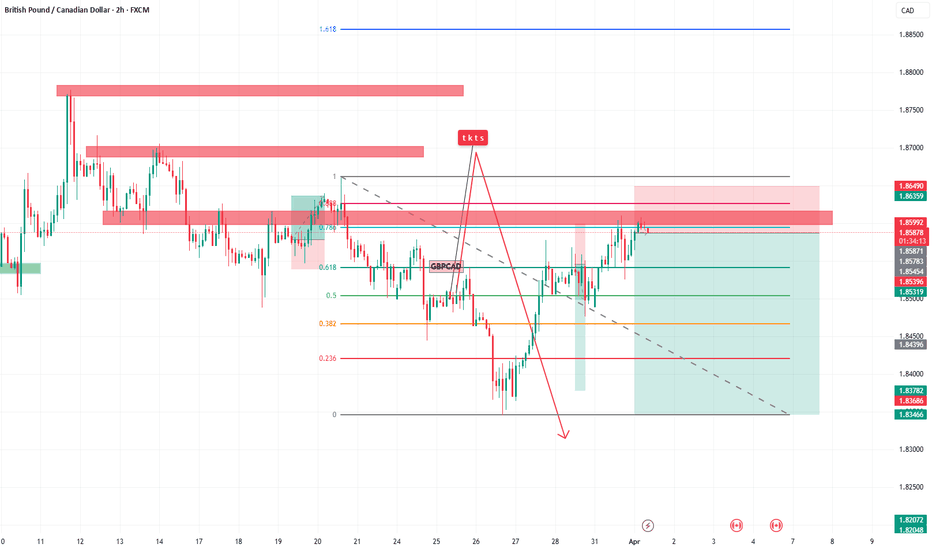

GBP/CAD 4H ANALYSIS – BULLISH BREAKOUT OR REVERSAL ?📉 Descending Channel

🔴 The price was moving inside a downward trend (channel) 📉, but it broke out ✅, signaling a potential bullish move 📈.

📍 Demand Zone (Support) at 1.85000 - 1.84201

🟦 Buyers stepped in here, pushing the price up 🚀.

🛑 Stop Loss: 1.84201 🔻 (If price falls below this, the bullish setup may fail ❌).

📍 Resistance Area Around 1.86000 - 1.86500

🔵 Key level to watch! If the price breaks above this zone, expect more upside 📈.

🎯 Target Point: 1.87727

🎯 If buyers remain strong, price could hit this level next! 🎯🚀

📊 Indicator Check:

📍 9-period DEMA (1.85000) 🟡 – Price is above this moving average, favoring a bullish bias ✅.

🔥 Possible Trade Setup:

✅ Buy Entry near 1.85000 - 1.85500

🎯 Target: 1.87727 📈

🛑 Stop Loss: 1.84201 🚨

If price breaks below 1.85000, be cautious ⚠️! A reversal to the downside could happen.

🚀 Overall Bias: Bullish (📈) above 1.85000, Bearish (📉) below **1

Gbpcadforecast

GBPCAD’s Bullish Surge: What’s Next? 💹 The GBPCAD has been in a strong bullish trend, reaching into previous highs on the daily timeframe—a key liquidity zone! 💰 This is a crucial area where smart money may take profits or induce a retracement before the next move.

📉 Given that price is currently overextended, I’m not looking to buy at these highs. Instead, I’ll be watching for a potential pullback into an unresolved imbalance, where we could see a high-probability long setup—if price action confirms the move. 🧐

💡 Patience is key in trading. Chasing price at extreme levels often leads to significant losses. I’ll be waiting for the right conditions to align before looking for an opportunity.

⚠️ Not financial advice. Always trade responsibly!

📊 Let me know your thoughts in the comments below.. 👇

Scenario on GBPCAD 13.2.2025I see the GBPCAD market as follows: the first sfp short from the price of 1.785 and the next one is at the price of 1.795. If I look long, the first interesting level for me is around the support of 1.7695-1.7672. The next one comes out below this support and if the market breaks through it, I think we will go lower.

GBP/CAD "Pound vs Canadian" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/CAD "Pound vs Canadian" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Buy Stop Orders above the breakout MA or Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most re cent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at the recent / nearest low level Using the 4H timeframe,

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.85000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

GBP/CAD "Pound vs Canadian" Forex Market is currently experiencing a Bullish trend., driven by several key factors.

🟡Fundamental Analysis:

The UK's economic growth has been slow, but the Bank of England's interest rate decisions may provide support for the pound. Canada's economy has been affected by the decline in oil prices, which may impact the Canadian dollar.

🔴Macroeconomic Factors:

UK Inflation: 2.5% (August), expected to remain low

Canada Inflation: 2.1% (July), expected to rise

UK Unemployment: 3.9% (July), expected to remain low

Canada Unemployment: 5.7% (July), expected to rise

UK GDP Growth: 1.0% (Q2), expected to slow down

Canada GDP Growth: 1.3% (Q2), expected to slow down

🟤COT Report:

The Commitment of Traders (COT) report shows that institutional traders are net long on the GBP/CAD pair, indicating a bullish sentiment.

🟣Market Sentiment:

Bullish: 65%

Bearish: 35%

Neutral: 0%

Retail Trader Sentiment:

Long: 70%

Short: 30%

Institutional Trader Sentiment:

Long: 60%

Short: 40%

🟢Overall Outlook:

The GBP/CAD pair is likely to continue its bullish trend, driven by the UK's economic growth prospects and the Bank of England's interest rate decisions. A strong break above the resistance level could confirm the uptrend.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBP/CAD "Pound vs Canadian" Forex Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/CAD "Pound vs Canadian" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Buy Stop Orders above the breakout MA or Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most re cent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at the recent / nearest low level Using the 4H timeframe,

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.85000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

GBP/CAD "Pound vs Canadian" Forex Market is currently experiencing a Bullish trend., driven by several key factors.

🟡Fundamental Analysis:

The UK's economic growth has been slow, but the Bank of England's interest rate decisions may provide support for the pound. Canada's economy has been affected by the decline in oil prices, which may impact the Canadian dollar.

🔴Macroeconomic Factors:

UK Inflation: 2.5% (August), expected to remain low

Canada Inflation: 2.1% (July), expected to rise

UK Unemployment: 3.9% (July), expected to remain low

Canada Unemployment: 5.7% (July), expected to rise

UK GDP Growth: 1.0% (Q2), expected to slow down

Canada GDP Growth: 1.3% (Q2), expected to slow down

🟤COT Report:

The Commitment of Traders (COT) report shows that institutional traders are net long on the GBP/CAD pair, indicating a bullish sentiment.

🟣Market Sentiment:

Bullish: 65%

Bearish: 35%

Neutral: 0%

Retail Trader Sentiment:

Long: 70%

Short: 30%

Institutional Trader Sentiment:

Long: 60%

Short: 40%

🟢Overall Outlook:

The GBP/CAD pair is likely to continue its bullish trend, driven by the UK's economic growth prospects and the Bank of England's interest rate decisions. A strong break above the resistance level could confirm the uptrend.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBP/CAD Fall of the Pound A Bearish Trap Has Been Set Rising Channel Breakdown

The chart previously exhibited a rising channel with two parallel white trendlines containing the price movement.

The price broke below the channel, signaling a shift in market structure from bullish to bearish.

Bearish Momentum Confirmation After the breakdown, the price retested the lower trendline but failed to reclaim it, confirming resistance.

A strong bearish rejection followed, indicated by the red shaded area showing selling momentum.

Short Entry & Risk-Reward Setup

The short position was entered near 1.78981, slightly below the breakdown point.

The stop-loss is set at 1.80996, positioned above the breakdown level to avoid whipsaws.

The take-profit target is 1.75724, aligning with previous support and a logical demand zone.

Indicators & Confluence

EMA or Trend-Based Indicator. The red shading suggests the price is trending below a dynamic moving average, reinforcing bearish sentiment.

Bearish Candlestick Formation, A series of red candles and a retest failure further confirm selling pressure.

Trade Rationale & Risk-Reward Analysis

Trade Type: Short

Entry: 1.78981

Stop Loss: 1.80996 (~200 pips above entry)

Take Profit: 1.75724 ( 325 pips below entry) Always book Profit every 10%

Risk-Reward Ratio: 1:1.6 , indicating a solid risk-adjusted trade with a favorable reward potential.

This trade capitalizes on the bearish breakdown of the rising channel, with a clear stop-loss placement and a logical take-profit target. If momentum sustains, the price could continue trending lower towards 1.75724 or even extend further.

GBPCAD - Idea for a buy !!Hello traders!

‼️ This is my perspective on GBPCAD.

Technical analysis: Here we are in a bullish market structure from 4H timeframe perspective, so I look for a long. My point of interest is imbalance filled + rejection from bullish OB and institutional big figure 1.78000.

Fundamental news: Tomorrow (GMT+2) we will see results Interest Rate on CAD. News with high impact on currency.

Like, comment and subscribe to be in touch with my content!

GBPCAD Under Pressure: Targeting Key Lows with Pullback Entry!GBPCAD is clearly facing downward pressure. On the daily timeframe, we can see the trend breaking previous lows. My target is the prior low levels, with entry anticipated on a pullback in the lower timeframe. This is not financial advice.

GBPCAD - Idea for a sell !!Hello traders!

‼️ This is my perspective on GBPCAD.

Technical analysis: Here we are in a bearish market structure from 4H timeframe perspective, so I look for a short. My point of interest is imbalance filled and rejection from bearish OB + level 1.77000.

Fundamental news: This week on Wednesday (GMT+2) we will see results of yearly CPI on GBP, news with high impact on currency.

Like, comment and subscribe to be in touch with my content!

GBPCAD - Potential downside move !!Hello traders!

‼️ This is my perspective on GBPCAD.

Technical analysis: Here we are in a bearish market structure from 4H timeframe perspective, so I look for a short. I expect bearish price action as we can see a rejection from resistance zone + institutional big figure 1.80000 after price filled the imbalance.

Like, comment and subscribe to be in touch with my content!

GBPCAD Bearish Momentum: Technical Analysis and Trade Idea.👀 👉 The GBPCAD has broken market structure to the downside on both the daily and four-hour charts. I’m anticipating further bearish movement, ideally following a pullback into my Fibonacci 5261.8% zone. Keep this pair on your radar during the US session tonight, as an upcoming data release could influence its movement. If the data aligns favorably and price action unfolds as outlined in the video, there may be a potential opportunity. ⚠️ This content is for educational purposes only and does not constitute financial advice.

GBP/CAD "Pound vs Canadian Dollar" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/CAD "Pound vs Canadian Dollar" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long & Short entry. 👀 So Be wealthy and safe trade 💪🏆🎉

Entry 📈 : You can enter a trade at any point.

Stop Loss 🛑: Using the 2H period, the recent / nearest Pullbacks.

Goal 🎯: Bullish Robbers TP 1.83700

Bearish Robbers TP 1.77800

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Based on the fundamental analysis 📰 I would conclude that the GBP/CAD (British Pound/Canadian Dollar) pair is: Bullish

Reasons:

Interest rate differential: The Bank of England's (BoE) interest rate (3.5%) is higher than the Bank of Canada's (BoC) interest rate (3.0%), making the GBP more attractive to investors.

Economic growth: The UK's GDP growth (1.1%) is relatively stable, while Canada's growth (1.5%) is more dependent on external factors, such as oil exports.

Brexit uncertainty: The ongoing Brexit process has led to a decline in the GBP, making it undervalued and potentially due for a rebound.

Commodity prices: Canada's economy is heavily reliant on commodity exports, and a decline in commodity prices could negatively impact the CAD.

However, it's essential to consider the following risks:

Global economic slowdown: A slowdown in global economic growth, particularly in the US and China, could negatively impact the GBP.

Oil prices: A rise in oil prices could support the CAD, as Canada is a major oil exporter.

BoC's monetary policy: The BoC's dovish stance and potential interest rate cuts could support the CAD.

Bullish Scenario:

Stronger UK economic data, such as GDP growth and inflation, supports the GBP

Decline in commodity prices, particularly oil, supports the GBP

Bearish Scenario:

Global economic slowdown and rise in oil prices weigh on the GBP

BoC's dovish stance and potential interest rate cuts support the CAD

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any decisions.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

GBPCAD is ready For a BuyHello Traders

In This Chart nzdcad HOURLY Forex Forecast By FOREX PLANET

today GBPCAD analysis 👆

🟢This Chart includes_ (GBPCAD market update)

🟢What is The Next Opportunity on GBPCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart

GBPCAD - Long active !!Hello traders!

‼️ This is my perspective on GBPCAD.

Technical analysis: Here we are in a bullish market structure from 4H timeframe perspective, so I look for a long. I expect bullish price action after price rejected from bullish order block. As well we have hidden divergence for a buy and on H1 we have regular divergence.

Like, comment and subscribe to be in touch with my content!

GBPCAD - Long from bullish OB !!Hello traders!

‼️ This is my perspective on GBPCAD.

Technical analysis: Here we are in a bullish market structure from 4H timeframe perspective, so I look for a long. I expect price to continue the retracement to fill that huge imbalance and then to reject from bullish OB + institutional big figure 1.79000.

Like, comment and subscribe to be in touch with my content!