GBPAUD longAll timeframes are in alignment that price is due for a bullish move.

3 month and monthly timeframe:

Price took a lot of bullish orders at 1.6000 from which we saw a lot of bullish momentum on the pair.

Price retested 1.8600, indicating that price would form a new bullish leg and go to the highs of 2.0850.

There has been a lot of choppy price action in the pursuit of that area but I believe that price will soon hit that target in the near future.

This is because this quarterly candle closure looks as if it will close above 2.0250 showing that price has more than enough buy volume to reach that target

On the monthly timeframe, December's monthly candle engulfed numerous wicks showing that buy volume has kicked in.

January and February saw price test the 1.9650 handle twice before collecting enough buy orders to go higher

Weekly:

There is not a lot to deduce here since price is heavily in alignment with the monthly and 3M timeframe

Daily:

Price broke and retested the 2.0300 level and went higher.

Price has formed a bullish pattern that has confirmed to me that 2.0720 is a magnetic region

So everything, price is doing currently is in order to pick up orders to head to that region

4 hour:

Price on the 4 hour has formed a very high confluence bullish pattern that shows me it will break the current highs.

2.0660 is the next magnetic zone for this timeframe and I am looking to long the pair to that region

My optimal entry region is at 2.0550 which is a psychological zone and the London session is drawing near.

I am waiting for a bullish confirmation to buy the pair in the next hour or two.

GBPAUD

GBPAUD buy Trade IdeaHello Traders

In This Chart GBP/AUD 4 HOURLY Forex Forecast By FOREX PLANET

today GBP/AUD analysis 👆

🟢This Chart includes_ (GBP/AUD market update)

🟢What is The Next Opportunity on GBP/AUD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBP/AUD BEARS ARE STRONG HERE|SHORT

GBPAUD SIGNAL

Trade Direction: short

Entry Level: 2.059

Target Level: 2.019

Stop Loss: 2.085

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9H

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

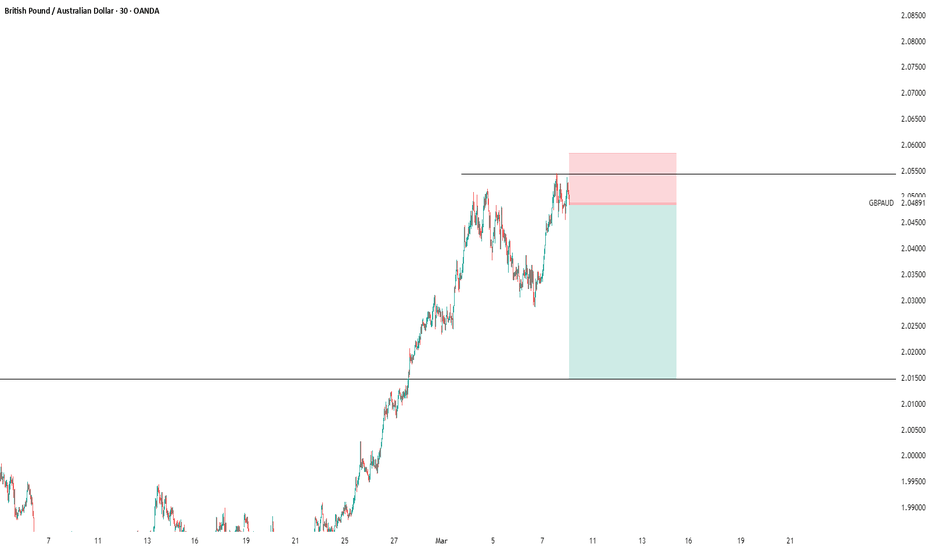

GBPAUD Approaching Major Resistance — Potential Sell SetupOANDA:GBPAUD is approaching a major resistance zone, highlighted by strong selling interest. This area has historically acted as a supply zone, increasing the likelihood of a bearish reversal if sellers step in.

The current market structure suggests that if the price confirms resistance within this zone, we could see further downside movement. A successful rejection could push the pair toward 2.03000, a logical target based on prior price behavior and the current structure.

However, if the price breaks and holds above this resistance, the bearish outlook may be invalidated, potentially leading to further upside.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

GBPAUD INTRADAY Bullish consolidation supported at 2.0227The GBPAUD currency pair maintains a bullish sentiment, supported by the prevailing long-term uptrend. However, recent price action suggests an overextended bullish breakout, approaching significant resistance zones on both daily and weekly timeframes.

The key trading level to watch is 2.0227. A potential overbought pullback from current levels, followed by a bullish rebound from 2.0227, could extend the upside, targeting 2.0499, with further resistance at 2.0577 and 2.0737 over a longer timeframe.

Conversely, a confirmed break below 2.0227, with a daily close under this level, could signal a corrective pullback towards 2.0077 and 2.9937.

Conclusion:

While the broader trend remains bullish, the current overextended move suggests the possibility of short-term retracements. Holding 2.0227 as support will be critical for further upside continuation, while a breakdown below this level could trigger deeper corrections. Traders should monitor price action closely and adjust risk management accordingly.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

gbpaud sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

Weekly Watchlist & Market Outlook (#1)Welcome back, guys! I’m Skeptic , and today, I’m breaking down my weekly watchlist with key market setups. Having a structured plan before the trading week starts helps you stay mentally prepared, avoid impulsive trades, and stick to your strategy. So, let’s dive in!

1. XAUUSD (Gold) 🟡

Daily TF:

Gold has maintained a strong major uptrend and recently completed a price correction to 2842.15 (36% Fib) before resuming its upward movement. This signals a potential continuation of the bullish trend.

Trigger (Daily): Break above 2954.24 🔼

4H TF:

Price is currently in a range between 2896 (support) and 2927 (resistance).

Long trigger:Breakout above 2927

Short trigger: Below 2896 (although trading in the trend’s direction is recommended for better R/R).

2. EURJPY 💶

Daily TF: The pair is ranging between 155.551 (support) and 161.166 (resistance).

4H TF:

Long trigger: Breakout above 161.166 📈 (RSI entering overbought territory could add confluence).

Short trigger: Break below 159.291 targeting the range’s bottom.

3. GBPAU D

Daily TF: The key resistance at 2.02396 has been broken, signaling a new uptrend.

4H TF:

Long trigger: Breakout above 2.05139 🔼 for trend continuation.

Short trigger: If 2.02396 fails as support (fake breakout), look for lower TF confirmation.

4. GBPNZD

Daily TF: Similar to GBPAUD, 2.23992 resistance has been broken, and price has pulled back.

4H TF:

Long trigger: Breakout above 2.26565 📈 for continuation.

Short trigger: If 2.23992 fails (fake breakout scenario).

5. AUDNZD

Daily TF:

A strong uptrend was recently broken, potentially signaling a price correction.

4H TF:

Short trigger: Break below 1.10115 🔻 (sign of further downside).

Long trigger: If price reclaims the broken trendline, indicating a fake breakdown.

Final Thoughts 💡

Thanks for following this week’s watchlist! If you have specific pairs or assets you’d like me to analyze, drop them in the comments.

Growing alone may be fast, but in the long run, teamwork wins. Let’s grow together. ❤️

GBPAUD Bullish breakout supported at 2.0227The GBPAUD currency pair maintains a bullish sentiment, supported by the prevailing long-term uptrend. However, recent price action suggests an overextended bullish breakout, approaching significant resistance zones on both daily and weekly timeframes.

The key trading level to watch is 2.0227. A potential overbought pullback from current levels, followed by a bullish rebound from 2.0227, could extend the upside, targeting 2.0499, with further resistance at 2.0577 and 2.0737 over a longer timeframe.

Conversely, a confirmed break below 2.0227, with a daily close under this level, could signal a corrective pullback towards 2.0077 and 2.9937.

Conclusion:

While the broader trend remains bullish, the current overextended move suggests the possibility of short-term retracements. Holding 2.0227 as support will be critical for further upside continuation, while a breakdown below this level could trigger deeper corrections. Traders should monitor price action closely and adjust risk management accordingly.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBP/AUD BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

The BB upper band is nearby so GBP-AUD is in the overbought territory. Thus, despite the uptrend on the 1W timeframe I think that we will see a bearish reaction from the resistance line above and a move down towards the target at around 1.991.

✅LIKE AND COMMENT MY IDEAS✅

GBPAUD Potential Short on a Trend reversal TradeOANDA:GBPAUD made a significant bullish run and interestingly, the move was pretty fast. Looking back in history, Price has hit a major Resistance and created a new low around the 2.03801. This area has been further broken and retested which suggests a possible bearish opportunity. I would recommend to trade this with some caution as the overall bullish move is still potentially on.

Results are not typical, past results does not guarantee future results, so do your due diligence.

Let's talk about your trade ideas too ;-)

GBP-AUD Bullish Bias! Buy!

Hello,Traders!

GBP-AUD is trading in an

Uptrend and the pair

Is making a local correction

But will soon hit a horizontal

Support of 2.0240 from where

We will be expecting a local

Bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bullish continuation?GBP/AUD is falling towards the pivot which acts as a pullback support and could bounce to the 1st resistance.

Pivot: 2.0243

1st Support: 2.0099

1st Resistance: 2.0507

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

GBPAUD Long Idea - 4H ChartGBPAUD is in a strong uptrend, breaking through key resistance levels and trading above the 200 EMA, confirming bullish momentum. The price is currently extended but may retest a key demand zone before continuing higher.

Trade Setup:

🔹 Entry: Look for a pullback into the 2.0250 - 2.0300 demand zone.

🔹 Stop Loss: Below 2.0200, under the recent structure for safety.

🔹 Target: A potential push towards 2.0800 - 2.1000, the next major resistance area.

📈 Watch for: Bullish rejection wicks, engulfing patterns, or confirmation from lower timeframes before entering long.

🔔 Bullish trend remains intact! Manage risk and trade accordingly. 🚀

#GBPAUD #Forex #Trading #PriceAction #TechnicalAnalysis

GBPAUD Bullish breakout The GBPAUD currency pair maintains a bullish sentiment, supported by a longer-term uptrend. Recent price action has confirmed a breakout above a key level, but the possibility of a retracement remains, making it crucial to assess both bullish and bearish scenarios.

Key Levels to Watch

Resistance Levels: 2.030, 2.040, 2.056

Support Levels: 2.010, 1.9927, 1.9770, 1.9620

Bullish Scenario

If GBPAUD sustains price action above the 2.010 breakout level, it could signal strong bullish momentum. A successful retest of this level as support may provide a foundation for further upside, with key resistance targets at 2.030, followed by 2.040 and ultimately 2.056 in the longer term.

Bearish Scenario

A failure to hold above 2.010, followed by a confirmed breakdown and daily close below this level, would weaken the bullish outlook. In this scenario, selling pressure could intensify, leading to downside targets at 1.9927, with further retracement potential toward 1.9770 and 1.9620 over an extended timeframe.

Conclusion

GBPAUD remains in a bullish structure, but price action around the 2.010 level will be critical in determining the next move. A strong hold above this level could reinforce further gains, while a breakdown below it may trigger deeper retracements. Traders should monitor key support and resistance levels closely for confirmation of the next directional move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBPAUD Selling Trading IdeaHello Traders

In This Chart GBP/AUD 4 HOURLY Forex Forecast By FOREX PLANET

today GBP/AUD analysis 👆

🟢This Chart includes_ (GBP/AUD market update)

🟢What is The Next Opportunity on GBP/AUD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPAUD Bullish breakout, The Week Ahead 03rd March '25The GBPAUD currency pair maintains a bullish sentiment, supported by a longer-term uptrend. Recent price action has confirmed a breakout above a key level, but the possibility of a retracement remains, making it crucial to assess both bullish and bearish scenarios.

Key Levels to Watch

Resistance Levels: 2.030, 2.040, 2.056

Support Levels: 2.010, 1.9927, 1.9770, 1.9620

Bullish Scenario

If GBPAUD sustains price action above the 2.010 breakout level, it could signal strong bullish momentum. A successful retest of this level as support may provide a foundation for further upside, with key resistance targets at 2.030, followed by 2.040 and ultimately 2.056 in the longer term.

Bearish Scenario

A failure to hold above 2.010, followed by a confirmed breakdown and daily close below this level, would weaken the bullish outlook. In this scenario, selling pressure could intensify, leading to downside targets at 1.9927, with further retracement potential toward 1.9770 and 1.9620 over an extended timeframe.

Conclusion

GBPAUD remains in a bullish structure, but price action around the 2.010 level will be critical in determining the next move. A strong hold above this level could reinforce further gains, while a breakdown below it may trigger deeper retracements. Traders should monitor key support and resistance levels closely for confirmation of the next directional move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBPAUD Selling Trading IdeaHello Traders

In This Chart GBP/AUD 4 HOURLY Forex Forecast By FOREX PLANET

today GBP/AUD analysis 👆

🟢This Chart includes_ (GBP/AUD market update)

🟢What is The Next Opportunity on GBP/AUD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts