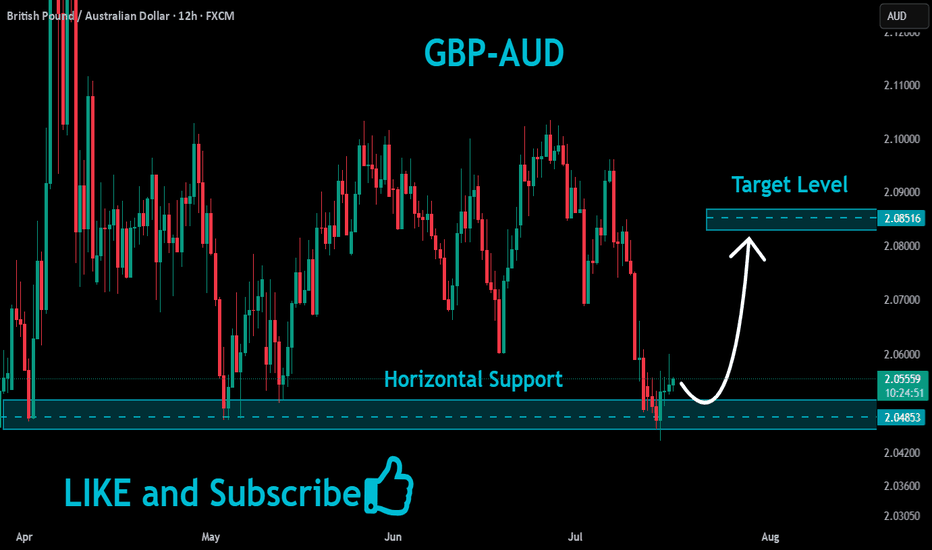

GBP/AUD At Very Interesting Buy Area , Don`t Miss 150 Pips !Here is my GBP/AUD 4H Chart and this is my opinion , the price moved very hard to downside And now creating new wave in the 4H Up Trendline and the price at strong support now 2.05000 which is forced the price many times to go up , so it`s my best place to enter a buy trade , and if you checked the chart you will see the price creating the new higher low to complete the new higher high . if we have a daily closure below my support area then this idea will not be valid anymore .

Gbpaudidea

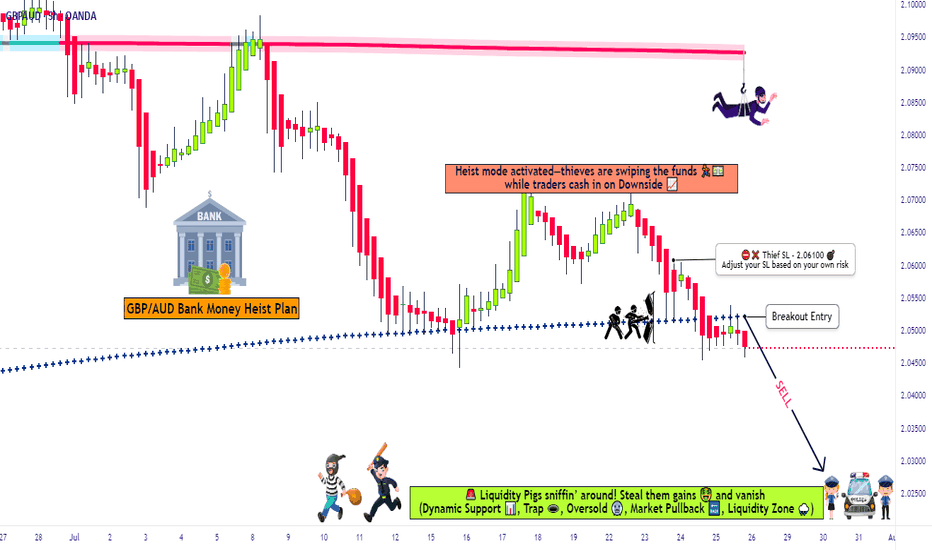

High-Stakes GBP/AUD Short Plan – Grab the Bag & Escape Early!💥🔥GBP/AUD HEIST OPERATION: The Pound vs Aussie Bear Trap Masterplan 🔥💥

(Thief Trader Exclusive TradingView Drop – Smash Boost If You’re Ready To Rob The Market!)

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌍

Welcome, Money Makers & Market Robbers! 🤑💰✈️

This isn't just analysis — it's a high-stakes forex heist, engineered using Thief Trading Style's elite blend of technical, macro, sentiment, and quantitative insights. We're cracking the GBP/AUD vault with sharp bearish setups targeting a major liquidity zone — aka the Police Barricade Support Area! 🚨🔫

📉 Plan of Attack – Short Entry Setup

This isn’t your typical chart — this is blueprint-grade precision. Here's the GBP/AUD short strategy for Day & Swing Traders:

🚪 ENTRY ZONE

Initiate bearish positions at or near recent highs (wick level).

Use limit orders stacked (layering/DCA style) on the 15m or 30m retest zones for sniper entries.

Look for wicks with rejection — that’s where the fake bullish robbers get trapped!

🛑 STOP LOSS

Place SL just above recent 4H swing highs (2.06100 as a reference).

Adjust according to position size and the number of orders you’re layering.

🎯 TARGET ZONE

Aim for 2.02500, or book partial profits earlier if the heist gets heat.

Escape before the alarms ring! Secure the bag and vanish like a pro.

🔍Fundamental & Sentiment Heist Intel 📚

This bearish pressure on GBP/AUD isn’t random — it’s triggered by a perfect storm:

COT Positioning flips 📊

Aussie strength from commodities & RBA commentary 📈

GBP uncertainty from macro tightening & economic data ⚖️

Sentiment exhaustion at highs + false bullish trap 📉

Consolidation zone breakdown = smart money move! 💼

Wanna go deep? 🧠

Tap into COT, Macro Trends, Intermarket Analysis & Thief’s proprietary scoreboardsss 📡🔗

⚠️ News & Position Management Alert 🚧

📰 Avoid entry around key news drops

🔒 Lock in profits with trailing SL

💼 Secure capital > Chase greed

🔥 SHOW SOME LOVE 🔥

💖 Smash that ❤️ BOOST button — it powers our next big heist!

Together, we rob the market with style, skill, and precision.

See you on the next breakout robbery mission, legends!

Stay dangerous. Stay profitable. Stay Thief. 🐱👤💵🚀

GBP/AUD Ready To Go Up After Melted , 2 Entries Valid !Here is my GBP/AUD 1H Chart and this is my opinion , the price moved very hard to downside without any correction and the price at strong support now 2.05000 which is forced the price many times to go up , so it`s my best place to enter a buy trade , and if you checked the chart you will see the price now creating a reversal pattern and i put my neckline and if we have a closure above it to confirm the pattern we can enter another entry to increase our contracts . if we have a daily closure below my support area then this idea will not be valid anymore .

Will This Breakout Unlock the Money Run? GBP/AUD Heist Begins!💼The Pound Heist: GBP/AUD Break-In Blueprint🔐

“The vault’s half open… Are you in or watching from the cameras?”

🌍 Hey crew! 💬 Hola, Ola, Bonjour, Hallo, Marhaba! 🌟

Welcome to another sneaky setup from the Thief Trading Syndicate™ 🕵️♂️💸

We're setting our sights on GBP/AUD — and the market's flashing green for a bold long entry mission. Read the plan carefully before suiting up. 🎯

🧠 Mission Brief:

The “Pound vs Aussie” market is now playing around a key resistance wall – it’s hot, it’s risky, and it’s primed for a breakout 🎇.

🟢 Entry:

Break & Close Above 2.10500 = 🚨 Green Light

🎯 Set a Buy Stop above the resistance zone —

OR

Sneak in with a Buy Limit during a clean pullback to recent high/low on the 15m or 30m timeframes 🔍.

⏰ Set an alert, don’t miss the moment the vault cracks open.

🛡️ Stop Loss Plan – Lock Your Exit:

🛑 For Buy Stops:

➡️ Wait till the breakout confirms — don’t rush your SL like a rookie 🐣

📍 Suggested SL at swing low (2.08700) based on the 3H timeframe

💡 Always size your SL based on your risk tolerance, not just the setup.

🎯 The Escape Plan – Target:

🏁 First Checkpoint: 2.13000

📤 Or slip out early if you sense heavy guards (resistance) on duty.

Use Trailing SL to lock your loot while staying in the run.

🧲 Scalper's Note:

Only rob the bullish side! If you’re packing heavy funds, hit fast — else join the swing crew and move with caution. 🎒

Lock in profits with trailing exits to avoid being caught in the chop 🌀.

📊 Why This Heist Works – Market Fuel:

🔥 Bullish sentiment fueled by:

Technical setup (Resistance > Breakout > Momentum Surge)

Risk zone analysis

Macro & COT outlooks

Sentiment + Intermarket Alignment

Stay informed — read the full macro game plan, news, and positioning tools. Knowledge = clean escape. 🧠💼

📰 News Alert:

⚠️ Avoid new entries during high-volatility events

✅ Use trailing SLs to protect any active trades

🔐 Stay safe, stay sharp — the market’s watching too 👁️

🆙 Support the Crew:

Smash the 💥 Boost Button 💥 if you ride with the Thief Style Traders 🐱👤💸

Let’s continue bagging pips & stacking gold, one chart at a time.

🚀 Next mission drops soon. Stay sharp. Stay sneaky. Stay paid.

#ThiefTrading #ForexHeist #GBPAUDPlan

GBPAUD Short From Resistance!

HI,Traders !

#GBPAUD went up sharply

Made a retest of the

Horizontal resistance level

Of 2.10010 from where we

Are already seeing a local

Bearish reaction so we

Are locally bearish biased

And we will be expecting

A local bearish correction !

Comment and subscribe to help us grow !

GBPAUD - Expecting Bearish Continuation In The Short TermM15 - Bearish divergence followed by the most recent uptrend line breakout.

Clean bearish trend with the price creating series of lower highs, lower lows.

No opposite signs.

Expecting further continuation lower until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

GBP/AUD Heist: Bullish Breakout Plan to Steal Profits!🌟 Pound vs. Aussie Heist: GBP/AUD Trading Plan 🚀💸

Hey Money Makers & Thieves! 🤑💰 Ready to pull off a master heist on the GBP/AUD Forex market? Based on 🔥 Thief Trading Style 🔥 blending technicals and fundamentals, here’s the plan to conquer the "Pound vs. Aussie" with a long entry strategy targeting the high-risk Red Zone. Let’s dive in! 📈🎯

Entry 📈:

The heist is live! Wait for the MA breakout at 2.10000 to strike—bullish profits are calling! 🔔

Set buy stop orders above the Moving Average for breakout entries.

Or, place buy limit orders on a 15 or 30-minute timeframe at the most recent swing low/high for pullback entries.

📌Pro tip: Set an alert on your chart to catch the breakout moment! 🚨

Stop Loss 🛑:

Protect your loot with a Thief SL at the recent swing low/high on the 4H timeframe (2.07400).

Adjust SL based on your risk, lot size, and number of orders. Stay sharp! 🔍

Target 🎯:

Aim for 2.14400 or exit early to secure profits before the target. Don’t get greedy! 💪

Scalpers, Listen Up 👀:

Stick to the long side for quick scalps.

Big players can jump in now; smaller traders, join the swing trade robbery with a trailing SL to lock in gains. 💰

Market Outlook 💵:

GBP/AUD is riding a bullish wave, fueled by fundamentals, macro trends, COT reports, quantitative analysis, sentiment, and intermarket dynamics. Stay updated as these can shift fast! 🌎📊

⚠️ Trading Alert: News & Position Management 📰:

Avoid new trades during news releases to dodge volatility traps.

Use trailing stop-loss orders to protect running positions and secure profits. 🚫

Latest Market Data (UTC+1, May 20, 2025, 12:02 PM BST):

Forex (GBP/AUD): Current price ~2.09850 (source: financialjuice.com).

COT Report (Latest Friday, May 16, 2025):

Non-commercial long positions increased, signaling bullish sentiment among large speculators.

Net long positions rose by 5,200 contracts (source: CFTC.gov).

Commodities & Metals: Gold and oil prices stable, supporting AUD strength but GBP bolstered by UK economic data.

Indices & Crypto: No direct impact, but risk-on sentiment in global indices supports bullish GBP/AUD bias.

💖 Boost the Heist! 💥:

Hit the Boost Button to power up our robbery team! 🤝 With the Thief Trading Style, we’re stealing profits daily. Stay tuned for the next heist plan! 🐱👤🚀

Happy trading, and let’s make that money! 💸🎉

Disclaimer: Trading involves risk. Always manage your risk and stay informed.

gbpaud buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPAUD – Key Level Changing RoleOANDA:GBPAUD

As you saw, we previously bought GBP/AUD from this level and made a good profit ✅

After the level was broken, we shorted and again took solid gains 📉

Now the level has broken upward, and we’re watching for a pullback to re-enter if a signal

shows up 📊👀

Remember: every trade is just a possibility, not a certainty!

Stop loss is part of the game and helps protect capital ⛔️

Smart Forex Analysis | Weekly Setups

Clean charts. No noise. Just levels.

#GBPAUD: +245 From Previous Analysis, 880+ Total Pips TargetIn our previous analysis, we clearly indicated our entry point, and the price followed suit, reversing straight and currently up 245+ in positive. Going forward, we expect a straight, clean move of 800+ points. If you missed this entry, there will be a correction within the next 4 hours. Just analyse the pinpoint and enter accordingly with proper risk management.

Good luck and trade safely!

Thank you for your unwavering support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

GBP/AUD "Pound vs Aussie" Forex Bank Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/AUD "Pound vs Aussie" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk ATR Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout then make your move at (2.07100) - Bearish profits await!"

however I advise to Place sell stop orders below the Breakout level (or) after the breakout of Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (2.10000) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 2.04700 (or) Escape Before the Target

💰💵💴💸GBP/AUD "Pound vs Aussie" Forex Bank Heist Plan (Day / Scalping Trade) is currently experiencing a Neutral trend (there is a chance to move bearishness).., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets & Overall Score... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

#GBPAUD: After A Strong Drop Price Seems To Rebounding! The British pound (GBPAUD) took a nosedive when the US president announced new tariffs on several countries. This caused gold to rise, and so did the Australian dollar (AUD).

You see, gold and the AUD are like best friends, they always move together. But things are changing now, and we’re not sure what’s going to happen next.

That’s why there are two different opinions in the market. When trading GBPAUD, it’s important to use accurate risk management and make decisions based on your risk tolerance.

Good luck and trade safely!

Much Love ❤️

Team Setupsfx!

GBP/AUD "Pound vs Aussie" Forex Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/AUD "Pound vs Aussie" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (1.96000) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 1.97300 (swing Trade Basis) Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.93400 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

GBP/AUD "Pound vs Aussie" Forex Market is currently experiencing a Bearish trend., driven by several key factors.

🟢Fundamental Analysis

- BoE Interest Rate Decision: The Bank of England's (BoE) decision to keep interest rates unchanged has led to a decrease in investor confidence, potentially impacting the GBP/AUD pair

- UK GDP Growth Rate: The UK's GDP growth rate is expected to be impacted by the BoE's dovish outlook and trade war fears, potentially leading to a decrease in the GBP/AUD pair

- Australian Employment Data: Australia's employment data is expected to be released soon, potentially impacting the AUD and the GBP/AUD pair

🔴Macroeconomic Trends

- Global Economic Trends: The ongoing trade war between the US and China is expected to impact global economic trends, potentially leading to a decrease in the GBP/AUD pair

- Inflation Rate: The UK's inflation rate is expected to be impacted by the BoE's monetary policy decisions, potentially leading to a decrease in the GBP/AUD pair

- Interest Rate Differentials: The interest rate differential between the UK and Australia is expected to impact the GBP/AUD pair, potentially leading to a decrease in the pair's value

🟣COT Report

- Institutional Traders: Institutional traders are net long on GBP/AUD, expecting a potential increase in the pair's value

- Retail Traders: Retail traders are net short on GBP/AUD, expecting a potential decrease in the pair's value

- Open Interest: Open interest is increasing, indicating a potential increase in market volatility

Non-Commercial Traders: 40% long, 60% short

Commercial Traders: 45% long, 55% short

Non-Reportable Traders: 35% long, 65% short

⚪Technical Analysis

- Trend: The current trend is bearish, with the GBP/AUD pair having declined by 5% over the past quarter.

- Moving Averages: The 50-day moving average is below the 200-day moving average, indicating a bearish trend.

🟤Market Sentiment

- Investor Sentiment: Institutional investors are 35% bullish, 45% bearish, and 20% neutral on the GBP/AUD pair.

- Retail Sentiment: Retail investors are 40% bullish, 30% bearish, and 30% neutral on the GBP/AUD pair.

- Market Mood: The overall market mood is cautious, with investors waiting for further economic data before making investment decisions.

⚫Overall Outlook

- Bearish: The GBP/AUD pair is expected to continue its downward trend, driven by a stronger AUD and a weaker GBP.

- Volatility: The GBP/AUD pair is expected to be volatile, with potential price swings of 5-10% in the short-term.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBP/AUD "Pound vs Aussie" Forex Market Bank Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/AUD "Pound vs Aussie" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 4H timeframe (2.04000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 2.08000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Read the Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook:

GBP/AUD "Pound vs Aussie" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBP/AUD Ready to Fly! 🚀 GBP/AUD Ready to Fly! 🚀

🔹 Pair: GBP/AUD

🔹 Bias: Bullish ✅

🔹 Entry Zone:

🔹 Stop Loss (SL): 🔴

🔹 Take Profit (TP): 🏆

📊 Market Outlook:

✅ Sell-side liquidity grabbed – Market cleared weak hands

✅ Supply zone broken – Buyers stepping in

✅ Bullish market structure – Higher highs forming

✅ Confluence with key demand zone – Strong support holding

📈 GBP/AUD looks ready for a strong bullish move. If price holds above key levels, expect further upside momentum! 🚀

💬 Drop your thoughts below! Are you bullish too? 👇🔥

#GBPAUD #ForexTrading #SmartMoneyConcepts #LiquidityGrab #TradingView #ForexSignals

GBP/AUD Ready To Go Down , Don`t Miss This 250 Pips !Here is my analysis on GBP/AUD , We have an old res forced the price to go down before and now it`s the third touch for the re area , so i think it will be the best place to sell this pair and targeting 250 pips .

This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

GBP/AUD Finally Made Double Top Pattern , Short Entry Valid !Here is my chart on GBP/AUD , Finally we have a very good reversal pattern after this huge movement to upside , the price made a double top reversal pattern , and the price broke the neckline and closed below it , so now i`m waiting the price to retest the broken neckline and then we can enter a sell trade if we have a good retest and targeting 250 Pips .

This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.