GBPJPY Sell Setup from Two Key Levels!Hey friends 👋

Here’s my carefully prepared GBPJPY analysis, just for you 📊

In this setup, I’ll be opening sell positions from two key levels:

1️⃣ 197.477

2️⃣ 198.100

My target level is: 🎯 195.560

Every single like you give truly fuels my motivation to keep sharing these insights.

Huge thanks to everyone who supports and encourages me with their likes 🙏

GBPJPY

EUR/USD | Holding Above 1.16 Could Unlock More Upside! (READ IT)By analyzing the EURUSD chart on the 4-hour timeframe, we can see that the price reacted beautifully to all the marked zones on the chart. Especially after reaching the 1.14 demand area, it experienced a strong bullish move, rallying over 200 pips to hit 1.16. Currently, EURUSD is trading around 1.16220, and if it holds above the 1.16 level, we can expect further upside. The next bullish targets are 1.16435, 1.16780, 1.17100, and 1.17500.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

GBPJPY: Strong Bullish Reversal from Demand ZoneGBPJPY has bounced sharply from a key demand zone, indicating renewed bullish momentum. The pair continues to follow the broader bullish bias in GBP crosses, with JPY weakness driven by the Bank of Japan's dovish policy stance.

Technical Analysis (4H Chart)

Pattern: Bullish rejection from the 195.30–195.50 demand zone.

Current Level: 195.58, rebounding from strong support, setting up for a potential upward leg.

Key Support Levels:

195.34 – immediate demand zone and critical support.

194.90 – deeper backup support if a pullback occurs.

Resistance Levels:

197.31 – near-term resistance and first upside target.

199.72 – extended target if bullish continuation strengthens.

Projection: As long as 195.34 holds, GBP/JPY could push toward 197.31, with potential for 199.72 if GBP strength persists.

Fundamental Analysis

Bias: Bullish.

Key Fundamentals:

GBP: Supported by the BOE’s cautious but tight stance due to persistent inflation pressures.

JPY: Remains fundamentally weak, with the BoJ avoiding major policy tightening while intervention threats only provide short-term support.

Risk Sentiment: Mild risk-on conditions favor GBP over safe-haven JPY.

Risks:

BoJ FX intervention could temporarily strengthen JPY.

A dovish BOE shift could slow GBP momentum.

Key Events:

BOE policy updates and UK CPI.

BoJ commentary and risk sentiment indicators.

Leader/Lagger Dynamics

GBP/JPY is a leader among JPY pairs due to GBP’s volatility and strength. It often outpaces EUR/JPY and CHF/JPY, making it a key pair for JPY sentiment shifts.

Summary: Bias and Watchpoints

GBP/JPY is bullish, with price rebounding from the 195.34 demand zone. Upside targets are 197.31 and 199.72. Watch for BOE communication, BoJ intervention signals, and global risk sentiment for confirmation of the move.

GBP/JPY Long Attack After MA Breakout – Loot the Beast!🔓 GBP/JPY Bullish Break-In Heist! 💷💣 Price Cracked the MA Vault 🎯

🏴☠️ Welcome to the GBP/JPY Treasure Run!

Thief Trader’s back in the FX vault—this time we’re after the Beast Pair. A clean moving average breakout just unlocked the vault at 196.900, and we’re going in heavy with layered long entries!

📈 Heist Blueprint:

Asset: GBP/JPY

🧭 Plan: Bullish (Price has broken key MA level)

🎯 Entry: ANY price above 196.900 (after MA breakout confirmation)

📉 Stop Loss: 195.000 (secure the backdoor)

💰 Target: 199.500 (clean getaway zone)

🔫 Entry Method: Limit orders stacked like trapdoors — Thief’s layering strategy in motion!

💼 Strategy Breakdown:

⚔️ Scalp Raiders: Snipe quick profits on the M15-M30 pullbacks.

🛡 Swing Bandits: Ride this bullish wagon up to 199.500. Use trailing SL to stay alive.

📡 Chart Radar: Eyes on volume spikes + MA alignment = green signal for aggressive buys.

🧠 Market Logic Behind the Heist:

🔥 MA breakout confirms buyer strength

🔍 Intermarket flow supports GBP dominance

📊 Sentiment & positioning flip to bullish

💼 Risk events priced in – no traps detected (yet)

🚨 Caution for Rookie Thieves:

News bombs ahead? Lock down with tighter SLs or pause the raid until the dust settles.

💎 Join the Crew of Chart Bandits!

👍 Like this plan? 🔁 Share it.

💬 Drop your view. 💣 Boost it with a 🚀

We're not just trading—we’re robbing the market with style.

🔐 Stay dangerous, stay profitable…

THIEF TRADER OUT. 🏴☠️📉📈

GBPJPY H4 | Heading into 50% Fibonacci resistanceGBP/JPY is rising towards the sell entry at 197.42, which has been identified as a pullback resistance that aligns with the 50% Fibonacci retracement and could reverse to the downside.

Stop loss is at 199.25, which is a swing high resistance.

Take profit is at 195.26, which is a swing low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

GBP/JPY Breakout Done , Short Setup Valid To Get 150 Pips !Here is my 1H Chart on GBP/JPY , We Have A Daily closure below my old support and new res and we have a very good bearish Price Action on 1 And 2 Hours T.F Also the price trying to retest the area now and giving a good bearish price action on smaller time frames , , So i see it`s a good chance to sell this pair and targeting 100 to 150 pips . and if we have a daily closure again above my new res then this idea will not be valid anymore .

GBP-JPY Bearish Bias! Sell!

Hello,Traders!

GBP-JPY is going down

And the pair made a breakout

Of the key horizontal level

Of 195.500 so we are

Bearish biased and we

Will be expecting a

Further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Volatile Times for GBPJPY: What’s Going On Behind the Moves?Good morning, Guys,

I’m anticipating a new short opportunity on GBPJPY once the pair reaches my sell zone level. From there, my target is set at 197.934.

Every like from you is what truly motivates me to keep sharing these insights.

Massive thanks to everyone who shows love and support!

GBP/JPY Trap? Smart Money Might Be Setting Up the Next Drop📊 1. Technical Overview

Price broke the bullish structure decisively, closing below a key demand zone between 195.00–196.00, leaving a large unfilled imbalance.

Last week's recovery candle suggests a potential pullback toward 197.40–197.80, now acting as a resistance confluence.

The descending channel and weak RSI further support a continuation of the bearish trend.

Bearish targets: 193.50 and 192.20

📈 2. COT (Commitment of Traders) Report

GBP:

Non-commercials are cutting long positions (–5,961) and adding shorts (+6,637) → Bearish divergence developing on GBP.

JPY:

Non-commercials are heavily increasing short exposure (+15,113), but remain strongly net-long overall, indicating a potential exhaustion of bullish JPY positioning.

💭 3. Retail Sentiment

Positioning is neutral: 51% long / 49% short.

This balance suggests no excessive retail bias, leaving room for directional moves without immediate contrarian pressure.

📆 4. Seasonality

August is historically bearish for GBP/JPY:

• –2.82% (20Y average)

• –3.04% (15Y average)

• –1.44% (5Y average)

The data shows a consistent historical bias to the downside during this month.

🎯 5. Strategic Outlook

• Primary Bias: Bearish below 197.40–197.80

• Invalidation: Weekly close above 198.10

• Targets: 195.00 > 193.50 > 192.20

The confluence of technical rejection, bearish COT dynamics, neutral sentiment, and negative seasonality supports a corrective scenario for August.

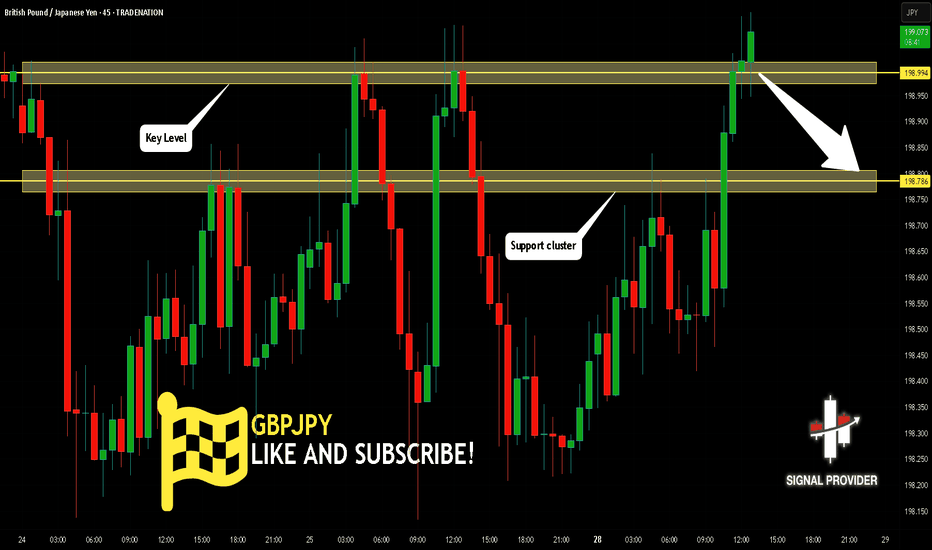

GBPJPY Is Very Bearish! Sell!

Please, check our technical outlook for GBPJPY.

Time Frame: 45m

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 198.994.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 198.786 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBP/JPY BULLS ARE GAINING STRENGTH|LONG

Hello, Friends!

Previous week’s red candle means that for us the GBP/JPY pair is in the downtrend. And the current movement leg was also down but the support line will be hit soon and lower BB band proximity will signal an oversold condition so we will go for a counter-trend long trade with the target being at 197.696.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPJPY and USDJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GBPJPY H4 | Bullish bounce offGBP/JPY has bounced off the buy entry, which has been identified as a swing low support and could potentially rise from this level to the take profit.

Buy entry is at 195.73, which is a swing low support that lines up with the 145% Fibonacci extension.

Stop loss is at 194.33, which is a swing low support.

Take profit is at 197.43, which is a pullback resistance that aligns with the 50% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

GBPJPY ready to drop?GBPJPY has printed a weekly bearish engulfer with a cross over of a weekly doji and price rejected from a weekly and monthly resistance line. As price is rejecting from a very important monthly and weekly resistance level, it is highly likely price may continue to drop to weekly support level.

As 4H timeframe showing a strong head and shoulder with rejection below, we may see continuation with strong trend.

Upon price action confirmation, a sell trade is high probable.

GBPJPYGBPJPY price is near the main resistance zone 200.168. If the price cannot break through the 200.186 level, it is expected that the price will go down. Consider selling the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

GBPJPY – Bearish Continuation Setup AheadPair: GBPJPY

Timeframe: 4H

Bias: Bearish

🔍 Technical Overview:

GBPJPY has broken down with high momentum and is now hovering at a 4H support zone (195.30). A clean break and close below this level opens the door for a deeper move toward the next support areas:

Entry Trigger: Break below 195.30

🎯 Target 1: 194.05

🎯 Target 2: 192.50

🛑 Stop Loss: Above 195.95 (previous resistance-turned-supply zone)

📉 RSI: 27.63 (Oversold but momentum-driven selloff suggests more downside)

🧠 Macro + Fundamental Confluence:

🏦 Central Bank Policy:

BOE (Bank of England) cut rates by 25bps (to 4.25%) in a hawkish tone, with internal disagreement (7–2 vote), signaling uncertainty and potential for further divergence.

Despite the “hawkish cut,” the market interpreted it cautiously, especially with falling UK economic momentum and weak retail data.

💴 Bank of Japan:

BoJ is slowly tightening policy — signaling an eventual exit from ultra-loose conditions.

Real interest rates remain negative, but the direction is now incrementally hawkish, strengthening the JPY across the board.

💡 Market Sentiment:

VIX at 20.42 = Risk-Off Environment → capital flows into safe-haven JPY, out of GBP.

With Nasdaq bullish, but volatility ticking up, JPY benefits from its safe-haven role.

📊 CFTC Positioning:

GBP: Longs decreasing, shorts rising, NNCs decreasing → Bearish bias

JPY: Longs flat, but massive drop in NNCs → institutional positioning is turning defensive

🧾 Economic Weakness:

UK Services PMI showing signs of stagnation

CPI and Retail Sales remain weak, suggesting limited scope for further GBP upside

Japan's latest Household Spending and Economy Watchers Survey show stabilizing conditions, supporting yen strength

📌 Final Take:

Fundamentals support the breakdown as monetary divergence and global sentiment drive capital into the JPY. Watch for confirmation via H4 close below 195.30 before entering the trade.

🧭 Trade idea aligns with macro, technicals, seasonality, and institutional flows.

GBPJPY: Bearish Market StructureLook to sell after the correction...

(H4)

✅ Confirmed BOS below 197.20

✅ LHs

✅ Supply Zone: 196.10 – 196.60

(H1)

✅ Nice impulse down from 197.30 to 195.50

✅ Short-Term Supply Zone: 195.90 – 196.20 (H1 OB inside H4)

Looking for price to tap this zone and form a new LH

(M15)

✅ Price consolidating after the drop

✅ No bullish BOS

✅ New LH

Expecting liquidity sweep above 195.90, then bearish BOS below 195.70 to confirm entry

❌ Invalidation: Bullish BOS above 196.70 on M15.

GBPJPY Will Move Higher! Long!

Take a look at our analysis for GBPJPY.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 195.702.

Considering the today's price action, probabilities will be high to see a movement to 197.050.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBP-JPY Risky Long! Buy!

Hello,Traders!

GBP-JPY collapsed on Friday

And the pair's final move

Was absorbed by the horizontal

Support of 195.400 so as the

Pair is oversold we will be

Expecting a local rebound

And a correction on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.