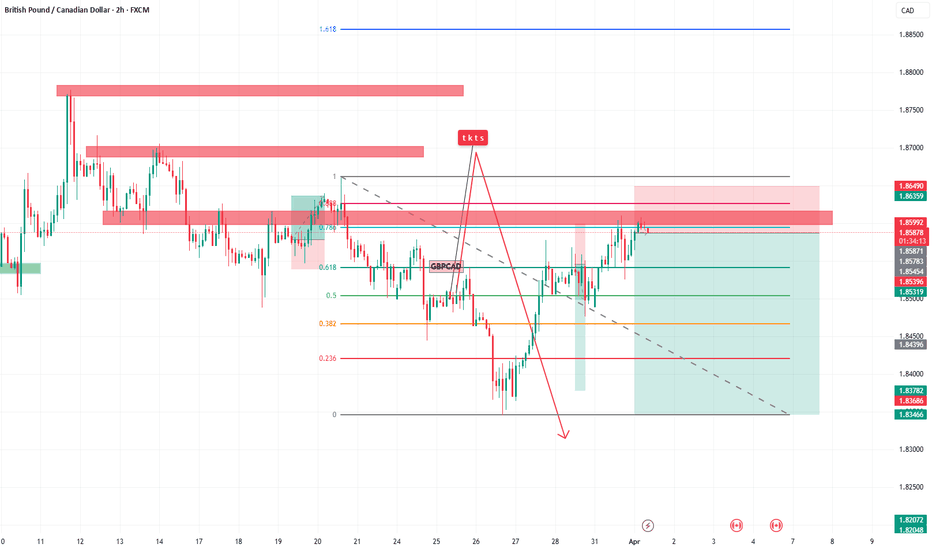

Gbpcadshort

GBPCAD will Fly , All Confirmations are in the Bullish Side Hello Traders

In This Chart GBPCAD HOURLY Forex Forecast By FOREX PLANET

today GBPCAD analysis 👆

🟢This Chart includes_ (GBPCAD market update)

🟢What is The Next Opportunity on GBPCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart

Mon 17th Mar 2025 GBP/CAD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/CAD Sell. Enjoy the day all. Cheers. Jim

SHORT ON GBP/CADGBP/CAD is rejecting a key supply area on the 15min after continuing to make (Lower Highs) on the Higher Time Frames.

There has been a change in market structure from Up to down on the lower timeframe signaling a possible drop.

GBP/CAD is highly over brought and I believe its ready to fall.

I will be selling GBP/CAD to the next swing low for about 100-150 pips. OANDA:GBPCAD

Fri 7th Mar 2025 GBP/CAD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/CAD Sell. Enjoy the day all. Cheers. Jim

GBPCAD’s Bullish Surge: What’s Next? 💹 The GBPCAD has been in a strong bullish trend, reaching into previous highs on the daily timeframe—a key liquidity zone! 💰 This is a crucial area where smart money may take profits or induce a retracement before the next move.

📉 Given that price is currently overextended, I’m not looking to buy at these highs. Instead, I’ll be watching for a potential pullback into an unresolved imbalance, where we could see a high-probability long setup—if price action confirms the move. 🧐

💡 Patience is key in trading. Chasing price at extreme levels often leads to significant losses. I’ll be waiting for the right conditions to align before looking for an opportunity.

⚠️ Not financial advice. Always trade responsibly!

📊 Let me know your thoughts in the comments below.. 👇

Gbpcad analysis This is a technical analysis of the GBP/CAD (British Pound/Canadian Dollar) currency pair on a 2-hour timeframe from OANDA. The chart highlights key support and resistance levels and suggests a potential price movement.

Key Observations:

1. Resistance Level (Near 1.8300):

Marked at the upper purple zone.

The price is approaching this resistance level, indicating potential selling pressure.

2. Support Level (Near 1.8050):

Marked at the lower purple zone.

This area has acted as a previous demand zone where buyers could step in.

Predicted Market Movement:

The blue arrow suggests a potential price rejection at the resistance level around 1.8300.

A downward movement is anticipated toward the support level at 1.8050.

The forecast includes a minor retracement before a deeper decline.

Trading Implications:

Sell Opportunity: If price shows rejection at resistance (1.8300), traders might look for short positions targeting the 1.8050 support.

Buy Opportunity: If the price reaches support (1.8050) and holds, traders may consider long positions.

This analysis assumes typical price action behavior, where resistance leads to sell-offs and support leads to buying interest. Traders should watch for confirmation signals before entering trades.

Scenario on GBPCAD 13.2.2025I see the GBPCAD market as follows: the first sfp short from the price of 1.785 and the next one is at the price of 1.795. If I look long, the first interesting level for me is around the support of 1.7695-1.7672. The next one comes out below this support and if the market breaks through it, I think we will go lower.

GBP/CAD Reversal Play: Riding the Support Zone to Triple TPIn this setup, I identified a strong support zone on the GBP/CAD 4-hour chart, marked in green. The price action tested this support multiple times, confirming its validity. Observing the bullish rejection wicks and the consolidation around this level, I anticipated a potential reversal.

I entered a long position at 1.78902, just above the support zone, ensuring a safe entry with confirmation of bullish momentum. My stop loss is placed slightly below the support at 1.77866 to protect against a false breakout while giving the trade enough breathing room.

For my take profit strategy, I set three target levels aligned with key resistance points:

Take Profit 1 at 1.79635 – This is the first resistance level, providing a conservative target.

Take Profit 2 at 1.79966 – A mid-level resistance, offering a balanced risk-reward ratio.

Take Profit 3 at 1.80379 – Targeting the upper resistance, maximizing potential gains if the bullish trend continues. OANDA:GBPCAD OANDA:GBPCAD

GBP/CAD Fall of the Pound A Bearish Trap Has Been Set Rising Channel Breakdown

The chart previously exhibited a rising channel with two parallel white trendlines containing the price movement.

The price broke below the channel, signaling a shift in market structure from bullish to bearish.

Bearish Momentum Confirmation After the breakdown, the price retested the lower trendline but failed to reclaim it, confirming resistance.

A strong bearish rejection followed, indicated by the red shaded area showing selling momentum.

Short Entry & Risk-Reward Setup

The short position was entered near 1.78981, slightly below the breakdown point.

The stop-loss is set at 1.80996, positioned above the breakdown level to avoid whipsaws.

The take-profit target is 1.75724, aligning with previous support and a logical demand zone.

Indicators & Confluence

EMA or Trend-Based Indicator. The red shading suggests the price is trending below a dynamic moving average, reinforcing bearish sentiment.

Bearish Candlestick Formation, A series of red candles and a retest failure further confirm selling pressure.

Trade Rationale & Risk-Reward Analysis

Trade Type: Short

Entry: 1.78981

Stop Loss: 1.80996 (~200 pips above entry)

Take Profit: 1.75724 ( 325 pips below entry) Always book Profit every 10%

Risk-Reward Ratio: 1:1.6 , indicating a solid risk-adjusted trade with a favorable reward potential.

This trade capitalizes on the bearish breakdown of the rising channel, with a clear stop-loss placement and a logical take-profit target. If momentum sustains, the price could continue trending lower towards 1.75724 or even extend further.

Wed 5th Feb 2025 GBP/CAD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/CAD Sell. Enjoy the day all. Cheers. Jim

GBPCAD is in the bearish directionHello Traders

In This Chart gbpcad HOURLY Forex Forecast By FOREX PLANET

today GBPCAD analysis 👆

🟢This Chart includes_ (GBPCAD market update)

🟢What is The Next Opportunity on GBPCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart

GBPCAD - Idea for a buy !!Hello traders!

‼️ This is my perspective on GBPCAD.

Technical analysis: Here we are in a bullish market structure from 4H timeframe perspective, so I look for a long. My point of interest is imbalance filled + rejection from bullish OB and institutional big figure 1.78000.

Fundamental news: Tomorrow (GMT+2) we will see results Interest Rate on CAD. News with high impact on currency.

Like, comment and subscribe to be in touch with my content!

GbpCad Short biasFirst trade set-up of the week. I'm looking to short from 1.76637. that's my poi. Till we clear previous week low which is Monday low 1.74561

That zone is interesting cause it is within an old week imbalance. Hence price would always be moved by Imbalance and Liquidity.

Please boost if you find this insightful 🫴

GBPCAD Under Pressure: Targeting Key Lows with Pullback Entry!GBPCAD is clearly facing downward pressure. On the daily timeframe, we can see the trend breaking previous lows. My target is the prior low levels, with entry anticipated on a pullback in the lower timeframe. This is not financial advice.

GBPCAD - Idea for a sell !!Hello traders!

‼️ This is my perspective on GBPCAD.

Technical analysis: Here we are in a bearish market structure from 4H timeframe perspective, so I look for a short. My point of interest is imbalance filled and rejection from bearish OB + level 1.77000.

Fundamental news: This week on Wednesday (GMT+2) we will see results of yearly CPI on GBP, news with high impact on currency.

Like, comment and subscribe to be in touch with my content!

GBPCAD - possible sells?Here is our view on GBPCAD . Potential short opportunities.

We believe that GBPCAD could continue to the downside . We have two possible entries . One could be at the pullback at 1.78061 . The second entry could be at the break of previous lows sitting at 1.76267 . We are aiming for the target and deeper lows sitting at 1.74818 . We can expect the higher pullback to be visited if 1.77443 is broken.

PARAMETERS ; for the pullback trade

- Entry: 1.78061

- SL: 1.78773

- TP: 1.74818

PARAMETERS ; for the break trade

- Entry: 1.76267

- SL: 1.76971

- TP 1.74818

KEY NOTES

- GBPCAD remains bearish.

- Break above 1.77443 would confirm a pullback to our first entry sitting at 1.78061.

- Break below previous lows (1.76267) would result in deeper pullbacks.

Happy trading!

FxPocket

GBPCAD Continuation SellOn the monthly, price has yet to reach the D extension. We had a shallow retracement on the monthly fib with a stall out at the 1.18 1.27 extension. We had weekly and daily rejection at 1.82XXX.

Long term picture, I see the potential for a sell down to 1.580XX. Shorter term (4HR), I see two possibilities, price could begin to retrace from current 4HR level 1.759XX or push down to the second Weekly level at 1.749XX and retrace back up to the 38.2 1.776X where we have 4HR resistance. The retracement up could be tradeable.

For this leg of price, I see the potential for a sell to 1.739X with further downside potential to 1.716XX. At 1.7166X I think it will be time to re-evaluate once we see how price reacts at this level.

GBPCAD - Potential downside move !!Hello traders!

‼️ This is my perspective on GBPCAD.

Technical analysis: Here we are in a bearish market structure from 4H timeframe perspective, so I look for a short. I expect bearish price action as we can see a rejection from resistance zone + institutional big figure 1.80000 after price filled the imbalance.

Like, comment and subscribe to be in touch with my content!