NATGAS Long Update! Buy!

Hello,Traders!

Here is another dimension

To the NG bullish forecast

That I posted last week.

In there we established

That the price is about to retest

The long-term rising support line

From where the rebound is almost

Inevitable. Now, the price has indeed

Almost reached that support and today

We are taking a closer look at the gas chart.

As you can see the rising support is

Confluencing with the horizontal support level

Which reinforces our bullish bias

And we are already seeing a bullish reaction

So I think that we can expect a move higher

And a retest of the local

Horizontal resistance level above

Buy!

Like, comment and subscribe to boost your trading!

See other ideas below too!

GAS

NATURAL GAS BEARISH OUTLOOKThe cold weather in US had done little to support a price rise of the Natural Gas, while the consumption was lower than predicted.

The price of the gas had broken its support at $5.3 and might be heading further down, testing prices of 4.25 in the next couple of days. In the opposite scenario the price might try to reach levels of $6.07

RSI and MACD both are supporting the bearish movement with MACD histogram below 0 line and RSI below the 50 neutral line.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

Is GAS giving us a good entry into buy?The data indicates that gas supplies in the US are beginning to withdraw part of the stock from circulation, therefore, it would mean that Texas could possibly resume its activity.

Technically we are in a good support, which we will try to make purchases, without neglecting the corresponding stops.

Good Trading.

Diego Castro Trader.

Natural Gas to GrowIt seems NG has started a new impulse wave as it finished C move down in late October. The momentum in price sees a higher low, and a potential for a bullish continuation should see a test of $7.1 resistance level. Major resistance is seen at $9.7.

I see energy as the ONLY short-medium term gainer. NASDAQ has been underperforming greatly in the index range, and will probably continue to see lower demand as earnings have been disappointing, and Fed's tightening policy continues.

UGA | Gasoline Oversold | LONGThe fund invests in futures contracts for gasoline, other types of gasoline, crude oil, diesel-heating oil, natural gas and other petroleum-based fuels. The Benchmark Futures Contract is the futures contract on gasoline as traded on the New York Mercantile Exchange that is the near month contract to expire, except when the near month contract is within two weeks of expiration.

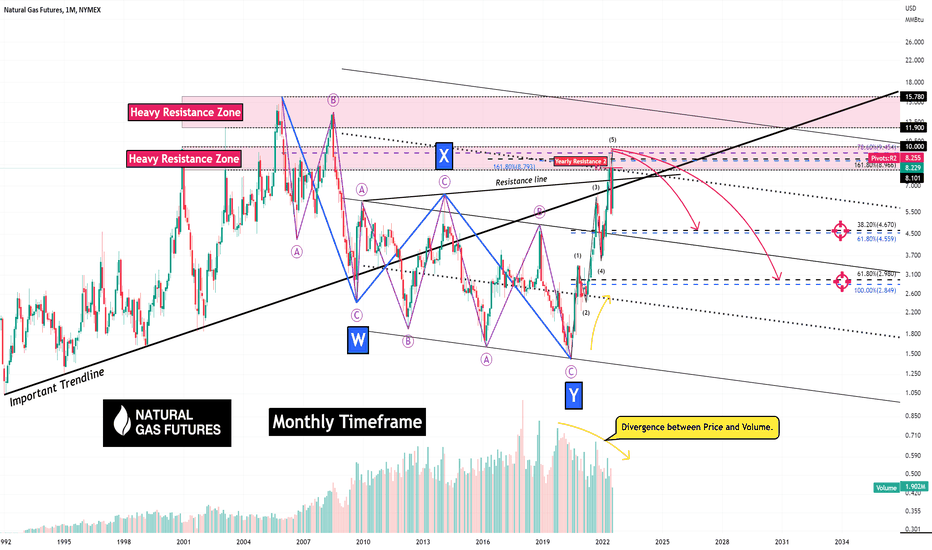

Natural Gas Futures (Road Map)!!!🗺️What are Natural Gas Futures ❗️❓

Natural Gas Futures can be used for hedging or speculating and can be traded nearly 24 hours per day, 6 days per week. Trading Natural Gas Futures allows hedgers to manage risk within the highly volatile natural gas price, which is driven by weather-related demand.

Natural Gas Futures is running in Heavy Resistance Zone & Important Trendlin & Resistance Line, and at the same time, it was able to pass the main wave 5 in this zone. So I expect Natural Gas Futures to go down to my🎯targets🎯 that I showed in my chart.

Where can Natural Gas Futures go (🎯Targets🎯)❗️❓

Target🎯: 4.67$-4.55$

Target🎯: 2.98$-2.84$

Natural Gas Futures Analyze, Monthly Timeframe (Logscale).

Also, we can see one of the valid candlestick reversal patterns (💫Shooting Star💫) at a weekly timeframe 👇

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy, this is just my idea, and I will be glad to see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

$NGAS - Is the Gas Crisis Over? (Short Trade)$NGAS - Is the Gas Crisis Over? (SHORT)

With the Economy slowing, a variety of commodities are showing weakness, think about $OIL and $COPPER.

$NGAS is still retesting this channel breakdown.

I'm looking for shorts in this area as the potential rewards are huge.

The war in Ukraine may be coming to an end, and this could have an impact on the price of natural gas. If the conflict ends, it may be possible to increase the supply of natural gas from Ukraine, which could lead to lower prices. Additionally, Europe already has enough natural gas to meet its needs for the entire winter, which could also help to keep prices down. However, it is important to remember that the price of natural gas is determined by many different factors, and it is impossible to predict with certainty how it will change in the future on a fundamental level. The charts look good.

When in doubt, get out! Or tighten stops.

At least that is what I did with NYSE:DINO and it looks like I was right.

This stock was one of the first #oil stocks to breakout to new highs after the June correction, that's why I bought it.

Now it seems like is also the first to break below support levels. I´ll be watching the other #oil stocks.

Always manage risk! Never average down!

HYUNDAI IS ALREADY CARRYING LNG, DO YOU KNOW ⁉️Ranks analytical crew welcomes everyone!

Today we will analyze the shares of a curious subsidiary of the automaker Hyundai from South Korea.

Hyundai Glovis Co Ltd (#GLOVS) – Ranks score - 94 %

The company operates in 3 sectors:

🔘 Logistics (auto parts and industrial goods)

🔘 Ocean cargo transportation (auto and industrial goods)

🔘 Distribution (used cars and metals)

Future businesses that the company plans to develop:

🔘 Smart logistics (using the Internet of Things)

🔘 Hydrogen business (logistics of hydrogen transportation)

🔘 Used electric car batteries (transportation and processing)

Why is it interesting to Ranks analysts ❓

🥇 The company is a major logistics operator of international cargo terminals + participates in the supply of liquefied natural gas (LNG)

🥈 The company has an outstanding financial position + it pays dividends

🥉 Valuation multipliers are very attractive + 94% of analysts recommend buying

What are the risks ❓

❌ The company reported worse than expected earnings in the 3rd quarter

❌ Global fuel cost growth limits profitability

Oil & MAJOR SUPPORT but Weekly paints INTERESTING picWe nibbled on #Oil & not off anywhere near worthy to nibble more

We're not making any large trades as we want to hold BIG year gains

@ MAJOR SUPPORT & starting 2b oversold

🚨🚨🚨

Hmmm, look at 2nd chart & then 3rd, what do you👀

$XOM $CVX $PSX $MPC #energy

A glitch in the energy matrix?Something weird is bubbling in the energy space.

Before we delve in, let us briefly explain what the S&P Energy Select Sector Index represents. Some of you might already be familiar with XLE, the ETF which tracks the S&P Energy Select Sector Index (IXE). This Index seeks to represent the Energy sector by aggregating a basket of names in the sector.

A breakdown of the top 10 Index components shows the Oil & Gas majors taking up roughly 75.41% of the Index, and 91% of the total Index component being Oil & Gas exposure, while the other 9% being energy-related equipment and services.

CME E-mini S&P Select Sector Futures, XAE, tracks the aforementioned energy index, with the added benefit of margin offset and deep liquidity.

Now given that the S&P Energy Select Sector Index is made up of mostly big Oil & Gas names, we would expect some correlation between the prices of oil and the Index itself.

A look at both from the depths of the low in March 2020 till now shows both products moving closely together up until recently, where zooming in we see…

the glitch in the matrix.... The 2 have been trading generally in lockstep since the bottom in 2020, but have diverged in a peculiar fashion, since the middle of July, with the energy sector gaining roughly 28% since, while Oil tumbles close to 30%!

Has the exuberance in energy stocks been overdone?

In our opinion yes and we see a couple of headwinds for the Energy Sector in general:

1) The impressive rally from the depths of COVID has been driven by rising oil prices and share buybacks. Oil prices are now faltering, and tightening Financial conditions/Recession could slow or stop buybacks.

2) Political pressure to apply a ‘windfall tax’ on oil and gas companies could eat into energy companies’ earnings.

3) Stabilized tension from the Russian-Ukraine means lower uncertainty and pressure on oil prices, as supply and demand find equilibrium from alternative sources.

4) China’s continued zero COVID policy means low demand from the world’s largest importer.

From a price action perspective, XAE is trading just slightly off the all-time high range, which could prove to be an area of resistance.

All things considered, we think this presents an opportunity to trade this divergence either by;

1) Shorting the XAE outright, which means to take a directional view on the Energy Index. A riskier trade.

2) Pair the XAE with the Crude Oil contract, by shorting the XAE and taking a long on the Crude Oil contract. A more risk-controlled approach.

Crude Oil Trades at a contract unit of 1000 barrels and the E-mini Energy Select Sector trades $100 x S&P Energy Select Sector Index. Each Index point is 100$ on the CME E-Mini Energy Select Sector Futures contract (XAE) and $1000 on the Crude Oil Futures. One way to construct this spread could be to calculate the contract value difference between the 2 products;

Spread = 100 x XAE1! – 1000 x CL1!

You can construct the chart on TradingView by typing the above into the product search bar.

This will show the Chart of the spread between the 2 products, which is close to the all-time high now.

As such we will lean on the short side of this spread, given the outperformance of the Energy Index relative to Crude Oil. We will also keep an eye on the upcoming OPEC meeting on December 4th to gauge the path forward for Oil Prices.

The charts above were generated using CME’s Real-Time data available on TradingView. Inspirante Trading Solutions is subscribed to both TradingView Premium and CME Real-time Market Data which allows us to identify trading set-ups in real-time and express our market opinions. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Disclaimer:

The contents in this Idea are intended for information purpose only and do not constitute investment recommendation or advice. Nor are they used to promote any specific products or services. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios. A full version of the disclaimer is available in our profile description.

Sources:

www.cmegroup.com

www.cmegroup.com

www.cmegroup.com

www.ssga.com

oilprice.com

oil 11-24 update.good evening,

---

remember in my last oil post when i called the top?

there was some really salty humans in the comment section who were most likely bag holders from the absolute peak of the bull run.

this is an update for them.

---

last post:

---

i feel like oil has entered into a quatervois here, which is basically "crossroad" in french.

currently seeing two potential trajectories:

1.

-oil runs up to 100ish through an expanded flat (green targets most probable, grey are weak, and red is unlikely, but always possible).

-after which, a swift downturn to my $57 target from the original post.

2.

-oil simply see's a dead-cat bounce, creates another hidden bearish divergence, and rolls over yet again - continuing it's bearish trajectory to my original target.

---

all paths lead down there, potentially even deeper - but the question as always is: which path's it gonna take?

ps. no offense to all the people who talk smack on my posts, you're always welcome if you have a proper argument.

just keep in mind, "fundamentals, is not a proper argument".

What you think about Ng(natrual gas)? as per my analysis. 7.351 is resistance for ng and target 4.136 (support for reverse)

Oil Prices might be heading up!On the chart, we're seeing that bounce towards the resistance above.

On the news, we see Russia and the OPEC thinking about reducing oil production to keep prices high.

We saw Qatar selling all that gas to China (a massive amount).

We are hearing more and more about blackouts in Europe.

NGAS BULLISH OUTLOOKNGAS prices started rising on Monday after a cold wave engulfed the European continent, testing its ability to coupe with the cold weather without its main natural gas supplier Russia.

The instrument broke the resistance levels of the triangle chart pattern entering into a bullish movement. RSI indicator is above the 50 neutral line and MACD histogram is above 0, both confirming the potential bullish movement.

If the trend continues the price might try to test levels of 7.649 In the opposite scenario, the price might try its previous support of 6.554

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.