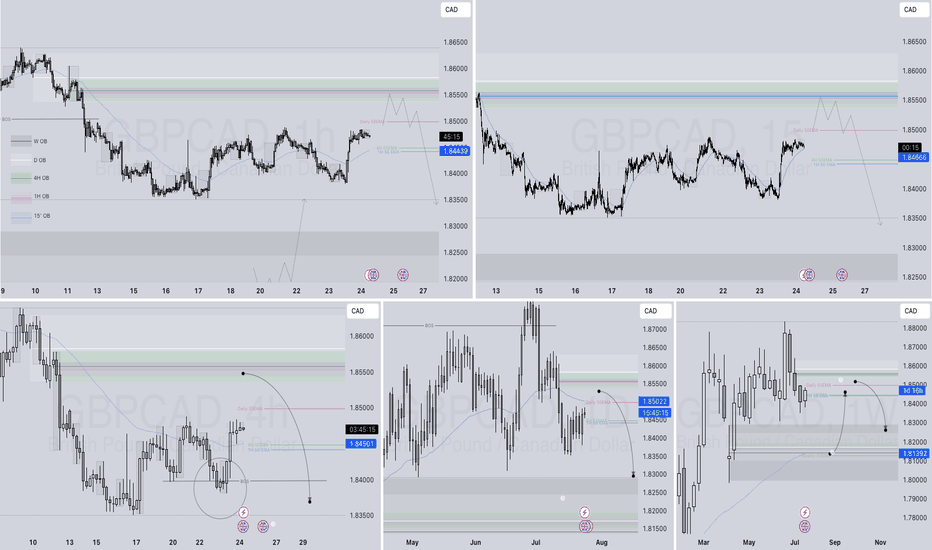

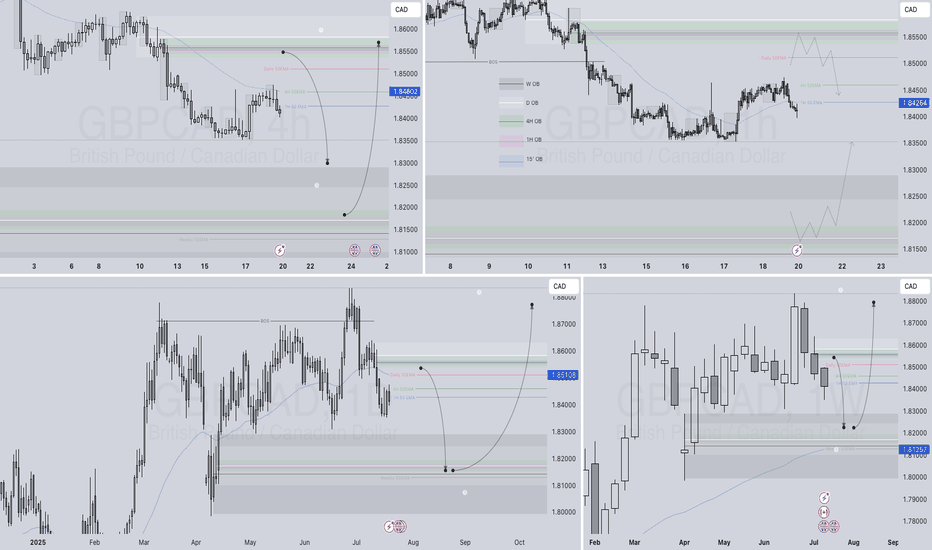

GBPCAD Q3 | D24 | W30 | Y25📊GBPCAD Q3 | D24 | W30 | Y25

Daily Forecast🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

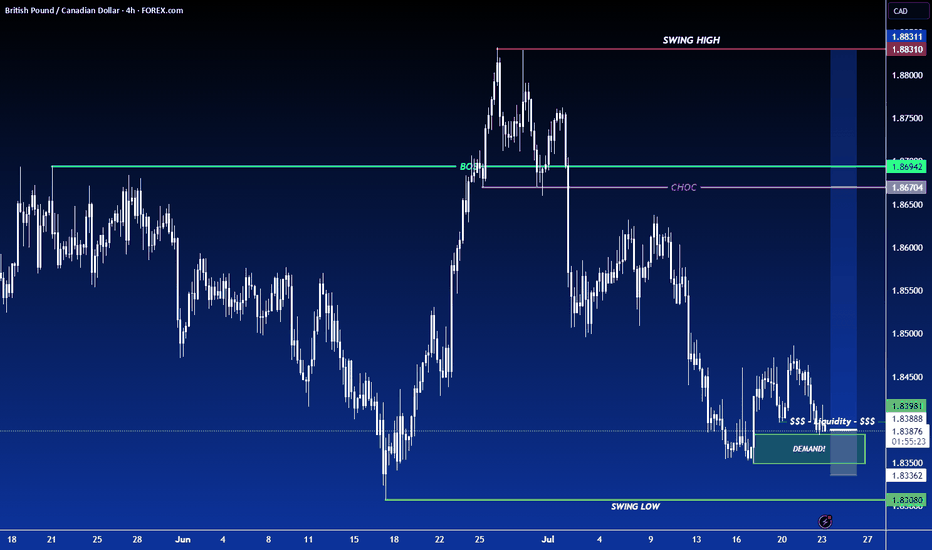

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT

GBPCAD

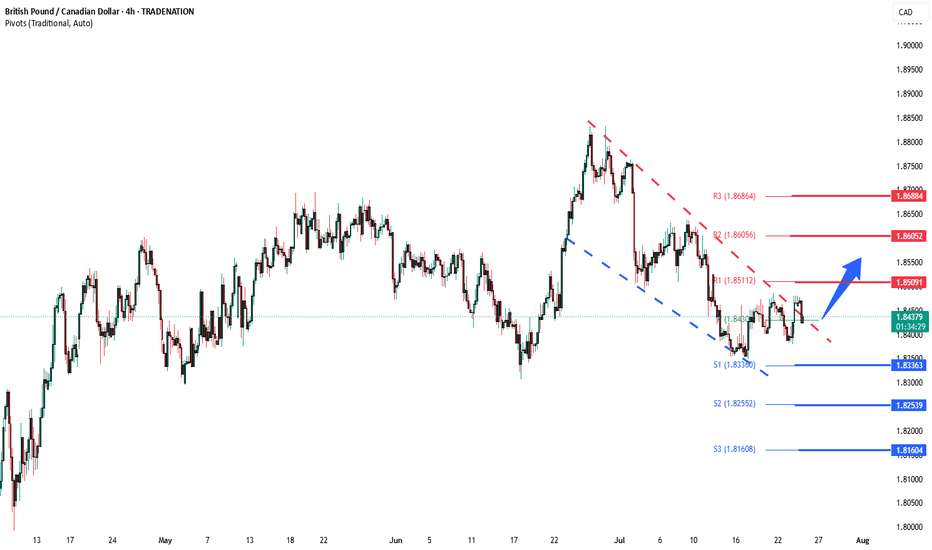

GBPCAD Bullish breakout supported at 1.8336The GBPCAD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 1.8336 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 1.8336 would confirm ongoing upside momentum, with potential targets at:

1.8510 – initial resistance

1.8600 – psychological and structural level

1.8690 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 1.8336 would weaken the bullish outlook and suggest deeper downside risk toward:

1.8254 – minor support

1.8160 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the GBPCAD holds above 1.8336. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

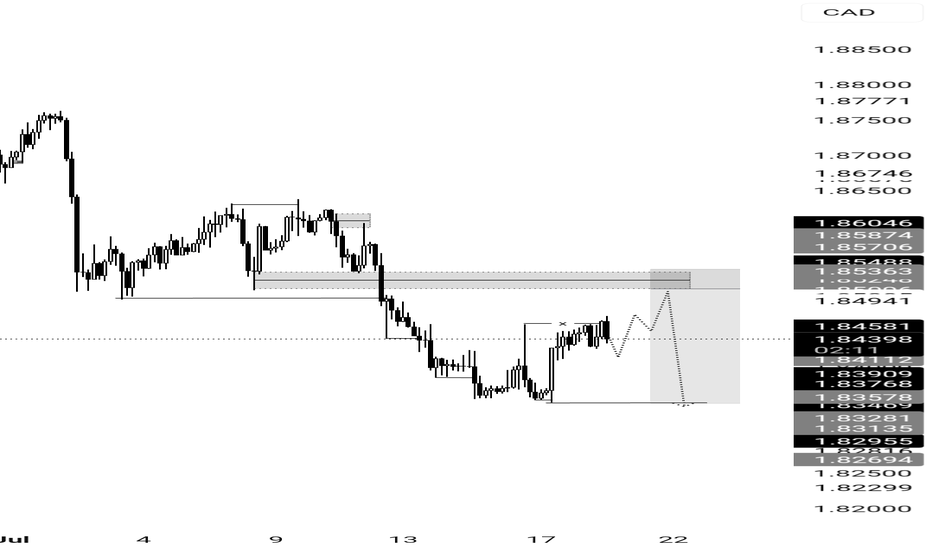

GBPCADDate:

July 23,2025

Session:

Tokyo and London session

Pair:

GBPCAD

Bias:

Long

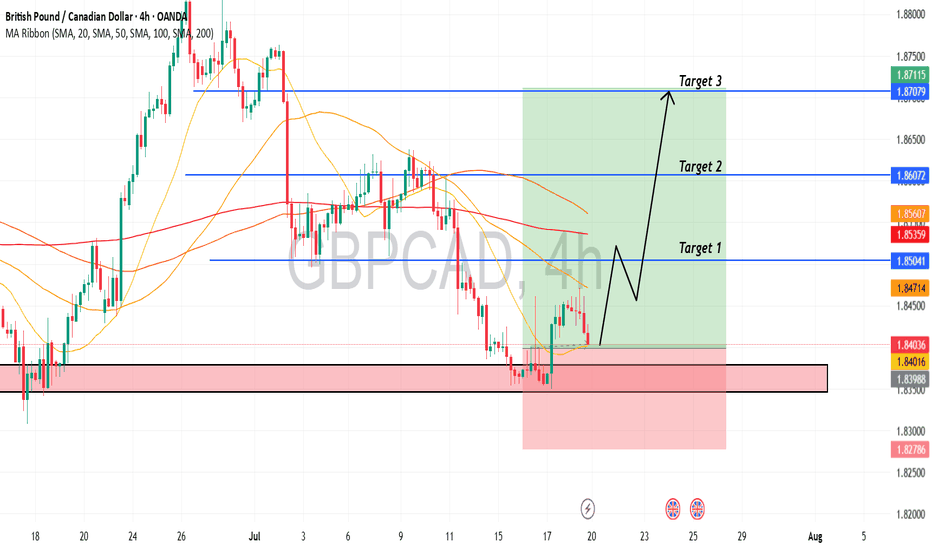

2 liquidity pools that are waiting to be swept this week. Looks like price is gonna be magnetized towards these levels during London and Tokyo. The trade may even stretch into NYC.

Entry: 1.83970

Stop Loss: 1.83674

Target: 1.84811

RR: 2.82

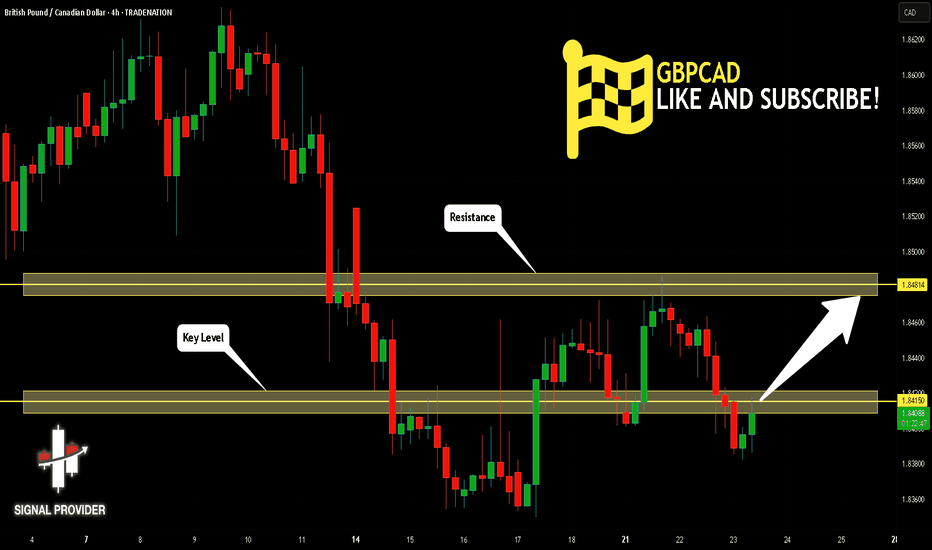

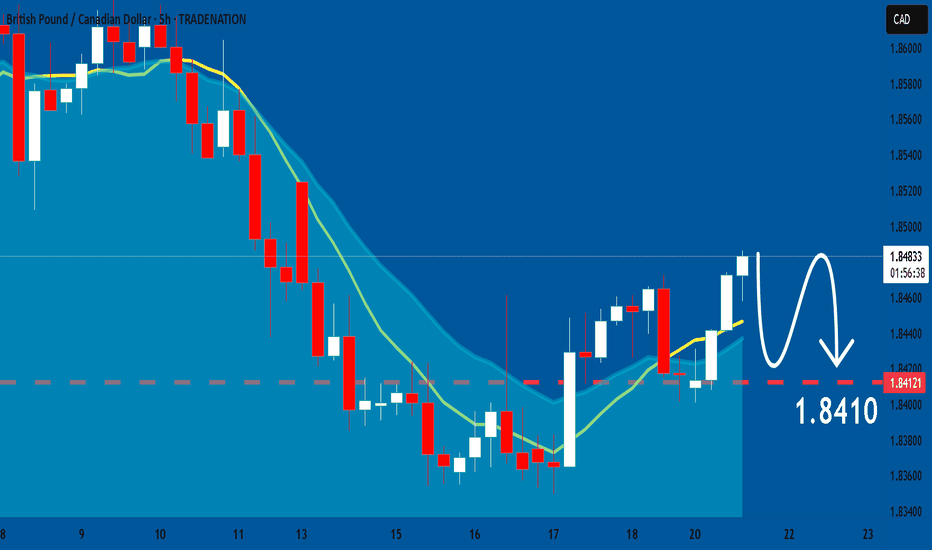

GBPCAD Is Very Bullish! Buy!

Please, check our technical outlook for GBPCAD.

Time Frame: 4h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 1.841.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 1.848 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

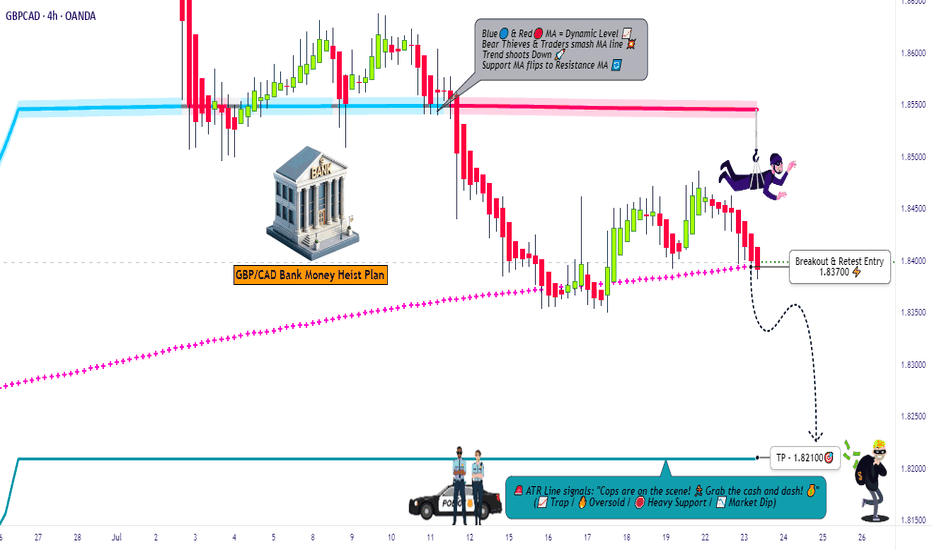

GBP/CAD Downtrend Setup – Clean Heist Entry Strategy🔥💷💣 THE GBP/CAD FOREX HEIST PLAN 💣💷🔥

Thief Trader Style – "Rob the Market, Not Each Other"

🧠 Smart Strategy | 🔍 Deep Analysis | 🎯 High Probability Plays | ⚔️ Risk-Controlled Attack

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba!

Dear Money Makers & Market Robbers, 🤑💰✈️

Welcome to another legendary forex robbery mission – this time, we’re planning the ultimate Pound vs. Loonie Heist (GBP/CAD). Powered by Thief Trading’s precision analysis (both technical & fundamental), this setup is designed for disciplined, stealthy traders who know how to attack at the right moment. Let’s take what’s ours from the market – the Thief way.

🔫 THE SETUP: GBP/CAD MARKET RAID

We’re eyeing a Short Entry near 1.83700 after the Moving Average Breakout Confirmation.

This ain’t just any pullback – this is a trap zone, a Police Barricade ATR Blue Zone, where liquidity fakes out the greedy bulls and invites a high-probability short for those with a thief’s vision.

Chart structure screams: overbought, slowing momentum, divergence + confluence = Bear Attack.

📍 Entry Plan:

💥 “The Heist is ON! Wait for the MA break… Then make your move at 1.83700!”

☑️ Sell Stop Orders – Just above the Moving Average or after key Support Break

☑️ Sell Limit Orders – For pullbacks at 15m or 30m TF near SWING H/L

☑️ Layered Entries / DCA Style – Multiple small entries for maximum control

☑️ Set Alerts! – Chart alarms keep your eyes sharp, your entries sharper.

🚨 Stop Loss Protocol (SL):

🛑 “No SL before breakout. You place early – you get burned.”

🗡️ After Breakout ONLY: SL near 1.84500, 4H Swing High

🛡️ Adapt based on your risk %, lot size, and number of open orders

🤫 Pro Tip: Smart SLs protect you, not limit you. Be like a ghost in the market.

🎯 Target Zone (TP):

📉 Initial Target: 1.82100

💨 “Get in, grab the bag, get out.”

You’re a thief – no greed, just precision. Exit before the alarms ring if the market flips!

🔎 Macro Factors Fueling the Bear Trend:

📉 Hawkish BOC tones down, GDP data contraction vibes

📈 GBP sentiment mixed; technical overbought signals dominate

🎭 Consolidation breakdown = High-Reward Entry Window

📰 News Awareness = Smart Survival:

⚠️ Avoid New Trades During Major News

📍 Use Trailing SLs to Protect Open Profits

🧨 Don’t get caught in the volatility trap – let the chaos work for you, not against you.

💥 BOOST THIS HEIST PLAN – ROBBERS UNITE 💥

Smash the “Boost” Button to power up our Thief Gang's momentum. Your support sharpens the edge for all fellow robbers in this daily market hustle.

🧠 Precision Plan

🧭 Risk-Aligned Entry

📈 Profitable Exit

That’s how Thief Traders operate.

🤑 Stay ready for the next drop. Another Forex bank is about to get robbed clean.

💣💰Let’s rob the charts – not each other.

— Thief Trader, Robbin’ with Logic & Style

🏴☠️📉📲

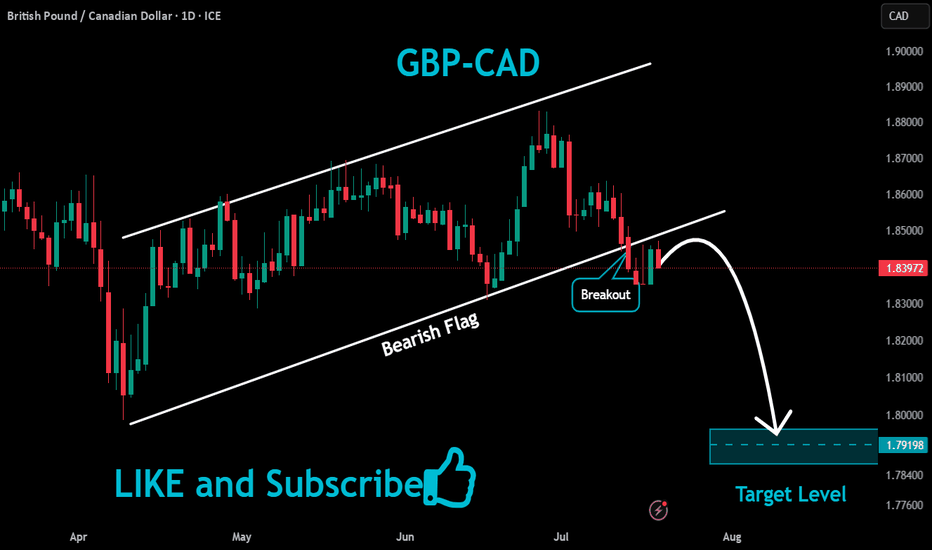

GBPCAD: Will Start Falling! Here is Why:

Remember that we can not, and should not impose our will on the market but rather listen to its whims and make profit by following it. And thus shall be done today on the GBPCAD pair which is likely to be pushed down by the bears so we will sell!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

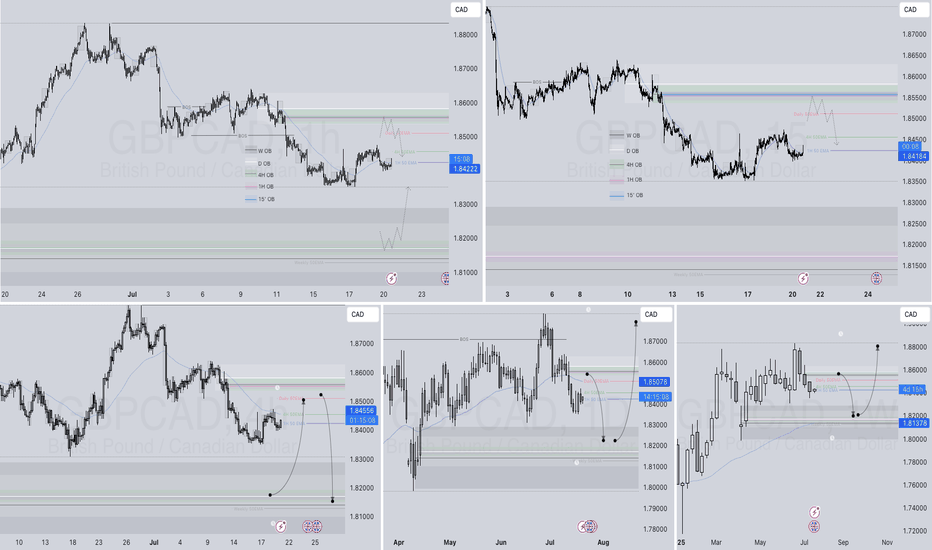

GBPCAD Q3 | D21 | W30 | Y25📊GBPCAD Q3 | D21 | W30 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT 📊

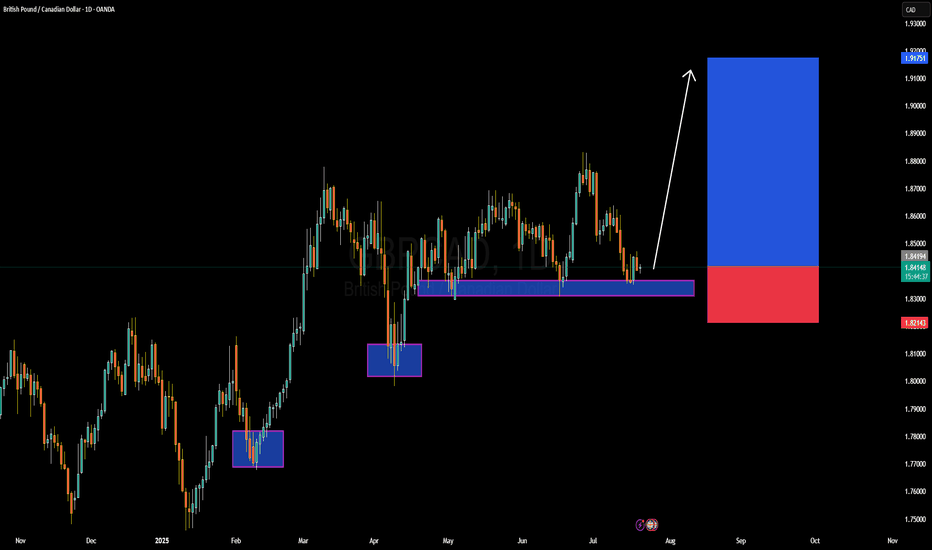

GBPCAD Forming Strong Bullish ReactionGBPCAD has once again tapped into a key daily demand zone that's held strong multiple times this year, forming a reliable support base around the 1.8200–1.8300 level. Price action has consistently respected this area, creating a clear bullish structure of higher lows following each test. The recent bounce indicates buyer interest is still strong, and I’ve entered long positions here with a high conviction that the bullish leg is about to resume. The risk-to-reward ratio on this setup is highly favorable, with upside potential targeting the 1.9150–1.9200 region.

From a macro perspective, the British pound remains supported by the Bank of England’s hawkish stance. Inflationary pressure in the UK remains sticky, keeping the door open for further rate hikes or at least prolonged tight monetary policy. On the flip side, the Canadian dollar is under slight pressure due to falling crude oil prices and the Bank of Canada's relatively more dovish outlook in recent statements, despite recent CPI upticks. This divergence in policy bias adds tailwind to the GBPCAD bullish bias.

Technically, this pair is respecting market structure with precision. Each bounce from the marked support zones has led to meaningful rallies, and current price behavior is following the same playbook. The consolidation over the past few sessions suggests accumulation, with a bullish breakout likely to follow. The marked blue target zone aligns with a clean price inefficiency and liquidity pool on the left side of the chart.

With momentum building and fundamental drivers favoring GBP strength, I expect a continuation move toward 1.9150 in the coming weeks. Patience and position management are key here, but the setup remains valid and in profit. Traders watching this zone should be alert for bullish confirmations and volume spikes to ride the next impulsive wave.

The GBPCAD is Unstoppable due to Strong Up TrendHello Traders

In This Chart GBPCAD HOURLY Forex Forecast By FOREX PLANET

today GBPCAD analysis 👆

🟢This Chart includes_ (GBPCAD market update)

🟢What is The Next Opportunity on GBPCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart

GBPCAD – WEEKLY FORECAST Q3 | W30 | Y25📊 GBPCAD – WEEKLY FORECAST

Q3 | W30 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT FOREX ANALYSIS 📊

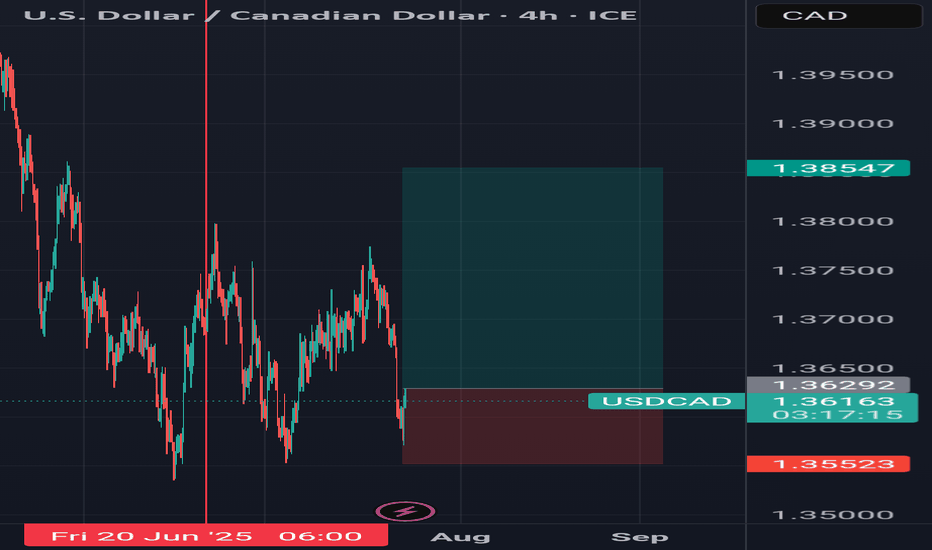

GBPCAD SELL IDEAFundamental:to cut rates thrice this year, in August, November and December. Money markets are pricing in a total of 48.6 basis points of BoE rate cuts by the year-end, with a 77.3% probability of a 25 basis point move in August.

Technical:A classical Breakerblock entry type to continue move lower

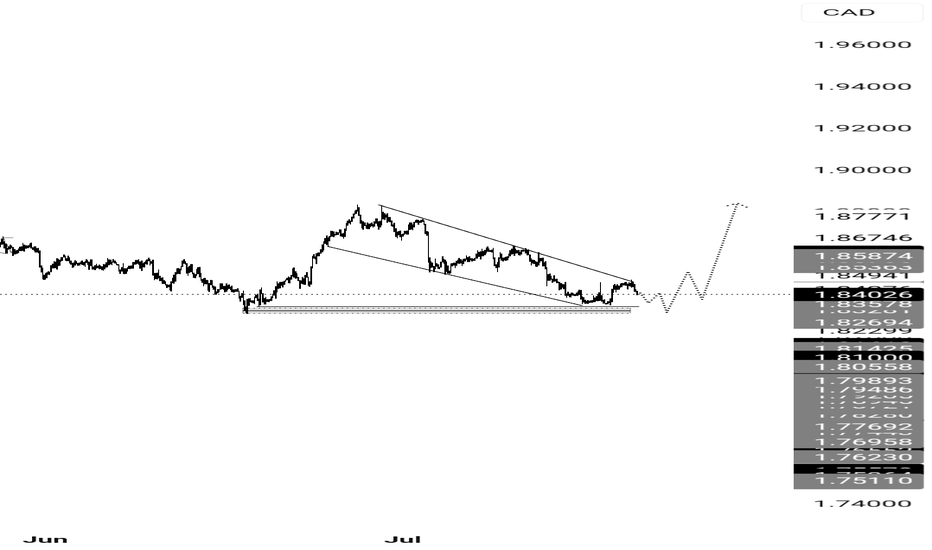

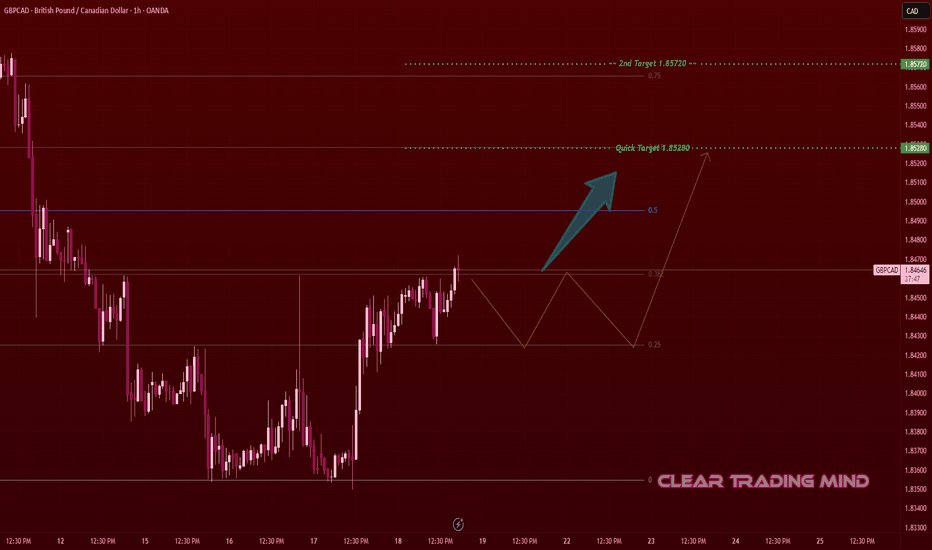

GBPCAD Showing Strength – Breakout Setup with Measured TargetsThis is my personal setup for GBPCAD on the 1-hour chart. After a strong downtrend, the price has started to form a bullish reversal pattern from the 1.83600 zone. I’m watching the current bullish structure which is showing good strength and higher lows.

🔹 Entry Idea:

I’m planning to enter above 1.84700, once price confirms a breakout and retest. This level also aligns with the 0.382 Fibonacci level.

🔹 Targets & PIPs:

🎯 First Target: 1.85280 (≈ 58 pips from entry)

🎯 Second Target: 1.85720 (≈ 102 pips from entry)

🔹 Reasoning:

- Price bounced from the 1.83600 support zone

- Forming bullish structure (higher highs & higher lows)

- Nearing Fibonacci midpoint resistance

- Increasing volume indicates potential buyers stepping in

This is my personal trade idea – not financial advice. Let’s see if price follows the plan!

GBPCAD – Key Level, Buy Setup & Dual StrategyRight now, price is sitting on a major level.

📌 If a valid buy signal shows up, I’ll enter a long position.

But that’s not all…

🔁 If price reaches the next resistance level, I’ll:

Hold my long position

Open a short position there

This way: ✅ If price reverses → my long trade is closed by trailing stop

✅ And my short trade runs into profit

→ I profit both from below and above

⚠️ If my short trade’s SL hits, no worries —

My long is still open and growing in profit.

📈 But if the resistance breaks and we get a pullback,

➡️ I’ll activate pyramiding and build more position with zero added risk.

GBPCAD LONG & SHORT – DAILY FORECAST Q3 | D17/18 | W29 | Y25GBPCAD LONG & SHORT – DAILY FORECAST

Q3 | D17/18 | W29 | Y25

FUN COUPON FRIDAY INCOMING !

Professional Risk Managers 👋

Welcome back to another FRGNT chart update 📈

Today we’re diving into some fresh Forex setups, using a combination of higher time frame order blocks and confirmation through breaks of structure.

Let’s see what price action is telling us today 👀

💡 Key Trade Confluences 📝

✅ Daily order block identified

✅ 4H order block identified

✅ 1H order block identified

🔑 As always, trading involves a degree of risk. That’s why, as Professional Risk Managers, it’s essential that we stay disciplined—sticking to both our risk management plan and our trading strategy.

📈 The rest is left to the balance of probabilities.

💬 Fail to plan, plan to fail.

🏆 It really is that simple.

❤️ Wishing you the very best on your trading journey—I’ll see you at the top.

🎯 Trade consistent,

FRGNT X

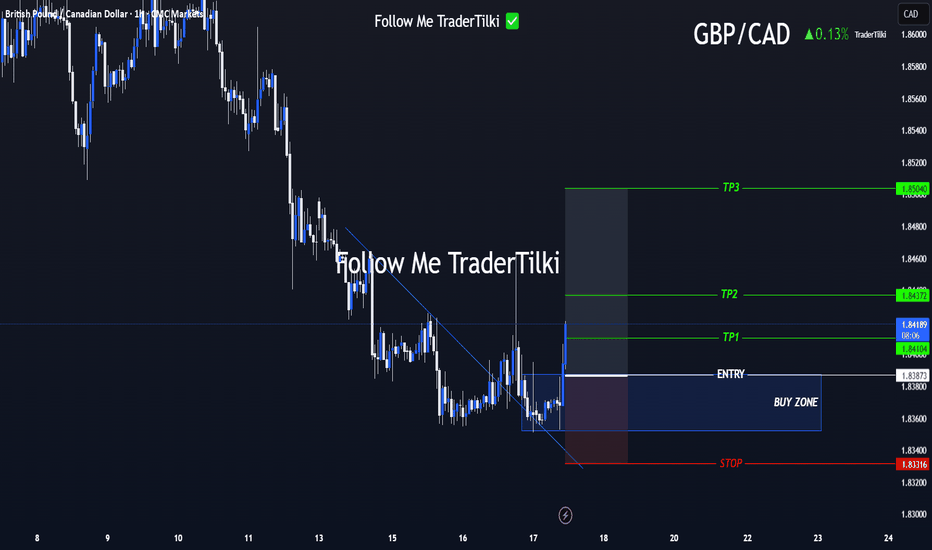

GBP/CAD Clarity in Motion! Levels Are Locked In Hey everyone 👋

📌 BUY LIMIT ORDER / GBP/CAD Key Levels

🟢 Entry: 1,83873

🎯 Target 1: 1,84104

🎯 Target 2: 1,84372

🎯 Target 3: 1,85040

🔴 Stop: 1,83316

📈 Risk/Reward Ratio: 2.18

I double-checked the levels and put together a clean, focused analysis just for you. Every single like seriously boosts my motivation to keep sharing 📈 Your support means the world to me!

Huge thanks to everyone who likes and backs this work 💙 Our goals are crystal clear, our strategy is solid. Let’s keep moving forward with confidence and smart execution!

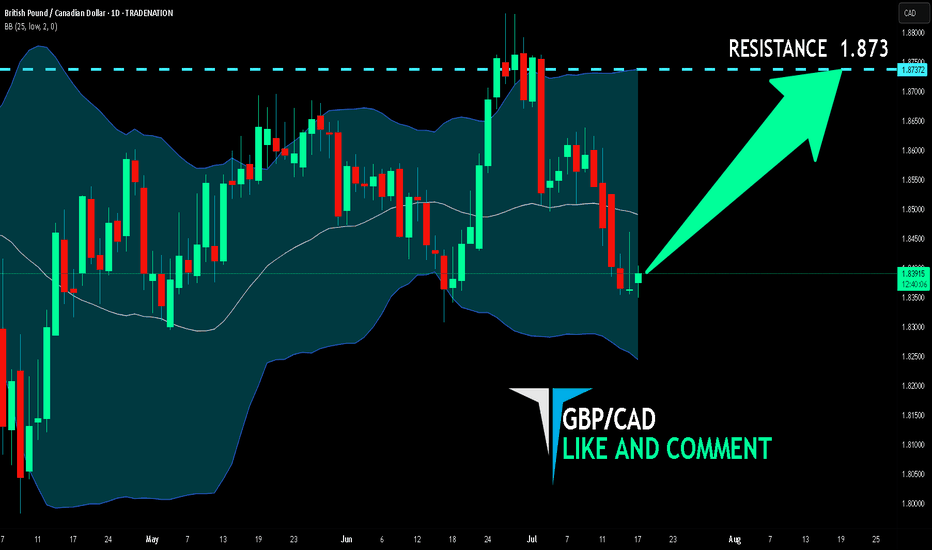

GBP/CAD BULLS ARE GAINING STRENGTH|LONG

Hello, Friends!

We are now examining the GBP/CAD pair and we can see that the pair is going down locally while also being in a downtrend on the 1W TF. But there is also a powerful signal from the BB lower band being nearby indicating that the pair is oversold so we can go long from the support line below and a target at 1.873 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/CAD BEARS ARE GAINING STRENGTH|SHORT

GBP/CAD SIGNAL

Trade Direction: short

Entry Level: 1.858

Target Level: 1.849

Stop Loss: 1.863

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 3h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPCAD SHORT FORECAST Q3 D15 W29 Y25GBPCAD SHORT FORECAST Q3 D15 W29 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPCAD Bulls Preparing – Watching Break Above VWAP🔹 Current View:

The pair has formed a Double Bottom pattern around 1.8500 after a strong bearish drop from a Double Top near the 4H Supply Zone. This indicates a potential reversal.

🔹 VWAP Insight:

The blue line is VWAP, acting as dynamic resistance. Price is currently testing this area. A clean break above it could confirm bullish momentum.

🔹 My Trading Plan:

I’m waiting for the price to move above the VWAP and reach my key level at 1.86400 to enter a long trade.

➡️ Entry: 1.86400

➡️ Target: 1.87200 (near previous supply zone high)

🔹 Technical Summary:

- Bearish Pressure Origin: Double Top + 4H Order Block

- Bullish Signal: Double Bottom formation

- VWAP Breakout Watch: Key for confirming strength

If the price clears VWAP and hits the entry, I’ll look for a move toward the 1.87200 resistance zone.