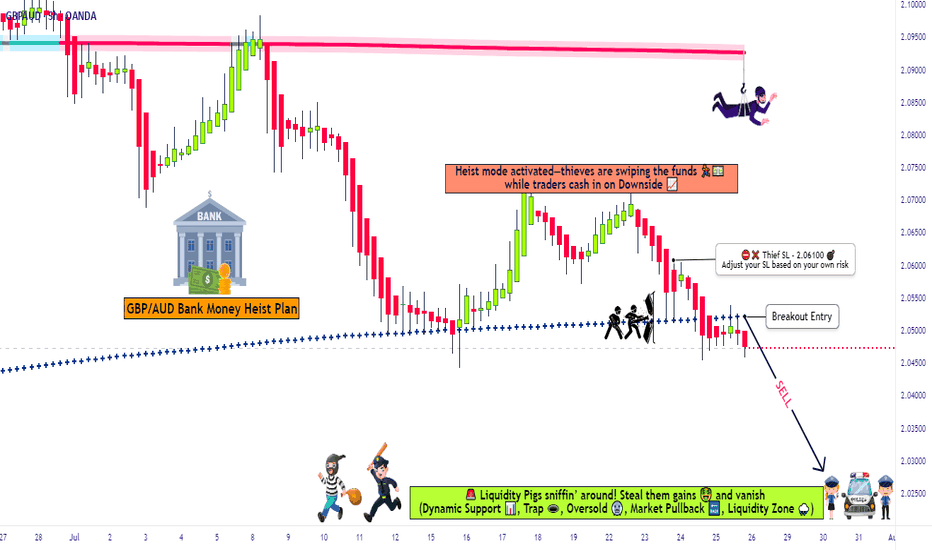

High-Stakes GBP/AUD Short Plan – Grab the Bag & Escape Early!💥🔥GBP/AUD HEIST OPERATION: The Pound vs Aussie Bear Trap Masterplan 🔥💥

(Thief Trader Exclusive TradingView Drop – Smash Boost If You’re Ready To Rob The Market!)

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌍

Welcome, Money Makers & Market Robbers! 🤑💰✈️

This isn't just analysis — it's a high-stakes forex heist, engineered using Thief Trading Style's elite blend of technical, macro, sentiment, and quantitative insights. We're cracking the GBP/AUD vault with sharp bearish setups targeting a major liquidity zone — aka the Police Barricade Support Area! 🚨🔫

📉 Plan of Attack – Short Entry Setup

This isn’t your typical chart — this is blueprint-grade precision. Here's the GBP/AUD short strategy for Day & Swing Traders:

🚪 ENTRY ZONE

Initiate bearish positions at or near recent highs (wick level).

Use limit orders stacked (layering/DCA style) on the 15m or 30m retest zones for sniper entries.

Look for wicks with rejection — that’s where the fake bullish robbers get trapped!

🛑 STOP LOSS

Place SL just above recent 4H swing highs (2.06100 as a reference).

Adjust according to position size and the number of orders you’re layering.

🎯 TARGET ZONE

Aim for 2.02500, or book partial profits earlier if the heist gets heat.

Escape before the alarms ring! Secure the bag and vanish like a pro.

🔍Fundamental & Sentiment Heist Intel 📚

This bearish pressure on GBP/AUD isn’t random — it’s triggered by a perfect storm:

COT Positioning flips 📊

Aussie strength from commodities & RBA commentary 📈

GBP uncertainty from macro tightening & economic data ⚖️

Sentiment exhaustion at highs + false bullish trap 📉

Consolidation zone breakdown = smart money move! 💼

Wanna go deep? 🧠

Tap into COT, Macro Trends, Intermarket Analysis & Thief’s proprietary scoreboardsss 📡🔗

⚠️ News & Position Management Alert 🚧

📰 Avoid entry around key news drops

🔒 Lock in profits with trailing SL

💼 Secure capital > Chase greed

🔥 SHOW SOME LOVE 🔥

💖 Smash that ❤️ BOOST button — it powers our next big heist!

Together, we rob the market with style, skill, and precision.

See you on the next breakout robbery mission, legends!

Stay dangerous. Stay profitable. Stay Thief. 🐱👤💵🚀

Gbpaudforecast

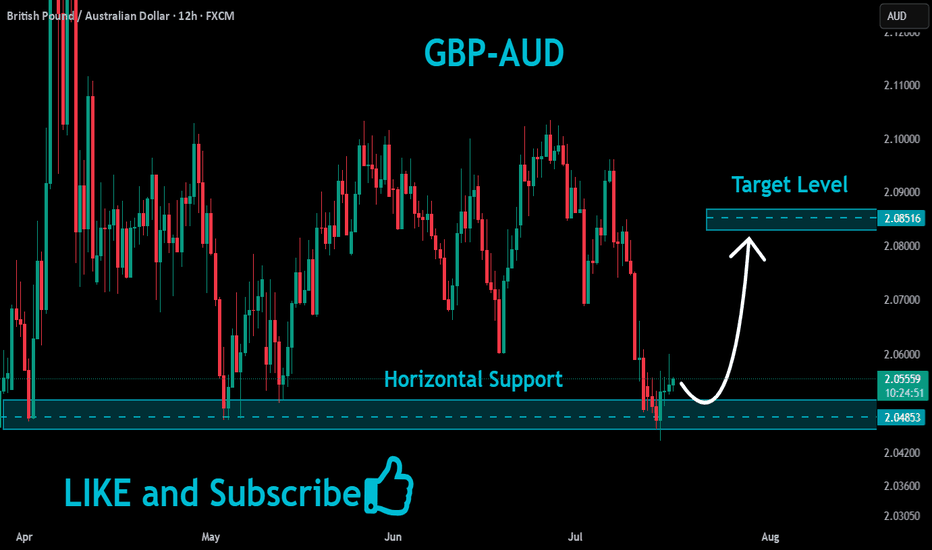

GBP/AUD Tests 2.048 for Potential ReboundFenzoFx—GBP/AUD is testing the critical support level at 2.048, coinciding with the VWAP. From a technical perspective, a bullish move toward an upper resistance level is likely.

In this scenario, GBP/AUD has the potential to test the bearish FVG at approximately 2.070. Please note that the bullish outlook should be invalidated if GBP/AUD falls and stabilizes below 2.048.

Will This Breakout Unlock the Money Run? GBP/AUD Heist Begins!💼The Pound Heist: GBP/AUD Break-In Blueprint🔐

“The vault’s half open… Are you in or watching from the cameras?”

🌍 Hey crew! 💬 Hola, Ola, Bonjour, Hallo, Marhaba! 🌟

Welcome to another sneaky setup from the Thief Trading Syndicate™ 🕵️♂️💸

We're setting our sights on GBP/AUD — and the market's flashing green for a bold long entry mission. Read the plan carefully before suiting up. 🎯

🧠 Mission Brief:

The “Pound vs Aussie” market is now playing around a key resistance wall – it’s hot, it’s risky, and it’s primed for a breakout 🎇.

🟢 Entry:

Break & Close Above 2.10500 = 🚨 Green Light

🎯 Set a Buy Stop above the resistance zone —

OR

Sneak in with a Buy Limit during a clean pullback to recent high/low on the 15m or 30m timeframes 🔍.

⏰ Set an alert, don’t miss the moment the vault cracks open.

🛡️ Stop Loss Plan – Lock Your Exit:

🛑 For Buy Stops:

➡️ Wait till the breakout confirms — don’t rush your SL like a rookie 🐣

📍 Suggested SL at swing low (2.08700) based on the 3H timeframe

💡 Always size your SL based on your risk tolerance, not just the setup.

🎯 The Escape Plan – Target:

🏁 First Checkpoint: 2.13000

📤 Or slip out early if you sense heavy guards (resistance) on duty.

Use Trailing SL to lock your loot while staying in the run.

🧲 Scalper's Note:

Only rob the bullish side! If you’re packing heavy funds, hit fast — else join the swing crew and move with caution. 🎒

Lock in profits with trailing exits to avoid being caught in the chop 🌀.

📊 Why This Heist Works – Market Fuel:

🔥 Bullish sentiment fueled by:

Technical setup (Resistance > Breakout > Momentum Surge)

Risk zone analysis

Macro & COT outlooks

Sentiment + Intermarket Alignment

Stay informed — read the full macro game plan, news, and positioning tools. Knowledge = clean escape. 🧠💼

📰 News Alert:

⚠️ Avoid new entries during high-volatility events

✅ Use trailing SLs to protect any active trades

🔐 Stay safe, stay sharp — the market’s watching too 👁️

🆙 Support the Crew:

Smash the 💥 Boost Button 💥 if you ride with the Thief Style Traders 🐱👤💸

Let’s continue bagging pips & stacking gold, one chart at a time.

🚀 Next mission drops soon. Stay sharp. Stay sneaky. Stay paid.

#ThiefTrading #ForexHeist #GBPAUDPlan

GBPAUD Short From Resistance!

HI,Traders !

#GBPAUD went up sharply

Made a retest of the

Horizontal resistance level

Of 2.10010 from where we

Are already seeing a local

Bearish reaction so we

Are locally bearish biased

And we will be expecting

A local bearish correction !

Comment and subscribe to help us grow !

GBPAUD - Expecting Bearish Continuation In The Short TermM15 - Bearish divergence followed by the most recent uptrend line breakout.

Clean bearish trend with the price creating series of lower highs, lower lows.

No opposite signs.

Expecting further continuation lower until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

#GBPAUD: Will price reverse to bullish, or continue dropping? GBPAUD fell further below our expectations in our previous analysis, but the price remains extremely bearish. GBP failed to hold on to its bullish momentum, leading the pair to drop 300 pips from our previous entry zone. Currently, price is trading at a key buying level, where we can expect a strong bullish volume to kick in the market and help us gain a nice clean bullish move. There are two areas for both entries. At the moment, you can use a small time frame to take any swing buy entry. Please ensure you manage your risk accurately before getting into the market.

Good luck and trade safely!

Thank you for your unwavering support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

#GBPAUD: +245 From Previous Analysis, 880+ Total Pips TargetIn our previous analysis, we clearly indicated our entry point, and the price followed suit, reversing straight and currently up 245+ in positive. Going forward, we expect a straight, clean move of 800+ points. If you missed this entry, there will be a correction within the next 4 hours. Just analyse the pinpoint and enter accordingly with proper risk management.

Good luck and trade safely!

Thank you for your unwavering support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

GBPAUD possible bearish for 2.0360#GBPAUD made a new high, then moved in a range 2.0685-2.1010 for a whole month. now support level 2.0685 broken. better to wait for correction/pullback to test the imbalance area between buyers and sellers. ideal level for short is 2.0960-65. stop loss: 2.1050, target: 2.0450 & 2.0360.

#GBPAUD: After A Strong Drop Price Seems To Rebounding! The British pound (GBPAUD) took a nosedive when the US president announced new tariffs on several countries. This caused gold to rise, and so did the Australian dollar (AUD).

You see, gold and the AUD are like best friends, they always move together. But things are changing now, and we’re not sure what’s going to happen next.

That’s why there are two different opinions in the market. When trading GBPAUD, it’s important to use accurate risk management and make decisions based on your risk tolerance.

Good luck and trade safely!

Much Love ❤️

Team Setupsfx!

GBPAUD Bullish Trend: Trade Idea with Entry, Stop Loss & Targets📈 The GBPAUD has been in a strong bullish trend, rallying to trade at a premium. 📈 In this video, we analyze the trend, market structure, and price action, while exploring a strategy focused on a retracement into 50% of the previous day's range. 🛠️ I also share a detailed trade idea, including potential entry points, stop-loss levels, and target zones. 🚀 Please note: this is not financial advice. #ForexTrading #GBPAUD #TeschnicalAnalysis #ScalpingStrategies #TradingIdeas"

GBPAUD - Look for Reversal Short (SWING) 1:4!After a strong bullish move, which can be seen as a correction before continuing the HTF downtrend, we've observed a clear confirmation of a triple top on the LTF. This suggests a potential opportunity to ride the trend south.

Additionally, the price has been in accumulation for a few days, likely collecting orders within the marked supply zone.

Let’s see how the market plays out — hopefully, it triggers our targeted TP1 and TP2.

Disclaimer:

This is simply my personal technical analysis, and you're free to consider it as a reference or disregard it. No obligation! Emphasizing the importance of proper risk management—it can make a significant difference. Wishing you a successful and happy trading experience!

GBPAUD OUTLOOKThe 12 month chart shows price reacting from a strong demand zone though the price is yet to contact the unmitigated supply at 2.4 price handle.

On the monthly chart, price has created a bearish order flow indicating seller pushed price to the identified 12-month demand zone at 1.44 price handle. The internal structure on the monthly charts shows price struggling to create new highs, indicating bears are still in control of this market.

On the weekly charts, the market structure shows a short term bullish correction within a larger bearish swing structure. We have several bearish change of characters indicating bears are still controlling this market. Presently, price has formed higher highs and is correcting targeting the unmitigated zone at 1.89. If price pushes further below 1.85, we will have confirmation of bearish market structure targeting the 1.71 price handle.

The Daily chart confirms bearish order flow, we will wait for bullish price correction thereafter place our sell limits targeting the unmitigated demand on the weekly chart.

GBP/AUD "Pound Vs Aussie" Forex Market Heist Plan on Bearish🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/AUD "Pound Vs Aussie" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 👀 So Be wealthy and safe trade.💪🏆🎉

Entry 📉 : You can enter a Bearish trade at any point.

however I advise placing sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high level should be in retest.

Stop Loss 🛑: Using the 2h period, the recent / nearest high level.

Goal 🎯: 1.97000 (OR) Before escape in the bank

Scalpers, take note : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Fundamental Outlook 📰🗞️

Based on the fundamental analysis, I would conclude that the GBP/AUD (British Pound/Australian Dollar) pair is : Bearish

Reasons:

Australian economic growth: Australia's economy is expected to grow at a rate of 2.5% in 2023, driven by a strong labor market, increasing business investment, and a rebound in the housing market.

Commodity prices: Australia is a major exporter of commodities such as iron ore, coal, and gold, and increasing prices for these commodities are expected to support the Australian dollar.

Interest rate differential: The Reserve Bank of Australia (RBA) has kept interest rates at a relatively high level of 1.5%, while the Bank of England (BoE) has kept interest rates at a low level of 1.0%, which could lead to a stronger Australian dollar.

UK economic uncertainty: The UK's economic uncertainty, particularly surrounding Brexit, could lead to a weaker pound.

Trade agreements: Australia has been signing trade agreements with other countries, which could improve the country's trade balance and support the Australian dollar.

However, it's essential to consider the following risks:

Global economic slowdown: A slowdown in global economic growth could reduce demand for the Australian dollar and drive down the pair.

China's economic slowdown: China is Australia's largest trading partner, and a slowdown in China's economy could impact Australia's economy and the Australian dollar.

UK economic growth: If the UK's economy grows more quickly than expected, it could lead to a stronger pound and a weaker Australian dollar.

Bearish Scenario:

Australian economic growth, commodity prices, and interest rate differential support the Australian dollar

UK economic uncertainty and trade agreements also contribute to the bearish case

Market Sentiment:

Bearish sentiment: 65%

Bullish sentiment: 35%

Neutral sentiment: 0%

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

#GBPAUD 1DAYGBPAUD Daily Analysis

The GBPAUD pair is trading near the resistance line of an uptrend channel on the daily chart, suggesting a potential reversal or correction from this level. The channel resistance indicates strong selling pressure, making it a key area to watch for bearish setups.

Technical Outlook:

Pattern: Uptrend Channel Resistance

Forecast: Bearish (Sell Opportunity)

Entry Strategy: Enter a sell position if the price confirms rejection at the channel resistance through bearish price action signals, such as a bearish engulfing candlestick or a double top pattern.

Traders should use indicators like RSI to check for overbought conditions or MACD for divergence that signals weakening bullish momentum. Apply proper risk management by placing stop-loss orders above the channel resistance and setting profit targets at key support levels within the channel.

GBP/AUD "Pound vs Aussie" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical analysis🔥, here is our master plan to heist the GBP/AUD "Pound vs Aussie" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 👀 So Be Careful, wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a trade after the breakout of black MA 2.00230

however I advise placing Multiple Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low & high level should be in retest.

Stop Loss 🛑: Using the 2H period, the recent / nearest low level.

Goal 🎯: 2.03000

Scalpers, take note : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

GBPAUD next possible moveYou already have all the tools you need to be profitable in trading. But:

- How long will it take for you to realize it?

- How long before you develop the essential habits to fully leverage these tools?

- And most importantly, how much longer before you take action?

Now, think about this: how much time do we waste every day, in our 24 hours, on activities that add nothing to our progress toward our goals?

Time is our most precious resource. Unlike money, which can be earned again, lost time is gone forever.

So, what will you do with your time starting today? The decision is yours. ⏳

GBPAUD: 600+ pips, possible big move happening soon! Dear Traders,

We have an excellent selling opportunity coming up where we can see price dropping in no time, and can help us gain few hundred pips. We hoping for this trade to be completed in two weeks time. Please watch the price carefully. Thank you.

GBP/AUD "Pound vs Aussie" Forex Bank Heist Plan on Bullish SideHola! Ola! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist GBP/AUD "Pound vs Aussie" Forex Bank based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry 📈 : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Low Point take entry should be in pullback.

Stop Loss 🛑 : Recent Swing Low using 4H timeframe

Attention for Scalpers : Focus to scalp only on Long side, If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

💖Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂