Bearish drop?GBP/CAD is rising towards the pivot and could drop to the 1st support.

Pivot: 1.8518

1st Support: 1.8369

1st Resistance: 1.8635

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

GBP (British Pound)

Pedramfxtrader | GBPUSD BUY We have a specific type of divergence on the 1-hour timeframe ⏳, indicating a potential drop 📉 in the higher timeframe. On the other hand, the lower 15-minute timeframe 🕒 gives us a buying perspective 📈. So, the analysis will be as shown in the image.

#GBPUSD #ForexTrading #PriceAction #ForexSignals #TradingAnalysis 💹

GBPUSD - Chasing the Bulls!!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPUSD has been overall bullish trading within the rising channel marked in red.

Moreover, the blue zone is a major daily support.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of daily support zone and lower red trendline acting as a non-horizontal support.

📚 As per my trading style:

As #GBPUSD approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

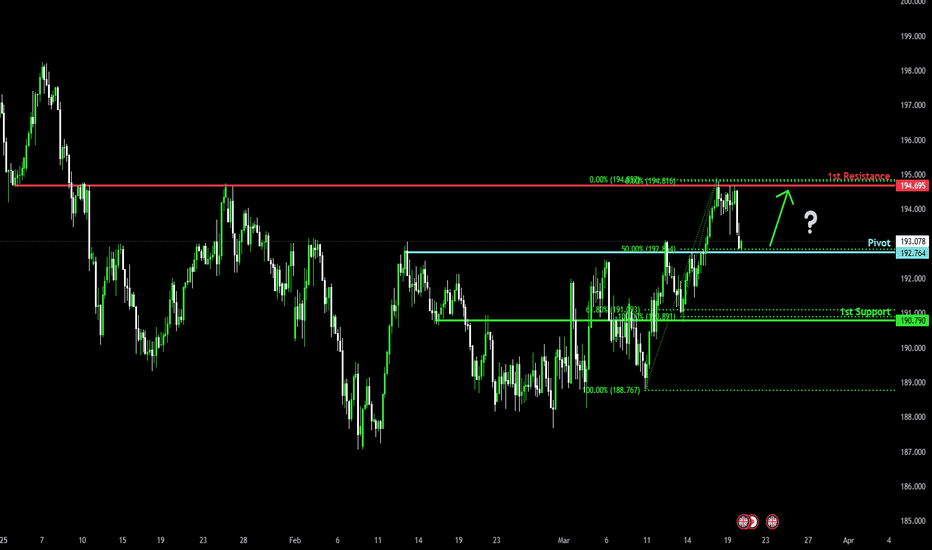

Bullish bounce?GBP/JPY is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 191.16

1st Support: 189.22

1st Resistance: 194.56

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

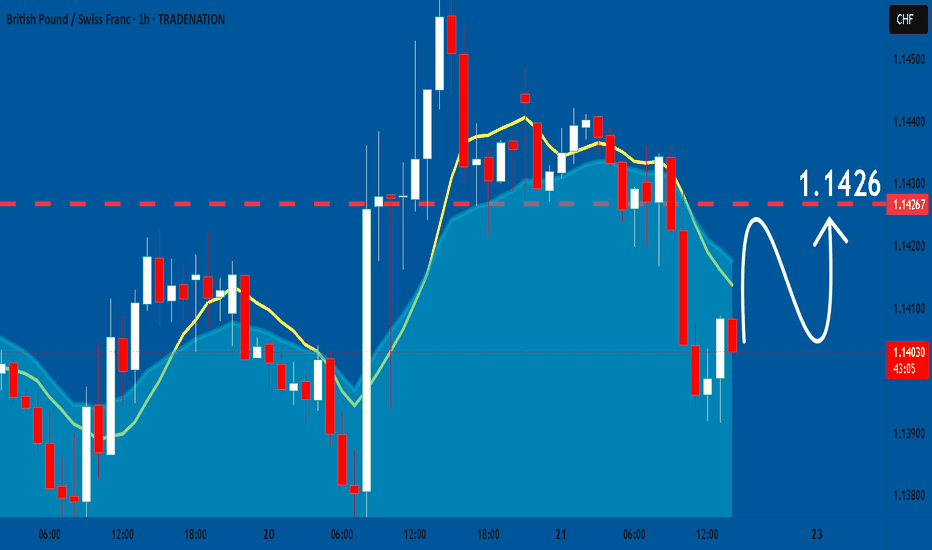

GBPCHF Is Going Up! Buy!

Please, check our technical outlook for GBPCHF.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 1.140.

Considering the today's price action, probabilities will be high to see a movement to 1.151.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBP/CHF BEARS ARE GAINING STRENGTH|SHORT

Hello, Friends!

Previous week’s green candle means that for us the GBP/CHF pair is in the uptrend. And the current movement leg was also up but the resistance line will be hit soon and upper BB band proximity will signal an overbought condition so we will go for a counter-trend short trade with the target being at 1.126.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPCHF: Will Keep Growing! Here is Why:

The price of GBPCHF will most likely increase soon enough, due to the demand beginning to exceed supply which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

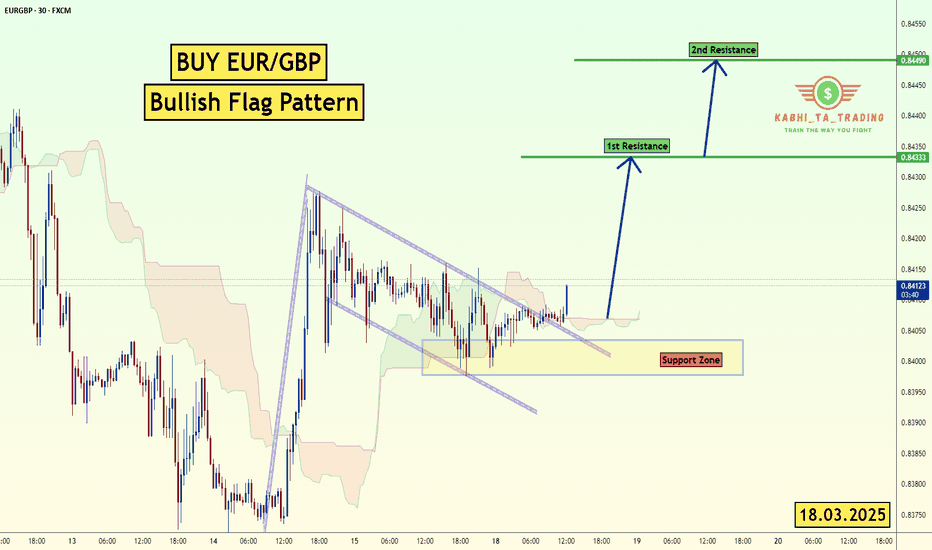

EUR/GBP LONG 4H

Hi, my name is Russo Andrea and I am a Forex Trader. Today I want to talk to you about a trading strategy that I am considering on EUR/GBP, a very interesting pair for those who, like me, operate in the currency markets.

The idea behind this trade is to go LONG on EUR/GBP. After analyzing the technical data and fundamentals, I believe that there is an interesting profit opportunity. Here are the details of my strategy:

Entry Point: 0.83781

Stop Loss (SL): 0.8550

Take Profit (TP): 0.84168

Trade Rationale: This trade is based on a combination of technical and fundamental analysis. Looking at the charts, we have a key support near the 0.83781 area, which represents an ideal level to open a long position. Technical indicators, such as RSI and moving averages, are showing signs of a possible bullish reversal.

On the other hand, my Stop Loss at 0.8550 was strategically placed to limit losses if the market moves against us, while still maintaining an acceptable risk for this trade. The Take Profit at 0.84168, on the other hand, represents a realistic level of profit based on previous resistances.

Risk Management: Risk management is essential in trading. It is important to always stick to your plan, without being influenced by emotions. With this trade, I am maintaining a balanced risk/reward ratio, increasing the probability of success in the long term.

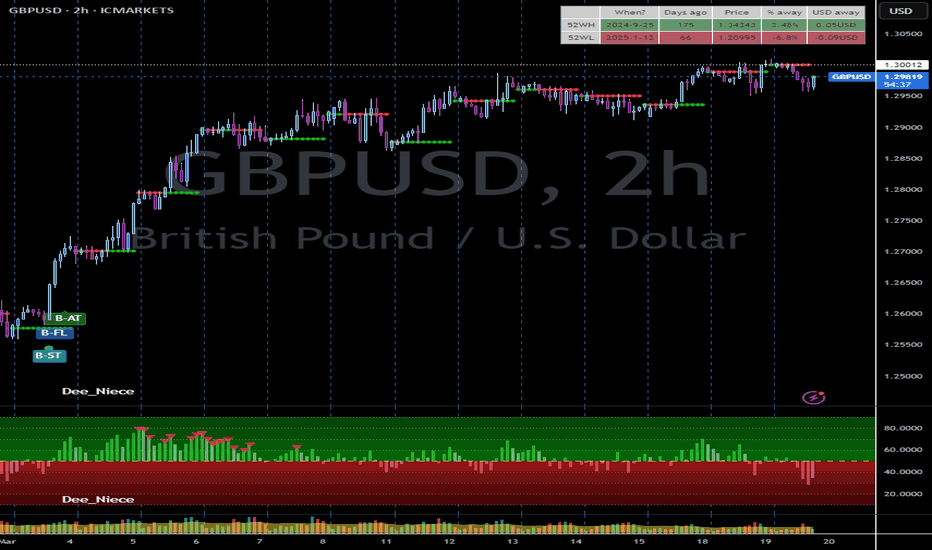

Potential bearish drop?The Cable (GBP/USD) has reacted off the pivot which is a pullback resistance and could drop to the 1st support which has been identified as a pullback support.

Pivot: 1.2963

1st Support: 1.3870

1st Resistance: 1.3007

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EURGBP: Rectangle Top rejection. Sell opportunity.EURGBP is neutral on its 1D technical outlook (RSI = 52.272, MACD = 0.002, ADX = 25.202), going from an almost overbought RSI to neutral as it got rejected on the R1 Zone. That is the top of the 6 month Rectangle pattern, where the last rejection pulled the price all the way down to the S1 Zone. This time the presence of both the LH and HL trendlines makes us consider a slightly tighter trading range. The trade is short, TP = 0.82600.

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

GBPJPY 1D MA200 rejection. Channel Down sell signal.The GBPJPY pair has been trading within a Channel Down pattern and the recent Bullish Leg got rejected yesterday on the 1D MA200 (orange trend-line). If the 1D RSI closes below its MA trend-line, we will have the ideal sell confirmation signal.

Our Target is the top of the 4-month Support Zone at 188.550.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

GBPCHF INTRADAY bullish continuation supported at 1.1366The GBP/CHF currency pair shows a bullish sentiment, supported by the prevailing uptrend. Recent intraday price action indicates a bounce back from the rising trendline support zone.

Bullish Scenario:

The key trading level to watch is 1.1366, representing the previous consolidation range. A corrective pullback to this level, followed by a bullish bounce, would likely target upside resistance at 1.1470. Further bullish momentum could see prices reaching 1.1510 and 1.1570 over the longer timeframe.

Bearish Scenario:

On the other hand, a confirmed loss of the 1.1366 support level, accompanied by a daily close below this point, would invalidate the bullish outlook. This would pave the way for a deeper retracement toward 1.1300, with the next support level at 1.1240.

Conclusion:

The prevailing sentiment remains bullish as long as 1.1366 holds as support. Traders should monitor this level for potential bounce signals to confirm continued upside momentum. A decisive break below 1.1366 would signal a shift to a bearish outlook, targeting lower support zones.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Bullish bounce off pullback support?GBP/JPY is falling towards the pivot which is a pullback support and could bounce to the 1st resistance which acts as a pullback resistance.

Pivot: 192.76

1st Support: 190.79

1st Resistance: 194.69

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bearish reversal?EUR/GBP is rising towards the pivot and could reveres to the 1st support.

Pivot: 0.8401

1st Support: 0.8356

1st Resistance: 0.8444

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

GBP/USD - 1.30 Break I've been monitoring Cable closely, waiting for a clean break above the 1.30 resistance level. Since the start of the month, no solid entry has presented itself, but the bulls seem to be gaining momentum as time progresses.

The chart is shaping up well, with 1.30 acting as a key resistance level. We've already seen multiple rejections this month, with price coming within 10 pips before reversing sharply.

If we get a confirmed breakout above 1.30, I'll be watching for a retest to establish it as support before entering a long position. The target is set at the psychological level of 1.325, aiming for a 3:1 risk-to-reward.

EUR/GBP Bullish Flag (18.3.25)The EUR/GBP pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Bullish Flag Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 0.8433

2nd Resistance – 0.8448

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

GBP/USD Bullish Breakout AnalysisThe GBP/USD currency pair has successfully broken above a key bullish trendline, signaling potential further upside momentum. This breakout suggests that buyers are gaining control, and the pair could continue its upward movement toward the next resistance levels.

Current Market Structure & Key Levels:

Breakout Confirmation: The pair has breached the bullish trendline resistance, indicating renewed bullish strength.

Immediate Resistance: The price is currently facing a strong resistance level at 1.28120. This level is critical as it could act as a temporary hurdle before further upside movement.

Break & Continuation: If GBP/USD successfully breaks and holds above 1.28120, we can expect bullish continuation toward the next upside targets at 1.28700 and 1.29650.

Support Levels: In case of a retracement, the pair might find support at the previously broken trendline, which could now act as a demand zone.

Technical Outlook:

Momentum Shift: The breakout of the trendline suggests a shift in momentum favoring buyers.

Volume Confirmation: If the breakout is accompanied by increasing trading volume, it will further strengthen the bullish bias.

Fundamental Factors: Any economic data releases related to GBP or USD, as well as central bank decisions, could influence price action and confirm or invalidate the breakout.

Trading Plan:

A confirmed break and retest of 1.28120 could provide a good buying opportunity with upside targets of 1.28700 and 1.29650.

A failure to break this resistance may result in a temporary pullback before another attempt at a breakout.

Traders should monitor price action, volume, and potential news catalysts to validate the breakout for further bullish continuation.

GBP/CHF "Pound vs Swiss" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/JPY "The Guppy" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (1.13700) then make your move - Bullish profits await!"

however I advise to placing the Buy Stop Orders above the breakout MA or placing the Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 1.12700 (swing Trade Basis) Using the 4H period, the recent / Swing Low or High level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.15500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

GBP/CHF "Pound vs Swiss" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

🔶 Fundamental Analysis

The GBP/CHF exchange rate is influenced by the UK's economic growth, inflation, and interest rates, as well as Switzerland's economic performance. Currently, the UK's economy is experiencing moderate growth, with a slight increase in inflation

🔷 Macroeconomic Analysis

The Bank of England has maintained a hawkish stance, with interest rates expected to remain high in the short term. This has led to a strengthening of the British pound. On the other hand, the Swiss National Bank has kept interest rates at historic lows, supporting the economy.

🔶 COT Data Analysis

The Commitments of Traders (COT) report shows that commercial traders are net short, while non-commercial traders are net long. This indicates a potential trend reversal.

💫COT Data Changes (February 4 - February 11, 2025)

Institutional Traders: Increased long positions by 5%, decreased short positions by 3%.

Retail Traders: Increased short positions by 2%, decreased long positions by 1%.

Large Banks: Increased long positions by 4%, decreased short positions by 2%.

💫Upcoming COT Data (February 18, 2025)

Expected Changes: Institutional traders may increase long positions, retail traders may decrease short positions.

Market Sentiment: Bullish sentiment expected to increase.

💫COT Data Trends

Long-term Trend: Institutional traders have maintained a net long position since January 2025.

Short-term Trend: Retail traders have increased short positions over the past two weeks.

🔷 Market Sentimental Analysis

Market sentiment is slightly bullish, with 55% of traders holding long positions. Institutional traders are holding long positions, while hedge funds are holding short positions. Retail traders are also holding long positions.

🔶 Market Sentiment by Trader Type

- Institutional Traders: 60% bullish, 40% bearish

- Hedge Funds: 55% bearish, 45% bullish

- Retail Traders: 55% bullish, 45% bearish

🔷 Positioning Data Analysis

Institutional traders are holding long positions, while corporate traders are holding short positions. Banks are maintaining a bearish stance.

🔶 Overall Outlook

The GBP/CHF exchange rate is expected to remain volatile in the short term, with a slight bullish bias due to the UK's economic growth and inflation. However, the pair's movement will largely depend on the overall performance of the UK and Swiss economies, as well as global economic trends

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBPCHF long – running at +25 pips but looking towards +1600It was in Sep 2022 that this pair made its (ATL) low at 1.01563. Since then, it meandered rather aimlessly (largely consolidating) but made a couple of higher lows. A double top was formed in July 2024, but that ended in a higher low. Here, began an uptrend that I believe is still intact. In Sep 2024 it slipped into a range as shown in the blue rectangle and has recently broken out of it to the upside. Price has been rather consistently above the (daily) 20ema this entire year and is not over-extended either.

PA at this time is not neat, plenty of wicks on both sides (check your daily chart). This is not what trend traders like to see, yet it does seem that the bulls are gaining control. This could be the early phase of a long bull trend or price could hit a resistance and fall down again. I would say that this is a high-risk trade at the moment.

I have taken a (small) long position already but will look to close it just before 1.1640 resistance. If, however, there is break above and pull back to that level, I will conclude that this pair is now firmly bullish and will target 1.3030 with a full position size (or multiple positions). That is a long way away and will be a good test of patience and nerves.

All this can be speculation too, but my risk is extremely limited right now – something well within my comfort zone.

This is not a trade recommendation, merely my own analysis. Trading carries a high level of risk, so only trade with money you can afford to lose and carefully manage your capital and risk. If you like my idea, please give a “boost” and follow me to get even more. Please comment and share your thoughts too!!

It’s not whether you are right or wrong, but how much money you make when you are right and how much you lose when you are wrong – George Soros

GBP/USD Channel Breakout (14.03.2025)The GBP/USD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Channel Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 1.2890

2nd Support – 1.2862

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.