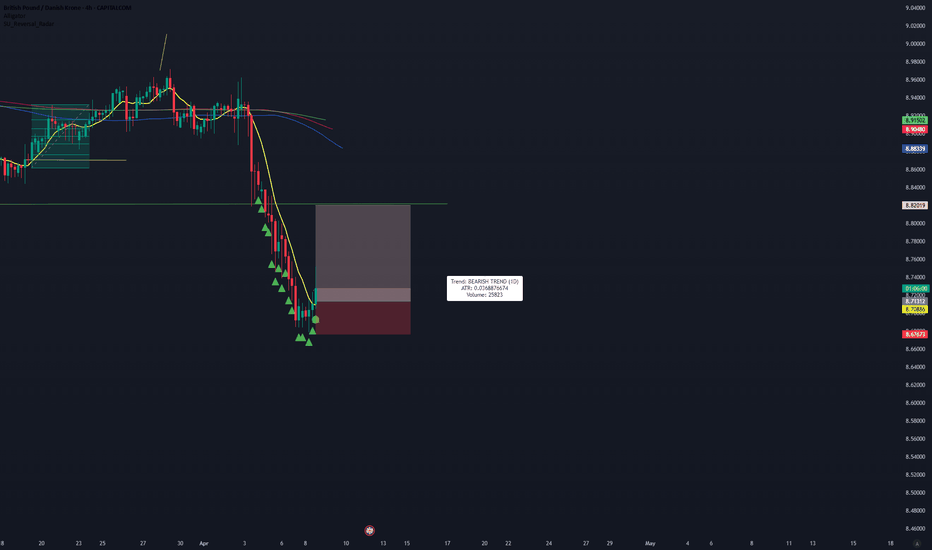

LONG Investment Opportunity on GBP/DKK 4H

Hello everyone, I am Trader Andrea Russo, and today I want to share with you a LONG investment opportunity on GBP/DKK. With the help of the SwipeUP Reversal Radar Multi-Timeframe Alerts indicator, we have managed to identify a setup that deserves attention for its bullish potential.

Here is the Investment Setup:

Entry Price: 8,714

Target Price (TP): 8,818, corresponding to an estimated profit of 1.20%.

Stop Loss (SL): 8,679, corresponding to a risk of 0.40%.

This setup is based on bullish pressure signals, with technical confirmations that show a potential reversal to the upside. The break of the Dynamic Resistance on the 4-hour (4H) chart supports the idea of a possible bullish movement.

As always, I encourage you to check the chart and apply proper risk management to ensure informed trading. Don't forget to use a strategic plan to capitalize on this setup. Happy trading everyone! 📈

GBPDKK

GBPDKK Sideways Trading Strategy! 📈 GBPDKK Sideways Trading Strategy! 📉

Hello traders! 📊 Today, I'd like to present a compelling trading opportunity in the GBPDKK currency pair. The 1-hour chart indicates a sideways market, with no clear bearish or bullish trend. To make the most of this situation, I have devised two trade plans using buy stop and sell stop orders, targeting potential support and resistance levels.

📉 Trade Plan 1 - Sell Stop 📉

🎯 Entry: Below S2 at 8.6742

🛡️ Stop Loss: Above S1 at 8.6852

🎯 Take Profit: 1:1 at 8.6632

In this plan, we are looking to capitalize on potential downside movement from the current sideways range. The entry point below S2 suggests a bearish continuation, while the stop loss above S1 provides a safety net in case of a reversal. The take profit is set at 1:1, aiming for a reasonable target within the range.

📈 Trade Plan 2 - Buy Stop 📈

🎯 Entry: Above R2 at 8.7212

🛡️ Stop Loss: Below R1 at 8.7161

🎯 Take Profit: 1:1 at 8.7263

In this plan, we are seeking to profit from potential upward movement. The entry above R2 implies a bullish breakout, while the stop loss below R1 mitigates risk if the price retraces. The take profit is set at 1:1, providing a balanced reward-to-risk ratio.

It's important to note that trading in a sideways market carries inherent risks, and caution should be exercised. As always, I advise using appropriate risk management techniques and not risking more than you can afford to lose.

Good luck! 🍀 Happy trading! 📈💹

#GBPDKK #Forex #TradingStrategy #TechnicalAnalysis #SidewaysMarket

GBPDKK mine thought reflexion

GBPDKK mine own perspective so what's your consideration on the price movement please comment in the below section ?

I believe that. So what is your expectations in comment below.

So guys Let's look at it 😍😍😍🥰😍😍😍😍 with #hasanat_hussain_al_ahmed_hasan

Learn forex then thought to does earn

Stay With me

Stay With trading

Stay With idea

Stay on trend

GBPDKK on the break of a weekly trendline 🦐GBPDKK on the daily chart is testing the weekly descending trendline.

The price can approach soon a daily resistance around 8.300.

IF the market will break and close above the structure we will set a nice long order according to Plancton's strategy.

–––––

Follow the Shrimp 🦐

Keep in mind.

• 🟣 Purple structure -> Monthly structure.

• 🔴 Red structure -> Weekly structure.

• 🔵 Blue structure -> Daily structure.

• 🟡 Yellow structure -> 4h structure.

• ⚫️ Black structure -> >4h structure.

Here is the Plancton0618 technical analysis , please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of the Plancton0618 strategy will trigger.

GBPDKK on the break of the channel 🦐GBPDKK has moved inside a discending channel.

Price created a double bottom before starting an impulse.

Now the price is breaking the structure and the channel, after a retrace till the 0.382 fib level is created a new impulse to the upside.

At the retest of the structure we can set a nice long order according with our strategy.

–––––

Follow the Shrimp 🦐

Here is the Plancton0618 technical analysis, please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of Plancton0618 strategy will trigger.

GBP/DKK long/buy idea. almost 220 pips move...In the name of ALLAH who is most merciful and the master...

We take trading as a business, not a gambling stuff.

We have calculated approximate risk to reward ratio.

Please note:

-> Never go beyond 1.5% risk of your total trading capital on a single trade,

-> Always move your stops to your entry levels after the price moves 100 pips towards target,

-> Close half of the trade position after market makes half movement towards target.

GBPDKK: Long term Sell opportunity.The pair has come a few points away this week from breaking into the 1M 8.8050 - 8.9550 Resistance Zone, on an extended 1W bullish streak (RSI = 67.077, ADX = 48.241). This level has been holding as a Resistance since November 2016 and rejects the uptrend every time.

It is natural to assume that this will happen again especially as the 1W RSI has Double Topped. This time also the 1W MA200 is coming in to apply pressure. Our Target Zone (on the medium term) is 8.4000 - 8.2500, which are symmetrical Support levels.

See how well those levels have helped us to call exact long entry and target levels on our last GBPDDK analysis:

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

GBPDKK: Sell opportunity for the medium term.The pair has been rising aggressively (1D RSI = 64.189) since early August and the Double Bottom formation on the 8.0000 1M Support. It is approaching the 1W Resistance (8.5000) but the 1D MA200 (orange line) is already applying selling pressure, similarly to what it did on September 2017 after the last rebound on the 1M SUpport.

With 1W still neutral (RSI = 52.606, ADX = 43.327, MACD = -0.040, Highs/Lows = 0.08030) we expect this Resistance to hold on the medium term and trade sideways within that and the 8.2570 1D Support.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

GBPDKK: Long term correction ahead. Sell opportunity on 1W.GBPDKK has been trading on a long term 1W Channel Up (RSI = 64.794, MACD = 0.060, Highs/Lows = 0.1840, B/BP = 0.2987) that is close to making a Higher High. According to the monthly Higher High trend line since Sept 2017, the price should pull back towards the median of the Channel. We are therefore shorting with TP = 8.5500.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.