Gbp-cad

GBP/CAD Short OpportunityAfter a long period of corrective price action in the form of an ascending channel, we can see price is approaching a high value area on the larger timeframe structure. With a little more development, we may see price momentum slow down further for a move to the downside. Personally I’ll be looking for shorting opportunities in the form of a sell stop below previous structure. Happy trading folks!

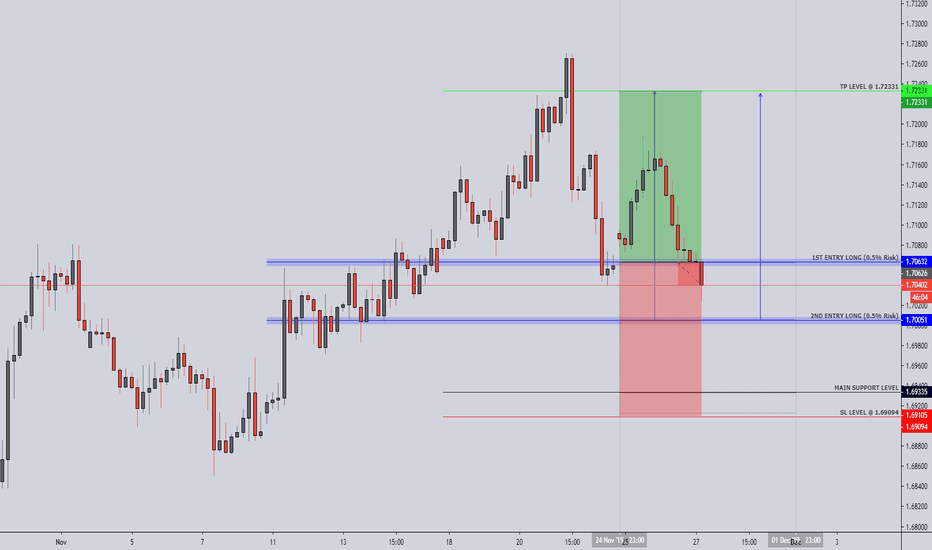

GBPCAD - FOREX - 27. NOVE. 2019Welcome to our weekly trade setup ( GBPCAD )!

-

1 HOUR

Bearish drop towards our support

4 HOUR

Waving market structure at our lows and support zone.

DAILY

Overall very bullish market with pullbacks, enter long now!

-

FOREX SETUP

BUY GBPCAD

1ST ENTRY @ 1.70630

2ND ENTRY @ 1.70050

SL @ 1.69090

TP @ 1.72330

RR: 1.1 / 2.35

Use 0.5% risk per Entry!

(Remember to add a few pips to all levels - different Brokers!)

Leave us a comment or like to keep our content for free and alive.

Have a great week everyone!

ALAN

GBPCAD SS Short + 48 Pip PotentialPrice is below the 60 and 15 KS as well as the cloud. This is a Type 1 trade with a High probability and decent RRR.

BO Entry = 1.7048

Stop = 1.7072

Risk = 25 pips

Profit target = 1.6999 ( The daily KS )

Reward = 48 Pips

RRR = 2 - 1

I would appreciate if you leave a comment or like as a thank you

Have a great week!!

Allen

GBPCAD Documentted MA Trade +47 Pip PotentialToday we started with a GBP bullish view but after the GBP pairs pushed down, we set-up an MA trade on this pair. Although this was not the last to reach the MA, price pulled back to the confluence of the MA and the 60 KS. Those who trade the Gold Method Ichimoku and have been in the training, know exactly what I am talking about.

Since this trade triggered later in the London session only about 75% in the trading room took advantage of either this pair or GUSD. All who got in made money :)

Just keep stacking those positive days :)

Allen

GBPCAD a la bajaEsperamos para entrar en short / ventas en GBPCAD

Tenemos dos patrones convergiendo en la misma zona de ventas

Nuestra entrada recomendada es en el OB y 0.88

Entrada en 1.31250

colocar SL en 1.3403

Take progit en 1.25805

Veremos como nos trata el mercado.

Saludos y que tengan excelentes trades!

Don't miss the great buy opportunity in GBPCADTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (1.7135). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. GBPCAD is in a uptrend and the continuation of uptrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 66.

Take Profits:

TP1= @ 1.7322

TP2= @ 1.7515

TP3= @ 1.7750

SL= Break below S2

Don't miss the great buy opportunity in GBPCADTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (1.7135). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. GBPCAD is in a uptrend and the continuation of uptrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 66.

Take Profits:

TP1= @ 1.7322

TP2= @ 1.7515

TP3= @ 1.7750

SL= Break below S2

GBPCAD 4HR - SHORT DONT MISS THE FALLA zigzag correction of ABC is completing for Subminuette Wave 2 and price is currently retesting the 61.8% Fibonacci Level.

There is also divergence on MACD indicating the bulls losing its buying power hinting a potential reversal.

SCENARIO

Recommendation: Sell

Wait for price to break the trendline downwards and Sell. Our first target is the channel support.

Goodluck.

GBPCAD BULLISH & BEARISH IDEASMonthly Confluence is telling me are indeed in a Bullish Market. We have a Bullish Pennant located right at the 61.8% Retracement which institutions do on purpose right at market closure so participants can pretty much gamble their money with either going long or short. For me to enter Long i'd like to price to show me an indefinite buyer market breaking above local resistance, if price comes back down hitting the red line, that means the trade is invalidated (No good). If price does continue lower and hits the green line, its a safe understanding that price did in fact reject of the 61.8 retracement and we are in a Bearish Continuation Market.