GBPAUD market outlookFX:GBPAUD

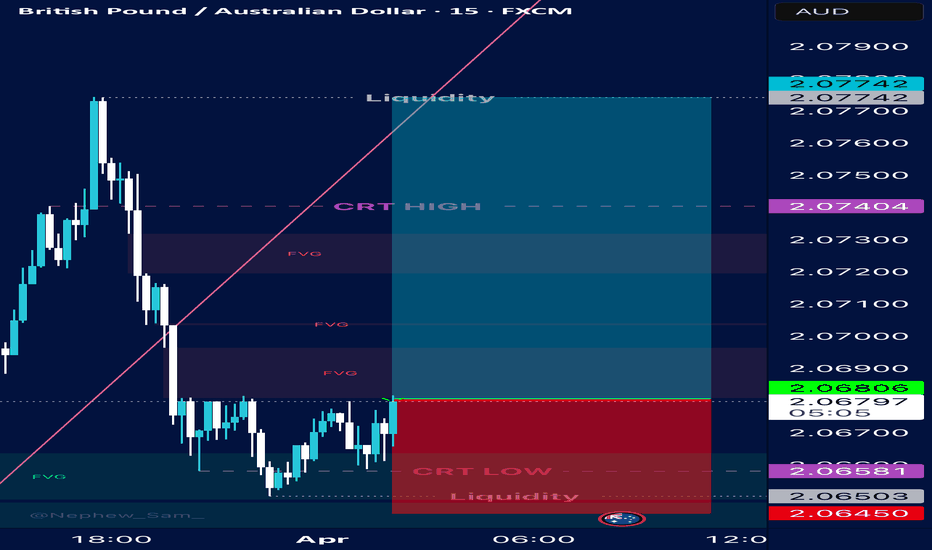

Price has reached and reacted off significant level of resistance zone at 2.16400, which was last seen on the 2nd of November 2015. On Friday's NY open, price created a false bullish signal with a 190 pips pin bar candle on the H1 chart. Instead, price reacted off its recent swap zone and continued its downtrend. If it breaks below 2.07720, we can anticipate a short-term continuous downtrend to the daily demand range, which is about 200 to 300 pip movement.

On the fundamentals, the Aussie dollar has recently hit a 5 year low against the USD, trading at just 60.5 US cents as the two world's largest economies have been ramping up tariffs to as high as 125%. The AUD may be impacted due to China being Australia's biggest trading partner and the trade war is only increasing uncertainty risks. On the bright side, the ASX 200 surged by 4.5% on a single day as Trump announces tariff pause, which was the highest increase in value on a single day ever since the pandemic in 2020. Both the UK and Australia have been imposed the same reciprocal tariff rates of 10%, for now, I expect a short-term downtrend before its continuation upwards, but we'll see what the coming week brings to us.

GBPAUD

GBP/AUD SELLERS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

The BB upper band is nearby so GBP-AUD is in the overbought territory. Thus, despite the uptrend on the 1W timeframe I think that we will see a bearish reaction from the resistance line above and a move down towards the target at around 2.090.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPAUD INTRADAY overbought consolidation supported at 2.1100GBPAUD retains a bullish outlook, driven by the prevailing uptrend. The latest price movement suggests a corrective pullback toward a previous consolidation zone, offering potential for trend continuation.

Key Support Level: 2.1100 – prior consolidation area and immediate decision point for bulls

Upside Targets:

2.1550 – initial resistance

2.1720 and 2.2000 – medium to longer-term bullish targets

A bullish bounce from 2.1100 would signal resumption of the upward trend, targeting the above resistance levels.

On the flip side, a confirmed break and daily close below 2.1100 would invalidate the bullish structure, setting up a deeper pullback toward 2.0860, with additional support at 2.0690 and 2.0580.

Conclusion

GBPAUD remains bullish above 2.1100. A bounce from this level favors upside continuation. A daily close below 2.1100 would shift momentum bearish, opening the path to deeper retracement targets.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBPAUD Massive Short! SELL!

My dear friends,

GBPAUD looks like it will make a good move, and here are the details:

The market is trading on 2.0922 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 2.0761

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPAUD - Already Over-Bought!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPAUD has been bullish trading within the rising channels in orange and red.

Currently, GBPAUD is retesting the upper bound of the channels.

Moreover, the $2.085 - $2.1 is a strong resistance zone.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper trendlines and green resistance zone.

📚 As per my trading style:

As #GBPAUD approaches the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPAUD - One More Leg!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPAUD has been overall bullish trading within the rising channel marked in blue.

Moreover, it is retesting a strong structure.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of structure and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #GBPAUD approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP/AUD BEST PLACE TO BUY FROM|LONG

Hello, Friends!

It makes sense for us to go long on GBP/AUD right now from the support line below with the target of 2.061 because of the confluence of the two strong factors which are the general uptrend on the previous 1W candle and the oversold situation on the lower TF determined by it’s proximity to the lower BB band.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPAUD analysis elliot. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBP-AUD Free Signal! Buy!

Hello,Traders!

GBP-AUD is trading in a

Local uptrend and the pair

Made a local correction

Of the horizontal support

Level of 2.0634 so we can

Enter a long trade with the

Take Profit of 2.0724 and

The Stop Loss of 2.0582

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

RBA Holds Their Cash Rate, May Cut Neither Confirmed Nor DeniedThe RBA held their cash rate at 4.1%, and keep a May cut up in the air without any appetite to commit to one. I highlight my observations on the RBA's statement, before updating my analysis for AUD/USD, AUD/CAD and GBP/AUD.

Matt Simpson, Market Analyst at City Index and Forex.com

GBPAUD Bullish breakout supported at 2.0596Trend Overview:

The GBPAUD pair remains in a strong uptrend, with recent price action confirming a breakout above a previous consolidation zone, now acting as a key support level at 2.0596.

Key Levels:

Support: 2.0596 (key level), 2.0530, 2.0440

Resistance: 2.0755, 2.0840, 2.0895

Bullish Scenario:

A pullback to 2.0596, followed by a bullish bounce, would reinforce the support level and signal further upside momentum. A breakout above 2.0755 may extend gains towards 2.0840 and 2.0895 in the longer term.

Bearish Scenario:

A daily close below 2.0596 would weaken the bullish outlook, increasing the likelihood of a retracement towards 2.0530, with 2.0440 as the next downside target.

Conclusion:

GBPAUD remains bullish above 2.0596, with potential upside targets at 2.0755, 2.0840, and 2.0895. However, a break below 2.0596 could shift momentum to the downside, targeting 2.0530 and 2.0440. Traders should monitor price action at 2.0596 for confirmation of the next directional move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBP_AUD SHORT SIGNAL|

✅GBP_AUD keeps growing

In a strong uptrend but

The pair will soon hit a

Horizontal resistance

Of 2.0620 from where

We can enter a counter-trend

(and therefore a riskier) short

Trade with the TP of 2.0532

And the SL of 2.0653

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP/AUD: Consolidation Breakout Signals Bullish ContinuationThe GBP/AUD market remains in a range-bound structure, fluctuating between the 2.0300 support and 2.0600 resistance levels. Recently, price broke and closed above both a downward trendline and the previous two daily highs, reinforcing a bullish bias.

With strong momentum visible on the daily timeframe, the market appears to be setting up for a consolidation expansion pattern. If the price continues to hold above the trendline and support level, a retest of last week’s high is likely, with further bullish movement possible. The next target is the resistance zone around 2.06490

GBPAUD Selling Trading IdeaHello Traders

In This Chart GBP/AUD 4 HOURLY Forex Forecast By FOREX PLANET

today GBP/AUD analysis 👆

🟢This Chart includes_ (GBP/AUD market update)

🟢What is The Next Opportunity on GBP/AUD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

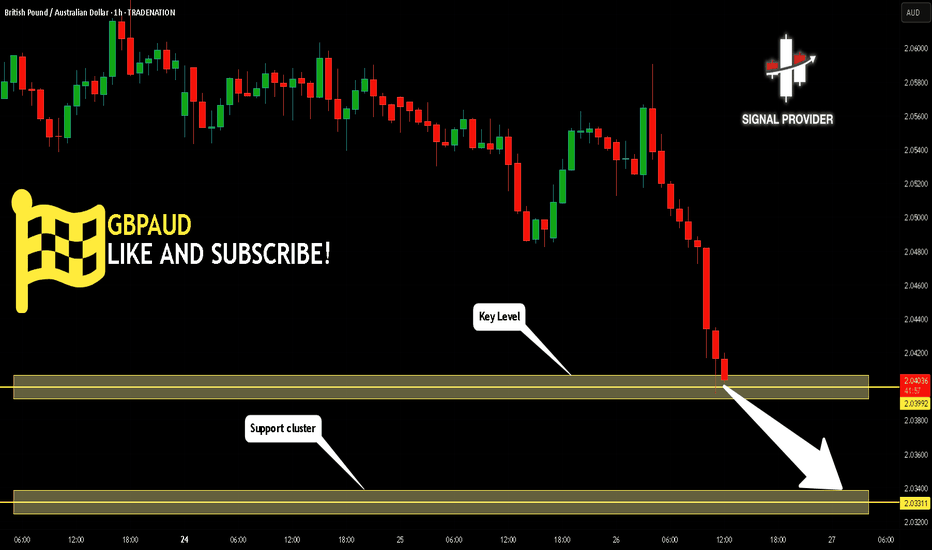

GBPAUD Will Move Lower! Short!

Please, check our technical outlook for GBPAUD.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 2.039.

Considering the today's price action, probabilities will be high to see a movement to 2.033.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBP/AUD Breakout (25.3.25)The GBP/AUD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Trendline Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 2.0448

2nd Support – 2.0400

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

GBP/AUD BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

We are now examining the GBP/AUD pair and we can see that the pair is going up locally while also being in a uptrend on the 1W TF. But there is also a powerful signal from the BB upper band being nearby, indicating that the pair is overbought so we can go short from the resistance line above and a target at 2.054 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅