GBPEUR

GBPEUR Ambitious realisation LONGThe last time The Fib welcomed GBPEUR anywhere near the 50.00% marker was way back in April 2018 but that is exactly the minimum we should expect, possible small retracement to the arrows as we are pushing our luck with the BB and then normal business to resume, in all likelyhood there will be no pit-stop and she will keep on keeping on.

NB the last time she reached higher than 50.00% was early 2017

GBPEUR: Quick short opportunity.The pair is trading within a 1D Channel Down (RSI = 39.482, MACD = -0.005, Highs/Lows = -0.0009) that has just priced its Lower High. Technically it should break the December 10 low of 1.1000 and make a new Lower Low but the August 18 1D support is directly beneath at 1.0986. So we are only taking this 4H Lower High opportunity to short to 1.1026.

Sterling: High volatility expected early next weekWell referenced political news is important.

Sterling could see serious volatility next week if political pundits are correct about Theresa May being forced out of her premiership next week in relation to Brexit confusion.

Rival MPs are already jostling for position as Wednesday is the big day.

The uncertainties could send GBP pairs into high volatility between 15 min to 4H time frames.

Avoid FOMO and getting stung, if you can.

EURGBP bearish wedgeLooks like a good bearish wedge, should break down here but could still make one more wave up. I am going in with half a pos and will increase if we move up to the upside of the wedge again or add those on the way down. Volume picture is also confirming the wedge.

Previous analysis:

GBP/EUR - Ranging marketLast week price rallied to major resistance and, again, gave a sharp rejection. This week, so far, we have retested support from the supportive price area (green line) and the weekly 55EMA. Price is once again stuck within these ranging levels (between the red and green lines).

I am bullish on this pair BUT I am staying out of this market until a Brexit deal is final. For those that wish to trade this pair it's advisable that you buy on the green line and short on the red line. Until one of those levels breaks it will continue to range.

If we break below the green line the next level of support is the weekly 13EMA then the 1.1200 price level. If we can break above the red line then the next resistance is the 1.1600 price level then the weekly 200EMA (be cautious of a false breakout on this level).

Be cautious with this pair. Brexit may be the catalyst we need to break the resistance.

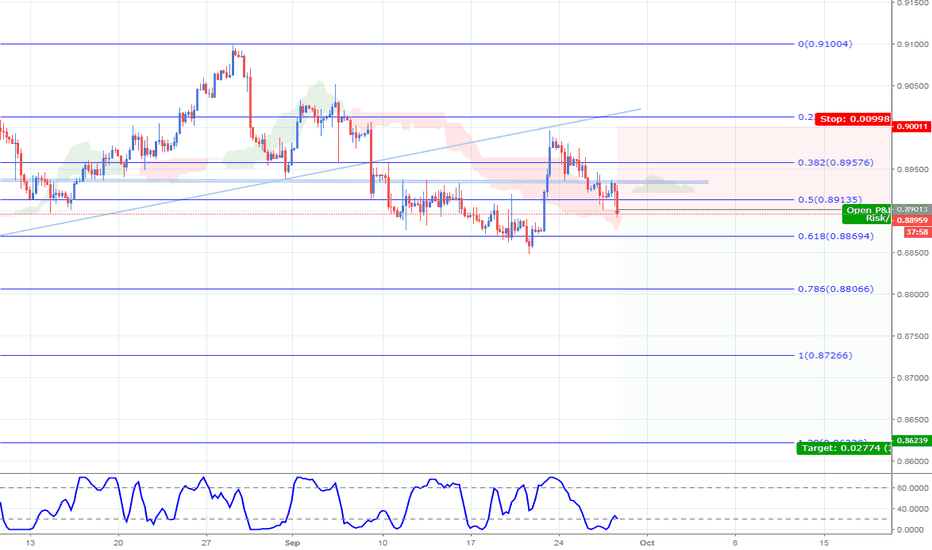

EURGBP 4HR SHORT TRADEEURGBP is forming lower lows and lower highs.

We have a clear selling zone 0.8935

We have re-tested the 23.6% retracement level and we have also re-tested the 4hr support line which turned resistance.

There are a number of good technical factors that support this short trade.

The fundamentals will be the biggest let down. Will Theresa May bury the Pound alive, or do we have a last minute deal wit the EU.

EUR/GBP long or short ? Hi everyone ! I have for you you my EURGBP analysis.

What I see now on the 1H chart is bearish divergence. So go short for now (0.9030 +/-), but What I see on the 4H chart is bearish too, It means for me that there is big chance that We will be on the short road in this week + RSI is pretty overbought on 1D.

Take care, everything is possible.

Enjoy your life and follow me !

For Educational Purposes Only.

GBPEURPotential head and shoulders formation. A fairly premature prediction admittedly, however the first peak and head are formed which makes it very likely we could be seeing a head and shoulders pattern being created. GBPEUR has hit support twice in this timeframe and it looks like it could be heading back down to support and if it doesn't break support by rising again a head and shoulders pattern is very likely and it would be a good opportunity to buy on support. GBPEUR has broke resistance to emphasise a more prominent head but nothing significant as it looks like it could be heading back down.

EURGBP: anticipating a break lowerThe range between 87.50 and 88.50 has been a significant zone for prices to trade at over the last 18 months. It was the high in the first half of 2017, and then the floor throughout the rest of the year, into 2018.

Since September 2017, EURGBP has been falling back into this zone, forming a 5 month bearish pennant. This is marked in orange.

Whilst this pattern may continue for some time, in the short-term momentum and relative strength has turned bearish too. On the 22nd February the MACD turned bearish, and the RSI into negative strength. Therefore the chance of a break lower has increased significantly from a week ago. 0.86 to 0.865 is the target for now.

EURGBP range bound trade set-up to avoid Dollar messrectangle range set-up is one of the high potential trade set-ups since December last year, usually it breaks the rectangle to the downside. This pair is in range bound and have already tested the support twice, if price fail to break to the upside then the chances are price will break the counter-trendline and will break below the rectangle support. Wait for RSI to reach over bought region or break of the counter trend line to the downside in lower time frame or a potential upside move if price break the region which seems unlikely at the current price movement.

GBPEUR Short, however long in sights. Hello everyone.

GBPEUR probably finishing its retracement very soon meaning a short trade is possible.

- If this pairs bullish momentum continues, wait for retracement onto the red line and then look for a confirmation for a potential long.

- More likely to become a long due to the bullish data that has been released today.

May or may not update this, do not wait for me.

Take care.

GBPEUR longHi guys

I spotted a fib retracement that hit the 50% retracement line and bounced off. Its headed towards Target 1 on the fib retracement 0.6

I then spotted my previous completed harmonic. We have already hit the 0.3 target so we are prob headed for the 0.6 target.

Target 1 is about 100 pips and target 2 about 200-odd