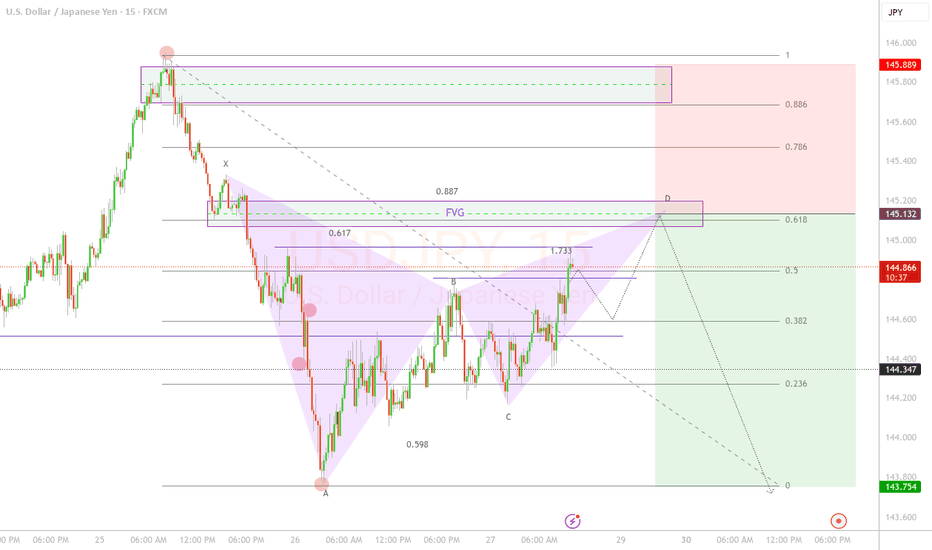

USD/JPY Bearish Gartley Pattern Completion - SELL SETUP

📊 Trade Overview

Pair: USD/JPY

Pattern: Bearish Gartley

Timeframe: 15 minutes

Direction: SHORT

Setup Type: Harmonic Pattern Completion + FVG Confluence

🎯 Market Analysis

The price is evidently bearish according to market structure, currently in a retracement phase, and I expect a bearish continuation at the 61.8 Fibonacci level of the wave.

The harmonic pattern establishes an 88.6 Fibonacci ratio for bearish entry with a balanced and low-risk R/R of 1:1.82 (profit - risk).

Gartley

USDCHF Forms Bullish Gartley, Targets Upside Despite Bearish BiaChart pattern- Bullish Gartley pattern

Potential Reversal Zone (PRZ)- 0.8070

USDCHF pare most of its gains improving risk mood. It hits an intraday low of 0.80877 and is currently trading around 0.80866. Intraday bias appears to be bearish as long as the resistance 0.8140 holds.

Technical Analysis Points to Further Upside

The pair is trading below the 55-EMA, 200 EMA and 365 EMA on the 4-hour chart indicates a bearish trend. The immediate resistance is at 0.8140 any break above targets 0.8180/0.8250/0.8300.

Support Levels and Potential Declines

On the downside, near-term support is around 0.8080, any violation below will drag the pair to 0.8000/0.7920.

Indicators (1-Hour)

CCI (50) - Bearish

Directional movement Index - Bearish

Trading Strategy Recommendation

It is good to buy on dips around 0.8070 with a stop-loss at 0.8040 for a TP of 0.8185..

ISMQ - interested EGX:ISMQ timeframe 1 day

Created Bullish Gartley pattern, so we can see action price in this point .

Entry level around 4.45

Stop loss 4.00

First target at 5.18

Second target 5.85

NOTE : this data according to timeframe 1 day.

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck

ICDI - save your profits and capital#ICDI timeframe 4 hours and also 2 hours

Created a bearish Gartley pattern

Sell point around 3.72 ( prices now is 3.74 )

Stop loss / reentry 3.80 (estimated loss -2.00%)

First target at 3.53 (estimated profit 4.87%)

Second target 3.80 (estimated profit up to 9.24%)

Third target 3.20 (estimated profit up to 13.90%)

NOTE: this data according to timeframe 4 hours and also 2 hours.

It's not an advice for investing, only my vision according to the data on chart.

Please consult your account manager before investing.

Thanks and good luck.

ADRI - Egyptian stock market - good for medium term investing #ADRI timeframe 1 DAY

Created Gartley Bullish pattern.

Entry level at 1.08 ( price now 1.07)

Stop loss 1.02 ( loss may go to up -5.50% ) - support 1.05

First target at 1.24 ( with profit around 14.49% ) resistance 1.15

Second target 1.37 ( with profit around 26.60% ) resistance 1.28

Third target 1.52 ( with profit around 40.84% ) resistance 1.45

NOTE : this data according to time frame I DAY , so its may take time up to 3 months .

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck

#EAST - great fundamental - positive long term #EAST timeframe 1 hour

Created Bullish Gartley pattern, so we can see action price in this point .

Entry level around 30.20

Stop loss 29.70

First target at 31.65

Second target 32.50

Third target 33.20

NOTE : this data according to timeframe 1 hour.

Also MACD show positive diversion that may support our idea.

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck

LUTS - out of box ( T1 10% VS SL 2% )EGX:LUTS timeframe 1 day

Created Bullish Gartley pattern, so we may see action price in this point.

Entry level around 0.573 ( prices now at 0.557 )

Stop loss 0.54 ( estimated loss 5.55% )

First target at 0.629 ( estimated profit 10.00% )

Second target 0.702 ( estimated profit 22.50% )

Third target 0.754 ( estimated profit 31.55% )

NOTE : this data according to timeframe 1 day.

Also MACD show positive diversion that may support our idea.

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck

HYPE Precision Trading — Pattern, Patience, ProfitHYPE has shown strong performance since early April, maintaining a clear uptrend. Currently, the market is consolidating in a range between $30 and $40 and it’s setting up for something interesting. Let’s break it down and map the next high-probability trade setup.

Potential Gartley Harmonic Pattern Forming

A valid Gartley pattern may be developing, with point D potentially forming around the $29 level. This zone offers solid confluence for a high-probability long setup.

🟢 Long Setup – Gartley Harmonic Pattern Completion at around $29

Confluences around $29–$28.3:

0.786 Fib retracement of XA

Trend-based Fib Extension 1:1

Negative -0.618 Fib as take-profit level for prior short

Anchored VWAP (0.666 band multiplier) acting as dynamic support

200/233 EMA/SMA support on the 4H TF

FVG + liquidity pool resting just below $30

Setup Details:

Entry Zone: Trend-based Fib Extension 1:1 or laddered between $30–$28.3

Stop Loss: Below $27.5 (adjust depending on where point D forms)

Target: 0.618 of CD leg ≈ $34.4

R:R ≈ 1:3.5

🔴 Short Setup – look for rejection at $36

0.618 Fib retracement from previous move (ideal short entry)

Invalidation: Break above $38.2 (above point C)

Take Profit: $30-$29

R:R ≈ 1:3

🧠 Educational Insight:

Harmonic patterns offer precise entries and targets by aligning Fibonacci levels with market structure. When combined with tools like Anchored VWAP and liquidity analysis, they become powerful tools for swing trading.

Summary:

HYPE continues to respect structure beautifully, offering repeated swing setups in the 10%–20% range. With clear fib symmetry and predictable behaviour, it remains one of the more technically sound altcoins.

Stay patient. Wait for the pattern to complete. As always — don’t chase. Let the trade come to you.

_________________________________

If you found this helpful, leave a like and comment below! Got requests for the next technical analysis? Let me know.

ECAP - Egyptian stock#ECAP timeframe 1 DAY

created 2 Bullish pattern ( Gartley and AB=CD ) , so we can see action price in this point .

Entry level at 22.70 ( price now 22.40 )

Stop loss 22.00( loss may go to up -3% )

First target at 24.45( with profit around 7.60% )

Second target 25.97( with profit around 14.70% )

NOTE : this data according to time frame I DAY ,

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck

#ALCN - not an advise it just an ideaaccording to chart we have triangle pattern and potential bearish pattern,

Now is testing the uber line of triangle pattern

so stop loss now is 22.22

target and next sell point is 23.50 to 23.65

rebuy at 23.89

It's not advice for investing, only my vision according to the data on the chart.

Please consult your account manager before investing.

Thanks and good luck.

#ABUK - very confusing / where is the bottom ??!!!!3 levels prices may respect it :

first : 49.18

secund : 43.64 ( may be )

third : 38.69 ( really, no one bigger than market )

i am waiting for any positive sign at any level, now MACD is negative on daily basis .

any way consider stop loss to save your capital

good luck

#ATQA Egyptian stock - great opportunity - great fundamental.#ATQA timeframe 30 minutes

created 2 strong Bullish Gartley pattern, so we can see action price in this point .

Entry level around 8.85 .

Stop loss 8.65 ( estimated loss -1.85% )

First target at 9.35 ( estimated profit 6.33% ) - resistance 9.15 .

Second target 9.69 ( estimated profit 10% )

NOTE : this data according to timeframe 30 minutes .

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck

VIRTUAL TA Masterclass — Elliott Wave Meets Gartley HarmonicVIRTUAL has been on fire! Printing a clean 5-wave Elliott impulse with a +431% run in just 33 days. But after every strong trend comes a healthy correction, and that’s where we likely are now. Trading below key resistance and showing signs of exhaustion. The question: Where is the next high probability trade setup?

Let’s break down what the chart is telling us.

🧠 Structure Overview

Wave 5 peaked at $2.2169

Wave A dropped -25%

Wave B bounced +30%

Currently: VIRTUAL's trading under the $2 psychological level and weekly open ($2.0358) → signs of momentum cooling

A corrective Wave C is likely underway, and all signs point toward a very specific zone.

⚠️ Liquidity Dynamics

The longer VIRTUAL grinds sideways near $2.00 without showing real momentum, the more vulnerable late long positions become:

Retail traders are buying resistance

SLs are likely clustered just below Wave A’s low

This creates a liquidity pocket waiting to be swept — perfect fuel for Wave C

🔍 The $1.58–$1.47 Support Cluster: 14 Layers of Confluence

This zone isn’t guesswork — it’s loaded with technical overlap:

1️⃣ 1:1 Trend-Based Fib Extension of Wave A → $1.573

2️⃣ Monthly Open → $1.5354

3️⃣ 0.382 Fib Retracement of the entire rally → $1.5295

4️⃣ Bullish Fair Value Gap → $1.57–$1.53

5️⃣ Anchored VWAP from ATH → ~$1.46

6️⃣ Anchored VWAP from Wave 3 → ~$1.46

7️⃣ 0.618 Fib Speed Fan Support (~end of May timing)

8️⃣ 4H 233 SMA → ~$1.52

9️⃣ 4H 200 EMA → ~$1.52

🔟 Daily 200 SMA → $1.5251

1️⃣1️⃣ Weekly 21 SMA → $1.462 (reinforces the VWAP zone)

1️⃣2️⃣ Declining Daily Volume → momentum weakening

1️⃣3️⃣ Liquidity Pool below Wave A → likely to be swept

1️⃣4️⃣ $2 = Golden Pocket Resistance + Psychological Barrier

🔴 Short Trade Setup (Active as Long as SFP Holds)

For those favouring downside continuation toward the Wave C target, a short setup is in play:

Entry: Weekly open retest around $2.0358

Stop-loss: Above SFP high at $2.143

Target: 1:1 Trend-Based Fib Extension of Wave A → $1.573 or the Swing Low of Wave A at $1.647

R:R ≈ 1:4 — a solid, well-structured short opportunity

As long as price remains below the SFP and the $2.00 golden pocket resistance, bears maintain control.

🟢 Long Trade Setup

Entry: Ladder between $1.58–$1.47

Avg. Entry: ~$1.53

SL: Below $1.40

TP1: $1.88 (local resistance) → R:R ≈ 1:2.5

TP2: $3.33 (0.618 Fib of entire bear market) → R:R ≈ 1:12

👉 Bonus TP for Harmonic Setup: 0.618 Fib of CD leg

✨ Bonus Confluence: Potential bullish Gartley Harmonic in Play

VIRTUAL is also forming a valid Gartley harmonic pattern — one of the most reliable reversal setups in classical trading theory.

🔸 XA: B retraced to 0.602 → ✅ (criterion: ~0.618)

🔸 AB: C retraced 0.87 → ✅ (valid range: 0.382–0.886)

🔸 CD: Projected to complete at 0.786 of XA → ~$1.474

• CD is a 1.356 expansion of BC

• AB ≈ CD symmetry is valid

• TP = 0.618 retracement of CD leg

This adds even more weight to the $1.47–$1.53 buy zone.

📘 Educational Takeaway

The best setups don’t rely on one method — they align multiple disciplines. Here, we have Elliott Waves, Fibonacci retracements, anchored VWAPs, volume structure, moving averages, time symmetry, and now a harmonic pattern — all pointing to the same opportunity. Most traders never wait for alignment. That’s why most lose.

💬 Final Words

✍️ Smart trading isn’t about always being in a trade — it’s about being in the right one at the right time.

While others FOMO at $2, you wait for the right opportunity to come to you — where structure, liquidity, and probability all shake hands.

The patient are rewarded. Always.

___________________________________

If you found this helpful, leave a like and comment below! Got requests for the next technical analysis? Let me know.

#OFH - one more time#OFH timeframe 30 minutes

created 2 strong Bullish Gartley pattern, so we can see action price in this point .

Entry level around 0.47.

Stop loss 0.465 ( estimated loss -1.00% )

First target at 0.49 ( estimated profit 4.00% )

Second target 0.50 ( estimated profit 6.40% )

Third target 0.51 ( estimated profit 8.15% )

NOTE : this data according to timeframe 30 minutes .

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck

#ABUK Egyptian stock - great opportunity - great fundamental.#ABUK timeframe 1 HOUR.

created Gartley Bullish pattern ( and AB=CD ) , so we can see action price in this point .

Entry level at 48.85 .

Stop loss 47.15( loss may go to up -3.00% )

First target at 51.25 ( with profit around 4.87% )

Second target 53.15 ( with profit around 8.75% )

Third target 55.25 ( with profit around 13.20% )

RSI show a positive diversion that's may support our idea .

NOTE : this data according to time frame I hour,

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck

ISMQ - great fundamental #ISMQ timeframe 1 HOUR

created Gartley Bullish pattern, so we can see action price in this point .

Entry level around 5.44

Stop loss 5.30 ( loss may go to up -2.50% )

First target at 5.76 ( with profit around 6.00% )

Second target 6.04 ( with profit around 11.13% )

Third target 6.24 ( with profit around 14.87% )

NOTE : this data according to time frame I hour,

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck

ORWE - fast and secure #ORWE - Timeframe 15 minutes .

Created 2 Bullish patterns ,( Gartley - AB=CD ) with same targets .

Entry level at 21.95

Stop loss 21.80

First target at 22.35

Second target 22.63

Third target 22.83

Also MACD and RSI show positive diversion that's may support our idea .

note : chart on timeframe 15 minutes

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck