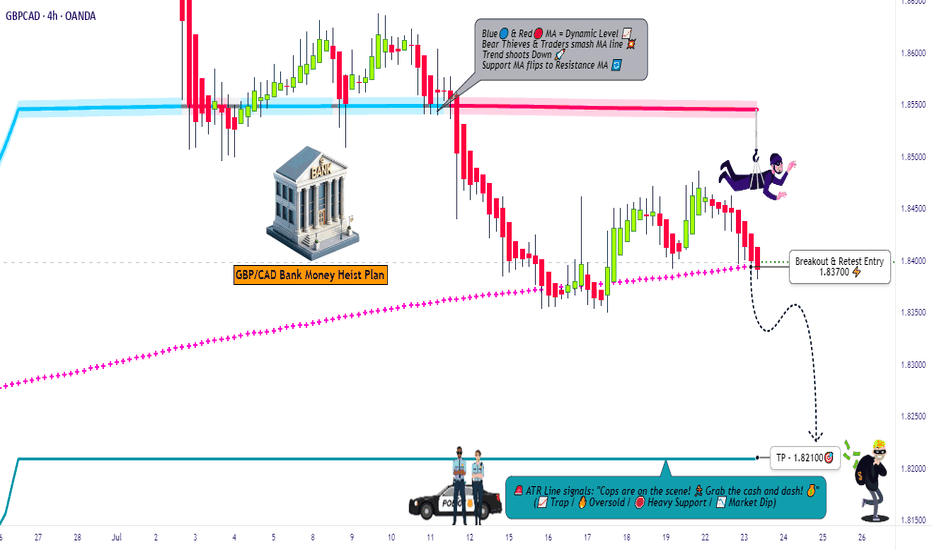

GBP/CAD Downtrend Setup – Clean Heist Entry Strategy🔥💷💣 THE GBP/CAD FOREX HEIST PLAN 💣💷🔥

Thief Trader Style – "Rob the Market, Not Each Other"

🧠 Smart Strategy | 🔍 Deep Analysis | 🎯 High Probability Plays | ⚔️ Risk-Controlled Attack

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba!

Dear Money Makers & Market Robbers, 🤑💰✈️

Welcome to another legendary forex robbery mission – this time, we’re planning the ultimate Pound vs. Loonie Heist (GBP/CAD). Powered by Thief Trading’s precision analysis (both technical & fundamental), this setup is designed for disciplined, stealthy traders who know how to attack at the right moment. Let’s take what’s ours from the market – the Thief way.

🔫 THE SETUP: GBP/CAD MARKET RAID

We’re eyeing a Short Entry near 1.83700 after the Moving Average Breakout Confirmation.

This ain’t just any pullback – this is a trap zone, a Police Barricade ATR Blue Zone, where liquidity fakes out the greedy bulls and invites a high-probability short for those with a thief’s vision.

Chart structure screams: overbought, slowing momentum, divergence + confluence = Bear Attack.

📍 Entry Plan:

💥 “The Heist is ON! Wait for the MA break… Then make your move at 1.83700!”

☑️ Sell Stop Orders – Just above the Moving Average or after key Support Break

☑️ Sell Limit Orders – For pullbacks at 15m or 30m TF near SWING H/L

☑️ Layered Entries / DCA Style – Multiple small entries for maximum control

☑️ Set Alerts! – Chart alarms keep your eyes sharp, your entries sharper.

🚨 Stop Loss Protocol (SL):

🛑 “No SL before breakout. You place early – you get burned.”

🗡️ After Breakout ONLY: SL near 1.84500, 4H Swing High

🛡️ Adapt based on your risk %, lot size, and number of open orders

🤫 Pro Tip: Smart SLs protect you, not limit you. Be like a ghost in the market.

🎯 Target Zone (TP):

📉 Initial Target: 1.82100

💨 “Get in, grab the bag, get out.”

You’re a thief – no greed, just precision. Exit before the alarms ring if the market flips!

🔎 Macro Factors Fueling the Bear Trend:

📉 Hawkish BOC tones down, GDP data contraction vibes

📈 GBP sentiment mixed; technical overbought signals dominate

🎭 Consolidation breakdown = High-Reward Entry Window

📰 News Awareness = Smart Survival:

⚠️ Avoid New Trades During Major News

📍 Use Trailing SLs to Protect Open Profits

🧨 Don’t get caught in the volatility trap – let the chaos work for you, not against you.

💥 BOOST THIS HEIST PLAN – ROBBERS UNITE 💥

Smash the “Boost” Button to power up our Thief Gang's momentum. Your support sharpens the edge for all fellow robbers in this daily market hustle.

🧠 Precision Plan

🧭 Risk-Aligned Entry

📈 Profitable Exit

That’s how Thief Traders operate.

🤑 Stay ready for the next drop. Another Forex bank is about to get robbed clean.

💣💰Let’s rob the charts – not each other.

— Thief Trader, Robbin’ with Logic & Style

🏴☠️📉📲

Gbpcadsell

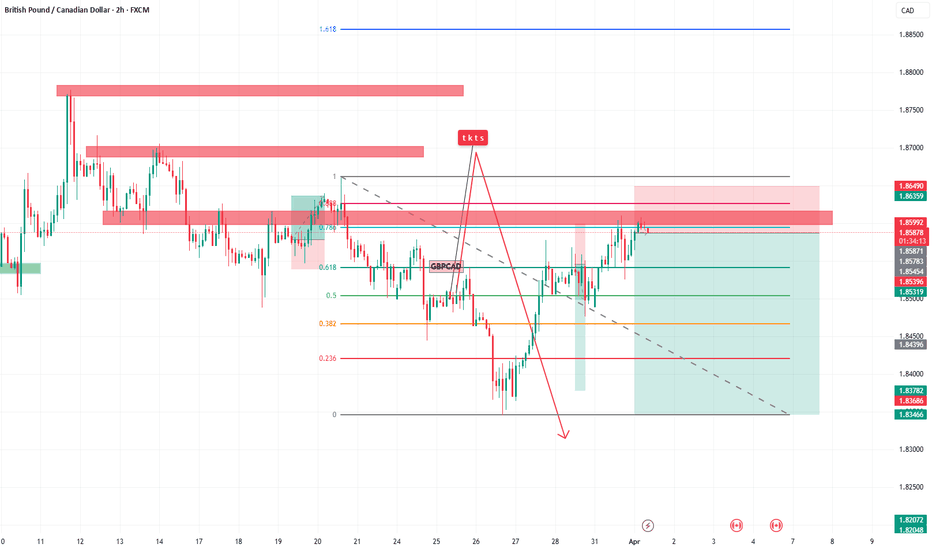

GBPCAD – Key Level, Buy Setup & Dual StrategyRight now, price is sitting on a major level.

📌 If a valid buy signal shows up, I’ll enter a long position.

But that’s not all…

🔁 If price reaches the next resistance level, I’ll:

Hold my long position

Open a short position there

This way: ✅ If price reverses → my long trade is closed by trailing stop

✅ And my short trade runs into profit

→ I profit both from below and above

⚠️ If my short trade’s SL hits, no worries —

My long is still open and growing in profit.

📈 But if the resistance breaks and we get a pullback,

➡️ I’ll activate pyramiding and build more position with zero added risk.

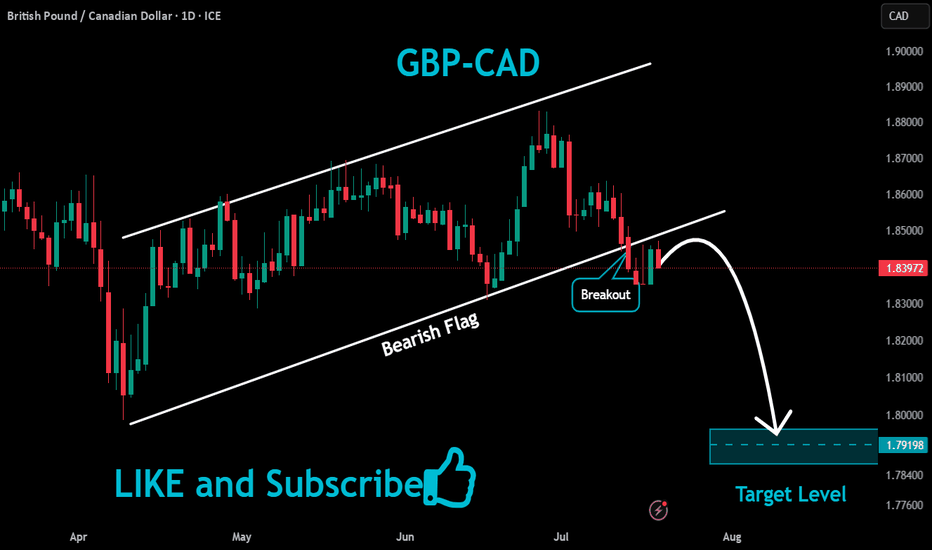

GBPCAD SHORT FORECAST Q3 D15 W29 Y25GBPCAD SHORT FORECAST Q3 D15 W29 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPCAD - Looking To Sell Pullbacks In The Short TermH1 - Strong bearish move.

No opposite signs.

Expecting further continuation lower until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

GBP/CAD Very Near Selling Area , Ready To Get 200 Pips ?Here is my daily chart on GBP/CAD , We have a very good res area the price very near it now and i`m waiting for touch for this res area and then i will enter a sell trade and targeting 200 pips at least , just waiting the price to give ma a good bearish price action from my res area and then i will enter . if the price close with daily candle above my res then this idea will not be valid .

GBP/CAD Made A New Wave , Golden Place To Sell Very Clear !Here is my opinion on GBP/CAD 2H Chart . we have finally a good wave and the price made a new down trendline and moving very good , now i put my fibo indicator and i`m waiting the price to retest a broken support and also 71% fib level and give me any bearish price action and then we can enter a sell trade to create new lower low .

GBPCAD Tests Bearish Trendline – Focus Shifts to BoC DecisionGBPCAD is currently respecting a well-defined descending trendline, showing multiple rejections and a sustained series of lower highs. The latest retest near 1.8460 was met with selling pressure, aligning with the broader bearish channel.

Key Levels:

Current Price: 1.8458

Resistance Area: 1.8470 – 1.8600 (trendline & previous highs)

Support Targets:

TP1: 1.8120 (key structure)

TP2: 1.7980

TP3: 1.7900 (major support zone)

Bearish Technical Confluence:

✅ Multiple rejections at trendline

✅ Lower highs & lower lows continue

✅ Potential reversal candlestick pattern forming

✅ Bearish breakout could accelerate toward 1.7980

📉 Fundamental Outlook – BoC Rate Decision in Focus (April 16)

Market Sentiment Split:

Initially, economists leaned toward a BoC hold, as recent data and trade optimism gave the central bank room to pause.

However, March CPI undershot expectations, triggering increased speculation of a rate cut.

Key Data Highlights:

Headline CPI fell to 2.3% YoY vs 2.6% previously, well below the 2.7% forecast.

Drop mainly due to gasoline and transport costs, which BoC may look through.

Core inflation (median 2.9%, trimmed 2.8%) remains elevated, supporting arguments for a hold.

Analyst Viewpoint:

“We still marginally favor a BoC hold given the proximity to elections and resilience in core inflation, but our conviction is lower after the CPI miss.” – Knightley & Pesole, ING

Market Reaction:

Loonie sold off post-CPI, but analysts believe the sell-off may be short-lived if BoC surprises with a hawkish hold.

Swap market odds of a cut rose to 45%, up from 33% pre-CPI.

🎯 Combined Technical + Fundamental Setup

If BoC holds rates, expect CAD strength → GBPCAD could accelerate downward toward 1.8120 → 1.7900.

If BoC cuts, GBPCAD may spike temporarily toward 1.8600, but downside pressure may resume unless accompanied by dovish forward guidance.

🛠️ Trade Plan:

Sell Bias Below: 1.8470

Entry Trigger: Bearish confirmation or post-BoC rejection

TP1: 1.8120

TP2: 1.7980

TP3: 1.7900

Invalidation Zone: Break and close above 1.8600

GBP/CAD At Interesting Area To Sell It And Get 250 Pips !This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

SHORT ON GBP/CADGBP/CAD is rejecting a key supply area on the 15min after continuing to make (Lower Highs) on the Higher Time Frames.

There has been a change in market structure from Up to down on the lower timeframe signaling a possible drop.

GBP/CAD is highly over brought and I believe its ready to fall.

I will be selling GBP/CAD to the next swing low for about 100-150 pips. OANDA:GBPCAD

Fri 7th Mar 2025 GBP/CAD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/CAD Sell. Enjoy the day all. Cheers. Jim

GBPCAD’s Bullish Surge: What’s Next? 💹 The GBPCAD has been in a strong bullish trend, reaching into previous highs on the daily timeframe—a key liquidity zone! 💰 This is a crucial area where smart money may take profits or induce a retracement before the next move.

📉 Given that price is currently overextended, I’m not looking to buy at these highs. Instead, I’ll be watching for a potential pullback into an unresolved imbalance, where we could see a high-probability long setup—if price action confirms the move. 🧐

💡 Patience is key in trading. Chasing price at extreme levels often leads to significant losses. I’ll be waiting for the right conditions to align before looking for an opportunity.

⚠️ Not financial advice. Always trade responsibly!

📊 Let me know your thoughts in the comments below.. 👇

Wed 5th Feb 2025 GBP/CAD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/CAD Sell. Enjoy the day all. Cheers. Jim

GBPCAD Under Pressure: Targeting Key Lows with Pullback Entry!GBPCAD is clearly facing downward pressure. On the daily timeframe, we can see the trend breaking previous lows. My target is the prior low levels, with entry anticipated on a pullback in the lower timeframe. This is not financial advice.

GBPCAD Continuation SellOn the monthly, price has yet to reach the D extension. We had a shallow retracement on the monthly fib with a stall out at the 1.18 1.27 extension. We had weekly and daily rejection at 1.82XXX.

Long term picture, I see the potential for a sell down to 1.580XX. Shorter term (4HR), I see two possibilities, price could begin to retrace from current 4HR level 1.759XX or push down to the second Weekly level at 1.749XX and retrace back up to the 38.2 1.776X where we have 4HR resistance. The retracement up could be tradeable.

For this leg of price, I see the potential for a sell to 1.739X with further downside potential to 1.716XX. At 1.7166X I think it will be time to re-evaluate once we see how price reacts at this level.

GBPCAD Bearish Momentum: Technical Analysis and Trade Idea.👀 👉 The GBPCAD has broken market structure to the downside on both the daily and four-hour charts. I’m anticipating further bearish movement, ideally following a pullback into my Fibonacci 5261.8% zone. Keep this pair on your radar during the US session tonight, as an upcoming data release could influence its movement. If the data aligns favorably and price action unfolds as outlined in the video, there may be a potential opportunity. ⚠️ This content is for educational purposes only and does not constitute financial advice.