GBPCAD | One Kiss at 1.8390, and I’m All In!The big picture of GBPCAD is BUY possible up to 1.8550

See the H4 BUY range?

It slid love note to BUY into my DMs since 17/JulY. I didn't fall blindly since H4 SELL range came in like a jealous ex.

So I flipped to SELL and I shared my love signal with you here. (check my last week GBPCAD signal).

See that bottom black line at 1.8370?

It got a gentle kiss from the Daily candle (REJECTION).

Then 15m already whispered, "a sweet breakout"!

📌LONG STORY SHORT, I'M BUY AT 1.8390

If H4 comes and kisses 1.8390 (just a touch and wick), I’m BUYING — no more playing hard to get. 😘

TP? 1.8490 — that’s a sweet 100-pips date night!

But if it cuddles (closes by body) That’s it — my heart will be broken. 💔

WISH ME LUCK...or TISSUES! 😂!!!

Gbpcadforecast

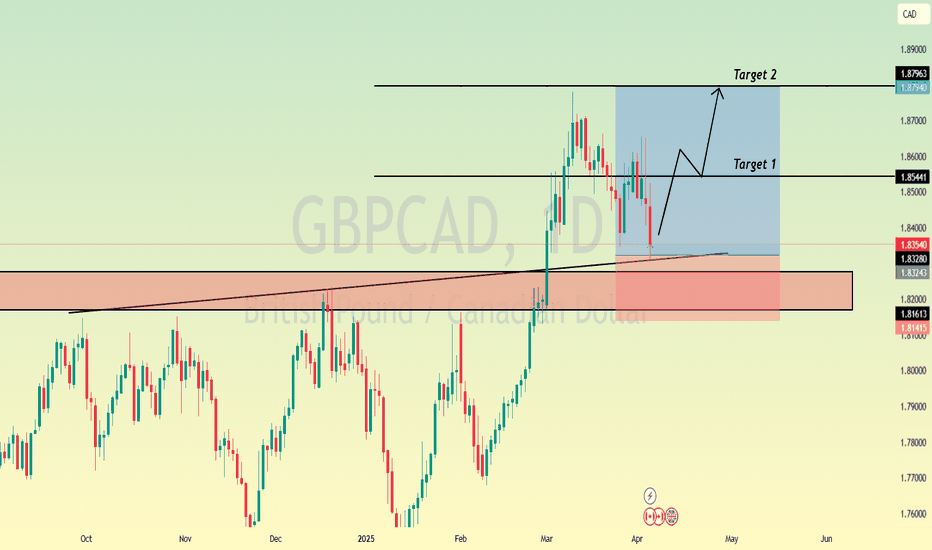

GBPCAD – Key Level, Buy Setup & Dual StrategyRight now, price is sitting on a major level.

📌 If a valid buy signal shows up, I’ll enter a long position.

But that’s not all…

🔁 If price reaches the next resistance level, I’ll:

Hold my long position

Open a short position there

This way: ✅ If price reverses → my long trade is closed by trailing stop

✅ And my short trade runs into profit

→ I profit both from below and above

⚠️ If my short trade’s SL hits, no worries —

My long is still open and growing in profit.

📈 But if the resistance breaks and we get a pullback,

➡️ I’ll activate pyramiding and build more position with zero added risk.

GBP/CAD: Smart Money Heist Strategy – Ready for the Breakout?💼💣 GBP/CAD Forex Bank Heist Plan 🚨 | "Thief Trading Style" 💹💰

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Welcome to all strategic traders, market tacticians & opportunity seekers! 🧠💸

Here’s our latest Forex blueprint based on the exclusive “Thief Trading Style” – a blend of tactical technicals, smart fundamentals, and stealthy price action moves. We’re preparing for a potential breakout heist on the GBP/CAD a.k.a “The Pound vs Loonie”.

🗺️ Heist Strategy Overview:

The market is forming a bullish setup with signs of consolidation, breakout potential, and trend reversal dynamics. We're eyeing a long entry, but timing is everything. This setup seeks to "enter the vault" just as resistance is breached and ride the move until the ATR High-Risk Zone—where many market players may exit.

🎯 Entry Plan:

📈 Primary Trigger Zone: Watch for a break and close above 1.87000.

🛎️ Set an alert! You’ll want to be ready when the opportunity knocks.

📍Entry Tips:

Place Buy Stop orders above the moving average or

Use Buy Limit entries on pullbacks near recent 15/30min swing lows.

(Perfect for both scalpers and swing traders!)

🛑 Stop Loss Placement:

Thief Trading Style uses a flexible SL system:

Recommended SL at the nearest 4H swing low (~1.85700)

Adjust SL based on your lot size, risk appetite & number of orders

🎤 Reminder: Set SL after breakout confirmation for buy-stop entries. No fixed rule—adapt to your style but manage risk wisely.

🎯 Target Zone:

🎯 Primary TP: 1.89000

🏃♂️ Or exit earlier if price enters a high-risk reversal area

🧲 Scalpers: Stick to long-side trades only and protect your profits with a trailing SL.

🔍 Why GBP/CAD? (Fundamental Notes):

Current momentum is bullish, supported by:

📊 Quant & Sentiment Analysis

📰 Macro Fundamentals & COT Data

📈 Intermarket Trends & Technical Scoring

Get the full data klick it 🔗

⚠️ Caution During News:

To avoid volatility spikes:

Refrain from entering new positions during high-impact news

Use trailing SLs to protect running profits

❤️ Show Support & Stay Tuned:

Smash the 🔥Boost Button🔥 if you love this kind of analysis!

Support the strategy, strengthen our community, and let’s continue this journey of smart, stylish trading.

Stay tuned for the next “heist plan” update—trade smart, stay alert, and manage your risk like a pro. 🏆📈🤝

The GBPCAD is Unstoppable due to Strong Up TrendHello Traders

In This Chart GBPCAD HOURLY Forex Forecast By FOREX PLANET

today GBPCAD analysis 👆

🟢This Chart includes_ (GBPCAD market update)

🟢What is The Next Opportunity on GBPCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart

GBPCAD - Looking To Sell Pullbacks In The Short TermH1 - Strong bearish move.

No opposite signs.

Expecting further continuation lower until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Looking at a bearish marketWe have a clear dealing range with the dealing range high at 1.88296 and dealing range low at 1.83054. This appear to be a bearish market because the daily liquidity has been raided and the structure has been broken to the downside to mitigate the fair value gap around the equilibrium price. We are ideally anticipating price to rebalance the imbalance and active the fair value gap at the extreme premium and provide us with a selling opportunity to the discounted area…

GBPCADThe first level I’ve marked is a short-term zone.

If we get a strong buy signal there with good R/R, I’ll enter and trail aggressively.

The second level is a stronger demand zone and a better area for potential long setups.

❗️Remember: These are just scenarios — not predictions.

We stay ready for whatever the market delivers.

GBP/CAD Turns Lower After Breaking 1.8709 SupportGBP/CAD broke below the 1.8709 support, and as of this writing, it is testing this level as resistance.

From a technical perspective, a new bearish wave could be on the horizon if the price holds below the previous day's high. In this scenario, the next bearish target could be the 1.8592 low.

GBP/CAD "Pound vs Loonie" Forex Bank Money (Day Trade Plan)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/CAD "Pound vs Loonie" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Blue MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the Neutral Level breakout then make your move at (1.83000) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (1.84500) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.81000 (or) Escape Before the Target

💰💵💸GBP/CAD "Pound vs Loonie" Forex Market Heist Plan (Scalping/Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"Pound vs Loonie Forex Heist: Snag GBP/CAD Profits with Thief"🌍 Hello, Global Money Heisters! Ciao, Hola, Salaam, Bonjour! 🌟

Dear Profit Pirates & Cash Chasers, 🤑💸✨

Here’s the slick plan to raid the GBP/CAD "Pound vs Loonie" Forex Vault with 🔥Thief Trading Style🔥, blending sharp technicals and juicy fundamentals. Follow the chart’s long entry strategy to hit the high-risk RED Zone. It’s a wild spot—overbought, consolidating, with bears lurking for a trap. Let’s nab those profits and treat ourselves! 🎉💰

---

GBP/CAD Real-Time Data (May 15, 2025, UTC+1) 📈

- Current Rate: ~1.8540 CAD per GBP, down -0.04% today but holding strong. 📊

- Retail Sentiment: ~65% bullish, eyeing a GBP climb. 😎

- Institutional Sentiment: ~55% bullish, cautiously optimistic. 💼

---

Heist Plan Highlights 🏴☠️

- Entry 📌: Wait for GBP/CAD to smash past 1.8650 (previous high) for a bullish breakout. Set Buy Stop above the Moving Average or Buy Limit at recent 15/30-min swing lows for pullbacks. Set an alert to catch the move! 🚨

- Stop Loss 🛑: Place SL at 1.8400 (4H swing low) for day trades. Adjust based on your risk, lot size, or multiple orders. If using Buy Stop, set SL post-breakout to avoid whipsaws. 🔥

- Target 🎯: Aim for 1.8950 or bail early if the RED Zone feels too hot. 🏃♂️

- Scalpers 👀: Stick to long scalps with trailing SL to lock in gains. Swing traders, join the heist with bigger moves! 💸

---

Why GBP/CAD is Hot 🔥

- Bullish Momentum: Technicals show GBP strength, backed by retail (65%) and institutional (55%) optimism. 📈

- Fundamentals: Check COT reports, macro news, and intermarket analysis for the full picture. Stay sharp with sentiment and future trends! 📰🌎

- News Alert 🚨: Avoid new trades during big news drops. Use trailing SL to protect running positions. 🛡️

---

Boost the Heist! 💪

Hit that Boost Button to supercharge our Thief Trading squad! 🚀 Let’s make stealing pips a breeze. Stay tuned for the next epic heist plan, Money Makers! 🤑🐱👤🎉

Happy Trading, and let’s loot the market together! 🤝❤️

GBPCAD: 700+ pips swing move in making; what you think? FX:GBPCAD

After looking at the daily timeframe, we have identified the price pattern with this particular pair, we pointed out the upcoming big move based on similar move that this pair has made. Currently price has been rebounding from the strong buying zone where we expect a large volume to kick in the market. First our main aim will be to see how price react at the downtrend trendline and if price successfully breakthrough the region. We can then enter more entries with this pairs targeting long term 700+ pips. Good luck and trade safe.

GBP/CAD "Pound vs Loonie" Forex Bank Money Heist (Bullish)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the NZD/JPY "Kiwi vs Yen" Forex Bank Heist. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Danger Resistance Zone. It's a Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the Crossing previous high (1.86800) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the nearest/swing low level Using the 5H timeframe (1.8400) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 1.90000

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸GBP/CAD "Pound vs Loonie" Forex Bank Money Heist is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets with overall score... go ahead to check 👉👉👉🔗🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰🗞️🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBP/CAD Bullish Setup:Targeting 1.86500 from Demand Zone SupportTrendline ➡️

Price is respecting an upward trendline 📈 connecting higher lows 🔵 (marked by dots).

Channel ➡️

Price is moving inside an ascending channel 🚀 (controlled bullish movement).

EMA (70) ➡️

The red curve ➰ is the 70 EMA. Price is near it — showing indecision but still respecting it ⚖️.

Demand Zone ➡️

A strong demand zone 🔵 is marked between 1.8400–1.8440 where buyers jump in 🛒 whenever price touches it.

Support Zone ➡️

A nearby support zone 🛡️ is around 1.8480–1.8500. It's acting like a stepping stone 🧗♂️ for price to climb.

Target ➡️

The target 🎯 is clearly marked at 1.86500 — aiming for a nice breakout! 🚀📈

Summary

🔵 Stay above the demand zone ➡️ good for buys!

🛡️ Watch the support ➡️ could be a retest and bounce!

❌ If price breaks below demand zone, the setup is invalid ⚠️.

Simple Trading Plan:

✅ Buy near 🔵 demand or 🛡️ support.

✅ Target 🎯 1.86500.

❌ Stop Loss below 🔵 1.8390 area.

The GBPCAD is Unstoppable due to Strong Up TrendGBPCAD H4 Analysis 📈

NZD AND AUD are linked with each other not directly but indirectly.

That's why if AUD weak then NZD is also weak and now as you can see these 4 pairs are going up without any retracement.

The pair is moving in a similar way like GBPAUD.

The red zone is a support zone a and last the the market was pumped from the same zone.

If The markets holds on the red zone or holds above the red zone , it will be a confirmation of buy .

If the markets breaks the red zone in the downside direction then but setup is no more valid.

The pair is looking to retest its higher resistance points according to the Weekly time frame.

#GBPCAD:Last Idea +400 Pips Up! Here is second entryIn our last analysis, the GBPCAD currency pair showed a smooth move. The price hit support levels, which means it might keep going up. We think it’ll go up by about 600 pips and might reach the 1.90 area.

Since there aren’t many places to stop for this trade, it’s important to set take profit levels based on your risk management plan.

We hope you’re doing well with your trading. If you find our ideas helpful, please let us know by liking, commenting, or sharing them.

Thanks for being a great supporter!

Team Setupsfx

GBPCAD trade ideaFX:GBPCAD

Potential short opportunity as price reaches Swap zone and closed with few rejection candles, signaling potential short-term reversal. Price previously respected the HTF Resistance zone, this is an extra confluence that it may continue its bearish order flow towards the downside. For scalping and intraday, we can target the H1 demand zone below and turn trade into breakeven if holding for longer time.

GBPCAD will Fly , All Confirmations are in the Bullish SideHello Traders

In This Chart GBPCAD HOURLY Forex Forecast By FOREX PLANET

today GBPCAD analysis 👆

🟢This Chart includes_ (GBPCAD market update)

🟢What is The Next Opportunity on GBPCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart

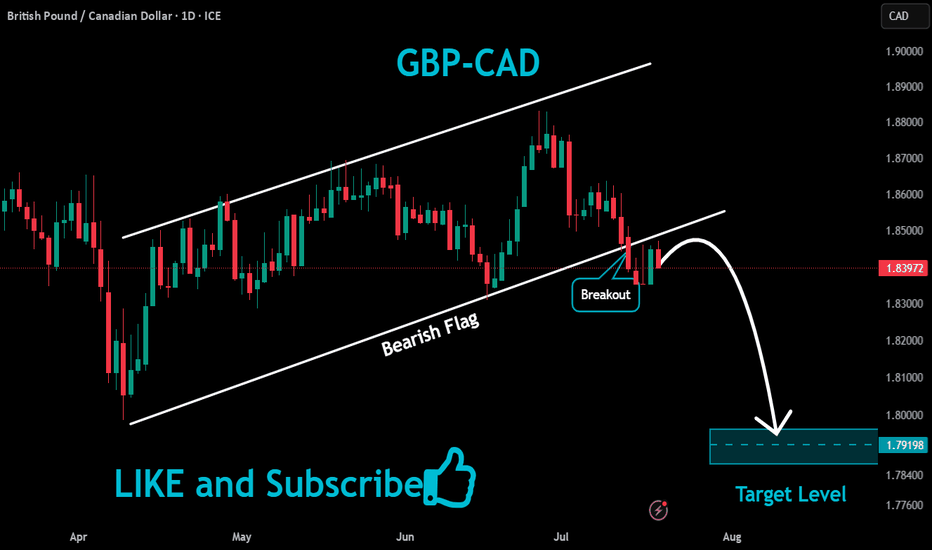

GBPCAD Tests Bearish Trendline – Focus Shifts to BoC DecisionGBPCAD is currently respecting a well-defined descending trendline, showing multiple rejections and a sustained series of lower highs. The latest retest near 1.8460 was met with selling pressure, aligning with the broader bearish channel.

Key Levels:

Current Price: 1.8458

Resistance Area: 1.8470 – 1.8600 (trendline & previous highs)

Support Targets:

TP1: 1.8120 (key structure)

TP2: 1.7980

TP3: 1.7900 (major support zone)

Bearish Technical Confluence:

✅ Multiple rejections at trendline

✅ Lower highs & lower lows continue

✅ Potential reversal candlestick pattern forming

✅ Bearish breakout could accelerate toward 1.7980

📉 Fundamental Outlook – BoC Rate Decision in Focus (April 16)

Market Sentiment Split:

Initially, economists leaned toward a BoC hold, as recent data and trade optimism gave the central bank room to pause.

However, March CPI undershot expectations, triggering increased speculation of a rate cut.

Key Data Highlights:

Headline CPI fell to 2.3% YoY vs 2.6% previously, well below the 2.7% forecast.

Drop mainly due to gasoline and transport costs, which BoC may look through.

Core inflation (median 2.9%, trimmed 2.8%) remains elevated, supporting arguments for a hold.

Analyst Viewpoint:

“We still marginally favor a BoC hold given the proximity to elections and resilience in core inflation, but our conviction is lower after the CPI miss.” – Knightley & Pesole, ING

Market Reaction:

Loonie sold off post-CPI, but analysts believe the sell-off may be short-lived if BoC surprises with a hawkish hold.

Swap market odds of a cut rose to 45%, up from 33% pre-CPI.

🎯 Combined Technical + Fundamental Setup

If BoC holds rates, expect CAD strength → GBPCAD could accelerate downward toward 1.8120 → 1.7900.

If BoC cuts, GBPCAD may spike temporarily toward 1.8600, but downside pressure may resume unless accompanied by dovish forward guidance.

🛠️ Trade Plan:

Sell Bias Below: 1.8470

Entry Trigger: Bearish confirmation or post-BoC rejection

TP1: 1.8120

TP2: 1.7980

TP3: 1.7900

Invalidation Zone: Break and close above 1.8600

GBPCAD will Fly , All Confirmations are in the Bullish SideHello Traders

In This Chart GBPCAD HOURLY Forex Forecast By FOREX PLANET

today GBPCAD analysis 👆

🟢This Chart includes_ (GBPCAD market update)

🟢What is The Next Opportunity on GBPCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart