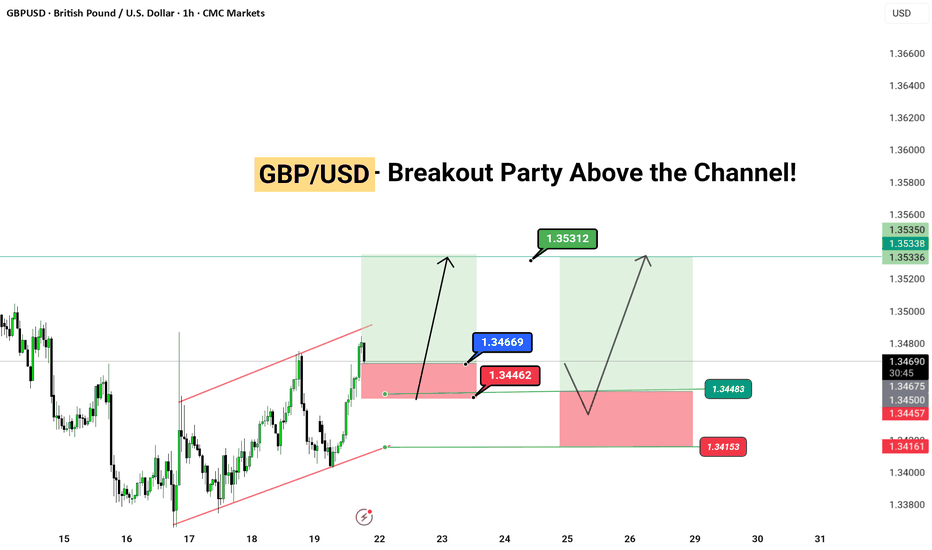

GBP/USD – Clean Breakout Play We just broke structure on the 1H. Simple setup, clean price action. Nothing complicated.

📍 Breakout Zone: 1.34669

✅ Target 1: 1.35312

✅ Target 2: 1.35350

❌ Stop Loss: 1.34462

⛔ Invalidation Level: 1.34153

🧠 Price broke out of the red channel and retested — now it's game on. If we stay above structure, next move is liquidity grab at the highs.

This is how you trap the market before it traps you.

🕒 Timeframe: 1H

⚙️ Strategy: Channel Breakout + Retest Confirmation

Gbousd

$GBIRYY -U.K Inflation Rate (December/2024)ECONOMICS:GBIRYY

December/2024

source: Office for National Statistics

-Annual inflation rate in the UK unexpectedly edged lower to 2.5% in December 2024 from 2.6% in November, below forecasts of 2.6%. However, it matched the BoE's forecast from early November.

Prices slowed for restaurants and hotels (3.4%, the lowest since July 2021 vs 4%), mainly due to a 1.9% fall in prices of hotels.

Inflation also slowed for recreation and communication (3.4% vs 3.6%) and services (4.4%, the lowest since March 2022 vs 5) and steadied for food and non-alcoholic beverages (at 2%). Meanwhile, prices decreased less for transport (-0.6% vs -0.9%) as upward effects from motor fuels and second-hand cars (1%) partially offset a downward effect from air fare (-26%).

Also, prices rose slightly more for housing and utilities (3.1% vs 3%). Compared to November, the CPI rose 0.3%, above 0.1% in the previous period but below forecasts of 0.4%.

The annual core inflation rate also declined to 3.2% from 3.5% and the monthly rate went up to 0.3%, below forecasts of 0.5%.

Daily Analysis of GBP to USD – Issue 174The analyst believes that the price of { GBPUSD } will decrease in the next 24 hours. This prediction is based on quantitative analysis of the price trend.

Please note that the specified take-profit level does not imply a prediction that the price will reach that point. In this framework of analysis and trading, unlike the stop-loss, which is mandatory, setting a take-profit level is optional. Whether the price reaches the take-profit level or not is of no significance, as the results are calculated based on the start and end times. The take-profit level merely indicates the potential maximum price fluctuation within that time frame.

GBPUSD GBP/USD is the forex ticker that shows the value of the British Pound against the US Dollar. It tells traders how many US Dollars are needed to buy a British Pound. The Pound-Dollar is one of the oldest and most widely traded currency pairs in the world. Follow the live GBP/USD rate with the chart and keep up to date with Pound-Dollar news and analysis. Plan your trades with the GBP/USD forecast and key pivot points data and support and resistance levels.

GBP/USD continues to fluctuate in a narrow band near 1.2800 in the American session on Wednesday. Earlier in the day, the data from the UK showed that the real GDP expanded by 0.2% on a monthly basis in January as expected but failed to trigger a reaction in the pair.

The Relative Strength Index (RSI) indicator on the 4-hour chart stays near 50, reflecting a lack of directional momentum. In case the pair stabilizes above 1.2800, where the mid-point of the ascending regression channel meets the Fibonacci 23.6% retracement of the latest uptrend, it could target 1.2850 (static level) and 1.2880 (upper limit of the ascending channel, end-point of the uptrend) next. confirm chart

GBPUSD What Next? SELL!

My dear subscribers,

My technical analysis for GBPUSD is below:

The price is coiling around a solid key level - 1.2735

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 1.2688

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

———————————

WISH YOU ALL LUCK

BluetonaFX - GBPUSD Potential Head and Shoulders BreakHi Traders!

We have a potential Head and Shoulders break on the GBPUSD 1D chart.

The price action is telling us that there is a bearish bias due to the market having lower highs and lower lows; additionally, the market is also below our 20 EMA.

We are looking for a break and a close below the neckline at the 1.25479 area which is August 2023's low.

As long as we remain below the 20 EMA (we MUST stay below the 20 EMA) our bearish view will continue.

Please do not forget to like, comment, and follow, as your support greatly helps.

Thank you for your support.

BluetonaFX

GBPUSD 4H GBPUSD

stabilizing above 1.2746 will support rising to touch 1.2806 then 1.2827 then 1.2850

stabilizing under 1.2746 will support falling to touch 1.2697 then 1.2661

the condition is closing 4h candle above 1.2746

Pivot Price: 1.2746

Resistance prices: 1.2806 & 1.2827 & 1.2850

Support prices: 1.2697 & 1.2624 & 1.2575

tendency: bullish

AUDUSD H1 SHORT SIGNAL On AUDUSD, we have a price currently in the 0.6680 zone after bouncing off a very strong value gap created on Friday. The price could now decline to the 0.66 zone where we have another value gap that would allow us to quickly return to the 0.6680 zone. Share your opinion; we would be delighted to hear it. Greetings from Nicola, CEO of Forex48 Trading Academy.

GBPUSD | Perspective for the new week | Follow-upA follow-up video to the previous analysis on the GBPUSD where we scooped over 400 pips profit (see link below for reference purposes).

The US dollar continues to plunge since the beginning of the year as fear of recession mounts. To further mount pressure on the Greenback is the data from the U.S. retail sales which fell by the most in a year in December and manufacturing output recorded its biggest drop in nearly two years, stoking fears that the world's largest economy is headed for a recession. In this regard, this video shed a technical light on the current market structure where the identification of flat channel around the 1.24000 and 1.23350 will serve as a yardstick for trading activities for the new week.

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

GBPUSD > The Perfect Setup for A Buy Entry!!Analysis of #GBPUSD

Hi traders, today we will have a look at #GBPUSD

the GBPUSD is in this beautiful wedge pattern as you can see on my chart, the market tested its trendline resistance and now started a move down, if you check y previous ideas on the GBPUSD where I explain why I expect the pound to move lower.

now, there is a very good support zone that coincides with trendline support near the 1.165-1.1600 key market level.

if the market drops to my key market support level I will drop a one-time frame looking for a bullish reaction to get in a buy trade with good reward to risk if the rules are met.

I hope you guys found this helpful, if you are new here click on follow, to get these ideas delivered straight to your email inbox, I will see you guys at the next one

Thanks for your continued support!

XAUUSD Daily Analysis: 02.26.2022As you can see, The price has been consolidated up to the $1850 and now is surfing over an upward trend line. If it can close itself over $1920 again, the doors would be opened for experiencing $1975 after a while. Otherwise a price falling until $1850 would be expected.

f you liked this idea or having your own opinion about it, I would be glad if you write it down in the comment section.

👤 Yazdan Ganjabi: @YazdanGanjabiTrading

📅 26.Feb.22

⚠️(DYOR)

eurusd (T.F)30M TA 2/23/22 could not break the resistance📈📉 Strong resistance range 1.13887-1.14028

And the bear scenario occurred and reached support (1.3032-1.12857)

⚠️ This Analysis will be updated ...

📊 # EURUSD

💹 Time Frame : 30M

👤 hosein alizadeh

📅 2/123/22

❤️ If you apperciate my work , Please like and comment , It Keeps me motivated to do better ❤️