GBPAUD Potential Bullish Reversal Setup – Key Breakout Levels GBPAUD is showing signs of a potential bullish reversal after a prolonged downtrend, with price consolidating within a descending wedge pattern. The pair is testing a breakout point, and fundamentals favor a bullish recovery supported by GBP strength relative to AUD weakness.

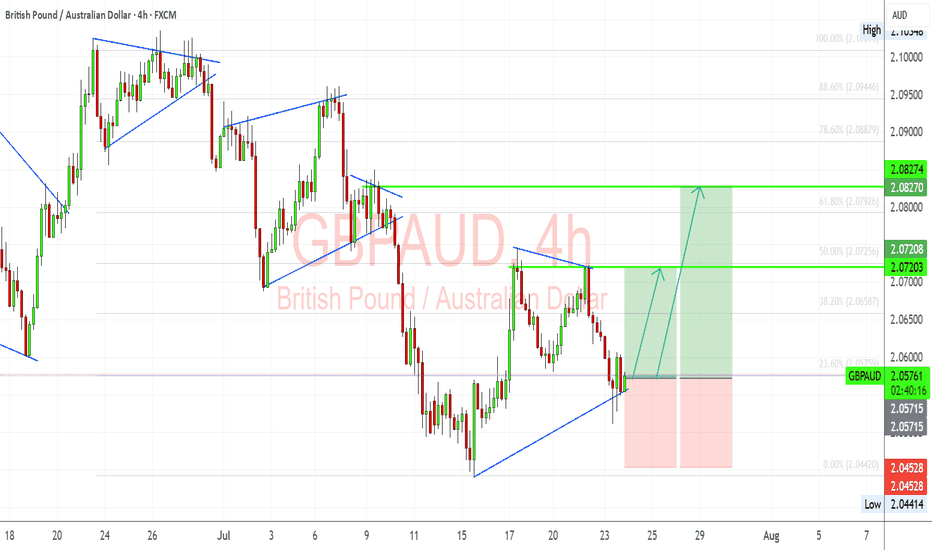

Technical Analysis (4H Chart)

Pattern: Descending wedge formation, often a bullish reversal structure.

Current Level: 2.0507, holding within the wedge and preparing for a potential breakout.

Key Support Levels:

2.0416 – immediate support and invalidation zone if broken.

2.0350 – extended support if bearish pressure resumes.

Resistance Levels:

2.0650 – near-term breakout level.

2.0740 – secondary bullish target if breakout confirms.

Projection: If the wedge breaks upward, price could rally toward 2.0650 initially, then 2.0740 for further confirmation of bullish momentum.

Fundamental Analysis

Bias: Bullish if breakout confirms.

Key Fundamentals:

GBP: BOE remains cautious but leans toward maintaining tight policy amid sticky inflation.

AUD: RBA is constrained by weaker growth and trade risks linked to global tariffs, limiting AUD upside.

Global Sentiment: Risk-off sentiment weighs on AUD, favoring GBP relative strength.

Risks:

Hawkish RBA surprise or strong China data could strengthen AUD.

BOE dovish signals may cap GBP upside.

Key Events:

BOE policy updates and UK inflation data.

RBA meeting and Chinese economic releases.

Leader/Lagger Dynamics

GBP/AUD is a lagger, often following EUR/AUD and GBP/USD movements, but it could gain momentum if GBP strength broadens against risk-sensitive currencies.

Summary: Bias and Watchpoints

GBP/AUD is setting up for a bullish reversal, with key breakout confirmation above 2.0650. A move toward 2.0740 would reinforce this scenario. The main watchpoints are BOE policy tone, RBA updates, and China’s economic signals.

Gbpaudtrade

GBPAUD Reverses from Key Zone – Long Setup in Play!Today I want to share with you a Long position on GBPAUD ( OANDA:GBPAUD ).

GBPAUD started to rise well from the Important Support line , Support zone(2.032 AUD-1.987 AUD) , and Potential Reversal Zone(PRZ) and managed to close the 4-hour candle above 2.053 AUD (important) .

In terms of Elliott wave theory , GBPAUD seems to have completed the main wave 4 . The main wave 4 structure was a Double Three Correction(WXY) .

Also, along the way, we can see a Bullish Marubozu candle , which could indicate a continuation of the uptrend .

I expect GBPAUD to break the Resistance lines soon and attack the Resistance zone(2.078 AUD-2.066 AUD) .

First Target: 2.065 AUD

Second Target: 2.076 AUD

Note: Stop Loss(SL): 2.040 =Worst SL

Please respect each other's ideas and express them politely if you agree or disagree.

British Pound/ Australian Dollar Analyze (GBPAUD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

GBPAUD is Holding above the Support , All Eyes on BuyingHello Traders

In This Chart GBPAUD HOURLY Forex Forecast By FOREX PLANET

today GBPAUD analysis 👆

🟢This Chart includes_ (GBPAUD market update)

🟢What is The Next Opportunity on GBPJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBP/AUD Trade Setup – Bullish Flag Breakout in PlayGBPAUD has formed a clean bullish flag structure after a significant impulsive move upward. Following the correction, we’re now testing breakout levels with clear Fibonacci confluence and bullish structure support around 2.0560. I'm anticipating a push toward the next resistance levels if buyers defend this trendline.

🔎 Technical Highlights (My View):

Bullish Flag Pattern: The corrective flag has broken to the upside and is being retested. This suggests a possible continuation of the bullish trend.

Fibonacci Support: Price bounced near the 23.6% retracement of the previous bullish leg, which acts as a minor but effective support in trending moves.

Bullish Trendline Holding: The ascending trendline from the July lows continues to act as dynamic support. This shows sustained buyer interest.

Target Zones:

TP1: 2.0720 – aligns with 50% retracement and recent structure.

TP2: 2.0827 – aligns with 78.6% retracement and past resistance.

SL: Below 2.0450 to invalidate the setup.

🏦 Fundamental Context:

GBP Strength: The Bank of England remains more hawkish than the RBA. UK inflation data remains sticky, and traders are still pricing in the potential for another hike if services inflation remains elevated.

AUD Weakness: AUD is under pressure due to soft labor market data and declining commodity demand from China. RBA minutes also struck a cautious tone, which weighs on the Aussie.

China Risk: AUD is sensitive to Chinese sentiment. Current trade and tariff tensions are adding indirect bearish pressure to the AUD.

⚠️ Risks to My Setup:

If Aussie labor or CPI data surprises to the upside, AUD could regain strength.

UK economic data deterioration (e.g., services PMI, wage inflation) could weaken GBP.

Break below 2.0450 would invalidate the bullish setup and suggest potential range continuation.

📅 Upcoming Catalysts to Watch:

UK Retail Sales – A strong print supports GBP continuation.

AU CPI (Trimmed Mean) – Any upside surprise could limit AUD downside.

China Industrial & Services PMI (if released soon) – indirect AUD mover.

⚖️ Summary – Bias & Trade Logic

I’m currently bullish GBP/AUD, expecting a continuation of the prior uptrend now that price has broken and retested the flag structure. Fundamentally, GBP is supported by relatively hawkish BoE expectations, while AUD remains pressured by RBA caution and China-linked macro weakness. My bias stays bullish as long as the trendline holds and Aussie data doesn’t surprise significantly.

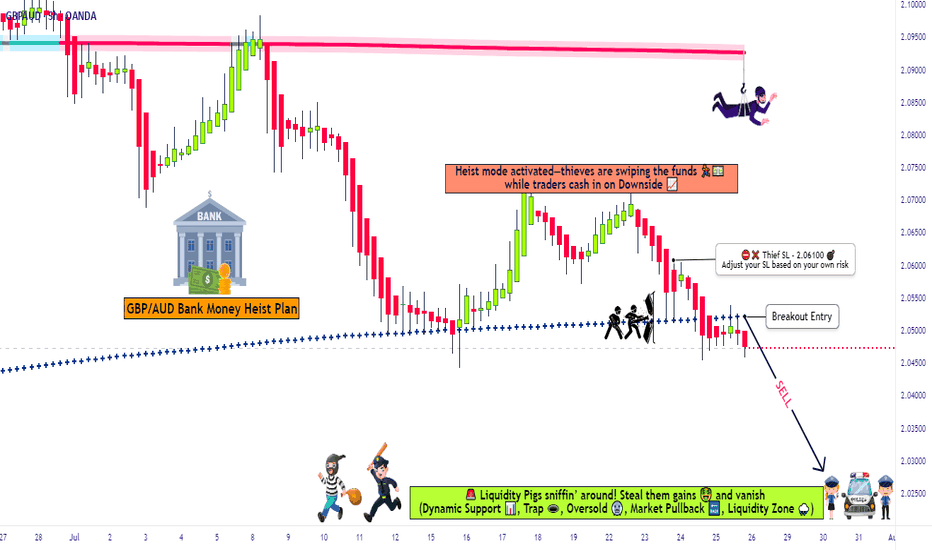

High-Stakes GBP/AUD Short Plan – Grab the Bag & Escape Early!💥🔥GBP/AUD HEIST OPERATION: The Pound vs Aussie Bear Trap Masterplan 🔥💥

(Thief Trader Exclusive TradingView Drop – Smash Boost If You’re Ready To Rob The Market!)

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌍

Welcome, Money Makers & Market Robbers! 🤑💰✈️

This isn't just analysis — it's a high-stakes forex heist, engineered using Thief Trading Style's elite blend of technical, macro, sentiment, and quantitative insights. We're cracking the GBP/AUD vault with sharp bearish setups targeting a major liquidity zone — aka the Police Barricade Support Area! 🚨🔫

📉 Plan of Attack – Short Entry Setup

This isn’t your typical chart — this is blueprint-grade precision. Here's the GBP/AUD short strategy for Day & Swing Traders:

🚪 ENTRY ZONE

Initiate bearish positions at or near recent highs (wick level).

Use limit orders stacked (layering/DCA style) on the 15m or 30m retest zones for sniper entries.

Look for wicks with rejection — that’s where the fake bullish robbers get trapped!

🛑 STOP LOSS

Place SL just above recent 4H swing highs (2.06100 as a reference).

Adjust according to position size and the number of orders you’re layering.

🎯 TARGET ZONE

Aim for 2.02500, or book partial profits earlier if the heist gets heat.

Escape before the alarms ring! Secure the bag and vanish like a pro.

🔍Fundamental & Sentiment Heist Intel 📚

This bearish pressure on GBP/AUD isn’t random — it’s triggered by a perfect storm:

COT Positioning flips 📊

Aussie strength from commodities & RBA commentary 📈

GBP uncertainty from macro tightening & economic data ⚖️

Sentiment exhaustion at highs + false bullish trap 📉

Consolidation zone breakdown = smart money move! 💼

Wanna go deep? 🧠

Tap into COT, Macro Trends, Intermarket Analysis & Thief’s proprietary scoreboardsss 📡🔗

⚠️ News & Position Management Alert 🚧

📰 Avoid entry around key news drops

🔒 Lock in profits with trailing SL

💼 Secure capital > Chase greed

🔥 SHOW SOME LOVE 🔥

💖 Smash that ❤️ BOOST button — it powers our next big heist!

Together, we rob the market with style, skill, and precision.

See you on the next breakout robbery mission, legends!

Stay dangerous. Stay profitable. Stay Thief. 🐱👤💵🚀

GBPAUD BUY SIGNAL. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

Will This Breakout Unlock the Money Run? GBP/AUD Heist Begins!💼The Pound Heist: GBP/AUD Break-In Blueprint🔐

“The vault’s half open… Are you in or watching from the cameras?”

🌍 Hey crew! 💬 Hola, Ola, Bonjour, Hallo, Marhaba! 🌟

Welcome to another sneaky setup from the Thief Trading Syndicate™ 🕵️♂️💸

We're setting our sights on GBP/AUD — and the market's flashing green for a bold long entry mission. Read the plan carefully before suiting up. 🎯

🧠 Mission Brief:

The “Pound vs Aussie” market is now playing around a key resistance wall – it’s hot, it’s risky, and it’s primed for a breakout 🎇.

🟢 Entry:

Break & Close Above 2.10500 = 🚨 Green Light

🎯 Set a Buy Stop above the resistance zone —

OR

Sneak in with a Buy Limit during a clean pullback to recent high/low on the 15m or 30m timeframes 🔍.

⏰ Set an alert, don’t miss the moment the vault cracks open.

🛡️ Stop Loss Plan – Lock Your Exit:

🛑 For Buy Stops:

➡️ Wait till the breakout confirms — don’t rush your SL like a rookie 🐣

📍 Suggested SL at swing low (2.08700) based on the 3H timeframe

💡 Always size your SL based on your risk tolerance, not just the setup.

🎯 The Escape Plan – Target:

🏁 First Checkpoint: 2.13000

📤 Or slip out early if you sense heavy guards (resistance) on duty.

Use Trailing SL to lock your loot while staying in the run.

🧲 Scalper's Note:

Only rob the bullish side! If you’re packing heavy funds, hit fast — else join the swing crew and move with caution. 🎒

Lock in profits with trailing exits to avoid being caught in the chop 🌀.

📊 Why This Heist Works – Market Fuel:

🔥 Bullish sentiment fueled by:

Technical setup (Resistance > Breakout > Momentum Surge)

Risk zone analysis

Macro & COT outlooks

Sentiment + Intermarket Alignment

Stay informed — read the full macro game plan, news, and positioning tools. Knowledge = clean escape. 🧠💼

📰 News Alert:

⚠️ Avoid new entries during high-volatility events

✅ Use trailing SLs to protect any active trades

🔐 Stay safe, stay sharp — the market’s watching too 👁️

🆙 Support the Crew:

Smash the 💥 Boost Button 💥 if you ride with the Thief Style Traders 🐱👤💸

Let’s continue bagging pips & stacking gold, one chart at a time.

🚀 Next mission drops soon. Stay sharp. Stay sneaky. Stay paid.

#ThiefTrading #ForexHeist #GBPAUDPlan

GBPAUD Short From Resistance!

HI,Traders !

#GBPAUD went up sharply

Made a retest of the

Horizontal resistance level

Of 2.10010 from where we

Are already seeing a local

Bearish reaction so we

Are locally bearish biased

And we will be expecting

A local bearish correction !

Comment and subscribe to help us grow !

gbpaud sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpaud buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPAUD - Expecting Bearish Continuation In The Short TermM15 - Bearish divergence followed by the most recent uptrend line breakout.

Clean bearish trend with the price creating series of lower highs, lower lows.

No opposite signs.

Expecting further continuation lower until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

gbpaud buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpaud buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPAUD buy Trade IdeaHello Traders

In This Chart GBP/AUD 4 HOURLY Forex Forecast By FOREX PLANET

today GBP/AUD analysis 👆

🟢This Chart includes_ (GBP/AUD market update)

🟢What is The Next Opportunity on GBP/AUD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

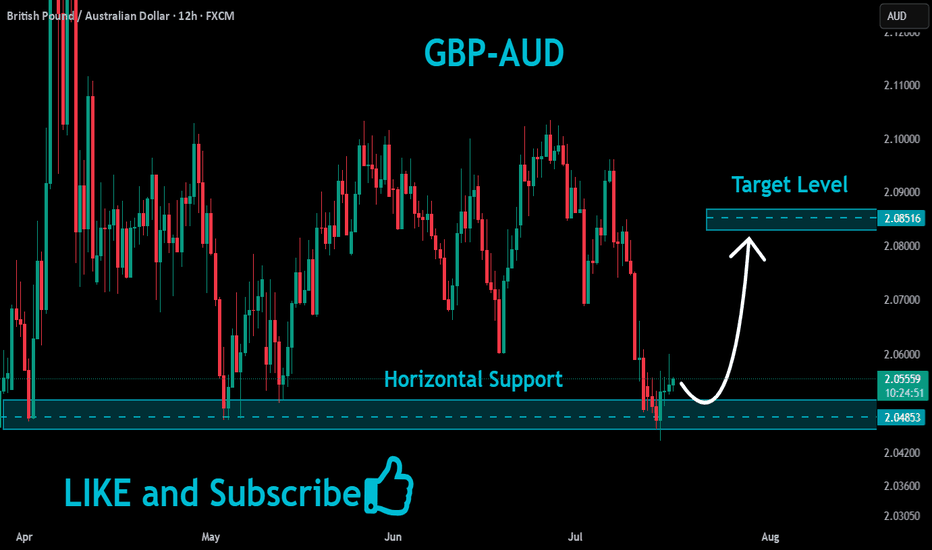

GBPAUD Wave Analysis: Is a Rally to 2.13677 on the Horizon?Hey Realistic Traders!

Can $OANDA: GBPAUD Keep the Bull Run Alive? Let’s Break It Down...

Trend Analysis

On the H4 timeframe, GBPAUD has broken out of a double bottom pattern, signaling a shift from a short-term bearish trend to a bullish one. Bullish momentum is further confirmed by price action trading above the EMA-200 line. On the higher timeframe, a falling wedge breakout pattern supports the bullish continuation scenario, aligning with the broader wave structure.

Wave Analysis

Applying Elliott Wave theory, the recent price action suggests the completion of Wave 2 around the 0.786 Fibonacci retracement level, aligning with the neckline breakout of the double bottom pattern. The potential formation of Wave 3, typically the strongest and most impulsive wave, targets 2.10265 as the first extension level with a further extension to 2.13677, calculated using Fibonacci extensions of the current bullish wave.

The outlook remains valid as long as the price stays above the key stop-loss level at 2.04774, invalidating the Wave 3 setup if breached.

Support the channel by engaging with the content, using the rocket button, and sharing your opinions in the comments below.

Disclaimer: "Please note that this analysis is solely for educational purposes and should not be considered a recommendation to take a long or short position on GBPAUD.

#GBPAUD: Will price reverse to bullish, or continue dropping? GBPAUD fell further below our expectations in our previous analysis, but the price remains extremely bearish. GBP failed to hold on to its bullish momentum, leading the pair to drop 300 pips from our previous entry zone. Currently, price is trading at a key buying level, where we can expect a strong bullish volume to kick in the market and help us gain a nice clean bullish move. There are two areas for both entries. At the moment, you can use a small time frame to take any swing buy entry. Please ensure you manage your risk accurately before getting into the market.

Good luck and trade safely!

Thank you for your unwavering support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

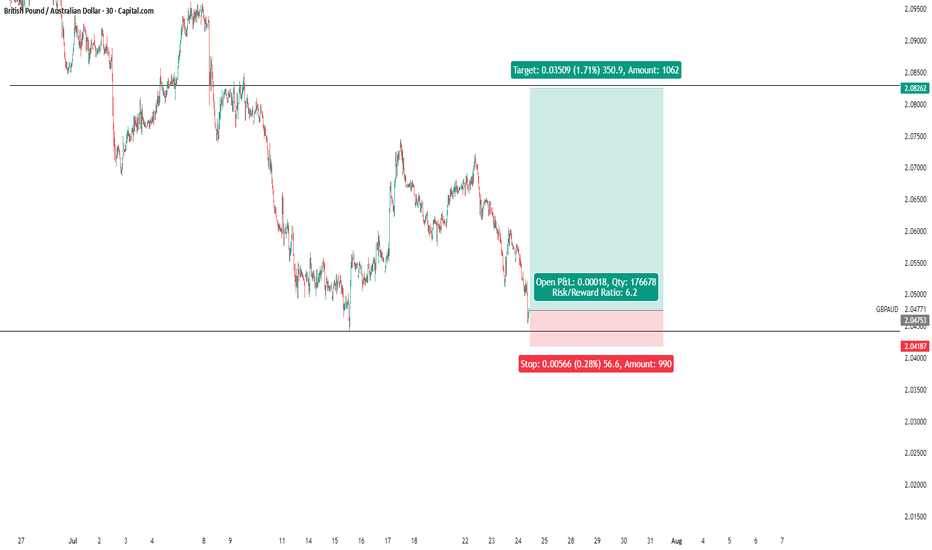

GBP/AUD Forex Heist - Bearish Breakout Blitz!🔥 Thief Trading Style: GBP/AUD Bearish Heist Plan 🔥

Hello, Profit Pirates & Market Marauders! 🤑

Get ready to raid the GBP/AUD (Pound vs. Aussie) forex market with a slick bearish strategy! 📊 Our Thief Trading Style fuses technical precision and fundamental insights to target a sharp downside move. Follow this charted plan to hit the high-risk Blue MA Zone and slip away with profits. Let’s make this heist count! 💪🎯

---

📊 Heist Blueprint: Trade Setup

- Market: GBP/AUD (Forex) 🌐

- Bias: Bearish Breakout 🌟

- Timeframe: 4H (Scalping/Day Trade) ⏰

Entry 📉:

- Breakout Move: Wait for a confirmed break below the Neutral Level at 2.05300. Place Sell Stop orders just below 2.05300 to ride the bearish wave. 🚀

- Pullback Play: For safer entries, set Sell Limit orders at the nearest 15M/30M swing high (e.g., 2.05600-2.05800) after a support break for pullback trades. 📍

- Trader Tip: Set a TradingView alert for the 2.05300 breakout to catch the action live! 🔔

Stop Loss 🛑:

- Breakout Traders: After the break confirms, place your Stop Loss above the recent 4H swing high at 2.08000 to shield against reversals. ⚠️

- Pullback Traders: Adjust Stop Loss based on your risk (e.g., 1-2% of account). Factor in lot size and multiple orders for precision. 📏

- Risk Alert: This is a high-octane heist! Keep position sizes tight to protect your capital. 🔥

Target 🎯:

- Aim for 2.03200, near the risky Blue MA Zone (an oversold area with potential consolidation or reversal). 🏴☠️

- Exit Strategy: Take profits early if bullish signals (e.g., pin bars, high volume) appear near 2.03200. 💸

Scalpers 👀:

- Focus on short-side scalps with tight trailing stops. Pair with day traders for the full heist or snag quick pips if your account supports it. 💰

---

📡 Why This Heist Could Pay Off

GBP/AUD is showing bearish momentum, fueled by:

- Technicals: A break below 2.05300, backed by lower highs on the 4H chart, signals strong downside potential. 📊

- Fundamentals: Weak UK economic data and Aussie strength (check COT reports) support a bearish outlook. 📰

- Seasonal Trends: GBP/AUD often softens in Q2 due to macroeconomic shifts. 📅

- Intermarket Factors: AUD’s correlation with commodity prices could pressure GBP lower. 🌎

---

⚠️ Risk Management: Guard Your Loot

- News Caution: Avoid new trades during high-impact events (e.g., UK CPI, RBA minutes) to sidestep volatility spikes. 🗞️

- Trailing Stops: Use trailing Stop Loss to secure profits as price approaches 2.03200. 🔒

- Position Sizing: Cap risk at 1-2% of your account per trade to stay in the game. 🚨

---

💥 Fuel the Heist! 💥

Join our Thief Trading Style crew by liking, commenting, and following for more electrifying trade plans! 🚀 Your support powers our market raids, helping us score profits with flair. Let’s dominate GBP/AUD together! 🤝🏆🎉

Hashtags: #GBPAUD #Forex #Bearish #DayTrading #Scalping #Breakout

Stay Alert: Another heist is brewing. Keep your charts primed, traders! 🐱👤😎

GBPAUD – Resistance Holding, Downside FavoredGBPAUD is rejecting the 2.0969 resistance zone, a key level where price has previously reversed. The current rejection candle at this zone suggests that bulls are struggling to sustain momentum.

The pair has been forming lower highs since April, and the recent rally into resistance looks corrective. If the pair breaks below 2.0750, expect a drop toward:

2.0481 – key demand zone and last swing low

2.0324 – final bearish target (range low)

🔻 Short bias valid below 2.0969

🔺 Invalidation if price closes above 2.10

Fundamental Overview:

🔻 GBP Pressures:

Despite hot inflation data, the Bank of England remains cautious, with no strong push for more hikes.

UK economic outlook is mixed; services holding up but manufacturing and consumer spending showing cracks.

Political uncertainty and EU trade rhetoric remain overhangs.

🟢 AUD Supportive Factors:

The RBA remains data-dependent but firm on not rushing into cuts.

Iron ore and commodity demand remain stable, supporting AUD.

Risk appetite and global recovery outlook help AUD hold strength.

Summary:

Bias: Bearish below 2.0969

Trigger: Rejection from resistance confirmed

Targets: 2.0481 → 2.0324

Fundamentals: Favor AUD with stronger commodity backdrop and less uncertainty than UK

gbpaud buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBP/AUD Heist: Bullish Breakout Plan to Steal Profits!🌟 Pound vs. Aussie Heist: GBP/AUD Trading Plan 🚀💸

Hey Money Makers & Thieves! 🤑💰 Ready to pull off a master heist on the GBP/AUD Forex market? Based on 🔥 Thief Trading Style 🔥 blending technicals and fundamentals, here’s the plan to conquer the "Pound vs. Aussie" with a long entry strategy targeting the high-risk Red Zone. Let’s dive in! 📈🎯

Entry 📈:

The heist is live! Wait for the MA breakout at 2.10000 to strike—bullish profits are calling! 🔔

Set buy stop orders above the Moving Average for breakout entries.

Or, place buy limit orders on a 15 or 30-minute timeframe at the most recent swing low/high for pullback entries.

📌Pro tip: Set an alert on your chart to catch the breakout moment! 🚨

Stop Loss 🛑:

Protect your loot with a Thief SL at the recent swing low/high on the 4H timeframe (2.07400).

Adjust SL based on your risk, lot size, and number of orders. Stay sharp! 🔍

Target 🎯:

Aim for 2.14400 or exit early to secure profits before the target. Don’t get greedy! 💪

Scalpers, Listen Up 👀:

Stick to the long side for quick scalps.

Big players can jump in now; smaller traders, join the swing trade robbery with a trailing SL to lock in gains. 💰

Market Outlook 💵:

GBP/AUD is riding a bullish wave, fueled by fundamentals, macro trends, COT reports, quantitative analysis, sentiment, and intermarket dynamics. Stay updated as these can shift fast! 🌎📊

⚠️ Trading Alert: News & Position Management 📰:

Avoid new trades during news releases to dodge volatility traps.

Use trailing stop-loss orders to protect running positions and secure profits. 🚫

Latest Market Data (UTC+1, May 20, 2025, 12:02 PM BST):

Forex (GBP/AUD): Current price ~2.09850 (source: financialjuice.com).

COT Report (Latest Friday, May 16, 2025):

Non-commercial long positions increased, signaling bullish sentiment among large speculators.

Net long positions rose by 5,200 contracts (source: CFTC.gov).

Commodities & Metals: Gold and oil prices stable, supporting AUD strength but GBP bolstered by UK economic data.

Indices & Crypto: No direct impact, but risk-on sentiment in global indices supports bullish GBP/AUD bias.

💖 Boost the Heist! 💥:

Hit the Boost Button to power up our robbery team! 🤝 With the Thief Trading Style, we’re stealing profits daily. Stay tuned for the next heist plan! 🐱👤🚀

Happy trading, and let’s make that money! 💸🎉

Disclaimer: Trading involves risk. Always manage your risk and stay informed.

gbpaud buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade