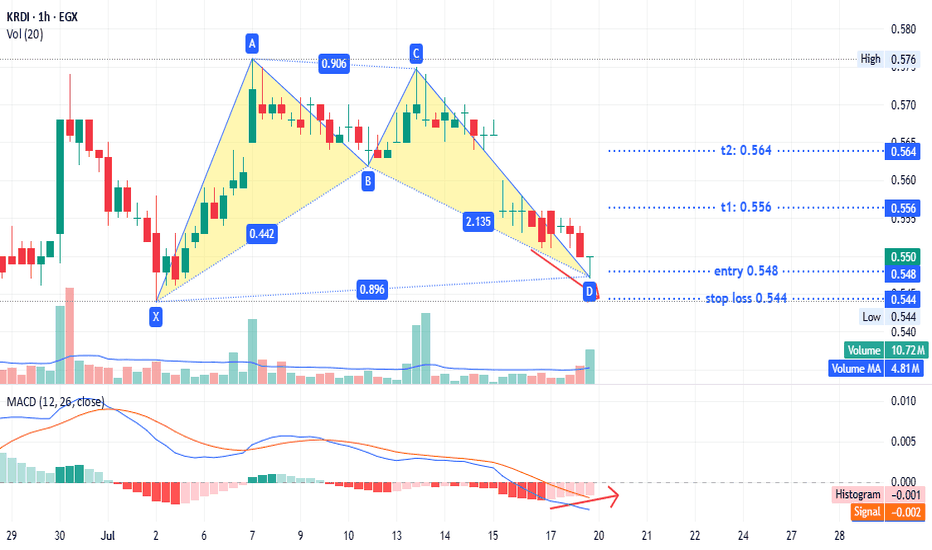

KRDI - just for fun but secured TASE:KRDI timeframe 1 hour

created bullish pattern

entry 0.548

stop loss : 0.544

T1: 0.556

T2: 0.564

MACD show positive diversion may that support our idea

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck

Bitcoin harmonic pattern. Back to back Gartley. BTCGOLD ratio.The BTC/GOLD ratio has experienced a significant correction, currently standing at 27 gold ounces per 1 Bitcoin, down from a peak of 41, representing a decline of 34%.

Gold, priced at $3,114 in US Federal Reserve notes, is in a sustained bull market.

It is reasonable to anticipate that the digital equivalent of gold will gain traction once gold stabilizes at a higher price point.

The Gartley pattern is recognized as the most prevalent harmonic chart pattern.

Harmonic patterns are based on the idea that Fibonacci sequences can be utilized to create geometric formations, which include price breakouts and retracements.

The Gartley pattern illustrated indicates an upward movement from point X to point A, followed by a price reversal at point A. According to Fibonacci ratios, the retracement from point X to point B is expected to be 61.8%.

At point B, the price reverses again towards point C, which should reflect a retracement of either 38.2% or 88.6% from point A.

From point C, the price then reverses to point D. At point D, the pattern is considered complete, generating buy signals with an upside target that aligns with points C and A, as well as a final price target of a 161.8% increase from point A.

Often, point 0 serves as a stop-loss level for the entire trade. While these Fibonacci levels do not have to be precise, greater proximity enhances the reliability of the pattern.

Will these consecutive Gartley patterns succeed in bolstering Bitcoin's strength? We will soon discover the answer.

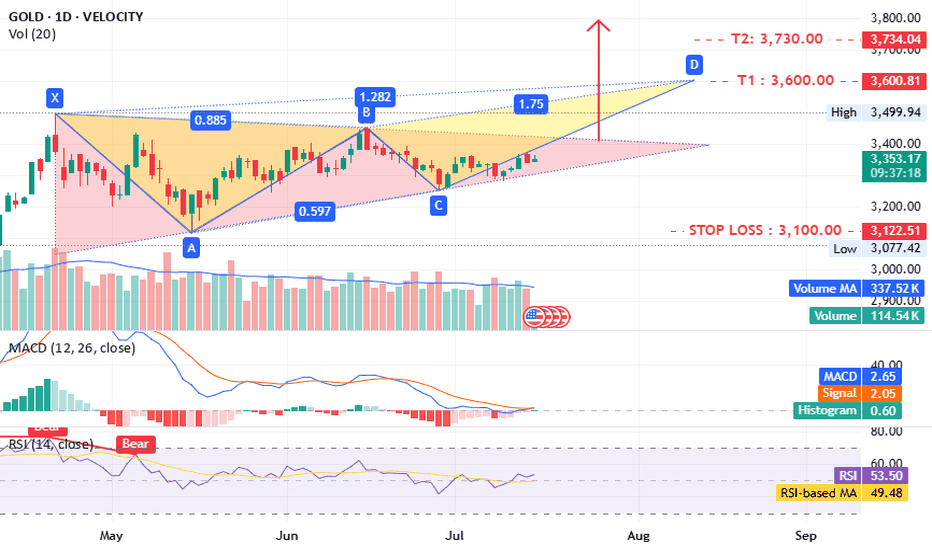

Gold what is next ?!!TVC:GOLD timeframe 1 day

is forming a potential triangle pattern, which could lead to a bearish setup.

The MACD and RSI indicators are positive, supporting this outlook. A close above 3400 would further confirm the idea.

Targets:

- T1: 3600

- T2: 3730–3800

Stop loss: 3100

Support: 3300–3260

Consider opening a long position now, with confirmation above 3400.

Disclaimer: This is not investment advice, only an analysis based on chart data. Consult your account manager before making any decisions. Good luck.

ARVA - many patterns give one target - Amazing EGX:ARVA timeframe 1 hour

Entry around 4.10

Stop loss at 3.75 (10% loss).

Targets at 5.50 and 6.00 (up to 44% profit).

Hourly chart shows a triangle pattern and bearish Gartley pattern.

Daily timeframe also indicates a bullish pattern with the same targets.

MACD and RSI support this analysis.

Note: This is not investment advice—only my analysis based on chart data. Consult your account manager before investing. Good luck!

BTC — Weekend Pump Fades.. All Eyes on the Gartley Reversal ZoneBitcoin has been consolidating in a tight range between $110K and $105K over the past two weeks. This weekend’s attempted breakout stalled out quickly! BTC was rejected at the Point of Control (POC) of the previous range and came close to the 0.786 retracement of the recent drop.

🧠 Reminder: Weekend pumps are notorious for being unreliable, especially without strong volume.

Now, the charts point toward something much more structured — a potential Gartley harmonic pattern forming, with multiple levels of confluence suggesting the next key decision zone is just around the corner.

🧩 Gartley Completion Zone: $106,290–$106,400

This price zone is loaded with confluence:

✅ 0.786 Fib retracement of the XA leg sits at $106,290

✅ 1.0 trend-based Fib extension of the BC leg is at $106,370

✅ Anchored VWAP from all-time high aligns precisely at $106,370

✅ VAL (Value Area Low) sits at the same level

✅ Imbalance (Fair Value Gap) from earlier price inefficiency lies in this exact region

All of this stacks up into a high-probability reaction zone.

🎓 Educational Insight: How to Trade a Gartley Harmonic

The Gartley pattern is one of the most powerful harmonic setups — a structured form of retracement and extension that captures exhaustion before reversals. Here's how it works:

🔹 XA: Impulse leg

🔹 AB: Retracement of 61.8% of XA

🔹 BC: Retraces 38.2%–88.6% of AB

🔹 CD: Extends to 78.6% retracement of XA and aligns with a 1.0–1.272 Fib extension of BC

🟢 Point D is the entry zone — your reversal opportunity.

📉 Stop-loss sits just below invalidation (Point X).

💰 Targets usually lie at 0.382 and 0.618 of the CD leg.

🔎 Why It Works: It traps late traders and captures price exhaustion at natural Fibonacci ratios. Combined with other tools — like VWAP, liquidity zones, and order flow — it becomes a high-conviction strategy. These patterns are most effective on higher timeframes like 4H or daily.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

ODIN - confused but easy NGM:ODIN timeframe: 1 hour

Identified a bearish Gartley pattern with:

- Sell point: 1.61

- Targets: T1 at 1.53, T2 at 1.45

- Stop loss/rebuy: 1.65

If rebuy is triggered:

- New targets: T1 at 1.74, T2 at 1.85

- Stop loss: 1.61

MACD and RSI indicators do not support the recent price rise, aligning with the bearish pattern.

Disclaimer: This is not investment advice, only an analysis based on chart data. Consult your account manager before making any decisions. Good luck.

BellRing Brands (BRBR) - Gartley Pattern + Kijun ConfluenceBellRing Brands (BRBR) Stock Analysis ( video version ):

In March 2025, I previously took a look at this budding public company BellRing Brands, Inc. for a long-term investment horizon. It was priced around 74 at the time, then the fall of the overall market status put additional pressure on its stock, although the company itself is booming and meets my fundamental parameters.

Since then, we had an awesome and confident forward guidance from the company in the last earnings call in May 2025: bellring.com/news/bellring-brands-reports-results-second-quarter-2025-affirms.

Now, looking at BellRing Brands (BRBR) once again, on a weekly chart, key technical patterns have formed that look very promising and solid with its many confluences.

TECHNICALS:

WEEKLY:

Many weekly confluences have appeared from a technical perspective. Here is what I see:

(1) There is a clear Bullish Gartley-ish pattern in a weekly retracement to 50% followed by a retracement to 78.6% of a preceding move.

(2) The price is around 78% fib support.

(3) Horizontal area of support: The 50 - 58 area is a whole prior area of horizontal support that was a prior resistance area back in July 2024, and the price has landed back on that area. You know what we say as technicians and investors: past resistance = future support.

(4) MACD Hidden Bullish Divergence (weekly)

(5) The price tested the weekly cloud and broke through; however, bullish extremes were triggered when that happen, which is rare based on all my personal studies. In fact, the current level 55-58 marks the end of a bearish double top cycle that began around March 2025.

(6) A weekly Doji with volume support (classified as a "dVa" in my old notes of Volume Price Analysis).

Here is the weekly chart:

MONTHY:

BRBR is poised to rally Q3 and Q4 2025.

We have a potential monthly bounce of the kijun forthcoming along with good fundamentals going forward supporting the growth of the company in the long term.

** potential monthly Kijun Trend Bounce **

Here is the monthly chart:

Target:

Currently, the price is 58.54. My tentative target is around 140 by March 2026.

Thus, with all the fundamental support, good forward-looking guidance, and the technical I believe that BellRing Brands (BRBR) is at a great price right now. It is prime to continue its stretch of growth for 2025. Looking forward with investor foresight, the case for BellRing Brands and its stock (BRBR) is not only a high-probability outlook of positivity, but a high odds outcome of technical price pattern success. What a great discount.... :)

XCUUSD - Bearish Gartley Pattern- if Gartley Pattern on EURUSD works, USD will be getting stronger over the next weeks

- HGN25 is ca 30% above the 5 year average for Jul contracts

- If tariffs don't come to effect - what I think will take place - the reduction in proce is possible

- then perhaps the Gartley Patter may work. Hopefully

Traders - have a good week!

$MPRC - Beware of the bears trap** EGX:MPRC - 1-Day Timeframe**

A highly complete bearish Gartley pattern is forming.

- **Sell Point:** Around 26.50

- **Stop Loss/Reentry:** 28.17 (estimated loss: -7.00%). A close above 28.17 would signal continued upward momentum.

- **First Target:** 23.70 (estimated profit: 10.40%)

- **Second Target:** 22.00 (estimated profit: up to 16.87%)

**Notes:**

- The RSI shows weakness but remains above 70, indicating strength. A close below 70 would signal a halt to the upward trend. Until then, the stock remains positive for the long term.

- This analysis is based on the 1-day timeframe.

**Disclaimer:** This is not investment advice—only my interpretation of the chart data. Consult your account manager before making any decisions. Good luck!