gbpaud sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

Gbpaudshort

gbpaud sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpaud analysis elliot. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

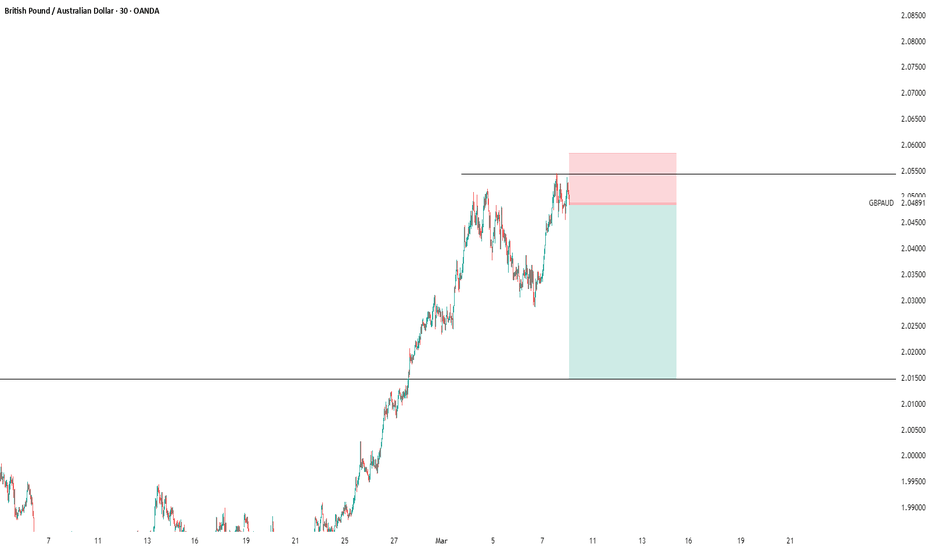

GBPAUD Potential Short on a Trend reversal TradeOANDA:GBPAUD made a significant bullish run and interestingly, the move was pretty fast. Looking back in history, Price has hit a major Resistance and created a new low around the 2.03801. This area has been further broken and retested which suggests a possible bearish opportunity. I would recommend to trade this with some caution as the overall bullish move is still potentially on.

Results are not typical, past results does not guarantee future results, so do your due diligence.

Let's talk about your trade ideas too ;-)

GBPAUD - Look for a long !!Hello traders!

‼️ This is my perspective on GBPAUD.

Technical analysis: Here we are in a bullish market structure from daily timeframe perspective, so I look for a long. My point of interest is imbalance filled + rejection from bullish OB and level 1.99000.

Like, comment and subscribe to be in touch with my content!

GBPAUD - Short Setup at Key Resistance LevelOANDA:GBPAUD is approaching a major resistance zone, an area where sellers have consistently stepped in, leading to notable reversals in the past. This level is marked by strong selling interest and historical price reactions, increasing the likelihood of a bearish move if sellers regain control.

The current price action suggests that if the pair confirms resistance through bearish engulfing candles, long upper wicks, or increased selling volume, we could see a downward move toward the 1.99200 level. However, if the price breaks above this zone, the bearish outlook could be invalidated, opening the door for further upside.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

GBPaud sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpaud sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPAUD - Bearish Reversal Pattern + SetupHello traders,

GBPAUD has been in an uptrend since last week. But now it is showing bearishness with the break of the demand zone.

Add to this the RSI divergence which makes this trade a higher probability setup.

My entry, sl and tp are as marked on the chart.

GBPAUD - Look for Reversal Short (SWING) 1:4!After a strong bullish move, which can be seen as a correction before continuing the HTF downtrend, we've observed a clear confirmation of a triple top on the LTF. This suggests a potential opportunity to ride the trend south.

Additionally, the price has been in accumulation for a few days, likely collecting orders within the marked supply zone.

Let’s see how the market plays out — hopefully, it triggers our targeted TP1 and TP2.

Disclaimer:

This is simply my personal technical analysis, and you're free to consider it as a reference or disregard it. No obligation! Emphasizing the importance of proper risk management—it can make a significant difference. Wishing you a successful and happy trading experience!

GBPAUD sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPAUD - Long activated earlier !!Hello traders!

‼️ This is my perspective on GBPAUD.

Technical analysis: Here we are in a bullish market structure from daily timeframe perspective, so I expect bullish price action after price filled the imbalance and rejected from bullish OB + institutional big figure 1.97000.

Like, comment and subscribe to be in touch with my content!

GBPAUD - Short after filling the imbalance !!Hello traders!

‼️ This is my perspective on GBPAUD.

Technical analysis: Here we are in a bearish market structure from 4H timeframe perspective, so I look for a short. My point of interest is imbalance filled + rejection from bearish OB and level 1.99000.

Like, comment and subscribe to be in touch with my content!

GBPAUD Analysis: Sell OpportunityDaily Swing Structure = Bearish

Daily Internal Structure = Bearish

Narrative:

We are pro-trend. Price has given us a bearih CHoCH signaling the end of the pullback phase.

4hrs

Swing Structure = Bearish

Internal Structure = Bearish.

With all structures aligned, we should look for bearish continuation moves with the marked demand zones giving us only reaction moves to start the pullback phases.

My expectation is for price to continue bearish until we hit our demand zone which then starts the pullback phase of prce.

Alternatively, Since we have already hit our demand range (where demand orderflow originated), we may get a bullish reaction from that where price goes to retest the unmitigated supply zone.

Thu 6th Feb 2025 GBP/AUD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/AUD Sell. Enjoy the day all. Cheers. Jim

GBPAUD - Weekly forecast, Technical Analysis & Trading IdeasMidterm forecast:

While the price is below the resistance 2.02967, beginning of downtrend is expected.

We make sure when the support at 1.94297 breaks.

If the resistance at 2.02967 is broken, the short-term forecast -beginning of downtrend- will be invalid.

Technical analysis:

A peak is formed in daily chart at 2.01490 on 02/03/2025, so more losses to support(s) 1.97390, 1.95896 and minimum to Major Support (1.94297) is expected.

Take Profits:

1.99134

1.97390

1.95896

1.94297

1.92784

1.91271

1.89131

1.85883

1.82533

1.80340

1.77000

1.72489

__________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 BOOST button,

. . . . . . . . . . . Drop some feedback below in the comment!

🙏 Your Support is appreciated!

Let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

GBPAUD, What will happen in near future ?Hello Traders, Hope you're doing Great.

For upcoming weeks, we'll probably see a downward momentum in this pair. From the viewpoint of Technical, the price has broken its last HL in Daily time frame and changed the trend. from the viewpoint of Fundamental, both Currencies are vulnerable about Risk off sentiment; but GBP is more Vulnerable than AUD because of bad data that came from Britain recently.

so with all of these reasons, Short Position is more reasonable and a downward momentum to the Demand zones is anticipated.

And finally tell me what do you think ? UP or DOWN ? leave your comment below this post.

If this post was helpful to you, please like it and share it with your friend.

THANKS.

GBPAUD - Potential long !!Hello traders!

‼️ This is my perspective on GBPAUD.

Technical analysis: Here we are in a bullish market structure from daily timeframe perspective, so I look for a long. We can see a rejection from LZ supported by hidden divergence on daily and regular divergence on H4.

Like, comment and subscribe to be in touch with my content!

GBP/AUD "Pound Vs Aussie" Forex Market Heist Plan on Bearish🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/AUD "Pound Vs Aussie" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 👀 So Be wealthy and safe trade.💪🏆🎉

Entry 📉 : You can enter a Bearish trade at any point.

however I advise placing sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high level should be in retest.

Stop Loss 🛑: Using the 2h period, the recent / nearest high level.

Goal 🎯: 1.97000 (OR) Before escape in the bank

Scalpers, take note : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Fundamental Outlook 📰🗞️

Based on the fundamental analysis, I would conclude that the GBP/AUD (British Pound/Australian Dollar) pair is : Bearish

Reasons:

Australian economic growth: Australia's economy is expected to grow at a rate of 2.5% in 2023, driven by a strong labor market, increasing business investment, and a rebound in the housing market.

Commodity prices: Australia is a major exporter of commodities such as iron ore, coal, and gold, and increasing prices for these commodities are expected to support the Australian dollar.

Interest rate differential: The Reserve Bank of Australia (RBA) has kept interest rates at a relatively high level of 1.5%, while the Bank of England (BoE) has kept interest rates at a low level of 1.0%, which could lead to a stronger Australian dollar.

UK economic uncertainty: The UK's economic uncertainty, particularly surrounding Brexit, could lead to a weaker pound.

Trade agreements: Australia has been signing trade agreements with other countries, which could improve the country's trade balance and support the Australian dollar.

However, it's essential to consider the following risks:

Global economic slowdown: A slowdown in global economic growth could reduce demand for the Australian dollar and drive down the pair.

China's economic slowdown: China is Australia's largest trading partner, and a slowdown in China's economy could impact Australia's economy and the Australian dollar.

UK economic growth: If the UK's economy grows more quickly than expected, it could lead to a stronger pound and a weaker Australian dollar.

Bearish Scenario:

Australian economic growth, commodity prices, and interest rate differential support the Australian dollar

UK economic uncertainty and trade agreements also contribute to the bearish case

Market Sentiment:

Bearish sentiment: 65%

Bullish sentiment: 35%

Neutral sentiment: 0%

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

GBPAUD SELL | Idea Trading AnalysisGBPAUD is moving on support zone

We expect a decline in the channel after testing the current level

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great SELL opportunity GBPAUD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad ⚜️