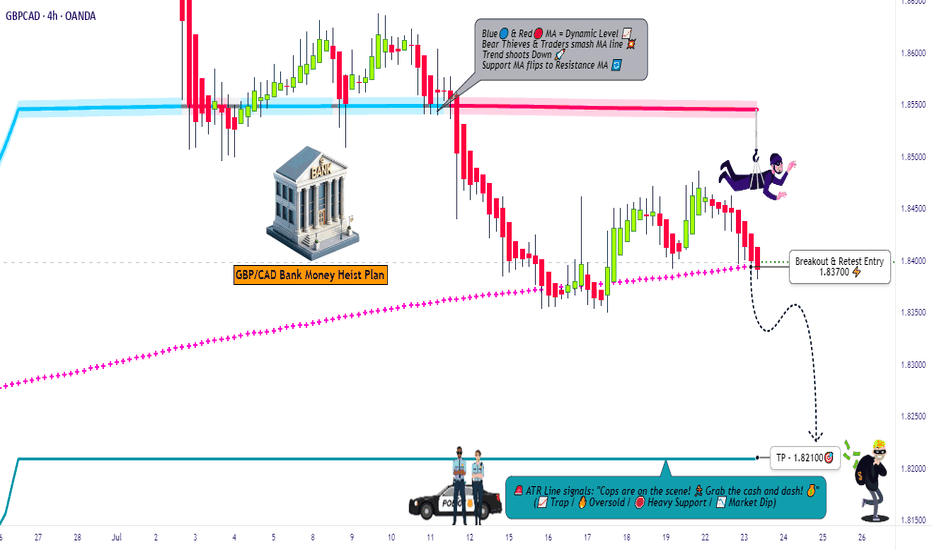

GBP/CAD Downtrend Setup – Clean Heist Entry Strategy🔥💷💣 THE GBP/CAD FOREX HEIST PLAN 💣💷🔥

Thief Trader Style – "Rob the Market, Not Each Other"

🧠 Smart Strategy | 🔍 Deep Analysis | 🎯 High Probability Plays | ⚔️ Risk-Controlled Attack

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba!

Dear Money Makers & Market Robbers, 🤑💰✈️

Welcome to another legendary forex robbery mission – this time, we’re planning the ultimate Pound vs. Loonie Heist (GBP/CAD). Powered by Thief Trading’s precision analysis (both technical & fundamental), this setup is designed for disciplined, stealthy traders who know how to attack at the right moment. Let’s take what’s ours from the market – the Thief way.

🔫 THE SETUP: GBP/CAD MARKET RAID

We’re eyeing a Short Entry near 1.83700 after the Moving Average Breakout Confirmation.

This ain’t just any pullback – this is a trap zone, a Police Barricade ATR Blue Zone, where liquidity fakes out the greedy bulls and invites a high-probability short for those with a thief’s vision.

Chart structure screams: overbought, slowing momentum, divergence + confluence = Bear Attack.

📍 Entry Plan:

💥 “The Heist is ON! Wait for the MA break… Then make your move at 1.83700!”

☑️ Sell Stop Orders – Just above the Moving Average or after key Support Break

☑️ Sell Limit Orders – For pullbacks at 15m or 30m TF near SWING H/L

☑️ Layered Entries / DCA Style – Multiple small entries for maximum control

☑️ Set Alerts! – Chart alarms keep your eyes sharp, your entries sharper.

🚨 Stop Loss Protocol (SL):

🛑 “No SL before breakout. You place early – you get burned.”

🗡️ After Breakout ONLY: SL near 1.84500, 4H Swing High

🛡️ Adapt based on your risk %, lot size, and number of open orders

🤫 Pro Tip: Smart SLs protect you, not limit you. Be like a ghost in the market.

🎯 Target Zone (TP):

📉 Initial Target: 1.82100

💨 “Get in, grab the bag, get out.”

You’re a thief – no greed, just precision. Exit before the alarms ring if the market flips!

🔎 Macro Factors Fueling the Bear Trend:

📉 Hawkish BOC tones down, GDP data contraction vibes

📈 GBP sentiment mixed; technical overbought signals dominate

🎭 Consolidation breakdown = High-Reward Entry Window

📰 News Awareness = Smart Survival:

⚠️ Avoid New Trades During Major News

📍 Use Trailing SLs to Protect Open Profits

🧨 Don’t get caught in the volatility trap – let the chaos work for you, not against you.

💥 BOOST THIS HEIST PLAN – ROBBERS UNITE 💥

Smash the “Boost” Button to power up our Thief Gang's momentum. Your support sharpens the edge for all fellow robbers in this daily market hustle.

🧠 Precision Plan

🧭 Risk-Aligned Entry

📈 Profitable Exit

That’s how Thief Traders operate.

🤑 Stay ready for the next drop. Another Forex bank is about to get robbed clean.

💣💰Let’s rob the charts – not each other.

— Thief Trader, Robbin’ with Logic & Style

🏴☠️📉📲

Gbpcadtrade

GBPCADThe first level I’ve marked is a short-term zone.

If we get a strong buy signal there with good R/R, I’ll enter and trail aggressively.

The second level is a stronger demand zone and a better area for potential long setups.

❗️Remember: These are just scenarios — not predictions.

We stay ready for whatever the market delivers.

GBP/CAD "Pound vs Canadian" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/CAD "Pound vs Canadian" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Buy Stop Orders above the breakout MA or Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most re cent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at the recent / nearest low level Using the 4H timeframe,

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.85000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

GBP/CAD "Pound vs Canadian" Forex Market is currently experiencing a Bullish trend., driven by several key factors.

🟡Fundamental Analysis:

The UK's economic growth has been slow, but the Bank of England's interest rate decisions may provide support for the pound. Canada's economy has been affected by the decline in oil prices, which may impact the Canadian dollar.

🔴Macroeconomic Factors:

UK Inflation: 2.5% (August), expected to remain low

Canada Inflation: 2.1% (July), expected to rise

UK Unemployment: 3.9% (July), expected to remain low

Canada Unemployment: 5.7% (July), expected to rise

UK GDP Growth: 1.0% (Q2), expected to slow down

Canada GDP Growth: 1.3% (Q2), expected to slow down

🟤COT Report:

The Commitment of Traders (COT) report shows that institutional traders are net long on the GBP/CAD pair, indicating a bullish sentiment.

🟣Market Sentiment:

Bullish: 65%

Bearish: 35%

Neutral: 0%

Retail Trader Sentiment:

Long: 70%

Short: 30%

Institutional Trader Sentiment:

Long: 60%

Short: 40%

🟢Overall Outlook:

The GBP/CAD pair is likely to continue its bullish trend, driven by the UK's economic growth prospects and the Bank of England's interest rate decisions. A strong break above the resistance level could confirm the uptrend.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBP/CAD "Pound vs Canadian" Forex Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/CAD "Pound vs Canadian" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Buy Stop Orders above the breakout MA or Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most re cent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at the recent / nearest low level Using the 4H timeframe,

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.85000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

GBP/CAD "Pound vs Canadian" Forex Market is currently experiencing a Bullish trend., driven by several key factors.

🟡Fundamental Analysis:

The UK's economic growth has been slow, but the Bank of England's interest rate decisions may provide support for the pound. Canada's economy has been affected by the decline in oil prices, which may impact the Canadian dollar.

🔴Macroeconomic Factors:

UK Inflation: 2.5% (August), expected to remain low

Canada Inflation: 2.1% (July), expected to rise

UK Unemployment: 3.9% (July), expected to remain low

Canada Unemployment: 5.7% (July), expected to rise

UK GDP Growth: 1.0% (Q2), expected to slow down

Canada GDP Growth: 1.3% (Q2), expected to slow down

🟤COT Report:

The Commitment of Traders (COT) report shows that institutional traders are net long on the GBP/CAD pair, indicating a bullish sentiment.

🟣Market Sentiment:

Bullish: 65%

Bearish: 35%

Neutral: 0%

Retail Trader Sentiment:

Long: 70%

Short: 30%

Institutional Trader Sentiment:

Long: 60%

Short: 40%

🟢Overall Outlook:

The GBP/CAD pair is likely to continue its bullish trend, driven by the UK's economic growth prospects and the Bank of England's interest rate decisions. A strong break above the resistance level could confirm the uptrend.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

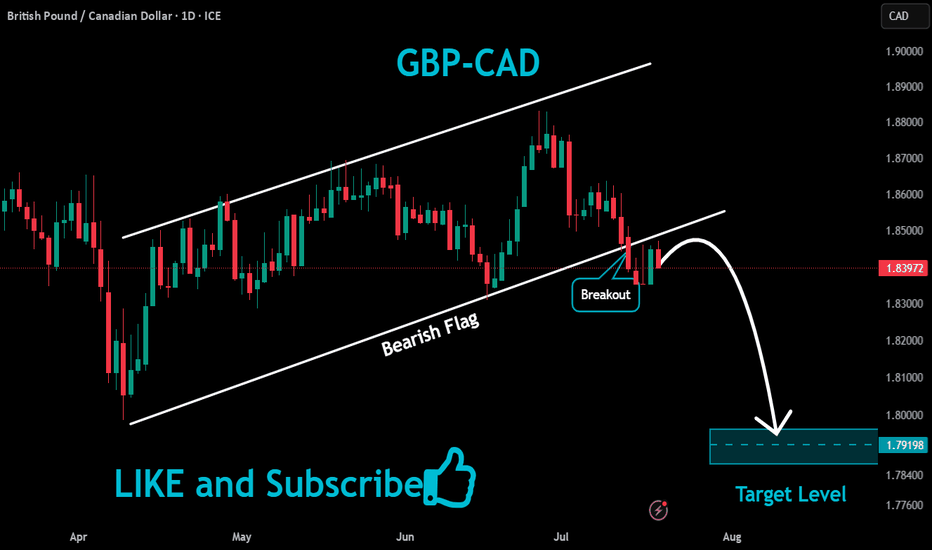

GBPCAD Under Pressure: Targeting Key Lows with Pullback Entry!GBPCAD is clearly facing downward pressure. On the daily timeframe, we can see the trend breaking previous lows. My target is the prior low levels, with entry anticipated on a pullback in the lower timeframe. This is not financial advice.

GBP/CAD "Pound vs Canadian Dollar" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/CAD "Pound vs Canadian Dollar" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long & Short entry. 👀 So Be wealthy and safe trade 💪🏆🎉

Entry 📈 : You can enter a trade at any point.

Stop Loss 🛑: Using the 2H period, the recent / nearest Pullbacks.

Goal 🎯: Bullish Robbers TP 1.83700

Bearish Robbers TP 1.77800

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Based on the fundamental analysis 📰 I would conclude that the GBP/CAD (British Pound/Canadian Dollar) pair is: Bullish

Reasons:

Interest rate differential: The Bank of England's (BoE) interest rate (3.5%) is higher than the Bank of Canada's (BoC) interest rate (3.0%), making the GBP more attractive to investors.

Economic growth: The UK's GDP growth (1.1%) is relatively stable, while Canada's growth (1.5%) is more dependent on external factors, such as oil exports.

Brexit uncertainty: The ongoing Brexit process has led to a decline in the GBP, making it undervalued and potentially due for a rebound.

Commodity prices: Canada's economy is heavily reliant on commodity exports, and a decline in commodity prices could negatively impact the CAD.

However, it's essential to consider the following risks:

Global economic slowdown: A slowdown in global economic growth, particularly in the US and China, could negatively impact the GBP.

Oil prices: A rise in oil prices could support the CAD, as Canada is a major oil exporter.

BoC's monetary policy: The BoC's dovish stance and potential interest rate cuts could support the CAD.

Bullish Scenario:

Stronger UK economic data, such as GDP growth and inflation, supports the GBP

Decline in commodity prices, particularly oil, supports the GBP

Bearish Scenario:

Global economic slowdown and rise in oil prices weigh on the GBP

BoC's dovish stance and potential interest rate cuts support the CAD

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any decisions.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

GBP/CAD Bank Money Heist Plan on Bullish SideHola! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist GBP/CAD Bank based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss 🛑 : Recent Swing Low using 30 min timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

GBP/CAD Bank Money Heist Plan on Bearish SideHola ola My Dear,

Robbers / Money Makers & Losers,

This is our master plan to Heist GBP/CAD Bank based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Short entry. Our target is Green Zone that is High risk Dangerous level, market is oversold / Consolidation / Trend Reversal / Trap at the level Bullish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Note: If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money.

Entry : Can be taken Anywhere, What I suggest you to Place Sell Limit Orders in 15mins Timeframe Recent / Nearest Swing High

Stop Loss : Recent Swing High using 2H timeframe

Warning : Fundamental Analysis comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style

GBPCAD - Look for Continuation Short (SCALP) 1:2.8!The price action is forming a structured bullish pattern in the HTF, supported by the major trendline. However, the price failed to break the monthly resistance and closed lower than the HTF candle.

If the market moves in our favor, it may react at the order block within the Supply Zone (DBD) on the lower time frame (LTF), presenting a potential scalp short opportunity with an R

of 1:3, supported by the Fibonacci Retracement. The target would be the nearest Demand Zone before the bullish trend continues, assuming the trendline remains intact.

This setup is high-risk since we're trading against the major trend. However, it's important to remember that there are often smaller trends within the larger trend.

Disclaimer:

This is simply my personal technical analysis, and you're free to consider it as a reference or disregard it. No obligation! Emphasizing the importance of proper risk management—it can make a significant difference. Wishing you a successful and happy trading experience!

GBPCAD Weekly Analysis and OutlookGBPCAD Weekly Analysis and Outlook

This week, the GBPCAD pair has exhibited a marked downward trajectory, closing in a bearish continuation phase. This downward momentum reflects a negative sentiment among traders, suggesting further potential for decline.

Current Market Overview:

The pair has been steadily descending, supported by unfavorable market conditions and bearish sentiment. As it approaches a key support zone, traders should closely monitor the price action. A successful break below this support would likely confirm the continuation of the bearish trend.

Expectations and Potential Scenarios:

Upon breaking the support zone, we anticipate that the GBPCAD will continue its downward momentum. This breakout could open the door to lower levels, offering traders potential opportunities to capitalize on the bearish trend.

Primary Expectation: If the support is broken, the price is likely to sustain its downward movement, potentially targeting lower support levels. This scenario would reinforce the bearish outlook, making it a favorable environment for short positions.

Alternative Scenario: However, if the price encounters strong support and fails to break through, a temporary pullback could occur. Traders should be prepared for this scenario, as it might provide opportunities to reassess entry points at higher levels before resuming the downward trend.

Conclusion:

In summary, the GBPCAD pair is poised for further downward movement following its recent bearish phase. Traders should watch for a decisive break below the support zone, which could serve as a catalyst for continued declines. Maintaining awareness of both bearish and corrective scenarios will be crucial for effective trading strategies. Stay updated with market developments and adjust your positions accordingly.

By Piptera Digital Solutions,

Invest Wisely!

GBP/CAD Ready for Short...The GBPCAD price is nearing a bearish order block, which could lead to a potential rejection between 1.75283 and 1.76063. Additionally, there is an unfilled imbalance in the range of 1.74736 to 1.74970. Share your thoughts in the comments section.

Fundamentally

The Canadian Dollar faced pressure following the release of official data indicating unexpected job losses in June, increasing the likelihood of another interest rate cut by the Bank of Canada. The Pound to Canadian Dollar exchange rate (GBP/CAD) surged to 1.7441, reaching its highest point since mid-June, as Statistics Canada reported a loss of 1.4K jobs in June, falling short of the expected 22.5K job growth.

This decline from the 26.7K jobs added in May suggests that the previous strong figure was an anomaly, masking a clear trend of deterioration in the labor market. With Canada's unemployment rate climbing to 6.4% from 6.2%, the Bank of Canada may be more inclined to implement a second interest rate cut.

GBPCAD Short Trade Setup A #short trade opportunity recently presented itself on the #poundloonie (#GBPCAD) #trading chart 📉.

This is indicated by the #bearish inverted pin bar candlestick 🕯️ pattern just below the 1.72552 horizontal resistance level.

This indicates a rejection of the same level, with potential price move in the downward 👇 ⬇️ direction (#sell).

Sufficient downward momentum should see price dumping towards the 1.69500 psychological level and possibly testing the strength of the 1.69171 horizontal support level.

As always, please apply appropriate risk management.

Happy trading!

#crosspair